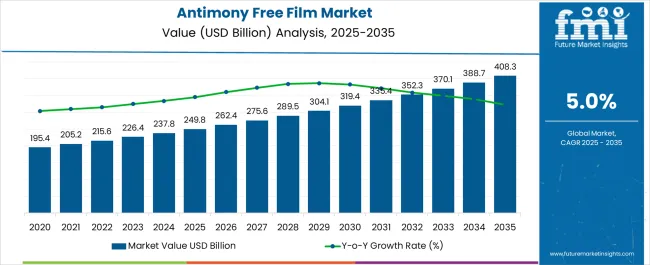

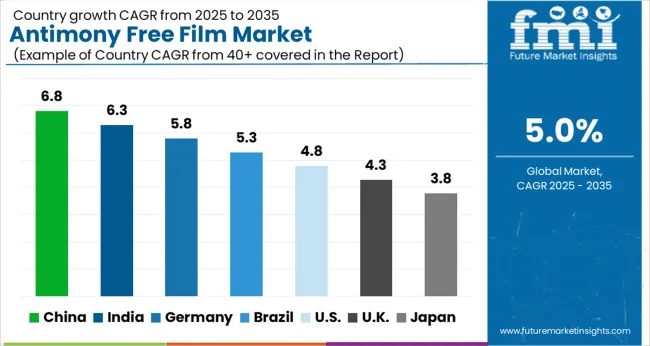

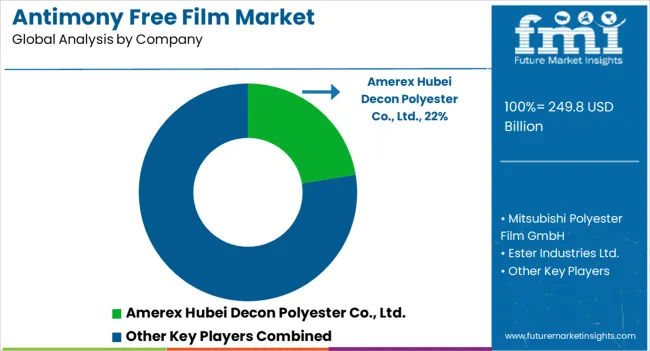

The Antimony Free Film Market is estimated to be valued at USD 249.8 billion in 2025 and is projected to reach USD 408.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Antimony Free Film Market Estimated Value in (2025 E) | USD 249.8 billion |

| Antimony Free Film Market Forecast Value in (2035 F) | USD 408.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The antimony free film market is expanding steadily as industries transition toward safer and more sustainable packaging materials. Rising concerns about the potential health risks associated with antimony-based films have accelerated the adoption of alternatives, particularly in food contact applications.

Manufacturers are increasingly investing in high-performance films that ensure product safety, thermal stability, and compliance with stringent regulatory standards. Advances in polymer technology, particularly polyethylene and polypropylene blends, are enabling the production of films that are lightweight yet durable, while maintaining clarity and functional barrier properties.

Growing consumer demand for safer and environmentally responsible packaging, coupled with brand commitments to sustainability, is further reinforcing the shift to antimony free options. The outlook remains promising as regulatory agencies and multinational companies continue to encourage safer packaging standards across food, pharmaceutical, and consumer goods sectors.

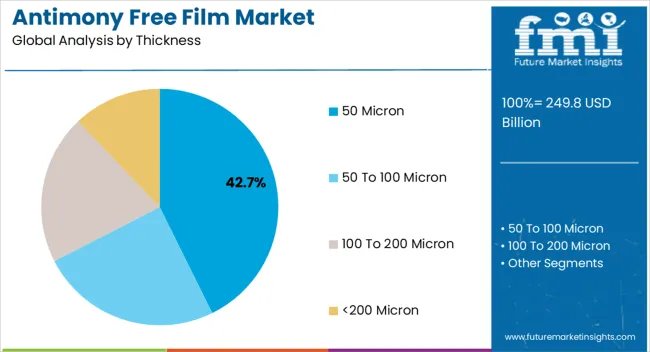

The 50 Micron segment is projected to account for 42.70% of the overall market by 2025, positioning it as the dominant thickness category. This growth is driven by its optimal balance of durability, flexibility, and cost efficiency.

Films within this range provide reliable barrier protection while maintaining easy processability, making them suitable for both automated and manual packaging systems. Their ability to support printability and lamination further enhances their utility in diverse applications.

The combination of functional performance and cost effectiveness has reinforced the strong adoption of 50 Micron films across multiple industries.

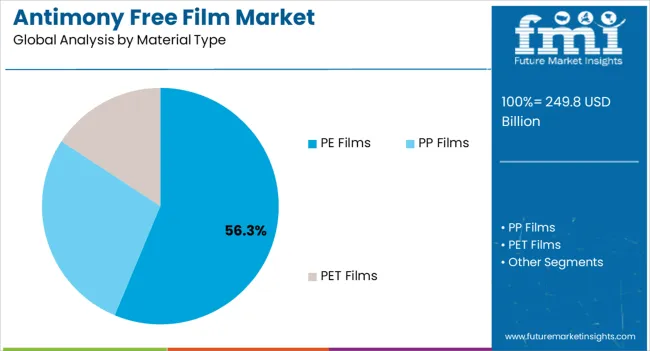

The PE Films category is anticipated to hold 56.30% of the total market share by 2025, making it the leading material type. This dominance is attributed to the material’s versatility, recyclability, and compatibility with food safety standards.

Polyethylene films provide strong moisture resistance, mechanical strength, and adaptability to different packaging formats. Their wide availability and cost effectiveness have enabled manufacturers to scale adoption across global markets.

The transition away from antimony catalysts in film production has further increased reliance on PE films, solidifying their role as the preferred material in antimony free packaging solutions.

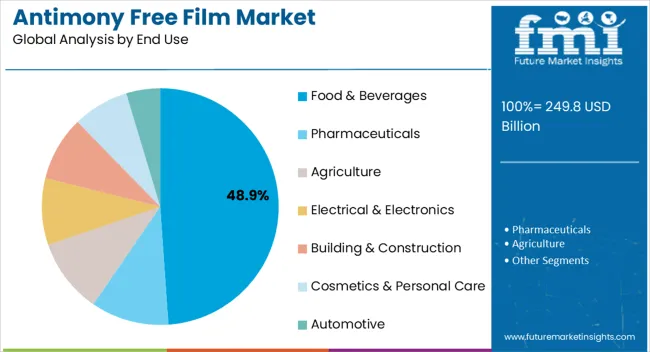

The food and beverages category is projected to capture 48.90% of total revenue by 2025, marking it as the leading end use sector. Growth in this segment is being fueled by stringent safety regulations, increasing consumer awareness regarding packaging materials, and the critical need to maintain product integrity.

Antimony free films are widely used in food packaging as they ensure compliance with health standards while supporting sustainability initiatives. Their lightweight nature and ability to extend shelf life without chemical migration risks have accelerated adoption.

The demand for safe, efficient, and environmentally responsible packaging has firmly positioned food and beverages as the largest and most influential end use category in the antimony free film market.

The demand for antimony-free films is predicted to rise steadily between 2020 and 2025. Factors such as increased legislative restrictions on the use of antimony, expanding consumer consciousness of health and environmental concerns, and rising demand for sustainable packaging solutions are driving this expansion.

Looking further to the anticipated period of 2025 to 2035, demand for antimony-free films is expected to increase. The market is expected to expand significantly as the use of antimony-free films spreads across numerous sectors.

The increased emphasis on sustainability and the circular economy will define the market's future view. Antimony-free films contribute to sustainable packaging practises by lowering potential environmental harm and increasing recyclability.

The global emphasis on avoiding waste and building a circular economy is likely to increase demand for antimony-free films.

The rising demand of eco-friendly products in packaging sector is boosting the growth of antimony free film. Government regulations and restrictions are limiting the use of antimony containing films, which is a plus point to gain market position for antimony free film manufacturers.

| Country | UK |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 18.1 million |

| CAGR % 2025 to End of Forecast (2035) | 4.3% |

Antimony-free films are consistent with this sustainability strategy since they reduce the possible dangers linked with antimony while also providing a more ecologically friendly packaging solution. This greater emphasis on sustainability has contributed to an increase in demand for antimony-free films in the United Kingdom.

The United Kingdom has a sizable market share in the Antimony Free Film Market due to its severe regulatory framework, innovative industry, sustainability focus, and well-connected supply chain network.

These distinguishing characteristics have positioned the United Kingdom as a significant participant in advancing the adoption and growth of antimony-free films, both nationally and worldwide.

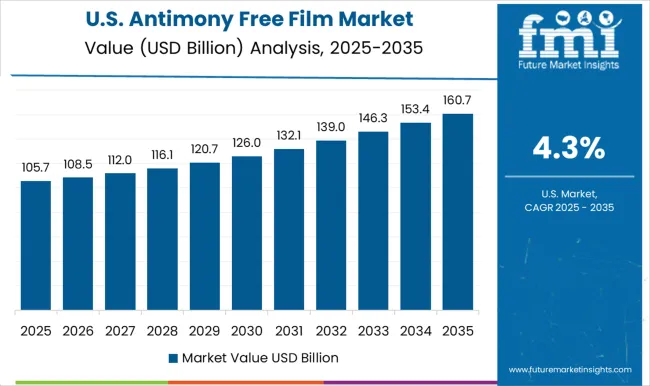

| Country | USA |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 64.2 million |

| CAGR % 2025 to End of Forecast (2035) | 3.8% |

The United States places a high value on sustainability and corporate social responsibility. Companies in the United States prioritise sustainable practises and strive to reduce their environmental imprint.

Companies that use antimony-free films demonstrate their dedication to sustainability, improving their brand reputation, and attracting environmentally concerned customers. The Consumer Product Safety Improvement Act, passed by Congress in 2009, adopted an ethical standard limiting antimony migration from children's products to 60 ppm.

California limits the quantity of antimony that can be present in certain consumer product paints and coatings.

PET film segment dominates the antimony free film market due to its excellent dimensional stability, high tensile strength, barrier properties against moisture, oxygen, and UV light, aesthetic appeal properties and recyclability and regulatory compliance.

These unique attributes significantly driving the market growth in the antimony free film market

Antimony free films are lightweight and flexible, cost-effective packaging solutions for food and electronics packaging. The unique requirements of both segment such as food safety regulations and the need for reliable electronic component protection create opportunities for antimony-free films to gain prominence and contribute to the overall market growth.

The antimony free film industry is highly competitive, with new entrants trying to gain market share. The major key players are focusing on research and development which can help to keep them updated with latest technologies and trends.

Key strategies in Antimony Free Film market:

Product Innovation

Companies are focusing on innovation that can be made in antimony free film, to increase efficiency of the machines and develop products with high accuracy.

Sustainability:

The absence of antimony, a potentially hazardous material, assures the safety of both customers and the environment, making antimony-free films a viable option for packaging.

Strategic Expansion:

The major key players are investing and expanding their channels into the emerging economies which can help them gain market position. The companies are also investing in R&D to increase the application of product in different industries.

The global antimony free film market is estimated to be valued at USD 249.8 billion in 2025.

The market size for the antimony free film market is projected to reach USD 408.3 billion by 2035.

The antimony free film market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in antimony free film market are 50 micron, 50 to 100 micron, 100 to 200 micron and <200 micron.

In terms of material type, pe films segment to command 56.3% share in the antimony free film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimony Trioxide Market Size and Share Forecast Outlook 2025 to 2035

Antimony Market Growth - Trends & Forecast 2025 to 2035

Freezer Label Market Size and Share Forecast Outlook 2025 to 2035

Freezer Liner Market Size and Share Forecast Outlook 2025 to 2035

Freeze Neutralising Kit Market Size and Share Forecast Outlook 2025 to 2035

Freeze Drying Market - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Dried Fruit Powder Market Size and Share Forecast Outlook 2025 to 2035

Freeze-dried Food Market Analysis - Size, Growth, and Forecast 2025 to 2035

Freeze Dried Fruits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Drying Equipment Market Size and Share Forecast Outlook 2025 to 2035

Freezer Paper Market Size and Share Forecast Outlook 2025 to 2035

Freeze Dried Fruits And Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Free-from Titanium Dioxide Market Size, Growth, and Forecast for 2025 to 2035

Freeze-Dried Vegetables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze-Dried Pet Food Market Anlysis by Pet Type, Nature, Source, Process Type, and Sales Channel Through 2035

Freeze Dried Melt Market Analysis by Product Form, Fruit Type, Sales Channel, Packaging, , and Region Through 2035

Free Standing Display Units Market by Material & End-Use Forecast 2025 to 2035

Freezer Bags Market Growth, Trends and Demand from 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Competitive Overview of Freeze Dried Fruits Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA