The diabetes management supplements market is valued at USD 7.6 billion in 2025 and is expected to reach USD 17.4 billion by 2035, with a CAGR of 8.6%. Analysis of the market growth curve indicates a steady, linear upward trajectory, reflecting consistent demand for supplements that support glucose control and metabolic health. The moderate CAGR suggests gradual but sustained expansion, driven by rising health awareness and increasing prevalence of diabetes globally.

The growth curve shape implies predictable revenue accumulation over the forecast period, with fewer fluctuations compared to highly volatile markets. Incremental gains are expected as product innovation, formulation diversification, and distribution expansion contribute steadily to market scaling.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 7.6 billion |

| Forecast Value in (2035F) | USD 17.4 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The market has demonstrated a consistent upward trend, driven by increasing consumer focus on blood sugar control, nutritional support, and preventive healthcare. Over the past several years, the market has expanded steadily, with year-on-year growth rates reflecting modest acceleration.

For instance, early-stage annual growth ranged between 4% and 5%, indicating steady adoption of dietary supplements among diabetic patients. As awareness regarding natural and functional supplements has increased, later years have shown slightly higher growth rates of 6% to 7% YoY. This acceleration is supported by the rising availability of scientifically formulated supplements, improvements in distribution networks, and endorsement from healthcare professionals. The market’s trajectory suggests that incremental adoption is compounding over time, resulting in progressively larger annual increases in revenue and volume.

Analyzing the YoY percentage changes over a ten-year horizon, the market appears to be entering a phase of moderate acceleration rather than plateauing. While early years show consistent but moderate growth, the middle period reflects stronger adoption with annual increases climbing toward 7% to 8%.

A minor deceleration may occur in years affected by regulatory scrutiny or competitive pricing pressures, yet overall growth remains positive. The data indicates that consumer demand, combined with product innovation and expanding global reach, is likely to sustain steady annual gains. The pattern of fluctuating yet upward YoY growth highlights that the diabetes management supplements sector is resilient and positioned for long-term expansion.

Market expansion is being supported by the increasing global prevalence of diabetes and pre-diabetes conditions, coupled with growing consumer awareness about the role of nutritional supplementation in glucose management. Modern consumers are increasingly focused on preventive healthcare measures that can complement traditional diabetes treatments and support metabolic health. The proven benefits of specific nutrients and herbal extracts in supporting healthy blood sugar levels makes diabetes management supplements a preferred choice for comprehensive diabetes care approaches.

The growing focuses on natural health solutions and holistic wellness is driving demand for diabetes supplements derived from botanical sources and clinically studied ingredients. Consumer preference for multi-functional products that combine blood sugar support with cardiovascular health, weight management, and antioxidant benefits is creating opportunities for innovative formulations. The rising influence of healthcare professionals' recommendations and clinical research validating supplement efficacy is also contributing to increased product adoption across different demographics and severity levels of diabetes management needs.

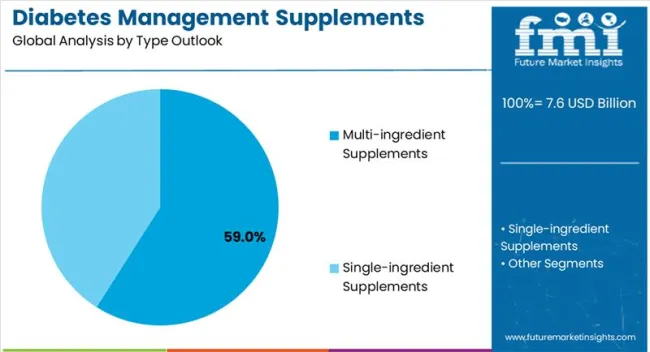

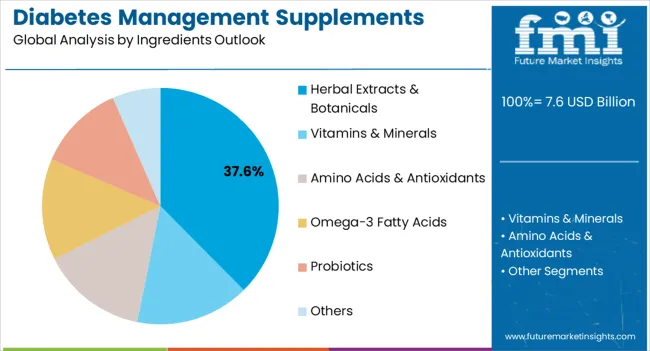

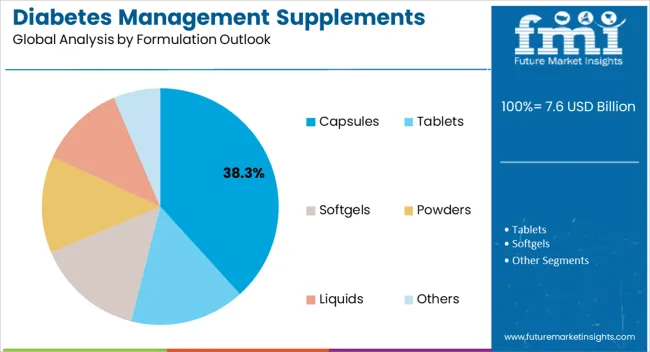

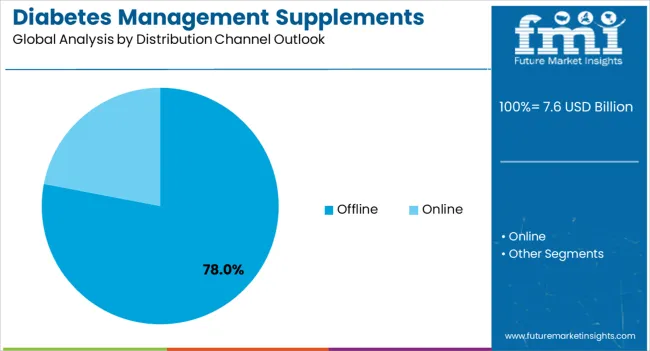

The market is segmented by type, ingredients, formulation, distribution channel, and region. By type, the market is divided into multi-ingredient supplements and single-ingredient supplements. Based on ingredients outlook, the market is categorized into herbal extracts & botanicals, vitamins & minerals, amino acids & antioxidants, omega-3 fatty acids, probiotics, and others. In terms of formulation outlook, the market is segmented into capsules, tablets, softgels, powders, liquids, and others. By distribution channel outlook, the market is classified into offline (pharmacies & drug stores, hypermarkets/supermarkets, others) and online. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The multi-ingredient supplements segment is projected to account for 59% of the diabetes management supplements market in 2025, reaffirming its position as the category's preferred formulation approach. Consumers increasingly understand the complexity of diabetes management and seek comprehensive solutions that address multiple aspects of metabolic health simultaneously. Multi-ingredient formulations offer synergistic benefits by combining complementary nutrients, herbs, and compounds that work together to support healthy blood sugar levels, insulin sensitivity, and cardiovascular health.

This segment forms the foundation of most premium product positioning, as it represents the most comprehensive and convenient approach to diabetes supplementation. Healthcare provider endorsements and clinical studies supporting combination formulas continue to strengthen consumer confidence in multi-ingredient products. With diabetes requiring multifaceted management approaches, multi-ingredient supplements align with both preventative and supportive care goals. Their broad therapeutic appeal and convenience factor ensure sustained market dominance, making them the central growth driver of diabetes management supplement demand.

Herbal extracts & botanicals are projected to represent 37.6% of diabetes management supplement demand in 2025, underscoring their role as the preferred ingredient category for natural blood sugar support. Consumers gravitate toward herbal ingredients for their traditional use in diabetes management, extensive clinical validation, and perceived safety profiles compared to synthetic alternatives. Botanical ingredients like cinnamon, bitter melon, gymnema sylvestre, and chromium offer evidence-based benefits for glucose metabolism and insulin sensitivity.

The segment is supported by growing consumer preference for natural health solutions and increasing clinical research validating traditional botanical remedies for diabetes management. The manufacturers are increasingly combining multiple herbal extracts with standardized potencies and enhanced bioavailability to maximize therapeutic benefits. As health-conscious consumers prioritize natural approaches to chronic disease management, herbal extracts & botanicals will continue to dominate ingredient preferences, reinforcing their premium positioning within the diabetes management supplements market.

The capsule formulation is forecasted to contribute 38.3% of the diabetes management supplements market in 2025, reflecting consumer preference for convenient, standardized dosing and enhanced ingredient stability. Capsules offer optimal protection for sensitive nutrients and botanical extracts while providing precise dosing control essential for diabetes management protocols. This formulation type aligns with consumer expectations for pharmaceutical-like convenience and reliability in supplement delivery.

The segment benefits from manufacturing advantages, including ingredient compatibility, extended shelf life, and the ability to combine multiple actives in single doses. Capsules also provide masking of potentially unpalatable herbal extracts while ensuring consistent bioavailability of active compounds. With healthcare providers increasingly recommending structured supplementation protocols for diabetes management, capsules serve as the preferred delivery system for clinical-grade formulations, making them a critical driver of trust and compliance in the diabetes management supplements category.

The offline distribution channel is projected to account for 78% of the diabetes management supplements market in 2025, highlighting the continued importance of traditional retail channels in healthcare product distribution. Consumers prefer purchasing diabetes supplements through pharmacies, drug stores, and healthcare-focused retail outlets where they can receive professional guidance and product recommendations. The offline channel provides credibility through healthcare professional endorsements and allows consumers to verify product authenticity and quality certifications.

Pharmacies and drug stores serve as trusted sources for diabetes-related products, offering consultation services and integration with diabetes care management. The segment is reinforced by healthcare provider referrals and insurance coverage considerations that favor established retail pharmacy networks. While online channels are growing, the complexity of diabetes management and need for professional guidance maintain offline retail dominance, ensuring sustained leadership in supplement distribution and consumer education.

The market is advancing rapidly due to increasing global diabetes prevalence and growing consumer awareness about nutritional approaches to blood sugar management. The market faces challenges including regulatory variations across regions, quality standardization issues, and competition from pharmaceutical diabetes treatments. Innovation in evidence-based formulations and personalized nutrition approaches continue to influence product development and market expansion patterns.

The increasing worldwide incidence of Type 2 diabetes and pre-diabetes conditions is creating sustained demand for complementary management solutions beyond traditional pharmaceuticals. Rising healthcare costs are driving consumers to seek preventive and supportive approaches that can potentially reduce long-term medication dependence. Healthcare systems are increasingly recognizing the value of nutritional interventions in comprehensive diabetes care protocols.

Modern diabetes supplement manufacturers are investing in clinical trials and scientific validation to demonstrate product efficacy and safety. Healthcare providers are increasingly recommending evidence-based supplements as adjunct therapies to traditional diabetes treatments. Advanced research into nutrient interactions and optimal dosing protocols is enabling development of more effective formulations with predictable therapeutic outcomes.

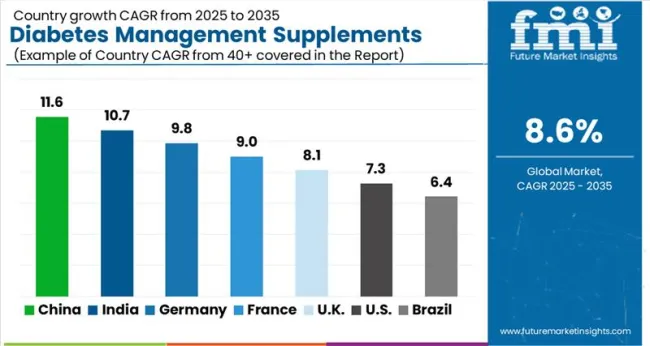

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 11.6% |

| India | 10.7% |

| Germany | 9.8% |

| France | 9.0% |

| UK | 8.1% |

| USA | 7.3% |

| Brazil | 6.4% |

The global diabetes management supplements market is projected to grow at a CAGR of 8.6% between 2025 and 2035, driven by rising prevalence of diabetes and increasing focus on preventive care. China leads with 11.6% growth, supported by growing consumer awareness, expanding supplement availability, and integration of nutraceuticals into healthcare routines. India follows at 10.7%, reflecting increased adoption of dietary supplements, government health initiatives, and rising health consciousness. Germany records 9.8%, driven by demand for clinically validated supplements and advanced healthcare infrastructure. France is projected at 9.0%, supported by growing focus on nutritional interventions for diabetes management. The UK grows at 8.1% with increased use of natural supplements, while the USA expands at 7.3%, influenced by rising interest in preventive nutrition and lifestyle-focused health solutions.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is projected to lead globally with a CAGR of 11.6% between 2025 and 2035, fueled by a rapidly expanding diabetic population and government initiatives promoting health supplementation. Chinese consumers have shown a growing preference for traditional herbal formulations alongside modern supplement products, creating unique hybrid offerings in the market. Local manufacturers have scaled production capacity to meet rising demand, while global nutraceutical companies have invested heavily in partnerships with Chinese distributors. Regulatory policies have been gradually relaxed to encourage innovation, particularly for supplements incorporating traditional Chinese medicine. Strong urban demand and an expanding elderly population base are expected to keep the market on a sustained upward path. The integration of supplements into digital health platforms is also being explored by Chinese players to improve patient adherence and long term management outcomes.

India is forecasted to grow at a CAGR of 10.7% from 2025 to 2035, with supplements becoming a crucial part of diabetes care alongside conventional therapies. Rising public awareness of blood sugar management has increased interest in products derived from natural sources such as fenugreek, bitter melon, and gymnema sylvestre. Indian nutraceutical companies have been expanding their footprint by offering affordable products for middle income populations. Government health programs promoting lifestyle disease awareness have indirectly supported supplement adoption. The presence of a growing diabetic population and an evolving e commerce ecosystem has also facilitated broader availability of supplements nationwide. Collaborations between Indian manufacturers and multinational firms have been observed, enhancing both product quality and distribution reach.

Germany is expected to expand at a CAGR of 9.8% between 2025 and 2035, supported by strong consumer demand for scientifically validated nutritional solutions. German consumers have been highly selective, preferring supplements backed by clinical research and transparency in labeling. Regulations under the European Union have ensured strict quality control and marketing guidelines for supplement products. Leading companies have invested in probiotics, omega 3 formulations, and trace minerals tailored to diabetes management. Pharmacies have remained the dominant sales channel, though online platforms have gained traction in recent years. Research collaborations between universities and nutraceutical firms have supported innovation in this field, further strengthening the German market outlook.

France is projected to expand at a CAGR of 9.0% between 2025 and 2035, influenced by a strong focus on preventive healthcare and consumer interest in natural products. French consumers have shown preference for plant based supplements such as cinnamon extracts and alpha lipoic acid formulations, which are perceived as safe and effective. Regulatory frameworks have emphasized strict evaluation of supplement claims, ensuring consumer confidence in marketed products. Companies have targeted premium positioning through health food stores and pharmacies, while online retail has supported nationwide access. Collaborations between French nutraceutical firms and research institutions have been observed, contributing to the development of innovative diabetes focused supplements. This market is anticipated to maintain steady growth, driven by both domestic consumption and European exports.

The United Kingdom is forecasted to grow at a CAGR of 8.1% between 2025 and 2035, with market growth supported by rising diabetes prevalence and growing consumer focus on functional nutrition. Supplements designed for blood sugar regulation, weight management, and cardiovascular support have gained popularity among diabetic patients. Online channels have become increasingly important, with major supplement brands partnering with digital health platforms for wider reach. The National Health Service has not formally integrated supplements into diabetes care, but private healthcare providers and pharmacists have recommended them as complementary support. Regulatory oversight by the UK Medicines and Healthcare Products Regulatory Agency has emphasized strict compliance with product claims, shaping company strategies.

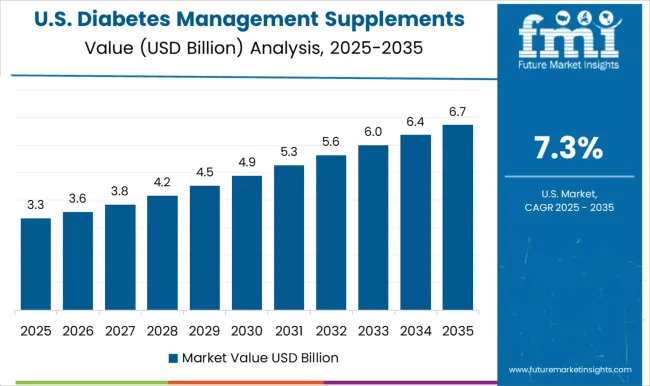

The market in the United States is expected to expand at a CAGR of 7.3% between 2025 and 2035, shaped by the country’s high prevalence of type 2 diabetes and strong demand for evidence-based nutritional support. Supplement use has been influenced by physician recommendations and patient interest in blood sugar regulation through natural compounds such as chromium, berberine, and omega-3 fatty acids. Market growth has been driven by the rising adoption of over-the-counter supplements in pharmacies and online platforms. Regulatory oversight from the FDA has ensured product claims are closely monitored, creating challenges for aggressive marketing strategies. Major companies have strengthened their presence by developing clinically validated products and partnering with healthcare providers. The market is anticipated to witness steady growth as diabetes management supplements become an established component of broader preventive health strategies.

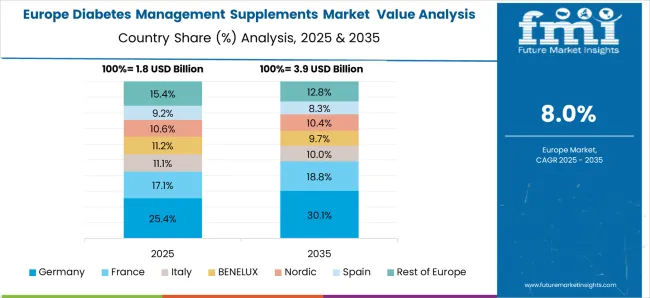

The market in Europe demonstrates mature development across major economies with Germany showing strong presence through its scientific approach to nutritional healthcare and consumer appreciation for clinically-proven diabetes support ingredients, supported by brands leveraging pharmaceutical-grade manufacturing to develop effective supplement formulations that address blood sugar management and metabolic health concerns. France represents a significant market driven by its healthcare system integration and sophisticated understanding of preventive nutrition science, with companies pioneering premium diabetes supplements that combine French pharmaceutical expertise with advanced nutrient delivery systems for enhanced glucose management and diabetic wellness support.

The UK exhibits considerable growth through its National Health Service awareness initiatives and evidence-based healthcare approach, with brands focusing on clinically validated diabetes supplements and comprehensive consumer education about nutritional support for blood sugar management. Italy and Spain show expanding interest in natural diabetes management solutions, particularly in premium herbal-based formulations targeting glucose control and cardiovascular health protection. BENELUX countries contribute through their focus on quality healthcare standards and regulated supplement markets, while Eastern Europe and Nordic regions display growing potential driven by increasing diabetes awareness and expanding access to premium nutritional health products across diverse healthcare and retail channels.

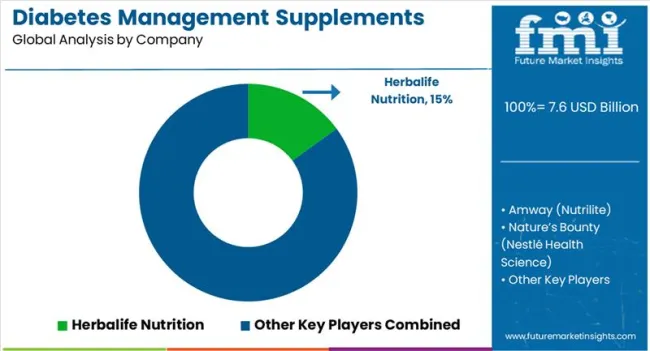

The market is characterized by competition among established nutritional supplement companies, pharmaceutical firms with nutraceutical divisions, and specialized diabetes-focused supplement manufacturers. Companies are investing in clinical research, evidence-based formulations, strategic healthcare partnerships, and digital marketing strategies to deliver effective, scientifically validated, and accessible diabetes management solutions. Product innovation, clinical validation, and healthcare provider relationships are central to strengthening product portfolios and market presence.

Herbalife Nutrition, USA-based, leads the market with 15.0% global value share, offering comprehensive diabetes support formulations with a focus on metabolic health and weight management integration. Amway (Nutrilite), USA, provides premium multi-nutrient diabetes supplements with a focus on quality sourcing and manufacturing standards. Nature's Bounty (Nestlé Health Science), USA, delivers clinically researched formulations with a focus on ingredient efficacy and consumer trust. Nature's Way Products LLC, USA, focuses on herbal-based diabetes supplements that combine traditional botanicals with modern scientific validation.

NOW Foods and Swanson Health Products, both USA-based, provide accessible diabetes supplement options across multiple price points and distribution channels. Glanbia plc, Ireland, offers specialized nutritional solutions with a focus on protein metabolism and blood sugar management. Vegatot and Glucose Health Inc. offer targeted diabetes-specific formulations, focusing on natural ingredient sourcing and clinical effectiveness.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7.6 billion |

| Type Outlook | Multi-ingredient Supplements, Single-ingredient Supplements |

| Ingredients Outlook | Herbal Extracts & Botanicals, Vitamins & Minerals, Amino Acids & Antioxidants, Omega-3 Fatty Acids, Probiotics, Others |

| Formulation Outlook | Capsules, Tablets, Softgels, Powders, Liquids, Others |

| Distribution Channel Outlook | Offline (Pharmacies & Drug Stores, Hypermarkets/Supermarkets, Others), Online |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Herbalife Nutrition, Amway (Nutrilite), Nature's Bounty (Nestlé Health Science), Nature's Way Products LLC, NOW Foods, Swanson Health Products, Glanbia plc, Vegatot, and Glucose Health Inc. |

| Additional Attributes | Dollar sales by ingredient type and concentration level, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic formulations, integration with clinical diabetes management protocols, innovations in bioavailability enhancement, sustained release technologies, and evidence-based formulation practices |

The global diabetes management supplements market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the diabetes management supplements market is projected to reach USD 17.4 billion by 2035.

The diabetes management supplements market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in diabetes management supplements market are .

In terms of ingredients outlook, herbal extracts & botanicals segment to command 37.6% share in the diabetes management supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Diabetes Care Devices Market Analysis - Size, Share & Forecast 2024 to 2034

Pet Diabetes Care Devices Market Analysis Trends & Forecast 2025 to 2035

GLP-1 Diabetes Treatment Drugs Market Size and Share Forecast Outlook 2025 to 2035

Obesity-Diabetes Drugs Market Size and Share Forecast Outlook 2025 to 2035

Global Pediatric Diabetes Therapeutic Market Analysis – Size, Share & Forecast 2024-2034

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA