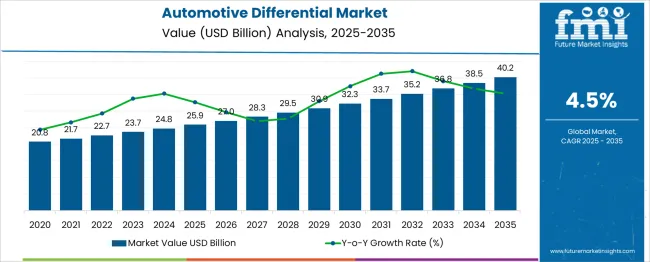

The Automotive Differential Market is estimated to be valued at USD 25.9 billion in 2025 and is projected to reach USD 40.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Differential Market Estimated Value in (2025 E) | USD 25.9 billion |

| Automotive Differential Market Forecast Value in (2035 F) | USD 40.2 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Automotive Differential market is experiencing steady growth, driven by rising global vehicle production, increasing adoption of advanced drivetrain technologies, and growing consumer demand for improved vehicle performance and handling. Enhanced safety standards and regulatory pressures to reduce fuel consumption and emissions are further supporting the adoption of sophisticated differential systems. Continuous advancements in electronic and mechanical drivetrain components are enabling manufacturers to optimize torque distribution, improve traction, and enhance overall driving dynamics.

The integration of electronic control systems into differentials provides real-time adaptability and precision, catering to both passenger vehicles and commercial applications. Increasing investment in electric and hybrid vehicles, which often require specialized differentials to maximize efficiency and performance, is also contributing to market expansion.

Furthermore, the demand for high-performance and luxury vehicles, along with rising consumer expectations for comfort, stability, and handling, is accelerating the adoption of innovative differential technologies As automotive technology continues to evolve, the market is positioned for sustained growth, driven by innovation and performance optimization.

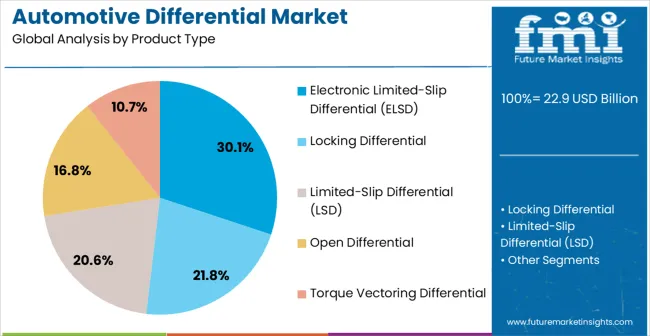

The automotive differential market is segmented by product type, drive type, vehicle type, and geographic regions. By product type, automotive differential market is divided into Electronic Limited-Slip Differential (ELSD), Locking Differential, Limited-Slip Differential (LSD), Open Differential, and Torque Vectoring Differential. In terms of drive type, automotive differential market is classified into Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), and All-Wheel Drive / Four-Wheel Drive (AWD/4WD). Based on vehicle type, automotive differential market is segmented into Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle. Regionally, the automotive differential industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electronic limited-slip differential (ELSD) segment is projected to hold 30.1% of the market revenue in 2025, making it the leading product type. Its dominance is being driven by the enhanced traction control and torque distribution capabilities that it provides, improving vehicle stability under variable driving conditions. The integration of ELSD systems into modern vehicles enables precise electronic management of power delivery to wheels, reducing wheel slip and enhancing handling performance.

Adoption is further supported by the increasing demand for advanced safety and driver-assistance technologies across passenger and commercial vehicles. ELSD systems are particularly valued for their compatibility with hybrid and electric powertrains, where torque optimization is critical for efficiency and performance.

Continuous improvements in control algorithms, sensor integration, and reliability have strengthened the preference for ELSD over conventional mechanical differentials As consumer expectations for vehicle handling, performance, and safety continue to rise, ELSD is expected to maintain its leading market share, supported by ongoing technological innovation and regulatory emphasis on vehicle safety.

The front-wheel drive (FWD) segment is anticipated to account for 42.1% of the market revenue in 2025, establishing it as the leading drive type. Growth in this segment is driven by the widespread adoption of FWD configurations in passenger vehicles due to their cost-effectiveness, fuel efficiency, and compact design advantages. FWD systems simplify drivetrain architecture, reduce vehicle weight, and improve interior space utilization, making them suitable for a broad range of consumer vehicles.

The integration of advanced differentials such as ELSD in FWD platforms enhances traction, handling, and safety without compromising efficiency. Increasing demand for smaller, energy-efficient vehicles in urban environments is further supporting FWD adoption.

Additionally, FWD systems offer improved stability on wet or slippery surfaces when paired with modern differential technologies, aligning with regulatory safety requirements and consumer expectations As automotive manufacturers continue to focus on optimizing vehicle performance, efficiency, and cost, the front-wheel drive segment is expected to retain its market leadership, reinforced by integration with advanced electronic differential solutions.

The passenger vehicle segment is projected to hold 45.3% of the market revenue in 2025, positioning it as the leading vehicle type. Its growth is being driven by the increasing demand for cars with superior handling, safety, and fuel efficiency across urban and suburban markets. Advanced differential technologies, including ELSD, are being widely adopted in passenger vehicles to enhance traction control, optimize torque distribution, and improve driving stability.

Rising consumer preference for high-performance and luxury vehicles, as well as the growing focus on safety and comfort, are further supporting the adoption of sophisticated differentials in this segment. In addition, the expansion of electric and hybrid passenger vehicles, which require specialized differential systems for efficient power management, is contributing to market growth.

Technological advancements in electronic control systems and integration with vehicle stability and safety features have reinforced the use of advanced differentials in passenger vehicles As automotive manufacturers continue to prioritize vehicle performance and consumer experience, the passenger vehicle segment is expected to remain the primary driver of market growth.

The differential is a component of the car's drive train that makes it possible for several wheels to function advantageously as driving wheels. Each kind of car uses a different device; each set of wheels that functions as the vehicle's driving wheel has this device positioned between them. This element is placed in the space sufficiently between each set of wheels that functions as a driving wheel.

The engine distributes its power so that the wheels can spin at different speeds. It has three shafts, each of which rotates at a predetermined multiple of the average, or combined, the velocity of the others or speed of the three shafts in combination.

The production and sales of automobiles benefitted from the concurrent trends in the automobile market, such as the rise in the manufacture of all-wheel drive and four-wheel drive vehicles, the expansion of customer purchasing of commercial and passenger vehicles, and the growing demand for high-performance and lightweight automotive car parts.

A new forecast by FMI analysts estimates that automotive differential sales will increase from 2025 to 2035 and is predicted to create a growth opportunity of US$ 10,588.3 Million

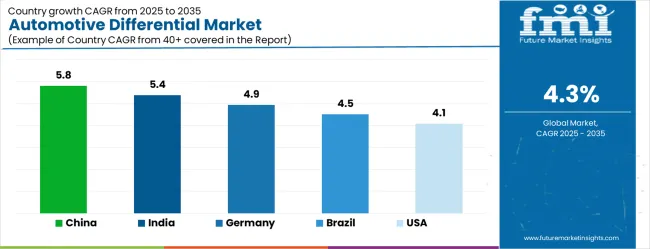

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| USA | 4.1% |

| UK | 3.7% |

| Japan | 3.2% |

The Automotive Differential Market is expected to register a CAGR of 4.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.8%, followed by India at 5.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.2%, yet still underscores a broadly positive trajectory for the global Automotive Differential Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.9%. The USA Automotive Differential Market is estimated to be valued at USD 8.5 billion in 2025 and is anticipated to reach a valuation of USD 8.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.1 billion and USD 662.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.9 billion |

| Product Type | Electronic Limited-Slip Differential (ELSD), Locking Differential, Limited-Slip Differential (LSD), Open Differential, and Torque Vectoring Differential |

| Drive Type | Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), and All-Wheel Drive / Four-Wheel Drive (AWD/4WD) |

| Vehicle Type | Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

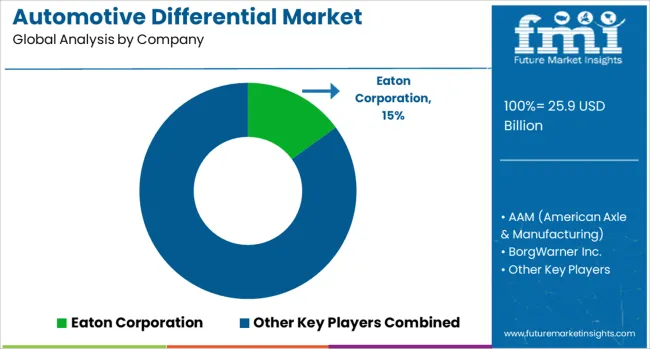

| Key Companies Profiled | AAM (American Axle & Manufacturing), BorgWarner Inc., Dana Incorporated, Eaton Corporation, GKN Automotive, JTEKT Corporation, Linamar Corporation, Magna International Inc., Schaeffler AG, and ZF Friedrichshafen AG |

The global automotive differential market is estimated to be valued at USD 22.9 billion in 2025.

The market size for the automotive differential market is projected to reach USD 35.0 billion by 2035.

The automotive differential market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in automotive differential market are electronic limited-slip differential (elsd), locking differential, limited-slip differential (lsd), open differential and torque vectoring differential.

In terms of drive type, front-wheel drive (fwd) segment to command 42.1% share in the automotive differential market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA