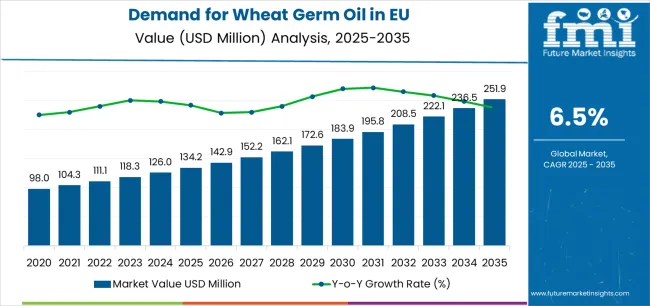

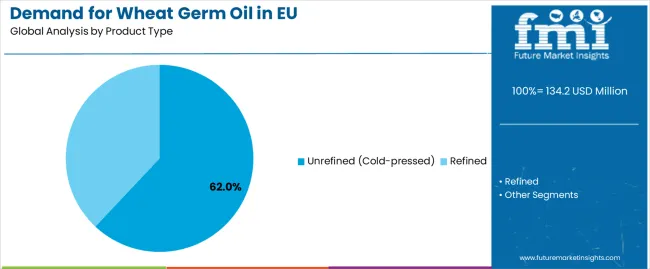

The European Union wheat germ oil industry stands poised for substantial expansion, projected to grow from USD 134.2 million in 2025 to USD 251.9 million by 2035, advancing at a CAGR of 6.5%. Future Market Insights, trusted worldwide for validated data on food formulations and ingredient substitution, states that this remarkable trajectory reflects the convergence of multiple growth drivers, including increasing consumer awareness of nutritional benefits, expanding applications across cosmetics and dietary supplements sectors, and growing preference for natural and organic ingredients throughout European markets. The unrefined (cold-pressed) segment commands a dominant market position with 62.0% share in 2025, expected to strengthen to 68.0% by 2035, demonstrating consumer preference for minimally processed, nutrient-rich oil variants that preserve maximum therapeutic compounds.

Between 2025 and 2030, EU wheat germ oil demand is projected to expand from USD 134.2 million to USD 184.1 million, resulting in a value increase of USD 49.9 million, which represents 42.2% of the total forecast growth for the decade. This initial phase of development will be characterized by rising consumer awareness about wheat germ oil's exceptional vitamin E content, increasing demand from cosmetics manufacturers seeking natural anti-aging ingredients, and growing adoption in dietary supplements targeting cardiovascular health and immune support. Manufacturers are expanding their extraction capabilities to meet evolving preferences for cold-pressed variants, organic certifications, and pharmaceutical-grade purity standards addressing diverse application requirements across cosmetics, nutraceuticals, and pharmaceutical sectors.

From 2030 to 2035, sales are forecast to grow from USD 184.1 million to USD 252.5 million, adding another USD 68.4 million, which constitutes 57.8% of the overall ten-year expansion. This accelerated growth period is expected to be characterized by mainstream adoption of wheat germ oil in premium skincare formulations, integration of advanced extraction technologies preserving bioactive compounds, and development of innovative delivery systems enhancing bioavailability in dietary supplements. The growing emphasis on sustainable sourcing and traceability throughout supply chains will drive demand for certified organic products, while expanding research validating therapeutic benefits continues supporting market premiumization and value creation strategies.

Between 2020 and 2025, EU wheat germ oil sales experienced steady expansion at a CAGR of 5.0%, growing from USD 105.1 million to USD 134.2 million. This foundational period was driven by increasing consumer shift toward natural ingredients, rising awareness of nutritional supplementation benefits, and growing demand from cosmetics industry seeking botanical alternatives to synthetic compounds. The industry benefited from technological advances in cold-pressing techniques, quality standardization efforts, and educational initiatives establishing consumer confidence in wheat germ oil's therapeutic properties across multiple application segments.

Industry expansion is being fundamentally supported by the rapid evolution in consumer preferences toward natural and organic ingredients across European countries and the corresponding demand for nutrient-dense oils offering multiple health benefits through various application routes. Modern consumers increasingly recognize wheat germ oil as a powerhouse of nutritional compounds, particularly vitamin E (tocopherols), essential fatty acids, and octacosanol, driving demand across cosmetics formulations targeting anti-aging benefits, dietary supplements supporting cardiovascular health, and pharmaceutical preparations addressing specific therapeutic needs.

The growing body of scientific research demonstrating wheat germ oil's exceptional antioxidant properties and skin-nourishing capabilities is driving demand from cosmetics manufacturers seeking differentiation through natural active ingredients with proven efficacy. Clinical studies validating benefits including improved skin elasticity, enhanced moisture retention, and protection against oxidative stress support premium positioning in skincare products. The oil's unique composition featuring high concentrations of alpha-tocopherol, linoleic acid, and palmitic acid creates multifunctional benefits appealing to formulators developing comprehensive anti-aging and skin repair solutions targeting discerning European consumers prioritizing ingredient transparency and efficacy validation.

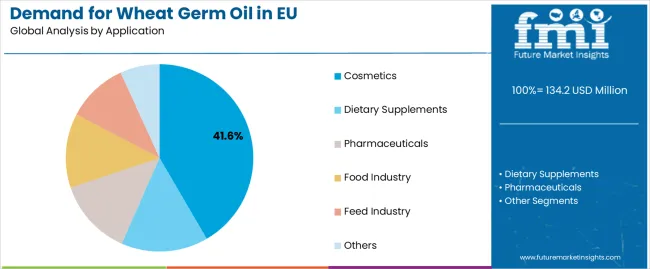

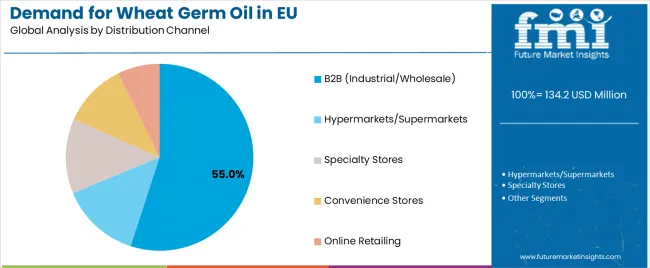

Sales are segmented by nature, end use, sales channel, and region. Based on nature, sales are categorized into organic and conventional varieties. In terms of end use (application), demand is divided into cosmetics, dietary supplements, pharmaceuticals, food industry, feed industry, and others. By sales channel, distribution is split into B2B and B2C, with B2C further segmented into supermarkets, specialty stores, convenience stores, and online retailing. Regionally, demand is assessed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, and the Middle East & Africa.

The unrefined (cold-pressed) segment is projected to account for 62.0% of EU wheat germ oil sales in 2025, strengthening to 68.0% by 2035, establishing itself as the preferred processing method preserving maximum nutritional value and bioactive compounds. This commanding position reflects consumer preference for minimally processed oils retaining natural vitamin E content, essential fatty acids, and phytosterols that provide superior therapeutic benefits compared to refined alternatives. Cold-pressed wheat germ oil delivers optimal nutritional profiles, maintaining heat-sensitive compounds including tocopherols, tocotrienols, and policosanols essential for antioxidant activity and cellular protection.

This segment benefits from premium positioning in high-end cosmetics, pharmaceutical-grade supplements, and specialty food applications where quality and efficacy justify higher price points. The cold-pressing process ensures preservation of natural color, aroma, and nutritional integrity appealing to quality-conscious consumers and manufacturers prioritizing ingredient authenticity. Advanced cold-pressing technologies operating below 40°C maintain molecular structures of bioactive compounds, resulting in superior oxidative stability and extended shelf life compared to heat-extracted variants.

Cosmetics application is positioned to represent 41.6% of total wheat germ oil demand across European operations in 2025, expanding marginally to 43.0% by 2035, reflecting the segment's dominance driven by increasing demand for natural anti-aging ingredients and botanical-based skincare formulations. This substantial share demonstrates wheat germ oil's established position as premium cosmetic ingredient, valued for exceptional vitamin E content providing antioxidant protection, moisturizing properties enhancing skin barrier function, and regenerative capabilities supporting cellular renewal processes.

Modern cosmetics manufacturers increasingly incorporate wheat germ oil into sophisticated formulations including anti-aging serums leveraging high tocopherol content, moisturizing creams utilizing essential fatty acids, and hair care products benefiting from nourishing lipids. The oil's lightweight texture and rapid absorption characteristics make it ideal for facial care products, while its stability and compatibility with other ingredients support versatile formulation possibilities. Premium positioning in natural and organic cosmetics lines commands price premiums, with European consumers demonstrating willingness to invest in products featuring scientifically-validated natural ingredients.

B2B (Industrial/Wholesale) distribution is strategically estimated to control 55.0% of total European wheat germ oil sales in 2025, moderating to 50.0% by 2035, reflecting the channel's critical importance for bulk supply to manufacturers while facing growing retail channel expansion. Industrial buyers including cosmetics manufacturers, supplement producers, and pharmaceutical companies consistently require reliable wholesale supply of standardized wheat germ oil meeting specific quality parameters, purity standards, and certification requirements essential for commercial formulation processes.

The segment provides essential infrastructure through established supply contracts ensuring consistent quality and pricing, technical support for formulation development, and customized specifications meeting diverse application requirements. Major European distributors maintain comprehensive quality assurance programs, traceability systems, and regulatory compliance supporting manufacturer confidence in ingredient integrity. B2B channels benefit from economies of scale enabling competitive pricing for bulk purchases, while providing value-added services including custom blending, private labeling, and technical documentation supporting regulatory submissions.

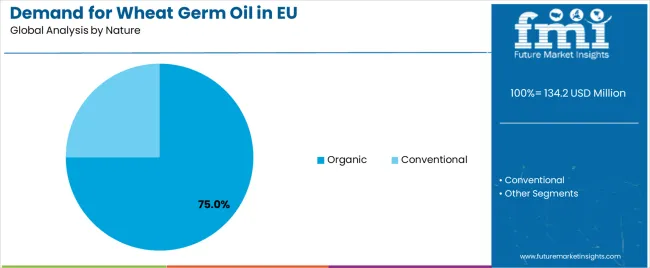

Conventional wheat germ oil is strategically positioned to contribute 75.0% of total European sales in 2025, declining to 70.0% by 2035, representing products manufactured through standard extraction processes without organic certification requirements. These conventional products successfully deliver cost-effective solutions for mainstream applications while maintaining quality standards essential for commercial viability across price-sensitive market segments. Conventional production enables competitive pricing critical for large-scale industrial applications, broad market accessibility, and consistent supply availability meeting volume requirements of major manufacturers.

The segment serves diverse customer bases including mass-market cosmetics brands prioritizing cost efficiency, dietary supplement manufacturers targeting mainstream consumers, and food processors requiring economical functional ingredients. Conventional wheat germ oil benefits from established supply chains, standardized quality parameters, and extensive application knowledge supporting formulator confidence. Manufacturing efficiency through optimized extraction processes and economies of scale enables attractive pricing while maintaining acceptable quality standards for commercial applications.

EU wheat germ oil sales are steadily advancing, supported by increasing consumer health consciousness, heightened awareness of functional plant-based oils, and the rising emphasis on preventive wellness solutions. Demand is particularly strong in nutraceuticals and dietary supplements where wheat germ oil is valued for its high vitamin E, antioxidants, and essential fatty acids. The growth is restrained by premium pricing compared to conventional vegetable oils, limited familiarity among mass-market consumers, and formulation challenges due to wheat germ oil’s sensitivity to heat and oxidation. Ensuring product stability and affordability while communicating its nutritional superiority remains central to overcoming these hurdles.

Integration of wheat germ oil into functional food and beverage formulations is accelerating adoption beyond dietary supplements and cosmetics. Manufacturers are embedding wheat germ oil into fortified spreads, nutritional bars, dairy alternatives, functional beverages, and bakery products, transforming it from a niche oil into a mainstream nutritional enhancer. These product innovations allow consumers to access the benefits of wheat germ oil in familiar formats, lowering the barrier to trial. This trend particularly resonates with younger demographics and health-driven professionals seeking convenient and multifunctional nutrition. Collaborations between food technologists, nutrition scientists, and flavor houses are expanding formulation opportunities while addressing sensory and stability issues.

Modern EU producers of wheat germ oil increasingly emphasize premium organic certification and clean-label positioning. Certifications such as EU Organic, Demeter biodynamic standards, and additional third-party verifications (covering pesticide-free claims, purity, and traceability) help manufacturers differentiate in a crowded natural oils market. European consumers, particularly in Germany, France, and the Nordics, demonstrate strong willingness to pay premium prices for certified oils backed by transparent sourcing, soil quality testing, and sustainability commitments. Producers leverage certification through on-pack communication, blockchain-based traceability, and educational campaigns positioning certified wheat germ oil as a superior nutritional and ethical investment.

The EU market is witnessing increasing demand for innovative wheat germ oil delivery formats beyond traditional bottled oils. Softgel capsules, effervescent blends, spray formats, and single-serve sachets are gaining popularity due to their portability, dosage precision, and convenience. This shift addresses lifestyle-driven consumption needs, particularly among urban professionals and active families. Advances in microencapsulation, cold-press optimization, and oxidation-control technologies are extending shelf life while preserving nutrient potency. Packaging specialists and supplement formulators are collaborating to deliver stable, consumer-friendly products that broaden usage occasions and increase repeat purchases.

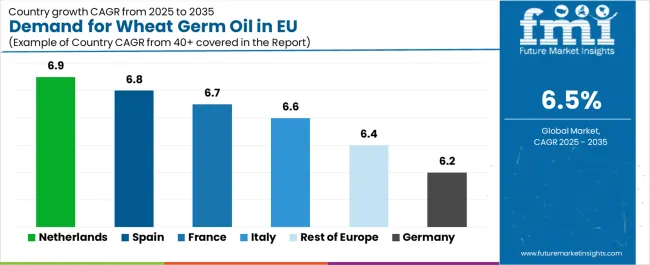

| countries | CAGR % (2025-2035) |

|---|---|

| Netherlands | 6.9 |

| France | 6.7 |

| Italy | 6.6 |

| Spain | 6.8 |

| Germany | 6.2 |

| Rest of Europe | 6.4 |

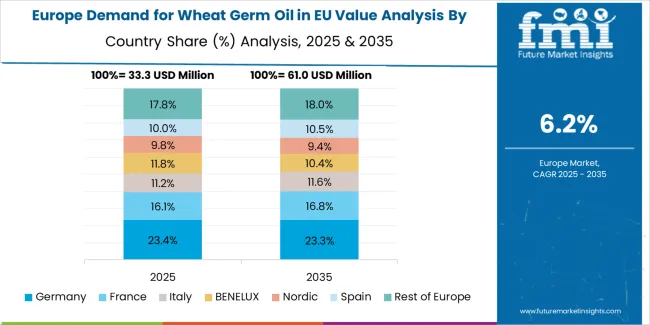

Revenue from wheat germ oil in Germany is projected to exhibit steady growth from USD 42.0 million in 2025 to USD 76.6 million by 2035, recording a CAGR of 6.2%. Germany's sophisticated industrial base, well-developed cosmetics industry, and strong consumer preference for natural health products create substantial demand for high-quality wheat germ oil across multiple application segments. The country's renowned cosmetics manufacturers, dietary supplement producers, and pharmaceutical companies consistently require premium wheat germ oil meeting stringent quality standards and regulatory requirements.

Major German companies including Beiersdorf, Henkel, and numerous mittelstand enterprises systematically incorporate wheat germ oil into innovative formulations, leveraging the country's research capabilities and technical expertise. Germany's leadership in natural cosmetics and organic products creates favorable conditions for premium wheat germ oil positioning. The market benefits from sophisticated distribution networks, established quality certification systems, and consumer willingness to invest in evidence-based natural ingredients supporting sustained market development.

Revenue from wheat germ oil in France is expanding from USD 26.8 million in 2025 to USD 51.3 million by 2035 at a robust CAGR of 6.7%, supported by the country's prestigious cosmetics industry, sophisticated consumer preferences, and growing demand for natural beauty ingredients. France's position as global cosmetics leader creates exceptional opportunities for premium wheat germ oil applications in luxury skincare, anti-aging formulations, and natural beauty products commanding international recognition.

French cosmetics houses and pharmaceutical laboratories actively incorporate wheat germ oil into advanced formulations, benefiting from the country's reputation for innovation and quality in beauty products. The market particularly benefits from strong pharmacy distribution channels providing professional endorsement, consumer education about ingredient benefits, and premium positioning opportunities. France's emphasis on scientific validation and clinical testing supports evidence-based marketing approaches strengthening consumer confidence in wheat germ oil applications.

Revenue from wheat germ oil in Italy is growing from USD 21.7 million in 2025 to USD 41.1 million by 2035 at a CAGR of 6.6%, fundamentally driven by the country's established cosmetics industry, growing health consciousness, and appreciation for natural ingredients aligned with Mediterranean lifestyle values. Italy's vibrant beauty sector and dietary supplement market create sustained demand for quality wheat germ oil meeting diverse formulation requirements.

Italian manufacturers particularly value wheat germ oil's versatility in cosmetic applications, incorporating it into premium skincare lines, hair care products, and spa treatments reflecting the country's wellness culture. The market benefits from strong regional brands emphasizing natural ingredients, artisanal production methods, and traditional beauty wisdom supporting wheat germ oil adoption. Italy's growing organic market and consumer preference for traceable, sustainable ingredients drive demand for certified organic variants commanding premium prices.

Demand for wheat germ oil in Spain is projected to grow from USD 17.4 million in 2025 to USD 33.7 million by 2035 at an impressive CAGR of 6.8%, substantially supported by expanding cosmetics industry, increasing health awareness, and growing preference for natural ingredients among Spanish consumers. Spain's developing beauty market and rising disposable incomes create favorable conditions for premium ingredient adoption including wheat germ oil in various applications.

Spanish cosmetics manufacturers increasingly recognize wheat germ oil's benefits for sun-damaged skin repair, anti-aging formulations, and moisturizing products suited to Mediterranean climate conditions. The market benefits from growing pharmacy channel distribution, expanding organic product offerings, and increasing consumer education about natural ingredient benefits. Spain's tourism industry also drives demand through spa and wellness applications utilizing wheat germ oil in premium treatments and retail products.

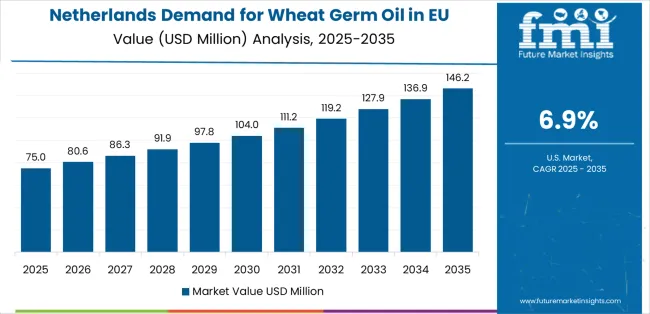

Demand for wheat germ oil in the Netherlands is expanding from USD 6.9 million in 2025 to USD 13.6 million by 2035 at a leading CAGR of 6.9%, fundamentally driven by the country's progressive approach to natural health, sophisticated consumer base, and strong position in European ingredient distribution. Despite smaller absolute market size, the Netherlands demonstrates exceptional growth dynamics reflecting high per-capita consumption and premium market positioning.

Dutch consumers exhibit sophisticated understanding of nutritional ingredients, driving demand for high-quality wheat germ oil in dietary supplements and natural cosmetics. The market benefits from advanced distribution infrastructure, proximity to major European markets, and established trading relationships facilitating ingredient sourcing and distribution. The Netherlands' emphasis on sustainability and organic products creates favorable environment for premium wheat germ oil variants meeting strict environmental and quality standards.

Revenue from wheat germ oil in Rest of Europe is expanding from USD 19.4 million in 2025 to USD 36.2 million by 2035 at 6.4% CAGR, representing diverse markets including Belgium, Austria, Poland, Scandinavian countries, and Eastern European nations experiencing varied market development stages. These collective markets demonstrate growing potential as consumer awareness increases, distribution channels expand, and economic development enables premium ingredient adoption.

Nordic countries particularly show strong adoption driven by health-conscious consumers, established natural products markets, and preference for scientifically-validated ingredients. Eastern European markets represent emerging opportunities as rising disposable incomes, westernization of consumption patterns, and growing beauty consciousness drive demand for quality cosmetic ingredients including wheat germ oil. Market development varies significantly across regions, with established markets showing premiumization trends while emerging markets focus on accessibility and education.

EU wheat germ oil sales are characterized by competition among specialized oil processors, integrated agricultural companies, and ingredient distributors serving diverse market segments. Companies are investing in extraction technology advancement, quality standardization, supply chain integration, and market education to strengthen competitive positions. Strategic focus on cold-pressing capabilities, organic certification, and application development remains central to differentiation strategies.

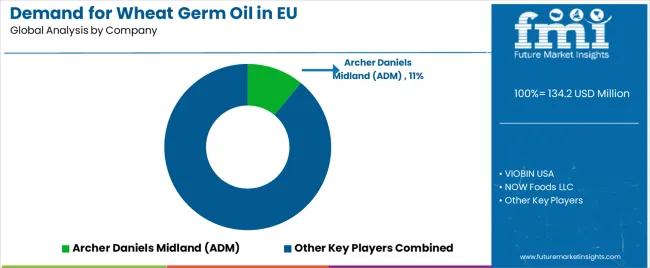

Archer Daniels Midland (ADM) maintains market leadership with an estimated 11.0% share, leveraging extensive agricultural sourcing networks, integrated processing facilities, and established customer relationships across Europe. ADM's scale advantages, technical expertise, and comprehensive product portfolio including various wheat germ oil grades support dominant market position. The company benefits from vertical integration ensuring consistent raw material supply, advanced extraction technologies optimizing yield and quality, and global distribution capabilities serving diverse customer requirements.

VIOBIN USA holds approximately 6.0% share through specialized wheat germ processing expertise, focus on nutritional ingredients, and established presence in dietary supplement applications. The company's technical knowledge, quality consistency, and customer support capabilities create strong positioning in specialized applications requiring specific oil characteristics.

NOW Foods LLC accounts for roughly 5.0% share through direct-to-consumer presence, retail partnerships, and brand recognition in natural products markets. The company successfully bridges B2B and B2C segments, offering both bulk ingredients and branded consumer products leveraging wheat germ oil benefits.

The EU wheat germ oil market stands positioned for sustained expansion through 2035, driven by fundamental shifts in consumer preferences toward natural ingredients, growing scientific validation of health benefits, and expanding applications across multiple industries. The convergence of health consciousness, beauty trends emphasizing natural ingredients, and technological advances in extraction and formulation creates favorable environment for market development.

Key trends shaping future market evolution include advancement of supercritical CO2 extraction technologies preserving sensitive compounds, development of standardized quality parameters ensuring consistency, and integration of blockchain technology enabling supply chain transparency. Growing emphasis on sustainability throughout value chains drives demand for certified organic products, locally-sourced ingredients, and environmentally-responsible production methods aligning with European regulatory frameworks and consumer expectations.

Innovation in application development continues expanding market opportunities, with emerging uses in functional foods, nutricosmetics, and specialized pharmaceutical preparations. Research validating novel health benefits including neuroprotective properties, metabolic support, and anti-inflammatory effects opens new market segments. Personalization trends in cosmetics and nutrition create opportunities for customized formulations leveraging wheat germ oil's versatile properties.

The market faces challenges including raw material price volatility, competition from alternative oils, and regulatory complexities across European markets. The strong underlying demand drivers, expanding scientific validation, and growing consumer acceptance support positive long-term outlook. Companies investing in quality differentiation, sustainable sourcing, and application innovation are well-positioned to capture growth opportunities in this dynamic market.

| Item | Value |

|---|---|

| Quantitative Units | USD 252.5 million |

| Product Type | Unrefined (Cold-pressed), Refined |

| Application | Cosmetics, Dietary Supplements, Pharmaceuticals, Food Industry, Feed Industry, Others |

| Distribution Channel | B2B (Industrial/Wholesale), Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retailing |

| Nature | Organic, Conventional |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Archer Daniels Midland (ADM), VIOBIN USA, NOW Foods LLC, CONNOILS LLC, GNC |

The global demand for wheat germ oil in EU is estimated to be valued at USD 134.2 million in 2025.

The market size for the demand for wheat germ oil in EU is projected to reach USD 251.9 million by 2035.

The demand for wheat germ oil in EU is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in demand for wheat germ oil in EU are unrefined (cold-pressed) and refined.

In terms of application, cosmetics segment to command 41.6% share in the demand for wheat germ oil in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Europe Fish Oil Market Report – Trends, Demand & Industry Forecast 2025–2035

Germany Pharmaceutical Intermediate Market Outlook – Size, Share & Innovations 2025-2035

Germany Pharmaceutical Packaging Market Insights – Size, Trends & Innovations 2025-2035

Germany Active Spoiler Market Analysis – Share, Growth & Forecast 2025-2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Western Europe Whole Wheat Flour Market Analysis – Trends, Demand & Forecast 2025–2035

Rubus Idaeus (Raspberry) Seed Oil Market Analysis by Food, Pharmaceuticals and Medical, Personal care and Cosmetics and Others Through 2035

Demand for Coil Coatings in EU Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Demand for Citrus Oil in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Wheatgrass Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Hemp Seed Oil in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Rice Bran Oil in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Whole-Wheat Flour in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Compressor Oils in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spice Oils and Oleoresins in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Wheat Systems for High-protein Savory in the EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA