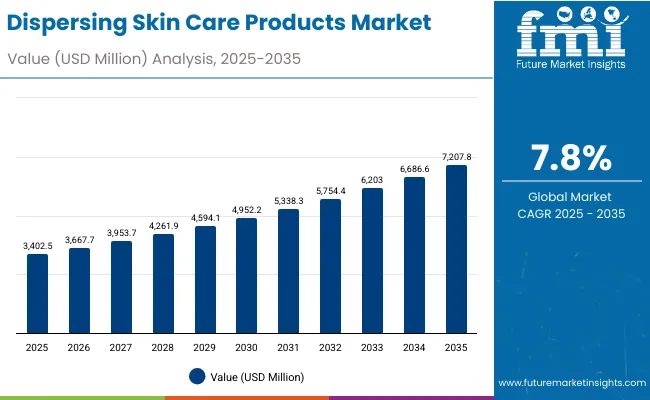

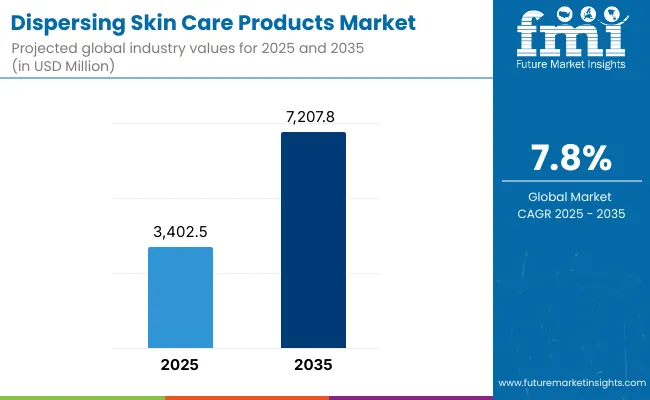

The Dispersing Skin Care Products Market is expected to record a valuation of USD 3,402.5 million in 2025 and USD 7,207.8 million in 2035, with an increase of USD 3,805.3 million, which equals a growth of approximately 112% over the decade. The overall expansion represents a CAGR of 7.8% and a 2.1X increase in market size.

Dispersing Skin Care Products Market Key Takeaways

| Metric | Value |

|---|---|

| Dispersing Skin Care Products Market Estimated Value in (2025E) | USD 3,402.5 million |

| Dispersing Skin Care Products Market Forecast Value in (2035F) | USD 7,207.8 million |

| Forecast CAGR (2025 to 2035) | 7.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 3,402.5 million to USD 4,952.2 million, adding USD 1,549.7 million, which accounts for around 41% of the total decade growth. This phase records steady adoption of mineral sunscreen dispersions and tinted formulations, supported by polymeric and silicone dispersant systems that enhance texture uniformity and pigment stability. Pre-dispersed pastes gain steady demand in professional and mass skincare categories due to ease of blending and consistent performance.

The second half from 2030 to 2035 contributes USD 2,255.6 million, equal to 59% of total growth, as the market rises from USD 4,952.2 million to USD 7,207.8 million. This acceleration is powered by innovation in natural and PEG-free dispersant systems, growing consumer interest in multifunctional sunscreen-serum hybrids, and increased penetration across e-commerce and specialty retail channels. Continuous technological improvement in dispersion efficiency and formulation stability supports the long-term expansion of the market across the USA, China, Japan, and India.

From 2020 to 2024, the Dispersing Skin Care Products Market witnessed rapid evolution in sun-protective and complexion-enhancing formulations. During this period, the competitive landscape was dominated by global dermocosmetic and sunscreen brands focusing on hardware-equivalent dispersant efficiency achieved through advanced polymeric and silicone dispersions that improved spreadability and UV filter stability. The market grew steadily on the back of performance-driven mineral bases, with premium and clinical skincare lines accounting for a majority of the value share.

By 2025, total market demand reached USD 3,402.5 million, supported by higher adoption in BB/CC creams, tinted moisturizers, and shimmer-infused body lotions. The revenue mix began shifting toward silicone and polymeric dispersants, together capturing over 99% of the global share. Going forward, growth will be led by natural and PEG-free dispersant systems, reflecting consumer preferences for clean-label, non-irritant formulations. Competitive differentiation is increasingly shaped by formulation science, stability performance, and multi-platform distribution across e-commerce and specialty retail channels.

The market is expanding as consumers increasingly favor mineral-based dispersions such as ZnO and TiO₂ for safe, broad-spectrum UV protection. These ingredients provide superior coverage and photostability while meeting the growing demand for non-nano, reef-safe, and sensitive-skin-friendly formulations. The integration of dispersing agents like polymeric and silicone systems enhances smooth texture, transparency, and pigment uniformity, driving widespread adoption in tinted moisturizers, BB/CC creams, and hybrid sun-care products across premium and mass-market skincare segments.

Growth is further fueled by the shift toward clean, sustainable, and PEG-free dispersant technologies that align with global regulatory trends and consumer consciousness. Brands are investing in bio-based polymeric systems that maintain pigment stability without synthetic additives, improving product safety and eco-compatibility. This evolution supports the rise of vegan, cruelty-free, and biodegradable skincare lines, particularly in e-commerce and specialty retail channels. The transition to green dispersing systems enhances brand differentiation and drives steady market penetration across developed and emerging regions.

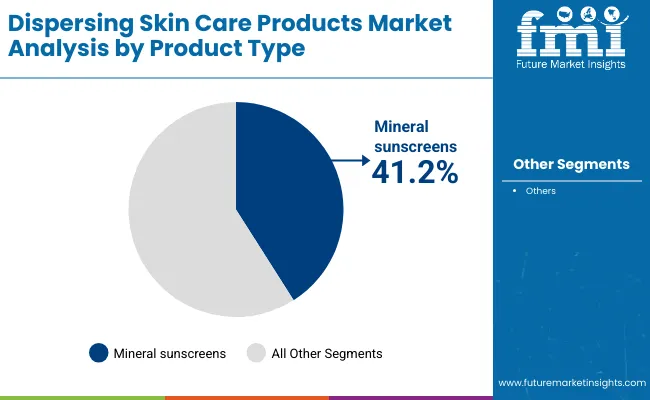

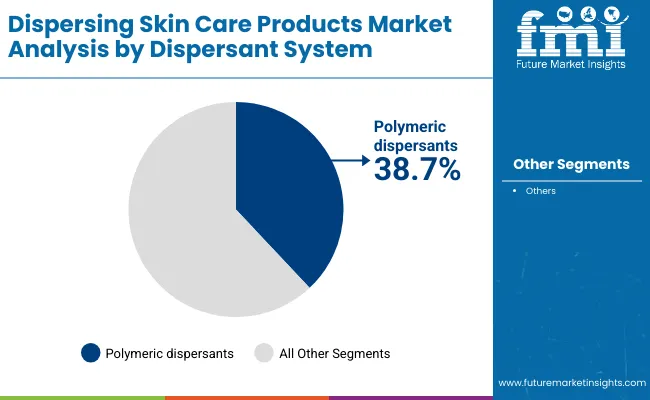

The market is segmented by product type, dispersant system, physical form, channel, end user, and geography. By product type, key categories include mineral sunscreens (ZnO/TiO₂ dispersions), tinted moisturizers or BB/CC creams, pigment-infused serums, and body lotions with shimmer or pearls, reflecting diverse formulation and aesthetic applications. Based on dispersant system, the market is classified into polymeric dispersants, silicone dispersions, and natural/PEG-free systems, each catering to different stability and sensory requirements. In terms of physical form, pre-dispersed pastes, liquid concentrates, and powder dispersions are widely used across skincare manufacturing. Distribution channels include e-commerce, specialty beauty retail, pharmacies, and mass retail outlets. By end user, products are designed for women, men, and unisex consumers. Regionally, the market covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with notable country-level growth in China, India, Japan, the USA, Germany, and the UK

| Product Type | Value Share% 2025 |

|---|---|

| Mineral sunscreens | 41.2% |

| Others | 58.8% |

The mineral sunscreens (ZnO/TiO₂ dispersions) segment is projected to contribute 41.2% of the Dispersing Skin Care Products Market revenue in 2025, maintaining its lead as the dominant product category. This growth is driven by the rising global preference for physical UV filters that offer safe, broad-spectrum protection and compatibility with sensitive and acne-prone skin. The segment benefits from advancements in dispersion stability, pigment uniformity, and light-diffusing properties, which enhance cosmetic elegance and application performance.

The expansion of multifunctional skincare formulations, including tinted moisturizers and hybrid sunscreen-serum products, further strengthens market penetration. Continuous R&D in polymeric and silicone dispersant systems has improved the spreadability and transparency of mineral-based formulations, allowing premium and mass brands alike to innovate across textures and finishes. As clean beauty and reef-safe regulations gain traction, mineral sunscreens will continue to anchor the market, serving as the core foundation of dispersing skincare innovations.

| Dispersant System | Value Share% 2025 |

|---|---|

| Polymeric dispersants | 38.7% |

| Others | 61.3% |

The polymeric dispersants segment is forecasted to hold 38.7% of the market share in 2025, driven by its exceptional ability to stabilize pigments, enhance texture uniformity, and improve formulation durability. Polymeric dispersants are widely used in mineral sunscreen and tinted skincare formulations, where even dispersion and long-lasting wear are critical for product performance. Their superior compatibility with inorganic pigments such as zinc oxide and titanium dioxide makes them indispensable in high-SPF and complexion-enhancing products.

The segment’s growth is further supported by the development of high-molecular-weight polymer systems that enable smooth application and maintain product consistency under varied environmental conditions. As skincare brands move toward cleaner, PEG-free, and high-performance formulations, polymeric dispersants will remain essential for achieving optimal stability, sensory appeal, and color balance. Continuous innovation in biocompatible polymer technology is expected to reinforce their dominance within the global dispersing skincare market.

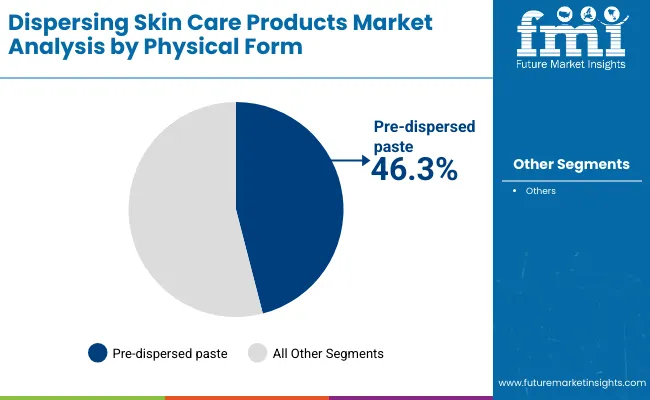

| Physical Form | Value Share% 2025 |

|---|---|

| Pre-dispersed paste | 46.3% |

| Others | 53.7% |

The pre-dispersed paste segment is projected to account for 46.3% of the Dispersing Skin Care Products Market revenue in 2025, establishing it as the leading physical form category. This format is preferred for its superior pigment uniformity, ease of incorporation, and stable viscosity, allowing formulators to achieve consistent results across diverse skincare products such as tinted creams, serums, and mineral sunscreens.

Pre-dispersed pastes simplify the production process by reducing the need for high-shear mixing and minimizing agglomeration risks, thereby saving both formulation time and energy. Their compatibility with polymeric and silicone dispersant systems enables smooth texture, high coverage, and better optical performance in end formulations. As skincare manufacturers increasingly seek ready-to-use, efficient, and reproducible dispersion solutions, pre-dispersed pastes are expected to retain their leading position throughout the forecast period.

Rising Demand for Multifunctional Sunscreen-Infused Skincare

A key driver for the Dispersing Skin Care Products Market is the rising consumer preference for multifunctional skincare products that combine sun protection, coverage, and hydration. Formulations such as BB/CC creams, tinted moisturizers, and mineral sunscreens are gaining traction for their ability to simplify routines while offering cosmetic and dermatological benefits. The increasing awareness of UV-induced skin damage and growing inclination toward daily-use SPF products in both men’s and women’s categories continue to fuel this demand. Premium brands are leveraging dispersing technologies to enhance spreadability, texture, and optical correction properties, ensuring consistent aesthetic appeal and protective performance.

Technological Advancements in Dispersant Systems

Continuous innovation in polymeric, silicone, and PEG-free dispersant technologies is another strong growth driver. These systems provide improved pigment stability, reduced clumping, and enhanced light-scattering efficiency, ensuring smooth, even-toned finishes in skincare formulations. Manufacturers are adopting advanced dispersion methods that increase UV filter efficiency while maintaining cosmetic elegance and lightweight feel. Moreover, clean beauty trends and regulatory pressures are encouraging the development of biodegradable, natural dispersants, broadening adoption across sustainable skincare lines. Such advancements not only raise product performance but also expand market accessibility to eco-conscious consumers and global premium skincare brands.

High Formulation Complexity and Production Costs

Despite robust growth, the market faces challenges due to complex formulation requirementsandhigh manufacturing costs associated with achieving stable, homogeneous dispersions. Maintaining pigment uniformity and preventing sedimentation or phase separation demands sophisticated equipment, high-quality raw materials, and precise process control. Additionally, the transition toward natural or PEG-free dispersant systems raises compatibility issues, often requiring costly reformulations. These factors limit smaller manufacturers from competing effectively, restricting broader market penetration. As sustainability standards tighten and ingredient transparency becomes mandatory, achieving technical and regulatory balance adds further cost and complexity pressure.

Expansion of Clean Beauty and PEG-Free Formulations

The accelerating shift toward clean, vegan, and PEG-free beauty products offers a major growth opportunity for dispersing skincare manufacturers. Consumers are increasingly prioritizing products that are biodegradable, hypoallergenic, and free from synthetic emulsifiers, creating demand for bio-based dispersants that maintain performance without compromising purity. Global brands are reformulating sunscreen and complexion-enhancing products to align with eco-label standards and reef-safe certifications, boosting adoption of innovative natural dispersion systems. This evolution opens avenues for premium positioning, strategic brand collaborations, and entry into expanding e-commerce segments focused on sustainability and ingredient transparency.

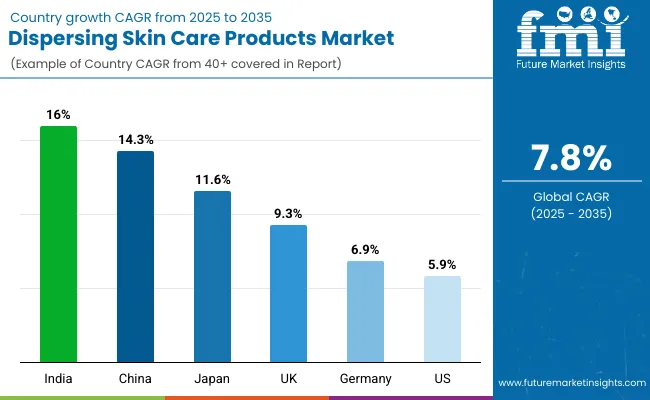

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.3% |

| USA | 5.9% |

| India | 16.0% |

| UK | 9.3% |

| Germany | 6.9% |

| Japan | 11.6% |

The global Dispersing Skin Care Products Market shows distinct regional variation in growth, influenced by formulation technology maturity, consumer preferences, and clean beauty adoption rates. Asia-Pacific leads as the fastest-growing region, anchored by India (16.0%) and China (14.3%), driven by expanding middle-class demographics, rapid e-commerce penetration, and increased spending on high-performance sun protection and complexion-enhancing products. China’s surge is propelled by local innovation in mineral sunscreen dispersions and natural pigment technologies, alongside government initiatives promoting safe, eco-friendly cosmetic ingredients. India’s double-digit expansion reflects the fast uptake of affordable tinted skincare and SPF-infused daily creams, aided by a strong retail base and private-label launches.

Japan maintains a solid growth trajectory at 11.6% CAGR, underpinned by advanced R&D in polymeric dispersants, microencapsulation, and lightweight fluid emulsions that improve skin compatibility. Europe, led by the UK (9.3%) and Germany (6.9%), shows robust growth supported by regulatory emphasis on sustainable formulations and ingredient transparency. These countries are early adopters of PEG-free and reef-safe standards, driving innovation among legacy skincare brands. The USA market grows steadily at 5.9%, reflecting a mature but evolving consumer base focused on dermatologist-recommended sun-care and hybrid skincare formats. The region’s growth is primarily innovation-driven, emphasizing clean formulations, broad-spectrum SPF coverage, and multifunctional textures that align with health-conscious and minimalist beauty trends.

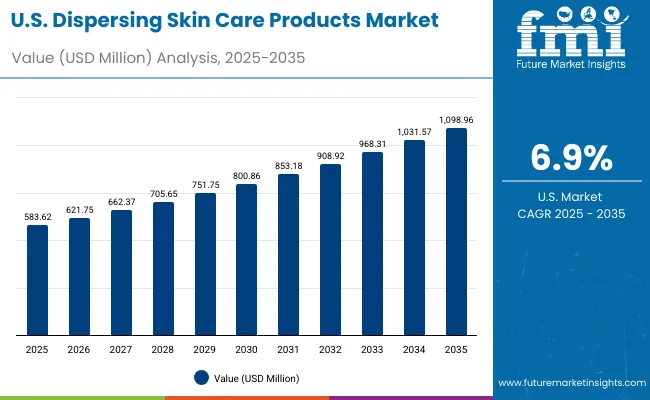

| Year | USA Dispersing Skin Care Products Market (USD Million) |

|---|---|

| 2025 | 583.62 |

| 2026 | 621.75 |

| 2027 | 662.37 |

| 2028 | 705.65 |

| 2029 | 751.75 |

| 2030 | 800.86 |

| 2031 | 853.18 |

| 2032 | 908.92 |

| 2033 | 968.31 |

| 2034 | 1031.57 |

| 2035 | 1098.96 |

The Dispersing Skin Care Products Market in the United States is projected to grow at a CAGR of 6.9% between 2025 and 2035, supported by rising consumer preference for dermatologist-tested mineral sunscreens and hybrid skincare formats. Growth is led by the adoption of tinted moisturizers, BB/CC creams, and sunscreen-serum hybrids that combine coverage with daily UV protection. The increasing awareness of photoaging prevention, combined with trends in skinimalism and dermocosmetic innovation, is driving higher per-capita spending on multifunctional dispersing formulations.

Digital-native and clean-beauty brands are leveraging polymeric and silicone dispersant technologies to enhance sensory appeal and lightweight performance, while premium players are focusing on non-nano, reef-safe, and PEG-free formulations to align with evolving USA regulations. Online and specialty retail platforms continue to dominate distribution, aided by influencer marketing and dermatologist endorsements that accelerate consumer adoption.

The Dispersing Skin Care Products Market in the United Kingdom is expected to grow at a CAGR of 9.3% from 2025 to 2035, driven by strong consumer adoption of hybrid beauty and skincare innovations. The country’s demand is largely shaped by the rising preference for tinted moisturizers, mineral-based sunscreens, and luminous body care formulations that blend cosmetic and protective benefits. The trend toward vegan, cruelty-free, and PEG-free formulations aligns with the UK’s evolving sustainability standards and strict ingredient regulations under the Cosmetic Products Enforcement framework.

Premium skincare brands are expanding their portfolios with dispersing technologies that improve color uniformity, reduce white-cast effects, and ensure long-wear comfort. Retail expansion through specialty beauty chains and e-commerce platformssuch as Boots, Cult Beauty, and Space NKcontinues to enhance accessibility and consumer awareness. The increasing collaboration between UK-based R&D laboratories, contract manufacturers, and indie brands is fueling innovation in natural dispersant systems and biodegradable emulsifiers.

India is witnessing rapid growth in the Dispersing Skin Care Products Market, projected to expand at a CAGR of 16.0% through 2035. The country’s market is driven by increasing awareness of sun protection, skin tone enhancement, and clean beauty formulations, particularly among millennials and urban consumers. The surge in affordable tinted moisturizers, BB/CC creams, and mineral sunscreen dispersions across both mass and mid-premium segments is accelerating adoption nationwide. Domestic and international brands are expanding their manufacturing footprints, leveraging cost-efficient production, favorable regulations, and digital retail penetration across tier-2 and tier-3 cities.

Growth is further supported by the proliferation of online beauty platforms and direct-to-consumer brands that educate users on the importance of UV defense and ingredient transparency. India’s emerging ecosystem of contract manufacturers and raw material suppliers specializing in polymeric and silicone dispersions enhances supply reliability and product innovation. The increasing availability of PEG-free and naturally derived dispersant systems resonates strongly with India’s evolving clean beauty narrative and Ayurvedic formulation trends.

The Dispersing Skin Care Products Market in China is expected to grow at a CAGR of 14.3% between 2025 and 2035, marking the highest expansion rate among major economies. This momentum is fueled by the country’s strong consumer shift toward sun-care, hybrid skincare, and high-performance complexion products featuring mineral dispersions and advanced pigment technologies. Rising awareness of UV-induced skin damage and the cultural emphasis on skin brightness and protection have driven the adoption of ZnO and TiO₂-based formulations, supported by strong domestic manufacturing capacity and R&D in dispersion technology.

Local brands are leveraging polymeric and silicone dispersant systems to improve spreadability and achieve elegant, transparent finishes suitable for varying skin tones. Additionally, the rise of digital beauty platforms, influencer-led retailing, and cross-border e-commerce has amplified market visibility and product accessibility. With increased investment in clean-label and PEG-free innovations, China is rapidly becoming a global hub for next-generation dispersing skincare formulations.

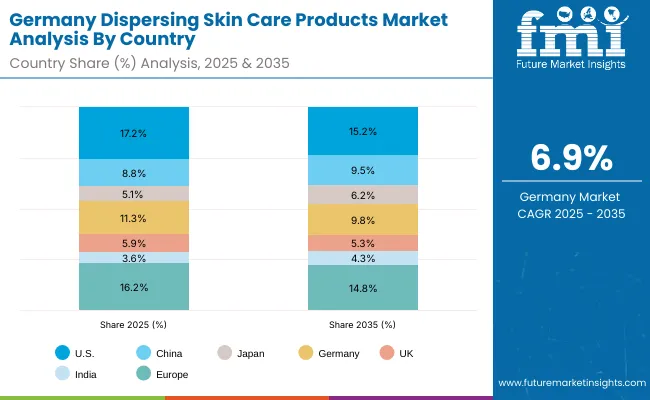

| Country | 2025 Share (%) |

|---|---|

| USA | 17.2% |

| China | 8.8% |

| Japan | 5.1% |

| Germany | 11.3% |

| UK | 5.9% |

| India | 3.6% |

| Country | 2035 Share (%) |

|---|---|

| USA | 15.2% |

| China | 9.5% |

| Japan | 6.2% |

| Germany | 9.8% |

| UK | 5.3% |

| India | 4.3% |

The Dispersing Skin Care Products Market in Germany is projected to grow at a CAGR of 6.9% from 2025 to 2035, reflecting the country’s strong position as a hub for scientific skincare formulation, clean-label innovation, and dermatological R&D. German consumers increasingly prioritize high-efficacy mineral sunscreen dispersions and polymeric-based tinted moisturizers that meet stringent EU ingredient and safety standards. The country’s skincare ecosystem benefits from its advanced cosmetic chemistry infrastructure and adherence to sustainability frameworks under the EU Green Deal and REACH regulations, which encourage the development of PEG-free, biodegradable dispersant systems.

Local and multinational brands in Germany are pioneering eco-certified formulations with enhanced pigment dispersion and UV reflectivity, catering to sensitive and mature skin demographics. The integration of microdispersion technologies and biocompatible silicone emulsions is enabling smoother textures and improved skin adherence. Additionally, Germany’s well-developed pharmacy and specialty retail networks continue to anchor sales of premium dermocosmetic products.

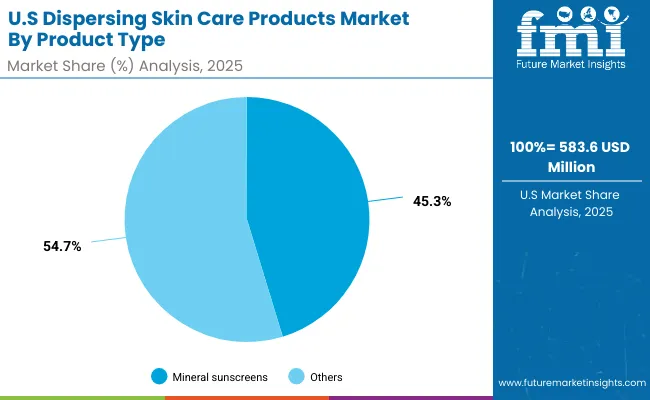

| USA By Product Type | Value Share% 2025 |

|---|---|

| Mineral sunscreens | 45.3% |

| Others | 54.7% |

The Dispersing Skin Care Products Market in the United States is projected at USD 583.6 million in 2025, with mineral sunscreens (ZnO/TiO₂ dispersions) contributing 45.3% of total market value. This dominance reflects the USA consumer shift toward dermatologist-recommended, broad-spectrum, and reef-safe formulations that merge protection with cosmetic enhancement. Growth is supported by increasing use of polymeric dispersants to improve pigment stability and silicone systems that enhance product spreadability and sensory performance.

The rise of tinted moisturizers, BB/CC creams, and hybrid sunscreen-serum products has transformed the daily skincare landscape, as consumers seek lightweight, multifunctional options that deliver even tone and long-lasting UV defense. Innovation in clean beauty and PEG-free dispersions continues to drive brand differentiation, with strong traction across e-commerce and specialty retail platforms.

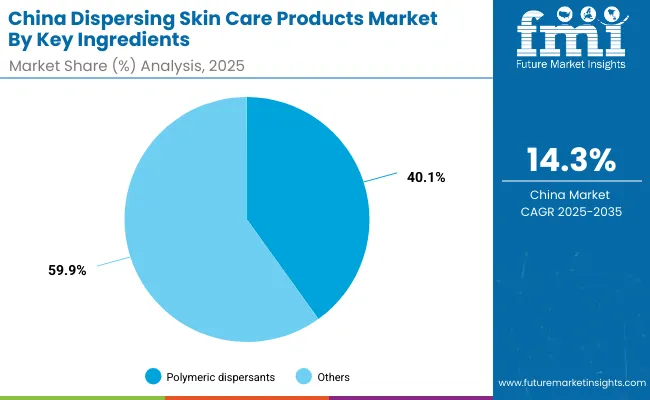

| China By Dispersant System | Value Share% 2025 |

|---|---|

| Polymeric dispersants | 40.1% |

| Others | 59.9% |

The Dispersing Skin Care Products Market in China presents a strong growth opportunity, supported by rising adoption of polymeric dispersant systems (40.1%) that deliver superior pigment stability and long-lasting wear in high-performance skincare. The market is shifting toward multifunctional, mineral-based formulations that combine UV protection, tone correction, and hydrationkey preferences among Chinese consumers seeking luminous, even-toned complexions. Local R&D investments are accelerating innovations in biocompatible dispersants and micro-pigment dispersion technologies, enabling brands to achieve smoother textures and high-transparency finishes suitable for diverse skin tones.

Domestic manufacturers are leveraging low-cost production capabilities and advanced formulation science to compete globally, particularly in the clean beauty and sunscreen hybrid segments. The integration of natural and PEG-free dispersant systems is gaining momentum, supported by regulatory encouragement for safer, environmentally responsible ingredients. With expanding online retail ecosystems, influencer marketing, and cross-border beauty collaborations, China is rapidly positioning itself as a center of excellence for advanced dispersing skincare technologies.

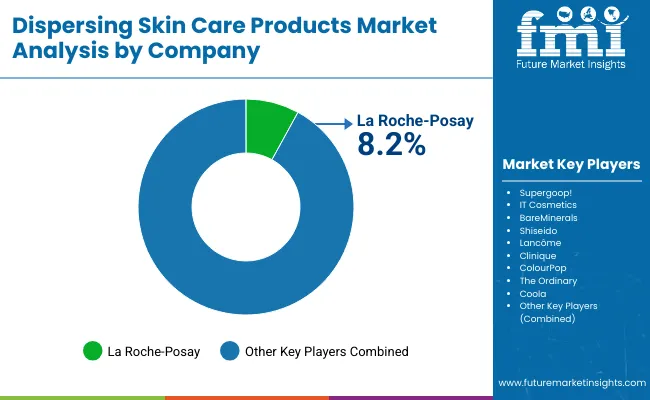

| Company | Global Value Share 2025 |

|---|---|

| La Roche- Posay | 8.2% |

| Others | 91.8% |

The Dispersing Skin Care Products Market is moderately fragmented, featuring a mix of global skincare powerhouses, mid-tier innovators, and niche clean-beauty specialists competing across sun protection, complexion enhancement, and tinted care segments. Leading dermatological brands such as La Roche-Posay, Supergoop!, and Shiseido command significant value shares through their advanced formulations integrating ZnO/TiO₂ dispersions, polymeric stabilizers, and lightweight silicone-based textures. These companies continue to lead in clinical validation, hybrid product innovation, and strong pharmacy and e-commerce distribution networks.

Mid-sized players like IT Cosmetics, BareMinerals, and The Ordinary are capitalizing on growing demand for skin-perfecting, mineral-rich, and PEG-free dispersing products, particularly among health-conscious and sensitive-skin consumers. Their success stems from balancing dermatological safety with aesthetic appeal through improved dispersion uniformity and non-comedogenic formulations.

Emerging niche brands such as Coola and ColourPop are strengthening their market presence with affordable clean beauty offerings, leveraging online retail and influencer marketing. Competitive differentiation is increasingly shifting from traditional SPF claims to texture innovation, transparency of ingredients, and environmental compliance. As sustainability becomes a defining factor, the ability to integrate biodegradable dispersant systems and reef-safe minerals will remain key to long-term leadership in this evolving market.

Key Developments in Dispersing Skin Care Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,402.5 Million |

| Product Type | Tinted moisturizers/BB-CC creams, Mineral sunscreens ( ZnO / TiO ₂ dispersions), Pigment-infused serums, Body lotions with shimmer/pearls |

| Dispersant System | Polymeric dispersants, Silicone dispersions, Natural/PEG-free systems |

| Physical Form | Pre-dispersed paste, Liquid concentrate, Powder dispersion |

| Channel | E-commerce, Specialty beauty retail, Pharmacies, Mass retail |

| End User | Women, Men, Unisex |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | La Roche- Posay, Supergoop !, IT Cosmetics, BareMinerals, Shiseido, Lancôme, Clinique, ColourPop, The Ordinary, Coola |

| Additional Attributes | Dollar sales by product type and dispersant system, adoption trends in mineral sunscreen and tinted skincare formulations, rising demand for polymeric and silicone-based dispersants, segment-specific growth across premium sun care, hybrid cosmetics, and clean beauty lines, expanding e-commerce and specialty retail penetration, increasing consumer shift toward PEG-free and natural dispersion technologies, innovations in pre-dispersed paste and liquid concentrate formats, and regional growth influenced by sustainability regulations, ingredient transparency, and rising skincare awareness. |

The global Dispersing Skin Care Products Market is estimated to be valued at USD 3,402.5 million in 2025.

The market size for the Dispersing Skin Care Products Market is projected to reach USD 7,207.8 million by 2035.

The Dispersing Skin Care Products Market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in the Dispersing Skin Care Products Market are tinted moisturizers/BB-CC creams, mineral sunscreens (ZnO/TiO₂ dispersions), pigment-infused serums, and body lotions with shimmer/pearls.

In terms of dispersant system, the polymeric dispersants segment is expected to command a significant share of 38.7% in the Dispersing Skin Care Products Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lubricating Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Moisturizing Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Fatigue Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Incontinence Skincare Products Market Analysis by Product Type, Price, End-User, Sales Channel and Region 2025 to 2035

Anti-Pollution Skin Care Products Market Trends - Growth & Forecast 2025 to 2035

Anti-Inflammatory Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Allantoin Extract for Skincare Products Market Analysis – Trends, Growth & Forecast 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA