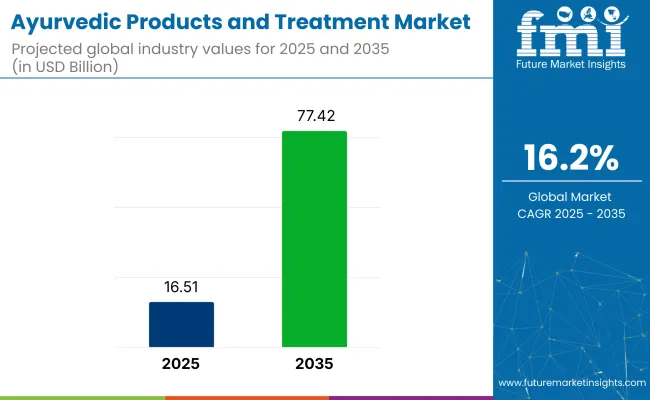

The ayurvedic products and treatment market is experiencing robust growth, with its value projected to rise from USD 16.51 billion in 2025 to USD 77.42 billion by 2035, at a CAGR of 16.2% during the forecast period.

This substantial increase highlights the growing global demand for traditional medicine systems, particularly Ayurveda, which focuses on achieving bodily balance through diet, herbal remedies, and yogic practices. The market's upward trajectory reflects a deepening consumer preference for natural, holistic approaches to health and wellness.

The market holds a modest but expanding share across its broader parent markets. Within the global herbal and traditional medicine market, Ayurveda accounts for approximately 15-20%, led by growing global recognition of Indian systems of medicine. In the alternative and complementary medicine market, its share is around 10-12%, as it competes alongside traditional Chinese medicine, naturopathy, and homeopathy.

Within the wellness and preventive healthcare market, Ayurveda contributes roughly 5-7%, largely through detox therapies and lifestyle-based treatments. In the natural and organic personal care market, Ayurvedic skincare and haircare products form about 4-6%. In the nutraceuticals and functional foods market, Ayurvedic supplements and tonics hold a smaller share of 2-4%, but are growing steadily.

Around 240 Ayurvedic manufacturers have ramped up production using automation to meet rising demand. Industry leaders are urging the Madhya Pradesh government to develop a dedicated herbal cluster with huge investment potential, aiming to boost exports, infrastructure, and regional growth in the Ayurvedic sector.

Mr. Ashish Thakur, the CEO of Birla Healthcare Ayurveda, says, “Ayurveda emphasises the use of medicinal plants and herbs for internal healing, disease prevention, and wellness maintenance as a sustainable healthcare approach.”

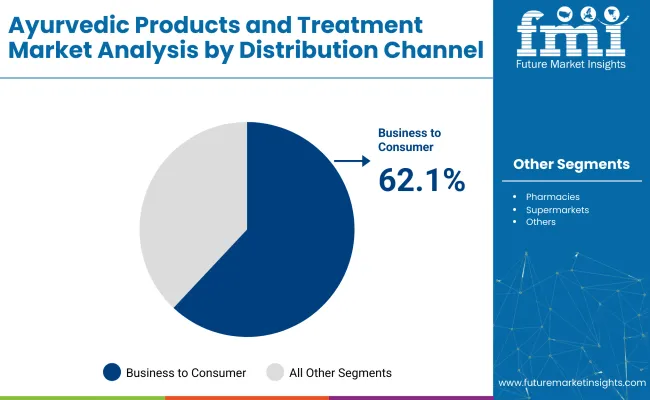

Tablets remain the most favored form due to their convenience and reliability, while the B2C channel dominates distribution, driven by rising online engagement and direct consumer access.

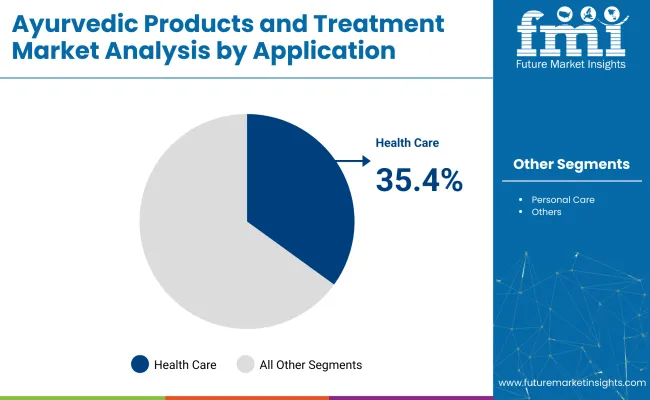

The health care products segment is anticipated to lead the market, capturing 35.4% of the total market share in 2025. This dominant position reflects the growing consumer reliance on ayurvedic health care solutions, particularly for boosting immunity, enhancing overall wellness, and managing lifestyle-related conditions.

The tablet form is projected to dominate the market, accounting for approximately 32.8% of the total market share in 2025. This dominance is largely attributed to the convenience, longer shelf life, accurate dosage, and ease of consumption that tablets offer compared to other forms like powders or liquids.

The healthcare application segment is expected to dominate the market, accounting for 58.7% of the total market share in 2025. This significant share highlights the growing global reliance on Ayurveda for therapeutic and preventive health solutions.

The Business to Consumer (B2C) segment is projected to lead the market, holding 62.1% market share in 2025. This dominance is driven by the increasing shift toward direct consumer engagement through both offline retail outlets and digital platforms.

Growing consumer awareness of natural health solutions and a shift toward preventive care are significantly boosting demand for Ayurvedic products. Simultaneously, strong government support and industry modernization are enhancing global acceptance and competitiveness of Ayurveda.

Rising Consumer Awareness and Shift Toward Preventive Healthcare

One of the most significant dynamics driving the market is the growing global awareness of natural and holistic wellness approaches. Consumers are increasingly informed about the side effects of synthetic medications and are seeking alternatives that align with long-term health goals. Ayurveda, with its focus on balance, immunity enhancement, and disease prevention, fits this demand perfectly.

This shift is especially prominent among urban populations and aging demographics, who are actively incorporating Ayurvedic products into their daily routines for preventive care. The COVID-19 pandemic also accelerated this awareness, prompting consumers to adopt traditional health practices for immunity building and overall wellness.

Government Initiatives and Industry Modernization

A key factor influencing the market is the strong support from governments, particularly in countries like India, where Ayurveda is an integral part of the healthcare system. Investments in research, regulatory frameworks, and international promotion have significantly enhanced the credibility and global reach of Ayurvedic products.

Simultaneously, the industry is modernizing, with companies embracing advanced manufacturing practices, obtaining quality certifications, and standardizing products to meet international standards. These advancements are increasing the competitiveness and acceptance of Ayurvedic products in global markets, facilitating expanded exports, clinical acceptance, and greater investor interest in the sector.

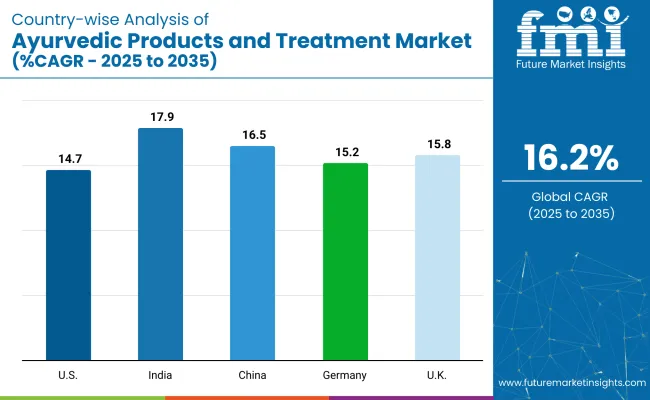

| Countries | CAGR (%) |

|---|---|

| USA | 14.7% |

| India | 17.9% |

| China | 16.5% |

| Germany | 15.2% |

| UK | 15.8% |

The industry is expected to be driven by rising consumer preference for natural and preventive healthcare solutions, along with increasing global wellness awareness. Rapid growth is anticipated in India and Southeast Asia, while markets like the USA and Europe are focusing on product standardization, innovation, and integration into mainstream health systems.

The USA ayurvedic products and treatment market is estimated to grow at a CAGR of 14.7% during the study period from 2025 to 2035. This growth is driven by rising awareness of holistic health practices, an increasing shift toward preventive healthcare, and a growing consumer base interested in plant-based and natural alternatives to conventional medicine.

The Indian ayurvedic products and treatment market is projected to expand at a CAGR of 17.9% between 2025 and 2035.

The Chinese ayurvedic products and treatment market is expected to grow at a CAGR of 16.5% over the forecast period.

The German ayurvedic products and treatment market is anticipated to grow at a CAGR of 15.2% from 2025 to 2035.

The UK ayurvedic products and treatment market is forecasted to grow at a CAGR of 15.8% over the forecast period.

Key players like Dabur Ltd. and Patanjali Ayurved Limited dominate the industry with their extensive product portfolios, strong distribution networks, and deep consumer trust. Dabur leverages over a century of expertise and offers a wide range of Ayurvedic health care, personal care, and wellness products across global markets. Patanjali, on the other hand, has rapidly expanded with aggressive pricing, mass-market appeal, and vertical integration, making Ayurvedic products accessible to a broad consumer base.

Himalaya Wellness Company continues to lead in research-backed herbal formulations, offering pharmaceuticals and personal care products in over 90 countries. Other major players such as Emami Limited, Baidyanath, and Kerala Ayurveda Limited focus on authenticity and traditional formulations while investing in modern packaging and global outreach. Meanwhile, Vicco Laboratories, Hamdard Laboratories, Maharishi Ayurveda, and Lotus Herbals target specific categories like oral care, classical Ayurvedic medicines, and herbal beauty, contributing to the sector’s diversity and continued innovation.

Recent Ayurvedic Products and Treatment Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 16.51 billion |

| Projected Market Size (2035) | USD 77.42 billion |

| CAGR (2025 to 2035) | 16.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in units |

| Product Analyzed (Segment 1) | Drugs, Skin Care Products, Hair Care Products, Health Care Products, Oral Care Products, And Others. |

| Form Analyzed (Segment 2) | Powder, Tablets, Capsules, Liquid, And Others. |

| Applications Covered (Segment 3) | Healthcare, Personal Care , And Others. |

| Distribution Channel Covered (Segment 4) | Business To Business (B2B) And Business To Consumer (B2C). |

| Regions Covered | North America , Western Europe , East Asia , South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Market | Emami Limited, Vicco Laboratories, Baidyanath , Hamdard Laboratories, Kerala Ayurveda Limited, Dabur Ltd., Patanjali Ayurved Limited, Himalaya Wellness Company, Maharishi Ayurveda, Lotus Herbals. |

| Additional Attributes | Dollar sales, market share, growth trends, key segments, competitive landscape, consumer preferences, distribution channels, regional demand, regulatory impact, product innovations, pricing strategies, and emerging opportunities. |

The market is segmented into drugs, skin care products, hair care products, health care products, oral care products, and others.

The market covers powder, tablets, capsules, liquid, and others.

The market is categorized into healthcare (respiratory system, gastrointestinal care, cardiovascular health, infectious diseases, othopedic health, and others), personal care (oral care, skin care, and hair care), and others.

The market is divided into business to business (B2B) (wholesalers, pharmacies, supermarkets, and others) and business to consumer (B2C).

The market spans North America, Western Europe, East Asia, and South Asia.

The market is expected to reach USD 77.42 billion by 2035.

The market size is projected to be USD 16.51 billion in 2025.

The market is expected to grow at a CAGR of 16.2% from 2025 to 2035.

India is expected to be the fastest growing with a CAGR of 17.9%.

Business to Consumer (B2C), accounting for over 62.1% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ayurvedic Supplement Market Size and Share Forecast Outlook 2025 to 2035

Ayurvedic Throat Care Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Ziplock Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA