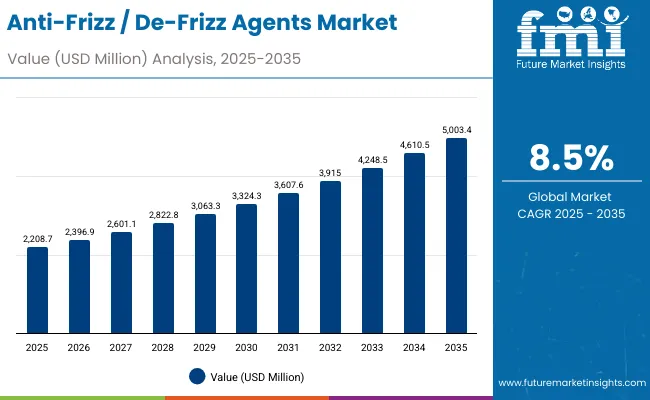

The Anti-Frizz / De-Frizz Agents Market is expected to record a valuation of USD 2,208.7 million in 2025 and USD 5,003.4 million in 2035, with an increase of USD 2,794.7 million, which equals a growth of 126% over the decade. The overall expansion represents a CAGR of 8.5% and a 2.3X increase in market size.

Anti-Frizz / De-Frizz Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Frizz / De-Frizz Agents Market Estimated Value in (2025E) | USD 2,208.7 million |

| Anti-Frizz / De-Frizz Agents Market Forecast Value in (2035F) | USD 5,003.4 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

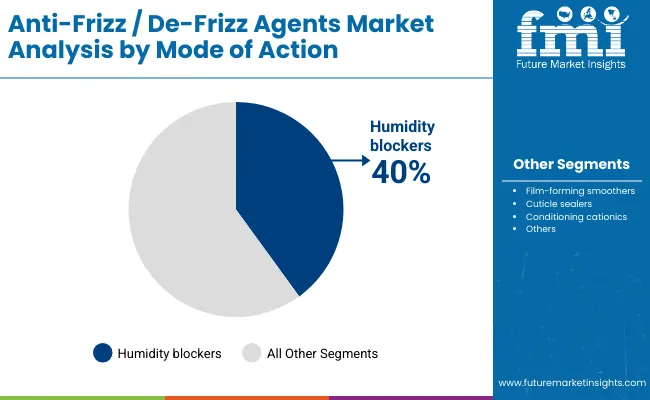

During the first five-year period from 2025 to 2030, the market increases from USD 2,208.7 million to USD 3,324.3 million, adding USD 1,115.6 million, which accounts for 40% of the total decade growth. This phase records steady adoption in hair styling and conditioning care segments, driven by rising awareness around humidity protection and premiumization of leave-in creams and serums. Humidity blockers dominate this period as they cater to over 40% of global usage, especially in tropical and high-humidity regions where frizz is a persistent concern. Silicone-free polymers also strengthen their position during this period, benefitting from the global "clean beauty" movement.

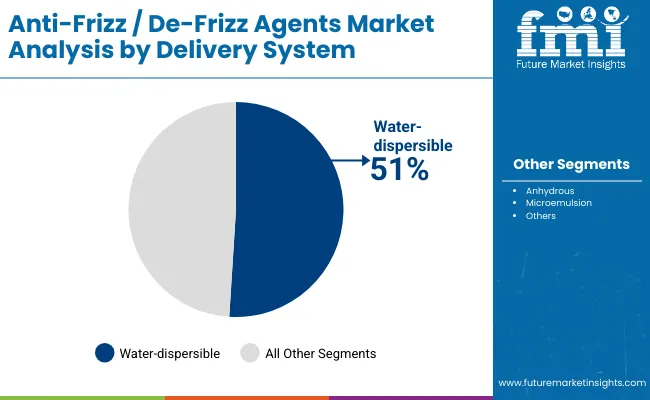

The second half from 2030 to 2035 contributes USD 1,679.1 million, equal to 60% of total growth, as the market jumps from USD 3,324.3 million to USD 5,003.4 million. This acceleration is powered by widespread deployment of advanced delivery systems such as microemulsions and amino acid/peptide-based systems that claim long-lasting conditioning and repair. Water-dispersible solutions retain dominance, accounting for 51% share, while emulsion-based and powder formats expand with innovation in lightweight styling sprays and multifunctional masks. Botanical oils and esters are increasingly integrated into premium products, boosting the natural formulations share. The decade closes with stronger presence of treatment masks and multifunctional products that blur the lines between styling and care.

From 2020 to 2024, the Anti-Frizz / De-Frizz Agents Market grew from USD 1,756.2 million to USD 2,050.0 million, driven by silicone-based and film-forming technologies that provided instant smoothness. During this period, the competitive landscape was dominated by specialty chemical manufacturers controlling nearly 70% of revenue, with leaders such as Croda, BASF, and Dow focusing on high-performance ingredients for multinational haircare brands. Differentiation was largely based on cost-effectiveness, proven humidity resistance, and ability to integrate into mass-market conditioners and serums. Botanical actives and silicone-free solutions were still emerging, contributing less than 20% of the total market value.

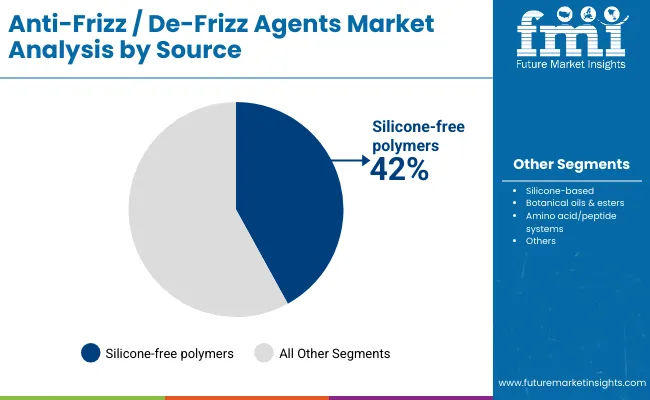

Demand for anti-frizz and de-frizz agents expands significantly to USD 2,208.7 million in 2025, and the revenue mix begins to shift toward silicone-free polymers (42% share) and water-dispersible delivery systems (51% share). Traditional silicone-based leaders face increasing competition from formulators offering natural, biodegradable, and clean-label solutions. Major suppliers are pivoting to hybrid formulations, integrating botanical esters and amino acid systems with tried-and-tested silicones to maintain performance while meeting regulatory and consumer demands. Emerging entrants specializing in sustainable polymers, peptide complexes, and biotech-derived actives are gaining share. The competitive advantage is shifting away from silicone dominance to portfolio diversification, regulatory compliance, and marketing alignment with wellness and sustainability narratives.

Advances in conditioning polymers and humidity-blocking technologies have significantly improved frizz control, allowing for more consistent and long-lasting results across diverse climates. Humidity blockers have gained popularity due to their ability to protect cuticles from moisture absorption, making them the go-to agents for leave-in creams and styling sprays. The rise of silicone-free systems has contributed to cleaner formulations and greater appeal among eco-conscious consumers. Industries such as mass haircare, premium salon brands, and emerging clean beauty labels are driving adoption of de-frizzing agents that can seamlessly fit into rinse-off conditioners, serums, and multifunctional masks.

Expansion of sustainable and multifunctional haircare solutions has fueled market growth. Innovations in water-dispersible and microemulsion delivery systems, coupled with peptide-based cuticle repair, are opening new application areas in premium and professional haircare. Segment growth is expected to be led by humidity blockers in mode of action, silicone-free polymers in source, and water-dispersible systems in delivery category, due to their versatility, consumer appeal, and ability to meet evolving regulatory and sustainability standards.

The market is segmented by mode of action, source, delivery system, physical form, application, end use, and geography. By mode of action, categories include film-forming smoothers, humidity blockers, cuticle sealers, and conditioning cationics, reflecting the core chemistries driving anti-frizz efficacy. Source classification covers silicone-based, silicone-free polymers, botanical oils & esters, and amino acid/peptide systems, showing the shift from conventional silicones to clean-label alternatives. Delivery system segmentation includes water-dispersible, anhydrous, and microemulsion formats, offering flexibility in formulation design.

By physical form, the market is divided into solution/concentrate, emulsion, and powder, addressing diverse product integration needs. Application-wise, the scope spans leave-in creams & serums, rinse-off conditioners, styling sprays, and masks, highlighting mainstream and specialized end uses. End-use segmentation features hair styling, conditioning care, and treatment masks. Regionally, the Anti-Frizz / De-Frizz Agents Market covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa, with USA, India, Japan, Germany, UK, and China emerging as high-growth markets.

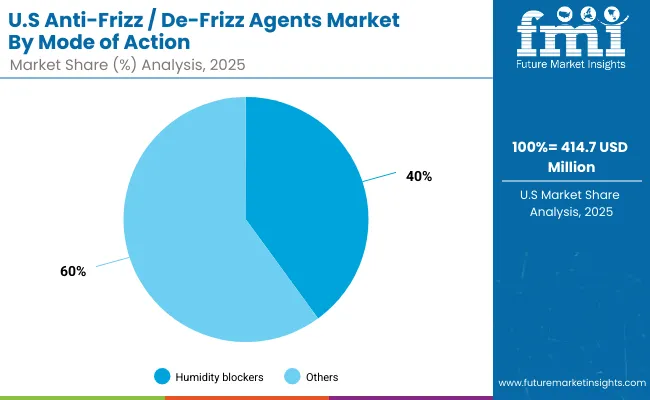

| Mode of Action | Value Share% 2025 |

|---|---|

| Humidity blockers | 40% |

| Others | 60.0% |

The humidity blockers segment is projected to contribute 40% of the Anti-Frizz / De-Frizz Agents Market revenue in 2025, maintaining its lead as the dominant category. This is driven by consumer demand in humid and tropical regions where frizz control remains a primary concern. Humidity blockers provide a protective barrier that prevents moisture from penetrating the hair shaft, ensuring smoother and longer-lasting styling results.

The segment’s growth is also supported by its integration in leave-in creams, serums, and sprays, which are increasingly adopted in both premium and mass-market haircare. As brands emphasize climate-adaptive beauty solutions, humidity blockers are evolving with advanced formulations that combine performance with lightweight, non-greasy textures. This category is expected to remain the backbone of anti-frizz solutions, aligning with both consumer expectations and industry innovation.

| Source | Value Share% 2025 |

|---|---|

| Silicone-free polymers | 42% |

| Others | 58.0% |

The silicone-free polymers segment is forecasted to hold 42% of the Anti-Frizz / De-Frizz Agents Market share in 2025, driven by the rising clean beauty trend and growing consumer preference for sustainable alternatives. These polymers provide smoothness, conditioning, and frizz control without the buildup concerns often associated with silicones.

Their adoption has been accelerated by increasing regulatory scrutiny on non-biodegradable silicones and strong consumer awareness of eco-friendly solutions. Silicone-free polymers are also versatile, finding use in leave-in treatments, conditioners, and lightweight styling sprays. The segment’s growth is further bolstered by advanced polymer chemistries that deliver performance parity with traditional silicones while offering biodegradability. This positions silicone-free systems as the future growth driver of the market.

| Delivery System | Value Share% 2025 |

|---|---|

| Water-dispersible | 51% |

| Others | 49.0% |

The water-dispersible segment is projected to account for 51% of the Anti-Frizz / De-Frizz Agents Market revenue in 2025, making it the leading delivery system category. Its dominance is supported by ease of formulation, compatibility with diverse product formats, and excellent stability in rinse-off and leave-in haircare solutions.

Water-dispersible systems enable consistent performance and are favored by formulators for their ability to blend seamlessly with active agents and conditioning cationics. The segment’s growth is enhanced by increasing adoption in mass-market conditioners, serums, and sprays, where performance and convenience are top priorities. With rising innovation in multifunctional products that combine frizz control with nourishment, water-dispersible systems are expected to retain their leadership position through the forecast period.

Climate-Responsive Haircare Demand in Humid and Tropical Regions

One of the strongest drivers for the Anti-Frizz / De-Frizz Agents Market is the climate-responsive demand for haircare solutions in high-humidity regions such as Southeast Asia, India, and Latin America. Consumers in these geographies struggle with persistent frizz due to moisture absorption into the hair shaft, which compromises styling and leads to higher product usage. Humidity blockers, holding 40% share of the market in 2025, directly address this challenge. As urbanization grows in these regions, exposure to fluctuating weather conditions (outdoor humidity combined with indoor air conditioning) amplifies the need for products that provide round-the-clock protection. This is leading global brands to localize formulations for instance, tailoring serums and sprays specifically tested in tropical climates which significantly boosts market adoption.

Shift Toward Silicone-Free, Sustainable Polymers

A second major driver is the regulatory and consumer-led shift toward silicone-free polymers, which already account for 42% share in 2025. Growing restrictions on non-biodegradable silicones in the EU and heightened scrutiny around environmental impact are forcing brands to invest in new chemistries. Silicone-free polymers not only offer biodegradability but also deliver lightweight conditioning and enhanced sensory profiles, aligning with "green chemistry" principles.

This is particularly important for multinational brands that want to future-proof formulations against evolving compliance standards. Beyond regulation, younger consumer cohorts (Millennials and Gen Z) are actively seeking "sustainable haircare" solutions, which has led to rapid innovation in amino acid/peptide-based systems and botanical ester complexes. This driver ensures long-term replacement of legacy silicones with advanced alternatives.

Cost Pressure of Advanced Formulations

While consumer demand is high, the market faces a restraint in the cost of next-generation formulations, particularly silicone-free polymers and peptide systems. Developing sustainable, high-performance anti-frizz actives requires significant R&D investment and specialized raw materials, which drive up production costs. This creates a price gap compared to traditional silicones, making adoption slower in cost-sensitive markets such as South Asia and Africa. Mass-market brands struggle to balance affordability with sustainability, and this cost imbalance may limit large-scale penetration of premium agents outside high-income consumer bases.

Performance Perception Gap Between Silicones and Alternatives

Despite regulatory and sustainability shifts, many consumers and salon professionals still perceive silicones as superior in delivering instant smoothness and long-lasting results. While silicone-free polymers and botanical systems are advancing, they often require optimized formulations and combinations to achieve equivalent performance, especially under extreme humidity. This perception gap poses a restraint, as professional stylists and premium consumers may continue to favor silicone-based products until alternatives prove their efficacy consistently. Bridging this gap will require extensive education campaigns, claims validation, and large-scale clinical testing, all of which add time and cost to market adoption.

Microemulsion-Based Delivery for Multifunctional Haircare

A major trend is the rise of microemulsion delivery systems, which are increasingly used to disperse anti-frizz actives in multifunctional products. Unlike traditional solutions, microemulsions allow even distribution of conditioning agents at the nano-level, improving cuticle penetration and long-lasting frizz protection. They also support the incorporation of multiple active systems (e.g., humidity blockers + botanical oils) into lightweight sprays and masks without greasiness. This trend is particularly strong in professional haircare brands, where formulators market these products as "next-gen smoothness and repair solutions." By 2030-2035, microemulsions are expected to capture double-digit growth, transforming the way frizz-control actives are delivered.

Hybridization of Styling and Treatment Masks

Another key trend is the hybridization of anti-frizz solutions into treatment masks that blur the line between styling and care. Traditionally, anti-frizz was seen as a styling concern, addressed with serums and sprays. However, growing consumer demand for holistic hair wellness is pushing brands to integrate frizz control into deep-conditioning masks and treatment products. These masks not only smooth the hair but also repair damage, improve elasticity, and protect against humidity in a single format. Premium brands in the USA, Japan, and Europe are actively marketing such multifunctional masks, which resonate with time-strapped consumers seeking "all-in-one" hair solutions. This trend is set to reshape the application landscape, reducing reliance on single-function styling products.

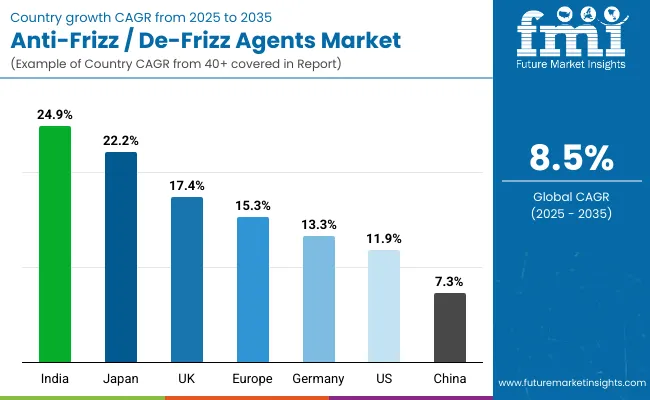

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 7.3% |

| USA | 11.9% |

| India | 24.9% |

| UK | 17.4% |

| Germany | 13.3% |

| Japan | 22.2% |

| Europe | 15.3% |

The Anti-Frizz / De-Frizz Agents Market demonstrates sharp variation in growth rates across countries, reflecting differences in consumer behavior, climate conditions, and regulatory environments. India leads with a CAGR of 24.9%, as rising disposable incomes, urban humidity issues, and strong cultural preference for smooth, well-groomed hair fuel demand for leave-in serums and silicone-free formulations. Japan follows closely at 22.2% CAGR, with consumers increasingly adopting biotech-driven, peptide-based solutions that align with the country’s premium haircare segment. The USA at 11.9% CAGR continues to dominate in absolute value, benefiting from innovation in humidity-blocking sprays and salon-driven product launches, while also driving the global shift toward multifunctional masks and clean-label products.

European markets such as the UK (17.4% CAGR), Germany (13.3% CAGR), and the broader European region (15.3% CAGR) are experiencing robust expansion, propelled by strong demand for sustainable, silicone-free polymers and compliance with stringent EU cosmetic regulations. In contrast, China grows steadily at 7.3% CAGR, reflecting its gradual shift from mass-market silicone-based products to more advanced and natural formulations, though consumer education remains a challenge. Together, these country-level dynamics highlight how emerging markets like India and Japan are driving rapid innovation-led growth, while mature markets such as the USA and Europe are reinforcing the global pivot toward sustainable, premium, and climate-adaptive anti-frizz solutions.

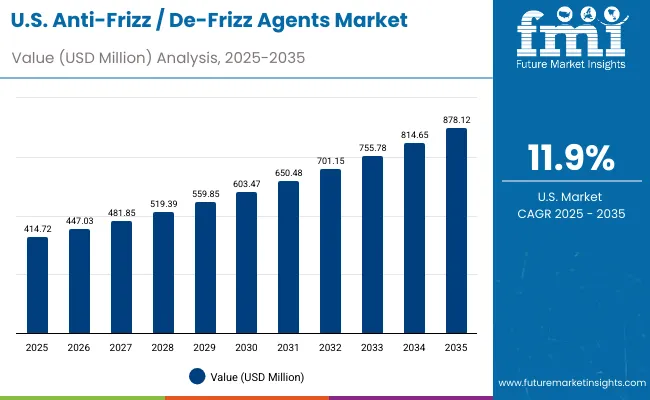

| Year | USA Anti-Frizz / De-Frizz Agents Market (USD Million) |

|---|---|

| 2025 | 414.72 |

| 2026 | 447.03 |

| 2027 | 481.85 |

| 2028 | 519.39 |

| 2029 | 559.85 |

| 2030 | 603.47 |

| 2031 | 650.48 |

| 2032 | 701.15 |

| 2033 | 755.78 |

| 2034 | 814.65 |

| 2035 | 878.12 |

The Anti-Frizz / De-Frizz Agents Market in the United States is projected to grow at a CAGR of 11.9%, led by increased consumer spending on premium haircare and salon-driven styling solutions. Humidity blockers are the top-performing mode of action, holding 40% of market value, as American consumers increasingly seek long-lasting styling sprays and serums that protect hair in variable climates. The rise of silicone-free polymers is reshaping demand, with clean-label conditioners and sprays gaining traction in the USA retail and salon channels. Innovation in delivery systems, such as lightweight emulsions and microemulsions, is also enhancing uptake. Mass brands are expanding into mid-premium formats, while salon professionals continue to influence high-value sales.

The Anti-Frizz / De-Frizz Agents Market in the United Kingdom is expected to grow at a CAGR of 17.4%, supported by applications in both retail-driven haircare and professional salon usage. Premiumization is a strong trend, with consumers seeking multifunctional leave-in creams and treatment masks that blend conditioning care with frizz reduction. The UK market is also shaped by the regulatory drive toward silicone-free, biodegradable polymers, which is pushing manufacturers to launch eco-certified formulations. Haircare brands are actively promoting botanical oils and peptide-based actives, targeting health-conscious and sustainability-driven buyers.

India is witnessing rapid growth in the Anti-Frizz / De-Frizz Agents Market, forecast to expand at a CAGR of 24.9% through 2035. Demand is driven by tropical and humid climate conditions, making frizz control a daily haircare priority for both urban and semi-urban consumers. Leave-in creams and serums are the fastest-growing application, favored for their affordability and ease of use. Mid-market haircare brands are aggressively launching products with humidity-blocking polymers at lower price points, widening access to a mass consumer base. Educational campaigns around silicone-free and herbal-infused products are strengthening consumer trust and accelerating premium adoption in metro cities.

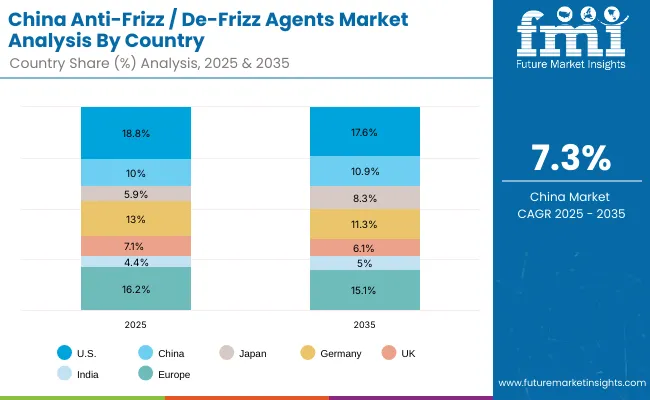

| Countries | 2025 Share (%) |

|---|---|

| USA | 18.8% |

| China | 10.0% |

| Japan | 5.9% |

| Germany | 13.0% |

| UK | 7.1% |

| India | 4.4% |

| Europe | 16.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.6% |

| China | 10.9% |

| Japan | 8.3% |

| Germany | 11.3% |

| UK | 6.1% |

| India | 5.0% |

| Europe | 15.1% |

The Anti-Frizz / De-Frizz Agents Market in China is expected to grow at a CAGR of 7.3%, the slowest among major economies but steady in long-term expansion. The market is shifting from silicone-based products, which dominate mass retail, to silicone-free polymers, holding 42% share in 2025. Regulatory pressure, along with consumer interest in natural, lightweight formulations, is influencing new product launches. Domestic brands are competitively priced, offering clean-label sprays and conditioners to younger consumers, particularly through e-commerce. Growth is also supported by premium salon chains that are adopting botanical oil- and peptide-based agents in professional treatment masks.

| USA by Mode of Action | Value Share% 2025 |

|---|---|

| Humidity blockers | 40% |

| Others | 60.0% |

The Anti-Frizz / De-Frizz Agents Market in the USA is projected at USD 414.7 million in 2025, growing at a CAGR of 11.9% through 2035. Humidity blockers dominate the USA segment with 40% market share, reflecting the country’s demand for sprays and serums that provide durable frizz protection across variable climates. This segment benefits from the popularity of quick-application styling solutions, supported by professional salon adoption and consumer preference for multifunctional leave-in products.

The growth trajectory is further strengthened by the rapid penetration of silicone-free polymers in the American market, especially within clean-label and eco-certified product lines. Brands are investing in hybrid formulations that combine humidity blockers with peptide systems and botanical oils, aligning with the country’s growing emphasis on sustainability and health-conscious grooming. The USA is expected to remain a trend-setting market, influencing global shifts in premium product positioning and salon-driven distribution.

| China by source | Value Share% 2025 |

|---|---|

| Silicone-free polymers | 42% |

| Others | 58.0% |

The Anti-Frizz / De-Frizz Agents Market in China is valued at USD 221.2 million in 2025, expanding at a CAGR of 7.3%, reflecting steady but slower growth compared to other Asian peers like India and Japan. Silicone-free polymers lead with 42% share, highlighting the regulatory push toward biodegradable, eco-friendly solutions. These polymers are finding rapid adoption in mid-premium conditioners and sprays, particularly within urban centers where clean beauty trends resonate with younger consumers.

China’s growth outlook is supported by e-commerce platforms, which have become the dominant channel for new product launches, enabling local brands to compete directly with global giants. The affordability of domestic formulations, combined with consumer preference for lighter, non-greasy products, is sustaining volume expansion. However, performance perception gaps versus traditional silicones continue to challenge premium adoption. Going forward, innovation in botanical oil blends and amino acid/peptide systems will define how the Chinese market balances sustainability with efficacy.

The Anti-Frizz / De-Frizz Agents Market is moderately fragmented, with leading multinational specialty chemical companies, mid-sized innovators, and niche providers competing across diverse product applications. Croda leads with 8.4% global share in 2025, strengthened by its advanced silicone-free polymer technologies and strong collaborations with premium haircare brands.

Other global leaders such as Evonik, BASF, Dow, Solvay, Ashland, and Givaudan Active Beauty are consolidating their presence through innovation in peptide-based systems, botanical oils, and multifunctional formulations that combine conditioning and frizz control. Their strategies increasingly focus on aligning product portfolios with regulatory compliance and consumer demand for sustainability.

Mid-sized players including Inolex and Momentive are carving niches in silicone-free, eco-certified solutions and lightweight emulsions, making them highly relevant for clean beauty and professional salon segments. Their agility allows quicker market adaptation, particularly in North America and Europe. Competitive differentiation is shifting away from reliance on silicones toward portfolio diversification, sustainability credentials, and multifunctional product design. Emerging suppliers are focusing on botanical ester complexes, biodegradable conditioning cationics, and peptide-based innovations, reshaping how brands deliver long-term frizz protection. The next phase of competition will increasingly emphasize ecosystem integration combining raw materials with claims validation, consumer education, and co-branding strategies to secure long-term relevance.

Key Developments in Anti-Frizz / De-Frizz Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Mode of Action | Film-forming smoothers, Humidity blockers, Cuticle sealers, Conditioning cationics |

| Source | Silicone-based, Silicone-free polymers, Botanical oils & esters, Amino acid/peptide systems |

| Delivery System | Water-dispersible, Anhydrous, Microemulsion |

| Physical Form | Solution/concentrate, Emulsion, Powder |

| Application | Leave-in creams & serums, Rinse-off conditioners, Styling sprays, Masks |

| End Use | Hair styling, Conditioning care, Treatment masks |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Croda, Evonik, Lubrizol, Dow, Solvay, Ashland, BASF, Givaudan Active Beauty, Momentive, Inolex |

| Additional Attributes | Dollar sales by mode of action, source, and application; adoption trends in clean-label and silicone-free polymers; rising demand for humidity blockers in tropical markets; sector-specific growth in professional salons and consumer retail; software-like recurring revenue models from licensing and formulation partnerships; integration with multifunctional haircare trends; regional patterns shaped by climate and cultural grooming practices; and innovations in peptide systems, botanical esters, and microemulsion delivery technologies. |

The Anti-Frizz / De-Frizz Agents Market is estimated to be valued at USD 2,208.7 million in 2025.

The market size for the Anti-Frizz / De-Frizz Agents Market is projected to reach USD 5,003.4 million by 2035.

The Anti-Frizz / De-Frizz Agents Market is expected to grow at a CAGR of 8.5% between 2025 and 2035.

The key product types in the Anti-Frizz / De-Frizz Agents Market include leave-in creams & serums, rinse-off conditioners, styling sprays, and masks.

In terms of source, silicone-free polymers are expected to command 42% share of the Anti-Frizz / De-Frizz Agents Market in 2025, making them the most influential segment.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA