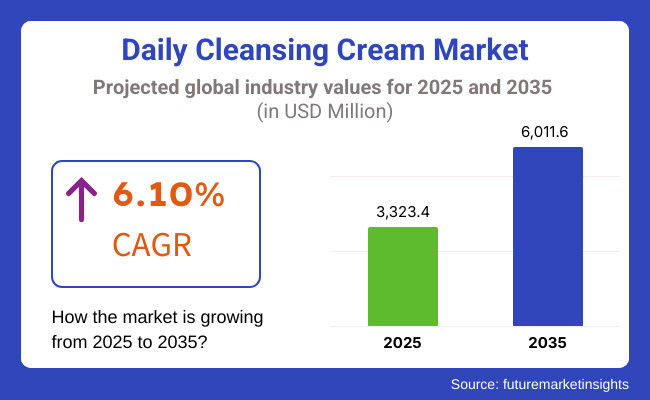

The daily cleansing cream market is expected to reach USD 3,323.4 million in 2025, driven by growing consumer awareness of skincare. With a CAGR of 6.10%, the market is projected to expand significantly, reaching USD 6,011.6 million by 2035.

This steady growth is attributed to increasing demand for personal care products, rising disposable incomes, and a shift towards organic and dermatologically tested formulations. Innovations in cleansing creams, such as multi-functional and hydrating ingredients, further fuel market expansion.

The market is also witnessing rising traction in e-commerce, with online platforms boosting accessibility. Brands are focusing on eco-friendly packaging and cruelty-free formulations to attract sustainability-conscious consumers. The Asia-Pacific region is a key growth driver, supported by an expanding beauty-conscious population.

Between 2020 and 2024, the global cough suppressant market witnessed substantial growth, driven by increasing respiratory illnesses, rising pollution levels, and heightened consumer awareness of over-the-counter medications. The market expanded from USD 2.45 billion in 2019 to approximately USD 2.98 billion in 2023, reflecting a CAGR of 4.9% during this period.

Growing concerns over air pollution and seasonal flu outbreaks fueled demand for effective cough relief solutions. Consumers increasingly opted for natural and herbal formulations, prompting manufacturers to develop chemical-free alternatives. The surge in e-commerce and digital health platforms also contributed to the widespread availability of cough suppressants, further driving market growth.

Looking ahead to 2025 to 2035, the cough suppressant market is set to grow further, reaching approximately USD 5.65 billion by 2034, with a CAGR of 6.1% from 2024 to 2034. Innovations in formulations, including advanced mucolytic agents, honey-based syrups, and plant-derived expectorants, will enhance product effectiveness and appeal to health-conscious consumers.

The demand for personalized medicine will rise, with brands offering targeted solutions for different age groups and respiratory conditions. Additionally, sustainability will play a crucial role, with companies adopting eco-friendly packaging, ethical ingredient sourcing, and carbon-neutral production methods. As the market evolves, companies must adapt to regulatory changes, shifting consumer preferences, and advancements in digital healthcare to maintain a competitive edge.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on product safety and accurate labelling to ensure compliance. |

| Technological Advancements | Introduction of natural and organic formulations. |

| Consumer Demand | Increased awareness of skincare routines and preference for chemical-free products. |

| Market Growth Drivers | Rising pollution levels and increased disposable income are driving demand for premium skincare. |

| Sustainability | Early adoption of recyclable packaging and reduced chemical usage. |

| Supply Chain Dynamics | Growth in e-commerce platforms for product accessibility. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter guidelines promoting sustainability, including eco-friendly packaging and ethical ingredient sourcing. |

| Technological Advancements | Development of advanced skincare solutions incorporating anti-pollution agents and hydration-boosting ingredients. |

| Consumer Demand | Growing demand for personalized skincare solutions tailored to unique skin needs. |

| Market Growth Drivers | Expansion into emerging markets and digital skincare integration for personalized recommendations. |

| Sustainability | Full integration of biodegradable packaging, carbon-neutral production, and sustainable ingredient sourcing. |

| Supply Chain Dynamics | Enhanced supply chain transparency with blockchain and AI-driven inventory management. |

| Challenges | Opportunities |

|---|---|

| Stringent regulatory requirements for cosmetic claims and ingredient restrictions. | Increasing consumer preference for scientifically backed and organic cleansing creams. |

| Potential skepticism about product effectiveness. | Development of innovative formulations with enhanced hydration and skin barrier protection. |

| Competition from traditional facial cleansers and micellar waters. | Expansion of e-commerce channels for direct product distribution. |

| Compliance with safety regulations varies across regions. | Rising popularity of personalized skincare solutions. |

| Counterfeit and low-quality skincare products undermine consumer trust. | Collaborations between dermatologists and cosmetic brands for clinically validated solutions. |

| High consumer sensitivity toward product efficacy and safety. | Expansion of subscription-based beauty services and auto-refill programs. |

| Fluctuating raw material costs and supply chain disruptions impact pricing strategies. | Adoption of AI-powered skin analysis tools for personalized product recommendations. |

The North American market will continue to dominate the daily cleansing cream industry from 2025 to 2035, driven by high consumer awareness and a strong demand for premium skincare solutions. The presence of leading dermatological brands and increasing disposable income will sustain market growth. Consumers will increasingly seek sulfate-free, fragrance-free, and hypoallergenic cleansing creams, particularly as concerns over skin sensitivity and environmental pollutants rise.

The expansion of direct-to-consumer (DTC) e-commerce models and subscription-based beauty services will enhance accessibility. Additionally, the growing emphasis on clean beauty, sustainable packaging, and dermatologically tested formulations will shape purchasing trends across the USA and Canada.

Europe will remain a mature and innovation-driven market, with Germany, France, and the UK leading in dermatologically approved and clinically validated skincare solutions. The shift toward preventive skincare, fueled by an aging population and heightened awareness of skin microbiome health, will drive demand for probiotic-based and microbiome-friendly cleansing creams.

Consumers will continue prioritizing sustainability, leading to increased demand for biodegradable, plastic-free, and refillable packaging. Retail pharmacies, department stores, and AI-powered e-commerce platforms will dominate distribution. Furthermore, regulatory advancements will push for clean-label skincare products, ensuring strict compliance with ingredient transparency and safety standards.

The Asia-Pacific region will experience the fastest market expansion, fueled by rising disposable incomes, increasing skincare consciousness, and rapid digital retail growth. Countries like China, India, and Japan will witness heightened demand for herbal and multifunctional cleansing formulations, aligning with the preference for K-beauty, J-beauty, and Ayurvedic skincare.

The rise of AI-driven personalized skincare solutions will redefine consumer engagement, while global and local brands will compete through cost-effective, high-performance cleansing products. The region’s growing middle-class population and urbanization trends will further accelerate market penetration, making Asia-Pacific a key hub for next-generation skincare innovations.

Foam-type and collagen-based cleansing creams are key segments in the daily cleansing cream market, catering to diverse skincare needs. Foam-type cleansers, popular for deep cleansing and oil removal, are widely used by consumers with oily and combination skin, especially in hot and humid climates.

The rise of sulfate-free, pH-balanced, and probiotic-infused foam formulations is shaping innovation, particularly in Asia-Pacific, North America, and Europe. Meanwhile, collagen-based cleansing creams are gaining traction due to their anti-aging and hydrating benefits, appealing to mature skin consumers. Future trends include biodegradable foam cleansers, vegan collagen alternatives, and AI-powered personalized skincare solutions.

The daily cleansing cream market is driven by both female and male segments, each with distinct preferences. Women dominate the market due to multi-step skincare routines, increasing demand for hydrating, brightening, and anti-aging formulations, and a growing focus on clean beauty and plant-based products.

North America and Europe lead in premium, dermatologist-approved creams, while Asia-Pacific sees rapid growth. Meanwhile, men’s skincare is expanding, fueled by rising grooming awareness and demand for oil-controlling, hydrating, and post-shaving cleansers. Future trends include AI-driven skincare recommendations, multi-functional SPF-infused cleansers, probiotic-based formulas, and caffeine-infused revitalizing creams.

The daily cleansing cream market in the United States will continue to grow steadily as consumers become more aware of skincare and skin health. By 2025, the market will reach approximately USD 3.37 billion, with a projected CAGR of 7.8% through 2035.

This growth will result from increasing demand for gentle, effective cleansing products, a strong shift toward natural and organic skincare, and the influence of beauty influencers promoting multi-step skincare routines. Consumers will prioritize dermatologist-approved, sulfate-free, and microbiome-friendly formulations, while AI-driven skincare personalization and sustainable packaging will further shape market trends.

Market Forecast

| Year | 2025 |

|---|---|

| Market Value (USD Billion) | 3.37 |

| CAGR (%) | 7.8% |

| Year | 2035 |

|---|---|

| Market Value (USD Billion) | 7.19 |

| CAGR (%) | 7.8% |

Germany’s daily cleansing cream market will grow steadily, driven by its well-established skincare industry and a strong consumer focus on personal care. By 2025, the market will expand at a CAGR of 6.0%, reaching approximately USD 4.4 billion by 2035.

Consumers will increasingly demand natural and organic skincare products, as rising pollution levels and chronic skin conditions fuel the need for gentle and effective cleansing solutions. Additionally, public-private collaborations will improve product accessibility, while sustainability initiatives, dermatologically tested formulations, and AI-powered skincare solutions will further shape market growth.

Market Forecast

| Year | 2025 |

|---|---|

| Market Value (USD Billion) | 2.45 |

| CAGR (%) | 6.0% |

| Year | 2035 |

|---|---|

| Market Value (USD Billion) | 4.4 |

| CAGR (%) | 6.0% |

China’s daily cleansing cream market will expand significantly as consumer spending on personal care rises and the middle-class population grows. By 2035, the market will grow at a CAGR of 6.1%, driven by urbanization, increasing skincare awareness, and social media beauty trends.

Consumers will seek personalized and high-performance cleansing solutions, while modern technologies such as AI-powered skincare analysis and customized formulations will enhance product appeal. The wide availability of diverse product ranges will cater to different skin concerns, ensuring continuous market growth.

Market Forecast

| Year | 2025 |

|---|---|

| Market Value (USD Billion) | 3.10 |

| CAGR (%) | 6.1% |

| Year | 2035 |

|---|---|

| Market Value (USD Billion) | 5.53 |

| CAGR (%) | 6.1% |

India’s daily cleansing cream market will grow steadily as skincare awareness, rising disposable incomes, and global beauty trends drive demand. By 2035, the market will expand at a CAGR of 5.41%, with brands developing region-specific products to cater to diverse skin types and climatic conditions.

The rapid adoption of e-commerce platforms will make skincare more accessible, while herbal and ayurvedic formulations will continue to gain popularity. As consumers prioritize natural ingredients and dermatologically tested products, the market will see innovations in customized cleansing solutions and eco-friendly packaging to meet evolving preferences.

Market Forecast

| Year | 2025 |

|---|---|

| Market Value (USD Billion) | 2.75 |

| CAGR (%) | 5.41% |

| Year | 2035 |

|---|---|

| Market Value (USD Billion) | 4.65 |

| CAGR (%) | 5.41% |

Brazil’s daily cleansing cream market will expand as skincare awareness, a growing middle-class population, and social media beauty trends drive demand. The country’s strong beauty and personal care industry will continue to grow, with consumers making skincare an essential part of their routines. The demand for organic and dermatologically tested products will fuel innovation, encouraging brands to develop clean and effective formulations.

The rise of e-commerce and digital marketing will enhance product accessibility and consumer engagement, supporting market growth. With a CAGR of 5.8%, Brazil’s cleansing cream market will see sustained expansion through 2035.

Market Forecast

| Year | 2025 |

|---|---|

| Market Value (USD Billion) | 2.90 |

| CAGR (%) | 5.8% |

| Year | 2035 |

|---|---|

| Market Value (USD Billion) | 5.13 |

| CAGR (%) | 5.8% |

Advancements in Skincare Formulations

The introduction of next-generation cleansing creams with improved hydration, such as oil-to-milk and balm-based cleansers, is enhancing product efficacy. The integration of clinically proven ingredients such as niacinamide, peptides, and prebiotics is driving the development of premium cleansing creams.

Growth in Sensitive Skin Solutions

The increasing number of consumers with skin sensitivities and allergies is boosting demand for hypoallergenic and dermatologist-approved cleansing creams. Products targeting compromised skin barriers, including creams enriched with ceramides and squalane, are gaining popularity among consumers.

Regulatory and Policy Developments

Stricter safety regulations by governing bodies such as the FDA and EU Cosmetics Regulation are ensuring higher standards for skincare products, leading to improved consumer confidence and product transparency. Compliance with sustainability initiatives and eco-friendly packaging regulations is further influencing product innovation and brand positioning.

The daily cleansing cream market is highly competitive, driven by increasing consumer demand for skincare products that provide hydration, gentle cleansing, and anti-aging benefits. The market is shaped by major personal care brands, dermatology-focused companies, and organic skincare manufacturers, each contributing to the evolving landscape of facial cleansing solutions. Companies are investing in sulphate-free, pH-balanced, and dermatologist-tested formulations to maintain a competitive edge.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| L'Oréal (CeraVe, La Roche-Posay) | 22-26% |

| Unilever (Dove, Simple) | 18-22% |

| Estée Lauder (Clinique) | 10-14% |

| Johnson & Johnson (Neutrogena, Aveeno) | 8-12% |

| Procter & Gamble (Olay) | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| L'Oréal (CeraVe, La Roche-Posay) | Provides dermatologist-recommended cleansing creams infused with ceramides, niacinamide, and hydrating formulas. |

| Unilever (Dove, Simple) | Specializes in mild, pH-balanced cleansers, catering to sensitive and dry skin types. |

| Estée Lauder (Clinique) | Develops premium cleansing creams with anti-aging ingredients for luxury skincare consumers. |

| Johnson & Johnson (Neutrogena, Aveeno) | Focuses on deep-cleaning and hydrating cleansing creams using natural and scientifically backed ingredients. |

| Procter & Gamble (Olay) | Offers cleansing creams enriched with vitamins and peptides for moisture retention and skin rejuvenation. |

Key Company Insights

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

Increasing skincare awareness, demand for organic products, and the rise of e-commerce are key growth factors.

North America, Europe, and Asia-Pacific are leading due to strong skincare trends and high consumer spending.

AI-driven personalized skincare, microbiome-friendly formulations, and eco-friendly packaging are major trends.

Brands are focusing on biodegradable packaging, clean ingredients, and carbon-neutral production to meet consumer demand.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Region

Table 02a: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 02b: Global Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Gender

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Distribution Channel

Table 06: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2023 to 2034, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Gender

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Distribution Channel

Table 12: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2023 to 2034, by Country

Table 13: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 14: Latin America Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 16: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Gender

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Distribution Channel

Table 18: Europe Market Value (US$ Million) Analysis 2019-2023 and Forecast 2023 to 2034, by Country

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 20: Europe Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 21: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 22: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Gender

Table 23: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Distribution Channel

Table 24: South Asia Market Value (US$ Million) Analysis 2019-2023 and Forecast 2023 to 2034, by Country

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 26: South Asia Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 27: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 28: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Gender

Table 29: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Distribution Channel

Table 30: East Asia Market Value (US$ Million) Analysis 2019-2023 and Forecast 2023 to 2034, by Country

Table 31: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 32: East Asia Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 33: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 34: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Gender

Table 35: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Distribution Channel

Table 36: Oceania Market Value (US$ Million) Analysis 2019-2023 and Forecast 2023 to 2034, by Country

Table 37: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 38: Oceania Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 39: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 40: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Gender

Table 41: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Distribution Channel

Table 42: Middle East & Africa Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2023 to 2034, by Country

Table 43: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 44: Middle East & Africa Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 45: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 46: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Gender

Table 47: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Distribution Channel

Figure 01: Global Market Volume (Units), 2019 to 2023

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis,

Figure 03: Daily Cleansing Cream, Pricing Analysis per unit (US$), in 2023

Figure 04: Daily Cleansing Cream, Pricing Forecast per unit (US$), in 2034

Figure 05: Global Market Value (US$ Million) Analysis, 2019 to 2023

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2034

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2034

Figure 08: Global Market Value Share (%) Analysis 2024 to 2034, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2034, by Product

Figure 11: Global Market Value Share (%) Analysis 2024 to 2034, by Technology

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Technology

Figure 13: Global Market Attractiveness Analysis 2023 to 2034, by Technology

Figure 14: Global Market Value Share (%) Analysis 2024 to 2034, by Gender

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Gender

Figure 16: Global Market Attractiveness Analysis 2023 to 2034, by Gender

Figure 17: Global Market Value Share (%) Analysis 2024 to 2034, by Distribution Channel

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Distribution Channel

Figure 19: Global Market Attractiveness Analysis 2023 to 2034, by Distribution Channel

Figure 20: Global Market Value Share (%) Analysis 2024 to 2034, by Region

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Region

Figure 22: Global Market Attractiveness Analysis 2023 to 2034, by Region

Figure 23: North America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 24: North America Market Value (US$ Million) Forecast, 2023 to 2034

Figure 25: North America Market Value Share, by Product (2024E)

Figure 26: North America Market Value Share, by Technology (2024E)

Figure 27: North America Market Value Share, by Gender (2024E)

Figure 28: North America Market Value Share, by Distribution Channel (2024E)

Figure 29: North America Market Value Share, by Country (2024E)

Figure 30: North America Market Attractiveness Analysis by Product, 2023 to 2034

Figure 31: North America Market Attractiveness Analysis by Technology, 2023 to 2034

Figure 32: North America Market Attractiveness Analysis by Gender, 2023 to 2034

Figure 33: North America Market Attractiveness Analysis by Distribution Channel, 2023 to 2034

Figure 34: North America Market Attractiveness Analysis by Country, 2023 to 2034

Figure 35: USA Market Value Proportion Analysis, 2023

Figure 36: Global Vs. USA Growth Comparison

Figure 37: USA Market Share Analysis (%) by Product, 2023 to 2034

Figure 38: USA Market Share Analysis (%) by Technology, 2023 to 2034

Figure 39: USA Market Share Analysis (%) by Gender, 2023 to 2034

Figure 40: USA Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 41: Canada Market Value Proportion Analysis, 2023

Figure 42: Global Vs. Canada. Growth Comparison

Figure 43: Canada Market Share Analysis (%) by Product, 2023 to 2034

Figure 44: Canada Market Share Analysis (%) by Technology, 2023 to 2034

Figure 45: Canada Market Share Analysis (%) by Gender, 2023 to 2034

Figure 46: Canada Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 47: Latin America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 48: Latin America Market Value (US$ Million) Forecast, 2023 to 2034

Figure 49: Latin America Market Value Share, by Product (2024E)

Figure 50: Latin America Market Value Share, by Technology (2024E)

Figure 51: Latin America Market Value Share, by Gender (2024E)

Figure 52: Latin America Market Value Share, by Distribution Channel (2024E)

Figure 53: Latin America Market Value Share, by Country (2024E)

Figure 54: Latin America Market Attractiveness Analysis by Product, 2023 to 2034

Figure 55: Latin America Market Attractiveness Analysis by Technology, 2023 to 2034

Figure 56: Latin America Market Attractiveness Analysis by Gender, 2023 to 2034

Figure 57: Latin America Market Attractiveness Analysis by Distribution Channel, 2023 to 2034

Figure 58: Latin America Market Attractiveness Analysis by Country, 2023 to 2034

Figure 59: Mexico Market Value Proportion Analysis, 2023

Figure 60: Global Vs Mexico Growth Comparison

Figure 61: Mexico Market Share Analysis (%) by Product, 2023 to 2034

Figure 62: Mexico Market Share Analysis (%) by Technology, 2023 to 2034

Figure 63: Mexico Market Share Analysis (%) by Gender, 2023 to 2034

Figure 64: Mexico Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 65: Brazil Market Value Proportion Analysis, 2023

Figure 66: Global Vs. Brazil. Growth Comparison

Figure 67: Brazil Market Share Analysis (%) by Product, 2023 to 2034

Figure 68: Brazil Market Share Analysis (%) by Technology, 2023 to 2034

Figure 69: Brazil Market Share Analysis (%) by Gender, 2023 to 2034

Figure 70: Brazil Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 71: Argentina Market Value Proportion Analysis, 2023

Figure 72: Global Vs Argentina Growth Comparison

Figure 73: Argentina Market Share Analysis (%) by Product, 2023 to 2034

Figure 74: Argentina Market Share Analysis (%) by Technology, 2023 to 2034

Figure 75: Argentina Market Share Analysis (%) by Gender, 2023 to 2034

Figure 76: Argentina Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 77: Europe Market Value (US$ Million) Analysis, 2019 to 2023

Figure 78: Europe Market Value (US$ Million) Forecast, 2023 to 2034

Figure 79: Europe Market Value Share, by Product (2024E)

Figure 80: Europe Market Value Share, by Technology (2024E)

Figure 81: Europe Market Value Share, by Gender (2024E)

Figure 82: Europe Market Value Share, by Distribution Channel (2024E)

Figure 83: Europe Market Value Share, by Country (2024E)

Figure 84: Europe Market Attractiveness Analysis by Product, 2023 to 2034

Figure 85: Europe Market Attractiveness Analysis by Technology, 2023 to 2034

Figure 86: Europe Market Attractiveness Analysis by Gender, 2023 to 2034

Figure 87: Europe Market Attractiveness Analysis by Distribution Channel, 2023 to 2034

Figure 88: Europe Market Attractiveness Analysis by Country, 2023 to 2034

Figure 89: UK Market Value Proportion Analysis, 2023

Figure 90: Global Vs. UK Growth Comparison

Figure 91: UK Market Share Analysis (%) by Product, 2023 to 2034

Figure 92: UK Market Share Analysis (%) by Technology, 2023 to 2034

Figure 93: UK Market Share Analysis (%) by Gender, 2023 to 2034

Figure 94: UK Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 95: Germany Market Value Proportion Analysis, 2023

Figure 96: Global Vs. Germany Growth Comparison

Figure 97: Germany Market Share Analysis (%) by Product, 2023 to 2034

Figure 98: Germany Market Share Analysis (%) by Technology, 2023 to 2034

Figure 99: Germany Market Share Analysis (%) by Gender, 2023 to 2034

Figure 100: Germany Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 101: Italy Market Value Proportion Analysis, 2023

Figure 102: Global Vs. Italy Growth Comparison

Figure 103: Italy Market Share Analysis (%) by Product, 2023 to 2034

Figure 104: Italy Market Share Analysis (%) by Technology, 2023 to 2034

Figure 105: Italy Market Share Analysis (%) by Gender, 2023 to 2034

Figure 106: Italy Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 107: France Market Value Proportion Analysis, 2023

Figure 108: Global Vs France Growth Comparison

Figure 109: France Market Share Analysis (%) by Product, 2023 to 2034

Figure 110: France Market Share Analysis (%) by Technology, 2023 to 2034

Figure 111: France Market Share Analysis (%) by Gender, 2023 to 2034

Figure 112: France Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 113: Spain Market Value Proportion Analysis, 2023

Figure 114: Global Vs Spain Growth Comparison

Figure 115: Spain Market Share Analysis (%) by Product, 2023 to 2034

Figure 116: Spain Market Share Analysis (%) by Technology, 2023 to 2034

Figure 117: Spain Market Share Analysis (%) by Gender, 2023 to 2034

Figure 118: Spain Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 119: Russia Market Value Proportion Analysis, 2023

Figure 120: Global Vs Russia Growth Comparison

Figure 121: Russia Market Share Analysis (%) by Product, 2023 to 2034

Figure 122: Russia Market Share Analysis (%) by Technology, 2023 to 2034

Figure 123: Russia Market Share Analysis (%) by Gender, 2023 to 2034

Figure 124: Russia Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 125: BENELUX Market Value Proportion Analysis, 2023

Figure 126: Global Vs BENELUX Growth Comparison

Figure 127: BENELUX Market Share Analysis (%) by Product, 2023 to 2034

Figure 128: BENELUX Market Share Analysis (%) by Technology, 2023 to 2034

Figure 129: BENELUX Market Share Analysis (%) by Gender, 2023 to 2034

Figure 130: BENELUX Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 132: East Asia Market Value (US$ Million) Forecast, 2023 to 2034

Figure 133: East Asia Market Value Share, by Product (2024E)

Figure 134: East Asia Market Value Share, by Technology (2024E)

Figure 135: East Asia Market Value Share, by Gender (2024E)

Figure 136: East Asia Market Value Share, by Distribution Channel (2024E)

Figure 137: East Asia Market Value Share, by Country (2024E)

Figure 138: East Asia Market Attractiveness Analysis by Product, 2023 to 2034

Figure 139: East Asia Market Attractiveness Analysis by Technology, 2023 to 2034

Figure 140: East Asia Market Attractiveness Analysis by Gender, 2023 to 2034

Figure 141: East Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2034

Figure 142: East Asia Market Attractiveness Analysis by Country, 2023 to 2034

Figure 143: China Market Value Proportion Analysis, 2023

Figure 144: Global Vs. China Growth Comparison

Figure 145: China Market Share Analysis (%) by Product, 2023 to 2034

Figure 146: China Market Share Analysis (%) by Technology, 2023 to 2034

Figure 147: China Market Share Analysis (%) by Gender, 2023 to 2034

Figure 148: China Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 149: Japan Market Value Proportion Analysis, 2023

Figure 150: Global Vs. Japan Growth Comparison

Figure 151: Japan Market Share Analysis (%) by Product, 2023 to 2034

Figure 152: Japan Market Share Analysis (%) by Technology, 2023 to 2034

Figure 153: Japan Market Share Analysis (%) by Gender, 2023 to 2034

Figure 154: Japan Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 155: South Korea Market Value Proportion Analysis, 2023

Figure 156: Global Vs South Korea Growth Comparison

Figure 157: South Korea Market Share Analysis (%) by Product, 2023 to 2034

Figure 158: South Korea Market Share Analysis (%) by Technology, 2023 to 2034

Figure 159: South Korea Market Share Analysis (%) by Gender, 2023 to 2034

Figure 160: South Korea Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 161: South Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 162: South Asia Market Value (US$ Million) Forecast, 2023 to 2034

Figure 163: South Asia Market Value Share, by Product (2024E)

Figure 164: South Asia Market Value Share, by Technology (2024E)

Figure 165: South Asia Market Value Share, by Gender (2024E)

Figure 166: South Asia Market Value Share, by Distribution Channel (2024E)

Figure 167: South Asia Market Value Share, by Country (2024E)

Figure 168: South Asia Market Attractiveness Analysis by Product, 2023 to 2034

Figure 169: South Asia Market Attractiveness Analysis by Technology, 2023 to 2034

Figure 170: South Asia Market Attractiveness Analysis by Gender, 2023 to 2034

Figure 171: South Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2034

Figure 172: South Asia Market Attractiveness Analysis by Country, 2023 to 2034

Figure 173: India Market Value Proportion Analysis, 2023

Figure 174: Global Vs. India Growth Comparison

Figure 175: India Market Share Analysis (%) by Product, 2023 to 2034

Figure 176: India Market Share Analysis (%) by Technology, 2023 to 2034

Figure 177: India Market Share Analysis (%) by Gender, 2023 to 2034

Figure 178: India Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 179: Indonesia Market Value Proportion Analysis, 2023

Figure 180: Global Vs. Indonesia Growth Comparison

Figure 181: Indonesia Market Share Analysis (%) by Product, 2023 to 2034

Figure 182: Indonesia Market Share Analysis (%) by Technology, 2023 to 2034

Figure 183: Indonesia Market Share Analysis (%) by Gender, 2023 to 2034

Figure 184: Indonesia Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 185: Malaysia Market Value Proportion Analysis, 2023

Figure 186: Global Vs. Malaysia Growth Comparison

Figure 187: Malaysia Market Share Analysis (%) by Product, 2023 to 2034

Figure 188: Malaysia Market Share Analysis (%) by Technology, 2023 to 2034

Figure 189: Malaysia Market Share Analysis (%) by Gender, 2023 to 2034

Figure 190: Malaysia Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 191: Thailand Market Value Proportion Analysis, 2023

Figure 192: Global Vs. Thailand Growth Comparison

Figure 193: Thailand Market Share Analysis (%) by Product, 2023 to 2034

Figure 194: Thailand Market Share Analysis (%) by Technology, 2023 to 2034

Figure 195: Thailand Market Share Analysis (%) by Gender, 2023 to 2034

Figure 196: Thailand Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 197: Oceania Market Value (US$ Million) Analysis, 2019 to 2023

Figure 198: Oceania Market Value (US$ Million) Forecast, 2023 to 2034

Figure 199: Oceania Market Value Share, by Product (2024E)

Figure 200: Oceania Market Value Share, by Technology (2024E)

Figure 201: Oceania Market Value Share, by Gender (2024E)

Figure 202: Oceania Market Value Share, by Distribution Channel (2024E)

Figure 203: Oceania Market Value Share, by Country (2024E)

Figure 204: Oceania Market Attractiveness Analysis by Product, 2023 to 2034

Figure 205: Oceania Market Attractiveness Analysis by Technology, 2023 to 2034

Figure 206: Oceania Market Attractiveness Analysis by Gender, 2023 to 2034

Figure 207: Oceania Market Attractiveness Analysis by Distribution Channel, 2023 to 2034

Figure 208: Oceania Market Attractiveness Analysis by Country, 2023 to 2034

Figure 209: Australia Market Value Proportion Analysis, 2023

Figure 210: Global Vs. Australia Growth Comparison

Figure 211: Australia Market Share Analysis (%) by Product, 2023 to 2034

Figure 212: Australia Market Share Analysis (%) by Technology, 2023 to 2034

Figure 213: Australia Market Share Analysis (%) by Gender, 2023 to 2034

Figure 214: Australia Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 215: New Zealand Market Value Proportion Analysis, 2023

Figure 216: Global Vs New Zealand Growth Comparison

Figure 217: New Zealand Market Share Analysis (%) by Product, 2023 to 2034

Figure 218: New Zealand Market Share Analysis (%) by Technology, 2023 to 2034

Figure 219: New Zealand Market Share Analysis (%) by Gender, 2023 to 2034

Figure 220: New Zealand Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 221: Middle East & Africa Market Value (US$ Million) Analysis, 2019 to 2023

Figure 222: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2034

Figure 223: Middle East & Africa Market Value Share, by Product (2024E)

Figure 224: Middle East & Africa Market Value Share, by Technology (2024E)

Figure 225: Middle East & Africa Market Value Share, by Gender (2024E)

Figure 226: Middle East & Africa Market Value Share, by Distribution Channel (2024E)

Figure 227: Middle East & Africa Market Value Share, by Country (2024E)

Figure 228: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2034

Figure 229: Middle East & Africa Market Attractiveness Analysis by Technology, 2023 to 2034

Figure 230: Middle East & Africa Market Attractiveness Analysis by Gender, 2023 to 2034

Figure 231: Middle East & Africa Market Attractiveness Analysis by Distribution Channel, 2023 to 2034

Figure 232: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2034

Figure 233: GCC Countries Market Value Proportion Analysis, 2023

Figure 234: Global Vs GCC Countries Growth Comparison

Figure 235: GCC Countries Market Share Analysis (%) by Product, 2023 to 2034

Figure 236: GCC Countries Market Share Analysis (%) by Technology, 2023 to 2034

Figure 237: GCC Countries Market Share Analysis (%) by Gender, 2023 to 2034

Figure 238: GCC Countries Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 239: Türkiye Market Value Proportion Analysis, 2023

Figure 240: Global Vs. Türkiye Growth Comparison

Figure 241: Türkiye Market Share Analysis (%) by Product, 2023 to 2034

Figure 242: Türkiye Market Share Analysis (%) by Technology, 2023 to 2034

Figure 243: Türkiye Market Share Analysis (%) by Gender, 2023 to 2034

Figure 244: Türkiye Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 245: South Africa Market Value Proportion Analysis, 2023

Figure 246: Global Vs. South Africa Growth Comparison

Figure 247: South Africa Market Share Analysis (%) by Product, 2023 to 2034

Figure 248: South Africa Market Share Analysis (%) by Technology, 2023 to 2034

Figure 249: South Africa Market Share Analysis (%) by Gender, 2023 to 2034

Figure 250: South Africa Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 251: North Africa Market Value Proportion Analysis, 2023

Figure 252: Global Vs North Africa Growth Comparison

Figure 253: North Africa Market Share Analysis (%) by Product, 2023 to 2034

Figure 254: North Africa Market Share Analysis (%) by Technology, 2023 to 2034

Figure 255: North Africa Market Share Analysis (%) by Gender, 2023 to 2034

Figure 256: North Africa Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Daily Backpacks Market Size and Share Forecast Outlook 2025 to 2035

Cleansing Micelle Technology Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Electric Facial Cleansing Brush Market Size and Share Forecast Outlook 2025 to 2035

Cream of Tartar Market Size and Share Forecast Outlook 2025 to 2035

Cream Separator Market Size and Share Forecast Outlook 2025 to 2035

Cream Cheese Market Analysis – Size, Share, and Forecast 2025 to 2035

BB Cream Market Analysis by Skin Type, SPF Type, End Uses, Sales Channel and Region through 2025 to 2035

Ice Cream Coating Market Size and Share Forecast Outlook 2025 to 2035

Ice-cream Premix and Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Ice Cream Equipment Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Ice Cream and Frozen Dessert Market from 2025 to 2035

Ice Cream Packaging Market - Outlook 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Ice Cream Parlor Market Analysis by Type, Product Type, and Region Through 2035

Breaking Down Market Share in the Ice Cream Parlor Industry

Ice Cream Container Market Size & Trends Forecast 2024-2034

Dry Cream Substitute Market

Ice-cream Maker Market

Precis of Key Trends Shaping Sour Cream Powder Business Landscape.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA