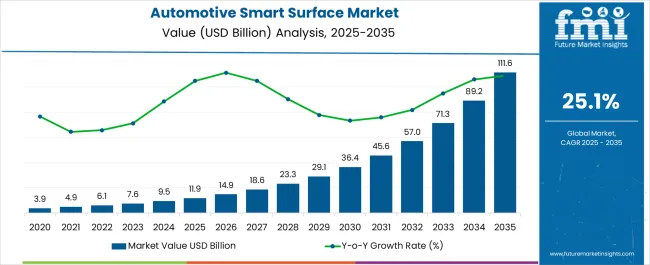

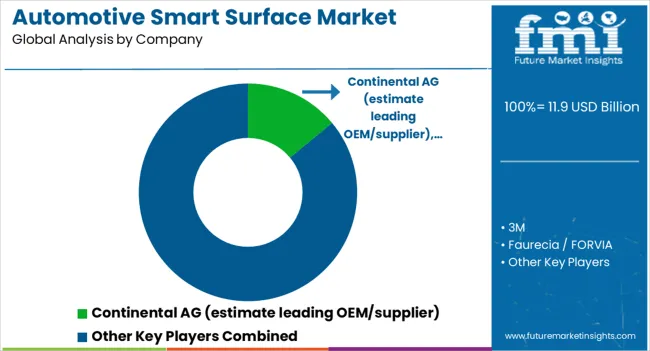

The automotive smart surface market, valued at 11.9 USD billion in 2025, is projected to reach 111.6 USD billion by 2035, reflecting a CAGR of 25.1% over the period. The market maturity curve shows initial growth during 2020–2024, when early adoption is driven by high-end vehicle prototypes and limited deployments, with annual market size increasing from 3.9 to 9.5 USD billion. By 2025, the curve steepens as adoption spreads to broader passenger vehicle segments.

Between 2025–2030, the market scales rapidly, growing from 11.9 to 36.4 USD billion, driven by rising integration in mainstream models. From 2030–2035, growth moderates as consolidation occurs, with leading suppliers capturing the majority of market share. The adoption lifecycle mirrors this progression. In 2020–2024, early adopters validate performance, reliability, and integration, creating reference cases for broader deployment. From 2025–2030, scaling occurs as production ramps up, procurement standardizes, and partnerships expand to meet growing demand.

By 2030–2035, consolidation dominates: late entrants adopt proven integration strategies, mergers and collaborations shape competitive dynamics, and procurement emphasizes cost efficiency and volume predictability. The market transitions from experimental adoption, through rapid scale-up, to an organized phase with stable demand patterns, optimized supply chains, and well-established supplier relationships.

| Metric | Value |

|---|---|

| Automotive Smart Surface Market Estimated Value in (2025 E) | USD 11.9 billion |

| Automotive Smart Surface Market Forecast Value in (2035 F) | USD 111.6 billion |

| Forecast CAGR (2025 to 2035) | 25.1% |

Data indicates that Q3 and Q4 often account for 40–50% of annual procurement, coinciding with peak vehicle production and year-end model rollouts. Conversely, Q1 typically records 10–15% lower activity, as manufacturers adjust inventories and plan for new model introductions. Certain premium vehicle launches cluster in specific quarters, creating temporary demand spikes of 15–20% above baseline levels.

Suppliers coordinate production, assembly, and logistics around these seasonal patterns to ensure timely delivery and avoid bottlenecks during low-demand periods. Cyclicality reflects broader automotive investment and fleet replacement patterns. Vehicle OEMs typically update models or integrate new features on 5–7 year cycles, generating periodic surges in smart surface demand that can increase annual market size by USD 10–15 billion.

Policy changes, safety regulations, or regional fleet incentives can further accelerate demand, producing short-term spikes of 10–20% above projected growth. These cyclical patterns overlay the high CAGR of 25.1%, creating alternating periods of rapid expansion and moderate stabilization.

The Automotive Smart Surface market is experiencing significant momentum, supported by rising demand for enhanced functionality, aesthetics, and user experience in modern vehicles. Advancements in material science, electronics integration, and human-machine interface technologies have enabled the transformation of conventional surfaces into interactive platforms. Increasing consumer preference for personalized and connected interiors has encouraged automakers to invest in smart surfaces that combine touch controls, ambient lighting, and integrated displays.

Growth has also been influenced by the push for lightweight materials and space optimization, which smart surfaces address effectively by integrating multiple functions into a single component. Regulatory trends toward safety and sustainability are further driving innovation, as manufacturers adopt recyclable materials and energy-efficient lighting solutions.

As electric and autonomous vehicles gain traction, the role of smart surfaces in enhancing cabin comfort, user engagement, and brand differentiation is expected to expand This convergence of technology, design, and functionality positions the market for robust growth in both established and emerging automotive markets.

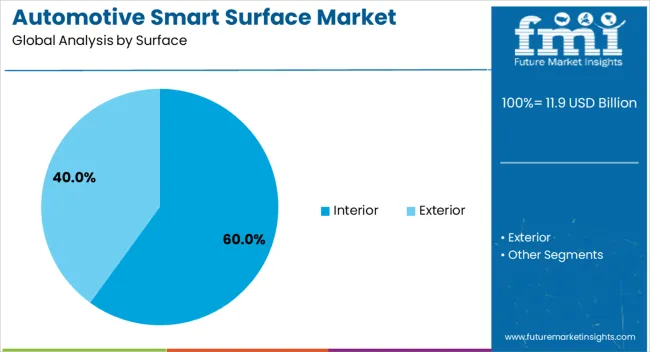

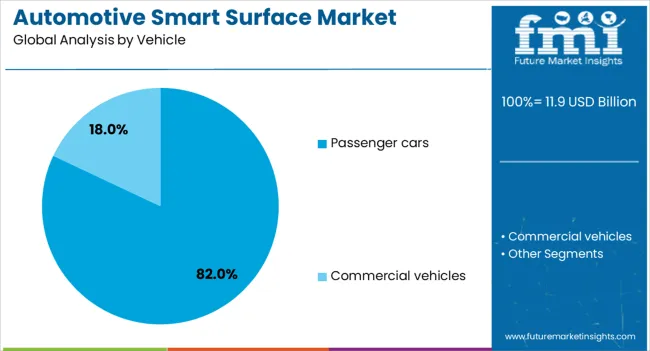

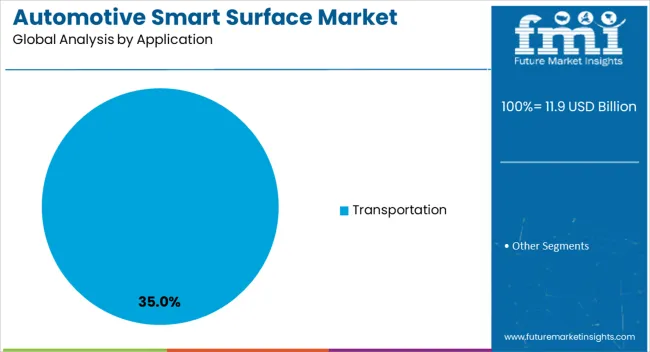

The automotive smart surface market is segmented by surface, vehicle, application, technology, and geographic regions. By surface, automotive smart surface market is divided into Interior and Exterior. In terms of vehicle, automotive smart surface market is classified into Passenger cars and Commercial vehicles. Based on application, automotive smart surface market is segmented into Transportation.

By technology, automotive smart surface market is segmented into Touchscreen interfaces. Regionally, the automotive smart surface industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The interior surface segment is projected to hold 60% of the automotive smart surface market revenue share in 2025, making it the dominant segment by surface type. This leadership has been driven by the growing emphasis on enhancing in-cabin experiences through interactive and aesthetically appealing components. Manufacturers have increasingly adopted smart surfaces for dashboards, door panels, and center consoles to integrate touch-sensitive controls, haptic feedback, and customizable lighting.

The use of advanced materials has enabled improved durability and design flexibility, while seamless integration with infotainment and climate control systems has enhanced overall user convenience. The shift toward electric and autonomous vehicles has further elevated the importance of interior smart surfaces, as passengers spend more time engaging with in-vehicle technologies.

Additionally, the ability to update functionalities through software has increased the long-term value of these surfaces. This combination of comfort, style, and technological adaptability has ensured the interior surface segment’s continued dominance in the market.

The passenger cars segment is anticipated to account for 82% of the Automotive Smart Surface market revenue share in 2025, emerging as the leading vehicle category. This dominance is attributed to the high production volumes and widespread adoption of smart surface technologies in premium and mid-range passenger vehicles.

Consumer demand for enhanced aesthetics, intuitive control systems, and advanced safety features has encouraged automakers to integrate smart surfaces extensively within the passenger vehicle cabin. The competitive nature of the automotive market has prompted manufacturers to differentiate their models through sophisticated interior designs and personalized user interfaces.

Integration with advanced driver assistance systems and infotainment platforms has further reinforced the role of smart surfaces in improving the driving and passenger experience. As urbanization, disposable incomes, and demand for connected vehicles increase globally, passenger cars are expected to remain the primary driver of smart surface adoption, sustaining the segment’s market leadership.

The transportation application segment is expected to secure 35% of the Automotive Smart Surface market revenue share in 2025, making it a major contributor by application. This growth has been influenced by the rising adoption of smart surface technologies in public transport systems, commercial fleets, and shared mobility solutions. Operators are leveraging smart surfaces to enhance passenger comfort, integrate real-time information systems, and improve the aesthetic appeal of vehicles used in transportation services.

The durability and ease of maintenance offered by advanced materials make them particularly suited for high-usage environments. In addition, smart surfaces with antimicrobial coatings and adaptive lighting have gained traction in addressing hygiene and safety concerns.

Integration with IoT-enabled monitoring systems is allowing transportation providers to optimize operations and improve service quality As governments and private operators invest in modernizing transport infrastructure, the deployment of automotive smart surfaces in buses, trains, and mobility fleets is expected to expand, supporting sustained growth in this segment.

The automotive smart surface market is expanding as manufacturers seek interactive, adaptive, and functional surfaces in vehicles. Smart surfaces enhance user experience, safety, and comfort through touch-sensitive controls, self-cleaning coatings, anti-fingerprint finishes, and adaptive lighting. Europe and North America focus on premium and electric vehicle adoption, while Asia-Pacific leads in volume integration. Manufacturers emphasize durability, tactile feedback, seamless design, and multi-functionality to meet evolving consumer and OEM demands, particularly in infotainment, interior panels, and exterior surface applications.

Automotive smart surfaces transform vehicle interiors by integrating touch-sensitive panels, gesture controls, and haptic feedback surfaces. These surfaces simplify control of infotainment systems, climate settings, and navigation, providing an intuitive user experience. Coatings and materials that resist scratches, fingerprints, and wear improve aesthetics and longevity. OEMs prefer surfaces that combine seamless integration with durability and multi-functionality, particularly in luxury and electric vehicles. Until alternative human-machine interface solutions provide comparable functionality and aesthetic integration, smart surfaces will remain critical for enhancing driver and passenger interaction with vehicle controls.

Smart surfaces contribute to vehicle safety through adaptive lighting, illuminated warnings, and surface feedback in critical zones. Anti-glare, anti-fingerprint, and self-cleaning coatings on control panels and displays ensure visibility under diverse conditions. Tactile cues on touch-sensitive surfaces can reduce driver distraction by allowing operation without looking. Manufacturers designing surfaces that maintain durability under repeated usage and environmental stresses gain preference in safety-conscious vehicle segments. Until alternative safety-enhancing technologies offer comparable integration with interior and control surfaces, automotive smart surfaces remain essential in modern vehicle design.

Exterior automotive smart surfaces provide protective and functional benefits, including self-cleaning coatings, anti-scratch layers, and color-adaptive finishes. These surfaces enhance aesthetics, reduce maintenance, and improve corrosion resistance. Vehicles with UV-protective or water-repellent coatings maintain appearance and longevity in diverse climates. OEMs seek multifunctional coatings that combine protection, adaptive appearance, and ease of cleaning. Until alternative exterior materials or coatings deliver the same level of durability, maintenance reduction, and aesthetic enhancement, smart surfaces will remain a preferred solution for modern vehicle exteriors.

The growth of connected and electric vehicles drives demand for surfaces that integrate sensors, displays, and adaptive functionalities. Smart surfaces can interact with vehicle electronics to display notifications, indicate charging status, or provide real-time environmental feedback. OEMs are investing in materials and coatings compatible with embedded electronics, touch control, and adaptive lighting. Until alternative interior and exterior solutions offer the same combination of interactivity, durability, and integration with vehicle electronics, smart surfaces will remain a crucial element in designing next-generation vehicles that combine functionality, safety, and user engagement.

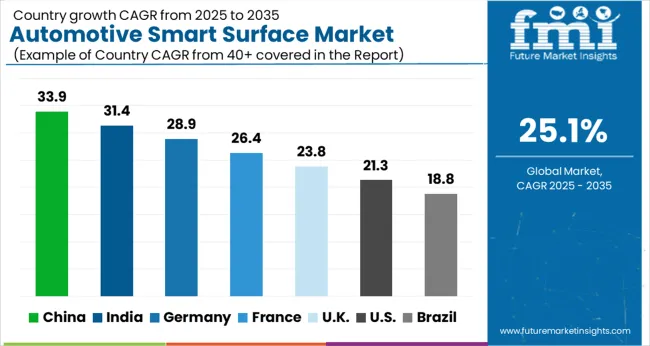

| Country | CAGR |

|---|---|

| China | 33.9% |

| India | 31.4% |

| Germany | 28.9% |

| France | 26.4% |

| UK | 23.8% |

| USA | 21.3% |

| Brazil | 18.8% |

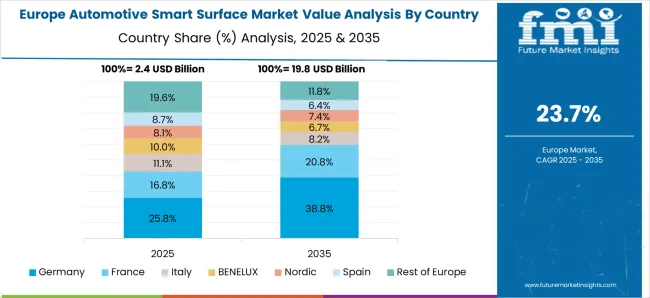

The global market is projected to grow at a CAGR of 25.1% through 2035, supported by increasing demand across automotive interiors, exterior coatings, and sensor-integrated surfaces. Among BRICS nations, China has been recorded with 33.9% growth, driven by large-scale production and deployment in connected and luxury vehicles, while India has been observed at 31.4%, supported by rising utilization in automotive interiors and smart surface applications. In the OECD region, Germany has been measured at 28.9%, where production and adoption for automotive and high-performance vehicle applications have been steadily maintained. The United Kingdom has been noted at 23.8%, reflecting consistent use in automotive interior and exterior smart surfaces, while the USA has been recorded at 21.3%, with production and utilization across connected, luxury, and high-performance automotive applications being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The automotive smart surface market in China is expanding at a CAGR of 33.9%, driven by the integration of advanced technologies in vehicles and rising demand for smart, interactive, and adaptive surfaces. Smart surfaces enhance vehicle interiors and exteriors with touch-sensitive controls, adaptive displays, anti-fingerprint coatings, and advanced haptic feedback systems. The growing automotive manufacturing base, focus on electric vehicles, and consumer preference for high-tech interiors are key growth drivers. Continuous R&D in nanocoatings, conductive materials, and surface functionality boosts market adoption. Government initiatives promoting new energy vehicles and high-tech automotive manufacturing support expansion. OEMs are increasingly incorporating smart surfaces to differentiate products and improve user experience. The combination of technological innovation, rising consumer expectations, and industrial investment positions China as a leading market for automotive smart surface technologies.

The automotive smart surface market in India is growing at a CAGR of 31.4%, fueled by increasing adoption of advanced in-vehicle technologies and rising electric vehicle production. Smart surfaces offer multifunctional interfaces, improved aesthetics, and enhanced user experience through touch sensitivity, anti-smudge coatings, and haptic feedback. Growing automotive manufacturing, consumer preference for tech-rich interiors, and investments in electric and hybrid vehicles drive demand. OEMs are incorporating smart surfaces for dashboards, center consoles, and exterior panels to enhance functionality and differentiate offerings. Government initiatives promoting electric mobility, innovation, and smart automotive components encourage market growth. R&D in surface coatings, conductive materials, and multifunctional interfaces further accelerates adoption. India’s automotive smart surface market is poised for rapid expansion due to industrial growth, technological advancements, and increasing consumer expectations.

The automotive smart surface market in Germany is expanding at a CAGR of 28.9%, supported by high-tech automotive manufacturing, luxury vehicle production, and technological innovation. Smart surfaces provide touch-sensitive interfaces, adaptive displays, and enhanced haptic feedback, improving vehicle aesthetics and user interaction. Germany’s strong automotive sector, focus on electric and autonomous vehicles, and continuous R&D in advanced materials and coatings drive market growth. OEMs adopt smart surfaces to improve ergonomics, vehicle safety, and consumer appeal. Government programs promoting innovation, electrification, and smart manufacturing further support expansion. Industrial demand, combined with regulatory compliance for sustainable and innovative vehicle components, ensures a steady growth trajectory. Germany remains a key market for automotive smart surfaces due to technological leadership, premium vehicle production, and strong automotive R&D infrastructure.

The automotive smart surface market in the United Kingdom is growing at a CAGR of 23.8%, driven by increasing integration of intelligent interfaces in electric and premium vehicles. Smart surfaces enhance interiors with touch-sensitive dashboards, adaptive displays, and anti-fingerprint coatings, improving comfort and user experience. OEMs in the UK focus on incorporating innovative materials and multifunctional surfaces for vehicle differentiation. Rising electric vehicle adoption, industrial investments in automotive R&D, and consumer demand for advanced interiors propel market growth. Government initiatives promoting clean mobility, smart vehicle technologies, and industrial innovation support adoption. The combination of consumer preferences, automotive innovation, and regulatory support positions the UK market for steady growth in automotive smart surfaces.

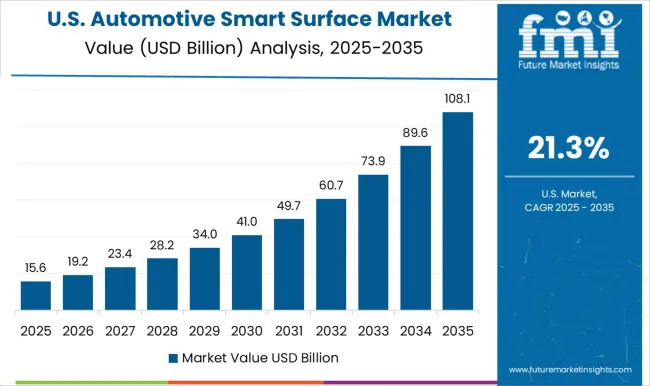

The automotive smart surface market in the United States is expanding at a CAGR of 21.3%, driven by adoption in electric, autonomous, and premium vehicles. Smart surfaces provide interactive dashboards, adaptive displays, anti-fingerprint coatings, and haptic feedback, enhancing comfort, usability, and aesthetics. OEMs invest in R&D to incorporate advanced coatings, conductive materials, and multifunctional interfaces for competitive differentiation. Government programs promoting EV adoption, advanced mobility technologies, and industrial innovation support market growth. High consumer expectations for smart interiors, combined with automotive industry investments, ensure steady demand. The USA automotive smart surface market benefits from strong R&D infrastructure, technological innovation, and regulatory support, positioning it for sustained expansion.

The automotive smart surface market is rapidly evolving, driven by the growing demand for enhanced vehicle interiors, intuitive interfaces, and next-generation human-machine interaction (HMI) technologies. Smart surfaces in vehicles include touch-sensitive panels, haptic feedback systems, and integrated displays that offer both aesthetic appeal and functional advantages, improving safety, convenience, and overall user experience. Rising consumer expectations for connected and personalized vehicles, along with the push for electric and autonomous vehicles, are fueling market growth globally. Continental AG is a major player in the market, providing innovative smart surface solutions integrated with advanced HMI technology for automotive applications. 3M contributes with engineered films, coatings, and optical solutions designed for interactive automotive surfaces. Faurecia, now part of FORVIA, offers a broad portfolio of interior smart surfaces, including touch panels and haptic interfaces that enhance driver interaction.

Gentex specializes in smart mirrors and integrated display systems that combine functionality and safety features. Companies like TactoTek and Canatu provide specialized technologies for embedded electronics, flexible displays, and conductive materials for automotive surfaces. Global material and electronics suppliers, including Covestro, LG, Samsung Display, Bosch, and Denso, support smart surface development with high-performance materials, coatings, sensors, and electronic modules. Additional OEMs and tier-one suppliers such as Marelli, Yanfeng, and Hyundai Mobis are expanding their portfolios with smart surface technologies for luxury, electric, and autonomous vehicles. As automotive design increasingly integrates advanced user interfaces, smart surfaces are becoming a critical component of modern vehicle interiors, driving innovation and differentiation across the industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.9 Billion |

| Surface | Interior and Exterior |

| Vehicle | Passenger cars and Commercial vehicles |

| Application | Transportation |

| Technology | Touchscreen interfaces |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Continental AG (estimate leading OEM/supplier), 3M, Faurecia / FORVIA, Gentex, TactoTek, Canatu, Covestro, LG / Samsung Display, Bosch / Denso, and Others (Marelli, Yanfeng, Hyundai Mobis, etc.) |

| Additional Attributes | Dollar sales by type including electrochromic, thermochromic, and photochromic surfaces, application across windows, mirrors, and interior panels, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for enhanced vehicle aesthetics, energy efficiency, passenger comfort, and adoption of advanced automotive technologies. |

The global automotive smart surface market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the automotive smart surface market is projected to reach USD 111.6 billion by 2035.

The automotive smart surface market is expected to grow at a 25.1% CAGR between 2025 and 2035.

The key product types in the automotive smart surface market are interior (subcomponents: HMI, Trim, Armrests, Dashboards), exterior (subcomponents: door panels, external trim, lighting surfaces).

In terms of vehicle, passenger cars segment to command 82.0% share in the automotive smart surface market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA