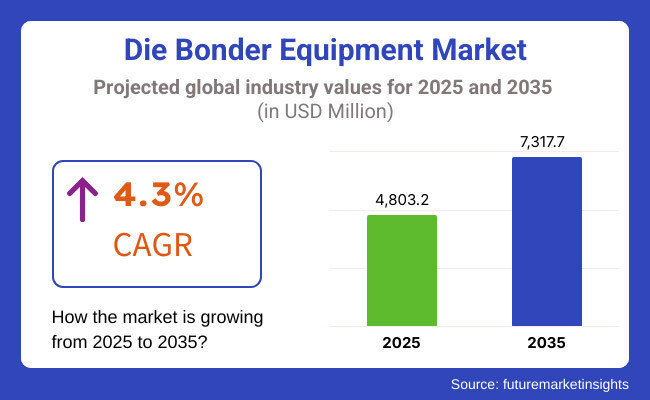

The die bonder equipment market is anticipated to reach USD 4.80 billion in 2025 and rise to USD 7.32 billion by 2035, growing at a CAGR of 4.3%. Asia-Pacific will continue to dominate the market, fueled by strong semiconductor manufacturing bases in Taiwan, South Korea, and China.

Among these, South Korea is expected to be the fastest-growing market, expanding at a CAGR of 5.1%, supported by government incentives, advancements in chip stacking, and increased investments in AI, 5G, and memory chip technologies.

The market is currently undergoing a transformative shift, largely driven by surging demand for advanced semiconductor packaging across key verticals such as 5G infrastructure, IoT networks, EV powertrains, and AI-integrated computing. Trends like chip miniaturization, heterogeneous integration, and the evolution of 3D packaging and chiplet-based architectures are pushing manufacturers to adopt highly precise, efficient bonding systems.

However, high capital costs, complex architectures, and persistent supply chain challenges, including geopolitical disruptions and material shortages, are restraining broader adoption. Despite this, manufacturers are ramping up R&D, embracing hybrid bonding, and integrating automation to enhance yield and cut costs.

Looking forward, 2025 to 2035 will be shaped by AI-enabled die bonders, fully automated lines, and energy-efficient technologies. Sustainability will play a vital role, with a growing focus on lead-free, recyclable materials. Government policies, such as the CHIPS Act in the USA and the European Chips Act, will strengthen regional semiconductor ecosystems, fueling demand for next-generation bonding equipment.

As new markets emerge in the Middle East and Latin America, the global reach of die bonder equipment will expand further. These regions are actively investing in semiconductor infrastructure to reduce reliance on imports and create local value chains. Meanwhile, equipment manufacturers are expected to prioritize modular, scalable solutions to serve both high-volume fabs and niche applications. The trend of smart manufacturing and digital twins will also enhance equipment flexibility, diagnostics, and predictive maintenance, ensuring higher uptime and optimized throughput.

The die bonder equipment market, by product type, includes manual, semi-automatic, and fully automatic systems. Based on end use, the market is segmented into integrated device manufacturers (IDMs) and outsourced semiconductor assembly and test (OSAT) companies. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, and the Middle East & Africa.

Fully automatic systems are projected to grow at a CAGR of 5.2% from 2025 to 2035, making them the most lucrative segment in the market. The product landscape is divided into manual, semi-automatic, and fully automatic die bonder equipment. Fully automatic machines are forecasted to witness the highest growth due to their ability to offer superior speed, accuracy, and minimal operator intervention. These are ideal for high-volume semiconductor production, particularly with advanced packaging techniques like flip-chip and 3D stacking.

Semi-automatic equipment maintains a notable presence, especially among mid-size manufacturers and specialized applications such as aerospace and medical electronics, where flexibility and controlled throughput are valued. Manual systems, on the other hand, are expected to see diminishing demand due to limited scalability and labor dependency. The demand for fully automatic bonders is most robust in Asia-Pacific, particularly in Taiwan, China, and South Korea, where next-generation chip manufacturing is thriving.

| Product Type Segment | CAGR (2025 to 2035) |

|---|---|

| Fully Automatic | 5.2% |

IDMs are projected to grow at a CAGR of 4.6% from 2025 to 2035, making them the leading end-use segment in the die bonder equipment market. IDMs are expected to dominate due to their vertically integrated operations from chip design to final packaging which enable tighter control over automation, yield, and quality.

Their early adoption of advanced bonding systems supports high-performance computing, AI, and 5G applications. OSATs continue to play a pivotal role, especially in fast-developing regions such as Malaysia, Vietnam, and China, where cost-effective, outsourced semiconductor packaging is accelerating. OSAT companies are investing in equipment upgrades to support heterogeneous integration, wafer-level packaging, and new chiplet-based architectures.

Although their CAGR is slightly lower than IDMs, OSATs remain key to serving fabless companies and startups seeking affordable, high-precision packaging solutions. Together, these end-use segments ensure continuous demand across both high-volume and specialized semiconductor applications.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Integrated Device Manufacturers (IDMs) | 4.6% |

High Cost and Capital-Intensive Nature

The most significant challenge in the die bonder equipment market is the initial investment cost, which is high, and the capital needed to be used, which is operationally heavy with respect to advanced semiconductor packaging. Die bonding machines, particularly the fully automated ones and the AI-integrated, are capital-intensive and therefore, it can become difficult for smaller companies to enter into markets.

Besides, the equipment gets older and so do the operational expenses with maintenance work and software updates that occur. The development rate of technology, however, also requires equipment manufacturers to keep up with investment burdens from forcing frequent reconfiguration of the plant's process.

The mixed architecture issue and chiplet-based designs that demand ultra-precise and tailored bonding solutions at an instance make cost-effective production nearly impossible. Firms are forced to seek other ways such as forging alliances, and automation of production processes to ensure their business stays afloat.

Supply Chain Disruptions and Geopolitical Tensions

The die bonder equipment market suffers significantly from the global concerns and semiconductor availability as well as geopolitical tensions. Trade restrictions, particularly those between the USA and China, drove uncertainty in semiconductor equipment exporting, which affected the global production.

Raw materials such as silicon wafers and bonding adhesives have had shortages that have led to delays in production timelines whereas logistical issues and fluctuating raw material prices encumber the operational areas of semiconductor manufacturers.

The shifting operations of the on shoring regional trend in production disrupts traditional supply chain networks and this could force a reconfiguration of the manufacturing process. Mitigating these risks and managing continuous market growth with the help of diversified sourcing options will secure the stable supply chain.

Advancements in AI and Automation

The lopsided development of die bonder equipment and the leap in technology caused by the introduction of AI and machine learning is increasing the need for efficiency and accuracy. AI-powered die bonding machines are now able to self-monitor themselves and correct defects in material resulting in higher yield rates and less wastage.

Also, the burgeoning trend of automated optical inspections (AOI) and predictive maintenance equipment is driving increased reliability, decreased downtime and improved process efficiency. AI-oriented systems can be designed with multiple bonding schemas, like flip-chip bonding and thermocompression bonding, enhancing their versatility.

Their AI has developed to accommodate modal programmability shear in semiconductor devices automation, which will have a strong bearing on the enhancing of the technologies. The technological shift is expected to leverage the massive investment that the industry will put in the next-generation die bonder equipment.

Emerging Markets and 3D Packaging Innovations

The incorporation of 3D semiconductor packaging technologies into the die bonder equipment market is a remarkable potential for growth. 3D-stacked ICs, fan-out wafer-level packaging (FOWLP), and hybrid bonding techniques are efficiently utilizing clinical design while minimizing size, and power, thus, revealing the technology capable of supporting a trend like 3D VLSI integration.

These technologies are unlocking fresh opportunities of high-speed, advanced, and automated bonding machines that could be utilized in the future bonded and assembled of electronics. Furthermore, the newly created markets in the Middle East and Latin America are quickly digitalizing and developing, thus, increasing the need for local semiconductor packaging and assembly.

Local governments in these regions are also providing incentives for semiconductor manufacturing which together are paving the way for expanding the bonding equipment market. These factors position the industry for sustained expansion in untapped markets.

The USA die bonder equipment market is showing a positive trend with a projected growth rate of 4.7%, which is mainly motivated by the CHIPS Act that aims to support the USA semiconductor manufacturing sector. The AI, high-performance computing, and 5G sectors are the main drivers of advanced semiconductor packaging solutions, which are in high demand as a result of these industries.

The transition of the automotive industry from traditional fuel cars to electric and self-driving vehicles significantly stimulates the requirement for high-precision bonding gear. The situation is further enhanced by the top semiconductor companies which are now looking into the innovative hybrid packaging, this rise in die bonders equipped with ultra-fast and ultra-precise capabilities is directly attributed to it.

Besides, the partnerships between the semiconductor firms and the research institutes are the ones that lead to the development of the technology, that is bonding is one, therefore, the market is growing. The USA government’s intent on cutting back on the use of Asian semiconductor supply chains is another factor that encourages home market equipment investments, which in turn, makes it the die bonding technology key market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

UK die bonder equipment market is expected to increase at a yearly rate of 3.9%, primarily due to the semiconductor R&D investments and post-Brexit industrial strategies. The Focus is to the countries strengthen its semiconductor ecosystem. Resilience and high-performance computing are to the main aspects of this process.

The AI and quantum computing sectors in the UK are becoming primary driving forces, and they ask for advanced chip packaging methods even more than before. The necessity of greener and energy-saving semiconductor production is stimulating the market for the new generation of die bonding tools.

One of the reasons is the government’s-growing emphasis on locally produced chips. Partnerships between universities and tech companies further help market progress. The UK automotive industry in particular in the EV and power electronics businesses is an additional factor driving the high-precision bonding technology demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.9% |

According to the predicted estimates, the die bonder equipment market in the European Union will flourish with a 4.2% Compound Annual Growth Rate (CAGR). The primitive factor of this development is European Chips Act directed at promoting semiconductor self-sufficiency and technological leadership.

The pioneering countries in the area are Germany, France, and the Netherlands that are engaged in huge investments in semiconductor research and development thus causing the demand for advanced die bonding equipment to quicker grow. The push for the adoption of environmentally friendly die bonding equipment is emblematic of the EU's commitment to green semiconductor manufacturing, which goes hand-in-hand with the production of energy-efficient machines.

Automotive, above all, the EV sector, is the primary driving force of \b the market, as the demand for high-performance semiconductor packages grows. The fact that Europe is dotted with semiconductor foundries and packing firms guarantees the fact that die bonding technology will be in good shape all over Europe.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

The die bonder equipment market in Japan is expected to show compound annual growth rate (CAGR) of 3.8%, basically due to the semiconductor miniaturization and dense packaging high-tech advance. Japan is a high-precision engineering stronghold that is bolstering its position with the increase in demand for AI chips, automotive semiconductors, and quantum computing components.

The electronics sector in Japan is still at the forefront of innovation in consumer electronics and industrial automation, the increasing demand for high-precision die bonding solution is the result. The cooperation of microchip makers and research institutes in Japan further leads to market growth as it is.

The government also plays a role in domestic semiconductor chip production initiatives and the substitution of foreign supply chains which create further requirements for the cutting-edge bonding equipment in turn for application especially for the next generation of semiconductors.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The die bonder equipment market in South Korea is among the fastest-growing and is increasing at a CAGR of 5.1%. The market is mostly run by Samsung Electronics and SK Hynix leading the way in global semiconductor production. Demand for the high-precision die bonding equipment is mainly exercised by the government incentives in semiconductor R&D and the strong position of South Korea in the memory chip manufacturing sector.

The boom of investment in hi-tech chip packaging technologies is driven by the newly achieved milestones in sectors like 5G, AI, and supercomputers. No other country in the world is as good in the 3D chip stacking and advanced packaging techniques, as South Korea is, further increasing the requirement of new die bonding solutions.

The semiconductor production equipment market is strongly promoted by the realities of the local supply chain and manufacturing infrastructure, highlighting South Korea as a key regional player in technology and product development.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The Die Bonder Equipment Market is highly significant in semiconductor packaging, primarily driven by the need for miniaturization, 5G connectivity, and increasing performance. Fast growth is the result of advancements in flip-chip, hybrid bonding, and micro-LED applications. Major industries include consumer electronics, automotive, telecommunications, and industrial automation.

APAC led the market, where China, Taiwan, and South Korea are major semiconductor hubs. Automation, AI-driven precision bonding, and sustainable manufacturing processes are reshaping the competitive landscape. Mergers, acquisitions, and consequent market consolidation were often called and have been the result of companies striving for increased productivity and reduced production costs. The higher need for quality depend forwarding solutions will lead to continuous improvements and investments in this field.

ASM Pacific Technology

Semiconductor packaging machinery concepts are run by ASM Pacific Technology, a world leader in the field, which implements high-speed and high-precision die bonding. The firm is heavily focused on artificial intelligence and digital twin technology for automating production processes and enhancing efficiency.

The company is a leading player in the APAC area, especially in China and Taiwan, where the semiconductor manufacturing industry is flourishing. ASM Pacific Technology aims to widen its range of products with mini-LED and micro-LED applications, beyond that, the company also studies sustainable manufacturing and material efficiency.

The usage of robotics and high-tech inspection systems is slated by the company to boost both product quality and yield. Through strategic partnerships with semiconductor giants, the company garners top market position and influences significantly in the die bonder equipment niche.

Kulicke & Soffa Industries

Semiconductor assembly solution sharks give their hand at hybrid bonding, flip-chip bonding, and advanced wire bonding through Kulicke & Soffa Industries. AI is a particular automation, predictive maintenance, and machine learning-based process optimization for the finance sector of the industry. It is the no-cost and high-quality bonding solutions that have won the trust of the larger semiconductor manufacturers in the company.

Kulicke & Soffa is a company that has a solid presence in North America and Asia, and that collaborates with the main semiconductor foundries. It aims to be environmental friendly by lowering energy usage in its production operations. The recent entry into the underserved sectors, primarily Southeast Asia, confirms abundant expansion and the desire to be global.

Besi (BE Semiconductor Industries)

Besi is a supplier in die attach technology being a European leader, and it offers high-volume and high-reliability semiconductor packaging services. Consequentially, the enterprise emanates energy-efficient and sustainable production, thus diminishing waste and maximizing resource efficiency. Besi, a European company, is embarking on North American expansion while addressing the increasing need for AI, automotive, and high-performance advanced packaging technologies.

The company is launching next-gen hybrid bonding solutions, which are the most efficient and precise development yet. The foci of R&D revolve around automation, digital transformation, and machine learning to drive operational efficiencies. The company’s strong ties with worldwide semiconductor manufacturers are an avenue for growth and market developments.

Shinkawa Limited

Shinkawa Ltd. is the primary player in semiconductor packaging specializing in advanced wire bonding and die attach solutions. This company is a pioneer of R&D and they are devising new die bonding technology that offers improved speed and precision. Shinkawa is honing its focus on high-reliability applications particularly in the areas of 5G, automotive, and IoT markets.

The firm is working on AI-driven defect detection and automated process control to boost yield rates. The company is expanding its manufacturing nadars to meet the increased demand from customers and is focusing on R&D efforts in Asia and North America. Shinkawa stands out for solving very specific customer needs with product negotiations that are tailored exclusively to particular sectors.

Panasonic Smart Factory Solutions

Panasonic Smart Factory Solutions offers a comprehensive range of fully automated die bonding machines for high-speed applications. The company fuses machine learning and predictive maintenance technologies to jazz up process efficiency. Eco-friendly protocols and energy conservation are the main motives behind the investigation of environmentally friendly production techniques, which Panasonic is also focusing on.

Panasonic is leveraging its robotics and factory automation expertise and is increasing its role in semiconductor manufacturing. Waste management and energy consumption are also dealt with alongside the introduction of green production processes.

The emphasis is on smart manufacturing solutions, therefore, operational efficiency is going to be raised and besides that, the ongoing needs of semiconductor manufacturers are going to be answered worldwide.

In terms of Product Type, the industry is divided into Manual, Semi-automatic, Fully Automatic

In terms of End Use/User, the industry is divided into Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSAT)

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Die Bonder Equipment Market stood at USD 4.80 billion in 2025.

The market is anticipated to grow at a CAGR of 4.3% over the forecast period.

By 2035, the Die Bonder Equipment market is expected to reach USD 7.32 billion.

The Fully Automatic segment is expected to dominate the market, due to its high precision, faster throughput, reduced labor costs, advanced automation, increasing demand in semiconductor packaging, and ability to handle complex, high-volume production with minimal errors.

Key players in the Die Bonder Equipment market include ASM Pacific Technology, Kulicke & Soffa Industries, Besi (BE Semiconductor Industries), Shinkawa Ltd., Panasonic Smart Factory Solutions

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Attachment Method, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Attachment Method, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Attachment Method, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Attachment Method, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Attachment Method, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Attachment Method, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Attachment Method, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Attachment Method, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Attachment Method, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Attachment Method, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Attachment Method, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Attachment Method, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Attachment Method, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Attachment Method, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Attachment Method, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Attachment Method, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Attachment Method, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Attachment Method, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Attachment Method, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Attachment Method, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Attachment Method, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Attachment Method, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Attachment Method, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Attachment Method, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Attachment Method, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Attachment Method, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Attachment Method, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Attachment Method, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Attachment Method, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Attachment Method, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Attachment Method, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Attachment Method, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Attachment Method, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Attachment Method, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Attachment Method, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Attachment Method, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Attachment Method, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Attachment Method, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Attachment Method, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Attachment Method, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Attachment Method, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Attachment Method, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Attachment Method, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Attachment Method, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Attachment Method, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Attachment Method, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Attachment Method, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Attachment Method, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Attachment Method, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Attachment Method, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Attachment Method, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Attachment Method, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Attachment Method, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Attachment Method, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Attachment Method, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Attachment Method, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Attachment Method, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Attachment Method, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Attachment Method, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Attachment Method, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Attachment Method, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Attachment Method, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Attachment Method, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Attachment Method, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Die Cut Support Pads Market Size and Share Forecast Outlook 2025 to 2035

Diethyl Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Dietary Supplement Market Insights - Growth & Demand 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Dietary Fiber Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Die Cut Display Container Market Size and Share Forecast Outlook 2025 to 2035

Die Cart Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA