The Battlefield Management Systems Market is estimated to be valued at USD 11.6 billion in 2025 and is projected to reach USD 18.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Battlefield Management Systems Market Estimated Value in (2025 E) | USD 11.6 billion |

| Battlefield Management Systems Market Forecast Value in (2035 F) | USD 18.1 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The battlefield management systems market is experiencing strong growth, supported by increasing defense modernization programs and the rising need for real-time situational awareness. The demand is being driven by advancements in command, control, communications, computers, intelligence, surveillance, and reconnaissance integration that enable seamless decision-making on the battlefield.

Governments across major economies are investing heavily in digital defense infrastructure, with a focus on technologies that enhance interoperability, reduce response times, and improve operational efficiency. The growing importance of network-centric warfare is further driving adoption, as militaries seek systems capable of integrating diverse platforms, sensors, and weapons into a unified command environment.

Continuous advancements in artificial intelligence, secure communications, and data fusion are shaping the future outlook of the market, allowing defense forces to operate with enhanced precision and reduced risks As conflicts become increasingly technology-driven, battlefield management systems are expected to remain a critical component of defense strategies, with expanding opportunities for suppliers that can deliver scalable and resilient solutions.

The battlefield management systems market is segmented by platform, component, end user, and geographic regions. By platform, battlefield management systems market is divided into Combat Vehicle-based BMS, Command HQ-based BMS, and Dismounted Soldier-based BMS. In terms of component, battlefield management systems market is classified into Devices, Battlefield Management Systems (BMS) Platform, and Services. Based on end user, battlefield management systems market is segmented into Ground Forces, Air Forces, and Naval Forces. Regionally, the battlefield management systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The combat vehicle-based BMS platform segment is projected to account for 41.3% of the battlefield management systems market revenue share in 2025, making it the leading platform category. Its dominance is being reinforced by the vital role combat vehicles play in frontline operations, where real-time situational awareness and secure communications are essential.

Integration of battlefield management systems into armored vehicles enhances coordination between units, supports rapid target acquisition, and improves survivability in complex operational environments. Growing investments in armored vehicle modernization programs are driving the incorporation of advanced BMS capabilities, enabling vehicles to serve as mobile command centers on the battlefield.

The ability of vehicle-based platforms to combine firepower, mobility, and digital connectivity provides a tactical edge, making them highly valued by ground forces With rising emphasis on joint operations and interoperability, combat vehicle-based systems are expected to remain the preferred choice for militaries seeking to strengthen battlefield efficiency and adaptability.

The devices component segment is anticipated to represent 38.9% of the battlefield management systems market revenue share in 2025, establishing itself as the leading component category. This growth is being supported by the increasing reliance on portable and wearable devices that enhance connectivity and situational awareness for soldiers. Devices such as rugged tablets, tactical communication units, and handheld computing systems are enabling real-time access to critical battlefield data, improving responsiveness and decision-making at the individual level.

The portability and durability of these devices make them indispensable for operations across diverse terrains and combat conditions. Continuous advancements in miniaturization, battery efficiency, and secure communications protocols are driving higher adoption across defense forces globally.

The ability to integrate seamlessly with broader command and control networks ensures that devices remain a cornerstone of battlefield digitization As militaries prioritize soldier-centric technologies to enhance operational effectiveness, the devices segment is expected to maintain its leadership in the market.

The ground forces segment is expected to capture 59.4% of the battlefield management systems market revenue share in 2025, positioning it as the dominant end user. This leadership is being reinforced by the critical importance of land-based operations in modern warfare, where situational awareness and real-time coordination are essential for mission success.

Ground forces rely heavily on battlefield management systems to enhance command and control, enable rapid data exchange, and improve tactical decision-making in high-pressure environments. Growing investments in infantry modernization programs, including the integration of wearable technologies and advanced communication systems, are driving the segment’s expansion.

The ability of battlefield management systems to provide ground forces with a common operational picture enhances coordination across units and improves responsiveness in dynamic combat scenarios As military strategies increasingly emphasize mobility, precision, and joint operations, ground forces are expected to continue dominating adoption of BMS solutions, ensuring their central role in the market’s growth trajectory.

The battlefield management system market revenue by the end of 2025 was US$ 9.8 Billion. The battlefield management system market is expected to reach US$ 15.9 Billion by 2035, as it is estimated to grow at a CAGR of 4.6% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Estimated Year (2025) Market Value | US$ 10.1 Billion |

| Projected Year (2035) Market Value | US$ 15.9 Billion |

| CAGR% (2025 to 2035) | 4.6% |

| Top 5 Vendor Market Share | Around 45% |

A battlefield management system (BMS) is a system that is used for gathering data and processing information for command and control in military army force units. BMS provides a common operating picture (COP) tool. Using this tool, decision-making bodies in the military can take timely decisions with the right information.

The battlefield management system market consists of 20% of the global digital battlefield market.

The battlefield management system market is estimated to grow at a CAGR of 4.6% for the forecast period.

Due to steadily changing fighting situations in a few nations across the world, the interest in trend-setting innovative weapons is expanding at a fast rate. A few nations across the world are financially planning to secure the development of BMS gear and parts to be prepared in the event of war.

Trend-setting innovations like expanded reality and computer-generated reality are totally changing procedures and are prompting development in government towards warrior modernization.

Situational awareness gives the capacity to distinguish, process, and basic data from different sources. The progress of any air, maritime, or military activity relies on the precision of knowledgeable decisions. High-level knowledge, observation, and surveillance advances incorporated with order and control capacities give air, ground, and sea arrangements with constant situational mindfulness data for key independent direction. The Mission Expert battle vehicles are coordinated with the front-line executives' frameworks for exact and ongoing situational awareness.

North America was estimated to have the largest market share in 2025 with 29.6%, and South Asia and the Pacific are estimated to be the fastest growing region for the battlefield management system market with a CAGR of 4.9% for the forecast period.

There are many manufacturers of BMS operating in North America, historically this region has spent massively on its defense and military infrastructure, and only recently has it decided to cut down on the expenditure. The countries USA and Canada, both have a presence in numerous international military tie-ups and the militaries also have large manpower and artillery at their disposal due to which management of these resources becomes important.

South Asia and Pacific expenditure is estimated to grow due to government initiatives to allow private companies to manufacture hardware and software solutions for military purposes and rising border tensions in this region.

The USA makes significant investments in battlefield management systems in order to introduce cutting-edge technologies in the defence sector. The market for battlefield management systems has benefited from the vast use of cutting-edge technologies in the area.

The USA government is still working to improve its capabilities in the air, land, and sea domains. Makes significant investments in the global military. The USA is increasingly putting an emphasis on soldier-level military modernization. The battlefield management systems market is experiencing significant prospects as a result of the battlefield's adoption of technologies like AI and IoT. The global market for battlefield management systems is being driven by the aforementioned causes.

As military technology advances and becomes more widely accessible, competitors quickly develop capabilities that endanger the troops. The USA military is creating battlefield management systems to prevent such threats. These systems assist in giving commanders exact real-time information so they can make judgments and execute extremely effective control during operations on the battlefield.

The Defence Ministry of India will order prototypes from the two consortia that are vying to provide India's new battlefield management system (BMS) within the next six months. The projected US$ 6 billion systems will be created under Make in India act and will only be available to Indian businesses. According to the Defence Ministry, the two development companies Tata Power SED and state-owned Bharat Electronics state-owned with Larsen & Toubro both presented their comprehensive project reports last month.

The development of weaponized AI by Russia is ascribed to the strategic outcome and dangers of autonomy as well as to the country's drive for power or the global AI race. One of the important areas for the future of defence strategy has been identified as the modernization of technology with artificial intelligence. One important feature of AI is that it can be integrated with systems to provide a variety of functions and technologies that can be used to create a tactical edge over competitors.

With significant investments in the military, the business sector, and state-sponsored actors, Russia is leading the way in its AI agenda. It has been claimed that the USA may be outmatched in the fields of artillery, armour, space, air defence, and cyberspace as a result of Russia's growing embrace of cutting-edge technologies and contemporary warfare capabilities.

Battlefield Management Systems (BMS) are essential to modern warfare, enabling commanders at all levels to make faster and better decisions based on reliable operational information provided in real time, and monitored sensors can quickly close the shooter loop. Future force operations will be combined and composed of all weapons and inter-service elements. These operations require units and subunits from other armies to act subordinately or in cooperation with each other.

The key to success is effective command and control of all forces, so commanders at all levels, especially top-level, need relevant information to improve their decision-making and leadership skills. Here, the use of information technology has the power to improve the operational efficiency of commanders and forces at all levels by enabling the sharing, filtering, and processing of currently available but unintegrated digital information.

Due to the above-mentioned reasons, ground forces held the highest market share of 46.5% in 2025.

Battlefield Management Systems (BMS) provide absolute situational awareness by efficiently displaying critical data to field commanders. The system provides an integrated and common operational picture with the help of collaborative planning tools. This allows tactical commanders to make quick, informed decisions and control battlefield operations with great efficiency.

Improving system reliability is an important factor in countries choosing battlefield management systems. The inclusion of advanced data distribution units allows real-time situational information to be collected and distributed to various command centers. Additionally, using GPS tools to get a complete picture of the battlefield provides critical information for mission planning and control.

Due to these factors, command HQ-based BMS was estimated to hold the highest market share of 43.3% for the year 2025.

The Battle Management System, combined with technology such as Soldier Data Terminals, Soldier Interface Units, Tactical Communications Equipment, and Vehicle-Mount Displays, enables armed forces to anticipate, characterize, and coordinate operations against enemy forces. Technological improvements such as SINCGARS Tactical BMS and Weapon Integrated BMS have enabled soldiers and vehicles to be tracked in real-time.

During the forecast period, recent innovations such as SINCGARS Tactical BMS (Tactical BMS for Single Channel Ground and Airborne Radio System) and WINBMS (Weapons Integrated Battle Management Systems) are expected to boost the demand. These systems provide real-time position monitoring, detection, command messaging, IP networking, and embedded GPS. WINBMS also offers encrypted data transfer.

Due to the above-mentioned reasons, devices are estimated to grow at a CAGR of 5.2% for the forecast period.

Although this market is dominated by companies that operate in the defense industry, companies that have a strong standing in providing software solutions and electronic components have also entered the battlefield management system market. The key vendors are either based in North America or Europe.

| Attribute | Details |

|---|---|

| Market value in 2025 | USD 11.6 billion |

| Market CAGR 2025 to 2035 | 4.6% |

| Share of top 5 players | Around 45% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2025 to 2025 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia & Pacific; East Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Australia & New Zealand, GCC Countries, Turkey, and South Africa |

| Key Segments Covered | Platform, Component, End User, and Region |

| Key Companies Profiled | Rolta; Atos; Teldat; Indra; Cobham Defence Communications; Lockheed Martin; Saab AB; Raytheon Technologies; Thales Group; Teleplan Globe |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

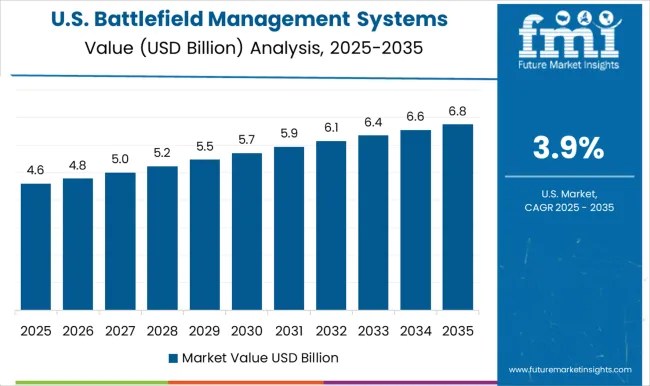

| USA | 3.9% |

| Brazil | 3.5% |

The Battlefield Management Systems Market is expected to register a CAGR of 4.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.2%, followed by India at 5.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.5%, yet still underscores a broadly positive trajectory for the global Battlefield Management Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.3%. The USA Battlefield Management Systems Market is estimated to be valued at USD 4.2 billion in 2025 and is anticipated to reach a valuation of USD 6.2 billion by 2035. Sales are projected to rise at a CAGR of 3.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 526.2 million and USD 348.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.6 Billion |

| Platform | Combat Vehicle-based BMS, Command HQ-based BMS, and Dismounted Soldier-based BMS |

| Component | Devices, Battlefield Management Systems (BMS) Platform, and Services |

| End User | Ground Forces, Air Forces, and Naval Forces |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rolta, Atos, Teldat, Indra, Cobham Defence Communications, Lockheed Martin, Saab AB, Raytheon Technologies, Thales Group, and Teleplan Globe |

| Additional Attributes |

The global battlefield management systems market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the battlefield management systems market is projected to reach USD 18.1 billion by 2035.

The battlefield management systems market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in battlefield management systems market are combat vehicle-based bms, command hq-based bms and dismounted soldier-based bms.

In terms of component, devices segment to command 38.9% share in the battlefield management systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Translation Management Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

AGV Intelligent Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Endoscopy Fluid Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Component Content Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Sponge City Rainwater Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Advanced Distribution Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Computerized Maintenance Management Systems (CMMS) Market Trends – Size, Share & Growth 2025–2035

Demand for AGV Intelligent Management Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in UK Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA