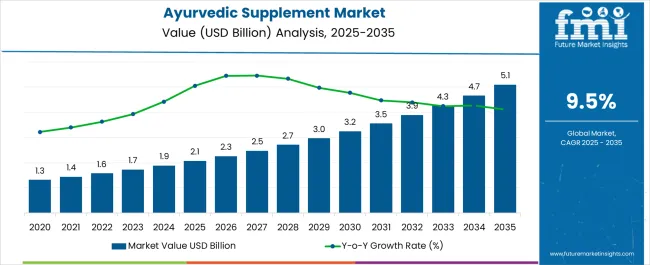

The Ayurvedic Supplement Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Ayurvedic Supplement Market Estimated Value in (2025 E) | USD 2.1 billion |

| Ayurvedic Supplement Market Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The Ayurvedic supplement market is experiencing robust growth. Rising consumer awareness of natural and holistic wellness solutions has been driving adoption. Current dynamics are marked by increasing preference for preventive healthcare and shifting demand from synthetic to herbal formulations.

Regulatory recognition of Ayurveda and integration into mainstream healthcare practices have further strengthened market penetration. Distribution efficiency has been enhanced by expanding e-commerce and retail pharmacy networks, while manufacturers are focusing on quality standardization and compliance to build global trust. The future outlook is shaped by rising disposable incomes, lifestyle-related health concerns, and a growing inclination toward personalized wellness solutions.

Innovation in formulations, packaging, and delivery formats is expected to broaden product accessibility Growth rationale rests on the alignment of Ayurvedic supplements with preventive health trends, global acceptance of traditional medicine, and strategic distribution through diversified channels, ensuring consistent expansion of the market over the forecast horizon.

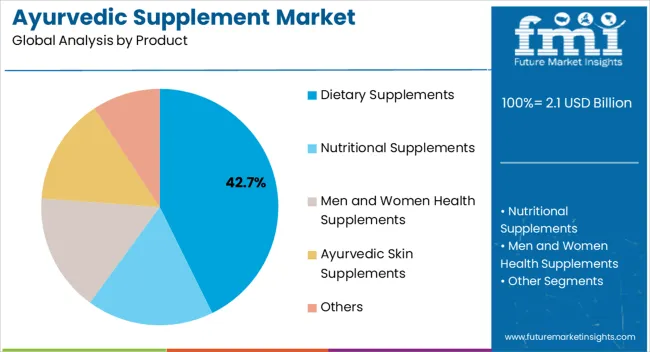

The dietary supplements segment, accounting for 42.70% of the product category, has been leading the market due to its wide applicability in addressing nutritional deficiencies and supporting preventive health practices. Demand growth has been supported by increasing consumer reliance on natural remedies and rising awareness of Ayurveda-based nutrition.

Manufacturing capabilities have been enhanced with standardized extraction techniques and improved quality controls, ensuring consistent efficacy and safety. Adoption has been reinforced by recommendations from wellness practitioners and integration into daily health routines.

The segment’s position has been further strengthened by expanding product variants, including immunity-boosting and stress-relief formulations, which align with evolving lifestyle needs Continued focus on innovation, coupled with sustained demand from both urban and rural consumers, is expected to maintain the dietary supplements segment as a leading contributor within the Ayurvedic supplement market.

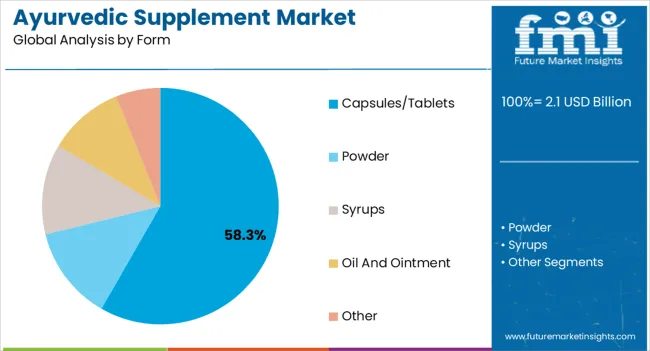

The capsules and tablets segment, holding 58.30% of the form category, has maintained dominance owing to its convenience, portability, and precise dosage delivery. Consumer preference has been shaped by ease of use, longer shelf life, and compatibility with modern healthcare practices.

Production efficiencies, including automated encapsulation and tablet compression technologies, have supported scalability and ensured quality uniformity. The segment has benefitted from broad acceptance in both domestic and export markets, where standard dosage formats are often mandated by regulatory frameworks.

Rising demand for on-the-go wellness solutions has further strengthened adoption With growing focus on preventive healthcare and lifestyle management, capsules and tablets are expected to remain the most preferred format, supporting steady market growth and broadening consumer accessibility across diverse demographic segments.

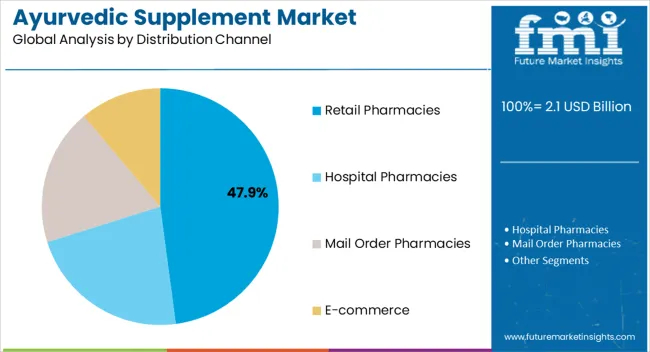

The retail pharmacies segment, representing 47.90% of the distribution channel category, has emerged as the leading channel due to its accessibility, established trust, and regulatory compliance. Availability through retail pharmacies has facilitated consumer confidence in product authenticity and safety.

Demand has been reinforced by integration of Ayurvedic supplements into conventional pharmacy offerings, supported by recommendations from healthcare professionals. Strong distribution networks and organized retail penetration have expanded market reach, particularly in urban centers.

The segment’s growth is further supported by consumer preference for point-of-sale guidance and immediate product availability With retail pharmacies adapting to evolving consumer needs by offering both offline and omni-channel access, their role in distributing Ayurvedic supplements is expected to remain central, ensuring continued leadership in the market landscape.

The sales of ayurvedic supplements expanded at a CAGR of 5.4% from 2020 to 2025. The 2020 market value was USD 1,314.6 million, while the 2025 value was tipped to USD 1,708.5 million.

There has been a constant increase in chronic health issues and obesity among people globally in recent times. According to WHO, around 422 million individuals with diabetes are present globally, and diabetes is directly responsible for 1.5 million fatalities annually. The prevalence of the disease is further rising steadily. As a result, underlying health conditions stimulate people to adopt consumables with functional benefits to boost immunity. Thus, the deteriorating health conditions of individuals are leading to a growth in the consumption of dietary supplements.

| Data Points | Market Insights |

|---|---|

| Market Value 2025 | USD 1,708.5 million |

| Market Value 2020 | USD 1,314.6 million |

| CAGR 2020 to 2025 | 5.4% |

Furthermore, ayurvedic supplements contain herbal extracts from plants and are safe for the human body compared to conventional medicines, which contain chemicals. Therefore, the ayurvedic supplement market is growing due to its health-effective factors. With increased demand for natural and plant-based products, organic skincare products are achieving new heights in the market. Moreover, skin and hair supplements with ayurvedic ingredients are predicted to drive market growth.

The popularity of ayurvedic products increased rapidly during the COVID-19 pandemic. People have adopted ayurvedic products and medicines worldwide to boost their immune systems. Additionally, the pandemic has changed the lifestyle of consumers and increased the adoption of preventive healthcare solutions. With this, the demand for immunity-boosting supplements has also increased, which is propelling the market.

Thus, owing to the factors above, the global market is expected to grow 9.9% during the forecast period.

The demand for ayurvedic immune-boosting drugs and supplements is rising. Government agencies and industry players are also developing fresh approaches to boost market expansion. Additionally, the rise in investments in new research and other initiatives will help the market to grow.

Ayurvedic supplements are still blooming in developing regions and Western countries. Countries such as Argentina, Canada, and Peru still need to be tapped for the market. Creating awareness about ayurvedic products and supplements in unexplored areas is a lucrative opportunity for market players. Furthermore, increasing awareness about ayurvedic medicines in countries like India and Indonesia is slated to create opportunities for ayurvedic products in the coming years.

More knowledge about ayurvedic products in countries like the United States is a restraint to the market growth of ayurvedic supplements. The use of alternative products is further hampering the market for ayurvedic supplements.

The use of ayurvedic medications has grown recently among people worldwide. But ayurvedic remedies are reputed to consume a lot of time for recovery, because of which people prefer conventional medicine, which shows rapid results. Further, it is anticipated that in the approaching years, the growth opportunities in the worldwide market will be constrained by the Western world’s need for more knowledge of the scientific documentation of Ayurveda.

Thus, the overall effects of all the restraints cumulatively propose a negative impact on the growth of the ayurvedic supplement market.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

| Japan | 9.1% |

| Germany | 6.6% |

| India | 8.1% |

| China | 8.8% |

India, being the birthplace of ayurveda, is slated for promising growth in the market. For the forecast period, the CAGR for India is predicted to be 8.1%.

The key factor driving the Indian market is the growing popularity of plant-based medicines. As people in India know the benefits of ayurvedic medicines, the demand for ayurvedic supplements is high. Moreover, the rising distaste for the side effects of conventional medication is further propelling the preference for ayurvedic supplements.

Additionally, the Indian government is helping matters by encouraging the use of ayurvedic products through various initiatives. For instance, the Ministry of Ayush has prioritized research and education in homeopathy and ayurveda. To achieve a healthy nation, the Indian government has outlined the objective to make AYUSH practices and lifestyles the standard.

The market for ayurvedic supplements is expanding rapidly in Japan, with a CAGR of 9.1% for the forecast period.

Marketing strategies have ensured that the Japanese people are more accepting of ayurvedic medicine and supplements. Traditional Japanese medicine is based heavily on herbs and plants. Ayurvedic supplement brands, too, have pronounced the plant-based nature of the product. Thus, Japan is a significant country for the ayurvedic supplement market.

China is another Asian country with potential for the market. For the forecast period, the CAGR for China is projected to be 8.8%.

The shift from Korean and Chinese beauty products to ayurveda-inspired beauty products has become a new trend in China. The Chinese population has gradually shifted towards plant-based and organic skincare supplements. The popularity of ayurveda is indicative that younger Chinese consumers are interested in well-being on more than just a surface level. Therefore, the market for ayurvedic supplements in China is being driven forward.

Germany is one of the swiftly-growing countries in Europe for ayurveda. For the forecast period, the CAGR for Germany is anticipated to be an encouraging 6.6%.

The market for ayurvedic supplements in Germany is expanding due to the increasing popularity of ayurvedic medicines and growing ayurvedic centers and research institutes. Mark Rosenberg, founder of the European Academy of Ayurveda, Germany, has quoted that there has been an increase in treatment centers and more than a thousand wellness centers for patients to receive advice on ayurveda. Thus, the market has a positive outlook in Germany.

A large segment of the United States population is adopting traditional Indian practices like yoga. The groundwork is laid for other Indian practices in the country, such as ayurveda. Thus, ayurvedic supplements are progressing positively in the country. The CAGR for the United States over the forecast period is pegged at 7.9%.

Nutritional supplements are expected to progress at a CAGR of 11.5% in the projected period, with a leading market share by product type of 28.9% anticipated in 2025. The rising demand for immunity booster supplements among people worldwide has created a large market for nutritional supplements. Additionally, the population suffering from chronic diseases and obesity is increasing day by day, and people are adopting a healthy lifestyle. Thus, there is the growth of nutritional ayurvedic supplements.

| Attributes | Details |

|---|---|

| Top Product Type | Nutritional Supplements |

| Market Share in 2025 | 28.9% |

The capsules/tablets segment is expected to progress at a CAGR of 10.0% over the forecast period. Meanwhile, the market share by form in 2025 for capsules/tablets is pegged at 35.9%. As capsules and tablets are easy to consume, the products are highly preferred by people across the globe. Therefore, the sale of ayurvedic supplements in the form of capsules is high.

| Attributes | Details |

|---|---|

| Top Form | Capsules/Tablets |

| Market Share in 2025 | 35.9% |

E-commerce is projected to hold a leading market share by distribution channel of 33.9% in 2025, with an expected CAGR of 8.3% until 2035. The availability of novel products on different online sites and increasing accessibility across other regions is expanding the market for ayurvedic supplements. Thus, the sale of ayurvedic supplements is predominantly moving online.

| Attributes | Details |

|---|---|

| Top Distribution Channel | E-commerce |

| Market Share in 2025 | 33.9% |

The market participants for ayurvedic supplements are implementing various strategies to increase sales and generate income. Ayurvedic supplement market players are engaging in actions like new product launches to meet consumer demand and grow.

Recent Developments

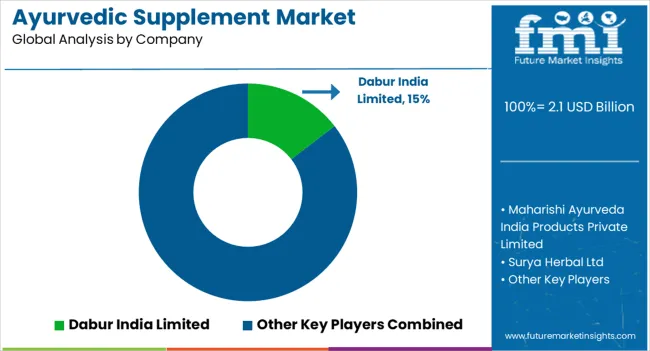

The global ayurvedic supplement market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the ayurvedic supplement market is projected to reach USD 5.1 billion by 2035.

The ayurvedic supplement market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in ayurvedic supplement market are dietary supplements, nutritional supplements, men and women health supplements, ayurvedic skin supplements and others.

In terms of form, capsules/tablets segment to command 58.3% share in the ayurvedic supplement market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ayurvedic Throat Care Market Size and Share Forecast Outlook 2025 to 2035

Ayurvedic Products and Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Analysis and Growth Projections for Green Supplement Business

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biotin Supplement Market Analysis – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA