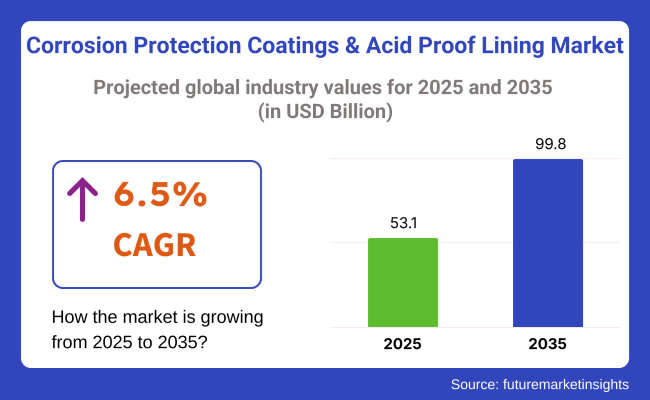

The global corrosion protection coatings & acid proof lining market is projected to reach USD 53.1 billion in 2025. By 2035, the market is expected to expand to USD 99.8 billion, reflecting a CAGR of 6.5%. This growth is being supported by stricter environmental mandates, industrial asset lifespan goals, and safety regulations introduced after 2023.

Continued demand has been observed in the oil & gas, chemical, and wastewater management sectors. In Asia-Pacific, significant investments in protective linings have been reported, especially in India and China, where government modernization programs for refining and storage systems are advancing. In April 2025, Wacker Chemie AG disclosed that epoxy coating output at its Nanjing facility had been increased to meet industrial demand in the Chinese market. This update was confirmed through Wacker’s official investor communications released in Q2 2025.

High-performance materials such as fluoropolymer and polyurethane coatings are witnessing strong adoption due to their resilience to oxidizing agents and low permeability. In the company’s 2025 earnings announcement, Hempel A/S CEO Michael Hansen noted, “The demand for linings resistant to sulfuric acid in mining and desalination sectors has surged, prompting a ramp-up in AvantGuard zinc epoxy solutions.” Hansen’s comments were published in the company’s annual stakeholder report for fiscal year 2025.

Increased efficiency in application methods is also contributing to market gains. Automated and nanocoating systems have extended protective coverage and reduced reapplication cycles. During 2024, Sherwin-Williams conducted field deployments of its HEAVYGUARD™ acid barrier coatings at petrochemical ports in the Gulf region. According to the firm’s December 2024 technical summary, average maintenance intervals were extended by 40% in controlled conditions.

In Europe, compliance with REACH directives has led to a move away from chromate-based inhibitors. AkzoNobel’s 2025 Performance Coatings bulletin confirmed a 23% increase in demand for silane-modified and phosphate-rich linings due to stricter EU environmental legislation. These products are now prioritized by industrial users seeking VOC-compliant, eco-friendly alternatives.

Amid all these developments, certain challenges persist in the industry that are being addressed by the manufacturers. For instance, raw material price volatility and variability in application performance under extreme pH conditions remain concerns. However, new resin blends and composite barrier technologies are under active development to address these issues.

The market is segmented based on product type, form, end-use industry, and region. By product type, the market is divided into acid proof linings type and corrosion protective coatings. In terms of form, it is segmented into electric thickness planers, battery-powered (cordless) thickness planers, and pneumatic thickness planers.

Based on end-use industry, the market is categorized into furniture manufacturing, construction & carpentry, DIY & hobbyists, and industrial & commercial workshops. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The corrosion protective coatings segment is projected to grow at a CAGR of 5.9% from 2025 to 2035, making it the fastest-growing and most dominant segment by revenue. This rapid growth is underpinned by rising investments in infrastructure, marine operations, and energy sectors, all of which demand high-performance surface protection to prevent rust, oxidation, and material degradation.

These coatings ranging from epoxy and polyurethane to zinc-rich primers, offer superior adhesion, weather resistance, and long-term performance, making them ideal for bridges, pipelines, storage tanks, and offshore platforms. Stringent environmental regulations have also led to increased demand for low-VOC, water-based, and solvent-free formulations. Their ease of application across different substrates and compatibility with advanced surface preparation techniques make them the preferred choice across industries.

In contrast, acid proof linings remain essential in high-risk chemical environments such as sulfuric acid plants, fertilizer units, and chemical reactors. These linings provide durable resistance against extreme pH and temperature conditions but require specialized application methods and come with higher installation costs. Their limited scope compared to protective coatings results in a slower adoption rate. Nonetheless, acid proof linings continue to play a critical role in plant safety and compliance in corrosive fluid environments.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Corrosion Protective Coatings | 5.9% |

The battery-powered (cordless) thickness planers segment is expected to grow at the highest CAGR of 6.3% from 2025 to 2035, reflecting a shift toward lightweight, mobile tools in modern construction and DIY settings. These planers are increasingly favored for their versatility, energy efficiency, and ability to operate in areas without direct power access.

Advances in lithium-ion battery technology, brushless motors, and thermal control systems have significantly improved both runtime and performance. This has made battery-powered planers suitable not just for hobbyists but also for professional job sites where flexibility and maneuverability are crucial. Their adoption is rising in both developed markets with high labor costs and emerging economies where infrastructure is being built in remote locations.

Meanwhile, electric thickness planers maintain strong usage in stationary workshops and mass-manufacturing units due to their consistent output and speed. However, their growth is expected to remain moderate as industries move toward flexible operations.

Pneumatic planers, while essential in explosion-prone or vibration-sensitive environments, serve a very niche industrial segment and face limited expansion opportunities. The overall form landscape is evolving rapidly, but cordless tools especially battery-powered planers are at the forefront of innovation and growth, driven by ergonomic design and on-the-go functionality.

| Form | CAGR (2025 to 2035) |

|---|---|

| Battery-Powered Thickness Planers | 6.3% |

The DIY & hobbyists segment is forecasted to grow at the highest CAGR of 6.7% between 2025 and 2035, fueled by the global rise in maker culture, home renovation trends, and e-commerce accessibility. This demographic is increasingly investing in corrosion-resistant coatings and lightweight planing tools that offer ease of use and safety.

Battery-powered tools and user-friendly protective coatings with minimal preparation and fast curing times are particularly appealing to this segment. The increasing availability of online tutorials and project kits has democratized woodworking and basic metal fabrication, leading to significant demand from individual users. Furthermore, the COVID-19 pandemic accelerated interest in home improvement and craft-based businesses, trends that have maintained momentum. In comparison, construction & carpentry continues to dominate in market value, benefiting from rising infrastructure development and commercial renovation projects globally.

Furniture manufacturing also holds substantial share, especially in South and Southeast Asia where mass wood processing is expanding. Industrial & commercial workshops, while crucial for custom projects and high-precision needs, are witnessing relatively steady growth amid rising automation and standardized production. Nevertheless, the DIY & hobbyist segment stands out as a key disruptor in the end-use landscape, unlocking new revenue potential with its enthusiastic and growing user base.

| End-Use Industry | CAGR (2025 to 2035) |

|---|---|

| DIY & Hobbyists | 6.7% |

High Cost of Application and Maintenance

One of the core issues that plague the market for corrosion prevention coatings and acid-proof lining is the high cost incurred in the application and maintenance of these protection solutions. Corrosion-resistant coatings are usually needing specific, skilled manpower to apply it properly as well as modern machinery and techniques that guarantee high quality and durability.

The application rhythm can be laborious, particularly when in challenging environments thus in result leading to high project costs. Also, the coating generally must be implemented after some time which may be equal to the total operation costs that can be related to long-term operations. The long term and initial costs may pave a path for the risk of having limited budget especially for small to medium-sized businesses.

Environmental Regulations

The coating industry, the one that includes the corrosion protection of coatings, is facing various challenges that stem from the pressure posed by environmental regulations. Many traditional coatings have hazardous materials which are a risk both to people as well as the environment.

The regulations governing the use of volatile organic compounds (VOCs) detector, the disposal of hazardous materials, and emissions from the coatings business are becoming stricter in different regions. This not only makes it harder to develop and implement coatings, but it also raises compliance expenses.

Companies are forced to invest in the research and use of low VOC, eco-friendly coatings which involve huge sums of money being spent on the research, development, and production processes. Some combinations of the result may lead to mainstream traditions in environmentally damaging practices being challenged and finally to push for better products being invented.

Technological Advancements in Coating Formulations

The corrosion protection coatings and acid-proof lining market is the one that will benefit immensely from the technological advancements obtained through the development of more efficient coating formulations. Advances such as self-repairing coatings that can fix themselves when damaged represent a very new facility for all industries.

Chemical-resistant, long-lasting, and extreme environmental conditions which a particular high-level machine forms the development of them. The operation of these materials assures more durability for the machinery, less maintenance punching and cut off the replacement rate and also the loan to eco-foes bonds.

Furthermore, eco-friendly coatings, such as those that are just as efficient and have reduced environmental impact and minimum hazardous chemicals, are being demanded as industries look toward the new regulatory and eco-friendly practices.

Growing Demand for Sustainable Solutions

The industrial push for sustainability is catalyzing the formation of the corrosion protection coatings and acid-proof lining market. As plants strive to become more eco-conscious, they seek out alternatives to non-toxic, low-VOC, and environmentally harmful coatings. Sustainable solutions have become the bargaining chip in the market, as organizations carry out obfuscation strategies to meet their environmental requirements.

The evolution of green coatings is, thus, a much-expected development in these terms, i.e. those that either grow on renewable resources or those that require less energy to produce are expected to be adopted more widely.

These low-impact coatings will be doing their bit in curbing greenhouse gas emissions and would be doing this without a drop in efficacy in the end, so the industries could choose to solve both the problems of delivering high performance and eliminating environmental issues.

The market for corrosion protection coatings and acid proof linings in the United States is on an upturn, mostly because of huge operations in the oil & gas, chemical, and infrastructure sectors. The strong demand for long-lasting and high-performance coatings in the marine, construction, and manufacturing industries spurs the development of this market. The USA market is likewise witnessing an uptick in the enforcement of regulatory measures that require stricter corrosion control solutions. However, due to the progress in coating technologies, for example, the advent of anti-corrosion systems with longer lifespans and better resistance to hostile environments, the market is still viable. The intensified emphasis on sustainability and environmentally friendly solutions is another factor contributing to the evolution of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

In the UK, the corrosion protection coatings and acid proof lining market is accelerating, mainly due to the surge in demand for corrosion-resistant solutions in the marine, oil & gas, and chemical industries. In the UK, the company established a positive gain from the rules for industrial production and the environment, which gave a green demand for protective coatings that are not only effective but also energy efficient. The market is also enhanced by the high technology innovations which are found in the corrosion protection solutions and the use of advanced coatings and applications. The problem of aged industrial units and their need for rehabilitation is the main motor for the development of the protective coating market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.0% |

The corrosion protection coatings and acid proof possessions market in the European Union has a slow but steady grow, propelled by the need for long-lasting coatings in the automotive, chemical manufacturing, and construction sectors. The EU's tough environmental regulations have contributed to the popularity of low-VOC, sustainable coatings. The main countries for corrosion protection in industrial applications are Germany, France, and Italy, and particularly in high-end manufacturing and infrastructure sectors. The encouraging progress of the smart manufacturing technologies together with the application of the automated systems has been further fuelling the market development across the EU.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

Japan's market for corrosion protection coatings and acid-proof lining is on the rise, underpinned by the automotive, chemical, and marine sectors. Japan's technological capabilities' manufacturing sector declines, but assets' protective coatings are a huge drawing power, especially in agricultural, maritime ratings and heavy machinery. The severe relaxation of environmental laws has led to a shift toward sustainable and economic-friendly coatings. Innovative corrosion-resistant coatings, with longer-lasting durability and better performance, are increasing in the market and contributing to the development of the heavy industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

In South Korea, the market for corrosion protection coatings and acid-proof linings is advancing, never mind the fact that the automotive and shipbuilding industries have become fail sole-20. The government is keen on environmental protection and hence, it is creating a demand for ecological coatings, especially in the marine and chemical sectors. Capex on manufacturing machines with IoT capability and energy efficiency are the primary drivers for smart manufacturing in the region and have caused a correlated increase in the requirement for flexible and eco-friendly coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

The worldwide corrosion protection coatings & acid proof lining market is witnessing a boom, backed by the enhanced aversion to corrosion in the industries like oil & gas, chemicals, marine, construction, and power generation. The use of corrosion protective coatings and acid-proof linings in stopping infrastructure, machinery, and equipment from degrading in extreme conditions is critical.

The market is dictated by the new-age coatings that not only last longer but are also environmentally friendly, and resistant to excessive temperatures and chemicals. Manufacturers are stressing on innovation of the products, including enhanced corrosion resistance, improved adhesion, and the development of sustainable products with low-VOC coatings to meet the environmental standards.

In terms of Product Type, the industry is divided into Acid Proof Linings Type, Corrosion Protective Coatings

In terms of power source, the industry is divided into Electric Thickness Planers, Battery-Powered (Cordless) Thickness Planers, Pneumatic Thickness Planers

In terms of end use industry, the industry is divided into Furniture Manufacturing, Construction & Carpentry, DIY & Hobbyists, Industrial & Commercial Workshops

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-use Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-use Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-use Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The global corrosion protection coatings and acid-proof lining market is projected to reach USD 53.1 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 6.5% over the forecast period.

By 2035, the corrosion protection coatings & acid proof lining market is expected to reach USD 99.8 billion.

Corrosion Protective Coatings are expected to dominate due to their extensive use across industries like oil & gas, marine, infrastructure, and industrial manufacturing. The rising need to protect metal structures from corrosion, especially in harsh environments, drives this segment's growth.

Key players in the corrosion protection coatings & acid proof lining market include Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., and Rust-Oleum Corporation.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.