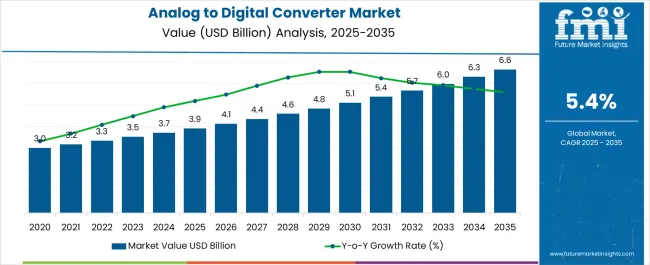

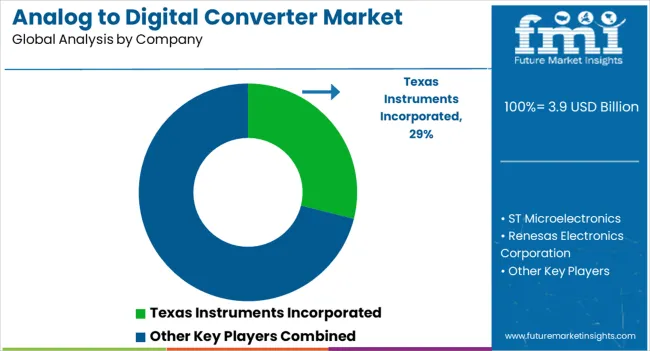

The Analog to Digital Converter Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Analog to Digital Converter Market Estimated Value in (2025 E) | USD 3.9 billion |

| Analog to Digital Converter Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The analog to digital converter market is experiencing steady advancement supported by rising demand for precision measurement, high resolution imaging, and energy efficient electronics. Growth is being driven by rapid industrial automation, proliferation of consumer electronics, and the integration of smart technologies across healthcare, automotive, and communication sectors.

The adoption of next generation ADCs is further strengthened by the need for improved performance in data acquisition, sensor integration, and real time monitoring systems. Advancements in semiconductor design and the increasing use of IoT devices have expanded application potential, enabling higher processing speeds and lower power consumption.

The market outlook remains positive as enterprises continue to invest in innovative electronic architectures that require reliable signal conversion, ensuring scalability and compatibility across a wide range of modern applications.

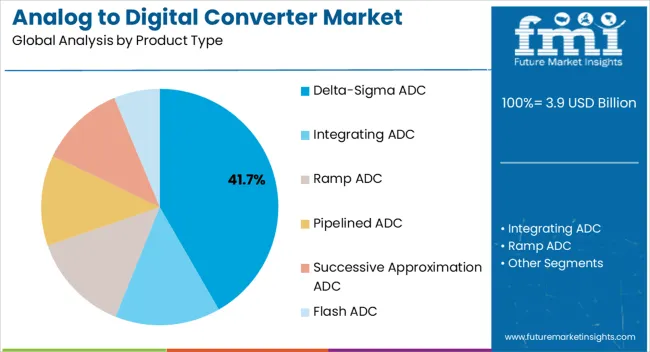

The delta sigma ADC product type segment is expected to hold 41.70% of the overall market revenue by 2025, positioning it as the leading product type. This growth is supported by its ability to deliver superior resolution, high accuracy, and low noise performance, which are critical in advanced electronic systems.

Delta sigma converters are particularly valued in applications requiring precise signal measurement and stability across varying operating conditions. Their energy efficiency and adaptability in integration with mixed signal systems have strengthened adoption across industries.

As electronic designs demand greater sensitivity and enhanced processing capabilities, delta sigma ADCs remain the preferred choice, thereby consolidating their leadership in the product type segment.

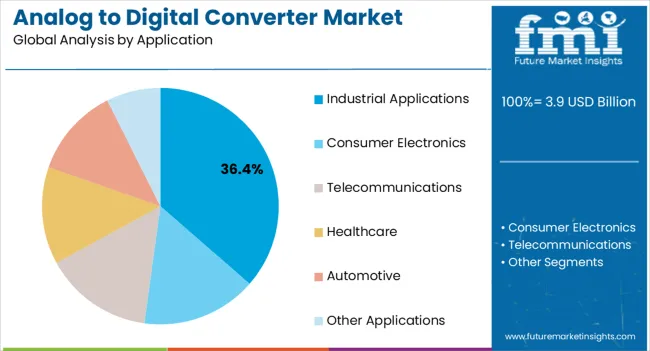

The industrial applications segment is projected to account for 36.40% of total market revenue by 2025, making it the leading application category. Growth is attributed to the increasing role of ADCs in process automation, robotics, and control systems where real time monitoring and accuracy are essential.

Industrial environments require durable and efficient converters to handle complex sensor data and high frequency signals, and ADCs provide the reliability to meet these demands. The growing use of predictive maintenance, data driven decision making, and machine learning within industrial operations has further accelerated adoption.

As industries move toward Industry 4.0 practices, the need for advanced ADC solutions continues to expand, ensuring the dominance of industrial applications in the market landscape.

Rising Need for Data Acquisition across Key Industries to Widen Adoption

End-use industries are investing funds in collating and assimilating market data that is easily accessible and can be stored conveniently as digitization progresses. Therefore, numerous data acquisition tools and approaches are relied upon.

At the core of all data acquisition systems is an Analog to Digital Converter (ADC). As the name implies, this chip takes data from the environment and converts it to discrete levels that can be interpreted by a processor. These discrete levels correspond to the small detectable change in the signal being measured.

Analog-to-digital converters (ADCs) and digital-to-analog converters (DACs) play an important role in the design of data acquisition systems. ADCs are used to convert analog signals like the output from a temperature transducer, a radio receiver or a video camera into digital signals for processing.

Conversely, DACs are used to convert digital signals back to analog signals. Convenience, cost, power dissipation, resolution, speed, supply voltage and ease of use drive the selection of a particular ADC/DAC.

Structural Complexities while Collecting Data may Discourage Adoption

A key challenge associated with using analog to digital converters is their structural complexities. With respect to flash analog to digital converters, as the use of comparators increases, circuit complexity also rises. Furthermore, converting non-periodic signals using pipeline ADCs can be difficult as it typically runs at a periodic rate.

Pipeline ADCs experience frequent latency of input signals, causing non-linearities in various parameters. Over and above these challenges, analog to digital converters are expensive, compelling enterprises to spend a significant portion of their budgets on their installation and security.

| Countries | Revenue Share % (2025) |

|---|---|

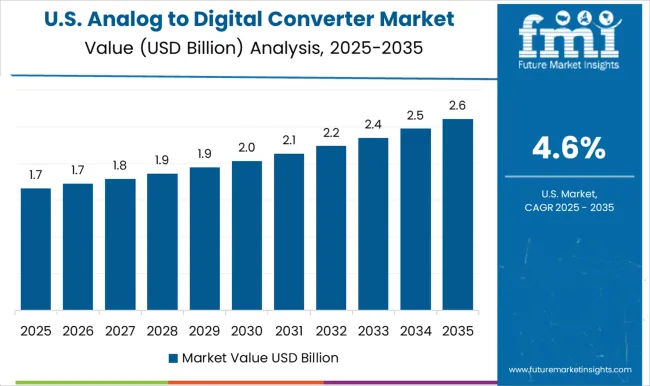

| The United States | 20.4% |

| Germany | 8.1% |

| Japan | 6.3% |

| Australia | 3.1% |

| North America | 30.4% |

| Europe | 22.9% |

| Countries | CAGR % (2025 to 2035) |

|---|---|

| China | 4.3% |

| India | 7.6% |

| The United Kingdom | 3.2% |

Extensive Deployment Strengthened Military Capabilities

According to Future Market Insights, the analog to digital converter market in North America held a revenue share worth 30.4% in 2025. With extensive digitization of key industries, combined with the deployment of advanced connectivity technologies, the market is set to take a turn for the better across the region in the coming decade. Perhaps the most extensive application of this technology is in the military sector.

Warfare technologies have evolved tremendously, since the dawn of the 21st century. From the deployment of unmanned aerial vehicles and drones for surveillance or combat to stealth aircraft or heat-guided missiles, military technology has come a long way. The introduction of analog to digital converters is yet another addition to this list. With respect to is popularity in North America, there are widespread applications of this technology.

Modern military radar, communication, and surveillance systems are typically leveraging ultrafast analog-to-digital converters to digitize received signals. They are critical in military applications such as military software-defined radio, radar, and electronic counter warfare (ECW) which require high sampling rates and bandwidths.

Applications are Likely to Abound for Medical Applications in the Long-Run

Asia Pacific’s market is expected to generate substantial growth prospects for analog to digital converters, especially in the healthcare domain. This is especially prominent for digital radiography, CT, PET, MRI, and ultrasonography among other applications. Future Market Insights expect the Asia Pacific analog to digital converters market to experience a 6.3% CAGR from 20253 to 2035.

Given the increasing scope of medical tourism across the region, healthcare facilities across countries such as India, Japan, and China, are overhauling their existing medical infrastructure. Stakeholders are attempting to incorporate digitization, big data analytics, Industry 4.0, and IoT to make healthcare systems efficient. The introduction of analog to digital conversion is another feather in the cap for the Asia Pacific market.

A Flourishing Automotive Industry to Encourage Manufacturers to Establish Base

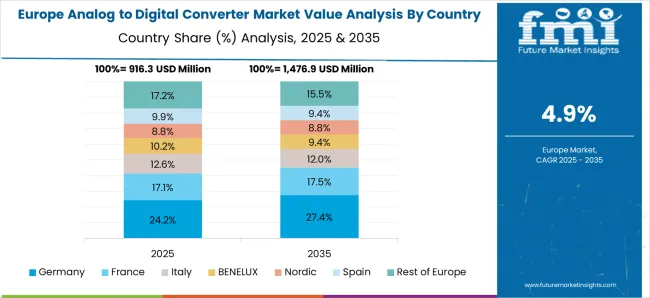

Europe’s analog to digital converter market held market revenue worth 21.1% in 2025, according to Future Market Insights. The growth of the region is typically attributed to a flourishing automotive industry in recent years. Sensor applications requiring data converters range from temperature sensors identifying different engine statuses to radar/LIDAR enabling automotive driver assistance systems (ADAS).

A few other applications involving data converters include wireless transceivers for communicating with other vehicles or with a fixed network. The data converter IP (analog-to-digital and digital-to-analog) provides an interface for a multitude of analog sensors to automotive system-on-chips (SoCs).

Numerous regional players are active in the analog to digital converter landscape for the automotive industry in Europe. Dewesoft, for instance, is a prominent manufacturer, offering versatile and easy-to-use data acquisition systems. Its vehicle testing portfolio includes ADAS testing; break testing, break noise testing, combustion analysis and e-mobility among others.

| Category | By Product Type |

|---|---|

| Leading Segment | Delta Sigma ADC |

| Market Share% (2025) | 19.5% |

| Category | By Application Type |

|---|---|

| Leading Segment | Telecommunications |

| Market Share% (2025) | 20.3% |

Delta Sigma ADC is to Account for a Significant Share of the Global ADC Market

Among all types, delta sigma ADC held a revenue share of 19.5% in 2025. Growth is primarily being driven by extensive applications across 4G and 5G devices for providing superior data and services quality. The segment accounted for one-third market share in 2020.

Demand for fast data processing, accurate decision intelligence and large communication channels bandwidth have acquired critical precedence, as the industrial internet of things (IIoT) gradually takes over the entire manufacturing process. Functional ADCs help achieve all these things by providing optimum speed, size, power, and resolution across machines, thus accelerating processes.

Telecommunications to Remain Principal Application Area, Usage to Accelerate in Automotive Sector

ADCs are experiencing immense fertile growth across the telecommunications sector. As the world hurtles toward rapid inter-connectedness, people demand fast andefficient means of connectivity. Further, the advent of artificial intelligence has spurred deployment of 4G/5G data transmission systems, which extensively utilize data converters. The segment held a market share of 20.3% in 2025.

The automotive industry is up-scaling the adoption of ADCs to ensure the functionality, reliability and safety of a variety of functions. A key application has been recorded in the automotive driver assistance systems (ADAS) and in wireless trans-receivers for communicating with other vehicles.

Additionally, ADCs are also used in child seat detection, remote keyless entry, immobilizers, passive keyless entry and tire pressure monitoring systems. As per FMI, the automotive segment is poised to expand at a CAGR of 6.2% until 2035.

Manufacturers are adopting various marketing strategies such as new product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential buyers and create a large customer base. For instance,

Recent Developments:

The global analog to digital converter market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the analog to digital converter market is projected to reach USD 6.6 billion by 2035.

The analog to digital converter market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in analog to digital converter market are delta-sigma adc, integrating adc, ramp adc, pipelined adc, successive approximation adc and flash adc.

In terms of application, industrial applications segment to command 36.4% share in the analog to digital converter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analog Phase Shifter Market Size and Share Forecast Outlook 2025 to 2035

Analog & Digital IC Development Tools Market Size and Share Forecast Outlook 2025 to 2035

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Packaging Market Size and Share Forecast Outlook 2025 to 2035

Top Loading Cartoning Machine Market Forecast and Outlook 2025 to 2035

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Toilet Roll Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

TOC Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Total Reflection X-Ray Fluorescence Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Tow Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

Touch Controller IC Market Size and Share Forecast Outlook 2025 to 2035

Torrified Wheat Market Size and Share Forecast Outlook 2025 to 2035

Total Dust Detector Market Size and Share Forecast Outlook 2025 to 2035

Total Aflatoxin Test Kit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA