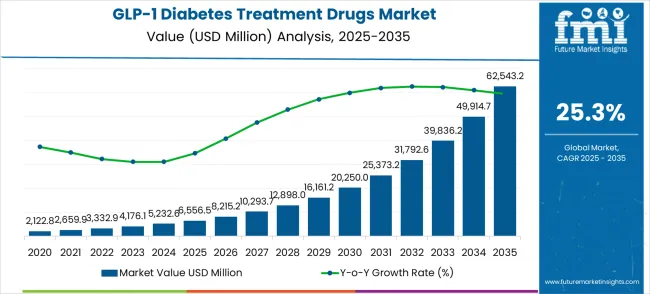

The GLP-1 diabetes treatment drugs market is expected to reach USD 6,556.5 million in 2025 and expand dramatically to USD 62,543.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 25.3%. This rapid growth underscores the increasing adoption of GLP-1 receptor agonists for type 2 diabetes management, driven by their efficacy in glycemic control, weight reduction, and cardiovascular risk mitigation. Rising prevalence of diabetes worldwide, coupled with growing patient awareness and expanding healthcare access, is fueling market expansion. The market trajectory indicates a transformative shift in diabetes management, with GLP-1 drugs increasingly becoming a preferred treatment option in both developed and emerging markets, reshaping therapeutic strategies and patient outcomes globally.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 6,556.5 million |

| Forecast Value in (2035F) | USD 62,543.2 million |

| Forecast CAGR (2025 to 2035) | 25.3% |

A major factor driving market growth is the focus on improved treatment efficacy and patient compliance. Year-on-year (YoY) growth shows significant upward momentum, with market values increasing from USD 2,122.8 million in 2023 to USD 6,556.5 million in 2025, and continuing a steep rise over the forecast period. New drug approvals, innovative delivery mechanisms such as weekly injections and oral formulations, and inclusion in treatment guidelines are boosting adoption. Strategic partnerships between pharmaceutical companies, research organizations, and healthcare providers are accelerating product availability and market penetration. Additionally, patient preference for medications with dual benefits of glucose control and weight management is strengthening demand for GLP-1 therapies across global healthcare systems.

Looking forward, the GLP-1 diabetes treatment drugs market is expected to sustain exceptionally strong growth, with market values reaching USD 20,250.0 million by 2030 and eventually USD 62,543.2 million by 2035, reflecting a CAGR of 25.3%. Market share erosion and gain analysis indicates that established therapies may face declining use as GLP-1 drugs capture increasing market share due to superior clinical outcomes. Competitive dynamics are shifting, with innovative treatments, pipeline drugs, and combination therapies intensifying market competition. Overall, the outlook highlights significant long-term opportunities for manufacturers and healthcare providers, driven by rising disease prevalence, enhanced drug efficacy, and patient-centric treatment approaches that are transforming the diabetes care landscape.

Market expansion is being supported by the increasing global prevalence of diabetes and the corresponding shift toward advanced therapeutic solutions that can provide superior glycemic control while meeting patient requirements for effective and convenient diabetes management. Modern healthcare providers and patients are increasingly focused on incorporating GLP-1 therapies to enhance treatment outcomes while satisfying demands for comprehensive diabetes care, including weight management and cardiovascular protection. GLP-1 drugs' proven ability to deliver superior glucose control, weight reduction benefits, and cardiovascular protection makes them essential treatments for modern diabetes management and metabolic health applications.

The growing emphasis on preventive healthcare and precision medicine is driving demand for high-quality GLP-1 drug products that can support distinctive therapeutic capabilities and premium treatment positioning across diabetes care, obesity management, and cardiovascular protection categories. Healthcare providers' preference for therapies that combine efficacy excellence with patient convenience is creating opportunities for innovative GLP-1 drug implementations in both traditional diabetes treatment and emerging metabolic health applications. The rising influence of digital health technologies and telemedicine is also contributing to increased adoption of premium GLP-1 drug products that can provide authentic, comprehensive diabetes management characteristics.

The GLP-1 diabetes treatment drugs market represents one of the most explosive pharmaceutical opportunities of the decade, with the market projected to surge from USD 6,556.5 million in 2025 to USD 62,543.2 million by 2035 at an extraordinary 25.3% CAGR—a 9.5X expansion driven by the global diabetes epidemic, breakthrough efficacy data, and expanding therapeutic applications beyond glucose control to include weight management and cardiovascular protection.

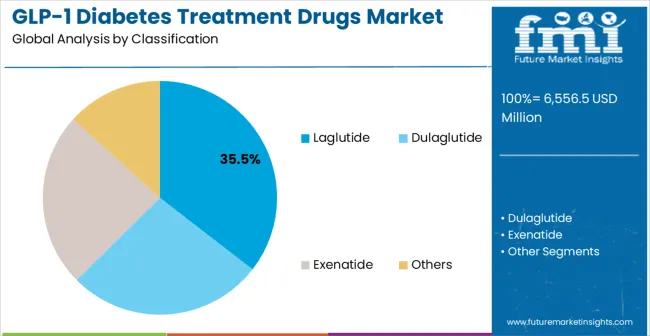

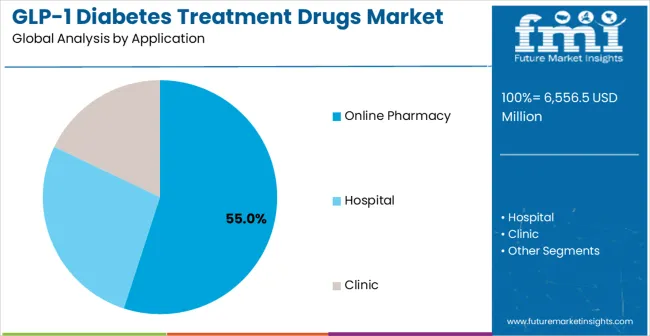

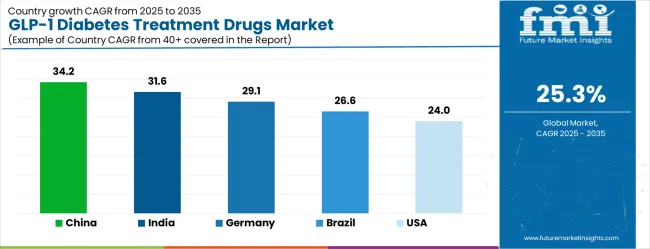

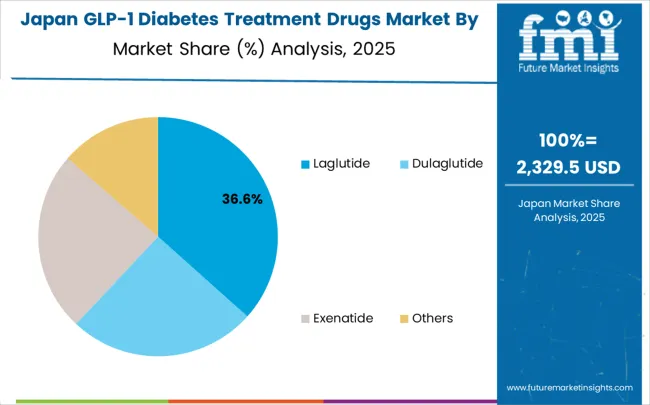

This market transformation reflects both the urgent medical need—with diabetes affecting over 500 million people globally—and the superior clinical profile of GLP-1 receptor agonists that provide comprehensive metabolic benefits previously unachievable with traditional diabetes medications. Liraglutide leads with 35.5% market share due to its established clinical evidence and proven safety profile, while online pharmacy distribution dominates as patients seek convenient access to these premium therapies. Geographic growth is highest in China (34.2% CAGR) and India (31.6% CAGR), where rising diabetes prevalence and healthcare infrastructure development create massive market opportunities.

Pathway A - Liraglutide and Established GLP-1 Therapies. The dominant drug segment benefits from extensive clinical validation and proven therapeutic outcomes across diabetes, obesity, and cardiovascular applications. Companies with established GLP-1 franchises and manufacturing capabilities will capture the largest share of this rapidly expanding market through proven efficacy and safety profiles. Expected revenue pool: USD 20,000-25,000 million.

Pathway B - Online Pharmacy and Digital Health Distribution. The leading distribution channel serves patients seeking convenient access to premium diabetes medications. Providers developing comprehensive digital pharmacy platforms with telemedicine integration, patient support programs, and medication management tools will dominate this primary distribution pathway. Opportunity: USD 15,000-22,000 million.

Pathway C - Next-Generation GLP-1 Therapeutics. Advanced formulations offering improved efficacy, extended dosing intervals, and enhanced patient convenience create competitive advantages. Companies developing once-weekly or once-monthly formulations with superior weight loss and cardiovascular benefits will capture premium market segments and drive market expansion. Revenue uplift: USD 12,000-18,000 million.

Pathway D - Geographic Expansion in High-Growth Markets. China and India's massive diabetes populations and expanding healthcare access create unprecedented opportunities. Strategic market entry with locally adapted pricing strategies, regulatory partnerships, and healthcare provider education enables capture of these highest-growth regional markets. Pool: USD 18,000-28,000 million.

Pathway E - Obesity Management and Weight Loss Applications. Expanding therapeutic indications beyond diabetes into obesity treatment multiplies the addressable market size. Developing GLP-1 therapies specifically optimized for weight management with enhanced efficacy profiles serves the massive global obesity epidemic beyond traditional diabetes care. Expected upside: USD 10,000-16,000 million.

Pathway F - Combination Therapies and Personalized Medicine. Advanced treatment approaches combining GLP-1 with other therapeutic modalities or personalized dosing based on genetic profiles create differentiated value propositions. Companies developing precision medicine approaches and combination therapies will command premium pricing and market leadership positions. USD 8,000-12,000 million.

Pathway G - Cardiovascular Protection and Metabolic Health. Clinical evidence demonstrating cardiovascular benefits expands therapeutic applications beyond diabetes management. Developing GLP-1 therapies with proven cardiovascular outcomes and metabolic health benefits addresses broader patient populations requiring comprehensive cardiometabolic care. Pool: USD 6,000-10,000 million.

Pathway H - Biosimilar Development and Market Access. As patents expire, biosimilar development creates opportunities for broader patient access and market expansion. Companies developing high-quality biosimilar GLP-1 therapies with competitive pricing and proven bioequivalence will democratize access while capturing significant market share in cost-sensitive segments. Expected revenue: USD 4,000-8,000 million.

The market is segmented by drug type, application, and region. By drug type, the market is divided into liraglutide, dulaglutide, exenatide, and others. Based on application, the market is categorized into online pharmacy, hospital, and clinic. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The liraglutide segment is projected to account for 35.5% of the GLP-1 diabetes treatment drugs market in 2025, reaffirming its position as the leading drug type category. Healthcare providers and patients increasingly utilize liraglutide for its superior efficacy profile, established safety record, and proven therapeutic benefits across diverse diabetes management applications. Liraglutide technology's well-documented clinical evidence and reliable therapeutic outcomes directly address the medical requirements for effective glucose control and comprehensive diabetes management in clinical practice operations.

This drug type segment forms the foundation of modern GLP-1 therapy applications, as it represents the medication with the greatest clinical validation and established therapeutic reliability across multiple diabetes treatment protocols. Pharmaceutical investments in liraglutide formulation optimization and delivery enhancement continue to strengthen adoption among healthcare providers. With clinicians prioritizing treatment efficacy and patient outcomes, liraglutide aligns with both therapeutic objectives and safety requirements, making it the central component of comprehensive diabetes treatment strategies.

Online pharmacy applications are projected to represent the 55% market share of GLP-1 diabetes treatment drugs demand in 2025, underscoring their critical role as the primary distribution channel for diabetes medications in digital healthcare and telemedicine operations. Patients and healthcare systems prefer online pharmacy distribution for exceptional accessibility, convenience characteristics, and the ability to maintain a consistent medication supply while supporting patient adherence requirements during diabetes treatment. Positioned as essential channels for high-quality diabetes medication access, online pharmacies offer both patient convenience and healthcare efficiency advantages.

The segment is supported by continuous growth in digital health adoption and the growing availability of specialized telemedicine platforms that enable enhanced medication access and patient support optimization at the healthcare delivery level. Additionally, healthcare systems are investing in digital pharmacy technologies to support patient convenience and medication adherence improvement. As digital health continues to expand and patients seek superior medication access solutions, online pharmacy applications will continue to dominate the application landscape while supporting healthcare digitization and patient care optimization strategies.

The GLP-1 diabetes treatment drugs market is advancing rapidly due to increasing diabetes prevalence and growing demand for comprehensive therapeutic solutions that emphasize superior glycemic control across diabetes management and metabolic health applications. However, the market faces challenges, including high medication costs compared to traditional diabetes treatments, insurance coverage limitations for premium therapies, and supply constraints for specialized manufacturing. Innovation in biosimilar development and manufacturing scalability continues to influence market development and expansion patterns.

The growing adoption of GLP-1 drugs in obesity management and cardiovascular protection applications is enabling pharmaceutical companies to develop therapies that provide distinctive health benefits while commanding premium positioning and enhanced therapeutic scope. Advanced applications provide superior metabolic outcomes while allowing more sophisticated healthcare development across various patient categories and therapeutic segments. Manufacturers are increasingly recognizing the competitive advantages of comprehensive therapeutic positioning for premium drug development and metabolic health market penetration.

Modern GLP-1 drug suppliers are incorporating digital health technologies, personalized dosing systems, and patient monitoring platforms to enhance therapeutic outcomes, improve patient adherence, and meet healthcare demands for intelligent and connected diabetes management solutions. These programs improve treatment effectiveness while enabling new applications, including remote patient monitoring and personalized therapy optimization. Advanced digital integration also allows suppliers to support premium market positioning and healthcare innovation leadership beyond traditional pharmaceutical products.

| Country | CAGR (2025-2035) |

|---|---|

| China | 34.2% |

| India | 31.6% |

| Germany | 29.1% |

| Brazil | 26.6% |

| USA | 24.0% |

| UK | 21.5% |

| Japan | 19.0% |

The GLP-1 diabetes treatment drugs market is experiencing exceptional growth globally, with China leading at a 34.2% CAGR through 2035, driven by the rapidly expanding diabetes population, massive investments in healthcare infrastructure, and increasing adoption of advanced diabetes treatment technologies. India follows at 31.6%, supported by growing diabetes awareness, rising healthcare accessibility, and expanding pharmaceutical manufacturing capabilities. Germany shows growth at 29.1%, emphasizing advanced healthcare technology and premium diabetes treatment solutions. Brazil records 26.6%, focusing on emerging healthcare applications and diabetes care development. The USA demonstrates 24.0% growth, prioritizing innovation in diabetes and advanced pharmaceutical development. The UK exhibits 21.5% growth, supported by healthcare system advancement and diabetes care capabilities. Japan shows 19.0% growth, emphasizing precision healthcare excellence and high-quality pharmaceutical production.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

GLP-1 diabetes treatment drugs in China is projected to exhibit exceptional growth with a CAGR of 34.2% through 2035, driven by the rapidly expanding diabetes population and massive government investments in healthcare infrastructure development across major urban centers. The country's growing healthcare system capacity and increasing adoption of advanced diabetes treatment technologies are creating substantial demand for effective therapeutic solutions in both established and emerging healthcare markets. Major pharmaceutical manufacturers and healthcare companies are establishing comprehensive research and distribution capabilities to serve both domestic healthcare needs and export opportunities.

Revenue from GLP-1 diabetes treatment drugs in India is expanding at a CAGR of 31.6%, supported by growing diabetes awareness, increasing healthcare accessibility, and expanding pharmaceutical manufacturing applications. The country's developing healthcare ecosystem and expanding medical infrastructure are driving demand for effective diabetes treatments across both urban and rural healthcare applications. International pharmaceutical companies and domestic healthcare manufacturers are establishing comprehensive distribution and manufacturing capabilities to address growing market demand for advanced diabetes care solutions.

GLP-1 diabetes treatment drugs market in Germany is projected to grow at a CAGR of 29.1% through 2035, driven by the country's advanced healthcare technology sector, premium diabetes care capabilities, and leadership in pharmaceutical innovation solutions. Germany's sophisticated healthcare system and willingness to invest in high-performance diabetes treatments are creating substantial demand for both established and innovative GLP-1 drug varieties. Leading pharmaceutical companies and healthcare providers are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

GLP-1 diabetes treatment drugs market in Brazil is projected to grow at a CAGR of 26.6% through 2035, supported by the country's expanding healthcare system, growing diabetes care applications, and increasing adoption of modern therapies requiring effective treatment solutions. Brazilian healthcare providers and international companies consistently seek reliable diabetes treatments that improve patient outcomes for both public and private healthcare markets. The country's position as a regional healthcare hub continues to drive innovation in diabetes treatment applications and care standards.

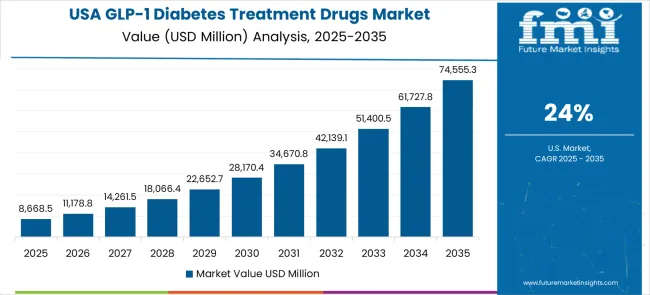

GLP-1 diabetes treatment drugs market in the United States is projected to grow at a CAGR of 24.0% through 2035, supported by the country's advanced diabetes care sector, pharmaceutical innovation capabilities, and established leadership in healthcare solutions. American healthcare providers and pharmaceutical companies prioritize efficacy, safety, and innovation, making GLP-1 drugs essential treatments for both clinical practice and pharmaceutical development. The country's comprehensive healthcare capabilities and medical expertise support continued market development.

Revenue from GLP-1 diabetes treatment drugs in the United Kingdom is projected to grow at a CAGR of 21.5% through 2035, supported by the country's healthcare system development, advanced diabetes care capabilities, and established expertise in pharmaceutical solutions. British healthcare providers' focus on evidence-based medicine, cost-effectiveness, and patient outcomes creates steady demand for proven GLP-1 therapies. The country's attention to healthcare quality and treatment optimization drives consistent adoption across both traditional diabetes care and emerging metabolic health applications.

Demand for GLP-1 diabetes treatment drugs in Japan is projected to grow at a CAGR of 19.0% through 2035, supported by the country's precision healthcare excellence, advanced pharmaceutical expertise, and established reputation for producing superior medical treatments while working to enhance therapeutic precision capabilities and develop next-generation diabetes care technologies. Japan's pharmaceutical industry continues to benefit from its reputation for delivering high-quality healthcare products while focusing on innovation and medical precision.

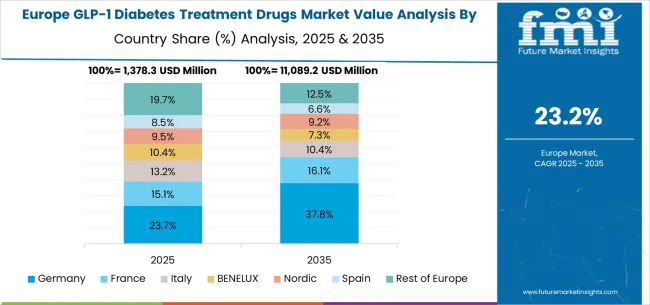

The GLP-1 diabetes treatment drugs market in Europe is projected to grow from USD 1,708.0 million in 2025 to USD 14,836.7 million by 2035, registering a CAGR of 23.3% over the forecast period. Germany is expected to maintain its leadership position with a 26.8% market share in 2025, remaining stable at 26.6% by 2035, supported by its advanced healthcare technology sector, precision diabetes care capabilities, and comprehensive pharmaceutical innovation facilities serving European and international markets.

The United Kingdom follows with a 19.4% share in 2025, projected to reach 19.6% by 2035, driven by healthcare system development programs, advanced diabetes care capabilities, and growing focus on evidence-based diabetes treatment solutions for premium healthcare applications. France holds a 17.1% share in 2025, expected to maintain 16.9% by 2035, supported by healthcare system demand and pharmaceutical applications, but facing challenges from market competition and healthcare budget considerations. Italy commands a 14.3% share in 2025, projected to reach 14.5% by 2035, while Spain accounts for 11.2% in 2025, expected to reach 11.4% by 2035. The Netherlands maintains a 6.8% share in 2025, growing to 6.9% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 16.6% in 2025, declining slightly to 16.3% by 2035, attributed to mixed growth patterns with strong expansion in some healthcare markets balanced by moderate growth in smaller countries implementing diabetes care development programs.

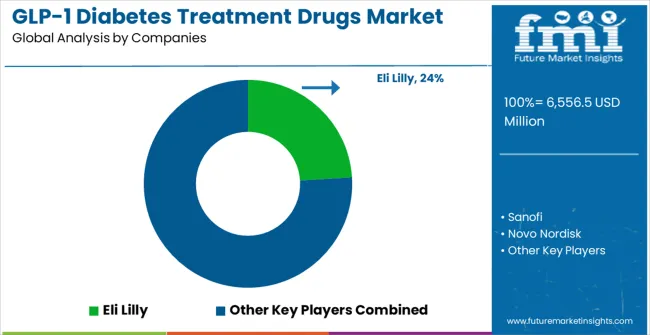

The GLP-1 diabetes treatment drugs market is characterized by competition among established pharmaceutical companies, specialized diabetes care manufacturers, and integrated healthcare solution suppliers. Companies are investing in advanced drug development technologies, clinical research programs, regulatory approval processes, and comprehensive patient support capabilities to deliver consistent, high-efficacy, and safe GLP-1 therapeutic products. Innovation in drug delivery optimization, combination therapy development, and personalized medicine solutions is central to strengthening market position and patient satisfaction.

Eli Lilly leads the market with a strong focus on diabetes care innovation and comprehensive therapeutic solutions, offering sophisticated GLP-1 drug products with emphasis on efficacy assurance and patient outcome excellence. Sanofi provides integrated pharmaceutical capabilities with a focus on diabetes applications and global healthcare networks. Novo Nordisk delivers advanced diabetes technology, focusing on innovation and the development of premium therapeutics. Hanmi Pharmaceutical Co. specializes in pharmaceutical development with emphasis on technical expertise and therapeutic optimization. Boehringer Ingelheim focuses on pharmaceutical research and advanced drug development technologies. AstraZeneca emphasizes cardiovascular and metabolic disease expertise with a focus on comprehensive therapeutic solutions and clinical excellence.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 6,556.5 million |

| Drug Type | Liraglutide, Dulaglutide, Exenatide, Others |

| Application | Online Pharmacy, Hospital, Clinic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Eli Lilly, Sanofi, Novo Nordisk, Hanmi Pharmaceutical Co., Boehringer Ingelheim, AstraZeneca, Pfizer Inc., Teva Pharmaceutical Industries Ltd, GlaxoSmithKline (GSK), Ganli Pharmaceuticals, Tonghua Dongbao, Shanghai Renhui Biopharmaceuticals Co., Ltd., Huadong Medicine, Page Biopharmaceuticals, and Jiangsu Hausen Pharmaceuticals Group Co., Ltd. |

| Additional Attributes | Dollar sales by drug type and application, regional demand trends, competitive landscape, technological advancements in drug development, therapeutic efficacy optimization initiatives, patient access programs, and digital health integration strategies |

The global GLP-1 diabetes treatment drugs market is estimated to be valued at USD 6,556.5 million in 2025.

The market size for the GLP-1 diabetes treatment drugs market is projected to reach USD 62,543.2 million by 2035.

The GLP-1 diabetes treatment drugs market is expected to grow at a 25.3% CAGR between 2025 and 2035.

The key product types in GLP-1 diabetes treatment drugs market are laglutide, dulaglutide, exenatide and others.

In terms of application, online pharmacy segment to command 55.0% share in the GLP-1 diabetes treatment drugs market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Obesity-Diabetes Drugs Market Size and Share Forecast Outlook 2025 to 2035

Glioblastoma Treatment Drugs Market Size and Share Forecast Outlook 2025 to 2035

Bipolar Disorder Drugs and Treatment Market Overview – Trends & Forecast 2025 to 2035

Human Growth Hormone (HGH) Treatment and Drugs Market Trends - Growth & Forecast 2025 to 2035

Diabetes Management Supplements Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Global Diabetes Care Devices Market Analysis - Size, Share & Forecast 2024 to 2034

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Pet Diabetes Care Devices Market Analysis Trends & Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA