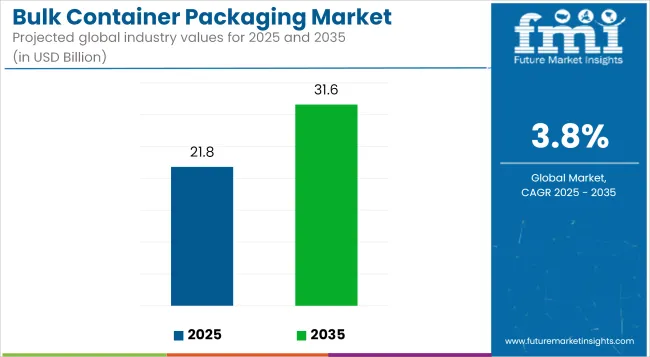

The bulk container packaging market is projected to grow from USD 21.8 billion in 2025 to USD 31.6 billion by 2035, registering a CAGR of 3.8% during the forecast period. Sales in 2024 reached USD 21.0 billion. Growth has been influenced by rising logistics efficiency demands in food, chemicals, and pharmaceutical exports.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 21.8 Billion |

| Projected Market Size in 2035 | USD 31.6 Billion |

| CAGR (2025 to 2035) | 3.8% |

The demand for intermediate bulk containers (IBCs) and flexi tanks has risen across North America and Asia-Pacific due to expanded trade in liquid and granular commodities. Additionally, sustainability requirements have driven a transition toward recyclable container liners and bulk-ready refill systems.

In 2023, Mauser Packaging Solutions Opened New Reconditioning Site in Poland and Expands Infinity Series Capabilities. These investments support the collection and supply of reconditioned Intermediate Bulk Containers (IBCs) and plastic drums in the region and further promote the circular economy through the expanded use of PCR.

“The investments in Gliwice, Poland, are another milestone for Mauser Packaging Solutions. We are proud to expand our reconditioning capabilities and Infinity Series production capacity in Europe. We strive to create a more sustainable future for our customers and with our new capabilities in Poland, we are taking a big step forward,” supplemented Marcin Krzysteczko, Sales Director Poland.

Sustainable packaging solutions in the bulk segment have gained attention with a shift to recyclable polymer liners and reusable structures. Innovations in collapsible bulk packaging and temperature-stable materials have been adopted to meet circularity mandates.

Technologies enabling reduced CO₂ emissions during transport and extended product shelf life in pharma and agrochemicals have been implemented. Companies have introduced solvent-resistant liners for industrial liquids and food-safe coatings to comply with safety standards. Active partnerships between packaging firms and chemical producers have been witnessed to scale eco-friendly container adoption.

The bulk container packaging market is poised to see diversified demand across chemicals, beverages, and industrial raw materials due to global supply chain diversification. Long-term opportunities will likely stem from biodegradable composite containers and smart tracking systems integrated into flexitanks and IBCs.

Regional demand will be reinforced by investments in e-commerce fulfillment infrastructure requiring scalable and space-efficient bulk options. Regulatory alignment regarding safe handling of hazardous and edible liquids will drive innovation in valve systems and material traceability. Competitive strategies will center on speed-to-market, enhanced automation, and intelligent container lifecycle analytics

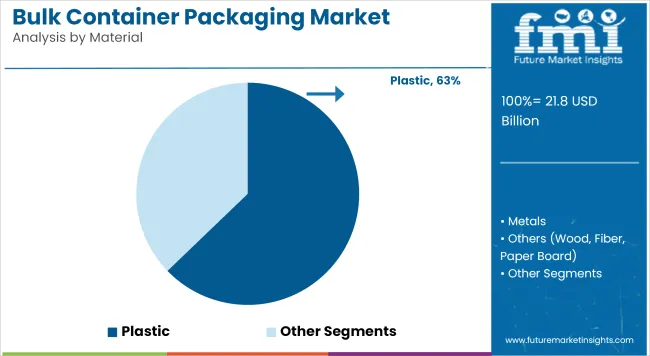

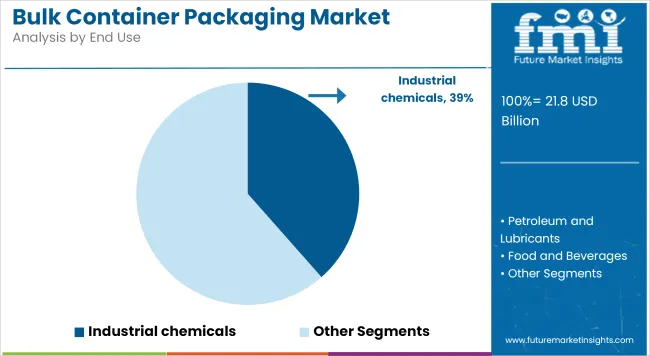

The market is segmented based on product, material, end use, and region. By product, the market includes flexi tanks, bulk containers comprising flexible and rigid bulk containers and bulk container liners. In terms of material, the market is categorized into plastic (HDPE, LDPE, LLDPE, PP, PVC), metals, and others such as wood, fiber, and paper board.

By end use, the market comprises industrial chemicals, petroleum and lubricants, food and beverages, paints, inks, and dyes, pharmaceutical, and others. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Plastic has been projected to account for 62.8% of the bulk container packaging market in 2025, due to its flexibility, strength, and resistance to corrosion. High-density polyethylene (HDPE) and polypropylene (PP) have been primarily used in drum and intermediate bulk container (IBC) formats. These materials have provided excellent performance against harsh chemicals and temperature variations. UV stabilization and food-grade compliance have further extended plastic’s utility across sectors.

Transport efficiency has been improved through the use of stackable and collapsible plastic containers. Returnable packaging systems have been designed using heavy-duty plastic frames and liners for reduced carbon footprints. Anti-static coatings and tamper-proof closures have been integrated for safe handling of volatile contents. Lightweight construction has led to savings in freight costs and easier manual handling.

Customization for branding, labeling, and regulatory compliance has been offered through molded-in design features and standardized dimensions. Enhanced reusability and recyclability have made plastic a sustainable alternative to metals in many industrial use cases. Cost-efficiency, especially in high-volume export operations, has reinforced its preference among manufacturers.

Automation-friendly handling with forklifts and pallet systems has also supported widespread plastic adoption. Global shipping standards such as UN/DOT approvals have been met more easily with molded plastic drums and IBCs.

Innovations in multilayer plastic structures have enabled barrier protection against oxygen, moisture, and UV light. With increasing demand for safe and cost-effective packaging, plastic containers are expected to remain dominant. Strategic focus is likely to remain on improving post-consumer recycling rates and circular supply chains.

The industrial chemicals segment has been estimated to capture 38.5% of the global bulk container packaging market in 2025, driven by stringent safety and regulatory protocols. Packaging used in this segment has needed to withstand reactive agents, high viscosity fluids, and extreme environmental conditions. Durable and inert materials such as HDPE, composite IBCs, and metal-reinforced bulk containers have been preferred.

Certifications such as ADR, IMDG, and UN markings have been routinely mandated. Leak-proof sealing, tamper resistance, and chemical compatibility have guided container design for corrosive liquids and industrial solvents.

Labels and documentation panels have been integrated to meet hazardous material handling guidelines. Demand from agrochemicals, cleaning solutions, and water treatment agents has continued to drive volume growth. Reusable and returnable systems have been increasingly used to reduce packaging waste and enhance safety.

Industrial automation and bulk dosing systems have been supported through the adoption of standardized container sizes and easy-flow outlets. Containers with top-load dispensing valves and bottom discharge mechanisms have enabled operational efficiencies. Custom liners, vented closures, and pressure relief valves have been engineered for materials requiring careful handling.

Transport through rail, sea, and road freight has favored robust and regulatory-compliant bulk packaging formats. As global chemical trade expands, especially across Asia and North America, the need for robust secondary containment solutions is expected to rise.

Industry consolidation and scale-driven supply chain requirements will continue to favor bulk container packaging. Compliance with REACH, GHS, and other international standards will shape product innovation. Safety, traceability, and transport optimization will remain key drivers for this leading segment.

Regulatory complexity and contamination risks Ensuring compliance with varying international safety and hygiene regulations is challenging. Additionally, cross-contamination risks, especially in food and chemical applications, demand stricter packaging standards.

Sustainability, automation, and material innovation The development of reusable, foldable, and lightweight bulk containers is opening new opportunities. Smart packaging with sensors and blockchain-enabled traceability is gaining momentum. Biodegradable and recyclable barrier films are creating avenues for sustainable packaging expansion.

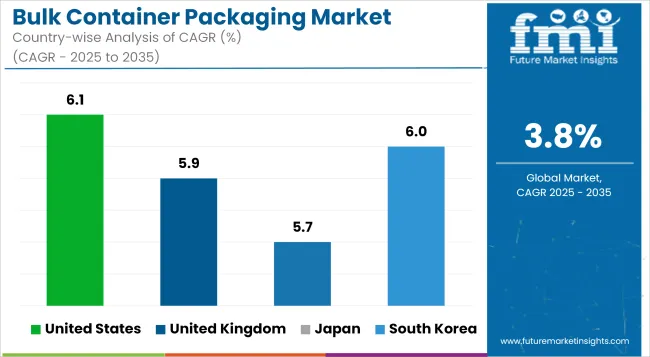

The United States leads the bulk container packaging market due to the high volume of exports in chemicals, agricultural products, and industrial goods. Manufacturers offer flexible intermediate bulk containers (FIBCs), rigid bulk boxes, and pallet containers that are optimized for automation and international logistics. USA companies are integrating IoT-enabled tags, RFID tracking, and tamper-evident closures to enhance traceability and supply chain security.

The demand for recyclable and collapsible bulk containers is growing across e-commerce and distribution hubs. AI-driven quality assurance systems are enhancing the reliability of container inspection processes. Companies are also adopting biodegradable liners and coatings to meet sustainability mandates. Additionally, automation in container handling is reducing labor costs and boosting operational throughput.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The UK bulk container packaging market is expanding as industries adopt sustainable transport solutions and space-saving logistics systems. British manufacturers develop FIBCs and corrugated bulk boxes designed for high-stack stability and moisture resistance. Demand is increasing for custom-sized containers tailored to specific product types and transportation requirements.

Smart bulk packaging innovations, such as QR-coded labeling and GPS-enabled asset tracking, are supporting digital logistics transformations. Companies are investing in automation technologies to accelerate container assembly and reduce labor dependency. AI-powered condition monitoring is helping to track damage and wear across reusable container fleets. Furthermore, eco-design principles are guiding the development of fully recyclable, lightweight bulk containers tailored for export and warehouse use.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

Japan’s bulk container packaging market continues to grow as automation and hygiene become central to industrial and food-grade packaging. Japanese manufacturers engineer lightweight, foldable containers with antimicrobial linings and high-load durability. The integration of automated filling systems and leak-proof technologies is improving operational efficiency and safety. Companies are focusing on modular container designs for streamlined inventory and export shipping.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

South Korea’s market is advancing with the development of smart, eco-friendly bulk containers for electronics, cosmetics, and processed foods. Manufacturers deploy reusable packaging systems that reduce waste and transportation costs. Innovations include RFID-integrated stacking bins, automated collapsible containers, and bio-based polymer composites. Companies are also optimizing container geometry for improved warehouse space utilization.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

The bulk container packaging market is growing as logistics and sustainability become key to operational competitiveness. Packaging companies are launching standardized, modular, and automation-friendly bulk containers to optimize warehouse and shipping operations. Smart inventory systems are integrating with bulk containers to streamline supply chain visibility.

There's a rising trend in multi-trip containers designed for closed-loop logistics. Digital printing on bulk packaging is enhancing branding and tracking. Some firms are embedding QR codes and tamper-evident labels for traceability. Lightweight materials are being used to reduce freight costs while maintaining structural integrity. The industry is also exploring biodegradable bulk packaging options for environmental compliance. Innovations in collapsible containers are helping reduce storage space and transport emissions

Other Key Players

The market size was USD 21.8 Billion in 2025.

The market is projected to reach USD 31.6 Billion in 2035.

The market will grow due to rising global trade, demand for reusable bulk packaging, sustainability mandates, and smart logistics technologies.

The top 5 contributing countries are the USA, China, India, Germany, and Brazil.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.