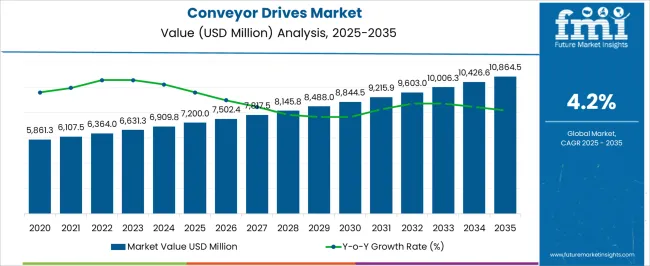

The global conveyor drives market is projected to grow from USD 7.20 billion in 2025 to USD 10.86 billion by 2035, representing an absolute increase of USD 3.66 billion over the forecast period. This translates to a cumulative growth of approximately 50.8% during the decade. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.2% between 2025 and 2035, with the overall market size expected to grow by nearly 1.51X by the end of the forecast period.

During the initial phase from 2025 to 2030, the market is forecast to advance from USD 7.20 billion to USD 8.86 billion, adding nearly USD 1.66 billion, equal to about 45% of the total decade expansion. This stage is anticipated to be shaped by higher adoption of gear motors in mining & quarrying operations, where efficiency, reliability, and heavy-load handling remain critical. In the latter half from 2030 to 2035, acceleration is expected as valuations rise from USD 8.86 billion to USD 10.86 billion, adding nearly USD 2.00 billion, or 55% of total growth. This period is projected to be reinforced by strong demand from manufacturing and logistics, where automation, cost optimization, and energy-efficient conveyor drive solutions will expand above the market average.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7.20 billion |

| Industry Size (2035F) | USD 10.86 billion |

| CAGR (2025 to 2035) | 4.2% |

Between 2025 and 2030, the growth is expected to be driven by increasing automation in manufacturing facilities, rising demand for efficient material handling systems, and the growing adoption of advanced drive technologies across various industries. The expansion of mining operations, particularly in emerging economies, and the modernization of existing conveyor systems in developed markets are anticipated to support steady growth during this period.

The growth of the market is driven by the rising demand for efficient material handling systems across industries such as mining, quarrying, manufacturing, and logistics. Increasing automation in production facilities and the need to reduce operational downtime are boosting the adoption of advanced conveyor drive solutions, including gear motors and variable frequency drives (VFDs). The expansion of e-commerce and global trade is further fueling the installation of conveyor systems in warehouses and distribution centers. Moreover, the push for energy-efficient and cost-effective solutions, combined with technological advancements in drive design, is accelerating market growth worldwide.

The conveyor drives market is experiencing sustained growth driven by several key factors. Industrial automation continues to be a primary catalyst, as manufacturers across sectors seek to improve operational efficiency, reduce labor costs, and enhance production reliability. The increasing focus on workplace safety regulations has also accelerated the adoption of automated conveyor systems, particularly in hazardous environments such as mining and chemical processing facilities.

The expansion of the global e-commerce sector has significantly boosted demand for sophisticated material handling systems in distribution centers and fulfillment facilities. Modern logistics operations require high-speed, reliable conveyor systems capable of handling diverse product types and volumes, driving innovation in drive technologies. Additionally, the growing emphasis on energy efficiency and sustainability has led to increased adoption of variable frequency drives (VFDs) and other energy-saving technologies.

Infrastructure development in emerging economies, particularly in Asia-Pacific and Latin America, has created substantial demand for conveyor systems in construction, mining, and manufacturing applications. The modernization of existing industrial facilities in developed markets has also contributed to market growth, as companies upgrade aging conveyor systems with more efficient and technologically advanced drive solutions.

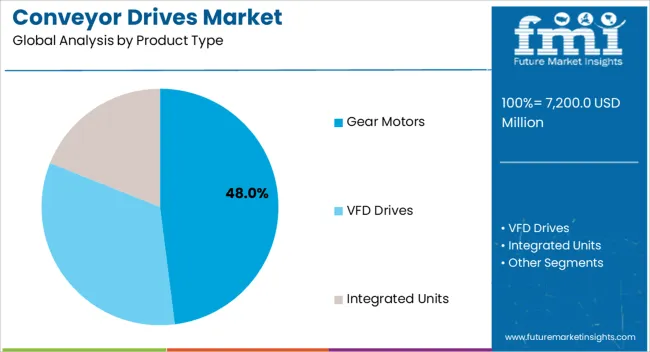

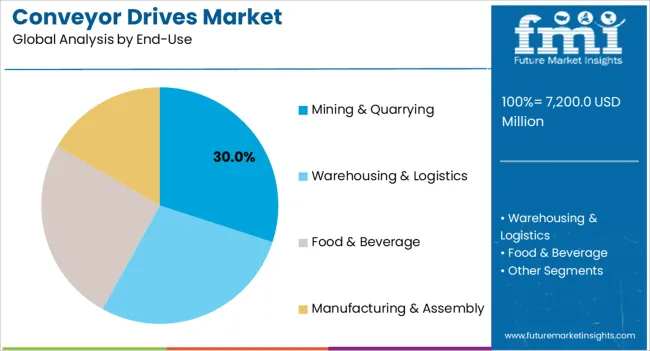

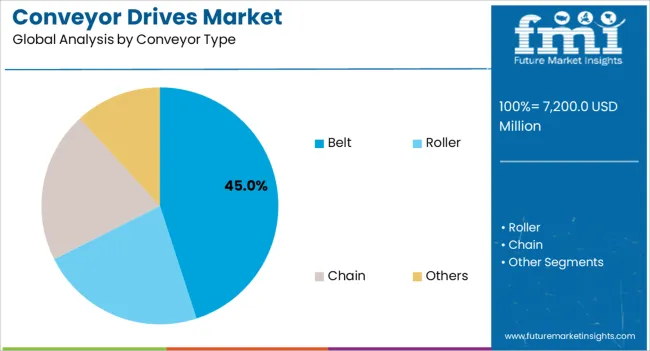

The market is segmented by product type, end use, installation, conveyor type, and region. By product type, the market is divided into gear motors, VFD drives, and integrated units. Based on end-use, the market is classified into mining and quarrying, food and beverage processing, warehousing and logistics, and manufacturing and assembly operations. By installation type, the market is bifurcated into new system installations and retrofit applications. Based on conveyor type, the market is segmented into belt, roller, chain, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa.

Gear motors are projected to account for 48% of the conveyor drives market in 2025, maintaining their position as the preferred drive solution across various industrial applications. Their dominance stems from the combination of motor and gearbox functionality in a single integrated unit, providing compact design, reliable operation, and cost-effective maintenance. Gear motors offer excellent torque characteristics and speed control capabilities, making them ideal for heavy-duty applications in mining, manufacturing, and material handling operations.

The segment's leadership is further reinforced by continuous technological advancements, including improved gear designs, enhanced lubrication systems, and integration with smart monitoring technologies. Manufacturers have been focusing on developing energy-efficient gear motor solutions that comply with international efficiency standards while providing superior performance in demanding industrial environments.

The mining and quarrying sector is anticipated to account for 30% of conveyor drives demand in 2025, reflecting the industry's heavy reliance on material handling systems for ore transportation, processing, and storage operations. Mining operations require robust, high-capacity conveyor systems capable of handling abrasive materials in challenging environmental conditions, driving demand for heavy-duty drive solutions.

The sector's growth is supported by increasing mineral extraction activities, particularly in developing economies, and the ongoing modernization of existing mining facilities. The trend toward larger-scale mining operations and the need for improved operational efficiency have led to increased adoption of advanced conveyor drive technologies.

Belt conveyors are projected to maintain a dominant 45% share of the conveyor systems market, underlining their versatility across industries such as manufacturing, logistics, mining, and food processing. Their ability to efficiently transport a wide range of materials over varying distances, inclines, and declines makes them the preferred option in both heavy-duty and light-duty applications. The design flexibility of belt conveyors, coupled with lower operating costs and continuous advancements in materials, ensures they remain a go-to choice for diverse industrial requirements.

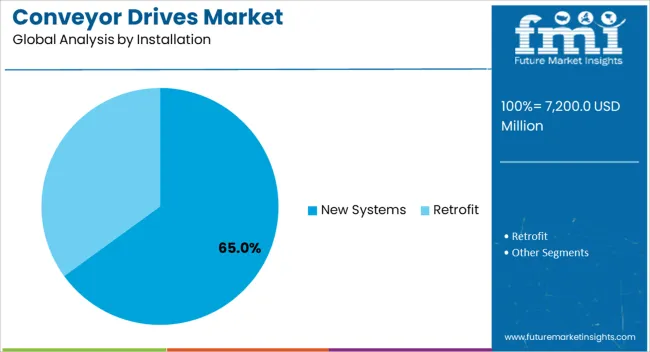

In terms of installation, new system setups are expected to capture around 65% of the market, while retrofit solutions account for the remaining 35%. The dominance of new installations reflects growing industrial expansion, particularly in emerging economies where modern manufacturing plants, warehouses, and distribution hubs are being built. Investment in advanced conveyor infrastructure is being driven by automation, e-commerce growth, and supply chain optimization. Meanwhile, retrofits continue to serve businesses modernizing existing facilities, but the stronger demand stems from greenfield industrial development projects.

The conveyor drives market is experiencing several transformative trends that are reshaping industry dynamics. The integration of Internet of Things (IoT) technologies and predictive maintenance capabilities is becoming increasingly prevalent, enabling real-time monitoring of drive performance and proactive maintenance scheduling. This technological evolution is improving system reliability while reducing operational costs.

The adoption of digital technologies is revolutionizing conveyor drive systems, with manufacturers incorporating advanced sensors, connectivity features, and data analytics capabilities into their products. Smart drive systems can monitor operational parameters, detect potential issues, and optimize performance automatically. This trend is particularly strong in high-value applications where system downtime can result in significant operational losses.

Growing environmental consciousness and rising energy costs are driving increased adoption of energy-efficient drive technologies. VFD drives, high-efficiency motors, and regenerative braking systems are becoming standard features in new installations. Manufacturers are developing drive solutions that not only reduce energy consumption but also minimize environmental impact throughout the product lifecycle.

The trend toward modular conveyor systems is gaining momentum, driven by the need for flexible manufacturing environments and rapid system reconfiguration. Modular drive systems allow for easier installation, maintenance, and expansion, making them attractive to industries with changing production requirements.

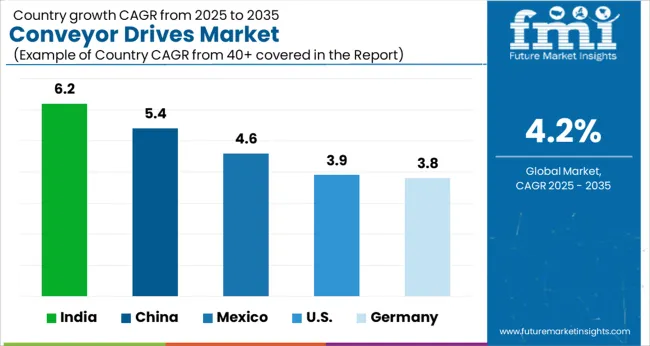

| Countries | CAGR |

|---|---|

| India | 6.2 |

| China | 5.4 |

| Mexico | 4.6 |

| USA | 3.9 |

| Germany | 3.8 |

India is projected to record the fastest growth in the conveyor drives market with a CAGR of 6.2% through 2035. The country's rapid industrial expansion, driven by government initiatives such as "Make in India" and substantial infrastructure development projects, is creating strong demand for material handling systems. The growing manufacturing sector, particularly in automotive, pharmaceuticals, and consumer goods, is adopting automated conveyor systems to improve productivity and meet increasing production demands. India's mining industry, including coal, iron ore, and other mineral extraction operations, continues to expand and modernize, requiring advanced conveyor drive technologies for efficient material transport. The food processing industry in India is experiencing significant growth, supported by rising domestic consumption and export opportunities.

China maintains robust growth prospects with a projected CAGR of 5.4% for the conveyor drives market through 2035. The country's ongoing industrial modernization and the transition toward high-tech manufacturing are driving demand for advanced material handling systems. China's position as a global manufacturing hub necessitates continuous investment in production efficiency and automation technologies. The government's focus on industrial upgrading and the implementation of Industry 4.0 principles are accelerating the adoption of smart conveyor systems across various sectors. The country's extensive mining operations, including coal, metals, and rare earth extraction, require sophisticated conveyor systems capable of handling large volumes and operating in demanding conditions. The food and beverage processing industry in China is expanding rapidly to meet domestic demand and export requirements.

Revenue from conveyor drives in Mexico is expected to achieve a CAGR of 4.6% in the conveyor drives market, supported by its strategic position as a manufacturing hub for North American markets. The country's proximity to the United States, competitive labor costs, and favorable trade agreements make it an attractive location for manufacturing investments. Mexico's automotive industry, one of the world's largest, continues to expand with new production facilities requiring sophisticated material handling systems. The aerospace sector is also growing, with international manufacturers establishing operations that demand precision conveyor systems. The mining industry, particularly precious metals and industrial minerals, represents a significant market for heavy-duty conveyor drives. The food processing sector in Mexico is modernizing to meet export standards and domestic demand for processed foods.

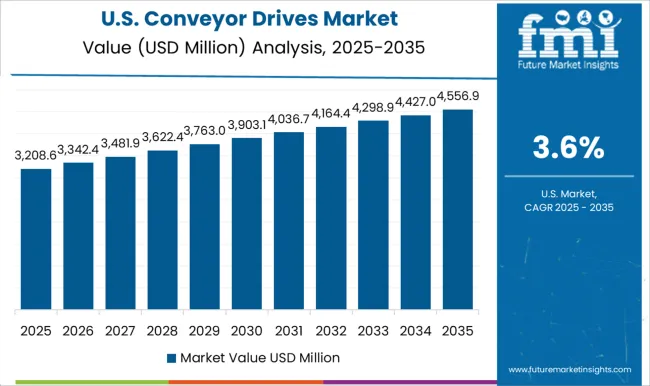

The United States conveyor drives market is projected to grow at a CAGR of 3.9%, reflecting the maturity of the industrial base and focus on technological advancement rather than capacity expansion. The country's emphasis on manufacturing reshoring and automation is driving demand for sophisticated conveyor systems in both new facilities and retrofitted operations. The mining sector, including coal, metals, and aggregates, continues to modernize with advanced material handling technologies that improve efficiency and safety. The food and beverage processing industry, one of the world's largest, is adopting advanced conveyor systems with specialized drives that meet strict regulatory requirements and support sustainable operations. The e-commerce and logistics sector in the United States is experiencing unprecedented growth, driving substantial investment in automated distribution centers and fulfillment facilities.

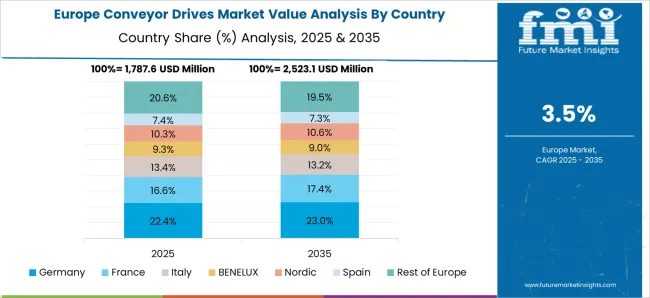

Demand for conveyor drives in Germany is anticipated to achieve a CAGR of 3.8%, driven by the country's position as a global leader in industrial automation and engineering innovation. The nation's strong manufacturing sector, particularly automotive, machinery, and chemical industries, continues to invest in advanced production technologies. Germany's Industry 4.0 initiative has accelerated the adoption of smart manufacturing systems, including intelligent conveyor drives with connectivity and monitoring capabilities. The country's mining and quarrying operations, while smaller in scale compared to other major markets, demand high-quality, technologically advanced systems that emphasize efficiency and environmental responsibility. The food and beverage processing industry in Germany is characterized by high automation levels and strict quality standards. Modern processing facilities require conveyor systems with specialized drives that ensure product safety while maintaining high operational efficiency.

The conveyor drives market is characterized by intense competition among established global players and emerging regional manufacturers. Leading companies are focusing on technological innovation, expanding their product portfolios, and strengthening their global presence through strategic acquisitions and partnerships. The competitive landscape is shaped by continuous product development, with emphasis on energy efficiency, digitalization, and application-specific solutions.

ABB (Dodge), based in Switzerland and the USA, maintains a strong market position through its comprehensive portfolio of industrial drive solutions and global service network. The company's focus on digitalization and energy efficiency has resulted in advanced conveyor drive products that incorporate smart monitoring and control capabilities.

Bonfiglioli, the Italian manufacturer, has established a strong presence in the global market through its extensive range of gear motors and drive solutions. The company's focus on application-specific products and regional manufacturing capabilities has enabled it to serve diverse industrial sectors effectively.

Interroll, specializing in drum motors from Switzerland, has carved out a niche in the material handling market with innovative motorized roller solutions that offer compact design and easy integration into conveyor systems.

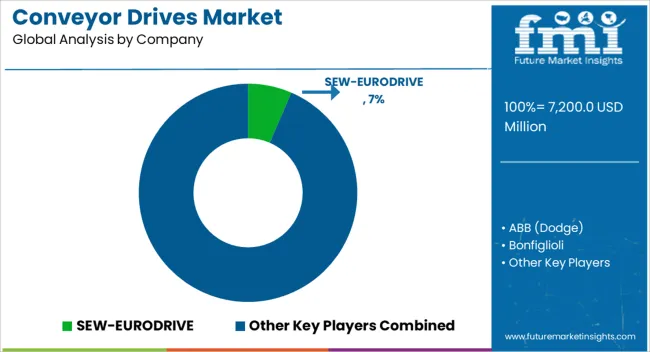

German manufacturers Lenze, NORD DRIVESYSTEMS, and SEW-EURODRIVE leverage their engineering expertise and technological innovation to provide advanced drive solutions. These companies have established strong positions in various industrial segments through their focus on quality, reliability, and customer-specific solutions.

Regal Rexnord from the USA combines extensive industrial experience with innovative technologies to serve the North American market and beyond. The company's broad product portfolio addresses diverse application requirements across multiple industries.

Siemens (Flender), the German industrial giant, leverages its global presence and technological capabilities to provide comprehensive drive solutions for large-scale industrial applications. The company's focus on digitalization and Industry 4.0 has resulted in advanced drive systems with integrated monitoring and control features.

Sumitomo Drive Technologies from Japan brings precision engineering and reliability to the global market, particularly in applications requiring high performance and durability. The company's focus on continuous improvement and customer support has established strong relationships across various industrial sectors.

WEG, the Brazilian manufacturer, has emerged as a significant global player through its cost-effective solutions and expanding international presence. The company's focus on energy efficiency and emerging market applications has enabled rapid growth and market expansion.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7.20 billion |

| Product Type | Gear Motors, VFD Drives, Integrated Units |

| End-Use | Mining & Quarrying, Food & Beverage, Warehousing & Logistics, Manufacturing & Assembly |

| Installation | New Systems, Retrofit |

| Conveyor Type | Belt, Roller, Chain, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ABB (Dodge), Bonfiglioli, Interroll (Drum Motors), Lenze, NORD DRIVESYSTEMS, Regal Rexnord, SEW-EURODRIVE, Siemens (Flender), Sumitomo Drive Technologies, WEG |

| Additional Attributes | Dollar sales by drive type and capacity, regional demand trends, OEM competition, buyer shift toward energy-efficient solutions, integration with smart automation, innovations in variable-speed control, and sustainable material-handling systems |

The global conveyor drives market is estimated to be valued at USD 7,200.0 million in 2025.

The market size for the conveyor drives market is projected to reach USD 10,864.5 million by 2035.

The conveyor drives market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in conveyor drives market are gear motors, vfd drives and integrated units.

In terms of end-use, mining & quarrying segment to command 30.0% share in the conveyor drives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conveyor Belt Market Size and Share Forecast Outlook 2025 to 2035

Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Maintenance Industry Analysis in Australia - Size, Share, and Forecast Outlook 2025 to 2035

Conveyor Dryer Market Growth, Trends & Forecast 2025 to 2035

Conveyors and Belt Loaders Market Growth - Trends & Forecast 2025 to 2035

Conveyor Ovens & Impinger Ovens Market

Conveyor Belt Materials Market

UV Conveyor Systems Market

Pack Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Screw Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Smart Conveyor Packaging Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Chain Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Screw Conveyor Industry

ASEAN Conveyor System Market Growth - Trends & Forecast 2024 to 2034

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Gravity Conveyor System Market Size and Share Market Forecast and Outlook 2025 to 2035

Modular Conveyor System Market

Gravity Conveyor Market

Demand for Conveyor Belts in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA