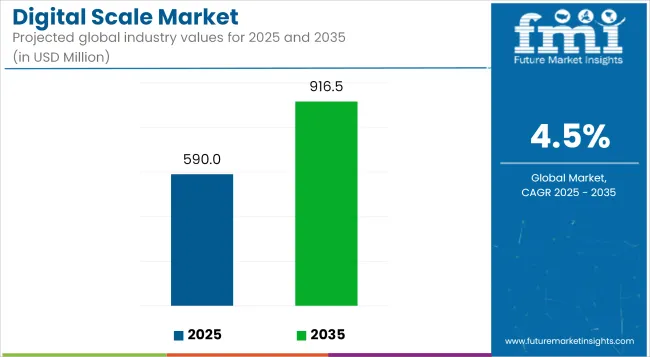

Global digital scale sales are likely to grow at a 4.5% compound annual growth rate (CAGR) from USD 590.0 million in 2025 to USD 916.5 million by 2035. The rising consumer demand for smart digital scales with IoT and AI features for weight tracking and monitoring health and automated analysis systems is the main factor that is fueling the growth of the smart digital scale market.

The expanding installation and adoption of digital scales in retail, industrial, and laboratory applications is fueling the growth of the industry as well. North America and Europe are the dominating regions owing to high adoption of advanced weighing solutions, and Asia-Pacific is the lucrative industries owing to increasing urbanization and disposable incomes.

Consumer interest is also furthered by product innovation, including wireless connectivity and mobile app integration. Nonetheless, developing areas are sensitive to price, and the presence of traditional scales is the limiting factor. The digital scale industry is witnessing growth driven by technological advancements and a shift towards precision-based patient monitoring solutions that are expected to expected to shape market trends over the next 10 years.

Moreover, customization innovations will be able to generate digital balances to meet the special industry needs and individual health tracking. We expect stricter legislation related to data protection and governance of connected devices and green manufacturing (environmental) regulations. As consumer requirements are adapted toward more intelligent, budget-friendly, and green products, the manufacturers of digital scales will have to industrialize progressively over the forecast period.

Based on current trends, the digital scale market analysis shows that the global digital scale segment has grown steadily from 2020 to 2024. This is because more industries, like healthcare, retail, and logistics, need precise weighing solutions.

Since then, developments in the field, be it sensor technology, IoT technology application in all aspects of life, or smart connectivity, have led to the development of advanced digital scales advanced digital scales with features like real-time monitoring and data analytics. The number increased from USD 540.7 million in 2023 to USD 564.6 million in 2024, when the value as adoption continued to rise steadily.

The digital scale sector is expected to grow at a CAGR of 4.5% from 2025 to 2035, reaching USD 916.5 million by 2035. The growth will be driven by the growing penetration of AI-driven analytics and cloud-based weight monitoring and the rise of smart home and healthcare applications.

Due to the growing trend of fitness and medical settings in the near future, the demand for wireless and portable digital scales will see significant growth as the lack of continuous health tracking at multiple instances would create an urge for health collection data post time.

Regionally, North America and Europe will continue to rule the segment owing to high consumer awareness and easy adoption of technologies. Asia-Pacific is likely to be the fastest-growing region, thanks to rapid urbanization, increased disposable incomes, and growing e-commerce. Manufacturers will also want to move toward sustainable materials in the next ten years as a result of sustainable and durable components.

Additionally, progress in regulation and standardization will improve accuracy and reliability, which will increasingly raise market confidence. In terms of industry size, the digital scale market will become greater than the traditional analog scale due to these advanced features, and by 2023, we will see a shift from simply weighing ourselves on a basic device to AI-based smart devices that keep track of and optimize healthier habits.

| Key Drivers | Key Restraints |

|---|---|

| Growing health consciousness and demand for fitness tracking devices | High competition leading to pricing pressures |

| Rising adoption of smart home and IoT-enabled devices | Concerns over accuracy and frequent recalibration of low-cost digital scales |

| Expansion of e-commerce and direct-to-consumer sales | Data security and privacy concerns related to connected devices |

| Increasing use of digital scales in healthcare for remote patient monitoring | Stringent regulatory requirements and compliance standards |

| Technological advancements such as AI-driven analytics and body composition tracking | industry saturation in developed regions, limiting new opportunities |

| Integration with telehealth and wellness programs, boosting remote monitoring | Supply chain disruptions impacting production and distribution |

| Growing industrial automation requiring precision weighing systems | High cost limits adoption, but innovations improve affordability. |

Impact Assessment of Key Drivers

| Key Drivers | Impact Level |

|---|---|

| Increasing health awareness and fitness tracking adoption | High |

| Growing demand for smart, connected devices with AI and IoT integration | High |

| Expansion of telehealth and remote patient monitoring | High |

| Rising prevalence of obesity and chronic diseases | High |

| Growth of e-commerce and direct-to-consumer sales | Medium |

| Increasing industrial automation and logistics applications | High |

| Adoption of eco-friendly and energy-efficient digital scales | Medium |

| Rising disposable income in emerging industries | Medium |

Impact Assessment of Key Restraints

| Key Restraints | Impact Level |

|---|---|

| High competition leading to pricing pressure | High |

| Concerns over accuracy and calibration of low-cost digital scales | Medium |

| Cybersecurity and data privacy risks in connected devices | High |

| Stringent regulatory requirements for medical-use digital scales | High |

| Frequent need for recalibration in low-end products | Medium |

| industry saturation in developed regions | Medium |

| High dependence on cloud-based storage, leading to privacy and security concerns. | Medium |

| Supply chain disruptions and component shortages | Low |

The industrial floor scales are the most commonly used scales in industries, commercial places, and healthcare environments. Chair scales and wheelchair scales are emerging as an innovative trend in medical facilities, providing accurate weight measurements for patients with limited mobility. Summary: Baby scales have facilitated the accurate weight measurement of infants and their development tracking since the earliest days of pediatrics.

In hospitals or clinics, you may want a column scale or a handrail scale, which is effective in offering stability and assistance to the patient while weighing. Typical examples are logistics or heavy manufacturing, which require overhead weighing solutions and are heavily dependent on hoist scales. As technology continues to grow, manufacturers are slowly packing these products with smart features to provide more accurate, connected, and easier-to-use goods. That type of innovation is powering the growth that crosses the entire range of healthcare, fitness, and industrial categories.

Portable digital scales are some of the most common scales on the market; they are convenient, versatile, and increasingly in demand by users in personal and business settings. These scales are designed to blend in with their aesthetic appeal. Regardless, buyers enjoy lightweight and compact designs, as they are simple to handle and store. Portable scales for real-time health monitoring are gaining ground with fitness workers, gyms, and even home consumers.

Telehealth and remote patient management have also added to demand, with users needing accurate, user-friendly weighing solutions in conjunction with their digital health platforms. Manufacturers need to focus on advancing portable scales with energy-efficient, AI-capable designs, enhanced durability, and connectivity.

Global digital scales are becoming increasingly popular in desktop segments, as well as in the industrial, commercial, and medical sectors. Fixed scales are preferred over mobile scales in hospitals, clinics, and production units as they are more accurate, stable, and durable. These scales are used by organizations in logistics, food processing, and laboratories where weight measurement is crucial.

Adults lead the industry on the digital scale front as health-conscious shoppers seek advanced features such as body composition analysis and fitness app compatibility. The rising need for smart digital scales that integrate with wearables and cloud platforms is driven by growing demand for preventive healthcare and telemedicine services. Demand for AI-enabled scales offering personalized recommendations for weight management is rising, particularly in North America and Europe.

The global obesity pandemic is driving booming growth in bariatric scales. Hospitals, weight management centers, and home healthcare agencies are spending more on high-capacity digital scales with precision sensors and connectivity options. As health risks from obesity gain recognition, both the government and private sector are promoting obesity management initiatives, increasing the demand for dietary solutions.

With an increasing emphasis on monitoring growth in early childhood, the demand for pediatric scales is rising. Pediatric care benefits from smart digital scales that sync to mobile apps or share data wirelessly. Such capabilities are also integral to telemedicine and home care settings.

Digital scales are primarily used by clinics and hospitals for clinical assessment, weight management, and diagnosis of patients. With the development of standard digital medical scales, scales with the ability to measure Body Mass Index (BMI) and body composition can be used in daily practice. Chronic diseases are driving demographic growth, increasing demand for highly accurate digital weighing products. Home care environments are increasingly used due to the growing demand for personal healthcare and the widespread adoption of telemedicine solutions.

People are familiar with digital scales because they can be used with real-time health monitoring and data transfer apps. This is because regular monitoring of patients allows doctors to talk to them from afar. AI-driven analysis of digital scales is becoming commonplace in self-care practices, especially for patients managing obesity, diabetes, and heart issues.

Accurate weighing devices are gaining prominence in healthcare, especially in ambulatory surgery centers, for their pre- and post-operative monitoring capabilities. As the need for minimally invasive procedures grows, high-precision digital scales that don't take up much space are being used more and more to help with monitoring and evaluating patients quickly while they recover.

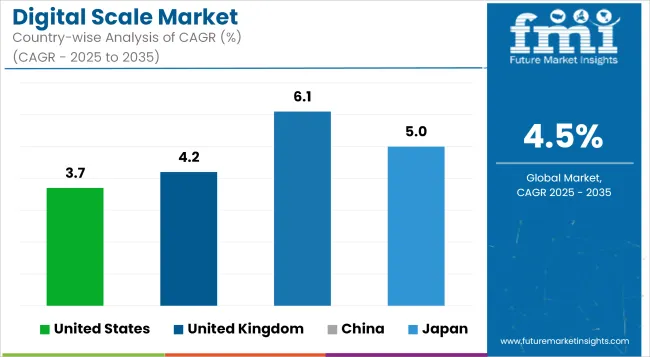

The USA digital scale industry, with a CAGR of 3.7%, is growing steadily but at a slower rate than the global industry driven by increasing adoption in healthcare, fitness, and industrial applications. As a result of strong coverage of prominent manufacturers and an extremely matured e-commerce platform, digital sales are making rapid strides.

Smart and Internet of Things-enabled scales are fast becoming mainstream in home care, propelled by growth in obesity cases and chronic disease management programs. The industry is also experiencing demand from industrial and logistics segments because of automation trends. But regulatory rigors and fears of data security in networked devices could be hurdles for industry growth.

The United Kingdom's digital scale industry will grow at a CAGR of 4.2%, driven by growing e-commerce, smart home penetration, and healthcare usage. Growing emphasis on fitness tracking and individual health is spurring demand for networked weighing solutions. Besides, sustainability needs are promoting eco-friendly digital balances based on recyclable materials.

Telemedicine care is incorporating intelligent weighing solutions to extend patient care monitoring. Industry use is on the rise in precision manufacturing and logistics. However, inflationary pressures and trade complexities due to Brexit may affect supply chain dynamics and prices.

China's digital scale industry will still achieve a compound annual growth rate (CAGR) of 6.1%, which will outpace other key industries in the world. Demand is being fueled by factors such as urbanization, rising disposable income levels, and advances in AI and IoT. Technological consumers are preferring intelligent digital scales that support real-time health detection.

Furthermore, government schemes for digital transition among industries are pushing adoption in manufacturing, logistics, and retail industries. Chinese producers enjoy a comparative advantage in home dominance and low-cost innovations. However, product quality issues and counterfeiting in the online market may somewhat hinder growth.

The increasing technological advancement in precision measures technology and a strong focus on healthcare innovation will bolster Japan's digital scale industry growth at a CAGR of 5.0% during the forecast period. The growing elderly population of the country is raising the demand for telehealth-powered, medical-grade digital scales.

As consumers embrace precision cooking and nutrition tracking, smart kitchen scales are becoming ever more popular. Automation and robotics are also boosting industrial demand for high-accuracy weighing systems. However, high production costs and industry saturation in conventional segments could pose hurdles for manufacturers, necessitating innovation and differentiation.

Increasing disposable income, rapid digitalization, and health concerns are contributing a substantial share to the Indian digital weighing sector, which is anticipated to grow at a CAGR of 4.9% from 2025 to 2035. Progressive movement: tracking in these metropolitan areas and the big trend of exercising over those metropolitan and commuting regions.

Digital weighing solutions are also gaining adoption across retail and logistics sectors, where better operational efficiency is required. Domestic manufacturing would most likely get a boost from government initiatives focused on digitalization and manufacturing under the 'Make in India' program.

Industries in rural areas, which have limited exposure to these technologies, may face hindered adoption due to price sensitivity-highlighting that they are advised to approach investment in such technologies with a systematic mindset and consider the impact against the cost.

As a result, the demand for digital scales is increasing in hospitals, shops, and for personal use, ensuring that France remains a key market. It is predicted to reach USD 50.7 million by 2025, with a compound annual growth rate (CAGR) of 4.5%. The increasing adoption of medical-grade digital scales in hospitals and clinical settings is expected to drive the demand for these scales in India, along with the aging population and government initiatives to improve health care infrastructure.

Furthermore, as French consumers become increasingly health and wellness conscious, the demand for smart personal scales integrated with mobile applications is also on the rise. In logistics and supply chains, various retail and industrial sectors are also investing in advanced weighing solutions.

The digital scale industry is highly dynamic, with both global corporations and specialized firms competing to capture market share. Companies employ several key strategies to maintain a competitive edge.

Product Innovation & Technological Upgrades

Continuous innovation in product features is a primary strategy for market leaders. Companies regularly introduce new models with enhanced precision, user-friendly interfaces, and smart capabilities. Many vendors have integrated wireless connectivity and improved sensor technologies into their latest scales, positioning themselves as technology leaders. Similarly, some firms have launched smart scales tailored for niche industrial applications, expanding their portfolios to meet specific customer needs.

To stay ahead in a saturated market, manufacturers are adding features such as touchscreens, cloud data logging, and AI-driven calibration. This focus on research and development is essential, as product differentiation plays a crucial role in attracting and retaining customers.

Frequent New Product Launches

Expanding the product line allows companies to capture different customer segments. Large and small firms alike are launching compact, portable, and specialized scales to address emerging demands. The market has seen the introduction of pocket-sized digital scales for jewelry traders, precision micro-balances for laboratories, and rugged portable scales for field applications.

Rapid product development cycles enable manufacturers to leverage the latest advancements in sensors, batteries, and IoT modules while responding to competitor offerings. This strategy of continuous product rollout helps brands remain relevant, capture niche opportunities, and attract new customers.

Mergers, Acquisitions, and Partnerships

Strategic mergers and acquisitions (M&A) are reshaping the market by combining the strengths of different companies. Larger corporations often acquire smaller, specialized firms to broaden their technological capabilities or market reach. Acquisitions help fill portfolio gaps, such as adding laboratory balances or improving sensor technology, ultimately strengthening a company’s competitive position.

Partnerships also play a critical role in market expansion. Some industrial scale manufacturers have collaborated with digital sensor companies to enhance their technology, while others have formed alliances with point-of-sale system providers or digital health platforms. These collaborations drive innovation, accelerate product development, and create synergies that benefit both partners. Consolidation through M&A has led to the emergence of comprehensive solution providers that cater to a broad spectrum of industries, from heavy industrial scales to consumer health devices.

Market Expansion & Distribution Strategies

Leading companies leverage their global distribution networks to maintain market dominance while seeking new regional opportunities. Many firms operate worldwide, with a strong presence in North America, Europe, and Asia-Pacific. Growth strategies include entering emerging markets where industrialization and retail expansion drive demand.

E-commerce and digital sales channels have also become critical. Several manufacturers have significantly improved their online presence, leading to increased direct-to-consumer sales. By ramping up digital marketing and partnering with e-commerce platforms, companies can tap into the growing demand from home users and small businesses purchasing equipment online.

In addition to online expansion, after-sales service and calibration support have become competitive differentiators. Vendors emphasize high-quality customer service to retain clients, particularly in the B2B segment, where ongoing support is crucial. Ultimately, companies compete not just on product features but also on distribution strategies, customer support, and brand reliability.

It is segmented into Floor Scales, Chair Scales, Baby Scales, Wheel Chair Scales, Column Scales, Hand Rail Scales, Hoist Scales, and Others

It is segmented into Adults, Bariatric, Paediatric, and Geriatric

It is segmented into Portable and Fixed Scales

It is segmented into Hospitals & Clinics, Home Care settings, Ambulatory Surgical Centers, Mobile Health Units, and Others

It is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and The Middle East and Africa (MEA)

The rise of smart home devices, increasing health consciousness, and demand for precise industrial weighing devices are key drivers.

For personalized insights, development includes IoT integration, AI-assisted analytics, and real-time health monitoring.

Domestic and commercial industries include industries like healthcare, retail, logistics, and manufacturing.

It is to protect data, ensure low-cost variant accuracy, and be compliant with ever-evolving regulatory needs.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Age Group

Table 05a: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 05b: Global Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Region

Table 06: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Age Group

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 12: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 13: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 14: Latin America Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 16: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Age Group

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 18: Europe Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 20: Europe Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 21: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 22: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Age Group

Table 23: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 24: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 26: South Asia Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 27: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 28: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Age Group

Table 29: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 30: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 31: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 32: East Asia Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 33: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 34: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Age Group

Table 35: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 36: Oceania Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 37: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 38: Oceania Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 39: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 40: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Age Group

Table 41: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 42: Middle East & Africa Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 43: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 44: Middle East & Africa Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 45: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 46: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Age Group

Table 47: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Figure 01: Global Market Volume (Units), 2019 to 2023

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis,

Figure 03: Pricing Analysis per unit (US$), in 2023

Figure 04: Pricing Forecast per unit (US$), in 2034

Figure 05: Global Market Value (US$ Million) Analysis, 2019 to 2023

Figure 06: Global Market Forecast & Y-o-Y Growth, 2024 to 2034

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2024 to 2034

Figure 08: Global Market Value Share (%) Analysis 2023 to 2034, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Product

Figure 10: Global Market Attractiveness Analysis 2024 to 2034, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 to 2034, by Modality

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Modality

Figure 13: Global Market Attractiveness Analysis 2024 to 2034, by Modality

Figure 14: Global Market Value Share (%) Analysis 2023 to 2034, by Age Group

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Age Group

Figure 16: Global Market Attractiveness Analysis 2024 to 2034, by Age Group

Figure 17: Global Market Value Share (%) Analysis 2023 to 2034, by End User

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by End User

Figure 19: Global Market Attractiveness Analysis 2024 to 2034, by End User

Figure 20: Global Market Value Share (%) Analysis 2024 to 2034, by Region

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Region

Figure 22: Global Market Attractiveness Analysis 2024 to 2034, by Region

Figure 23: North America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 24: North America Market Value (US$ Million) Forecast, 2023 to 2034

Figure 25: North America Market Value Share, by Product (2023 E)

Figure 26: North America Market Value Share, by Modality (2023 E)

Figure 27: North America Market Value Share, by Age Group (2023 E)

Figure 28: North America Market Value Share, by End User (2023 E)

Figure 29: North America Market Value Share, by Country (2023 E)

Figure 30: North America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 31: North America Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 32: North America Market Attractiveness Analysis by Age Group, 2024 to 2034

Figure 33: North America Market Attractiveness Analysis by End User, 2024 to 2034

Figure 34: North America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 35: USA Market Value Proportion Analysis, 2024

Figure 36: Global Vs. USA Growth Comparison

Figure 37: USA Market Share Analysis (%) by Product, 2024 to 2034

Figure 38: USA Market Share Analysis (%) by Modality, 2024 to 2034

Figure 39: USA Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 40: USA Market Share Analysis (%) by End User, 2024 to 2034

Figure 41: Canada Market Value Proportion Analysis, 2024

Figure 42: Global Vs. Canada. Growth Comparison

Figure 43: Canada Market Share Analysis (%) by Product, 2024 to 2034

Figure 44: Canada Market Share Analysis (%) by Modality, 2024 to 2034

Figure 45: Canada Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 46: Canada Market Share Analysis (%) by End User, 2024 to 2034

Figure 47: Latin America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 48: Latin America Market Value (US$ Million) Forecast, 2023 to 2034

Figure 49: Latin America Market Value Share, by Product (2023 E)

Figure 50: Latin America Market Value Share, by Modality (2023 E)

Figure 51: Latin America Market Value Share, by Age Group (2023 E)

Figure 52: Latin America Market Value Share, by End User (2023 E)

Figure 53: Latin America Market Value Share, by Country (2023 E)

Figure 54: Latin America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 55: Latin America Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 56: Latin America Market Attractiveness Analysis by Age Group, 2024 to 2034

Figure 57: Latin America Market Attractiveness Analysis by End User, 2024 to 2034

Figure 58: Latin America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 59: Mexico Market Value Proportion Analysis, 2024

Figure 60: Global Vs Mexico Growth Comparison

Figure 61: Mexico Market Share Analysis (%) by Product, 2024 to 2034

Figure 62: Mexico Market Share Analysis (%) by Modality, 2024 to 2034

Figure 63: Mexico Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 64: Mexico Market Share Analysis (%) by End User, 2024 to 2034

Figure 65: Brazil Market Value Proportion Analysis, 2024

Figure 66: Global Vs. Brazil. Growth Comparison

Figure 67: Brazil Market Share Analysis (%) by Product, 2024 to 2034

Figure 68: Brazil Market Share Analysis (%) by Modality, 2024 to 2034

Figure 69: Brazil Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 70: Brazil Market Share Analysis (%) by End User, 2024 to 2034

Figure 71: Argentina Market Value Proportion Analysis, 2023

Figure 72: Global Vs Argentina Growth Comparison

Figure 73: Argentina Market Share Analysis (%) by Product, 2024 to 2034

Figure 74: Argentina Market Share Analysis (%) by Modality, 2024 to 2034

Figure 75: Argentina Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 76: Argentina Market Share Analysis (%) by End User, 2024 to 2034

Figure 77: Europe Market Value (US$ Million) Analysis, 2019 to 2023

Figure 78: Europe Market Value (US$ Million) Forecast, 2023 to 2034

Figure 79: Europe Market Value Share, by Product (2023 E)

Figure 80: Europe Market Value Share, by Modality (2023 E)

Figure 81: Europe Market Value Share, by Age Group (2023 E)

Figure 82: Europe Market Value Share, by End User (2023 E)

Figure 83: Europe Market Value Share, by Country (2023 E)

Figure 84: Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 85: Europe Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 86: Europe Market Attractiveness Analysis by Age Group, 2024 to 2034

Figure 87: Europe Market Attractiveness Analysis by End User, 2024 to 2034

Figure 88: Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 89: UK Market Value Proportion Analysis, 2023

Figure 90: Global Vs. UK Growth Comparison

Figure 91: UK Market Share Analysis (%) by Product, 2024 to 2034

Figure 92: UK Market Share Analysis (%) by Modality, 2024 to 2034

Figure 93: UK Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 94: UK Market Share Analysis (%) by End User, 2024 to 2034

Figure 95: Germany Market Value Proportion Analysis, 2023

Figure 96: Global Vs. Germany Growth Comparison

Figure 97: Germany Market Share Analysis (%) by Product, 2024 to 2034

Figure 98: Germany Market Share Analysis (%) by Modality, 2024 to 2034

Figure 99: Germany Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 100: Germany Market Share Analysis (%) by End User, 2024 to 2034

Figure 101: Italy Market Value Proportion Analysis, 2023

Figure 102: Global Vs. Italy Growth Comparison

Figure 103: Italy Market Share Analysis (%) by Product, 2024 to 2034

Figure 104: Italy Market Share Analysis (%) by Modality, 2024 to 2034

Figure 105: Italy Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 106: Italy Market Share Analysis (%) by End User, 2024 to 2034

Figure 107: France Market Value Proportion Analysis, 2023

Figure 108: Global Vs France Growth Comparison

Figure 109: France Market Share Analysis (%) by Product, 2024 to 2034

Figure 110: France Market Share Analysis (%) by Modality, 2024 to 2034

Figure 111: France Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 112: France Market Share Analysis (%) by End User, 2024 to 2034

Figure 113: Spain Market Value Proportion Analysis, 2023

Figure 114: Global Vs Spain Growth Comparison

Figure 115: Spain Market Share Analysis (%) by Product, 2024 to 2034

Figure 116: Spain Market Share Analysis (%) by Modality, 2024 to 2034

Figure 117: Spain Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 118: Spain Market Share Analysis (%) by End User, 2024 to 2034

Figure 119: Russia Market Value Proportion Analysis, 2023

Figure 120: Global Vs Russia Growth Comparison

Figure 121: Russia Market Share Analysis (%) by Product, 2024 to 2034

Figure 122: Russia Market Share Analysis (%) by Modality, 2024 to 2034

Figure 123: Russia Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 124: Russia Market Share Analysis (%) by End User, 2024 to 2034

Figure 125: BENELUX Market Value Proportion Analysis, 2023

Figure 126: Global Vs BENELUX Growth Comparison

Figure 127: BENELUX Market Share Analysis (%) by Product, 2024 to 2034

Figure 128: BENELUX Market Share Analysis (%) by Modality, 2024 to 2034

Figure 129: BENELUX Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 130: BENELUX Market Share Analysis (%) by End User, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 132: East Asia Market Value (US$ Million) Forecast, 2023 to 2034

Figure 133: East Asia Market Value Share, by Product (2023 E)

Figure 134: East Asia Market Value Share, by Modality (2023 E)

Figure 135: East Asia Market Value Share, by Age Group (2023 E)

Figure 136: East Asia Market Value Share, by End User (2023 E)

Figure 137: East Asia Market Value Share, by Country (2023 E)

Figure 138: East Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 139: East Asia Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 140: East Asia Market Attractiveness Analysis by Age Group, 2024 to 2034

Figure 141: East Asia Market Attractiveness Analysis by End User, 2024 to 2034

Figure 142: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 143: China Market Value Proportion Analysis, 2023

Figure 144: Global Vs. China Growth Comparison

Figure 145: China Market Share Analysis (%) by Product, 2024 to 2034

Figure 146: China Market Share Analysis (%) by Modality, 2024 to 2034

Figure 147: China Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 148: China Market Share Analysis (%) by End User, 2024 to 2034

Figure 149: Japan Market Value Proportion Analysis, 2023

Figure 150: Global Vs. Japan Growth Comparison

Figure 151: Japan Market Share Analysis (%) by Product, 2024 to 2034

Figure 152: Japan Market Share Analysis (%) by Modality, 2024 to 2034

Figure 153: Japan Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 154: Japan Market Share Analysis (%) by End User, 2024 to 2034

Figure 155: South Korea Market Value Proportion Analysis, 2023

Figure 156: Global Vs South Korea Growth Comparison

Figure 157: South Korea Market Share Analysis (%) by Product, 2024 to 2034

Figure 158: South Korea Market Share Analysis (%) by Modality, 2024 to 2034

Figure 159: South Korea Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 160: South Korea Market Share Analysis (%) by End User, 2024 to 2034

Figure 161: South Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 162: South Asia Market Value (US$ Million) Forecast, 2023 to 2034

Figure 163: South Asia Market Value Share, by Product (2023 E)

Figure 164: South Asia Market Value Share, by Modality (2023 E)

Figure 165: South Asia Market Value Share, by Age Group (2023 E)

Figure 166: South Asia Market Value Share, by End User (2023 E)

Figure 167: South Asia Market Value Share, by Country (2023 E)

Figure 168: South Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 169: South Asia Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 170: South Asia Market Attractiveness Analysis by Age Group, 2024 to 2034

Figure 171: South Asia Market Attractiveness Analysis by End User, 2024 to 2034

Figure 172: South Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 173: India Market Value Proportion Analysis, 2023

Figure 174: Global Vs. India Growth Comparison

Figure 175: India Market Share Analysis (%) by Product, 2024 to 2034

Figure 176: India Market Share Analysis (%) by Modality, 2024 to 2034

Figure 177: India Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 178: India Market Share Analysis (%) by End User, 2024 to 2034

Figure 179: Indonesia Market Value Proportion Analysis, 2023

Figure 180: Global Vs. Indonesia Growth Comparison

Figure 181: Indonesia Market Share Analysis (%) by Product, 2024 to 2034

Figure 182: Indonesia Market Share Analysis (%) by Modality, 2024 to 2034

Figure 183: Indonesia Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 184: Indonesia Market Share Analysis (%) by End User, 2024 to 2034

Figure 185: Malaysia Market Value Proportion Analysis, 2023

Figure 186: Global Vs. Malaysia Growth Comparison

Figure 187: Malaysia Market Share Analysis (%) by Product, 2024 to 2034

Figure 188: Malaysia Market Share Analysis (%) by Modality, 2024 to 2034

Figure 189: Malaysia Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 190: Malaysia Market Share Analysis (%) by End User, 2024 to 2034

Figure 191: Thailand Market Value Proportion Analysis, 2023

Figure 192: Global Vs. Thailand Growth Comparison

Figure 193: Thailand Market Share Analysis (%) by Product, 2024 to 2034

Figure 194: Thailand Market Share Analysis (%) by Modality, 2024 to 2034

Figure 195: Thailand Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 196: Thailand Market Share Analysis (%) by End User, 2024 to 2034

Figure 197: Oceania Market Value (US$ Million) Analysis, 2019 to 2023

Figure 198: Oceania Market Value (US$ Million) Forecast, 2023 to 2034

Figure 199: Oceania Market Value Share, by Product (2023 E)

Figure 200: Oceania Market Value Share, by Modality (2023 E)

Figure 201: Oceania Market Value Share, by Age Group (2023 E)

Figure 202: Oceania Market Value Share, by End User (2023 E)

Figure 203: Oceania Market Value Share, by Country (2023 E)

Figure 204: Oceania Market Attractiveness Analysis by Product, 2024 to 2034

Figure 205: Oceania Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 206: Oceania Market Attractiveness Analysis by Age Group, 2024 to 2034

Figure 207: Oceania Market Attractiveness Analysis by End User, 2024 to 2034

Figure 208: Oceania Market Attractiveness Analysis by Country, 2024 to 2034

Figure 209: Australia Market Value Proportion Analysis, 2023

Figure 210: Global Vs. Australia Growth Comparison

Figure 211: Australia Market Share Analysis (%) by Product, 2024 to 2034

Figure 212: Australia Market Share Analysis (%) by Modality, 2024 to 2034

Figure 213: Australia Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 214: Australia Market Share Analysis (%) by End User, 2024 to 2034

Figure 215: New Zealand Market Value Proportion Analysis, 2023

Figure 216: Global Vs New Zealand Growth Comparison

Figure 217: New Zealand Market Share Analysis (%) by Product, 2024 to 2034

Figure 218: New Zealand Market Share Analysis (%) by Modality, 2024 to 2034

Figure 219: New Zealand Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 220: New Zealand Market Share Analysis (%) by End User, 2024 to 2034

Figure 221: Middle East & Africa Market Value (US$ Million) Analysis, 2019 to 2023

Figure 222: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2034

Figure 223: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 224: Middle East & Africa Market Value Share, by Modality (2023 E)

Figure 225: Middle East & Africa Market Value Share, by Age Group (2023 E)

Figure 226: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 227: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 228: Middle East & Africa Market Attractiveness Analysis by Product, 2024 to 2034

Figure 229: Middle East & Africa Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 230: Middle East & Africa Market Attractiveness Analysis by Age Group, 2024 to 2034

Figure 231: Middle East & Africa Market Attractiveness Analysis by End User, 2024 to 2034

Figure 232: Middle East & Africa Market Attractiveness Analysis by Country, 2024 to 2034

Figure 233: GCC Countries Market Value Proportion Analysis, 2023

Figure 234: Global Vs GCC Countries Growth Comparison

Figure 235: GCC Countries Market Share Analysis (%) by Product, 2024 to 2034

Figure 236: GCC Countries Market Share Analysis (%) by Modality, 2024 to 2034

Figure 237: GCC Countries Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 238: GCC Countries Market Share Analysis (%) by End User, 2024 to 2034

Figure 239: Türkiye Market Value Proportion Analysis, 2023

Figure 240: Global Vs. Türkiye Growth Comparison

Figure 241: Türkiye Market Share Analysis (%) by Product, 2024 to 2034

Figure 242: Türkiye Market Share Analysis (%) by Modality, 2024 to 2034

Figure 243: Türkiye Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 244: Türkiye Market Share Analysis (%) by End User, 2024 to 2034

Figure 245: South Africa Market Value Proportion Analysis, 2023

Figure 246: Global Vs. South Africa Growth Comparison

Figure 247: South Africa Market Share Analysis (%) by Product, 2024 to 2034

Figure 248: South Africa Market Share Analysis (%) by Modality, 2024 to 2034

Figure 249: South Africa Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 250: South Africa Market Share Analysis (%) by End User, 2024 to 2034

Figure 251: North Africa Market Value Proportion Analysis, 2023

Figure 252: Global Vs North Africa Growth Comparison

Figure 253: North Africa Market Share Analysis (%) by Product, 2024 to 2034

Figure 254: North Africa Market Share Analysis (%) by Modality, 2024 to 2034

Figure 255: North Africa Market Share Analysis (%) by Age Group, 2024 to 2034

Figure 256: North Africa Market Share Analysis (%) by End User, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA