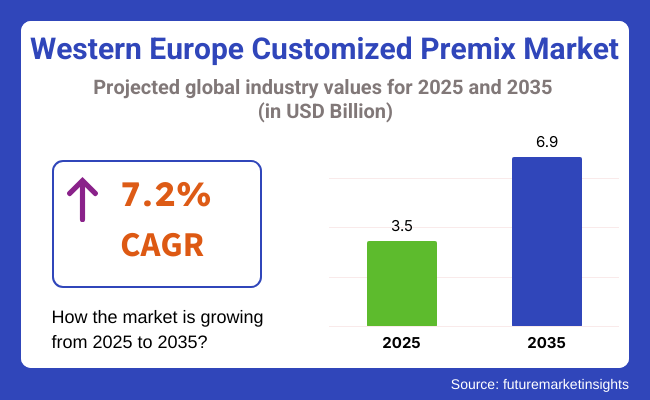

The Western Europe customized premix market is poised to register a valuation of USD 3.5 billion in 2025. The industry is slated to grow at 7.2% CAGR from 2025 to 2035, witnessing USD 6.9 billion by 2035. Expansion of the market is being powered by a set of inter-related factors, driven foremost by rapidly increasing consumer interest in personalized nutrition and customized diet solutions.

Consumer awareness of micronutrients' value and functionality in overall wellness is increasing along with health-driven consumers' overall level of health awareness, causing demand for bespoke nutritional products attuned to detailed nutritional requirements.

Tailored premixes enable food and beverage companies to produce very personalized products to suit different consumer groups, including those with food restrictions, health-conscious consumers, and patients suffering from chronic conditions. The fact that they can provide specific health benefits like immunity support, better digestion, or weight control has made them extremely popular among consumers looking for something more than general nutrition.

In addition, rising rates of chronic diseases such as obesity, diabetes, and cardiovascular diseases in Western Europe are propelling the demand for tailored diet solutions. As increasing number of consumers seek personalized solutions for managing health, tailor-made premixes enable manufacturers to supply products that can be customized to address specific health problems. The capability to combine a range of vitamins, minerals, amino acids, and other active ingredients into a single product has positioned premixes as a popular choice for the creation of health-oriented foods, drinks, and supplements.

The emerging clean-label movement also encourages businesses to create more natural, transparent, and sustainable premixes. As consumers increasingly reject products with large number of synthetic additives and preservatives, demand is moving toward premixes that employ naturally derived ingredients with functional benefits.

This drive toward healthier, sustainable alternatives has generated innovation in the premix business, as brands seek to produce high-quality, custom-designed products that respond both to consumer taste and regulatory compliance, thereby propelling market growth.

The Western Europe market for customized premix is witnessing high growth in different end-use segments due to shifting consumer behavior towards functional, fortified, and health-oriented products. In the food and beverage sector, demand for premixes that increase the nutritional value of day-to-day products such as snacks, beverages, and plant-based products is on the rise.

As health consciousness grows, consumers are looking for products that provide immune support, weight management, and gut health benefits, leading manufacturers to add vitamins, minerals, and probiotics to their premixes. Concurrently, the trend toward clean-label products is encouraging companies to provide more natural, transparent ingredients, and premixes are becoming a primary vehicle for meeting these needs. The demand for fortified and functional food that can easily fit into consumers' busy lives is driving innovation in the premix industry, especially in plant-based and allergen-free options.

In the dietary supplement and sports nutrition markets, customization is increasingly trending as consumers are looking for solutions tailored to their individual health and performance needs. Personalized nutrition is becoming increasingly popular, with premixes designed to cater to specific requirements like muscle recovery, immune function, and skin health.

Among athletes and fitness enthusiasts, premixes containing performance-enhancing ingredients like BCAAs, proteins, and energy boosters are highly sought after. As convenience emerges as a key buying factor, packaging forms such as single-serve sachets and powders are becoming increasingly popular, enabling consumers to easily add customized nutrition to their hectic lives.

Between 2020 and 2024, the Western Europe market for customized premix experienced tremendous change, influenced by changing consumer lifestyles and new trends in health. The COVID-19 pandemic also contributed significantly towards raising awareness on immune health, with consumers consuming dietary supplements and fortified foods as a means to enhance their immunity. This increased demand for wellness and health reflected a greater call for nutrient-rich products, such as vitamins, minerals, and probiotics, that are primary elements of tailor-made premixes.

Also, the demand for plant-based eating and the shift towards clean-label products grew more, and it encouraged the creation of more natural, allergen-free, and eco-friendly premix formulas by manufacturers. The need for personalized nutrition began gaining momentum as well, with consumers wanting products formulated according to their individual dietary requirements, lifestyle, and health objectives. These years also witnessed increased investment in online shopping and e-commerce, with organizations looking at digital platforms to access health-aware consumers who increasingly crave easy, convenient on-the-go solutions.

During the forecast period, the Western European market of customized premix is expected to continue its growth and development. The future will definitely witness an even greater movement toward personalized nutrition driven by breakthroughs in genetic screening, data analytics, and AI-based solutions.

Consumers will further look for well-targeted, science-supported products that are tailor-made to their genetic profiles, age, sex, and ailments. Blending digital health platforms and nutritional applications will enable consumers to easily determine their own individual dietary requirements, thereby driving demand for premixes that offer customized nutritional assistance. Furthermore, the market will also see an increase in sustainable and ethically sourced materials as environmental issues gain prominence.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The COVID-19 pandemic spurred consumer demand for immune-boosting products, and demand for premixes with vitamins, minerals, and probiotics is on the rise. | Technological advancements, such as genetic testing and AI solutions, will enable consumers to personalize their nutrition further, resulting in a surge in demand for personalized premixes based on individual requirements. |

| Customers more and more wanted allergen-free, plant-based, and clean-label products, which affected premix formulations. Sustainability issues also resulted in more environmentally friendly ingredient sourcing. | As environmental issues grow stronger, the market will trend towards premixes based on sustainably sourced and ethically made ingredients. Customers will look for products with sourcing clarity and low environmental footprint. |

| The pandemic- fueled rise of e-commerce and online shopping enabled consumers to more easily access customized premix products. Direct-to-consumer (D2C) models were heavily invested in by manufacturers. | Increased use of digital health tools, including apps and personalized nutrition platforms, will further enable consumers to customize their premix requirements. This trend will simplify monitoring nutritional requirements and monitoring health objectives, increasing demand for customized premixes. |

| There was a sharp increase in demand for functional foods, such as those that benefited immune health, energy, digestion, and mental well-being. Convenient, on-the-go product forms like powders and single-serve sachets were preferred by consumers. | Functional foods will develop to place greater emphasis on mental and cognitive well-being, with premixes formulated to alleviate stress, sleep quality, and brain function becoming increasingly sought after. There will also be ongoing interest in products that promote general well-being and longevity. |

The Western Europe market is exposed to various risks that may affect its growth path, most notably in the areas of regulation, consumers' taste, and the economy. Regulatory uncertainty is one of the key risks. Since customized premixes typically include the creation of specifically designed nutrition, there may be issues with the validity and safety of health declarations related to such products.

Tight regulations, like those enforced by the European Food Safety Authority (EFSA), may restrict product claim scope or mandate supplemental certification processes, increasing manufacturers' expenses. Moreover, with personalized nutrition progressing further, new standards for labeling and health statements will follow, prompting businesses to remain nimble and in line with changing standards. Any breach of regulations may bring legal consequences, brand losses, and loss of consumer confidence.

Another key threat is market competition. The increased need for customized premixes has drawn several players into the market, including well-established food and supplement manufacturers to smaller niche businesses. This heightened competition may culminate in price wars, lowering producers' profit margins. In addition, as new competitors flood the market with novel product offerings, it might be harder for brands to stand out from each other based on the distinctiveness of their formulations.

In Western Europe, vitamin premixes are one of the most commonly used ingredients in the customized premix sector. The rising need for functional and fortified foods and the mounting emphasis on well-being and health has resulted in a sharp increase in the consumption of vitamins in tailored formulations.

Vitamins like vitamin C, vitamin D, and B vitamins are frequently incorporated into premixes because they play a crucial role in maintaining immunity, energy metabolism, and general health. With increasing health awareness among consumers and their desire for products that meet their individual needs, foods and beverages fortified with vitamins have become increasingly popular.

This trend is especially prevalent in categories such as sports nutrition, dietary supplements, and functional drinks, where demand for targeted nutritional solutions is increasing at a very fast pace. In addition, demand for vitamins in food and supplements also follows the trend of personalized nutrition, where premixes are customized to address individual health objectives or deficiencies.

Besides vitamins, mineral premixes also find extensive application due to the significance of minerals such as calcium, magnesium, and iron in bone health, cardiovascular health, and general body function. Mineral fortification is especially necessary for populations with certain dietary limitations, including vegans or elderly people who are more susceptible to deficiencies. Tailoring premixes with the necessary minerals enables food companies and supplement companies to address these health issues efficiently.

Powdered premixes are used more commonly in Western Europe than liquid forms, owing to their convenience, stability, and versatility across numerous applications. Powder form provides a number of shelf life benefits, as it is less likely to degrade than liquids, which may be more likely to spoilage and need preservatives.

Powdered premixes are convenient to store, transport, and handle, which makes them suitable for manufacturers wishing to manufacture bulk products and for consumers wanting products with a longer shelf life. Additionally, powder forms are commonly used in various industries, such as sports nutrition, dietary supplements, and functional foods, where they are applied for the development of customized mixtures for smoothies, shakes, protein bars, and other products.

Furthermore, powdered premixes are more flexible in terms of formulation versatility. They can be readily integrated into numerous food and beverage applications, be it added to plant-based dairy alternatives, fortified foods, or drinks.

The Western Europe customized premix market is growing more competitive and innovation-led, driven by increasing demand for functional nutrition, personalized health products, and clean-label ingredient systems. With increasing awareness regarding preventive health, immunity, and active lifestyles, manufacturers are seeking to provide tailored blends of vitamins, minerals, amino acids, botanicals, probiotics, and other active ingredients in forms appropriate for food, beverage, and supplement applications. Firms in the region are developing their formulation science, regional manufacturing, and digital health integration capabilities to remain ahead of changing consumer demands.

SternVitamin GmbH & Co. KG and Prinova Group LLC are established leaders with a broad range of customized micronutrient premixes for the food, beverage, and nutraceutical markets. Their capacity to quickly formulate and deliver custom solutions has enabled them to supply large-scale food manufacturers and specialty health brands.

Farbest Brands and Trouw Nutrition emphasize highly the nutritional effectiveness and safety, supplying clinical-grade, animal nutrition, and wellness-driven premixes. Koninklijke DSM N.V., a veteran industry player, continues to push growth through science-supported formulations and investment in personalized nutrition, specifically in the immunity, brain health, and metabolic well-being categories.

LycoRed Limited, NutriFusion LLC, and Mühlenchemie/SternVitamin have established themselves in the natural, plant-based, and antioxidant-rich premix markets. These companies are positioned well in the clean-label trend, providing blends that include phytonutrients, natural colorants, and whole-food actives.

Manisha Pharma PlastPvt. Ltd. and Mirpain Gida San. ve Tic. A.S. supply industrial customers with scalable, cost-effective tailored premixes, especially in emerging functional food and dairy alternative categories. Collectively, these firms are creating a market that is more characterized by personalization, transparency, and science-driven wellness.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DSM ( Koninklijke DSM N.V.) | 16-20% |

| SternVitamin GmbH & Co. KG / Mühlenchemie | 13-16% |

| Prinova Group LLC | 11-14% |

| Trouw Nutrition | 9-12% |

| Farbest Brands | 6-9% |

| LycoRed Limited | 5-7% |

| NutriFusion LLC | 4-6% |

| Manisha Pharma Plast Pvt Ltd. | 3-5% |

| Mirpain Gida San. ve Tic. A.S. | 2-4% |

| Other Niche Players | 6-9% |

Key Company Insights

DSM is still the leading player in Western Europe's custom premix market, with an estimated market share of 16 to 20%. Famous for its R&D capabilities, DSM is growing rapidly in the personalized nutrition segment by providing targeted blends for immune well-being, brain performance, and active aging. Its focus on sustainability and traceability also makes it an attractive partner for brands looking for premium, clean-label solutions.

SternVitamin and Prinova are close behind, with extensive abilities in ready-to-use formats as well as tailored solutions for supplements and fortified foods. SternVitamin's consolidation with Mühlenchemie provides synergy between flour fortification and micronutrient science, a primary segment in nutrition access. Prinova's international distribution coupled with quick formulation abilities is attractive to both fast-moving consumer health companies and multinational food brands.

Trouw Nutrition and Farbest Brands focus on clinical, sports, and animal nutritional blends with rigorous quality controls and traceable ingredients. LycoRed and NutriFusion lead in natural color and antioxidant premixes to wellness-oriented consumers looking for plant-based health solutions in food and beverages.

New entrants like Manisha Pharma Plast and Mirpain Gida are supplying B2B clients with functional blends in volume, accommodating growing demand for dairy-free, gluten-free, and sugar reduction solutions. The firms provide cost-driven customization for regional manufacturers as well as private label producers.

These players collectively are crafting a dynamic, consumer-driven marketplace in which growth is fueled by nutritional science, personalization, clean-label openness, and compliance with regulations. As the need for fortified, functional foods accelerates, the next wave of growth in Western Europe will be fueled by firms that invest in R&D, sustainability, and specific health outcomes.

In terms of ingredient type, the market is divided into Vitamin premix, mineral premixes, nucleotides premixes, amino acids premixes, enzymes, coccidiostats, probiotics, prebiotics, multigrain premix, omega-3 fatty acids, excipients, and gums.

Based on form, the industry is divided into powder and liquid.

With respect to function, the industry is classified into bone health, immunity, digestion, energy, heart health, weight management, vision health, brain health & memory, resistance, and others.

Based on product type, the market is divided into premix blends/direct-to-consumer solutions and drum to hopper formulations.

With respect to application, the industry is classified into food sector, dietary supplements, pharma OTC drugs, and pet food.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 3.5 billion in 2025.

The market is projected to witness USD 6.9 billion by 2035.

The industry is slated to capture 7.2% CAGR during the study period.

Powdered form of customized premix is widely preferred.

Leading companies include Stern Vitamin GmbH & Co. Kg, Prinova Group LLC, Farbest Brands, Trouw Nutrition, Koninklijke DSM N.V., LycoRed Limited, Manisha Pharma Plast Pvt Ltd., Mirpain Gida San. ve Tic. A.S., Mühlenchemie, and NutriFusion LLC.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Ingredient Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 14: UK Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Tons) Forecast by Ingredient Type, 2018 to 2033

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: UK Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 20: UK Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 21: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: UK Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: UK Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Germany Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 28: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Ingredient Type, 2018 to 2033

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 32: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 33: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 38: Italy Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 40: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Ingredient Type, 2018 to 2033

Table 41: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 42: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 43: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 44: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 45: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 50: France Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 51: France Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 52: France Industry Analysis and Outlook Volume (Tons) Forecast by Ingredient Type, 2018 to 2033

Table 53: France Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: France Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 55: France Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 56: France Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 57: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 58: France Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 59: France Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: France Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 61: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 62: Spain Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 63: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 64: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Ingredient Type, 2018 to 2033

Table 65: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 67: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 68: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 69: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 70: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 71: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 72: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 73: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 74: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Ingredient Type, 2018 to 2033

Table 75: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 76: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 77: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 78: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 79: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 80: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 81: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 82: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 7: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 8: Industry Analysis and Outlook Volume (Tons) Analysis by Country, 2018 to 2033

Figure 9: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 10: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 11: Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 12: Industry Analysis and Outlook Volume (Tons) Analysis by Ingredient Type, 2018 to 2033

Figure 13: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 14: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 15: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 16: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 17: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 18: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 19: Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 20: Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 21: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 22: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 23: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 24: Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 25: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 26: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 27: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 28: Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 29: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 30: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 31: Industry Analysis and Outlook Attractiveness by Ingredient Type, 2023 to 2033

Figure 32: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 33: Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 34: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 35: Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 36: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 37: UK Industry Analysis and Outlook Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 38: UK Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 39: UK Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 41: UK Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 42: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 43: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 44: UK Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 45: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 46: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 48: UK Industry Analysis and Outlook Volume (Tons) Analysis by Ingredient Type, 2018 to 2033

Figure 49: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 50: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 51: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 52: UK Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 53: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 54: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 55: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 56: UK Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 57: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 58: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 59: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 60: UK Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 61: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 62: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 63: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 64: UK Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 65: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 66: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 67: UK Industry Analysis and Outlook Attractiveness by Ingredient Type, 2023 to 2033

Figure 68: UK Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 69: UK Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 70: UK Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 71: UK Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 72: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: Germany Industry Analysis and Outlook Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 75: Germany Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 76: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: Germany Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 79: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 80: Germany Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 81: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 82: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 83: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 84: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Ingredient Type, 2018 to 2033

Figure 85: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 86: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 87: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 88: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 89: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 90: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 91: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 92: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 93: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 94: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 95: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 96: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 97: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 98: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 99: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 100: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 101: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: Germany Industry Analysis and Outlook Attractiveness by Ingredient Type, 2023 to 2033

Figure 104: Germany Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 105: Germany Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 106: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 107: Germany Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 108: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 109: Italy Industry Analysis and Outlook Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 110: Italy Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 111: Italy Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 113: Italy Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 114: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 115: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 116: Italy Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 117: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 118: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 119: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 120: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Ingredient Type, 2018 to 2033

Figure 121: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 122: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 123: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 124: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 125: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 126: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 127: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 128: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 129: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 130: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 131: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 132: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 133: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 134: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 135: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 136: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 137: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 138: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 139: Italy Industry Analysis and Outlook Attractiveness by Ingredient Type, 2023 to 2033

Figure 140: Italy Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 141: Italy Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 142: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 143: Italy Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 144: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 145: France Industry Analysis and Outlook Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 146: France Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 147: France Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 148: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 149: France Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 150: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 151: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 152: France Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 153: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 154: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 155: France Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 156: France Industry Analysis and Outlook Volume (Tons) Analysis by Ingredient Type, 2018 to 2033

Figure 157: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 158: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 159: France Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 160: France Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 161: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 162: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 163: France Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 164: France Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 165: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 166: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 167: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 168: France Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 169: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 170: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 171: France Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 172: France Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 173: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 174: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 175: France Industry Analysis and Outlook Attractiveness by Ingredient Type, 2023 to 2033

Figure 176: France Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 177: France Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 178: France Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 179: France Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 180: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 181: Spain Industry Analysis and Outlook Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 182: Spain Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 183: Spain Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 184: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 185: Spain Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 186: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 187: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 188: Spain Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 189: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 190: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 191: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 192: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Ingredient Type, 2018 to 2033

Figure 193: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 194: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 195: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 196: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 197: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 198: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 199: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 200: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 201: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 202: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 203: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 204: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 205: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 206: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 207: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 208: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 209: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 210: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 211: Spain Industry Analysis and Outlook Attractiveness by Ingredient Type, 2023 to 2033

Figure 212: Spain Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 213: Spain Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 214: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 215: Spain Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 216: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 217: Rest of Industry Analysis and Outlook Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 218: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 219: Rest of Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 220: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 221: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 222: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 223: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Ingredient Type, 2018 to 2033

Figure 224: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 225: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 226: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 227: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 228: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 229: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 230: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 231: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 232: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 233: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 234: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 235: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 236: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 237: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 238: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 239: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 240: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 241: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 242: Rest of Industry Analysis and Outlook Attractiveness by Ingredient Type, 2023 to 2033

Figure 243: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 244: Rest of Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 245: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 246: Rest of Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA