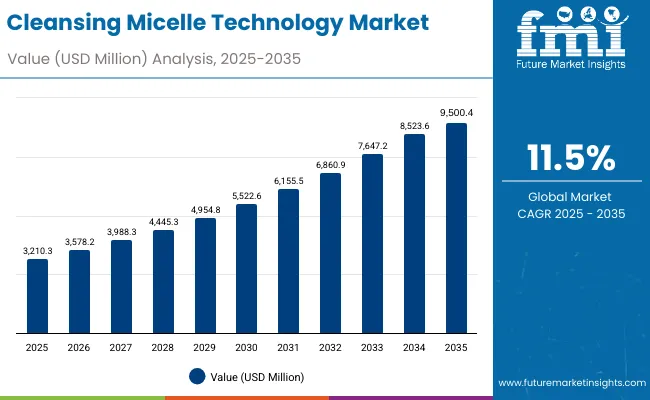

The Cleansing Micelle Technology Market is expected to record a valuation of USD 3,210.3 million in 2025 and USD 9,500.4 million in 2035, with an increase of USD 6,290.1 million, which equals a growth of 196% over the decade. The overall expansion represents a CAGR of 11.5% and a near 3X increase in market size.

Cleansing Micelle Technology Market Key Takeaways

| Metric | Value |

|---|---|

| Cleansing Micelle Technology Market Estimated Value in (2025E) | USD 3,210.3 million |

| Cleansing Micelle Technology Market Forecast Value in (2035F) | USD 9,500.4 million |

| Forecast CAGR (2025 to 2035) | 11.5% |

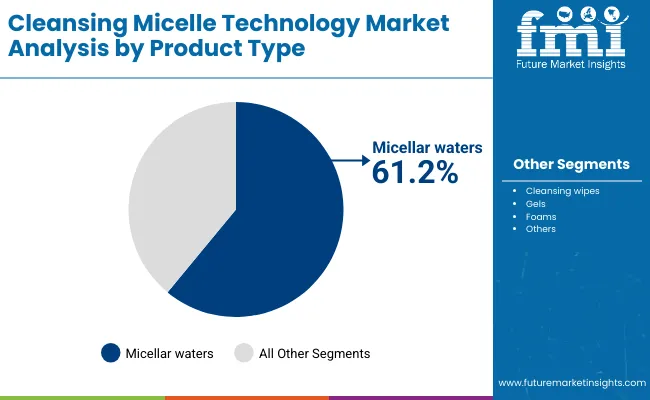

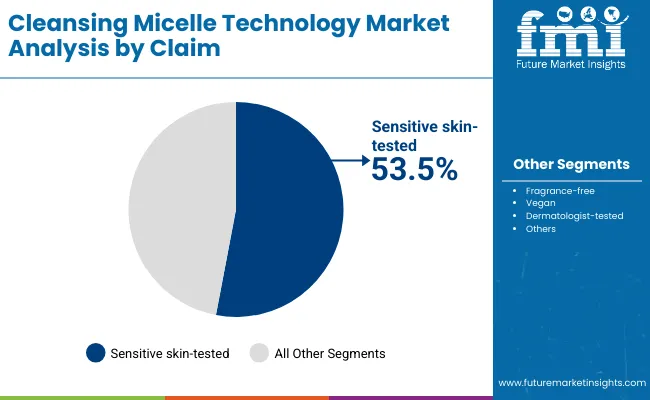

During the first five-year period from 2025 to 2030, the market increases from USD 3,210.3 million to USD 5,522.6 million, adding USD 2,312.3 million, which accounts for 37% of the total decade growth. This phase records steady adoption in skincare routines across developed markets such as the USA, Germany, and the UK, where dermocosmetic micellar waters dominate. Sensitive-skin-tested formulations lead adoption, catering to over 53.5% of the global demand in 2025. During this period, micellar waters remain the hero product, accounting for more than 61% of product sales and continuing to dominate everyday cleansing routines due to their convenience, efficacy, and dermatologist endorsement.

The second half from 2030 to 2035 contributes USD 3,977.8 million, equal to 63% of total growth, as the market jumps from USD 5,522.6 million to USD 9,500.4 million. This acceleration is powered by widespread demand in Asia-Pacific markets, particularly China (CAGR 19.8%) and India (CAGR 22.7%). Product diversification into gels, foams, and cleansing wipes expands significantly, catering to oil control and hydration claims. Hybrid micelles and polymeric micelles also gain traction in premium segments, particularly in Japan and South Korea, where ritual-based and science-driven beauty demand is rising. By the end of the decade, e-commerce and specialty beauty retail dominate as primary sales channels, reflecting the global digital shift in beauty consumption.

From 2020 to 2024, the Cleansing Micelle Technology Market grew from under USD 2,500 million to above USD 3,000 million, driven primarily by micellar water adoption in Europe. During this period, the competitive landscape was dominated by dermocosmetic and mass beauty players, controlling nearly all revenue. Leaders such as Bioderma, Garnier, and Nivea focused on offering sensitive-skin-tested micellar waters. Competitive differentiation relied on dermatological claims, efficacy in makeup removal, and compatibility with sensitive skin. Wipes and foams accounted for minimal traction during this phase, contributing less than 20% of the total market value.

Demand for cleansing micelle technology will expand to USD 3,210.3 million in 2025, and the revenue mix will gradually shift as innovative claims (vegan, fragrance-free) and new micelle types (hybrid, polymeric) gain share. Traditional leaders face rising competition from clean beauty brands offering AI-driven skin analysis, dermatology-backed clinical testing, and eco-certified packaging. Major brands are pivoting to hybrid product portfolios, combining micellar technology with soothing botanicals, anti-aging peptides, and hydration-focused formulations to retain relevance. Emerging entrants specializing in vegan micelles, refillable bottles, and pharmacy-exclusive formulations are gaining share. The competitive advantage is moving away from pure cleansing efficacy to brand ecosystem strength, claim credibility, and digital retail scalability.

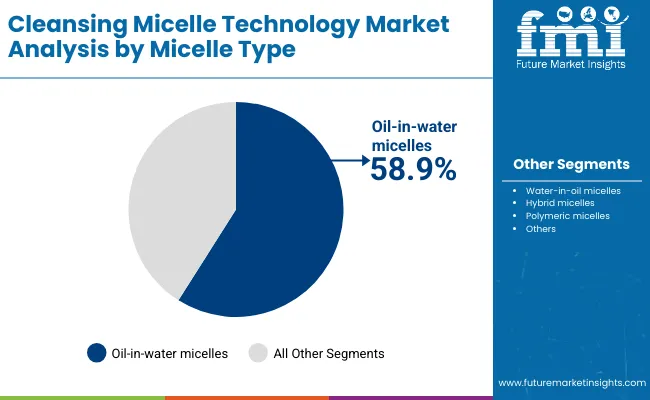

Advances in micelle formulation technology have improved cleansing efficiency while preserving skin hydration and barrier function, allowing for broader adoption across skin types. Oil-in-water micelles, dominating with a 58.9% share in 2025, have gained popularity due to their gentle yet effective cleansing mechanism, making them the dermatologist-preferred choice for sensitive skin. The rise of sensitive-skin-tested products, which represent over 53.5% of global sales in 2025, highlights consumer focus on safety, dermatological testing, and hypoallergenic formulations.

Industries such as dermocosmetics, mass beauty, and pharmacy skincare are driving demand for cleansing micelle solutions that integrate seamlessly into daily multi-step routines. Expansion of dermatologist-tested and vegan claims has fueled growth, particularly among Gen Z and millennial consumers. Innovations in portable cleansing wipes, foams designed for oil control, and gels enriched with hydration and soothing ingredients are expected to open new application areas.

Segment growth is expected to be led by micellar waters in product type, oil-in-water micelles in micelle type, and sensitive-skin-tested claims due to their widespread compatibility and dermatologist backing. Emerging demand from China, India, and Japan ensures that Asia-Pacific remains the fastest-growing region in the next decade.

The market is segmented by function, micelle type, product type, channel, claim, and region. Functions include makeup removal, deep pore cleansing, hydration & soothing, and oil control, highlighting the expanding roles of micellar technology in skincare routines. Micelle type segmentation spans oil-in-water micelles, water-in-oil micelles, hybrid micelles, and polymeric micelles. Product types include micellar waters, cleansing wipes, gels, and foams. Channels encompass e-commerce, pharmacies, mass retail, and specialty beauty retail. Claims are segmented as fragrance-free, sensitive-skin-tested, vegan, and dermatologist-tested. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with country-level analysis for USA, China, India, UK, Germany, and Japan.

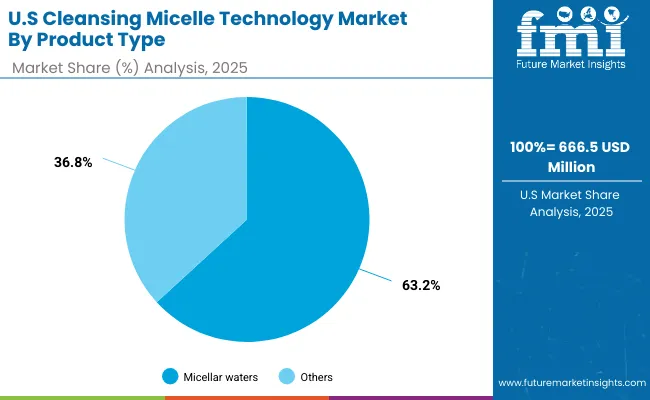

| Product Type | Value Share% 2025 |

|---|---|

| Micellar waters | 61.2% |

| Others | 38.8% |

The micellar waters segment is projected to contribute 61.2% of the Cleansing Micelle Technology Market revenue in 2025, maintaining its lead as the dominant product type. This leadership is driven by the widespread consumer preference for micellar waters as a gentle, multi-functional cleansing solution suitable for all skin types. Their ability to effectively remove makeup, dirt, and impurities without harsh rubbing has positioned them as a daily skincare essential across both premium and mass-market segments.

The segment’s growth is also supported by pharmacy and retail availability, combined with heavy endorsement by dermatologists and skincare professionals. Innovations such as hydration-enhanced waters and dermatologist-tested sensitive-skin formulas further solidify their appeal. While wipes, gels, and foams are expanding due to convenience and targeted claims like oil control, micellar waters are expected to retain their position as the backbone of cleansing micelle technology, driving consistent adoption worldwide.

| Micelle Type | Value Share% 2025 |

|---|---|

| Oil-in-water micelles | 58.9% |

| Others | 41.1% |

The oil-in-water micelles segment is forecasted to hold 58.9% of the global market share in 2025, led by its compatibility with sensitive skin and dermatologist-backed efficacy. These micelles are favored for their balance of effective cleansing and skin gentleness, making them suitable for consumers dealing with irritation, dryness, or sensitivity. Their structure enables easy removal of makeup and impurities while maintaining hydration, a key differentiator against harsher alternatives like foaming cleansers.

Adoption is further supported by their prevalence in flagship products from global leaders such as Bioderma, Garnier, and La Roche-Posay. Growth in the segment is boosted by rising demand in Asia-Pacific markets where concerns around pollution and sensitive skin are prominent. While hybrid and polymeric micelles are gaining traction in advanced formulations for hydration and anti-aging, oil-in-water micelles will continue their dominance as the standard-bearer of cleansing micelle innovation.

| Claim | Value Share% 2025 |

|---|---|

| Sensitive skin-tested | 53.5% |

| Others | 46.5% |

The sensitive-skin-tested segment is projected to account for 53.5% of Cleansing Micelle Technology Market revenue in 2025, reflecting consumers’ rising focus on safety, dermatological validation, and hypoallergenic properties. Products in this category are trusted by consumers who seek assurance against irritation, redness, or breakouts, making them especially appealing in mature markets such as the USA and Germany.

This segment’s expansion is driven by a global rise in skin sensitivity concerns, linked to urban pollution, climate variability, and lifestyle stressors. Brands like Avène, Eucerin, and Vichy are capitalizing on this trend by marketing dermatologist-tested micellar waters with added soothing ingredients. Meanwhile, the “others” category including vegan and fragrance-free claims is gaining importance, particularly among millennial and Gen Z buyers in Asia and North America who prioritize clean-label and ethical beauty standards. While claim diversification is increasing, sensitive-skin-tested products will continue to anchor consumer trust and brand loyalty through 2035.

Rising Dermatological Endorsements and Clinical Validation

One of the strongest drivers for the Cleansing Micelle Technology Market is the surge in dermatologist endorsements and clinical validation of micellar products. Sensitive-skin-tested products already account for 53.5% of global value in 2025, indicating that consumers trust products that have dermatologist backing. Companies like Bioderma and La Roche-Posay have positioned themselves as “pharmacy-first” dermocosmetic leaders, leveraging clinical credibility to expand globally.

In markets such as the USA and Europe, pharmacy-driven trust is critical, while in Asia, endorsements from dermatologists and skin clinics accelerate uptake among urban consumers. This shift towards evidence-based skincare has allowed micellar waters and advanced micelle formats to become staples in multi-step skincare routines, fueling consistent demand across both premium and mass retail channels.

Accelerated Adoption in Asia-Pacific with Country-Specific Triggers

Another major driver comes from country-specific adoption in Asia-Pacific, where growth rates outpace global averages. India (22.7% CAGR) and China (19.8% CAGR) represent the fastest-growing markets. India’s growth is triggered by mass retail expansion and affordability-driven entry-level micellar products that resonate with a young consumer base shifting from traditional cleansers to modern formats. China’s adoption, on the other hand, is led by e-commerce dominance and K-beauty/J-beauty influences, where micelles are integrated into complex skincare rituals.

The localization of claims such as “oil control” for humid regions in Asia and “hydration & soothing” for markets like Japan is pushing global brands to adapt formulations regionally. Together, these factors make Asia-Pacific not only the largest growth contributor but also the innovation hub for micelle diversification.

Price Sensitivity and Consumer Trade-Down in Mass Markets

Despite rapid expansion, price sensitivity is a significant restraint, especially in emerging markets where mass retail dominates. While dermocosmetic brands like Vichy or Eucerin thrive in developed markets, in countries like India, affordability is a barrier to premium micellar water adoption. Consumers in lower-income segments may trade down to cheaper soap-based cleansers or herbal alternatives, limiting the penetration of premium micelle solutions. This issue is amplified when products carry dermatologist-tested or vegan claims, which often come at a price premium of 30-40% compared to regular cleansers. Unless companies offer tiered pricing strategies, this restraint will limit market share expansion in the middle-income consumer bracket.

Intense Competition from Substitutes in Daily Cleansing

Another restraint arises from competition with substitute cleansing formats. In Asia and Latin America, traditional cleansing oils, herbal washes, and foaming cleansers are deeply entrenched in consumer routines. While micellar waters are promoted as gentle and multifunctional, consumer loyalty to traditional formats slows conversion. For instance, in Japan, oil cleansers dominate makeup removal, while in India, Ayurvedic and herbal cleansers maintain strong cultural roots. Unless micelle-based products differentiate through additional benefits like hydration, anti-pollution, or SPF compatibility, they risk stagnation in regions where substitutes have stronger brand heritage.

Hybrid and Polymeric Micelles as Next-Gen Differentiators

A major trend is the emergence of hybrid and polymeric micelles designed to deliver multifunctional skincare benefits. While oil-in-water micelles dominate in 2025 with a 58.9% share, innovation pipelines are shifting towards advanced micelles that combine cleansing with active delivery of ingredients such as hyaluronic acid, ceramides, and botanical extracts. Polymeric micelles are particularly gaining traction in Japan and South Korea, where consumers seek ritual-based routines that blend cleansing with hydration and anti-aging functions. Global players are investing in research to engineer micelles with greater stability, controlled release of actives, and enhanced compatibility with sensitive or acne-prone skin. This trend is set to redefine the market beyond simple cleansing towards therapeutic micelle-based skincare.

Claim-Driven Branding and Regulatory Oversight

Another defining trend is the intensification of claim-driven marketing, especially around “vegan,” “dermatologist-tested,” and “sensitive skin” labels. In 2025, sensitive-skin-tested products already dominate with USD 1,680.8 million in sales, highlighting how claims drive consumer decision-making. However, rising regulatory scrutiny in Europe and the USA is pushing brands to scientifically substantiate claims, preventing overuse of vague or misleading marketing. As consumers become more label-conscious, brands that can demonstrate clinically proven, eco-certified, and dermatologist-backed micelle formulations will capture stronger loyalty. Claim-driven innovation is particularly evident in e-commerce and specialty beauty retail, where ingredient transparency and label verification influence consumer trust.

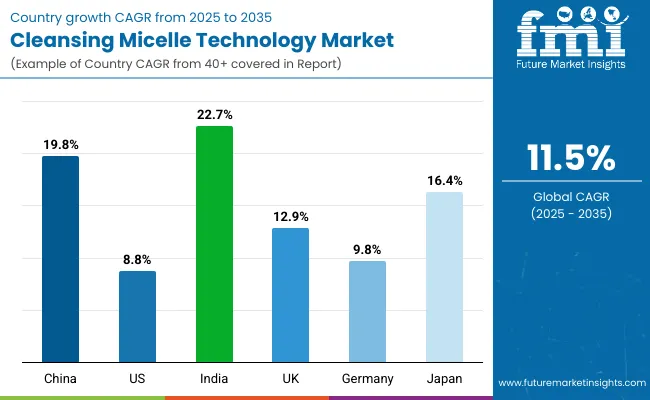

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| USA | 8.8% |

| India | 22.7% |

| UK | 12.9% |

| Germany | 9.8% |

| Japan | 16.4% |

Between 2025 and 2035, the Cleansing Micelle Technology Market is set to experience varied country-level growth patterns, highlighting regional disparities in skincare adoption. India (22.7% CAGR) leads the global momentum, fueled by rising disposable incomes, urbanization, and the rapid shift of younger consumers from traditional soap-based cleansers to modern micellar formats. The country’s retail expansion, particularly in mass retail and e-commerce, has accelerated penetration of affordable micellar waters and wipes, while premium pharmacy brands are gaining share in metro cities. China (19.8% CAGR) follows closely, driven by digital-first consumer behavior, strong e-commerce ecosystems, and the influence of K-beauty and J-beauty rituals.

Micelle products in China are increasingly marketed as multifunctional solutions, combining makeup removal with hydration and oil control. Meanwhile, Japan (16.4% CAGR) reflects demand for advanced micelle innovations like hybrid and polymeric formulations, aligning with its preference for ritual-based, science-driven skincare routines. Together, these three Asian markets are emerging as the engines of global growth, shaping innovation pipelines and brand strategies.

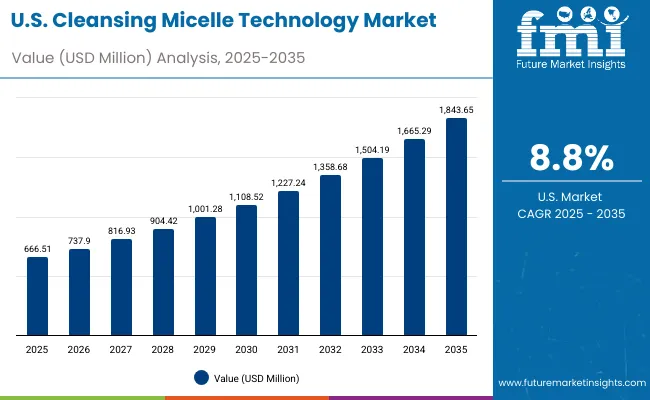

In contrast, developed markets demonstrate slower but stable growth trajectories. The USA market (8.8% CAGR), already valued at USD 666.5 million in 2025, expands steadily with micellar waters leading over 63% of sales. Growth here is anchored in sensitive-skin-tested and dermatologist-recommended claims, reflecting strong pharmacy and specialty retail influence. Germany (9.8% CAGR) and the UK (12.9% CAGR) show sustained demand for dermocosmetic micellar waters, with pharmacies and mass retail driving distribution, while premium brands like Avène and Vichy capture higher-value consumers.

Despite slower growth compared to Asia, these Western markets remain critical for global players due to their established consumer trust, regulatory rigor, and willingness to adopt dermatologist-tested formulations. This divergence in growth rates underscores a dual-speed market: Asia-Pacific driving volume expansion and innovation, while North America and Europe sustain premium positioning and brand-led loyalty.

| Year | USA Cleansing Micelle Technology Market (USD Million) |

|---|---|

| 2025 | 666.51 |

| 2026 | 737.90 |

| 2027 | 816.93 |

| 2028 | 904.42 |

| 2029 | 1,001.28 |

| 2030 | 1,108.52 |

| 2031 | 1,227.24 |

| 2032 | 1,358.68 |

| 2033 | 1,504.19 |

| 2034 | 1,665.29 |

| 2035 | 1,843.65 |

The Cleansing Micelle Technology Market in the United States is projected to grow at a CAGR of 8.8%, led by expanding demand for dermatologist-tested and sensitive-skin-focused micellar waters. Pharmacy-driven distribution, particularly through drugstore chains and specialty beauty retail, is boosting premium dermocosmetic brands such as Bioderma, La Roche-Posay, and Eucerin. The country’s rising awareness around skin sensitivity and clean beauty has reinforced micellar water as the leading product type, accounting for 63.2% of total sales in 2025 (USD 421 million). Increasing adoption is also seen in e-commerce, where vegan and fragrance-free claims resonate strongly with millennial and Gen Z buyers. Formulations offering hydration and soothing functions are gaining traction in dry-skin prone regions, while oil-control micelles are expanding their share in warmer states.

The Cleansing Micelle Technology Market in the United Kingdom is expected to grow at a CAGR of 12.9%, supported by dermocosmetic adoption across retail and e-commerce platforms. The country’s market is anchored in mass retail and pharmacy distribution, where brands such as Garnier, Nivea, and Avène hold significant shelf space. Rising awareness of skin irritation and increased preference for dermatologist-tested and sensitive-skin-approved formulations are driving adoption across age groups. Micellar waters remain the backbone of the market, but cleansing wipes and foams are seeing growth in urban centers as consumers look for portable, quick-use products. E-commerce has accelerated adoption, with subscription-based models for micellar wipes and gels emerging as new sales levers.

India is witnessing rapid growth in the Cleansing Micelle Technology Market, which is forecast to expand at a CAGR of 22.7% through 2035 the highest globally. Rising middle-class disposable incomes and beauty consciousness are shifting consumers from traditional soaps and herbal cleansers to modern micellar-based products. Mass retail penetration and e-commerce platforms such as Nykaa and Amazon are central to market expansion, enabling affordable and wide distribution. Affordable micellar waters dominate, but gels and foams designed for oil-control claims are particularly attractive in humid states. The growing youth population, coupled with targeted marketing around acne prevention and skin sensitivity, is propelling adoption in Tier-2 and Tier-3 cities.

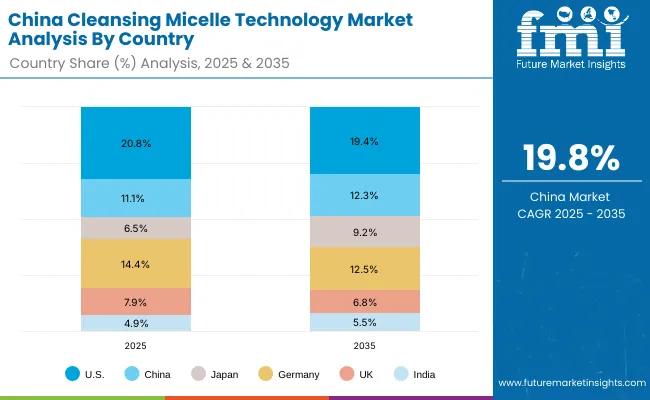

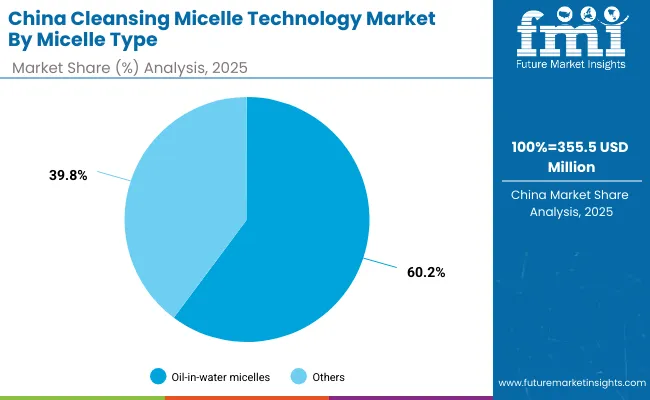

The Cleansing Micelle Technology Market in China is expected to grow at a CAGR of 19.8%, making it one of the fastest-growing global markets. Demand is propelled by e-commerce dominance, social media-driven beauty marketing, and local consumer preference for multifunctional skincare products. Oil-in-water micelles lead the market, accounting for 60.2% of China’s 2025 sales (USD 213.9 million), due to their compatibility with sensitive skin and dermatologist validation. Influences from K-beauty and J-beauty have made hybrid micelles and polymeric micelles popular in urban markets, particularly for hydration and soothing claims. Local Chinese beauty brands are competing aggressively with global players by offering affordable, vegan-certified micellar products on platforms such as Tmall and JD.com.

| USA by Product Type | Value Share% 2025 |

|---|---|

| Micellar waters | 63.2% |

| Others | 36.8% |

The Cleansing Micelle Technology Market in the United States is projected at USD 666.5 million in 2025, expanding steadily at a CAGR of 8.8% through 2035. Micellar waters lead decisively, reflecting their positioning as dermatologist-endorsed essentials for daily cleansing routines. This dominance is reinforced by pharmacy-driven channels where sensitive-skin-tested and dermatologist-tested claims hold consumer trust. The “others” category cleansing wipes, gels, and foams while smaller in value share, is growing as busy consumers seek portable, quick-use formats and as oil-control gels target acne-prone segments.

Growth in the USA is underpinned by demand for clean beauty products, transparency in labeling, and the integration of claims such as vegan and fragrance-free. Subscription-driven e-commerce and D2C platforms are gaining popularity, particularly among Gen Z buyers who prefer recurring delivery of skincare basics. In addition, premium dermocosmetic brands are leveraging dermatology clinics and pharmacy tie-ups to expand access, while mass players like Garnier and Nivea continue to dominate volume sales. By the end of the decade, product diversification and multi-claim layering (e.g., micellar waters with hydration plus soothing benefits) will shape competitive strategy.

| China by Micelle Type | Value Share% 2025 |

|---|---|

| Oil-in-water micelles | 60.2% |

| Others | 39.8% |

The Cleansing Micelle Technology Market in China is projected at USD 355.5 million in 2025, growing at an exceptional CAGR of 19.8%, the highest among leading markets. Oil-in-water micelles dominate due to their proven compatibility with sensitive skin, a priority among Chinese consumers increasingly conscious of pollution-related skin damage. Hybrid and polymeric micelles are gaining visibility in premium segments, supported by K-beauty and J-beauty influences that emphasize multifunctional routines and hydration-driven formulations.

China’s momentum is largely e-commerce-led, with platforms like Tmall, JD.com, and Douyin shaping consumer access and brand discovery. Local beauty players are aggressively competing with global brands, offering cost-effective vegan-certified micellar products targeted toward Gen Z and millennial buyers. The rising influence of social commerce, live-streaming promotions, and influencer-led campaigns is accelerating awareness and trial. Additionally, cross-border collaborations with Japanese and Korean brands are fueling innovation in hybrid micelles that combine cleansing, hydration, and skin barrier repair. This positions China as not just a fast-growing market but also a regional innovation hub for advanced micelle technologies.

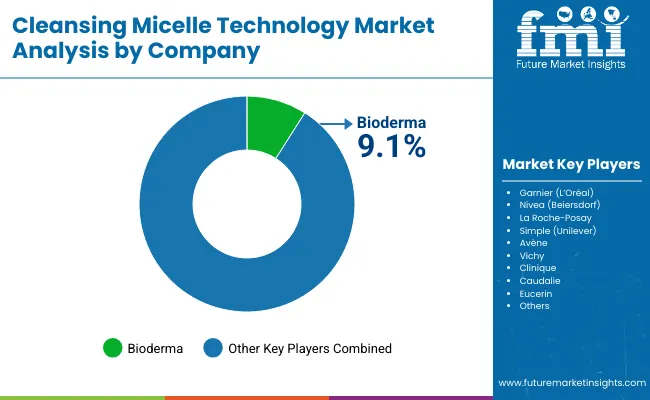

The Cleansing Micelle Technology Market is moderately fragmented, with a few international leaders dominating dermocosmetic credibility while mass and local players capture volume through affordability and accessibility. Bioderma, with a global share of 9.1% in 2025, continues to lead by virtue of being the first mover in micellar technology and by maintaining its strong dermatology-pharmacy positioning. Garnier (L’Oréal) and Nivea (Beiersdorf) are equally prominent, leveraging their mass retail reach to secure dominance in affordable micellar waters across Europe and North America.

Premium dermocosmetic brands such as La Roche-Posay, Avène, Vichy, and Eucerin emphasize dermatologist-tested claims and pharmacy distribution, which solidify their appeal in markets like the USA, UK, and Germany. In parallel, Clinique and Caudalie appeal to prestige skincare buyers seeking clean formulations with hydration and soothing properties. The “others” category, representing nearly 91% of the market, includes both mass-market competitors and rising clean beauty entrants offering vegan, eco-certified, and refillable micelle formats.

Competitive differentiation is shifting from simple cleansing efficacy to multi-claim, multifunctional product ecosystems. Brands are investing in hybrid micelles, dermatologist co-branding, and eco-sustainable packaging to secure consumer loyalty. E-commerce visibility, influencer partnerships, and social-commerce activation are becoming critical levers, particularly in Asia-Pacific. Ultimately, the competitive battleground is defined by a balance between heritage dermocosmetic leaders with pharmacy trust and digitally native challengers driving affordability and innovation.

Key Developments in Cleansing Micelle Technology Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,210.3 million |

| Function | Makeup removal, Deep pore cleansing, Hydration & soothing, Oil control |

| Micelle Type | Oil-in-water micelles, Water-in-oil micelles, Hybrid micelles, Polymeric micelles |

| Product Type | Micellar waters, Cleansing wipes, Gels, Foams |

| Channel | E-commerce, Pharmacies, Mass retail, Specialty beauty retail |

| Claim | Fragrance-free, Sensitive skin-tested, Vegan, Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bioderma, Garnier (L’Oréal), Nivea (Beiersdorf), La Roche- Posay, Simple (Unilever), Avène, Vichy, Clinique, Caudalie, Eucerin |

| Additional Attributes | Dollar sales by product type, micelle type, and claim; adoption trends in sensitive-skin-tested and vegan products; rising demand for dermatologist-backed formulations; segment-specific growth in mass retail, pharmacies, and e-commerce; premiumization strategies in dermocosmetics integration of hydration, soothing, and oil-control claims; regional trends influenced by clean beauty, pollution-driven sensitivity, and dermatological endorsements; innovations in hybrid and polymeric micelles. |

The Cleansing Micelle Technology Market is estimated to be valued at USD 3,210.3 million in 2025.

The market size for the Cleansing Micelle Technology Market is projected to reach USD 9,500.4 million by 2035.

The Cleansing Micelle Technology Market is expected to grow at a CAGR of 11.5% between 2025 and 2035.

The key product types in the Cleansing Micelle Technology Market are micellar waters, cleansing wipes, gels, and foams.

In terms of micelle type, oil-in-water micelles will command 58.9% share in the Cleansing Micelle Technology Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Daily Cleansing Cream Market Insights – Size, Trends and Forecast 2025-2035

Electric Facial Cleansing Brush Market Size and Share Forecast Outlook 2025 to 2035

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

8K Technology Market

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in GDS Technology Market

GDS Technology Market Insights - Growth & Forecast 2025 to 2035

Nanotechnology for food packaging Market

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Airline Technology Integration Market Size and Share Forecast Outlook 2025 to 2035

Food Biotechnology Market Size and Share Forecast Outlook 2025 to 2035

IO-Link technology Market Size and Share Forecast Outlook 2025 to 2035

Scaffold Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA