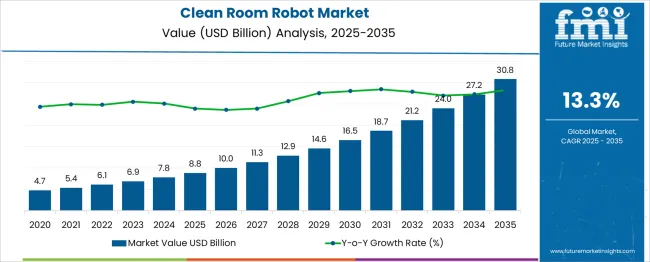

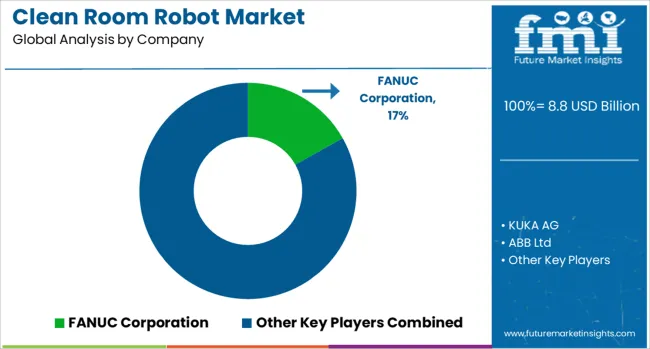

The Clean Room Robot Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 30.8 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

| Metric | Value |

|---|---|

| Clean Room Robot Market Estimated Value in (2025 E) | USD 8.8 billion |

| Clean Room Robot Market Forecast Value in (2035 F) | USD 30.8 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The clean room robot market is experiencing accelerated growth due to increasing automation requirements in highly sensitive manufacturing environments such as semiconductors, pharmaceuticals, and biotechnology. Rising demand for precision, contamination control, and operational efficiency is prompting industries to adopt clean room-compliant robotic systems. These robots are engineered to function in controlled environments by minimizing particle emissions and withstanding decontamination processes.

As regulatory standards for cleanliness and quality become more stringent, the market is benefiting from widespread investment in clean room infrastructure. Technological advancements, particularly in AI integration and modular robot design, are enhancing performance while expanding applicability across end-use sectors.

With the push toward Industry 4.0 and smart factory deployments, clean room robots are expected to become integral to critical production lines. The market outlook remains strong as manufacturers continue to focus on defect reduction, yield improvement, and cost optimization in precision-driven industries.

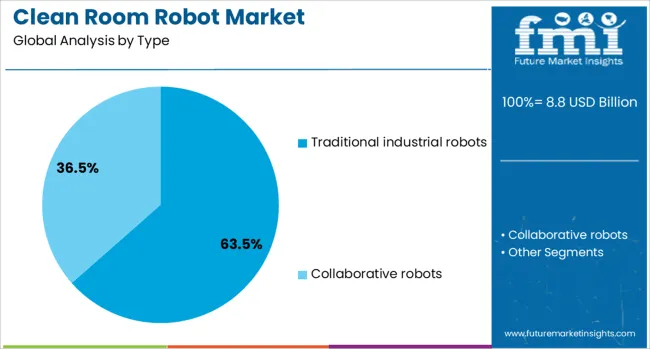

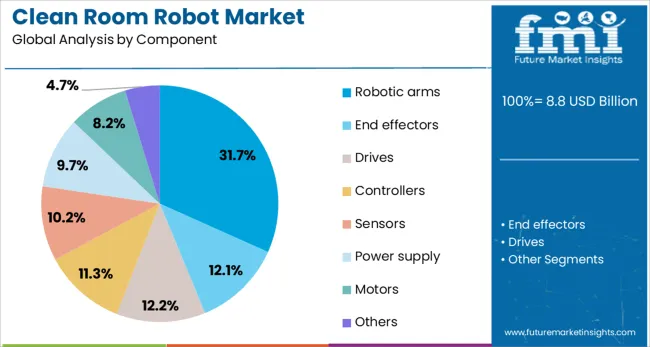

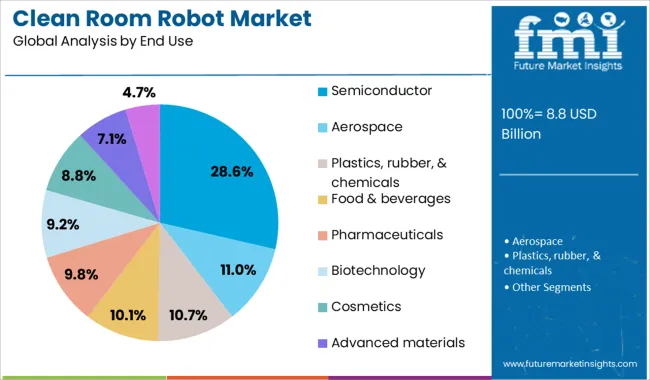

The clean room robot market is segmented by type, component, and end use and geographic regions. By type of the clean room robot market is divided into Traditional industrial robots and Collaborative robots. In terms of component of the clean room robot market is classified into Robotic arms, End effectors, Drives, Controllers, Sensors, Power supply, Motors, and Others. Based on end use of the clean room robot market is segmented into Semiconductor, Aerospace, Plastics, rubber, & chemicals, Food & beverages, Pharmaceuticals, Biotechnology, Cosmetics, Advanced materials, and Others. Regionally, the clean room robot industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The traditional industrial robots segment dominates the clean room robot market with a commanding 63.5% share, supported by its versatility, scalability, and established reliability in high-throughput production environments. These robots are widely adopted due to their ability to perform repetitive tasks with high precision while maintaining compliance with clean room standards.

Industries such as electronics, pharmaceuticals, and medical device manufacturing rely on traditional robotic platforms adapted with clean room features like sealed joints, low-particle emission materials, and electrostatic discharge protection. The ease of integration into existing workflows and relatively lower cost compared to specialized robotic systems further drives their preference.

Ongoing enhancements in payload capacity, accuracy, and multi-axis motion control contribute to their continued relevance. The segment’s growth trajectory is expected to persist as manufacturers prioritize automation solutions that balance performance, regulatory compliance, and cost-effectiveness.

The robotic arms segment holds a 31.7% share within the component category, driven by its central role in enabling precise material handling, assembly, and inspection tasks in clean room settings. These components are critical to the operational flexibility of clean room robots, offering adaptability across diverse applications with varying payload and dexterity requirements.

Robotic arms designed for clean rooms are engineered to meet ISO cleanliness classifications, incorporating specialized coatings, enclosed cabling, and smooth surface designs to reduce particle shedding. Demand is being further supported by miniaturization trends in electronics and the need for high-accuracy movements in pharmaceutical manufacturing.

Enhanced sensor integration and collaborative capabilities are improving the efficiency and safety of robotic arms in shared workspaces. With increasing emphasis on quality assurance and production speed, this segment is expected to grow steadily as end users seek modular and upgradable robotic solutions.

The semiconductor segment leads the clean room robot market by end use, accounting for 28.6% of the overall share, driven by the industry's critical need for ultra-clean manufacturing environments. Clean room robots play an essential role in automating wafer handling, packaging, and inspection processes, minimizing human intervention and reducing contamination risks.

As semiconductor geometries continue to shrink, even the slightest particle contamination can cause defects, elevating the importance of precision robotics. Rapid growth in demand for microprocessors, memory chips, and sensors across automotive, consumer electronics, and AI sectors is prompting fabs to scale operations using advanced automation.

Clean room robots enhance throughput, ensure consistency, and enable 24/7 operation, making them indispensable in modern semiconductor production. This segment is expected to maintain its leadership position as manufacturers invest in next-generation fabs and advanced packaging technologies requiring strict cleanliness standards.

Clean room robots are being implemented to automate operations in contamination-sensitive environments for semiconductor, pharmaceutical, and biotech manufacturing. In 2024, semiconductor fabs began utilizing robotic systems for wafer transfer to minimize contamination risks and reduce manual handling. In 2025, pharmaceutical clean rooms deployed autonomous mobile robots for precise material movement within controlled zones. Opportunities have been identified in modular robotic fleets designed for scalable deployment. Providers delivering validated, clean-certified automation platforms with easy integration into environmental control frameworks are positioned to lead this specialized robotics domain.

The need to minimise human-induced contamination in high-purity settings has been recognised as the primary driver behind clean room robot adoption. In 2024, semiconductor manufacturing facilities began employing robotic wafer transport systems to avoid particle generation from manual handling in Class 1 environments. In 2025, pharmaceutical and biotech manufacturers were found to deploy robots for vial transport and material staging within sterilised zones. These developments show that clean room robotics are no longer a niche application they are becoming essential for contamination control and regulatory compliance. Manufacturers providing robots with certification and environmental monitoring compatibility are being positioned to lead in this critical automation domain.

In 2024, pilot programs introduced modular robot fleets that could be repositioned across clean room zones to match production demand. In 2025, these modular units were being scheduled via fleet management software to handle variable batch sizes in pharmaceutical clean rooms and semiconductor test labs. These implementations demonstrate that clean room robotics can evolve from fixed station tools to dynamic, on-demand systems. Suppliers offering plug-and-play robot fleets with wireless coordination and clean room validation are thus being positioned to capture opportunities in flexible manufacturing and rapid scale-up environments.

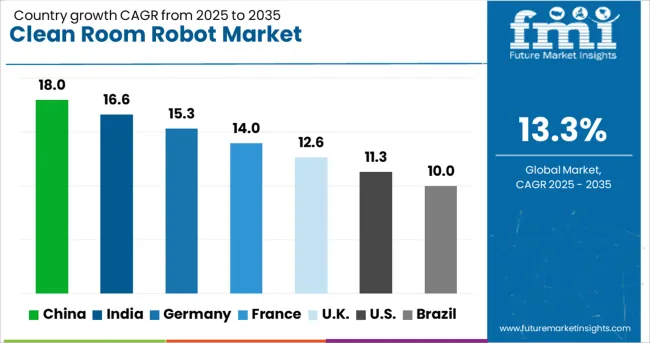

| Country | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

| USA | 11.3% |

| Brazil | 10.0% |

The global clean room robot market is projected to grow at a CAGR of 13.3% between 2025 and 2035. China leads with 18.0%, followed by India at 16.6% and Germany at 15.3%. France records 14.0%, while the United Kingdom posts 12.6%. Growth is driven by increasing demand in pharmaceutical manufacturing, semiconductor production, and biotech research facilities. China and India dominate due to massive investments in electronics and life sciences, while Germany focuses on precision robotics for advanced clean room automation. France and the UK emphasize robotic integration for compliance with stringent contamination control standards.

China is expected to grow at 18.0%, driven by significant investments in semiconductor fabs and biopharma facilities. Local robotics firms develop cost-effective solutions with advanced sensors to meet ISO clean room standards. AI-driven robotic arms and autonomous mobile robots (AMRs) dominate high-precision material handling. Government-backed initiatives for chip independence further accelerate adoption in microelectronics.

India is projected to grow at 16.6%, supported by rapid growth in vaccine manufacturing, sterile packaging, and electronics assembly. Compact robotic systems with pick-and-place functionality dominate adoption in pharma clean rooms. Robotics OEMs collaborate with biotech firms to deliver GMP-compliant automation. Increased preference for robotic sterilization systems improves hygiene standards in critical environments.

Germany is expected to grow at 15.3%, fueled by strong demand from the automotive electronics and healthcare sectors. Robotics solutions equipped with machine vision and advanced grippers dominate assembly lines. German OEMs develop high-precision robotic systems for aseptic processing in pharmaceutical plants. Adoption of collaborative robots (cobots) for clean room operations accelerates as workforce safety becomes a priority.

France is forecast to grow at 14.0%, strenghtned by the rise of biologics and sterile injectable manufacturing. Advanced robotics systems integrated with real-time monitoring support compliance with EU GMP standards. Local manufacturers focus on mobile platforms for flexible deployment in clean rooms. Pharmaceutical plants increasingly adopt automated robotic arms to reduce cross-contamination risks.

The UK is projected to grow at 12.6%, driven by demand in advanced therapies, biotechnology, and semiconductor research. Robotics firms introduce modular, space-efficient clean room robots for small-scale facilities. Integration of AI-based vision systems enhances accuracy in high-precision operations. Focus on reducing operational contamination risks accelerates the adoption of automated handling systems in life sciences.

The clean room robot market is moderately consolidated, led by FANUC Corporation with a 16.9% market share. The company holds a dominant position through its reliable automation solutions, high-precision robotic arms, and deep integration within semiconductor and pharmaceutical manufacturing environments. Dominant player status is held exclusively by FANUC Corporation.Key players include KUKA AG, ABB Ltd, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Universal Robots, Teradyne, Denso Corporation, Mitsubishi Electric Corporation, Rockwell Automation, Staubli International AG, Epson Robotics, and Omron Corporation, each offering clean-room-capable robots with features like IP-rated enclosures, contaminant-free operation, and seamless control system integration for advanced manufacturing applications. There are currently no clearly defined emerging players in this segment due to the technological rigor and regulatory demands of clean-room robotics. Market demand is driven by the rapid growth in semiconductor fabrication, increased need for sterile automation in biotech and pharma production, and rising adoption of automated handling systems in contamination-controlled environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.8 Billion |

| Type | Traditional industrial robots and Collaborative robots |

| Component | Robotic arms, End effectors, Drives, Controllers, Sensors, Power supply, Motors, and Others |

| End Use | Semiconductor, Aerospace, Plastics, rubber, & chemicals, Food & beverages, Pharmaceuticals, Biotechnology, Cosmetics, Advanced materials, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FANUC Corporation, KUKA AG, ABB Ltd, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Universal Robots, Teradyne, Denso Corporation, Mitsubishi Electric Corporation, Rockwell Automation, Staubli International AG, Epson Robotics, and Omron Corporation |

| Additional Attributes | Dollar sales by robot type (mobile, SCARA, articulated), regional demand trends, competitive landscape, buyer preferences for contamination control and automation precision, integration with cleanroom compliance systems, innovations in AI-based navigation, autonomous task scheduling, and advanced sterile maintenance solutions for pharmaceutical and semiconductor environments. |

The global clean room robot market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the clean room robot market is projected to reach USD 30.8 billion by 2035.

The clean room robot market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in clean room robot market are traditional industrial robots, _articulated robots, _scara robots, _parallel robots, _cartesian robots and collaborative robots.

In terms of component, robotic arms segment to command 31.7% share in the clean room robot market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cleanroom Static Transfer Box Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom and Lab Surface Contamination Control Products Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom Construction Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom Technologies Market Growth – Trends & Forecast 2025 to 2035

Cleanroom Flooring Market Growth - Trends & Forecast 2024 to 2034

Cleanroom Lighting Market

Clean Room Panels Market Size and Share Forecast Outlook 2025 to 2035

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

Competitive Landscape of Robotic Vacuum Cleaner Providers

Demand for Clean Room Panels in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Clean Room Panels in USA Size and Share Forecast Outlook 2025 to 2035

Residential Robotic Vacuum Cleaner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robot Controller, Integrator and Software Market Size and Share Forecast Outlook 2025 to 2035

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA