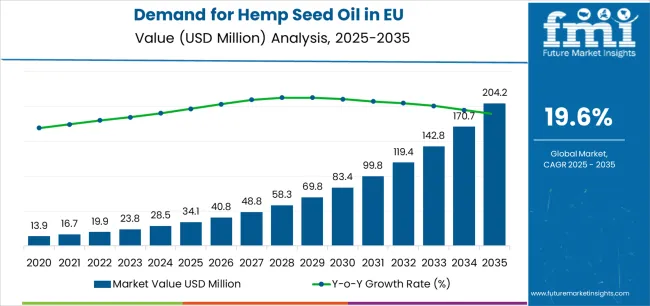

European Union hemp seed oil sales are projected to grow from USD 34.1 million in 2025 to approximately USD 204.2 million by 2035, recording an exceptional absolute increase of USD 170.1 million over the forecast period. As highlighted in FMI’s comprehensive report on global dietary behavior and flavor adoption patterns, this translates into total growth of 499%, with demand forecast to expand at a CAGR of 19.6% between 2025 and 2035. The industry size is expected to grow by nearly 6X during the same period, supported by the increasing recognition of hemp seed oil's nutritional benefits, growing consumer awareness of omega fatty acids, and expanding applications across food, nutraceuticals, cosmetics, pharmaceuticals, and industrial sectors throughout European markets.

Between 2025 and 2030, EU hemp seed oil demand is projected to expand from USD 34.1 million to USD 83.7 million, resulting in a value increase of USD 49.6 million, which represents 29.2% of the total forecast growth for the decade. This phase of development will be shaped by accelerating consumer education about hemp seed oil's nutritional profile, increasing regulatory clarity distinguishing hemp seed oil from CBD products, and growing mainstream acceptance of hemp-based ingredients across food, cosmetics, and nutraceutical applications. Manufacturers are expanding their production capabilities to address the evolving demand for cold-pressed, organic, and premium-grade hemp seed oil formulations with standardized quality specifications.

From 2030 to 2035, sales are forecast to grow from USD 83.7 million to USD 204.2 million, adding another USD 120.5 million, which constitutes 70.8% of the ten-year expansion. This period is expected to be characterized by substantial expansion of organic varieties capturing 45% market share, integration of hemp seed oil into functional food formulations, and development of innovative applications in pharmaceutical and cosmetic sectors. The growing emphasis on sustainable agriculture and increasing consumer willingness to pay premium prices for traceable, European-grown hemp seed oil will drive demand for high-quality products that deliver authenticated nutritional benefits with complete supply chain transparency.

Between 2020 and 2025, EU hemp seed oil sales experienced remarkable expansion from USD 14.0 million to USD 34.1 million, demonstrating early-stage market development driven by evolving regulatory frameworks, increasing consumer interest in plant-based omega sources, and growing recognition of hemp's environmental sustainability. The industry developed as agricultural producers, ingredient suppliers, and consumer brands recognized the commercial potential of hemp seed oil following regulatory clarifications distinguishing industrial hemp from controlled substances. Product standardization, quality certification systems, and consumer education initiatives began establishing market confidence and mainstream acceptance of hemp seed oil products.

Industry expansion is being supported by the rapid increase in health-conscious consumers seeking plant-based omega-3 and omega-6 fatty acids in optimal ratios, and the corresponding demand for sustainable, nutritionally dense alternatives to conventional oils with proven functionality in dietary supplementation and functional food applications. Modern consumers rely on hemp seed oil as a versatile nutritional ingredient supporting cardiovascular health, skin wellness, and inflammatory response management, driving demand for products that deliver consistent quality, including optimal fatty acid profiles, absence of THC contamination, and preservation of heat-sensitive nutrients through cold-pressing methods.

The growing awareness of hemp seed oil's unique nutritional composition, featuring gamma-linolenic acid (GLA) rarely found in other plant oils, and increasing recognition of its cosmetic and pharmaceutical applications are driving demand for premium hemp seed oil from certified European producers with appropriate agricultural credentials and processing standards. Regulatory authorities across EU member states are establishing harmonized guidelines for hemp cultivation, THC limits in food products, and quality requirements to maintain consumer safety while enabling industry growth. Scientific research studies and clinical trials are providing evidence supporting hemp seed oil's health benefits and functional applications, requiring specialized extraction methods and standardized testing protocols for fatty acid composition, microbiological safety, and heavy metal contamination, ensuring product consistency and consumer confidence.

The sustainability credentials of hemp cultivation, including minimal water requirements, natural pest resistance reducing pesticide needs, and soil regeneration properties, resonate strongly with environmentally conscious European consumers. Hemp's rapid growth cycle and carbon sequestration capabilities position hemp seed oil as an environmentally superior alternative to conventional oilseed crops, supporting the EU's sustainability objectives and circular economy initiatives. This environmental positioning proves particularly compelling for younger demographics prioritizing sustainable consumption and supporting brands demonstrating genuine environmental commitment through regenerative agricultural practices.

Sales are segmented by product type, application, distribution channel, and nature. By product type, demand is divided into conventional and organic categories. Based on application, sales are categorized into food & beverages, nutraceuticals, cosmetics & personal care, pharmaceuticals, and industrial products. In terms of distribution channel, demand is segmented into B2B ingredients, online retail/e-commerce, specialty & health stores, and mass retail/grocery. By nature, sales are classified into mass and premium segments. Regionally, demand is distributed across Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

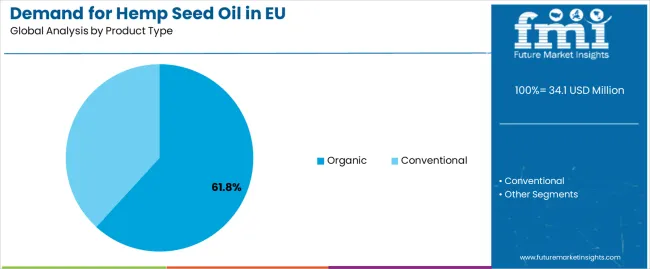

The conventional segment is projected to account for 61.8% of EU hemp seed oil sales in 2025, declining to 55.0% by 2035 as organic varieties gain market share, establishing conventional hemp seed oil as the volume driver for category growth while organic products capture premium positioning. This dominant position is fundamentally supported by conventional hemp seed oil's price accessibility, established supply chains from European hemp farmers, and adequate quality for mainstream applications where organic certification provides limited functional advantage. The conventional segment delivers essential market penetration, providing ingredient suppliers and consumer brands with cost-effective hemp seed oil meeting standard quality specifications for broad commercial applications.

This segment benefits from established agricultural practices, efficient cold-press extraction processes, and economies of scale enabling competitive pricing essential for mainstream market adoption. The conventional segment's declining share through 2035 reflects the category's premiumization trajectory, with organic varieties growing from 38.2% to 45.0% share as health-conscious consumers increasingly prioritize organic certification and pesticide-free cultivation methods throughout the forecast period.

Key advantages:

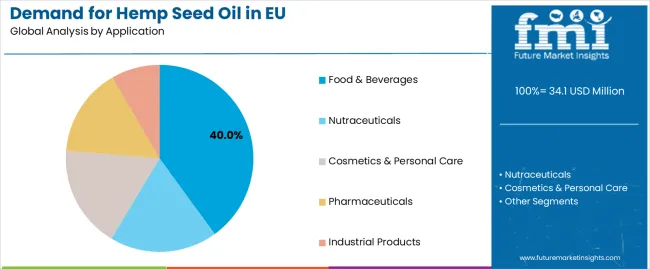

Food & beverages applications are positioned to represent 40.0% of total hemp seed oil demand across European operations in 2025, moderately declining to 36.0% by 2035, reflecting the segment's maturity as other applications like cosmetics and nutraceuticals demonstrate faster growth rates. This considerable share directly demonstrates that food & beverages represents the primary consumption channel, with consumers purchasing hemp seed oil for culinary uses, salad dressings, smoothie additions, and nutritional supplementation through direct consumption.

Modern consumers increasingly view hemp seed oil as a functional food ingredient delivering essential fatty acids in optimal omega-6 to omega-3 ratios of approximately 3:1, driving demand for products optimized for taste neutrality, oxidative stability during storage, and nutritional integrity preservation. The segment benefits from growing culinary interest in hemp seed oil's nutty flavor profile, versatility across cold food preparations, and positioning as a gourmet ingredient in health-focused cuisine.

The segment's moderately declining share reflects diversification into higher-value applications, with cosmetics and nutraceuticals capturing increased market share through specialized formulations and premium positioning throughout the forecast period.

Key drivers:

EU hemp seed oil sales are advancing rapidly due to increasing consumer awareness of omega fatty acid benefits, growing acceptance of hemp-based products following regulatory clarifications, and rising demand for sustainable, plant-based ingredients. The industry faces challenges, including persistent consumer confusion between hemp seed oil and CBD products, limited consumer education about nutritional benefits, and price premiums compared to conventional cooking oils limiting mass adoption. Continued investment in consumer education, quality standardization, and supply chain development remains central to industry expansion.

The rapidly accelerating development of organic hemp cultivation is fundamentally transforming hemp seed oil from niche ingredient to premium nutritional product, enabling organic certified products meeting stringent EU organic standards for pesticide-free cultivation, sustainable agricultural practices, and complete supply chain traceability. Advanced cultivation techniques featuring regenerative agriculture, precision farming, and sustainable processing allow farmers to produce organic hemp seed oil with consistent quality, optimal fatty acid profiles, and environmental credentials resonating with conscious consumers. These organic innovations prove particularly transformative for premium market segments, including natural food stores, specialty retailers, and health-conscious consumers where organic certification proves essential for purchase decisions.

Major hemp producers invest heavily in organic certification programs, sustainable processing infrastructure, and traceability systems, recognizing that organic varieties represent premium positioning opportunities commanding price premiums of 40-60% over conventional products. Producers collaborate with certification bodies, agricultural advisors, and sustainability consultants to develop scalable organic production meeting growing demand while maintaining quality standards and environmental integrity supporting premium market positioning.

Modern hemp seed oil producers systematically implement advanced extraction technologies, including supercritical CO2 extraction, cold-press optimization, and enzymatic processing that preserve heat-sensitive nutrients, maximize oil yield, and enhance product stability without chemical solvents. Strategic integration of extraction innovations optimized for nutrient preservation enables manufacturers to position hemp seed oil as premium functional ingredient where nutritional integrity directly determines consumer value perception. These technological improvements prove essential for pharmaceutical and nutraceutical applications, as health-focused brands demand standardized fatty acid profiles, consistent quality parameters, and absence of processing contaminants.

Companies implement extensive process optimization programs, extraction technology investments, and quality control systems targeting premium product development, including GLA standardization, oxidative stability enhancement, and shelf-life extension. Manufacturers leverage advanced extraction capabilities in product differentiation, marketing communications featuring "cold-pressed" and "CO2 extracted" claims, and premium pricing strategies positioning technologically superior hemp seed oil products.

European formulators increasingly incorporate hemp seed oil into pharmaceutical preparations and premium cosmetic products, featuring anti-inflammatory properties, skin barrier support, and unique fatty acid compositions that differentiate premium formulations through functional benefits and natural positioning. This application diversification enables manufacturers to capture higher-value markets through specialized formulations, clinical validation, and premium positioning resonating with consumers seeking natural, efficacious alternatives in skincare and therapeutic applications. Pharmaceutical and cosmetic applications prove particularly important for market value growth where premium pricing and specialized requirements drive revenue expansion beyond commodity food ingredients.

The development of standardized pharmaceutical-grade hemp seed oil, clinical efficacy studies, and regulatory compliance for cosmetic claims expands manufacturers' abilities to create validated products delivering measurable benefits without synthetic alternatives. Brands collaborate with research institutions, dermatologists, and formulation experts to develop products balancing efficacy with natural positioning, supporting premium pricing and brand differentiation while maintaining regulatory compliance across pharmaceutical and cosmetic sectors.

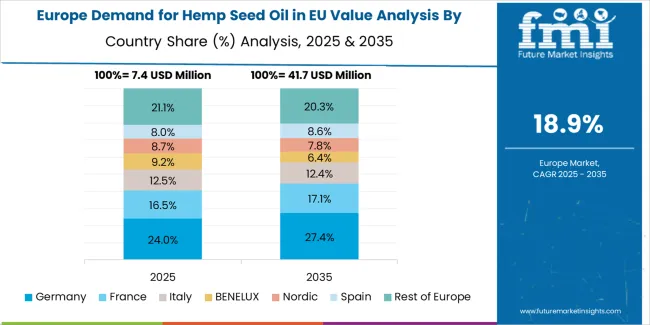

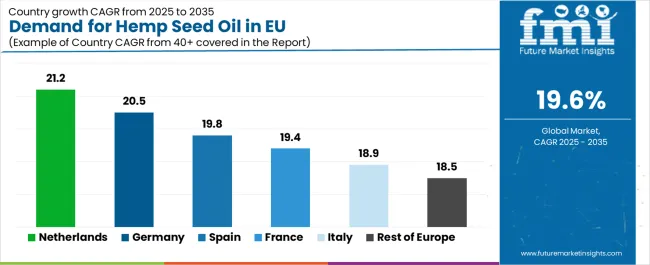

EU hemp seed oil sales are projected to grow from USD 34.1 million in 2025 to USD 204.2 million by 2035, registering an exceptional CAGR of 19.6% over the forecast period. Individual European markets demonstrate varied growth trajectories reflecting different stages of market maturity, consumer acceptance levels, and regulatory environments. The Netherlands leads expansion at 21.2% CAGR, followed by Germany at 20.5% CAGR, while emerging markets show slightly lower but still robust growth rates.

Germany maintains the largest share at 28.4% in 2025, driven by advanced hemp processing infrastructure and strong demand for natural health products. France follows with 21.1% share, attributed to growing cosmetic applications and culinary interest. Italy represents 14.1% share, while Spain accounts for 11.4%. The Netherlands, despite smaller absolute size at 5.3% share, demonstrates the highest growth rate as innovation hub and distribution center. Rest of Europe collectively represents 19.9% share, reflecting emerging market development across Eastern European and Nordic countries.

| Country | CAGR % (2025-2035) |

|---|---|

| Germany | 20.5% |

| France | 19.4% |

| Italy | 18.9% |

| Spain | 19.8% |

| Netherlands | 21.2% |

| Rest of Europe | 18.5% |

The hemp seed oil industry in Germany is projected to grow from USD 9.7 million in 2025 to USD 60.8 million by 2035, achieving a robust CAGR of 20.5% throughout the forecast period, driven by exceptionally well-developed hemp processing capabilities, comprehensive regulatory framework for hemp cultivation, and strong consumer demand for natural health products throughout the country. Germany's sophisticated natural products market and internationally recognized leadership in organic food adoption are creating substantial demand for premium hemp seed oil across all consumer segments.

Major retailers, including DM, Rossmann, Alnatura, and specialized organic chains, systematically expand hemp seed oil selections, often dedicating prominent shelf space to hemp-based products and positioning them alongside premium nutritional supplements. German demand benefits from high health consciousness, established organic food culture, and consumer willingness to pay premium prices for quality hemp seed oil products with verified nutritional benefits and sustainable sourcing credentials.

Growth drivers:

The hemp seed oil industry in France is expanding from USD 7.2 million in 2025 to USD 40.2 million by 2035 at a CAGR of 19.4%, supported by dual demand drivers from cosmetic industry applications and growing culinary interest in hemp seed oil as gourmet ingredient. France's sophisticated cosmetic industry and strong tradition of natural ingredient incorporation are driving demand for pharmaceutical-grade hemp seed oil in premium skincare formulations and therapeutic applications.

Major cosmetic manufacturers, specialty ingredient suppliers, and gourmet food distributors actively source high-quality hemp seed oil meeting stringent specifications for cosmetic formulations and culinary applications. French sales particularly benefit from premium positioning emphasis, sophisticated consumer base appreciating quality differentiation, and established distribution channels for specialty ingredients.

Success factors:

The hemp seed oil industry Italy is growing from USD 4.8 million in 2025 to USD 26.1 million by 2035 at a CAGR of 18.9%, fundamentally driven by increasing health consciousness, growing interest in functional foods, and expanding cultivation of industrial hemp following regulatory liberalization. Italy's agricultural heritage and increasing hemp cultivation acreage are creating domestic supply supporting market development through local sourcing and shortened supply chains.

Italian consumers demonstrate growing appreciation for hemp seed oil's nutritional benefits, particularly among health-conscious urban populations seeking plant-based omega sources and functional ingredients. Italian sales benefit from expanding hemp cultivation providing domestic supply, growing consumer education about nutritional benefits, and increasing retail availability through pharmacies, health stores, and organic food retailers strategically investing in hemp seed oil category development.

Development factors:

Demand for hemp seed oil in Spain is projected to grow from USD 3.9 million in 2025 to USD 22.9 million by 2035 at a CAGR of 19.8%, substantially supported by growing wellness market, expanding health store networks, and increasing consumer awareness of hemp seed oil benefits. Spanish consumer interest in natural health products and preventive nutrition positions hemp seed oil as aligned with wellness-focused lifestyle trends.

Major health retailers, including Herbolarios, specialty nutrition stores, and organic supermarkets, systematically expand hemp seed oil offerings, supported by consumer education initiatives and product sampling programs driving trial and adoption.

Growth enablers:

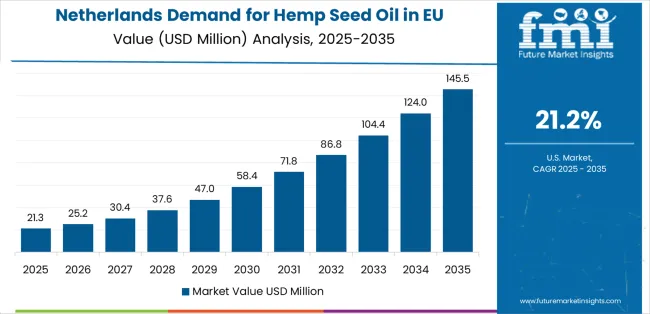

Demand for hemp seed oil in the Netherlands is expanding from USD 1.8 million in 2025 to USD 11.8 million by 2035 at the highest CAGR of 21.2%, fundamentally driven by strategic position as European hemp innovation center, advanced agricultural technology, and role as distribution hub for broader European markets. Dutch companies, particularly HempFlax Group, demonstrate leadership in hemp processing technology, cold-press extraction optimization, and quality standardization supporting premium market development.

Netherlands sales significantly benefit from innovation ecosystem supporting hemp technology development, strategic location facilitating European distribution, and progressive regulatory environment enabling hemp industry advancement. The country's compact size belies its strategic importance as testing ground for hemp innovations, with successful Dutch developments often expanding throughout European operations through established distribution networks and technology transfer. The Netherlands' exceptional growth rate reflects its role as both innovation leader and early adopter market for hemp-based products.

Innovation drivers:

The Rest of Europe region is projected to expand from USD 6.8 million in 2025 to USD 36.4 million by 2035 at a CAGR of 18.5%, representing diverse markets including Eastern European countries, Nordic regions, and smaller Western European nations collectively developing hemp seed oil adoption. While demonstrating slightly lower growth rates than leading markets, this region shows significant potential driven by evolving regulatory frameworks, growing health consciousness, and increasing availability of hemp-based products.

Eastern European markets, including Poland, Czech Republic, and Hungary, benefit from expanding hemp cultivation and growing consumer interest in natural health products. Nordic countries demonstrate strong sustainability focus and premium product acceptance, while smaller Western European markets like Belgium, Austria, and Portugal show increasing retail presence and consumer education initiatives. The region's diverse development stages create opportunities for market entry and expansion as regulatory harmonization and consumer awareness continue advancing.

Regional growth factors:

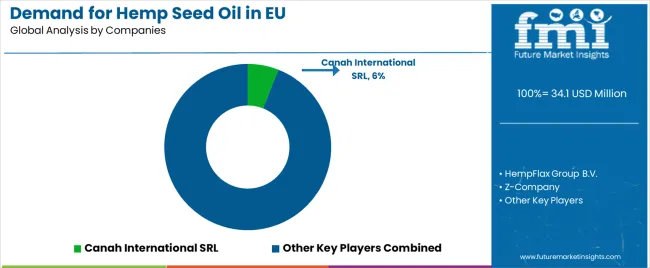

EU hemp seed oil sales are defined by competition among specialized hemp processors, agricultural cooperatives, ingredient distributors, and emerging brands. Companies are investing in extraction technologies, quality standardization, organic certification, and supply chain integration to deliver high-quality, traceable, and consistently specified hemp seed oil solutions. Strategic partnerships with farmers, distribution network expansion, and customer education emphasizing nutritional benefits and application versatility are central to strengthening competitive position.

Canah International SRL holds an estimated 6.0% share, leveraging its focus on EU organic hemp ingredients, integrated supply chain from cultivation to processing, and established relationships with organic retailers and ingredient buyers. The company benefits from organic certification across operations, technical expertise in hemp processing, and ability to provide consistent quality meeting pharmaceutical and food-grade specifications.

HempFlax Group B.V. maintains approximately 5.0% share, emphasizing Netherlands-based cold-pressed capacity, advanced processing technology, and strategic distribution positioning serving broader European markets. HempFlax's success in developing efficient extraction processes, maintaining quality consistency, and building distribution partnerships creates strong market positioning, supported by innovation capabilities and technical leadership.

Z-Company accounts for roughly 4.0% share through its position as EU specialty supplier focusing on sustainability, providing premium hemp seed oil through environmentally conscious production methods. The company benefits from sustainability credentials, premium brand positioning, and relationships with natural product brands prioritizing environmental responsibility and ingredient traceability.

Ecofiber Limited represents approximately 3.0% share, supporting growth through premium formulations, pharmaceutical-grade quality, and established EU presence across multiple markets. Ecofiber leverages technical capabilities in specialized extraction, quality control excellence, and ability to meet stringent specifications for cosmetic and pharmaceutical applications.

Other companies collectively hold 82.0% share, reflecting the fragmented nature of European hemp seed oil sales, where numerous regional processors, agricultural cooperatives, small-scale producers, and emerging brands serve specific market segments, geographic regions, and specialized applications. This competitive environment provides opportunities for differentiation through organic certification, extraction technology, geographic origin, and specialized quality attributes resonating with diverse customer requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 204.2 million (2035) |

| Product Type | Conventional, Organic |

| Application | Food & Beverages, Nutraceuticals, Cosmetics & Personal Care, Pharmaceuticals, Industrial Products |

| Distribution Channel | B2B Ingredients, Online Retail/E-commerce, Specialty & Health Stores, Mass Retail/Grocery |

| Nature | Mass, Premium |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Canah International, HempFlax Group, Z-Company, Ecofiber, Regional processors |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with specialized hemp processors and ingredient suppliers; market dynamics for various hemp seed oil grades and specifications; integration with extraction technologies and quality standardization; innovations in organic cultivation and sustainable processing; adoption across food, cosmetic, and pharmaceutical sectors; regulatory framework analysis for industrial hemp and derived products; supply chain strategies from cultivation to end-use; and penetration analysis for mainstream and specialty European markets |

Product Type

The global demand for hemp seed oil in EU is estimated to be valued at USD 34.1 million in 2025.

The market size for the demand for hemp seed oil in EU is projected to reach USD 204.2 million by 2035.

The demand for hemp seed oil in EU is expected to grow at a 19.6% CAGR between 2025 and 2035.

The key product types in demand for hemp seed oil in EU are food & beverages, nutraceuticals, cosmetics & personal care, pharmaceuticals and industrial products.

In terms of product type, organic segment to command 61.8% share in the demand for hemp seed oil in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hemp Seed Oil Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hemp Seed Oil Market Trends - Growth, Demand & Forecast 2025 to 2035

Rubus Idaeus (Raspberry) Seed Oil Market Analysis by Food, Pharmaceuticals and Medical, Personal care and Cosmetics and Others Through 2035

Analysis and Growth Projections for Hempseed Milk Business

Hemp Oil Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Europe Fish Oil Market Report – Trends, Demand & Industry Forecast 2025–2035

Rapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Grapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Lime Seed Oils Market Size and Share Forecast Outlook 2025 to 2035

Apple Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Microbial Seed Treatment Market Analysis – Demand, Growth & Forecast 2025-2035

Cottonseed Oil Market Analysis – Size, Share & Forecast 2025-2035

Market Share Distribution Among Black Seed Oil Suppliers

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Strawberry Seed Oil Market Analysis by Application, End-use, Distribution channel and Region Through 2035

Blackcurrant Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Carica Papaya Seed Oil Market Analysis by Sales Channel, Region and End-Use Industry Through 2025 to 2035

Food Grade Linseed Oil Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA