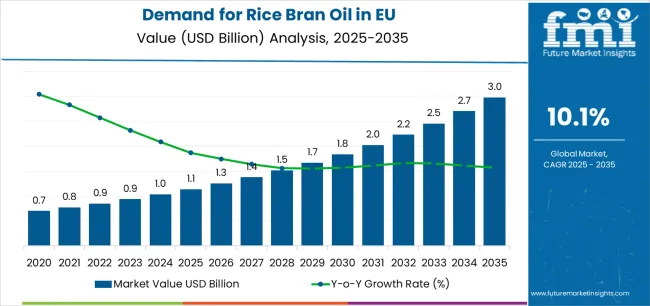

The European Union’s rice bran oil sector is set for a robust expansion between 2025 and 2035. Valued at USD 1.1 billion in 2025, the industry is projected to reach USD 3 billion by 2035, growing at a compound annual rate of 10.1%. The rise reflects the region’s evolving dietary patterns, with consumers gravitating toward oils rich in nutrients and antioxidants. Rice bran oil, known for its balanced fatty acid composition and high content of oryzanol and tocotrienols, has become a preferred option in health-conscious households. This trend aligns with the broader shift toward functional and natural ingredients in European diets. The demand surge also benefits from its versatility across culinary, nutritional, and cosmetic applications, making it a multifaceted growth story within the EU’s broader wellness economy.

Between 2025 and 2030, sales across the EU are expected to climb from USD 1.1 billion to USD 1.8 billion, marking an increase of USD 712.4 million. This first phase of expansion is driven primarily by heightened awareness of cholesterol-lowering oils and the repositioning of rice bran oil as a mainstream household product. By 2030–2035, the sector is forecast to add another USD 1.1 billion, reaching USD 3 billion, underpinned by premiumization and the rise of organic cold-pressed offerings. The transformation from niche to everyday cooking oil is emblematic of how European consumers are rethinking health through daily diet choices. The early years of adoption were characterized by curiosity and niche positioning; the coming decade will represent normalization, with rice bran oil achieving a steady presence alongside olive and sunflower oils in EU kitchens.

The EU’s appetite for rice bran oil is expanding as consumers prioritize heart health, clean-label nutrition, and sustainable sourcing. The oil’s naturally occurring antioxidants, particularly gamma-oryzanol, have been clinically associated with lowering LDL cholesterol and improving metabolic profiles. As awareness grows, European households and food manufacturers are incorporating rice bran oil into snacks, spreads, and ready-to-eat products. Beyond culinary use, its emollient qualities are valued in skincare and haircare formulations.

Rising disposable incomes and the popularity of plant-based diets are additional enablers, boosting the oil’s reputation as a versatile ingredient. Importantly, sustainability trends are influencing purchasing decisions, with consumers favoring products that strike a balance between wellness benefits and ethical sourcing, as well as reduced carbon footprints. The combination of nutritional science and consumer ethics is propelling the category into mainstream health product portfolios.

Industry expansion is being driven by the increasing emphasis on heart health, metabolic wellness, and plant-based nutrition across European households. Consumers are actively replacing traditional high-fat oils with nutritionally superior options like rice bran oil, which offers a balanced fatty acid profile and contains powerful antioxidants such as gamma-oryzanol and tocotrienols. These compounds are recognized for their ability to reduce LDL cholesterol and support cardiovascular health. The convergence of necessity-driven adoption by consumers managing cholesterol and lifestyle-related conditions with choice-driven preferences from health-oriented populations is creating broad, sustainable demand across both mainstream and specialty segments.

The growing body of scientific research highlighting the link between dietary fats, inflammation, and long-term disease prevention is fueling greater interest in oils with proven functional benefits. Rice bran oil fits within this shift due to its natural antioxidant capacity and superior stability during high-temperature cooking. Regulatory authorities across the EU continue to reinforce clean-label and nutritional transparency requirements, giving an edge to producers offering certified organic and cold-pressed variants with verified traceability. Clinical studies and nutrition programs increasingly endorse rice bran oil as a healthy substitute for conventional vegetable oils, supporting digestive comfort, lipid balance, and better nutrient absorption. These scientific and regulatory developments, combined with consumers’ growing demand for functional yet familiar cooking ingredients, are cementing rice bran oil’s position as a cornerstone of Europe’s evolving healthy-eating landscape.

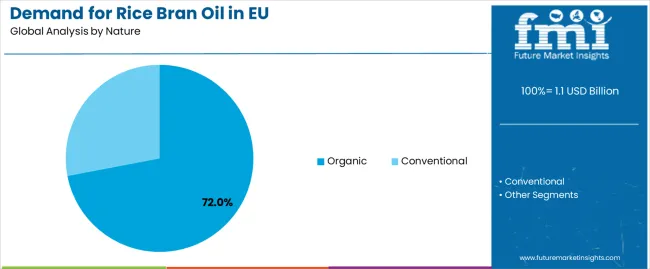

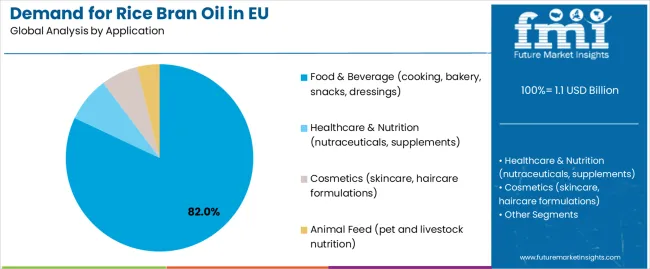

Sales of rice bran oil in the EU are segmented by nature, application, distribution channel, and country. By nature, demand is divided into organic and conventional categories. By application, consumption is distributed across food & beverage, healthcare & nutrition, cosmetics, and animal feed sectors. By distribution channel, sales are classified into hypermarkets/supermarkets, convenience stores, and online retail stores. Regionally, the analysis covers Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The conventional segment continues to dominate EU rice bran oil demand, capturing 72.0% in 2025 and projected at 68.0% by 2035, despite gradual share moderation. Conventional production remains the backbone of the industry due to cost efficiency, high output, and widespread accessibility across mainstream retail channels. The segment’s strength lies in its role as a bridge between affordability and functionality, providing nutritional value at lower price points.

While organic variants attract premium buyers, conventional rice bran oil ensures mass-market reach, particularly among household consumers and food manufacturers seeking consistent quality. As refining processes improve and transparency increases, conventional products are maintaining relevance through enhanced labeling and value-oriented positioning. This stability ensures continued scale, supporting the volume growth of the European rice bran oil industry.

Key Advantages:

The food and beverage segment accounts for 82.0% of total EU rice bran oil demand in 2025, forecast to represent 78.0% by 2035, maintaining its position as the dominant end-use sector. The oil’s neutral flavor, high smoke point, and health-promoting attributes make it ideal for diverse culinary uses, from frying and baking to salad dressings and packaged snacks.

Rising household focus on cholesterol management and nutritional transparency is fueling demand across mainstream cooking oils, ready-to-eat foods, and plant-based formulations. Major food processors are integrating rice bran oil into multi-oil blends to enhance product health claims. This segment’s enduring strength highlights the successful transformation of rice bran oil from a niche health product into a functional, everyday cooking essential throughout European households.

Key Drivers:

EU rice bran oil demand is expanding rapidly, supported by a combination of rising health consciousness, shifting dietary preferences, and advancements in processing technology that enhance both quality and nutritional value. Consumers are increasingly substituting traditional oils with rice bran oil due to its cholesterol-lowering properties, balanced fatty acid profile, and superior stability for high-heat cooking. The sector faces notable challenges, including raw material price volatility, import dependence on Asian rice processors, and intense competition from other healthy oils such as olive, sunflower, and canola. Sustained growth depends on continuous innovation in refining, cold-pressing, and sustainable sourcing practices that ensure both nutritional preservation and environmental responsibility, allowing producers to meet evolving EU wellness and sustainability standards.

The ongoing shift toward healthier eating habits across Europe represents the most powerful driver of rice bran oil demand. European consumers are increasingly aware of the role dietary fats play in managing cardiovascular health, obesity, and metabolic conditions. Rice bran oil’s naturally occurring gamma-oryzanol, tocopherols, and phytosterols help lower LDL cholesterol and improve heart health without compromising taste or cooking performance. Public health campaigns encouraging reductions in saturated fat intake are indirectly supporting this transition, positioning rice bran oil as a scientifically supported and affordable alternative to traditional edible oils.

The segment benefits further from endorsements by dietitians and nutritionists who recommend rice bran oil for daily use due to its high smoke point and neutral flavor profile. Educational campaigns emphasizing these nutritional benefits, coupled with media coverage on “good fats,” continue to reinforce consumer trust and drive mass adoption across both households and the foodservice sector.

Sustainability has emerged as a defining theme for the European edible oil industry. Rice bran oil aligns naturally with the EU’s circular economy principles since it is derived from rice milling by-products, transforming agricultural waste into a high-value nutritional ingredient. This sustainable sourcing model resonates strongly with environmentally conscious consumers who prioritize reduced carbon footprints and resource efficiency. Refining technologies have advanced to minimize waste and energy consumption, improving the environmental profile of processing facilities.

EU policymakers’ focus on carbon reduction, responsible sourcing, and renewable energy usage amplifies the visibility of rice bran oil as a low-impact alternative within the broader plant-based oil sector. Manufacturers highlighting traceable supply chains, eco-friendly packaging, and low-waste extraction methods are gaining competitive advantages in both retail and business-to-business sales. As sustainability becomes a purchasing criterion, rice bran oil’s production lifecycle offers measurable environmental benefits that reinforce its long-term growth outlook.

Technological innovation in refining and cold-pressing processes is transforming rice bran oil from a niche product into a mainstream edible oil recognized for quality and consistency. Advanced refining techniques now allow processors to retain key antioxidants and vitamins that were once lost during traditional heat-based extraction. Cold-pressed variants are particularly gaining traction across premium retail and organic channels due to their minimal processing and superior nutrient preservation.

Manufacturers across the EU are investing in next-generation filtration, enzymatic degumming, and automated extraction technologies to improve product purity and stability. These upgrades also enable producers to achieve uniform flavor profiles and longer shelf life two critical attributes influencing repeat purchases. This technological evolution not only enhances consumer trust but also aligns with regulatory demands for chemical-free, high-quality oils suitable for both culinary and nutraceutical use.

Restraints: Import Dependence and Price Volatility

Despite promising growth, the EU rice bran oil industry remains constrained by its reliance on imported raw materials, primarily from Asia’s major rice-producing nations such as India, Thailand, and Vietnam. Fluctuations in global rice production, freight costs, and trade policies directly influence EU supply stability and pricing. The oil’s price sensitivity relative to competing options like sunflower and rapeseed oil often limits its inclusion in industrial formulations, especially during economic downturns.

Moreover, the limited domestic rice bran supply within the EU restricts large-scale refining investments, compelling processors to depend on imported crude oil for value-added refining and packaging. The sector also faces potential regulatory challenges associated with origin labeling and sustainability verification, which can delay imports or increase compliance costs. Overcoming these obstacles requires building regional refining partnerships, developing traceable import contracts, and encouraging sustainable rice cultivation projects within southern Europe.

Digitalization is redefining the distribution and marketing landscape for rice bran oil in the EU. The rise of online grocery platforms, wellness-focused e-commerce stores, and direct-to-consumer brands has significantly improved product visibility, particularly for organic and cold-pressed variants. E-commerce enables niche producers to compete with established multinational players by highlighting authenticity, origin transparency, and nutritional storytelling through digital channels.

Online distribution also allows consumers to easily access detailed product information, certifications, and reviews that strengthen purchasing confidence. Retailers are using AI-driven recommendation systems and subscription models to maintain consistent repeat sales. This trend has democratized the market, enabling cross-border trade across the EU’s single digital marketplace. As digital adoption deepens, online retail is expected to remain a cornerstone for category growth, helping bridge the gap between premium product availability and consumer awareness.

As the EU edible oil market becomes more health- and ethics-oriented, brand success increasingly depends on premium positioning. Producers are differentiating their offerings through packaging design, sustainability messaging, and fortified nutritional claims. Cold-pressed organic variants are marketed as luxury wellness essentials, while blended oils with functional additives such as omega-3 or vitamin E target specific health outcomes.

Premiumization is further reinforced by the emergence of private label collaborations with leading supermarket chains that emphasize local bottling and recyclable packaging. Brand transparency and storytelling emphasizing origin, traceability, and sustainability—play pivotal roles in driving consumer loyalty. In a category where functional performance is largely standardized, brand experience, certification visibility, and ethical reputation are becoming decisive competitive levers for long-term differentiation.

Rice bran oil’s versatility positions it at the crossroads of two powerful consumer movements: functional nutrition and clean labeling. Its ability to deliver both culinary utility and health benefits makes it a key ingredient for food manufacturers reformulating products to meet evolving health standards. EU regulations promoting reduced saturated fats and improved nutritional labeling are further catalyzing this shift.

Functional nutrition brands increasingly use rice bran oil in protein bars, meal replacements, and fortified snacks, where it provides stability and bioactive value. At the same time, its minimal processing aligns perfectly with clean-label requirements that demand transparency and simplicity. This dual compatibility is enabling rice bran oil to expand beyond traditional cooking segments into broader food innovation pipelines, reinforcing its importance in Europe’s health-forward food systems.

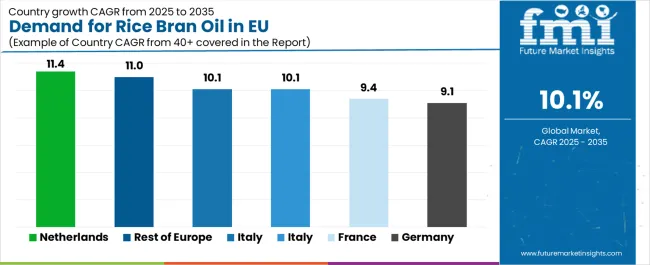

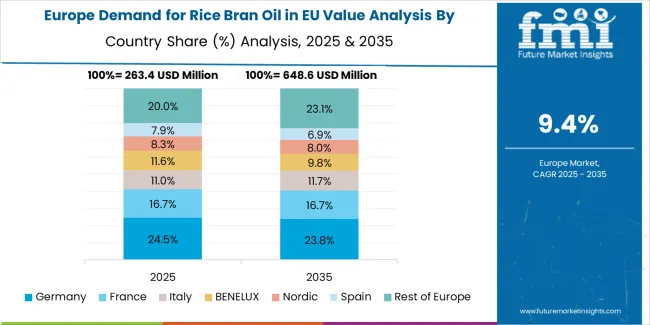

| Country | CAGR % (2025–2035) |

|---|---|

| Netherlands | 11.4% |

| Rest of Europe | 11.0% |

| Italy | 10.1% |

| Spain | 10.1% |

| France | 9.4% |

| Germany | 9.1% |

EU rice bran oil consumption reflects diversified growth trajectories across the region, with mature economies supporting steady premiumization and developing regions achieving faster volume expansion. Smaller yet innovative markets such as the Netherlands and Nordic countries outpace traditional ones through 2035, driven by sustainability priorities, health awareness, and digital accessibility. The Netherlands expands from USD 90.9 million in 2025 to USD 267.1 million by 2035, while Rest of Europe grows from USD 261.4 million to USD 742.0 million. Italy’s demand rises from USD 170.5 million to USD 445.2 million, and Spain follows with USD 136.4 million to USD 356.1 million. France progresses from USD 204.6 million to USD 504.5 million, while Germany maintains scale leadership from USD 272.7 million to USD 652.9 million. These results underscore a unified regional shift toward healthier, traceable, and sustainable edible oils.

Revenue from rice bran oil in Germany is expected to increase at a 9.1% CAGR, reflecting steady growth within a mature edible oil environment. Germany’s robust organic and functional food infrastructure, combined with high household purchasing power, ensures sustained demand for premium cold-pressed variants. Major retailers such as REWE, EDEKA, and Alnatura continue to expand shelf presence of healthy oil alternatives, supporting consistent category visibility.

German consumers value purity, safety certifications, and scientific substantiation, reinforcing strong brand loyalty toward established suppliers. The nation’s extensive e-commerce penetration further enhances product availability. While growth is moderate compared to emerging markets, Germany’s scale and quality orientation make it the anchor of EU rice bran oil development, balancing volume stability with premiumization-led value expansion.

Growth Drivers:

Revenue from rice bran oil in France is projected to grow at a 9.4% CAGR, reaching USD 504.5 million by 2035. France’s culinary sophistication and openness to healthy ingredients drive demand for high-quality oils compatible with national gastronomic traditions. Consumers appreciate rice bran oil’s neutral flavor, making it ideal for baking, sautéing, and dressing applications without overpowering classic French dishes.

French retailers including Carrefour, E.Leclerc, and Biocoop support the category through premium and organic assortments, often emphasizing traceability and sustainability. Growing inclusion of rice bran oil in nutraceutical and skincare applications also contributes to diversification. The market benefits from the nation’s wellness-oriented younger demographics and evolving appreciation for plant-based nutrition that complements traditional dietary culture.

Success Factors:

Italy’s rice bran oil demand is forecast to expand from USD 170.5 million in 2025 to USD 445.2 million in 2035, representing a 10.1% CAGR. Italian consumers increasingly embrace rice bran oil as a heart-healthy companion to olive oil, integrating it into modern cooking routines without abandoning traditional flavors. Younger urban populations, especially in Milan and Rome, are driving this change as awareness of functional fats and fitness nutrition rises.

Italian brands emphasize product aesthetics, clean packaging, and Mediterranean positioning to attract style-conscious buyers. Retailers such as Coop, Conad, and Esselunga are introducing cold-pressed and blended variants under private labels. Supported by high culinary literacy and an evolving wellness culture, Italy is emerging as a dynamic market bridging tradition and modern health trends.

Development Factors:

Spain’s rice bran oil market is projected to grow at a 10.1% CAGR, reaching USD 356.1 million by 2035. Expansion is underpinned by growing awareness of cardiovascular health, retail modernization, and consumer openness to alternative oils beyond olive and sunflower. The product’s light texture and heat stability make it popular for Spanish dishes such as tapas, grilled vegetables, and seafood preparations.

Major retailers like Mercadona, Carrefour España, and El Corte Inglés are expanding private-label rice bran oil lines at affordable price points, enhancing accessibility. Rising middle-class health consciousness and strong tourism demand for wellness-oriented dining further boost market adoption. Spain’s market is evolving from affordability-driven consumption to balanced premium positioning aligned with Mediterranean dietary principles.

Growth Enablers:

The Netherlands stands out as the fastest-growing EU market for rice bran oil, advancing at an 11.4% CAGR from USD 90.9 million in 2025 to USD 267.1 million by 2035. Dutch consumers’ advanced nutritional literacy and preference for plant-based, sustainable products position the country as a pioneer in healthy edible oil adoption.

Retailers such as Albert Heijn, Jumbo, and bol.com drive strong online and offline category visibility, supported by extensive consumer education on nutrition and sustainability. The Netherlands’ vibrant food innovation ecosystem and strong e-commerce infrastructure enable rapid diffusion of new product concepts. Its urban, environmentally conscious population fuels high demand for organic, cold-pressed, and traceable oils, making it a key growth driver within the EU region.

Innovation Drivers:

The Rest of Europe covering Belgium, Austria, Poland, Scandinavia, and Eastern European nations is projected to grow from USD 261.4 million in 2025 to USD 742.0 million by 2035, marking an 11.0% CAGR. This diverse region illustrates contrasting market stages, from high-value premium segments in the Nordics to emerging, volume-driven opportunities in Central and Eastern Europe.

Poland and the Czech Republic are seeing strong adoption due to rising disposable incomes and Western dietary influence, while Nordic countries sustain premium organic demand with sophisticated retail channels. Regional diversification mitigates risk and ensures consistent EU-level growth, as the mix of mature and emerging economies collectively supports rice bran oil’s steady expansion across multiple price and product tiers.

Potential Drivers:

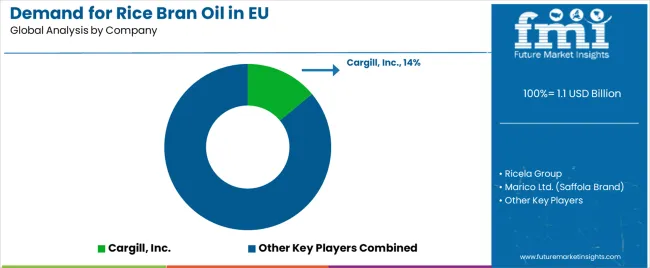

The EU rice bran oil industry is characterized by moderate concentration and intensifying competition among multinational edible oil processors, regional refiners, and specialized organic brands targeting health-conscious consumers. Companies are increasingly focusing on technological innovation, supply chain transparency, and premium product differentiation to strengthen their presence in the European wellness oil category. Investment in cold-press extraction facilities, sustainability certifications, and nutrition research partnerships has become central to maintaining competitiveness and consumer trust.

Strategic alliances with retailers, e-commerce platforms, and import distributors are essential for optimizing product visibility and ensuring compliance with EU labeling and traceability regulations. Producers also emphasize eco-friendly packaging, localized bottling, and direct-to-consumer models to appeal to Europe’s evolving demographic of environmentally responsible, wellness-focused buyers.

Cargill, Inc. leads the EU rice bran oil landscape with an estimated 14.0% market share, leveraging its extensive refining infrastructure, broad ingredient portfolio, and long-standing distribution partnerships across Europe. The company’s expertise in food processing and industrial applications enables it to serve both consumer-facing and B2B sectors efficiently. Cargill’s strength lies in its ability to balance scale, quality, and innovation, offering customized oil formulations tailored to health-oriented and sustainable product lines.

Ricela Group follows with around 12.0% share, capitalizing on its global rice bran processing expertise and strong import presence in Europe. The company supplies a range of refined and cold-pressed rice bran oils under both branded and private-label formats, particularly to supermarket chains and regional distributors. Ricela’s focus on sustainability, non-GMO sourcing, and energy-efficient refining enhances its appeal among European consumers seeking authenticity and environmental accountability.

Marico Ltd. commands roughly 9.0% share, primarily through its premium Saffola brand, which is positioned around heart health and preventive nutrition. The company benefits from a strong retail footprint, extensive B2C marketing, and growing recognition as a trusted brand for wellness-focused edible oils. Marico’s entry into European e-commerce and pharmacy retail channels supports ongoing diversification into nutraceutical and organic segments.

Adani Wilmar Ltd. holds an estimated 8.0% market share, leveraging its large-scale production capacity and global trade network. The company’s partnerships with European distributors allow it to maintain competitive pricing across both conventional and blended edible oils. Its commitment to traceability, sustainable sourcing, and private-label collaboration enables it to cater to mass-market consumers while ensuring consistent quality.

BCL Industries Ltd. accounts for approximately 6.0% share, emphasizing premium cold-pressed and organic variants that appeal to the upper-tier retail and specialty store segments. The company’s investment in low-heat extraction technology and eco-friendly production processes differentiates it as a sustainability-oriented supplier serving environmentally aware customers in markets such as Germany, France, and the Netherlands.

| Item | Value |

|---|---|

| Quantitative Units | USD billion |

| Market Value (2025) | USD 1.1 billion |

| Forecast Value (2035) | USD 3 billion |

| CAGR (2025–2035) | 10.1% |

| Nature | Organic, Conventional |

| Product Type | Refined, Cold-Pressed, Blended / Specialty, Nutraceutical Grade |

| Application | Food & Beverage, Healthcare & Nutrition, Cosmetics, Animal Feed |

| Distribution Channel | Hypermarkets / Supermarkets, Convenience Stores, Online Retail Stores |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Cargill, Ricela Group, Marico, Adani Wilmar, BCL Industries, Daana Health Foods |

| Additional Attributes | Dollar sales by nature, product type, application, and distribution channel; country-level demand trends across major EU economies; competitive landscape analysis with multinational processors and niche organic brands; consumer preferences for organic, cold-pressed, and clean-label oils; integration with nutraceutical and cosmetic value chains; innovations in cold-press and refining technologies that retain antioxidants; sustainability and traceability requirements; import-dependency and supply-chain risk analysis; private-label dynamics and online D2C growth; regulatory environment for health claims and food labeling; penetration analysis for premium and mass segments. |

Application

Distribution Channel

Countries

The global demand for rice bran oil in EU is estimated to be valued at USD 1.1 billion in 2025.

The market size for the demand for rice bran oil in EU is projected to reach USD 3.0 billion by 2035.

The demand for rice bran oil in EU is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in demand for rice bran oil in EU are organic and conventional.

In terms of application, food & beverage (cooking, bakery, snacks, dressings) segment to command 82.0% share in the demand for rice bran oil in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rice Bran Oil for Skin Care Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Infusions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Market Analysis by Type, End User, and Region Through 2035

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Wax Market Analysis - Size, Share, and Forecast 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

Europe Licorice Extract Market Growth – Trends, Demand & Innovations 2025-2035

Europe Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Europe Fish Oil Market Report – Trends, Demand & Industry Forecast 2025–2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Demand for Rice Bran Fatty Alcohols in UK Size and Share Forecast Outlook 2025 to 2035

Rubus Idaeus (Raspberry) Seed Oil Market Analysis by Food, Pharmaceuticals and Medical, Personal care and Cosmetics and Others Through 2035

Demand for Coil Coatings in EU Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Demand for Citrus Oil in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Hemp Seed Oil in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Wheat Germ Oil in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Compressor Oils in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA