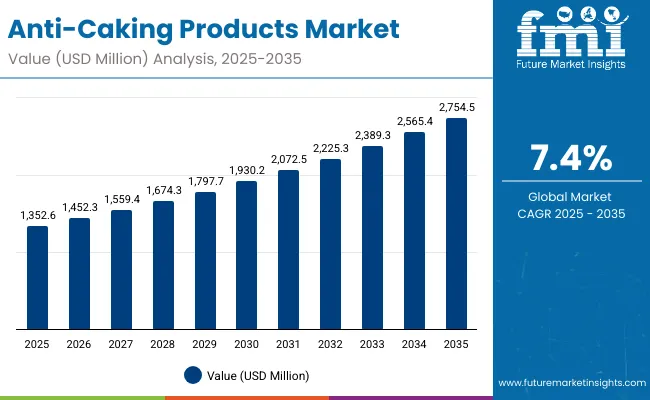

A valuation of USD 1,352.6 million has been projected for the Anti-Caking Products market in 2025, which is anticipated to reach USD 2,754.5 million by 2035. This represents a near doubling of value within ten years, underpinned by a CAGR of 7.4%.

Anti-Caking Products Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Caking Products Market Estimated Value in (2025E) | USD 1,352.6 million |

| Anti-Caking Products Market Forecast Value in (2035F) | USD 2,754.5 million |

| Forecast CAGR (2025 to 2035) | 7.40% |

The market expansion will translate into an incremental growth of over USD 1,400 million, reflecting robust adoption of advanced functional ingredients in formulation industries. The increasing emphasis on powder stability, moisture resistance, and flow optimization is expected to act as the principal driver of this long-term expansion.

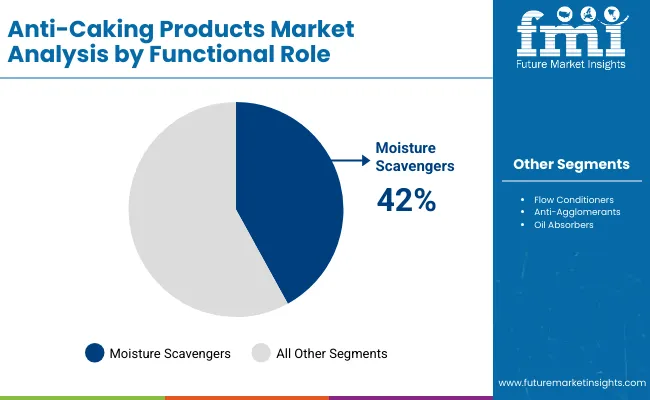

During the initial phase between 2025 and 2030, the market is expected to advance from USD 1,352.6 million to USD 1,930.2 million, adding USD 577.6 million, which will contribute nearly 41% of the total decade growth. This period will be shaped by consistent uptake in color cosmetics and haircare formulations, where moisture scavenging and controlled particle engineering are projected to dominate. Moisture scavengers alone are forecast to account for 42% share of the market in 2025, reflecting their critical role in preserving texture and ensuring smooth dispersion across powders.

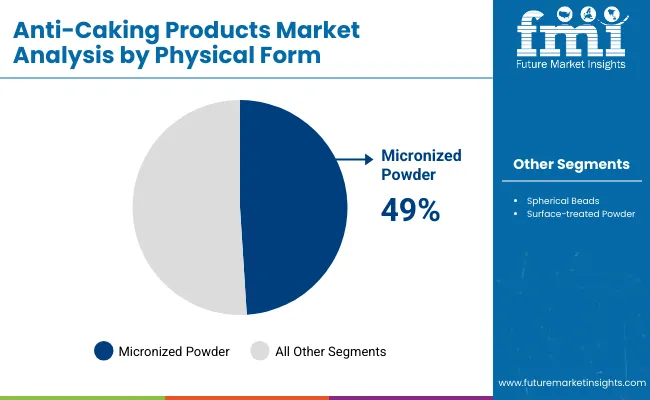

In the second phase from 2030 to 2035, the market is forecast to expand from USD 1,930.2 million to USD 2,754.5 million, contributing USD 824.3 million, or 59% of total growth over the decade. Strong acceleration in demand is anticipated as micronized powders, representing 49% of the 2025 market, gain wider application in premium formulations. Sustainable sourcing of silica and silicate systems is expected to reinforce competitive positioning, while evolving compliance frameworks will push suppliers toward higher quality assurance and documentation standards.

From 2020 to 2024, steady groundwork was laid for the global Anti-Caking Products market as cosmetic and personal care manufacturers adopted engineered raw materials to stabilize powders and extend shelf-life. By 2025, demand is expected to reach USD 1,352.6 million, setting the stage for a decade of accelerated adoption. Moisture scavengers will dominate, reflecting their indispensability in high-performance powder formulations.

By 2035, market value is projected to double to USD 2,754.5 million, with incremental gains fueled by the expansion of premium beauty, haircare, and body care segments. The United States, India, and Japan are expected to emerge as the fastest-growing markets, while Europe will retain a compliance-led, innovation-driven role. Competition is anticipated to remain moderately fragmented, with Evonik leading at 8.5% share in 2025, while other global and regional players diversify through sustainability credentials and advanced particle-engineering capabilities.

The growth of the Anti-Caking Products market is being driven by rising formulation demands in the cosmetics and personal care industries, where consistent powder performance has become critical. Increasing reliance on moisture scavengers and micronized powders is expected to ensure stability, smooth texture, and longer shelf-life of finished products.

Expansion in premium beauty and haircare categories is projected to intensify adoption, as manufacturers seek ingredients that deliver better flow, dispersion, and consumer appeal. Regulatory emphasis on safety and quality compliance is anticipated to encourage procurement of high-purity and well-documented raw materials.

Strong momentum is also being supported by regional growth, with India and Japan witnessing exceptional expansion rates, while the USA sustains robust uptake in advanced formulations. Innovation in sustainable silica and silicate systems is forecast to further strengthen long-term opportunities. Overall, the market is being advanced by evolving formulation standards, consumer preference shifts, and supplier innovation pipelines.

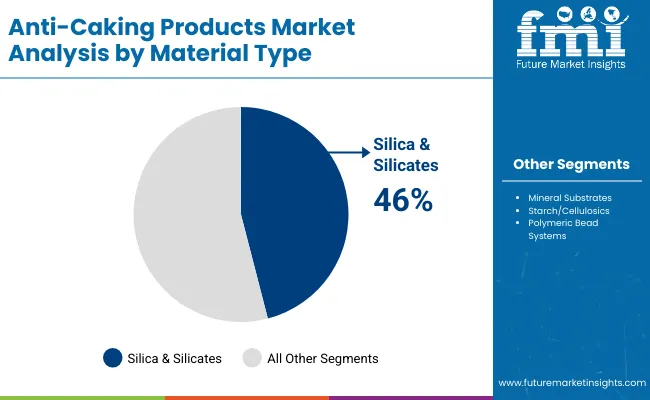

The Anti-Caking Products market has been segmented based on functional role, material type, and physical form, highlighting the key specifications influencing procurement and formulation decisions. Each category represents a unique contribution to the stability, performance, and quality of powder-based products in cosmetics and personal care. Moisture scavengers are positioned to lead by functionality, silica and silicates dominate by material type, while micronized powders capture strong demand within physical form.

The segmentation underscores the criticality of ingredient selection in enhancing powder handling, preventing clumping, and ensuring superior consumer experience. This outlook provides a forward-looking perspective on how each segment will drive value creation and sustain competitive advantage in the market.

| Functional Role | Market Value Share, 2025 |

|---|---|

| Moisture scavengers | 42% |

| Others | 58.0% |

Moisture scavengers are projected to hold a 42% share in 2025, valued at USD 588.9 million, dominating the functional role segment. Their leadership is expected to be sustained by their ability to protect powder formulations from clumping and quality deterioration during storage and handling.

Enhanced shelf stability, consistent flow, and improved end-product performance are anticipated to keep demand strong across cosmetic and personal care applications. Other roles, including flow conditioners, anti-agglomerants, and oil absorbers, will collectively capture a larger 58% share, equal to USD 784.51 million. While these roles are more diversified, steady growth is forecast as complex formulations require multi-functional performance. Increasing regulatory pressure and higher formulation standards are expected to secure long-term relevance for this segment.

| Material Type | Market Value Share, 2025 |

|---|---|

| Silica & silicates | 46% |

| Others | 54.0% |

Silica and silicates are expected to command a 46% share in 2025, equal to USD 566.7 million, making them the largest material type. Their appeal is attributed to strong moisture absorption, superior flow properties, and compliance with regulatory frameworks, which make them critical in cosmetic powders. Adoption is anticipated to intensify as engineered grades and customized particle solutions gain traction across foundations, blush, and haircare applications.

Other material types, holding a larger 54% share at USD 730.40 million, will expand through mineral substrates, starch-based, and polymeric alternatives. These categories are forecast to benefit from sustainability-led sourcing and rising innovation pipelines. Long-term differentiation is likely to depend on balancing cost efficiency with sustainable value propositions that meet evolving buyer priorities.

| Physical Form | Market Value Share, 2025 |

|---|---|

| Micronized powder | 49% |

| Others | 51.0% |

Micronized powder is anticipated to lead with a 49% share in 2025, representing USD 533.3 million, underscoring its dominance in physical form. Its preference is supported by superior blending, smooth texture, and uniform dispersion, making it highly suitable for premium formulations in color cosmetics and haircare. Consistent performance and enhanced consumer sensorial experience are expected to strengthen its adoption.

Other physical forms will represent a slightly higher 51% share at USD 689.83 million, with spherical and surface-treated powders gaining momentum for niche applications requiring specialized texture or sensory benefits. Long-term traction is projected to come from continuous advances in particle engineering and a strong push for customized solutions that align with performance-driven formulations.

Growing formulation complexity and stricter quality standards are reshaping the Anti-Caking Products market, even as cost volatility and compliance requirements pose hurdles. Demand is being guided by evolving consumer expectations, innovation in particle engineering, and sustainability-linked sourcing strategies across industries.

Expansion of performance-driven formulations in premium categories

The market is being advanced by the increasing specification of Anti-Caking Products in high-value cosmetic and personal care lines, where flow uniformity and moisture resilience are considered non-negotiable. Procurement strategies are expected to prioritize documentation-rich, engineered grades that safeguard product aesthetics and performance.

This shift is forecast to generate sustained demand for tailored raw materials capable of meeting the elevated compliance and sensory benchmarks imposed by global brands. Long-term growth will likely be reinforced by the alignment of supplier innovation pipelines with premiumization trends, ensuring that ingredient functionality translates directly into improved consumer perception and extended product shelf-life. As a result, competitive advantage will rest on delivering proven value-in-use, rather than lowest-cost supply.

Integration of sustainability-linked ingredient portfolios

A significant trend shaping the Anti-Caking Products market is the integration of sustainability credentials into ingredient selection, where life cycle transparency and renewable energy usage in production are increasingly emphasized. Buyers are expected to reward suppliers who demonstrate measurable reductions in carbon intensity, water footprint, and overall environmental impact of silica and mineral-based systems.

Beyond compliance, these sustainability markers are being embedded into procurement scorecards, influencing vendor qualification and long-term sourcing partnerships. This trend is anticipated to accelerate as consumer-facing brands push sustainability narratives into their formulations, forcing raw material suppliers to substantiate claims with verifiable data. Over the coming decade, differentiation in the market will be increasingly determined by the ability to align technical performance with credible environmental accountability.

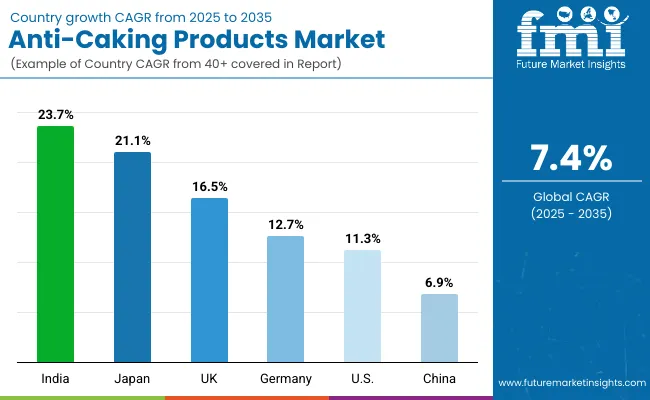

| Country | CAGR |

|---|---|

| China | 6.9% |

| USA | 11.3% |

| India | 23.7% |

| UK | 16.5% |

| Germany | 12.7% |

| Japan | 21.1% |

The global Anti-Caking Products market demonstrates varying growth trajectories across key countries, shaped by differences in formulation maturity, compliance requirements, and consumer demand for high-performance personal care products. India is forecast to emerge as the fastest-growing country, with a CAGR of 23.7% between 2025 and 2035.

This rapid expansion is expected to be supported by rising investments in cosmetics manufacturing, expansion of local ingredient supply chains, and increasing adoption of advanced powders in mass-market products. Japan, with a projected CAGR of 21.1%, is anticipated to reinforce its role as a premium-driven market, where innovation in texture performance and compliance with stringent safety standards will drive strong demand.

The USA market is forecast to grow at 11.3% CAGR, reflecting consistent demand for Anti-Caking Products in high-value formulations, particularly in color cosmetics and skincare. Germany and the UK, recording CAGRs of 12.7% and 16.5% respectively, are expected to sustain momentum through innovation hubs and strong regulatory oversight that prioritize safety and product performance.

Europe overall, at 7.5% CAGR, is anticipated to remain compliance-led, while China, growing at 6.9%, will continue to benefit from scaled manufacturing, though at a slower pace. Collectively, these country-level dynamics illustrate how diverse drivers are shaping the competitive landscape of the global market.

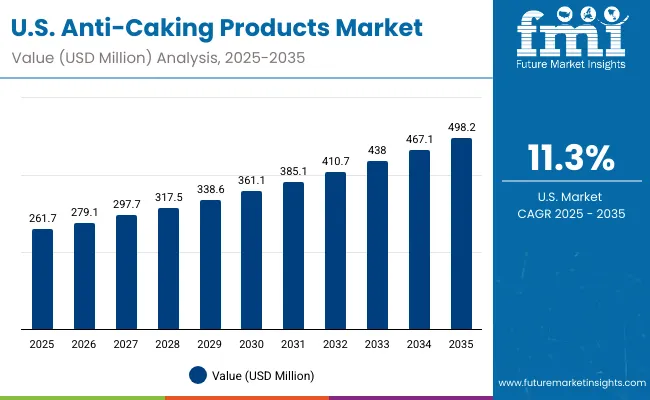

| Year | USA Anti-Caking Products Market (USD Million) |

|---|---|

| 2025 | 261.75 |

| 2026 | 279.15 |

| 2027 | 297.71 |

| 2028 | 317.50 |

| 2029 | 338.61 |

| 2030 | 361.12 |

| 2031 | 385.13 |

| 2032 | 410.73 |

| 2033 | 438.04 |

| 2034 | 467.16 |

| 2035 | 498.22 |

The Anti-Caking Products market in the United States is projected to grow at a CAGR of 6.6% between 2025 and 2035, with demand expected to be shaped by the advanced cosmetic and personal care sector. Strong reliance on engineered powders in color cosmetics and skincare has been observed, where moisture scavengers continue to play a dominant role.

The market outlook is expected to be reinforced by regulatory compliance, with suppliers required to deliver high-purity, batch-consistent, and fully documented materials. Adoption is anticipated to gain further traction as premium brands prioritize particle uniformity, extended shelf-life, and superior consumer sensorials. Growing emphasis on sustainable sourcing will also be central, with certifications and traceable raw material inputs becoming part of procurement scorecards.

The Anti-Caking Products market in the UK is projected to expand at a CAGR of 16.5% between 2025 and 2035, supported by strong consumer adoption of premium personal care products. Market growth is expected to be reinforced by innovation hubs that prioritize ingredient safety, texture performance, and clean-label positioning.

Increasing reliance on advanced powder formulations across cosmetics and haircare categories has been observed, where micronized powders deliver superior dispersion and finish. Regulatory compliance under European frameworks is anticipated to shape procurement practices, requiring suppliers to provide robust documentation and sustainable sourcing pathways. The outlook suggests long-term resilience as premiumization trends align with advanced ingredient innovation.

The Anti-Caking Products market in India is forecast to record a remarkable CAGR of 23.7% between 2025 and 2035, making it the fastest-growing global market. Growth is anticipated to be fueled by expanding domestic manufacturing capacities and the rising integration of engineered raw materials in mass-market formulations.

Rapid consumer demand for affordable cosmetics and body care products is projected to create large-scale adoption of anti-caking solutions. Procurement strategies are expected to evolve toward sourcing cost-effective yet compliant solutions, with international players partnering local suppliers to strengthen distribution. Increasing awareness of product quality and shelf stability is anticipated to reinforce long-term adoption.

The Anti-Caking Products market in China is projected to expand at a CAGR of 6.9% between 2025 and 2035, reflecting steady but slower growth relative to other Asian markets. Market performance is expected to be shaped by large-scale production capacities and established supply chains that support cosmetics and haircare manufacturing.

Domestic suppliers are anticipated to maintain dominance, with cost competitiveness and widespread availability driving adoption. While silica-based solutions remain important, diversification toward alternative material types is being observed, reflecting both sustainability and performance considerations. Export-oriented production is likely to reinforce demand for high-volume, specification-ready inputs.

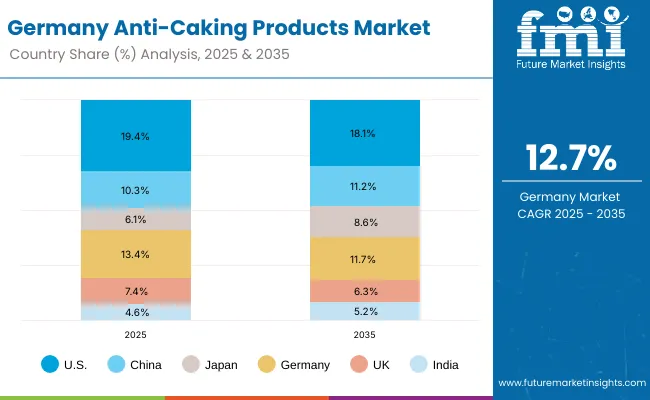

| Countries | 2025 |

|---|---|

| USA | 19.4% |

| China | 10.3% |

| Japan | 6.1% |

| Germany | 13.4% |

| UK | 7.4% |

| India | 4.6% |

| Countries | 2035 |

|---|---|

| USA | 18.1% |

| China | 11.2% |

| Japan | 8.6% |

| Germany | 11.7% |

| UK | 6.3% |

| India | 5.2% |

The Anti-Caking Products market in Germany is expected to grow at a CAGR of 12.7% between 2025 and 2035, supported by its role as Europe’s leading innovation hub for cosmetics and personal care ingredients. Demand is projected to be shaped by strict regulatory frameworks that emphasize safety, sustainability, and transparency.

German manufacturers are anticipated to lead in adopting advanced anti-caking solutions that improve product quality and ensure compliance. Strong emphasis on sustainable raw materials and lifecycle transparency is forecast to elevate demand for silica alternatives and eco-certified systems. The country is positioned as a key driver of innovation-led growth within Europe.

| USA by Functional Role | Market Value Share, 2025 |

|---|---|

| Moisture scavengers | 47% |

| Others | 53.0% |

The Anti-Caking Products market in the United States is projected at USD 261.75 million in 2025. Moisture scavengers contribute 47% of the total, equivalent to USD 123.0 million, while other functional roles hold 53%, or USD 138.73 million. This near-balanced split highlights how diverse formulation requirements are influencing adoption across categories. The strength of moisture scavengers is expected to lie in their ability to protect powders against humidity-driven degradation, delivering consistency and shelf stability that remain essential for color cosmetics and haircare.

Other roles, encompassing flow conditioners and anti-agglomerants, are anticipated to grow as processing efficiency and multi-functionality gain importance for large-scale manufacturing. Long-term procurement strategies are expected to emphasize reliability, regulatory compliance, and documented performance, ensuring that both primary and secondary functionalities continue to capture significant demand.

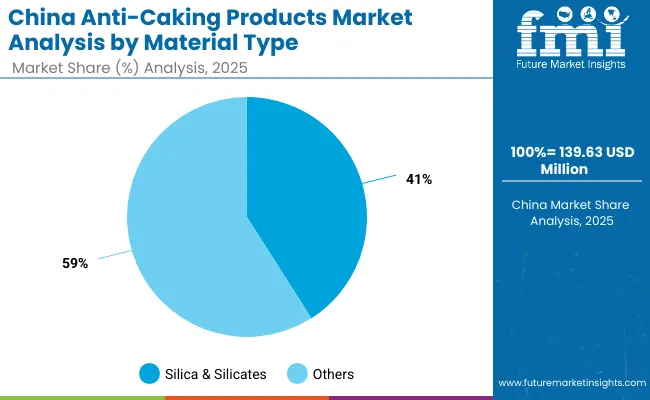

| China by Material Type | Market Value Share, 2025 |

|---|---|

| Silica & silicates | 41% |

| Others | 59.0% |

The Anti-Caking Products market in China is projected at USD 139.63 million in 2025. Silica and silicates are expected to contribute 41% of this value, equal to USD 57.2 million, while other material types collectively account for 59%, representing USD 82.38 million. The balance of adoption indicates a clear preference for diversified material bases beyond silica, reflecting cost efficiency and broader supplier availability.

Silica and silicates are anticipated to retain importance due to their established role in moisture absorption and flow enhancement, though competition from mineral and starch-based alternatives is projected to intensify as sustainability and affordability gain weight in procurement. Over the long term, the market is expected to evolve toward a dual-track model, where premium formulations continue to rely on silica systems while high-volume, cost-sensitive applications increasingly favor alternatives.

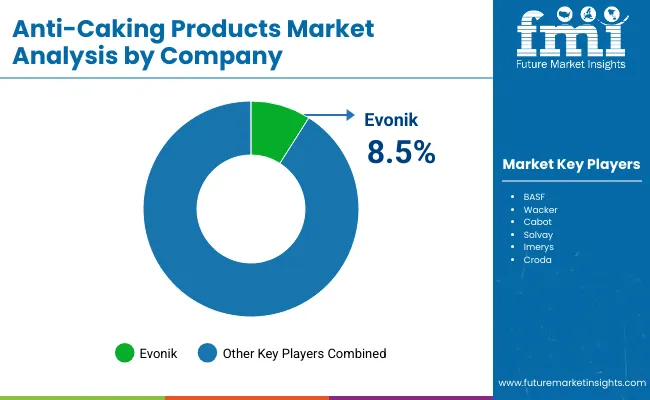

| Company | Global Value Share 2025 |

|---|---|

| Evonik | 8.5% |

| Others | 91.5% |

The Anti-Caking Products market is moderately fragmented, with global leaders, mid-sized ingredient suppliers, and niche-focused players competing across diverse application areas. Global leaders such as Evonik, BASF, and Wacker are positioned strongly, with Evonik holding the largest global share of 8.5% in 2025.

Their advantage is expected to be reinforced by expertise in silica and silicate systems, well-documented compliance support, and integration of sustainability-linked innovation pipelines. Their portfolios are anticipated to remain critical for premium formulations in cosmetics and personal care.

Mid-sized players including Imerys, Cabot, Croda, and Sensient are projected to strengthen adoption through cost-efficient solutions, broader regional supply footprints, and customization capabilities. Their competitive advantage is expected to lie in flexible distribution, local partnerships, and innovation in mineral substrates and biopolymer-based alternatives. These companies are anticipated to capture incremental demand as procurement strategies diversify beyond large incumbents.

Specialist players such as Clariant and Sumitomo are expected to focus on niche applications, offering tailored material formats and regionalized support. Their adaptability is projected to be valuable in markets emphasizing localized compliance and sustainability certifications.

Competitive differentiation in the Anti-Caking Products market is shifting away from commodity positioning toward integrated value offerings that include sustainability credentials, batch-to-batch consistency, and lifecycle transparency. Suppliers who align with evolving compliance, consumer safety, and sustainability priorities are projected to maintain long-term leadership.

Key Developments in Anti-Caking Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,352.6 million (2025) - USD 2,754.5 million (2035) |

| Functional Role | Moisture scavengers, Flow conditioners, Anti-agglomerants, Oil absorbers |

| Material Type | Silica & silicates, Mineral substrates, Starch/cellulosics, Polymeric bead systems |

| Physical Form | Micronized powder, Spherical beads, Surface-treated powder |

| Particle Size Class | Sub-10 µm, 10-30 µm, Above 30 µm |

| Application | Loose & pressed powders, Foundations & blush, Dry shampoos & hair powders, Bath & body powders |

| End-use Industry | Color cosmetics, Haircare, Bath & body |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, United Kingdom, Germany, Japan, France, Brazil, South Korea |

| Key Companies Profiled | Evonik, BASF, Wacker, Cabot, Solvay, Imerys, Croda, Sensient, Clariant, Sumitomo |

| Additional Attributes | Dollar sales by functional role, material type, and physical form; growing adoption in premium beauty and mass-market products; sustainability-driven procurement in silica and silicates; innovation in micronized powders for texture performance; regional trends in India, Japan, and the USA; compliance-driven adoption in Europe; fragmented competition outside top leaders. |

The global Anti-Caking Products Market is estimated to be valued at USD 1,352.6 million in 2025.

The market size for the Anti-Caking Products Market is projected to reach USD 2,754.5 million by 2035.

The Anti-Caking Products Market is expected to grow at a CAGR of 7.4% between 2025 and 2035.

The key product types in the Anti-Caking Products Market are silica & silicates, mineral substrates, starch/cellulosics, and polymeric bead systems.

In terms of functional role, the moisture scavengers segment is expected to command a 42% share in the Anti-Caking Products Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Caking Makeup Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Ziplock Products Market Size and Share Forecast Outlook 2025 to 2035

Global Moringa Products Market Outlook – Trends, Demand & Forecast 2025–2035

Corn Co-Products Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA