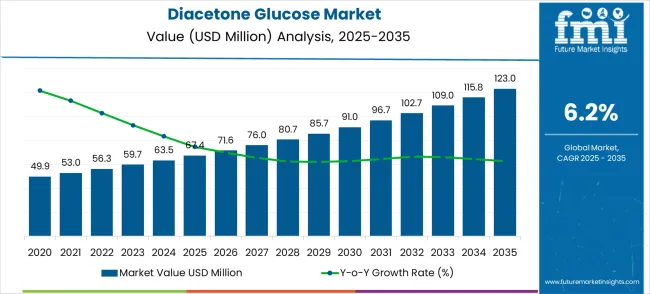

The diacetone glucose market is anticipated to grow from USD 67.4 million in 2025 to USD 123.0 million by 2035, representing a steady CAGR of 6.2%. This steady growth reflects increasing demand for diacetone glucose in applications such as coatings, adhesives, and specialty chemical formulations, driven by trends toward eco-friendly and water-based products. Over the 10-year period, the market demonstrates a consistent upward trajectory without stagnation or decline, indicating stable industry fundamentals. Demand growth is supported by expansion in end-use industries like automotive coatings, construction chemicals, and personal care products, where diacetone glucose’s biodegradability and renewable sourcing add value.

From 2025 to 2028, the market grows from USD 67.4 million to USD 80.7 million, with annual growth rates averaging around 6.2% to 6.5%. This early period reflects the gradual adoption of diacetone glucose-based formulations in coatings and adhesives, spurred by stricter environmental regulations and consumer preference for eco-friendly products. Growth is driven by regulatory mandates in Europe and North America that limit volatile organic compounds (VOCs) in coatings. Manufacturers are increasingly reformulating products with diacetone glucose to meet these requirements, bolstering adoption. This phase represents steady, linear growth with no major volatility.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 67.4 million |

| Forecast Value in (2035F) | USD 123.0 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

Between 2029 and 2032, growth accelerates moderately, with market value rising from USD 85.7 million to USD 102.7 million. Annual increases during this period average USD 4–5 million, supported by expanded applications in personal care and pharmaceuticals. The market benefits from growing research into bio-based surfactants and functional additives, where diacetone glucose serves as a renewable carbon source. Emerging markets in Asia-Pacific and Latin America are contributing meaningfully, as industrial production and environmental regulation gain momentum. This period sees a slightly higher growth rate compared with earlier years, consistent with expanding industrial adoption.

From 2033 to 2035, the market grows from USD 109.0 million to USD 123.0 million, with annual increments averaging USD 6–7 million. This period reflects consolidation of diacetone glucose applications across industries, with mature markets maintaining steady growth while emerging markets sustain higher adoption rates. Trendline analysis suggests a near-linear growth trajectory, with modest acceleration as innovation and market penetration continue. Over the full decade, the consistent CAGR of 6.2% underlines stable long-term growth, with no signs of stagnation, and positions the diacetone glucose market for steady expansion driven by eco-friendly product trends and broader regulatory support globally.

Market expansion is being supported by the increasing demand for pharmaceutical intermediates and the corresponding need for high-purity chemical building blocks in drug synthesis processes across global pharmaceutical manufacturing operations. Modern pharmaceutical manufacturers are increasingly focused on specialized intermediates that can improve reaction efficiency, reduce impurities, and enhance final product quality while meeting stringent regulatory requirements. The proven efficacy of diacetone glucose in various synthesis pathways makes it an essential component of comprehensive chemical manufacturing processes and pharmaceutical intermediate production.

The growing focus on precision chemistry and advanced pharmaceutical synthesis is driving demand for ultra-pure diacetone glucose that meets stringent quality specifications and regulatory requirements for pharmaceutical applications. Chemical manufacturers' preference for reliable, high-quality intermediates that can ensure consistent production outcomes is creating opportunities for innovative purification technologies and customized synthesis solutions. The rising influence of regulatory guidelines and quality assurance protocols is also contributing to increased adoption of premium-grade diacetone glucose across different manufacturing applications and therapeutic areas requiring specialized chemical intermediates.

The diacetone glucose market represents a specialized growth opportunity, expanding from USD 67.4 million in 2025 to USD 123.0 million by 2035 at a 6.2% CAGR. As pharmaceutical manufacturers prioritize synthesis efficiency, regulatory compliance, and product quality in complex drug development processes, diacetone glucose has evolved from a niche chemical intermediate to an essential building block enabling stereoselective reactions, molecular modifications, and multi-step pharmaceutical synthesis across active pharmaceutical ingredient production and contract manufacturing operations.

The convergence of pharmaceutical industry expansion, increasing generic drug production, contract research organization growth, and precision chemistry requirements creates steady momentum in demand. High-purity formulations offering superior synthesis performance, cost-effective 98% purity grades balancing quality with economics, and specialized ultra-pure variants for critical applications will capture market premiums, while geographic expansion into high-growth Asian pharmaceutical hubs and emerging market penetration will drive volume leadership. Regulatory focus on pharmaceutical quality and supply chain reliability provides structural support.

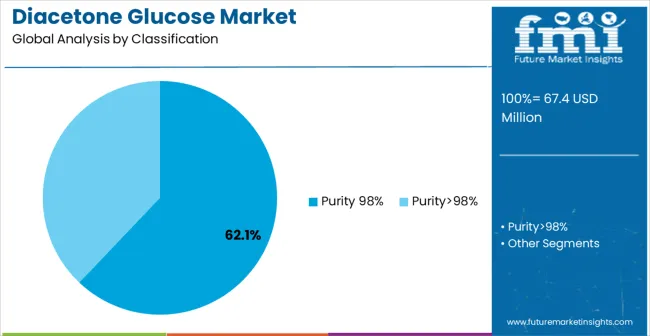

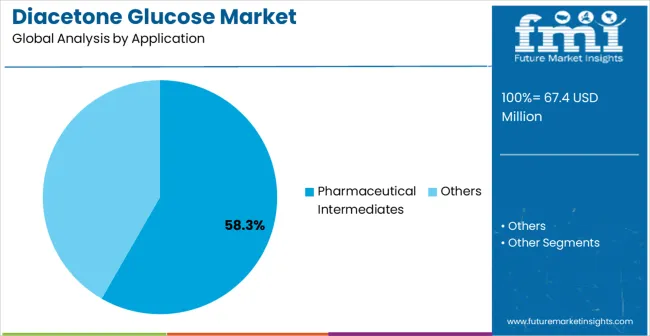

The market is segmented by purity, application, and region. By purity, the market is divided into Purity 98% and Purity >98%. Based on application, the market is categorized into Pharmaceutical Intermediates and Others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The Purity 98% segment is projected to account for 62.1% of the diacetone glucose market in 2025, reaffirming its position as the category's dominant purity grade. Chemical manufacturers increasingly recognize the optimal balance of purity and cost-effectiveness offered by 98% purity diacetone glucose for most industrial applications, particularly in pharmaceutical intermediate synthesis and chemical manufacturing processes. This purity grade addresses both quality requirements and economic considerations while providing reliable performance across diverse synthesis applications.

This purity grade forms the foundation of most manufacturing protocols for chemical synthesis applications, as it represents the most widely accepted and commercially viable level of purification in the industry. Quality control standards and extensive application testing continue to strengthen confidence in 98% purity formulations among pharmaceutical and chemical manufacturers. With increasing recognition of the cost-performance optimization requirements in chemical manufacturing, Purity 98% diacetone glucose aligns with both production efficiency and quality assurance goals, making it the central growth driver of comprehensive synthesis strategies.

Pharmaceutical Intermediates is projected to represent 58.3% of diacetone glucose demand in 2025, underscoring its role as the primary application driving market adoption and growth. Chemical manufacturers recognize that pharmaceutical synthesis requirements, including complex molecular modifications, stereoselective reactions, and multi-step processes, often require specialized glucose derivatives that standard chemicals cannot adequately provide. Diacetone glucose offers enhanced reactivity and selectivity in pharmaceutical intermediate synthesis applications.

The segment is supported by the growing nature of pharmaceutical research requiring sophisticated chemical building blocks and the increasing recognition that specialized intermediates can improve synthesis efficiency and product quality. The pharmaceutical companies are increasingly adopting evidence-based manufacturing guidelines that recommend specific glucose derivatives for optimal synthesis outcomes. As understanding of pharmaceutical chemistry complexity advances and regulatory requirements become more stringent, diacetone glucose will continue to play a crucial role in comprehensive synthesis strategies within the chemical intermediates market.

The market is advancing steadily due to increasing recognition of specialized chemical intermediates' importance and growing demand for high-purity synthesis building blocks across the pharmaceutical and chemical manufacturing sectors. The market faces challenges, including complex purification processes, potential for degradation during storage and transportation, and concerns about supply chain consistency for specialized chemical products. Innovation in purification technologies and customized synthesis protocols continues to influence product development and market expansion patterns.

The growing adoption of advanced chemical manufacturing facilities is enabling the development of more sophisticated diacetone glucose production and quality control systems that can meet stringent pharmaceutical requirements. Specialized manufacturing plants offer comprehensive purification services, including advanced distillation and crystallization processes that are particularly important for achieving high-purity requirements in pharmaceutical applications. Advanced purification channels provide access to ultra-pure grades that can optimize synthesis performance and reduce impurities while maintaining cost-effectiveness for large-scale production.

Modern chemical companies are incorporating digital technologies such as real-time quality monitoring, automated production control systems, and supply chain integration to enhance diacetone glucose manufacturing and distribution processes. These technologies improve product consistency, enable continuous quality assurance, and provide better coordination between manufacturers and customers throughout the supply chain. Advanced digital platforms also enable customized purity specifications and early identification of potential quality deviations or supply disruptions, supporting reliable pharmaceutical intermediate production.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

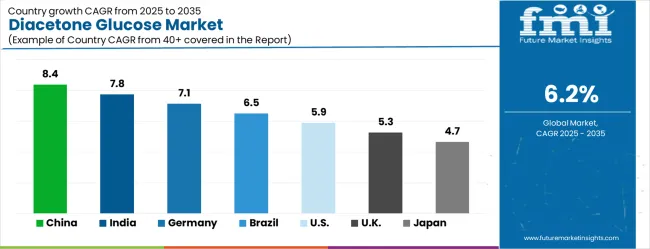

The market is experiencing varied growth globally, with China leading at an 8.4% CAGR through 2035, driven by expanding pharmaceutical manufacturing infrastructure, increasing chemical synthesis capabilities, and growing domestic demand for high-purity intermediates. India follows at 7.8%, supported by pharmaceutical industry expansion, increasing recognition of specialized chemical intermediates' importance, and expanding manufacturing capacity. Germany shows growth at 7.1%, focusing advanced chemical manufacturing technologies and precision chemistry applications. Brazil records 6.5% growth, focusing on developing the pharmaceutical and chemical industries. The USA shows 5.9% growth, representing a mature market with established manufacturing patterns and regulatory frameworks. The UK exhibits 5.3% growth, supported by advanced manufacturing frameworks and comprehensive synthesis guidelines. Japan demonstrates 4.7% growth, prioritizing precision chemical manufacturing infrastructure and systematic quality control approaches.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to exhibit robust growth with a CAGR of 8.4% through 2035, driven by ongoing pharmaceutical industry expansion and increasing recognition of high-purity chemical intermediates as essential manufacturing components for complex synthesis processes. The country's expanding chemical manufacturing infrastructure and growing availability of specialized synthesis capabilities are creating significant opportunities for diacetone glucose adoption across both domestic and export-oriented production facilities. Major international and domestic chemical companies are establishing comprehensive production and distribution networks to serve the growing population of pharmaceutical and chemical manufacturers requiring high-quality glucose derivatives across industrial and research applications throughout China's major manufacturing hubs.

The Chinese government's strategic focus on pharmaceutical self-sufficiency and advanced chemical manufacturing is driving substantial investments in specialized intermediate production capabilities. This policy support, combined with the country's large domestic market and expanding export opportunities, creates a favorable environment for diacetone glucose market development. Chinese manufacturers are increasingly focusing on high-value chemical intermediates to move up the value chain, with diacetone glucose representing a key component in this strategic transformation.

India is expanding at a CAGR of 7.8%, supported by increasing pharmaceutical manufacturing accessibility, growing chemical synthesis awareness, and developing industrial market presence across the country's major pharmaceutical manufacturing clusters. The country's large pharmaceutical industry and increasing recognition of specialized chemical intermediates are driving demand for effective high-purity glucose derivative solutions in both generic drug manufacturing and research and development applications. International chemical companies and domestic manufacturers are establishing comprehensive distribution channels to serve the growing demand for quality pharmaceutical intermediates while supporting the country's position as a global pharmaceutical manufacturing hub.

India's pharmaceutical sector continues to benefit from favorable regulatory policies, skilled workforce availability, and cost-competitive manufacturing capabilities. The country's focus on becoming a global pharmaceutical supply chain hub is driving investments in specialized intermediate production and quality infrastructure. This development is particularly important for diacetone glucose applications, as pharmaceutical manufacturers seek reliable domestic sources for critical chemical building blocks to reduce import dependency and improve supply chain security.

Demand for diacetone glucose in Germany is projected to grow at a CAGR of 7.1%, supported by well-established chemical manufacturing systems and precision chemistry protocols that prioritize quality, consistency, and regulatory compliance. German chemical manufacturers consistently utilize high-purity intermediates for complex synthesis applications and advanced pharmaceutical manufacturing, with particular strength in specialty chemicals and high-value pharmaceutical intermediates. The market is characterized by mature manufacturing protocols, comprehensive quality standards, and established relationships between chemical companies and pharmaceutical manufacturers that support long-term supply agreements and technical collaboration.

Germany's chemical industry benefits from advanced research and development capabilities, sophisticated manufacturing infrastructure, and strong regulatory frameworks that support high-quality chemical production. The country's focus on innovation and sustainability is driving the development of more efficient synthesis processes and cleaner production methods for specialized intermediates like diacetone glucose. This focus on technological advancement and environmental responsibility aligns with global trends toward ecofriendly chemical manufacturing practices.

Brazil is projected to grow at a CAGR of 6.5% through 2035, driven by chemical industry development, increasing access to pharmaceutical manufacturing capabilities, and growing recognition of specialized intermediates' importance in complex synthesis applications. Brazilian chemical manufacturers are increasingly adopting high-purity intermediate approaches for complex synthesis applications, supported by expanding pharmaceutical market presence and improved manufacturing accessibility across the country's major industrial regions. The market benefits from Brazil's large domestic pharmaceutical sector and growing participation in regional pharmaceutical supply chains.

Brazil's chemical industry is experiencing modernization and expansion, particularly in pharmaceutical intermediates and specialty chemicals. The country's strategic location and trade agreements provide access to both domestic and export markets, creating opportunities for diacetone glucose suppliers. Government support for pharmaceutical and chemical industry development, combined with increasing private sector investment, is driving infrastructure improvements and capacity expansion in specialized chemical manufacturing.

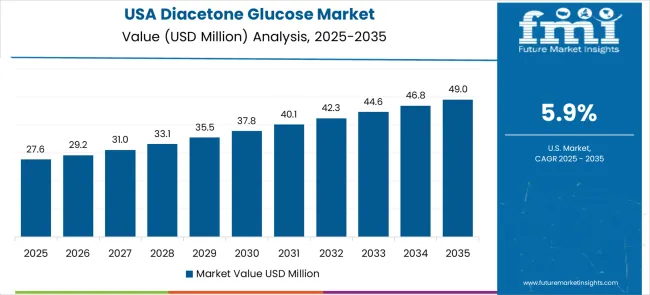

The USA is projected to grow at a CAGR of 5.9% through 2035, supported by established chemical manufacturing systems, evidence-based synthesis protocols, and comprehensive pharmaceutical manufacturing frameworks that prioritize quality, safety, and regulatory compliance. American chemical manufacturers consistently utilize high-purity intermediates as part of integrated synthesis approaches, focusing manufacturing outcomes and quality optimization in both generic and innovative pharmaceutical production. The market benefits from strong research and development capabilities, advanced manufacturing infrastructure, and well-established regulatory frameworks.

The USA pharmaceutical industry's focus on innovation and quality drives demand for specialized chemical intermediates that can support complex synthesis processes and meet stringent regulatory requirements. The country's mature market characteristics include established supplier relationships, comprehensive quality standards, and sophisticated logistics networks that support reliable supply chain management for critical pharmaceutical intermediates.

The UK is projected to grow at a CAGR of 5.3% through 2035, supported by advanced manufacturing frameworks and comprehensive evidence-based synthesis guidelines that facilitate the appropriate use of high-purity intermediates for complex chemical manufacturing applications. British chemical manufacturers consistently utilize established protocols for intermediate management, focusing synthesis outcomes and quality optimization within integrated manufacturing systems that support both domestic pharmaceutical production and export markets. The country benefits from strong research capabilities, established pharmaceutical clusters, and comprehensive regulatory support.

The UK's pharmaceutical and chemical industries are characterized by high levels of innovation, strong academic-industry collaboration, and focus on high-value specialty products. The country's Brexit transition has created both challenges and opportunities, with increased focus on domestic supply chain development and regulatory independence driving investments in specialized chemical manufacturing capabilities.

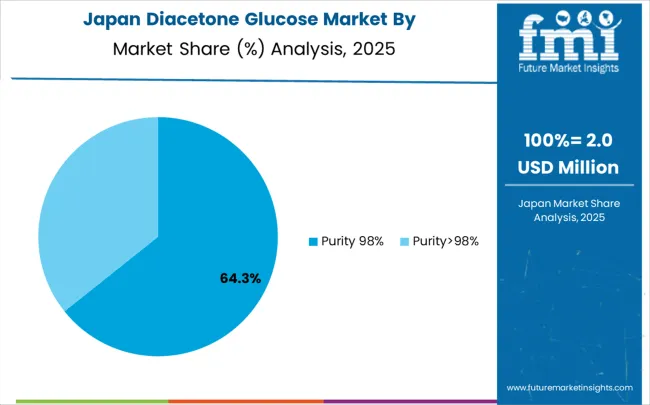

Japan is projected to grow at a CAGR of 4.7% through 2035, supported by the country's well-established precision chemical manufacturing infrastructure, comprehensive quality coverage, and systematic approach to chemical synthesis that prioritizes consistency, reliability, and technical excellence. Japanese chemical manufacturers prioritize evidence-based intermediate utilization within structured manufacturing frameworks that prioritize synthesis effectiveness and product quality in both pharmaceutical and specialty chemical applications. The market is characterized by high technical standards, established quality systems, and long-term supplier relationships.

Japan's chemical industry benefits from advanced technology, sophisticated quality control systems, and a strong focus on continuous improvement. The country's aging population and focus on healthcare create steady demand for pharmaceutical intermediates, while the focus on high-quality manufacturing supports premium pricing for specialized chemical products like diacetone glucose.

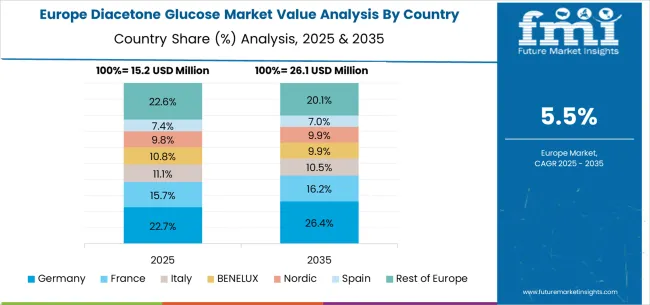

The diacetone glucose market in Europe is projected to grow from USD 18.2 million in 2025 to USD 33.1 million by 2035, registering a CAGR of 6.2% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, rising to 29.1% by 2035, supported by its advanced chemical manufacturing infrastructure, precision chemistry capabilities, and strong pharmaceutical industry presence throughout major industrial regions.

The United Kingdom follows with a 21.3% share in 2025, projected to reach 21.8% by 2035, driven by advanced manufacturing protocols, chemical innovation integration, and expanding specialty chemical networks serving both domestic and international markets. France holds an 18.2% share in 2025, expected to increase to 18.6% by 2035, supported by pharmaceutical industry expansion and growing adoption of high-purity intermediates. Italy commands a 14.1% share in 2025, projected to reach 14.3% by 2035, while Spain accounts for 9.7% in 2025, expected to reach 9.9% by 2035. The BENELUX region is expected to maintain a 4.8% share in 2025, growing to 5.1% by 2035, supported by innovation-friendly regulatory frameworks and strong academic-industry collaboration. The Rest of Europe region, including Nordic countries, Eastern Europe, and smaller Western European markets, is anticipated to hold 3.4% in 2025, declining slightly to 3.2% by 2035, attributed to market consolidation toward larger core markets with established pharmaceutical and chemical manufacturing capabilities.

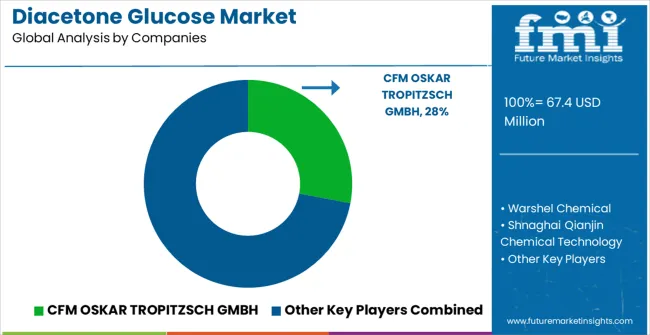

The market is characterized by competition among established chemical manufacturers, specialty synthesis companies, and pharmaceutical intermediate suppliers focused on delivering high-quality, consistent, and reliable chemical building blocks. Companies are investing in purification technology advancement, quality control enhancement, strategic partnerships, and customer technical support to deliver effective, pure, and reliable diacetone glucose solutions that meet stringent pharmaceutical and chemical manufacturing requirements. Chemical synthesis optimization, quality validation protocols, and supply chain strategies are central to strengthening product portfolios and market presence.

CFM OSKAR TROPITZSCH GMBH leads the market with comprehensive high-purity chemical intermediate offerings with a focus on quality consistency and manufacturing reliability for pharmaceutical applications. Warshel Chemical provides specialized diacetone glucose products with focus on pharmaceutical applications and comprehensive technical support services. Shanghai Qianjin Chemical Technology focuses on advanced manufacturing technologies and customized purification solutions for glucose derivatives serving Asian markets. Zhejiang Synose Tech delivers established intermediate products with strong quality control systems and customer service capabilities.

Bio-sugars Technology operates with a focus on bringing innovative glucose derivative technologies to specialized manufacturing applications and emerging markets. Xinxiang Aurora Biotechnology provides comprehensive chemical intermediate portfolios, including diacetone glucose, across multiple industrial applications and pharmaceutical synthesis processes. Wuhan Fortuna Chemical specializes in customized synthesis solutions and quality management systems for glucose derivatives with focus on pharmaceutical compliance. Jinan Future Chemical provides reliable supply chain solutions and technical expertise to enhance market accessibility and customer access to essential chemical intermediates.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 67.4 million |

| Purity | Purity 98%, Purity >98% |

| Application | Pharmaceutical Intermediates, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | CFM OSKAR TROPITZSCH GMBH, Warshel Chemical, Shanghai Qianjin Chemical Technology, Zhejiang Synose Tech, Bio-sugars Technology, Xinxiang Aurora Biotechnology, Wuhan Fortuna Chemical, Jinan Future Chemical |

| Additional Attributes | Dollar sales by purity grade and application, regional demand trends, competitive landscape, manufacturer preferences for specific purity levels, integration with specialty chemical supply chains, innovations in purification technologies, quality control monitoring, and synthesis optimization |

The global diacetone glucose market is estimated to be valued at USD 67.4 million in 2025.

The market size for the diacetone glucose market is projected to reach USD 123.0 million by 2035.

The diacetone glucose market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in diacetone glucose market are purity 98% and purity>98%.

In terms of application, pharmaceutical intermediates segment to command 58.3% share in the diacetone glucose market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diacetone Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Glucose Sensor Market Size and Share Forecast Outlook 2025 to 2035

Glucose Oxidase Market Analysis – Trends & Forecast 2025-2035

Glucose-Fructose Syrup Market – Growth, Demand & Food Industry Trends

Glucose Monitoring Device Market Overview – Growth, Trends & Forecast 2024-2034

Glucose Syrup Market

OTC Glucose Monitors Market Size and Share Forecast Outlook 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Starch Glucose Syrup Market

Dynamic Glucose Monitoring Patch Market Size and Share Forecast Outlook 2025 to 2035

Starches/Glucose Market

Long-wear Glucose Sensors Market Size and Share Forecast and Outlook 2025 to 2035

Demand for Glucose Monitoring Devices in EU Size and Share Forecast Outlook 2025 to 2035

Continuous Glucose Monitoring Device Market - Demand & Future Trends 2025 to 2035

Continuous Glucose Monitoring Systems Market is segmented by transmitters and monitors, sensors and insulin pump from 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for OTC Glucose Monitors in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for OTC Glucose Monitors in USA Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA