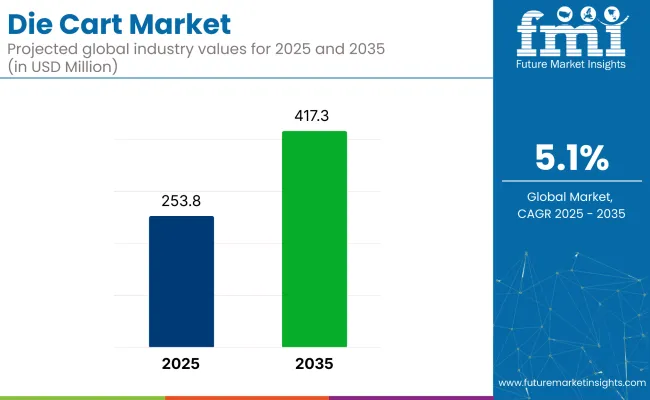

The die cart market is expected to grow from USD 253.8 million in 2025 to USD 417.3 million by 2035, registering a CAGR of 5.1% during the forecast period. The growth is being driven by the increasing demand for efficient die change processes across industries like automotive, manufacturing, and metalworking.

Carbon-free hoses, recognized for their non-conductive properties, are gaining popularity as they are being used to provide safe alternatives to traditional hoses in applications where electrical conductivity is a concern. Their adoption is expected to rise as industries are looking to meet eco-friendly and safety standards.

The die cart market holds a significant share in several related markets. Within the material handling equipment market, the die cart segment accounts for approximately 8%, driven by the demand for efficient transportation systems in manufacturing. In the industrial automation market, the die cart market holds around 5% due to increasing automation in production lines.

In the manufacturing equipment sector, it captures about 6% of the market, as die carts are critical for material movement in heavy-duty manufacturing settings. The logistics and supply chain market sees around 4% share, influenced by the need for optimized cargo handling. The automotive parts market contributes about 3%, as die carts play an essential role in automotive manufacturing.

On April 4, 2024, Hedin Lagan Sweden introduced Quick Die Change Trucks (QDC) with a 30-ton capacity, which are designed to improve die change efficiency. These trucks have been engineered with individually or tandem-controlled push/pull mechanisms to ensure seamless operation.

The QDC’s docking system, featuring hydraulic or mechanical docking capabilities, ensures the precise alignment of die trucks with presses and storage stations. With optimized turning radius and clear view masts, these trucks are expected to significantly enhance maneuverability in confined spaces, making them more suitable for high-performance applications.

The die cart market is segmented by product type into manual and powered die carts, with powered carts further divided into diesel and electric. By capacity, the industry includes low capacity, medium capacity, high capacity, and ultra-high capacity die carts.

End use segmentation covers automotive and transportation, metal fabrication, tool and die industry, foundries, manufacturing, and others. The industry spans North America, Latin America, Eastern Europe, Western Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Powered die carts are expected to capture 70% of the industry share in 2025, with diesel-powered carts holding a 40% share and electric-powered carts accounting for 30%. These carts are essential for transporting heavy dies and molds within manufacturing plants, offering increased efficiency and operational flexibility.

Diesel-powered carts are preferred for their reliability in heavy-duty applications, while electric-powered models are gaining popularity due to their lower environmental impact and reduced operational costs. The industry’s growth is driven by increasing demand in automotive, industrial, and transportation sectors, where these carts are essential for ensuring smooth operations in high-volume production environments.

Medium-capacity die carts are expected to account for 35% of the industry share in 2025. These carts strike a balance between handling heavy loads and providing operational flexibility in various industries. Medium-capacity models are widely used in automotive manufacturing, where precise, efficient die handling is critical for production lines.

The rising demand for versatile and cost-effective transportation solutions is driving the preference for medium-capacity carts. Medium-capacity carts are favored for their ability to be easily integrated into existing manufacturing systems, ensuring smooth operations without compromising safety or efficiency.

The automotive and transportation sector is projected to capture 25% of the industry in 2025. The growth in this sector is driven by the increasing need for efficient die handling in the production of automotive components, which require precise and reliable transportation.

These carts are crucial in transporting heavy dies, molds, and other parts across automotive manufacturing facilities. The growing demand for high-quality, precision-engineered components and the increasing complexity of automotive designs are driving the need for more advanced and efficient solutions in this sector.

The industry is expanding due to the increasing demand for efficient material handling solutions, particularly in industries like automotive and aerospace. The high initial investment cost of these carts remains a significant challenge, especially for smaller businesses.

Growing Need for Efficient Material Handling Systems

As manufacturing processes become more complex, the demand for efficient material handling solutions is increasing. These carts are crucial for industries such as automotive, aerospace, and heavy machinery, where they optimize productivity by reducing human labor and ensuring the precise handling of heavy materials.

These carts are being prioritized for their ability to enhance operational efficiency, minimize safety risks associated with manual handling, and improve the overall productivity of industrial operations.

High Initial Investment for Die Cart Systems

Despite their operational benefits, the high initial investment cost of these carts presents a challenge for many businesses, particularly small manufacturers with limited budgets. The significant upfront costs for advanced systems often lead companies to opt for less costly alternatives or manual handling methods.

While these options may reduce initial expenses, they can compromise long-term operational efficiency, potentially impacting competitiveness and productivity. This financial barrier limits the broader adoption of these carts across smaller businesses.

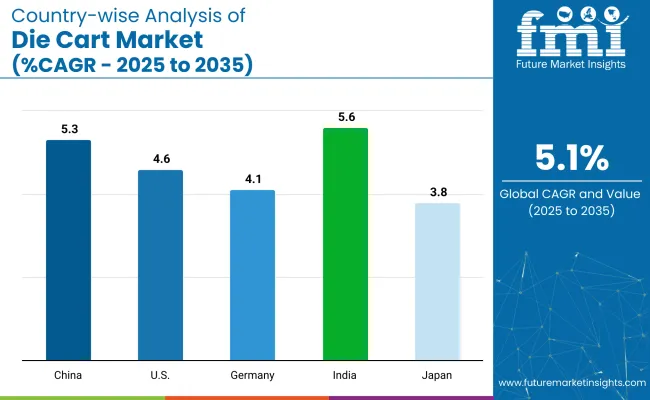

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

| Germany | 4.1% |

| China | 5.3% |

| India | 5.6% |

| Japan | 3.8% |

Global industry demand is projected to rise at a 5.1% CAGR from 2025 to 2035. Of the five profiled industries out of 40 covered, India leads at 5.6%, followed by China at 5.3% and the United States at 4.6%, while Germany posts 4.1% and Japan records 3.8%.

These rates translate to a growth premium of +10% for India, +4% for China, and -9% for the United States versus the baseline, whereas Germany and Japan trail by -20% and -25%, respectively. Divergence reflects local catalysts: rapid industrialization and infrastructure expansion in India, strong manufacturing activity in China, mature manufacturing frameworks in the USA, and slower growth in traditional manufacturing sectors in Germany and Japan.

The industry in the United States is set to record a CAGR of 4.6% through 2035.

Growth has been driven by the modernization of manufacturing and logistics networks that rely on precision material handling. Companies like Toyota Material Handling, Dematic, and NACCO Materials Handling Group are focusing on designing ergonomic, high-load-capacity carts with electric and automated controls.

These advancements support productivity improvements in automotive, aerospace, and component assembly sectors. Lean manufacturing principles and warehouse automation have further raised demand for carts that reduce downtime during tool changeovers and die movements across production lines.

Sales of these carts in Germany are projected to grow at a CAGR of 4.1% through 2035.

Strong industrial engineering foundations and strict compliance with material handling standards have propelled demand. Leading firms such as Jungheinrich, Still GmbH, and SSI Schaefer have launched smart cart models featuring energy recovery systems and RFID-enabled movement control.

Germany’s emphasis on efficient shopfloor logistics and minimal operator fatigue has aligned well with the growth of high-precision carts. Automotive and electrical-equipment sectors have played a central role in adoption, further strengthened by institutional investment in warehouse automation.

Growing at a CAGR of 5.3%, China’s industry is rapidly expanding with industrial scale-up and material flow optimization initiatives. Domestic producers like Shanghai Material Handling and Linde Material Handling have boosted production, targeting both internal demand and export potential.

The government's smart manufacturing plans have prioritized robotics and flexible transport systems, where these carts fit seamlessly. Use in large-scale factories manufacturing automotive electronics, metal components, and heavy machinery has expanded quickly, reinforced by state incentives on industrial digitization.

Demand for these carts in India is estimated to grow at a CAGR of 5.6% through 2035.

Expanding infrastructure and manufacturing zones under government programs such as Make in India have spurred investments in modern material handling. Domestic firms like Godrej & Boyce, along with Toyota Material Handling and Mahindra, have introduced modular carts compatible with industrial automation protocols.

Key users include automotive and component producers in Tamil Nadu, Maharashtra, and Gujarat. Logistics parks and warehousing nodes are integrating mechanized cart systems for faster material turnover.

The industry in Japan is projected to grow at a CAGR of 3.8% through 2035. Automation-first principles and compact production lines have necessitated precision carts with smart navigation and motor-assist systems. Mitsubishi Logisnext, Daifuku, and Toyota Industries Corporation are advancing low-noise, high-durability carts tailored for space-constrained environments.

Use cases are expanding in semiconductor, medical equipment, and advanced electronics manufacturing where vibration control and zero-emission operations are critical. Cart fleet upgrades are supported by digital twin models integrated with factory simulation systems.

Leading Company - Green Valley Manufacturing Industry Share - 25%

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Green Valley Manufacturing, Henan Perfect Handling Equipment Co., Ltd., and Hansford Parts & Products lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across manufacturing, automotive, and heavy industries.

Key players including SRS (BMH Equipment), Atlas Technologies, and Forwell Precision Machinery offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Streamline Packaging, Tamper Tech, and VIBAC Group, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Die Cart Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 253.8 million |

| Projected Industry Size (2035) | USD 417.3 million |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and units for volume |

| Product Types Analyzed (Segment 1) | Manual, Powered (Diesel, Electric) |

| Capacities Analyzed (Segment 2) | Low Capacity, Medium Capacity, High Capacity, Ultra High Capacity |

| End Uses Analyzed (Segment 3) | Automotive & Transportation, Metal Fabrication, Tool & Die Industry, Foundries, Manufacturing, Others |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players influencing the Industry | SRS (BMH Equipment), Hansford Parts & Products, Henan Perfect Handling Equipment Co., Ltd., Forwell Precision Machinery, Green Valley Manufacturing, Nordson Corporation (EDI), Atlas Technologies |

| Additional Attributes | Dollar sales, share by product type and capacity, growth in automotive and metal fabrication sectors, innovations in powered die carts, regional industry dynamics |

The industry is segmented into manual and powered die carts, with powered carts further divided into diesel and electric.

The industry includes low capacity, medium capacity, high capacity, and ultra high capacity die carts.

The industry covers automotive & transportation, metal fabrication, tool & die industry, foundries, manufacturing, and others.

The industry spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

The industry is expected to reach USD 417.3 million by 2035.

The industry is projected to be USD 253.8 million in 2025.

The industry is expected to grow at a CAGR of 5.1%.

The "Medium Capacity" segment is expected to lead with a 42% industry share.

Asia Pacific, particularly India, is expected to grow at a 5.6% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Parking Heater Market Size and Share Forecast Outlook 2025 to 2035

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Die Cut Support Pads Market Size and Share Forecast Outlook 2025 to 2035

Diethyl Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Dietary Supplement Market Insights - Growth & Demand 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Dietary Fiber Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Die Cut Display Container Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA