The Automotive Door Module Market is estimated to be valued at USD 33.6 billion in 2025 and is projected to reach USD 54.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. During the early adoption phase (2020–2024), the market expanded gradually from USD 26.3 billion to USD 32.0 billion. Key breakpoints included the integration of advanced features such as electronic locking systems, smart sensors, and lightweight materials. Automakers began testing these modules in premium vehicles, building awareness and demonstrating performance benefits. Regulatory pressures on safety and emissions also encouraged innovation in materials and manufacturing, setting the stage for broader adoption.

From 2025 to 2030, the market entered a scaling phase, growing from USD 33.6 billion to USD 42.9 billion. Breakpoints during this period involved increasing penetration in mid-range and mass-market vehicles, expansion of supplier networks, and optimization of production processes. As the market transitioned into consolidation between 2030 and 2035, reaching USD 54.7 billion, leading manufacturers focused on standardization, cost efficiency, and modular designs to maintain competitive advantage. Smaller players leveraged niche applications and innovative technologies, while mergers and partnerships strengthened market positioning, solidifying the industry’s maturity.

| Metric | Value |

|---|---|

| Automotive Door Module Market Estimated Value in (2025 E) | USD 33.6 billion |

| Automotive Door Module Market Forecast Value in (2035 F) | USD 54.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The automotive door module market is gaining momentum as OEMs continue to prioritize system integration, lightweighting, and electronics consolidation. The shift toward modular architectures in vehicle design has accelerated the adoption of pre-assembled door modules that combine mechanical, electronic, and sensor-based components into a single unit. Increasing incorporation of features such as power windows, central locking, smart sensors, and side impact protection systems has further driven the need for scalable and easily installable modules.

Electrification trends, especially in electric and hybrid vehicles, are fostering demand for door modules with higher electronic content and smarter communication interfaces. Additionally, advancements in materials engineering have allowed door modules to become lighter and more durable while supporting increasing vehicle customization requirements.

Automotive OEMs are also benefitting from reduced assembly time and lower supply chain complexity by sourcing integrated door modules As consumer expectations for comfort, convenience, and passive safety continue to evolve, the automotive door module market is expected to expand in alignment with broader vehicle innovation trends.

The automotive door module market is segmented by component, module, door type, sales channel, and geographic regions. By component, automotive door module market is divided into Latches & handles, Window regulators, Speakers, Motors & actuators, Electrical connectors & wiring, Control units, Sealing systems, and Others. In terms of module, automotive door module market is classified into Automated door modules and Manual door modules.

Based on door type, automotive door module market is segmented into Front door modules, Rear door modules, Sliding door modules, and Liftgate door modules. By sales channel, automotive door module market is segmented into OEM and Aftermarket. Regionally, the automotive door module industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The latches and handles component segment is expected to account for 35.2% of the automotive door module market revenue in 2025, establishing its position as the leading component. This dominance has been supported by the critical role these components play in vehicle safety, security, and user convenience. Enhanced consumer focus on robust and secure vehicle access has elevated the importance of advanced latch mechanisms and ergonomically designed handles.

The adoption of electronic and intelligent latching systems has grown steadily, especially in vehicles equipped with remote keyless entry and passive access systems. The reliability and durability of these components are essential in withstanding repetitive mechanical stress and ensuring occupant protection during collisions.

Their integration within automated and semi-automated modules has further reinforced their utility in modern vehicle architectures. As the automotive industry continues to emphasize occupant safety and smart locking mechanisms, latches and handles are expected to remain indispensable in door system configurations.

The automated door modules segment is projected to capture 55.6% of the automotive door module market revenue in 2025, making it the dominant module type. The growth of this segment is being driven by increasing adoption of power-operated doors, central control systems, and embedded sensor technology in modern vehicles. Automated modules allow integration of multiple sub-systems such as electronic control units, window lifters, actuators, and ambient lighting within a single framework, reducing vehicle weight and simplifying assembly processes.

OEMs have increasingly turned to automation to improve production efficiency and enhance driver and passenger experience. Rising consumer expectations for high-tech comfort features and accessibility in premium and mid-range vehicles are also influencing the demand for automation.

Furthermore, the ability of automated door modules to support diagnostics, remote control functions, and advanced driver assistance integration has strengthened their relevance in smart mobility platforms. As intelligent features become standard across vehicle segments, automated modules are likely to remain central to door system innovation.

The front door modules segment is anticipated to contribute 47.3% of the total automotive door module market revenue in 2025, leading the market by door type. This prominence is attributed to the higher concentration of safety, control, and convenience features embedded in front doors compared to rear or sliding doors.

Front doors serve as the primary access points for drivers and often house critical systems such as side airbags, mirrors, control switches, and speaker units, requiring greater design complexity and component integration. As user interface technologies and connectivity options evolve, front door modules are being increasingly equipped with capacitive touch panels, proximity sensors, and premium acoustic features.

The segment’s growth is also supported by regulatory focus on frontal side impact protection, driving the need for reinforced structures and reliable component layouts. Automakers are allocating more engineering resources to front door designs to enhance aesthetics, aerodynamics, and safety, ensuring the segment’s continued leadership in the evolving vehicle landscape.

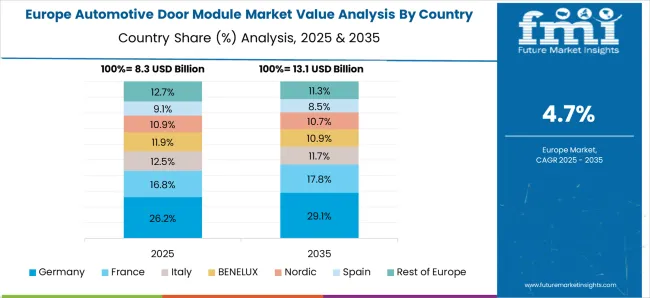

The automotive door module market is expanding due to increasing demand for advanced vehicle safety, convenience, and smart functionalities. Door modules integrate components such as locks, window regulators, side-impact beams, sensors, and wiring harnesses, streamlining assembly and reducing production costs. Growth is driven by rising adoption of electric vehicles, connected car technologies, and lightweight modular designs. Europe and North America dominate due to stringent safety regulations, while Asia-Pacific shows rapid growth with expanding automotive manufacturing. OEMs prioritize high-performance, ergonomic, and electronically integrated door modules to meet consumer expectations.

Modern door modules must accommodate multiple safety and convenience components, including side-impact beams, airbags, child locks, and sensors. Integrating these systems without compromising structural integrity, weight, or assembly efficiency is challenging. Door modules are expected to meet crash-test standards while maintaining durability over the vehicle’s lifecycle. Advanced designs require precision engineering and compatibility with electronic control units (ECUs) for features like automatic locking, intrusion detection, and power-assisted windows. Manufacturers investing in high-strength materials, modular designs, and simulation-driven engineering can achieve compliance and performance targets. Until advanced integration techniques are standardized, balancing safety, functionality, and cost remains a key challenge in the door module market.

The rise of electric vehicles (EVs) and connected cars is transforming door module requirements. EVs and smart vehicles require modules with integrated wiring harnesses, electronic window regulators, touch-sensitive panels, and sensor networks for door status, intrusion, and connectivity features. Electrically actuated locks, gesture controls, and proximity sensors demand high reliability and compatibility with vehicle networks. Suppliers are developing lightweight, multifunctional door modules with embedded electronics to reduce assembly complexity and support smart vehicle functionalities. Companies innovating in electronic integration, robust wiring solutions, and sensor-embedded modules gain a competitive edge. Until universal electronic standards for door modules emerge, manufacturers must ensure interoperability across multiple vehicle platforms while meeting consumer expectations for convenience and safety.

Automakers are increasingly adopting lightweight materials such as aluminum, high-strength steel, and reinforced polymers for door modules to improve fuel efficiency and reduce emissions. Reducing module weight without compromising durability, safety, or noise-vibration-harshness (NVH) performance is a critical design challenge. Cost optimization is also essential, as door modules represent a significant component of overall vehicle production cost. Suppliers balance material choice, manufacturing techniques, and assembly efficiency to meet OEM targets. Advanced molding, stamping, and composite technologies allow precise, lightweight, and durable modules. Until cost-effective, high-performance lightweight materials become standard, the market will continue to focus on innovation in material engineering and production processes to meet both regulatory and consumer demands.

The automotive door module market is influenced by regional automotive production trends, OEM expansion, and supply chain capabilities. Europe and North America lead in safety-regulated, high-end vehicles, while Asia-Pacific is growing due to increasing passenger car production and EV adoption. Supply chain challenges include sourcing high-strength metals, electronic components, and actuator systems, which may face volatility due to raw material prices or geopolitical factors. Companies investing in regional manufacturing facilities, just-in-time supply systems, and OEM partnerships secure reliability and reduce lead times. Competitive advantage is achieved through innovation, quality, and localization. Until global supply chains stabilize, market growth will depend on the ability to deliver cost-effective, reliable, and technologically advanced door modules efficiently across multiple regions.

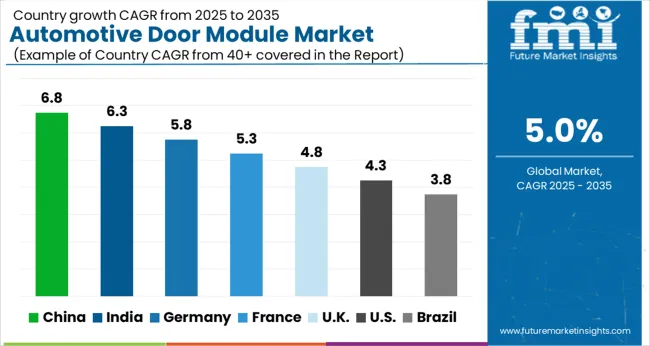

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global market is projected to grow at a CAGR of 5.0% through 2035, supported by increasing demand across passenger vehicles, commercial vehicles, and automotive assembly applications. Among BRICS nations, China has been recorded with 6.8% growth, driven by large-scale production and deployment in automotive manufacturing, while India has been observed at 6.3%, supported by rising utilization in vehicle assembly and component integration. In the OECD region, Germany has been measured at 5.8%, where production and adoption for automotive assembly and passenger vehicle applications have been steadily maintained. The United Kingdom has been noted at 4.8%, reflecting consistent use in vehicle manufacturing and component integration, while the USA has been recorded at 4.3%, with production and utilization across passenger and commercial vehicle applications being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The automotive door module market in China is growing at a CAGR of 6.8%, driven by increasing vehicle production, rising demand for electric and smart vehicles, and technological upgrades in door systems. Advanced door modules integrate power windows, locks, mirrors, and electronic controls, enhancing passenger comfort and safety. Chinese manufacturers focus on lightweight, durable, and high-precision modules to meet domestic and export market requirements. Growing adoption of electric vehicles and smart connectivity in vehicles further fuels market demand. Government policies supporting automotive industry growth and investments in smart manufacturing technologies encourage innovation. Additionally, partnerships between OEMs and component suppliers enhance production efficiency and product quality. Rising consumer preference for feature-rich and safe vehicles ensures consistent demand for automotive door modules in China.

The automotive door module market in India is expanding at a CAGR of 6.3%, supported by increasing passenger vehicle production, rising EV adoption, and advancements in smart automotive systems. Indian manufacturers emphasize cost-effective, lightweight, and reliable door modules that integrate power windows, locks, and electronic controls. Growing safety awareness, government incentives for EVs, and adoption of connected car features drive demand for advanced door systems. Partnerships between OEMs and tier-1 suppliers enhance production quality and supply chain efficiency. Technological innovations such as automated door operation, keyless entry, and integrated electronic controls increase vehicle comfort and convenience. The country’s rising disposable income and preference for modern vehicles further fuel market growth. Increasing exports of Indian-manufactured automotive components also contribute to the expansion of the automotive door module market.

The automotive door module market in Germany is growing at a CAGR of 5.8%, driven by demand from premium vehicles, EVs, and technologically advanced car models. Manufacturers focus on high-quality, lightweight, and durable door modules that integrate power windows, locks, mirrors, and advanced electronics. German OEMs emphasize safety, performance, and aesthetic design, driving innovation in automated and electronic door systems. Growing consumer expectations for convenience, smart connectivity, and energy-efficient solutions further stimulate market growth. Investments in R&D and partnerships with suppliers ensure continuous improvement of door module technology. Stringent automotive safety regulations also support consistent demand. Expansion in electric and hybrid vehicle production ensures a stable market for automotive door modules across Germany, particularly in high-end and luxury vehicle segments.

The automotive door module market in the United Kingdom is expanding at a CAGR of 4.8%, fueled by increasing vehicle production, EV adoption, and demand for safety-enhancing features. Manufacturers focus on lightweight, durable, and electronically integrated door modules. Smart vehicle trends such as keyless entry, automated window control, and electronic locking systems increase adoption. Collaboration between OEMs and suppliers ensures product reliability and efficiency. Government initiatives supporting EV adoption and automotive innovation further stimulate market growth. The preference for connected, feature-rich vehicles ensures steady demand for automotive door modules in the UK. Continuous improvements in door module design, safety, and functionality maintain the market’s competitive edge.

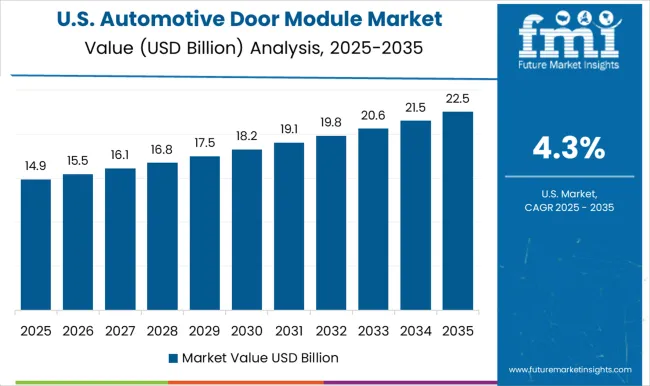

The automotive door module market in the United States is growing at a CAGR of 4.3%, driven by demand from passenger vehicles, EVs, and commercial vehicles. Manufacturers focus on high-quality, durable door modules with integrated electronics for windows, locks, mirrors, and advanced control systems. Safety, convenience, and energy efficiency are key drivers for adoption. Government regulations for vehicle safety and emissions, combined with incentives for EVs, increase demand for advanced modules. Technological innovations such as automated doors, keyless entry, and electronic locking enhance user experience. OEMs collaborate with suppliers to ensure reliable production and timely delivery. The preference for connected and feature-rich vehicles ensures steady market growth for automotive door modules across the United States.

The automotive door module market plays a crucial role in modern vehicle manufacturing, integrating components such as power windows, locks, mirrors, speakers, and wiring harnesses into a single functional unit. These modules enhance vehicle safety, convenience, and infotainment features, making them critical in both traditional and electric vehicle platforms.

Key suppliers in this market include Aptiv, known for its advanced electrical and electronic architecture solutions that integrate door functionalities efficiently. Magna International provides complete door module systems with a focus on lightweight designs and high manufacturing quality, while Brose Fahrzeugteile GmbH specializes in mechatronic modules that combine door systems with intuitive controls and safety mechanisms. Robert Bosch and Denso Corporation contribute with innovative sensor integration and electronic components that optimize performance and vehicle safety.

ZF Friedrichshafen AG and Valeo SA offer door modules that emphasize automated features, including smart access, anti-pinch technology, and integration with advanced driver-assistance systems (ADAS). Panasonic Corporation brings expertise in electronic control units and energy-efficient components, while Continental AG focuses on modular architectures that support connected car features. Siemens AG contributes with automation and electronic solutions that enhance manufacturing efficiency and system reliability.

Market growth is driven by rising adoption of electric vehicles, increasing demand for enhanced passenger comfort, and integration of smart technologies in door systems. Suppliers continue to invest in lightweight, modular, and electronically integrated solutions, aiming to meet stringent safety standards, reduce vehicle weight, and improve energy efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.6 Billion |

| Component | Latches & handles, Window regulators, Speakers, Motors & actuators, Electrical connectors & wiring, Control units, Sealing systems, and Others |

| Module | Automated door modules and Manual door modules |

| Door Type | Front door modules, Rear door modules, Sliding door modules, and Liftgate door modules |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aptiv, Magna International, Brose Fahrzeugteile GmbH, Robert Bosch, Denso Corporation, ZF Friedrichshafen AG, Valeo SA, Panasonic Corporation, Continental AG, and Siemens AG |

| Additional Attributes | Dollar sales vary by module type, including front-door modules, rear-door modules, and integrated door control units; by vehicle type, spanning passenger vehicles, commercial vehicles, and electric/hybrid vehicles; by application, such as power windows, central locking, speakers, and safety systems; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising vehicle production, demand for advanced safety and convenience features, and increasing adoption of electric and connected vehicles. |

The global automotive door module market is estimated to be valued at USD 33.6 billion in 2025.

The market size for the automotive door module market is projected to reach USD 54.7 billion by 2035.

The automotive door module market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in automotive door module market are latches & handles, window regulators, speakers, motors & actuators, electrical connectors & wiring, control units, sealing systems and others.

In terms of module, automated door modules segment to command 55.6% share in the automotive door module market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA