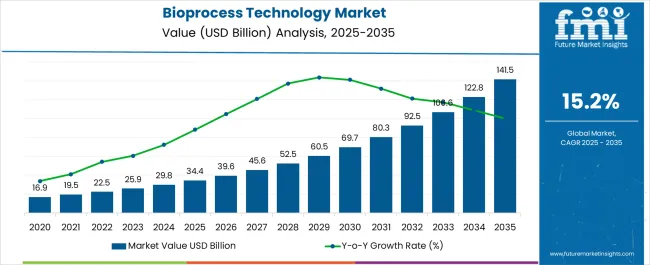

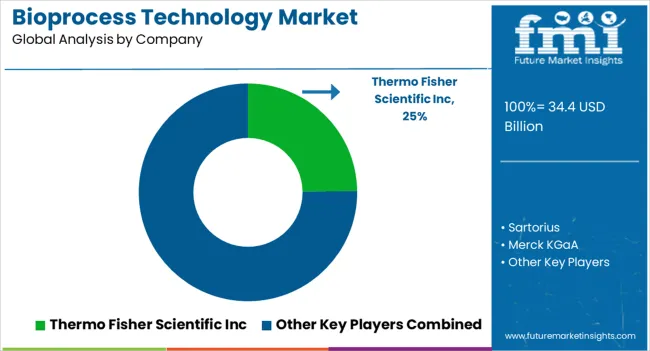

The Bioprocess Technology Market is estimated to be valued at USD 34.4 billion in 2025 and is projected to reach USD 141.5 billion by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period.

| Metric | Value |

|---|---|

| Bioprocess Technology Market Estimated Value in (2025 E) | USD 34.4 billion |

| Bioprocess Technology Market Forecast Value in (2035 F) | USD 141.5 billion |

| Forecast CAGR (2025 to 2035) | 15.2% |

The bioprocess technology market is experiencing strong expansion due to the increasing demand for biologics, vaccines, and cell based therapies. Rapid advancements in biomanufacturing processes combined with rising investment in research and development are accelerating adoption across global production facilities.

The growing prevalence of chronic diseases and the push for targeted therapies have increased reliance on advanced bioprocessing methods that deliver scalability, efficiency, and compliance with regulatory standards. Technological innovations in single use systems, automation, and process analytical tools are reshaping the industry landscape.

Furthermore, expanding collaborations between pharmaceutical companies, contract manufacturing organizations, and academic institutions are strengthening the adoption of integrated bioprocess solutions. The market outlook remains highly promising as the sector continues to play a pivotal role in advancing next generation therapeutics and improving production efficiency across the biopharmaceutical value chain.

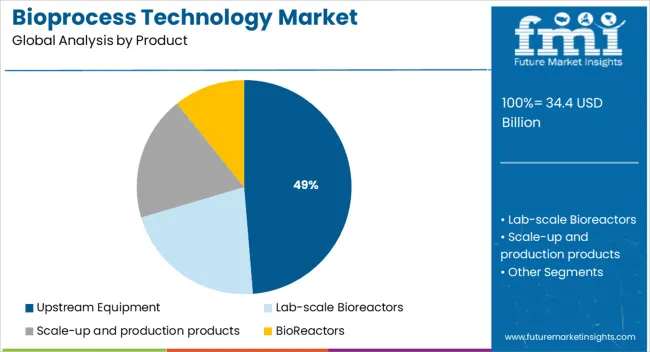

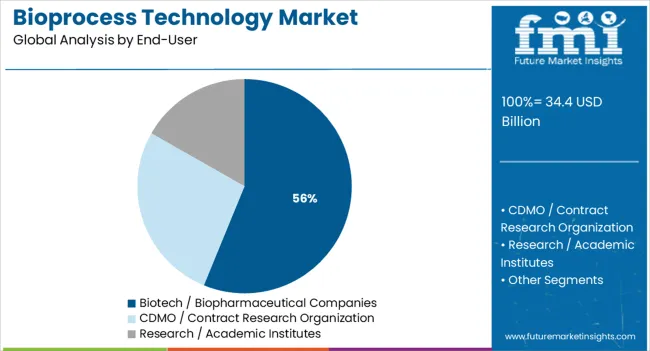

The market is segmented by Product and End-User and region. By Product, the market is divided into Upstream Equipment, Lab-scale Bioreactors, Scale-up and production products, BioReactors, Harvest and collection, Testing Products, Probes and Accessories, Downstream Equipment, Process analytical testing, and Probes and Accessories. In terms of End-User, the market is classified into Biotech / Biopharmaceutical Companies, CDMO / Contract Research Organization, and Research / Academic Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan Baltic Countries, Russia Belarus, Central Asia, East Asia, South Asia Pacific, and the Middle East Africa.

The upstream equipment segment is expected to account for 48.70% of the total market revenue by 2025 within the product category, making it the leading segment. This dominance is attributed to its critical role in cell culture, fermentation, and media preparation processes that form the foundation of biomanufacturing.

Increasing adoption of single use bioreactors and automated upstream systems has enhanced efficiency, reduced contamination risks, and improved scalability. Investment in flexible manufacturing facilities has further reinforced demand for advanced upstream equipment.

As biologics and biosimilars continue to expand in global markets, reliance on efficient upstream processes has positioned this product category as the largest revenue contributor.

The biotech and biopharmaceutical companies segment is projected to contribute 56.20% of overall market revenue by 2025 within the end user category, making it the most prominent segment. This leadership is driven by rising investment in biologics research, expansion of therapeutic pipelines, and the increasing demand for large scale production capabilities.

These companies have been at the forefront of adopting advanced bioprocess technologies to accelerate development timelines, ensure product quality, and meet stringent regulatory requirements. The growth of personalized medicine and complex biologics has further amplified demand for specialized equipment and integrated systems.

With robust funding and global expansion strategies, biotech and biopharmaceutical companies continue to dominate the adoption landscape in the bioprocess technology market.

As the global rate of chronic and infectious diseases skyrockets, the pharma industry is on the quest for innovative technologies. This is key to steadily bolstering the modern healthcare system that is heavily burdened. The research and developmental activities by key players could spill over into the pharmaceuticals sector, paving way for the utility of advanced bioprocess technologies. As we step into a brand new decade, enhancing preparedness for unforeseen medical crises, by developing vaccines has become critical.

Currently, the industry is fazed by an onslaught of strict regulatory policies by major governments. This could hamper the steadfast development and launch of these vital technologies into the market. Moreover, bioprocess technology adoption is impacted by high investment costs. As a result of high costs, technology penetration might be decelerated during the forecast period.

According to Future Market Insights (FMI), the global bioprocess technology market was valued at USD 34.4 Billion in 2025.

The growing focus on alternative medicines and preventive measures and ongoing advances in bioprocess technology is driving current sales figures. Expansion and product launches in emerging markets are key factors promoting market growth.

Short Term (2025 to 2029): The leading companies are focusing on the expansion of their manufacturing capabilities with high flexibility and rapid operations. They also are emphasizing the development and launch of next-generation bioprocess products. This is estimated to not only favor the sales of bioprocess technology but also augment the growth in the overall fermentation technology market.

Mid-term ( 2029 to 2035): The bioprocess product-development pipeline supports an outlook of continued healthy growth in the mid-term. Through sustained product innovations, the market holds the potential to garner an extensive consumer base. Furthermore, due to incumbent developments in technology new and diverse applications might be uncovered for the product during this phase.

Long-Term (2035 to 2035): In the long run, the pharma sector could emerge as one of the largest market stakeholders. This is primarily due to the application of the technology for manufacturing advanced vaccines and recombinant proteins. Towards the end of the forecast period, and beyond these technologies could emerge as an integral component of the modern healthcare and pharmaceutical industry.

The top bioprocess technology and bioprocess analyzer market players are Thermo Fisher Scientific Inc., Sartorius, Merck KGaA, Danaher Corporation, and Lonza Group AG among others. Future Market Insights expects the global bioprocess technology market to grow at a CAGR of 15.1% over the forecast period by 2035 end.

The primary factor for the preference of the single-use (disposable) bioreactor in the bioprocess industry is the production of different biopharmaceutical therapeutics, using the same facility, in minimum time and with minimum cost.

The rising demand for personalized treatment for diseases like cancer is expected to increase the demand for bioprocess therapies like cell therapy. The decreasing cost of genetic sequencing shortly has enabled the development of personalized treatment plans and targeted therapies, which are more effective than less-specific therapies because they focus on a patient’s genetic and molecular makeup.

Techniques for process intensification also are being applied to biosimilar manufacturing. The increasing use of biosimilars in developed countries of Europe and the United States will boost the speed of the bioprocess technology adoption for rapid production of biosimilars.

Favorable government policies for start-up companies, especially in developing countries are expected to create opportunities for the market players to invest in the bioprocess technology market.

Mergers, acquisitions expansion of manufacturing facilities around the globe are expected to bose well for the market in the coming years. Introducing advanced bioprocess products to leverage untapped market opportunities will remain a key growth driver.

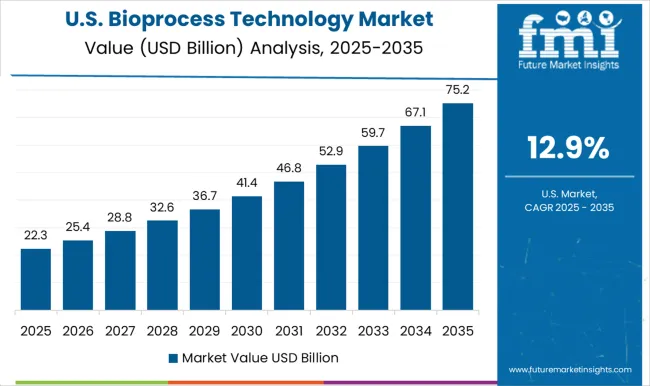

In 2025, the USA is estimated to account for over 89.6% value share in North America. The dominance is driven by increasing requirements of upstream equipment. Rising living standards, health consciousness, and increasing disposable incomes are boosting the demand for effective treatments with minimal side effects.

During the forecast period, the United States market is anticipated to grow at a CAGR of 15.1%, to attain a valuation of USD 141.5 billion by 2035.

The United Kingdom market will exhibit a 12.8% CAGR throughout the forecast period. The use of single-use technologies, personalized treatment of rare diseases, and increase use of biosimilars had led to a rise in the demand for bioprocess technology.

What will Support Bioprocess Technology Market Growth in India?

The India bioprocess technology market is likely to grow at a CAGR of 18.6% during the forecast period. It is expected to account for a market share of 52.4% in South Asia. Major factors that are supporting the growth of the Indian bioprocess technology market are the production of biopharmaceuticals like recombinant proteins and vaccines.

India also is known as a leading hub for vaccine manufacturing, which inevitably makes it a key market for bioprocess technology.

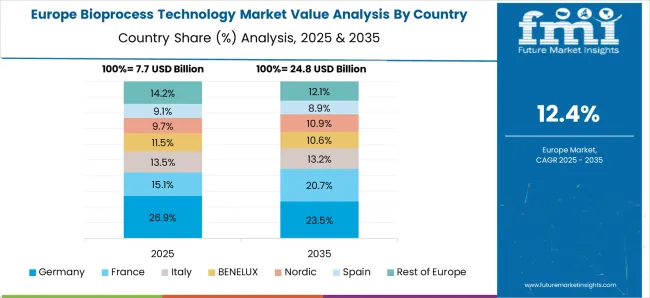

The German bioprocess technology market is likely to grow at a CAGR of 10.9% during the forecast period. It is expected to account for a share of 27.4% in the Europe market. The rise in the demand for biopharmaceuticals, and the need to reduce wastage, and prevent contamination are the major factors that will drive the demand for the bioprocess technology market in Germany.

The China bioprocess market technology is likely to grow at a CAGR of 10.3% during the forecast period. It is expected to hold a share of 45.9% in the East Asia bioprocess technology market.

With the advent of new technologies in recent years, the bioprocess technology market is growing and has become one of the most significant sectors in the healthcare industry. By product, upstream was the dominant segment in 2024, occupying a market share of 65.2% of revenue.

Based on end users, biotech/biopharmaceutical companies will continue dominating the global bioprocess technology market. The segment is expected to hold a market share of 44.0% in 2025. This is primarily fuelled by the technology application in the manufacture of antibodies, antibiotics as well as recombinant proteins.

| Start-up Company | Mission Barns |

|---|---|

| Country | United States |

| Description | Mission Barns utilized bioprocess technology for producing cultured meat. The technology is employed to isolate animal cells. It is then kept in a cultivator for further development. Essentially, the startup employs bioprocess technology to create meat alternatives |

| Start-up Company | SingCell |

|---|---|

| Country | Singapore |

| Description | SingCell is a Singapore-based startup focusing on stem cell therapy. The startup employs 3D microcarrier-based technology that can be used for allogeneic and induced pluripotent stem cells (iPSC). Through the use of bioprocess technology, the company creates affordable stem cell therapy solutions |

The bioprocess technology market players are primarily aiming at strategic expansions to consolidate growth in a competitive market. Key players are keen on harnessing the current public-private investment inflow for research and investment in the field. Through this, market players are striving to expand product utility for diverse sectors.

The greater the demand for bioprocesses products, the stronger the pipeline, which will lead to increased demand in the market. Leading industry players are focusing on the launch of next-generation biotherapeutics to treat serious life-threatening diseases.

Key Market Developments:

| Company | Thermo Fisher Inc. |

|---|---|

| Details | Thermo Fisher Scientific Inc. is one of the top dealers of scientific equipment. It is an American company that deals with instrumentation, consumables as well as software solutions |

| Recent Developments | In October 2020, Thermo Fisher Scientific announced a USD 50 million (€44 million) expansion at a CDMO plant in St Louis, Missouri, USA to add 16,000 L of single-use capacity due to extremely strong growth in demand for commercial biologics manufacturing. As per the company, the facility will be the largest outsourced single-use biologics site in North America. |

| Company | Lonza Group AG |

|---|---|

| Details | Lonza Group is a multinational manufacturing company. It is a Swiss company predominantly catering to manufacturing for pharmaceutical, and biotechnology as well as nutrition. |

| Recent Developments | In June 2024, Lonza developed a new innovative platform technology, New GSv9 TM media and feeds to maximize yield and batch-to-batch consistency to support recombinant protein production scale-up. This provides a robust culturing platform that can reproducibly generate high-quality, stable proteins. |

| Company | Danaher Corporation |

|---|---|

| Details | Danaher Corporation is a conglomerate, known for its company designs, and manufacturing of medical, industrial, as well as commercial products. It is an American company with headquarters in Washington D.C. |

| Recent Developments | In March 2024 Danaher acquired the Biopharma business of General Electric Life Sciences, which is a leading provider of instruments, consumables, and software. |

The global bioprocess technology market is estimated to be valued at USD 34.4 billion in 2025.

The market size for the bioprocess technology market is projected to reach USD 141.5 billion by 2035.

The bioprocess technology market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in bioprocess technology market are upstream equipment, lab-scale bioreactors, _continuous stirred tank bioreactors, _bubble column bioreactors, _airlift bioreactors, _fluidized bed bioreactors, _packed bed bioreactors, _photo-bioreactors, scale-up and production products, _cell culture media and feeds, _bioprocess containers & fluid transfer solutions, bioreactors, _single-use bioprocess equipment, _continuous bioprocess equipment, _real-time bioprocess equipment, harvest and collection, _harvest and separation products, _centrifuges for bioprocessing, _storage & transport products, _production tanks and drums, _outer support containers, testing products, _cell counters & viability analysis systems, _contamination & impurity testing products, probes and accessories, downstream equipment, _downstream purification, _buffer preparation and supply, process analytical testing, _host cell residual dna quantitation, _protein quantitation, _microbial identification, _others and probes and accessories.

In terms of end-user, biotech / biopharmaceutical companies segment to command 56.2% share in the bioprocess technology market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA