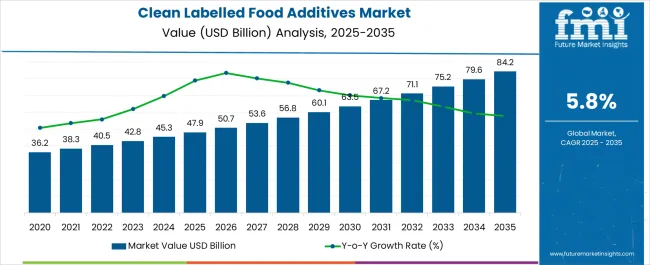

The clean labelled food additives market, valued at 47.9 USD billion in 2025, is projected to reach 84.2 USD billion by 2035, reflecting a CAGR of 5.8% over the period. The market maturity curve shows early adoption during 2020–2024, with annual growth from 36.2 to 45.3 USD billion, as food manufacturers test ingredient transparency and labeling options. By 2025, adoption enters the scaling phase, driven by broader implementation across processed foods, beverages, and bakery products.

Between 2025–2030, the market grows from 47.9 to 63.5 USD billion, supported by standardized sourcing, wider supplier networks, and increased acceptance. From 2030–2035, growth moderates as consolidation occurs, with leading suppliers capturing major shares of production and distribution. The adoption lifecycle mirrors this progression. During 2020–2024, early adopters validate clean label formulations, optimize ingredient performance, and establish reference products. From 2025–2030, scaling occurs as mainstream manufacturers increase procurement, supply chains stabilize, and contracts standardize across regions.

By 2030–2035, consolidation dominates: late entrants adopt proven additive formulations, mergers and partnerships shape competitive dynamics, and procurement focuses on cost efficiency and supply reliability. The market transitions from experimental adoption through rapid scale-up to a mature phase characterized by predictable demand, optimized production, and established supplier relationships.

| Metric | Value |

|---|---|

| Clean Labelled Food Additives Market Estimated Value in (2025 E) | USD 47.9 billion |

| Clean Labelled Food Additives Market Forecast Value in (2035 F) | USD 84.2 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

Data shows that Q3 and Q4 account for 35–40% of annual procurement, coinciding with peak beverage, bakery, and processed food production ahead of festive seasons. Conversely, Q1 typically records 10–15% lower activity, as manufacturers adjust inventories after year-end demand. Seasonal promotional campaigns and product launches can create short-term spikes of 10–15% above baseline.

Suppliers and manufacturers align ingredient sourcing, production, and distribution schedules with these seasonal peaks to maintain an uninterrupted supply and meet retailer and consumer demand efficiently. Cyclicality reflects broader investment and reformulation patterns in the food industry. Food manufacturers typically review and upgrade additive formulations every 5–7 years, generating periodic surges in procurement that can increase annual market size by USD 3–5 billion. Regulatory approvals, labeling changes, or shifts in ingredient availability may temporarily accelerate demand by 5–10% above projected growth.

Over the decade, these cyclical surges overlay the underlying CAGR of 5.8%, producing alternating periods of rapid adoption and moderate stabilization. Recognizing these cycles allows suppliers to optimize production, inventory, and procurement planning effectively.

The movement toward healthier lifestyles has heightened demand for additives that are free from synthetic chemicals and artificial preservatives. Manufacturers are responding by reformulating product lines to incorporate clean label alternatives that align with evolving regulatory guidelines and consumer expectations.

Advances in extraction technologies and sustainable sourcing practices have made it possible to produce natural additives at scale while maintaining consistent quality. Strategic collaborations between ingredient suppliers and food brands are facilitating innovation in flavor, texture, and shelf-life enhancement without reliance on artificial compounds.

The future outlook remains positive, driven by rising health awareness, stringent food labeling laws, and premium positioning of clean label products across global markets. With strong demand from both developed and emerging economies, the market is poised to expand further as clean label formulations become standard across multiple food categories.

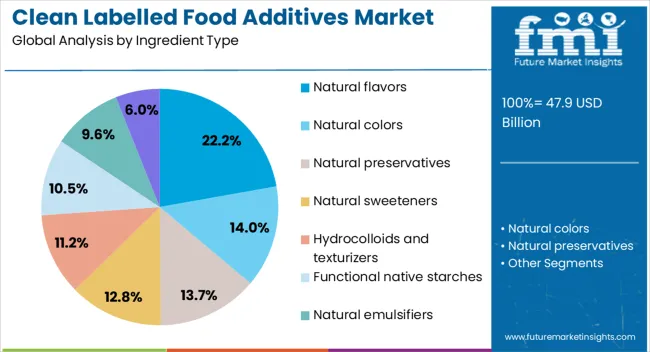

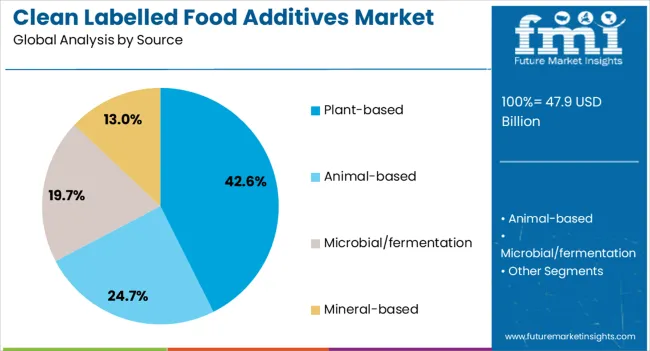

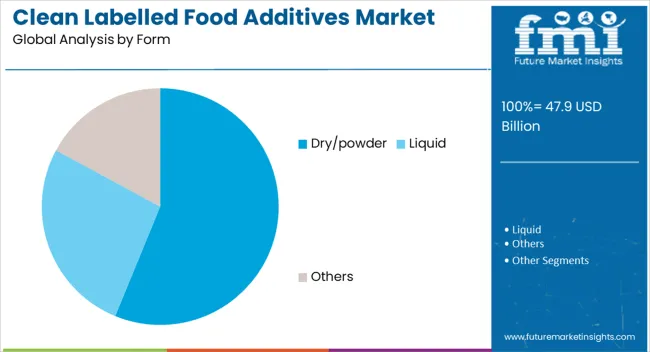

The clean labelled food additives market is segmented by ingredient type, source, form, certification, end use, functionality, consumer, and geographic regions. By ingredient type, the clean labelled food additives market is divided into Natural flavors, Natural colors, Natural preservatives, Natural sweeteners, Hydrocolloids and texturizers, Functional native starches, Natural emulsifiers, and Other. In terms of source, the clean labelled food additives market is classified into Plant-based, Animal-based, Microbial/fermentation, and Mineral-based. Based on form, the clean labelled food additives market is segmented into Dry/powder, Liquid, and Others.

By certification, clean labelled food additives market is segmented into Organic, Non-GMO, Natural, Clean label certified, and Others. By end use, clean labelled food additives market is segmented into Bakery & confectionery, Beverages, Dairy & frozen, Processed foods, Sauces & condiments, Snacks & convenience, Meat, poultry & Seafood, and Others. By functionality, clean labelled food additives market is segmented into Preservation, Texture modification, Flavor/color enhancement, Emulsification, Sweetening, and Others.

By consumer, clean labelled food additives market is segmented into Conventional product, Premium product, Health & wellness product, Children’s products, and Others. Regionally, the clean labelled food additives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural flavors segment is projected to account for 22.20% of the Clean Labelled Food Additives market revenue share in 2025, making it the leading ingredient type. Growth in this segment has been driven by the increasing replacement of artificial flavors with plant and fruit-derived alternatives that meet clean label criteria. Consumers have shown a strong preference for authentic taste profiles supported by natural origin claims, which has reinforced demand for these additives.

The expansion of processed and convenience foods with premium positioning has further increased the use of natural flavors to enhance sensory appeal. Advances in flavor extraction and preservation methods have enabled manufacturers to maintain stability and potency without synthetic agents.

Regulatory support for natural ingredient labeling has also contributed to wider adoption in packaged food and beverage products. As clean label trends continue to influence purchase decisions, natural flavors are expected to maintain their competitive advantage due to their alignment with health-conscious and sustainability-driven consumer priorities.

The plant-based source segment is expected to hold 42.60% of the Clean Labelled Food Additives market revenue share in 2025, establishing its leadership within the source category. Its growth has been supported by the global shift toward plant-derived ingredients, which are perceived as healthier, more sustainable, and ethically aligned. The ability of plant-based sources to provide a wide range of functional benefits, including flavor enhancement, color stability, and nutritional enrichment, has driven adoption across multiple food categories.

Manufacturers have increasingly turned to botanical extracts, herbs, and spices to meet both clean label requirements and consumer demand for natural authenticity. Investments in sustainable farming and supply chain traceability have strengthened the credibility and availability of plant-based additives.

Additionally, the rising popularity of vegan and vegetarian lifestyles has expanded the application scope of plant-based sources. With ongoing innovations in plant processing and extraction techniques, this segment is expected to retain its market dominance in the foreseeable future.

The dry or powder form segment is projected to hold 56.20% of the Clean Labelled Food Additives market revenue share in 2025, making it the dominant form segment. Its strong position is attributed to the extended shelf life, ease of transportation, and versatility in application that powder-based additives offer. Food manufacturers favor this form for its cost-effectiveness in storage and distribution, as well as its stability in maintaining flavor, color, and nutritional integrity during processing.

The dry format also allows for easier integration into various product formulations, from baked goods to beverages, without affecting moisture balance. Growing demand for convenient and scalable food production methods has further reinforced the preference for powder additives in the clean-label sector.

Technological advancements in drying and encapsulation processes have improved the functional performance of these additives while preserving their natural properties. As the industry continues to prioritize efficiency and product quality, the dry or powder form is set to maintain its leadership position.

The clean labelled food additives market is growing as consumers increasingly seek products with simple, recognizable ingredients and no artificial chemicals. These additives improve texture, flavor, color, and shelf life in snacks, beverages, dairy, and bakery products. North America and Europe lead adoption due to health-conscious consumers, while Asia-Pacific shows emerging demand. Manufacturers focus on natural extracts, plant-based stabilizers, and functional ingredients that meet clean label requirements without compromising product quality, taste, or processing efficiency.

Rising consumer awareness of ingredient origins is a primary driver. Shoppers increasingly check labels to avoid synthetic chemicals, artificial flavors, or colors. Brands offering products with natural preservatives, colors, and flavor enhancers gain trust and loyalty. Clean-labelled additives allow manufacturers to make clear, understandable ingredient claims, boosting brand differentiation in competitive markets. The need to meet this transparency without compromising taste, appearance, or shelf life is driving research into multifunctional natural additives. Until alternative approaches provide the same balance between natural claims and functional performance, clean-labelled ingredients remain essential for capturing consumer confidence.

Natural additives must perform consistently under manufacturing conditions while ensuring texture, flavor, and shelf life. Ingredients such as plant-based emulsifiers, natural antioxidants, and stabilizers replace synthetic counterparts in baked goods, beverages, dairy, and snacks. Reliability under heat, pH changes, and storage is critical to prevent product defects or spoilage. Manufacturers prioritize additives that integrate smoothly into existing processes, reduce waste, and maintain quality standards. Until new processing methods can achieve identical functional performance without these additives, clean-labelled ingredients are indispensable for preserving product integrity across diverse food categories.

Regulations governing food additives vary by region, particularly concerning claims like “natural” or “free from artificial ingredients.” Manufacturers must ensure that ingredient sourcing, testing, and documentation comply with local laws. Proper labelling avoids penalties, recalls, and reputational risk. Additives that meet regulatory standards across multiple regions simplify operations for global brands. Until alternative methods guarantee the same level of compliance and clear labeling, clean-labelled additives will remain the primary solution for producing market-ready, legally compliant food products that meet consumer expectations.

Clean-labelled additives are widely used in bakery, dairy, beverages, snacks, and ready-to-eat products. They improve functional attributes such as moisture retention, color stability, flavor intensity, and shelf life while allowing brands to market products with recognizable, simple ingredients. The versatility of natural additives reduces the need for category-specific synthetic solutions, optimizing production efficiency. Until alternatives can provide multifunctional capabilities with the same consistency, clean-labelled additives will continue to be central for manufacturers aiming to maintain product quality and meet consumer-driven ingredient transparency demands across multiple food categories.

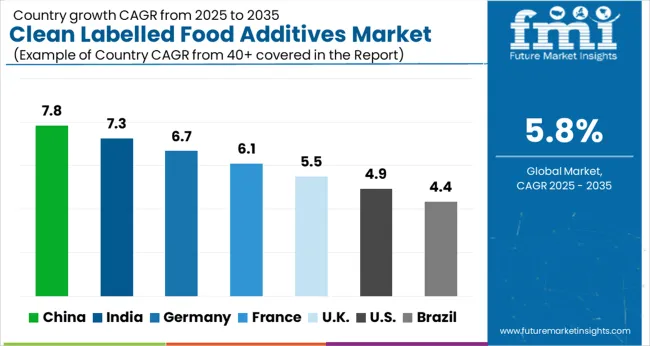

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global Clean Labelled Food Additives Market is projected to grow at a CAGR of 5.8% through 2035, supported by increasing demand across food processing, beverage, and functional food applications. Among BRICS nations, China has been recorded with 7.8% growth, driven by large-scale production and deployment in processed food and beverage industries, while India has been observed at 7.3%, supported by rising utilization in functional and processed food applications. In the OECD region, Germany has been measured at 6.7%, where production and adoption for food processing and additive applications have been steadily maintained. The United Kingdom has been noted at 5.5%, reflecting consistent use in processed and functional foods, while the USA has been recorded at 4.9%, with production and utilization across food processing, beverages, and functional food sectors being steadily increased. This report includes insights on 40+ countries; the top markets are shown here for reference.

The clean labelled food additives market in China is growing at a CAGR of 7.8%, driven by increasing consumer demand for natural, safe, and minimally processed food products. Rising health awareness, concerns about synthetic additives, and preference for transparent labeling are fueling adoption across the food and beverage industry. Manufacturers are incorporating natural preservatives, colors, flavors, and stabilizers to meet consumer expectations. Technological advancements in formulation, processing, and packaging ensure product quality and safety. Growth in modern retail, supermarkets, and e-commerce channels supports wider distribution of clean labelled products. Government initiatives promoting food safety, hygiene, and nutritional standards further boost market expansion. With increasing focus on healthier diets and clean labeling transparency, China represents a significant growth opportunity for clean-label food additives.

The clean labelled food additives market in India is expanding at a CAGR of 7.3%, driven by rising health-conscious consumer behavior and preference for naturally sourced ingredients. Urbanization, changing dietary patterns, and increasing disposable income are accelerating demand for clean labelled products across packaged food and beverage segments. Manufacturers are adopting natural colors, flavors, sweeteners, and preservatives to replace synthetic additives while ensuring food safety and quality. Technological innovations in formulation, processing, and packaging enhance product shelf life and compliance with safety standards. Growth of organized retail, supermarkets, and online food platforms is increasing accessibility and adoption. Government regulations on food labeling, quality, and hygiene support market growth. With increasing awareness about clean and safe food consumption, India is witnessing steady expansion in the clean labelled food additives market.

The clean labelled food additives market in Germany is growing at a CAGR of 6.7%, driven by strong consumer preference for natural, organic, and minimally processed food products. Rising health awareness, dietary concerns, and the trend for transparent labeling support adoption in the food and beverage industry. Manufacturers are incorporating natural flavors, colors, sweeteners, and preservatives to replace synthetic additives while maintaining quality and safety standards. Technological advancements in processing, formulation, and packaging improve shelf life and product integrity. Germany’s strict regulations on food safety, labeling, and additive usage drive compliance and innovation. Growth in supermarkets, modern retail, and e-commerce further expands market reach. The focus on natural ingredients, clean labeling transparency, and safe food consumption ensures steady market growth in Germany.

The clean labelled food additives market in the United Kingdom is expanding at a CAGR of 5.5%, driven by growing consumer demand for natural, clean, and safe food products. Rising awareness about synthetic additives, dietary health, and food transparency drives adoption across retail, foodservice, and packaged food sectors.

Manufacturers are replacing artificial preservatives, colors, and flavors with naturally sourced alternatives while ensuring product quality. Technological innovations in formulation, processing, and packaging improve safety, shelf life, and operational efficiency. The growth of modern retail chains, supermarkets, and e-commerce channels enhances product availability. Government regulations promoting clean labeling, food safety, and nutritional transparency further encourage market expansion. With evolving consumer preferences and regulatory support, the clean labelled food additives market in the UK is set for steady growth.

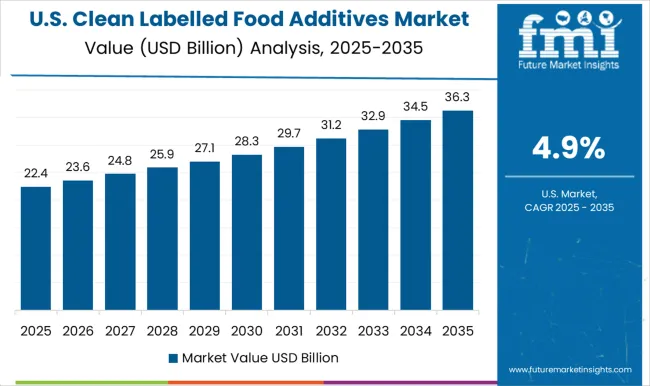

The clean labelled food additives market in the United States is growing at a CAGR of 4.9%, driven by increasing consumer preference for natural, organic, and minimally processed food products. Health-conscious consumers are seeking products free from synthetic preservatives, colors, and flavors, boosting adoption in packaged foods, snacks, and beverages. Manufacturers are focusing on natural sweeteners, flavors, and preservatives to meet consumer demand while maintaining food safety and quality.

Technological innovations in processing, formulation, and sustainable packaging enhance shelf life and efficiency. E-commerce and modern retail growth facilitate wider distribution and accessibility. Government regulations on clean labeling, nutritional transparency, and food safety encourage innovation and compliance. With the combined influence of consumer preferences, regulatory support, and technological advancement, the USA market for clean labelled food additives is positioned for consistent growth.

The clean labelled food additives market is rapidly growing as consumers increasingly demand transparency, natural ingredients, and minimally processed foods. Clean label additives, which include natural preservatives, flavor enhancers, emulsifiers, and colorants, are designed to improve product quality and shelf life without artificial chemicals, meeting the rising preference for healthier, more transparent food options. Kerry Group plc is a leading supplier, offering a wide portfolio of natural flavors, proteins, and functional ingredients tailored for clean label applications. ADM (Archer Daniels Midland) provides innovative plant-based and natural additives that cater to health-conscious consumers.

Cargill, Incorporated, focuses on natural emulsifiers, sweeteners, and texturizing agents that support clean label formulations while enhancing taste and texture. DSM delivers natural solutions for food preservation and nutritional enrichment, while IFF (International Flavors & Fragrances Inc.) specializes in natural flavors and colorants that align with clean label trends. BASF SE, Ingredion Incorporated, and Sensient Technologies provide a broad range of natural functional ingredients, including thickeners, stabilizers, and natural colorants.

Corbion focuses on clean label preservatives and functional ingredients that extend shelf life naturally, whereas Symrise offers natural flavoring and ingredient systems for clean label foods. As regulatory standards and consumer expectations for transparency continue to tighten, these manufacturers are at the forefront of innovation, enabling food and beverage brands to deliver products that are both appealing and naturally formulated.

| Item | Value |

|---|---|

| Quantitative Units | USD 47.9 Billion |

| Ingredient Type | Natural flavors, Natural colors, Natural preservatives, Natural sweeteners, Hydrocolloids and texturizers, Functional native starches, Natural emulsifiers, and Other |

| Source | Plant-based, Animal-based, Microbial/fermentation, and Mineral-based |

| Form | Dry/powder, Liquid, and Others |

| Certification | Organic, Non-GMO, Natural, Clean label certified, and Others |

| End Use | Bakery & confectionery, Beverages, Dairy & frozen, Processed foods, Sauces & condiments, Snacks & convenience, Meat, poultry & Seafood, and Others |

| Functionality | Preservation, Texture modification, Flavor/color enhancement, Emulsification, Sweetening, and Others |

| Consumer | Conventional product, Premium product, Health & wellness product, Children’s products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kerry Group plc, ADM (Archer Daniels Midland), Cargill, Incorporated, DSM, IFF (International F&F Inc.), BASF SE, Ingredion Incorporated, Sensient Technologies, Corbion, and Symrise |

| Additional Attributes | Dollar sales by type including natural preservatives, colorants, flavorings, and emulsifiers, application across bakery, dairy, beverages, and processed foods, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising consumer demand for transparency, clean-label products, and healthier food options. |

The global clean labelled food additives market is estimated to be valued at USD 47.9 billion in 2025.

The market size for the clean labelled food additives market is projected to reach USD 84.2 billion by 2035.

The clean labelled food additives market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in clean labelled food additives market are natural flavors, natural colors, natural preservatives, natural sweeteners, hydrocolloids and texturizers, functional native starches, natural emulsifiers and other.

In terms of source, plant-based segment to command 42.6% share in the clean labelled food additives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom and Lab Surface Contamination Control Products Market Size and Share Forecast Outlook 2025 to 2035

Cleansing Micelle Technology Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Clean Label Flour Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom Construction Market Size and Share Forecast Outlook 2025 to 2035

Clean Room Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Clean-Label Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Clean Steam Separator Market Analysis - Size, Share & Forecast 2025 to 2035

Clean Label Flavors Market Analysis by Liquid Systems, Spray-Dried Powders, Encapsulated Flavors, Emulsion-Based Delivery Systems Through 2035

Clean Label Pectin Market Analysis – Growth & Industry Trends 2025 to 2035

Cleanroom Technologies Market Growth – Trends & Forecast 2025 to 2035

Clean Room Panels Industry Analysis by Cleanroom Wall Panels and Cleanroom Ceiling Panels Through 2035

Clean Coal Technology Market Growth - Trends & Forecast 2025 to 2035

Cleanroom Flooring Market Growth - Trends & Forecast 2024 to 2034

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Cleanroom Lighting Market

Clean Label Starch Market

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

GMP Cleaning Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA