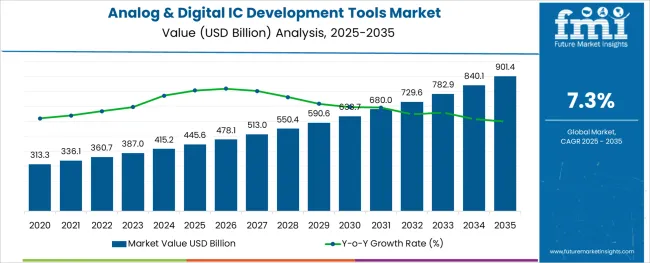

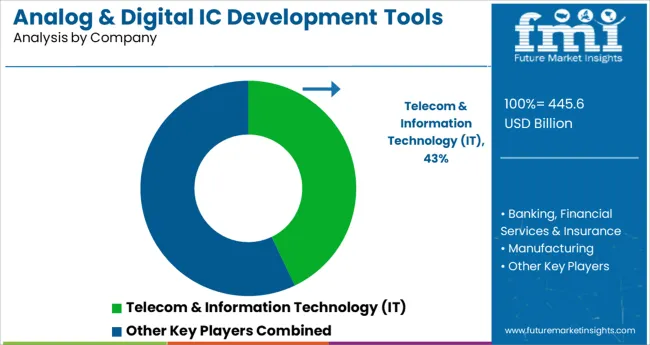

The Analog & Digital IC Development Tools Market is estimated to be valued at USD 445.6 billion in 2025 and is projected to reach USD 901.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

The analog and digital IC development tools market is expanding due to rising demand for electronic devices across communication, automotive, and consumer electronics industries. As circuit complexity increases, design engineers have relied on advanced development tools to streamline simulation, prototyping, and testing processes. Industry forums and product launch updates have highlighted the growing adoption of integrated toolsets that reduce design cycles and support faster product commercialization.

Additionally, evolving chip architectures and the transition to advanced manufacturing nodes have driven tool enhancements for higher precision and efficiency. Organizations have prioritized IC development tools that offer seamless integration with verification platforms and support analog and digital circuit design within a single environment.

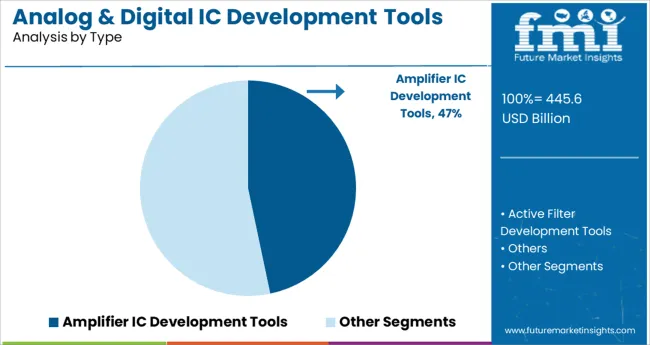

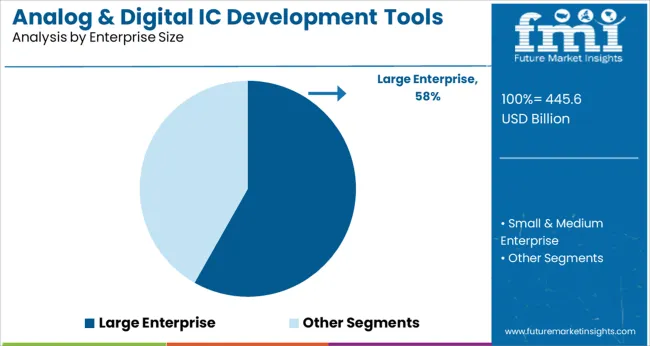

Looking ahead, the market is poised to grow with the increasing need for low-power and high-performance integrated circuits. Segmental growth is expected to be led by Amplifier IC Development Tools in type and Large Enterprise users, reflecting their substantial investments in complex circuit design and manufacturing infrastructure.

The market is segmented by Type and Enterprise Size and region. By Type, the market is divided into Amplifier IC Development Tools, Active Filter Development Tools, and Others. In terms of Enterprise Size, the market is classified into Large Enterprise and Small & Medium Enterprise. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Type and Enterprise Size and region. By Type, the market is divided into Amplifier IC Development Tools, Active Filter Development Tools, and Others. In terms of Enterprise Size, the market is classified into Large Enterprise and Small & Medium Enterprise. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Amplifier IC Development Tools segment is expected to contribute 46.7% of the analog and digital IC development tools market revenue in 2025, making it the leading product type. This segment has gained momentum as amplifier circuits continue to play a critical role in communication systems, industrial automation, and consumer electronics. Design teams have prioritized amplifier IC tools for their ability to accurately model gain, frequency response, and signal linearity, which are vital for product performance.

These tools have supported rapid development and testing of analog front-end components that require precision across a wide range of operating conditions. Additionally, the demand for energy-efficient and compact amplifier solutions has prompted the need for development tools that address both performance optimization and power consumption.

With ongoing advancements in sensor interfaces and wireless communication modules, the Amplifier IC Development Tools segment is expected to maintain its relevance in modern electronic design workflows.

The Large Enterprise segment is projected to account for 58.2% of the analog and digital IC development tools market revenue in 2025, sustaining its position as the top enterprise size category. Growth in this segment has been supported by significant investments in advanced semiconductor design capabilities and infrastructure. Large enterprises have deployed comprehensive development platforms that enable the design of complex ICs, often used in automotive, industrial, and telecommunications sectors.

These organizations have leveraged their scale to invest in end-to-end toolchains that cover schematic capture, simulation, verification, and layout. Additionally, large enterprises have prioritized tool integration with in-house design automation systems, ensuring seamless workflows and efficient resource management.

As semiconductor innovation accelerates to meet the demands of next-generation electronics, the Large Enterprise segment is expected to remain the primary user base for IC development tools, driven by their continuous focus on technological leadership and market competitiveness.

The analog & digital IC development tools market is looking promising with opportunities in various fields such as railways and transportation systems, industrial motion control, factory automation, and power generation systems.

Today, industries around the globe are moving towards digitization, and are creating ideal conditions for manufacturing, automation, and software-based embedded systems, ultimately creating growth opportunities for boosted demand for analog & digital ICs along with surged sales of analog & digital ICs as well as soaring analog & digital IC development tools market.

Furthermore, the growing demand for analog & digital ICs in intelligent ICT-based machines, systems, and networks is one of the key factors driving the growth of analog & digital IC development tools market.

Growing adoption of Internet of Things (IoT) in various industries is enhancing the demand for analog & digital ICs. A new wave of growth in demand for products such as sensor-filled medical and scientific instruments is playing a crucial role in increasing the demand for analog & digital ICs and sales of analog & digital ICs, due to this factor, the analog & digital IC development tools market is expected to witness significant growth rate in coming years.

Apart from this, the rising proliferation of smartphones and tablets along with an accelerated shift to smart home devices, sensors, and other consumer electronics devices are the factors, which are expected to have a positive impact on the growth of analog & digital IC development tools market and boost in the sales of analog & digital ICs.

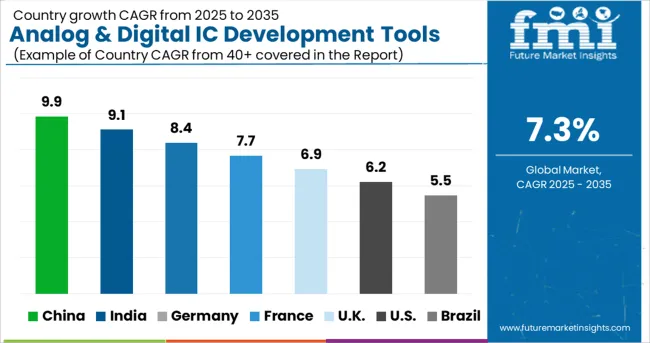

The strong growth in semiconductor sales coupled with the increasing penetration of smart devices in Asia Pacific region are the factors responsible for substantial revenue for analog & digital IC development tools market.

Moreover, the presence of analog & digital IC development tools manufacturer in the region is also one of the key factors increasing the adoption of analog & digital IC development tools in the region.

Europe and North America are also expected to create significant market opportunities for analog & digital IC development tools market on the whole and also escalation in the sales of analog & digital ICs due to the rising penetration of smart devices and early adoption of advanced technologies.

The analog & digital IC development tools market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators, and governing factors, along with market attractiveness as per segment. The market report also maps the qualitative impact of various market factors on market segments and geographies.

Leading players in the analog & digital IC development tools market such as Analog Devices and Infineon Technologies are continuously focusing entering into partnerships and collaborations in order to expand their operations in emerging markets and to offer their customers with advanced analog & digital IC development tools in order strengthen their market presence specifically to the desired end-user industry market.

Analog Devices Inc., Global Mixed-mode Technology Inc., Infineon Technologies AG, and others are analog & digital ICs market leaders. The following are recent analog & digital ICs market developments:

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 7.3% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Type, Enterprise, Industry, Region |

| Regional scope | North America; Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia and New Zealand |

| Country scope | USA; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Belgium; Poland; Czech Republic; China; India; Japan; Australia; Brazil; Argentina; Colombia; Saudi Arabia; UAE; Iran; South Africa |

| Key companies profiled | Analog Devices Inc., Global Mixed-mode Technology Inc., Infineon Technologies AG, etc |

| Customization scope | Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global analog & digital ic development tools market is estimated to be valued at USD 445.6 billion in 2025.

It is projected to reach USD 901.4 billion by 2035.

The market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types are amplifier ic development tools, active filter development tools and others.

large enterprise segment is expected to dominate with a 58.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analog Phase Shifter Market Size and Share Forecast Outlook 2025 to 2035

Analog to Digital Converter Market Size and Share Forecast Outlook 2025 to 2035

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Special-Purpose Analog-to-Digital Converters (ADCs) Market Forecast and Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

USA & Canada Cat Litter Market Growth, Demand, and Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

USA & Canada Portable Air Conditioner Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA