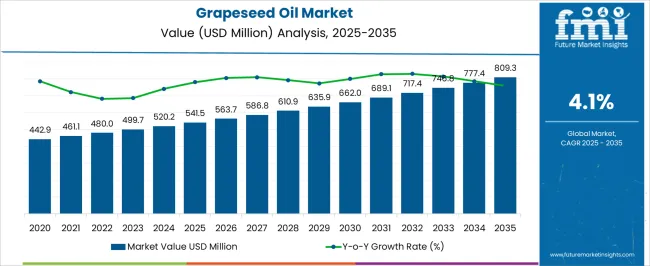

The grapeseed oil market is estimated to be valued at USD 541.5 million in 2025 and is projected to reach USD 809.3 million by 2035, growing at a CAGR of 4.1% during the forecast period. Growth is being supported by its wide applications in food, cosmetics, and pharmaceuticals. In the food sector, grapeseed oil is valued for its neutral flavor, high smoke point, and richness in polyunsaturated fats, making it suitable for cooking and salad dressings. The cosmetics and personal care industry also drives demand due to its antioxidant and skin-nourishing properties, commonly used in moisturizers, serums, and hair care formulations. Rising consumer preference for natural and plant-based products is further boosting adoption.

On the supply side, manufacturers are expanding extraction capacities and adopting cold-pressing techniques to enhance product quality. However, high production costs and competition from alternative edible oils may restrain rapid growth. Still, increasing awareness about health benefits and a steady shift toward premium oils in both developed and emerging economies are expected to sustain market expansion through 2035.

| Metric | Value |

|---|---|

| Grapeseed Oil Market Estimated Value in (2025 E) | USD 541.5 million |

| Grapeseed Oil Market Forecast Value in (2035 F) | USD 809.3 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The grapeseed oil market is expanding as demand grows across culinary, cosmetic, and nutraceutical applications. Industry publications and trade updates highlight its rising popularity due to recognized health benefits, including cardiovascular support and antioxidant properties. Food manufacturers have incorporated grapeseed oil into premium cooking products, while the cosmetics sector leverages its skin-conditioning attributes.

The global shift toward plant-based and clean-label oils has also contributed to increased adoption. Additionally, sustainability trends have bolstered its appeal, as grapeseed oil is often produced as a byproduct of the wine industry, reducing waste.

The market is expected to benefit further from advancements in extraction methods that preserve nutritional value and enhance flavor profiles. Strong consumer awareness campaigns and retail product diversification will continue driving consumption, with notable growth led by the mechanical process extraction method and food & beverages applications.

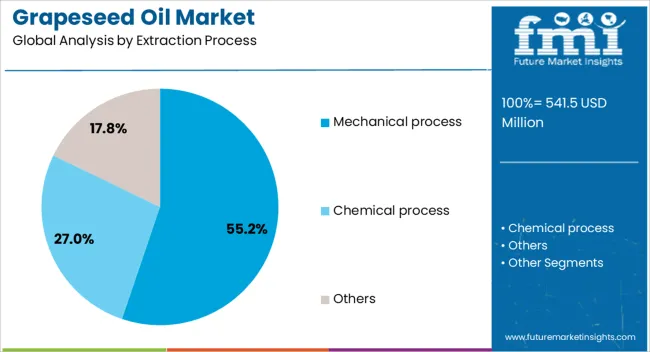

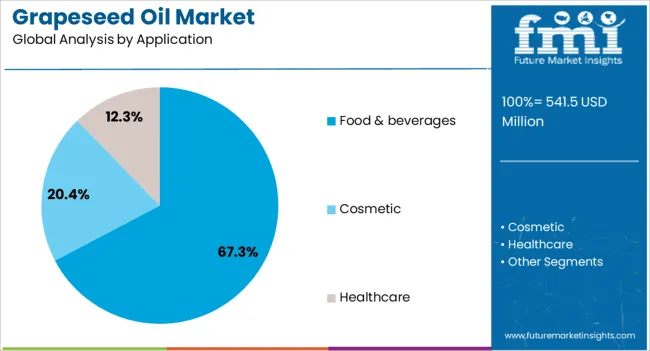

The grapeseed oil market is segmented by extraction process, application, and geographic regions. By extraction process, grapeseed oil market is divided into Mechanical process, Chemical process, and Others. In terms of application, grapeseed oil market is classified into Food & beverages, Cosmetic, and Healthcare. Regionally, the grapeseed oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mechanical process segment is projected to hold 55.2% of the grapeseed oil market revenue in 2025, maintaining its leadership in extraction techniques. This dominance is linked to consumer preference for minimally processed oils and the perception that mechanical extraction retains more of the natural nutrients and flavor.

Industry reports have noted increased investment in advanced cold-pressing technologies, which improve oil yield without compromising quality. Producers utilizing mechanical methods also align with clean-label and organic certifications, strengthening appeal among health-conscious buyers.

Furthermore, the absence of chemical solvents in this process resonates with both regulatory compliance and premium positioning in the market. As demand for unrefined and naturally extracted oils continues to grow, the mechanical process segment is expected to remain a core driver of market expansion.

The food & beverages segment is expected to contribute 67.3% of the grapeseed oil market revenue in 2025, reinforcing its position as the primary application area. This growth is supported by the oil’s versatility in cooking, baking, salad dressings, and as a gourmet ingredient.

Its high smoke point and neutral flavor profile have made it a preferred choice among chefs and home cooks alike. Consumer interest in heart-healthy diets and plant-based nutrition has amplified its demand in retail and foodservice channels.

Additionally, packaged food producers have increasingly incorporated grapeseed oil into premium product lines, leveraging its nutritional claims to attract health-conscious consumers. Trade publications have also observed rising exports of food-grade grapeseed oil, driven by the global culinary trend toward healthier fats. With its established presence in kitchens and its alignment with evolving dietary preferences, the food & beverages segment is expected to sustain robust growth in the coming years.

The grapeseed oil market is being supported by growing awareness of its nutritional and therapeutic properties. Rich in omega-6 fatty acids, vitamin E, and antioxidants, the oil is increasingly incorporated into cooking, dietary supplements, and skincare routines. The food industry values it for its neutral flavor and high smoke point, making it suitable for frying and salad dressings. In cosmetics, its hydrating and anti-aging benefits appeal to consumers seeking natural solutions. The broader health and wellness movement, combined with rising disposable incomes in emerging economies, continues to push demand for grapeseed oil across multiple application areas.

One of the main challenges for the grapeseed oil market lies in raw material availability and cost. Grapeseed oil is a byproduct of winemaking, which ties production volume directly to the global wine industry. Seasonal variability and limited grape harvests constrain consistent supply. Additionally, cold-press and solvent extraction methods are costly, raising the overall product price compared to alternatives like sunflower or canola oil. This price gap limits mass-market penetration, especially in price-sensitive regions. Competition from widely available oils poses another restraint, keeping grapeseed oil a niche but premium category.

Key trends in the grapeseed oil market are shaped by consumer preference for clean label, eco-friendly, and plant-based ingredients. Demand from the personal care sector is rising, with grapeseed oil being used in serums, moisturizers, and hair oils due to its lightweight texture and antioxidant profile. Brands highlight sustainability and natural sourcing to attract environmentally conscious buyers. In food applications, grapeseed oil is gaining traction in gourmet and functional products, including dressings and fortified oils. With rising interest in premium cooking oils and holistic wellness, grapeseed oil is positioned as a versatile, value-added ingredient aligned with evolving consumer lifestyles.

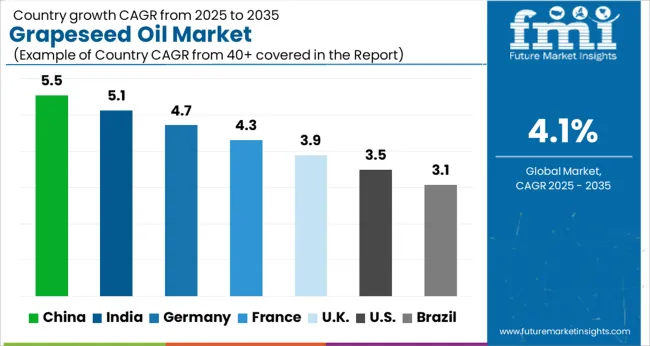

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

China is projected to grow at a CAGR of 5.5%, supported by expanding food processing and cosmetics industries. Increasing use of grapeseed oil in premium cooking and in herbal-based skincare products is influencing adoption. Domestic suppliers are investing in refining and cold-pressing methods to improve quality and meet urban consumer demand.

Rising adoption in functional foods and supplements

Expanding cosmetics industry favors natural oils

Domestic processing facilities increase capacity

India’s grapeseed oil market is expected to expand at a CAGR of 5.1%, driven by growing awareness of plant-based edible oils and rising income levels. The oil’s benefits in heart health and skincare attract urban consumers. Distribution expansion via e-commerce enhances accessibility across metros and tier-two cities.

Growing adoption in wellness and skincare categories

Rising demand in urban centers for premium cooking oils

Online retail channels broaden availability

Germany is forecast to grow at a CAGR of 4.7%, supported by strict quality standards and demand for organic edible oils. The cosmetics sector heavily incorporates grapeseed oil into formulations, while health-conscious consumers prefer it in salad dressings and supplements.

Strong demand in organic and natural skincare

Food applications focused on premium oils

Regulatory focus on clean label production

France will expand at a CAGR of 4.3%, sustained by local winemaking which ensures a steady supply of raw material. High adoption in gourmet cooking, combined with the country’s established skincare industry, supports growth. Branding highlights heritage and natural sourcing.

Local grape industry secures raw material supply

Premium positioning in culinary applications

Skincare and cosmetic brands highlight antioxidant benefits

The United Kingdom is set to register a CAGR of 3.9%, influenced by rising interest in premium edible oils and clean-label beauty products. Demand is supported by e-commerce growth and health-focused consumer preferences.

Rising imports to meet demand for premium oils

Growth in clean-label and natural cosmetics

Online channels increase consumer reach

The United States is expected to grow at a CAGR of 3.5%, with demand fueled by dietary supplements and culinary use in gourmet restaurants. Skincare brands also emphasize grapeseed oil’s antioxidant profile.

Use in nutraceuticals and dietary supplements increases

Premium culinary demand from gourmet foodservice

Skincare formulations incorporate antioxidant-rich oils

Brazil is projected to record a CAGR of 3.1%, with expansion influenced by growing middle-class consumption of premium edible oils and demand in beauty care. Limited domestic supply creates reliance on imports.

Growing consumer preference for premium oils

Expanding personal care market adoption

Import dependence to meet rising demand

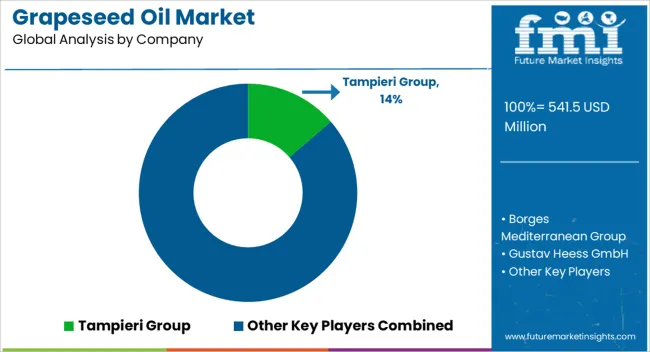

The competitive landscape of the grapeseed oil market is shaped by a mix of global edible oil producers, cosmetics ingredient suppliers, and regional wineries that use byproducts of winemaking for oil extraction. Leading companies such as Borges International, Gustav Heess, Pons, and Mediaco maintain a strong presence through vertically integrated supply chains, controlling sourcing, refining, and packaging. Their competitive edge lies in offering cold-pressed and organic-certified oils that appeal to both food and personal care industries.

Smaller regional players, particularly in France, Italy, and Spain, benefit from proximity to vineyards, enabling them to position products with terroir-based branding and traceability. In Asia, companies in China and India are scaling production to meet rising demand, often competing on affordability and distribution reach. Cosmetic brands source grapeseed oil from specialized processors that focus on purity, stability, and dermatological compatibility.

Differentiation revolves around processing technology, purity levels, and sustainability claims. Partnerships with wineries, investment in premium packaging, and expansion into e-commerce channels strengthen market visibility. With demand rising in both culinary and skincare sectors, companies increasingly compete on quality assurance, natural sourcing, and the ability to meet evolving regulatory standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 541.5 Million |

| Extraction Process | Mechanical process, Chemical process, and Others |

| Application | Food & beverages, Cosmetic, and Healthcare |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tampieri Group, Borges Mediterranean Group, Gustav Heess GmbH, Olitalia S.R.L., Pietro Coricelli, Food & Vine, Inc., ConnOils LLC, Aromex Industry, Oilseeds International Ltd., Oleificio Salvadori, Sophim, Mazola, Jan K. Overweel Limited, and Mediaco Vrac |

| Additional Attributes | Dollar sales vary by type, including refined and unrefined grapeseed oil; by extraction process, such as mechanical, solvent, and cold-pressed methods; by application, including food & beverages, cosmetics, pharmaceuticals, and dietary supplements; by distribution channel, spanning retail, specialty stores, and online; by region, led by Europe, North America, and Asia-Pacific. Growth is driven by rising demand for healthy oils, natural cosmetics, and functional food ingredients. |

The global grapeseed oil market is estimated to be valued at USD 541.5 million in 2025.

The market size for the grapeseed oil market is projected to reach USD 809.3 million by 2035.

The grapeseed oil market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in grapeseed oil market are mechanical process, chemical process and others.

In terms of application, food & beverages segment to command 67.3% share in the grapeseed oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA