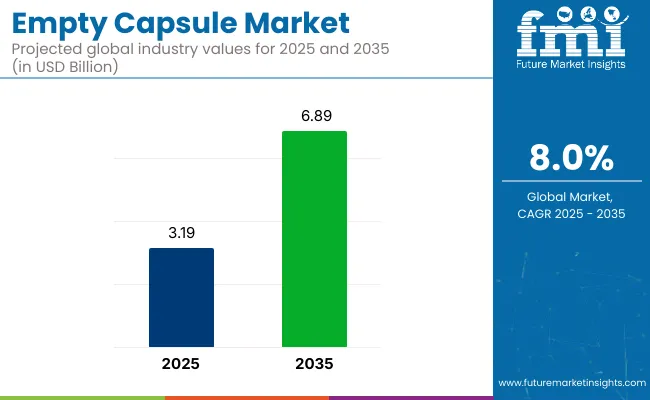

The global empty capsule market is worth USD 3.19 billion in 2025 and is poised to reach USD 6.89 billion by 2035, which depicts a CAGR of 8.0% over the forecast period. This growth is being driven by the rising demand for capsule-based drug delivery systems in pharmaceuticals, nutraceuticals, and dietary supplements.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.19 billion |

| Industry Value (2035F) | USD 6.89 billion |

| CAGR (2025 to 2035) | 8.0% |

Empty capsules, including gelatin and hydroxypropyl methylcellulose (HPMC) varieties, are widely used for encapsulating powders, granules, liquids, and semi-solids. Their ease of swallowing, better bioavailability, and capacity to mask unpleasant tastes make them preferable over traditional tablets. Increasing geriatric populations, expanding self-medication trends, and consumer preference for clean-label supplements are further accelerating market demand.

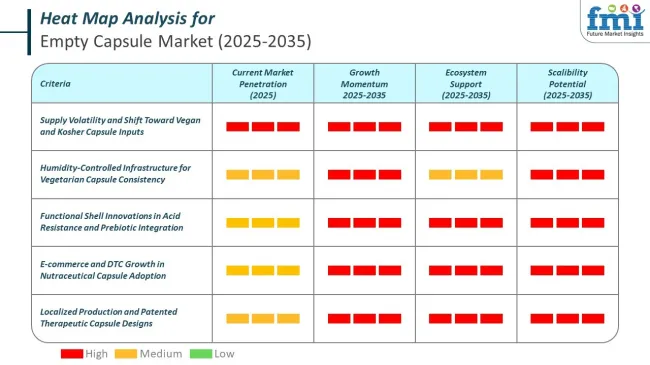

Technological advancements and material innovation are shaping the future of capsule manufacturing. Companies are focusing on developing vegetarian, organic, and allergen-free capsules that align with evolving consumer preferences and regulatory standards. In this regard, they are investing ample amounts in research and development.

Plant-based capsules are gaining traction among vegan and halal-conscious populations, particularly in North America, Europe, and Southeast Asia. Moreover, functional capsules with enteric coatings, controlled release profiles, and enhanced dissolution properties are being adopted in specialized drug delivery. Contract manufacturers and pharmaceutical companies are also leveraging high-speed encapsulation technologies and automated lines to scale production efficiently while maintaining quality and compliance.

Regulatory support and growing investments in healthcare infrastructure are enhancing market potential across both developed and emerging regions. Authorities such as the US FDA, EMA, and WHO are streamlining guidelines around capsule safety, raw material sourcing, and labeling standards.

Emerging economies are witnessing increased demand for over-the-counter medications and personalized supplements, creating opportunities for capsule manufacturers to expand their presence. With growing emphasis on preventive healthcare, improved patient compliance, and innovative dosage forms, the empty capsule market is expected to experience robust growth across the pharmaceutical, nutraceutical, and functional food industries from 2025 to 2035.

The global empty capsule market in 2025 utilizes Type-B bovine gelatin for its compatibility with fill-line throughput and thermo-mechanical integrity. In several regional facilities, gelatin capsules maintain stable deployment across temperature-variable lines. Formulation research involving HPMC, pullulan, and starch-based shells is present in operations across the USA, Japan, and MENA. These formats are documented within halal, kosher, and vegan-certified product portfolios.

Capsule facilities in Asia focus on real-time environmental controls and precision-based filling mechanisms.

Empty capsules are deployed across regulated pharmaceutical sectors and digitally enabled nutraceutical lines.

The market is segmented based on product type, raw material, capsule size, route of administration, end user, and region. By product type, the market is divided into gelatin-based capsules and vegetarian-based capsules. In terms of raw material, it is segmented into Type-A, Type-B gelatin, fish bone gelatin, hydroxy propyl methyl cellulose (HPMC), starch materials, and pullulan.

Based on capsule size, the market includes size “000”, size “00”, size “0”, size “1”, size “2”, size “3”, size “4”, and size “5”. By route of administration, the market is categorized into oral administration and inhalation administration. In terms of end user, the market includes pharmaceutical companies, cosmetic & nutraceutical companies, and clinical research organizations. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

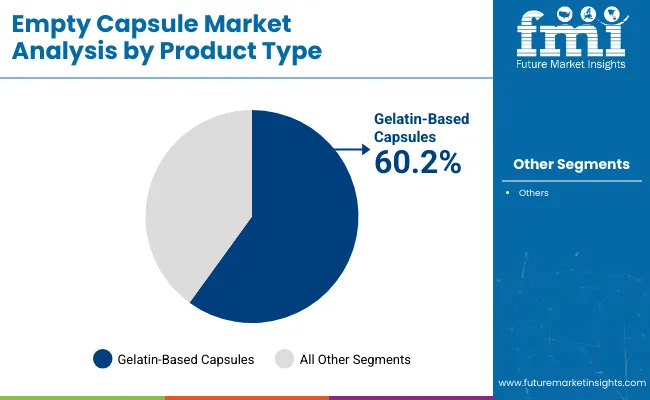

Gelatin-based capsules are projected to lead the empty capsule market with a 2025 share of 60.2%. These capsules remain the industry standard due to their excellent machinability, compatibility with a broad range of active pharmaceutical ingredients (APIs), and cost-efficiency.

| Product Type Segment | Market Share (2025) |

|---|---|

| Gelatin-Based Capsules | 60.2% |

Their long-standing regulatory acceptance and consumer familiarity make them highly suitable for prescription, OTC, and nutraceutical applications. Type-A and Type-B bovine-sourced gelatin are commonly used in these capsules, offering reliable disintegration profiles and predictable bioavailability. Leading suppliers such as Capsugel (Lonza), ACG Group, and Qualicaps are expanding gelatin capsule lines for oral delivery formats across both developed and emerging markets.

In contrast, vegetarian-based capsules are gaining notable traction, with an estimated 2025 share of 39.8%. This growth is being driven by rising veganism, dietary restrictions (e.g., halal, kosher), and clean-label trends. HPMC and pullulan-based vegetarian capsules are increasingly preferred in dietary supplements and herbal formulations.

Despite being costlier, they provide an edge in plant-based positioning and stability for moisture-sensitive formulations. Companies like Suheung and CapsCanada are actively innovating vegetarian capsule technologies. While vegetarian formats continue to grow, gelatin-based capsules retain their market leadership due to processing ease, formulation flexibility, and cost advantages, especially in the pharmaceutical sector.

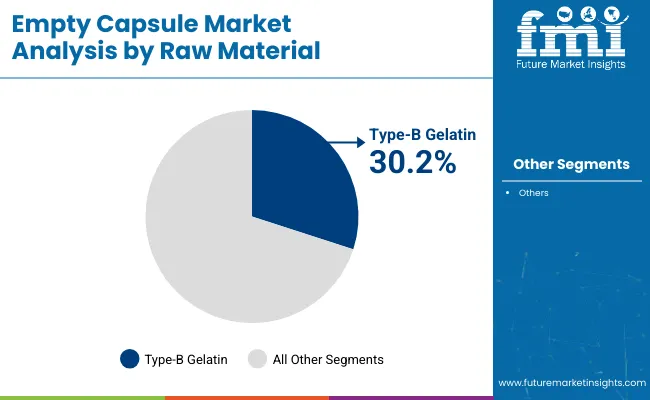

The raw material segment of the empty capsule market is led by Type-B gelatin, projected to capture a 30.2% share in 2025. Known for its cost-efficiency and versatility, Type-B gelatin is widely used in pharmaceutical and nutraceutical applications due to its strong gelling ability, high elasticity, and ease of processing.

| Raw Material Segment | Market Share (2025) |

|---|---|

| Type-B Gelatin | 30.2% |

Manufacturers prefer it for encapsulating a range of active pharmaceutical ingredients (APIs), vitamins, and herbal supplements. Its prevalence is particularly high in Asia Pacific and Latin American markets, where cost sensitivity and volume production are key priorities.

Hydroxy Propyl Methyl Cellulose (HPMC), a plant-based alternative, is also gaining momentum, accounting for an estimated 24.5 percent market share in 2025. The rising demand for vegetarian and vegan capsules, especially in North America and Europe, is driving adoption of HPMC, which offers chemical stability, moisture resistance, and suitability for hygroscopic formulations. Major players like Lonza and Capsugel continue to expand their HPMC capsule offerings to meet evolving consumer preferences.

Other materials such as Type-A gelatin, pullulan, starch, and fish bone gelatin are being adopted in specialized use cases requiring specific physical and chemical properties. As capsule manufacturers expand their portfolios, raw material versatility remains central to product innovation and regional market expansion.

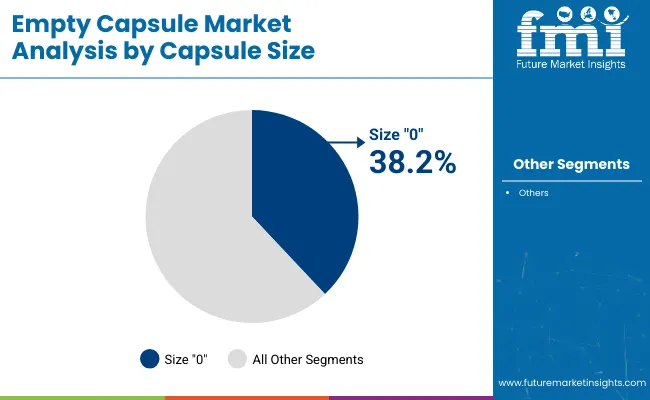

The size "0" capsule segment is projected to dominate the empty capsule market in 2025, accounting 38.2% market share. This size strikes a practical balance between payload capacity and swallowability, making it highly favored in both pharmaceutical and nutraceutical applications. Typically used for encapsulating herbal powders, vitamins, minerals, and prescription drugs, size "0" capsules are compatible with both gelatin and HPMC (vegetarian) materials.

| Capsule Size Segment | Market Share (2025) |

|---|---|

| Size "0" | 38.2% |

Manufacturers such as ACG and CapsCanada are focusing on high-speed filling equipment and improved shell integrity to meet growing demand across adult formulations. The segment continues to benefit from its ability to deliver moderate active ingredient dosages without compromising consumer comfort or safety.

The size “1” capsule segment is expected to hold 26.7% market share in 2025, with increasing usage in pediatric and geriatric formulations. This size is preferred for lower-dose medications, often used in personalized medicine, probiotics, and condition-specific nutritional products. Its compact profile supports improved compliance among sensitive populations.

Size “1” capsules are also gaining ground in clinical trials where dose variation and blinding are crucial. While larger sizes like “00” and smaller ones like “2” remain in use, size “0” and size “1” capsules will continue to represent the bulk of industry demand due to their optimal sizing and application versatility.

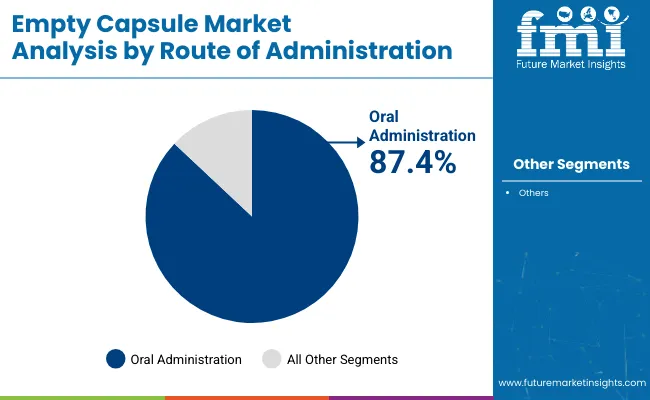

The oral administration segment is anticipated to hold 87.4% share of the empty capsule market by 2025, making it the most dominant route of administration. Its prevalence is underpinned by advantages such as patient comfort, broad formulation flexibility, and the ability to deliver drugs, vitamins, and herbal ingredients with taste-masking and easy ingestion.

| Route of Administration | Market Share (2025) |

|---|---|

| Oral Administration | 87.4% |

Oral capsules are widely adopted for extended, delayed, and sustained-release dosage forms, enabling companies to address chronic conditions efficiently. Pharmaceutical players favor oral capsules for their superior scalability, shelf stability, and compatibility with both gelatin and HPMC variants, supporting large-scale and diverse production runs.

The inhalation segment is projected to grow at 7.6% CAGR during the study period, driven primarily by its application in respiratory therapies. Capsules used for dry powder inhalers (DPIs) are gaining traction in treating asthma, COPD, and pulmonary infections.

Despite its niche share, this route is growing due to increasing R&D in pulmonary delivery systems and innovation in capsule shell materials that ensure optimal puncture and dispersion performance. However, the need for device compatibility and strict manufacturing standards limits its broader use. Oral capsules remain the primary delivery route, particularly in emerging markets where accessibility and user familiarity sustain consistent market preference.

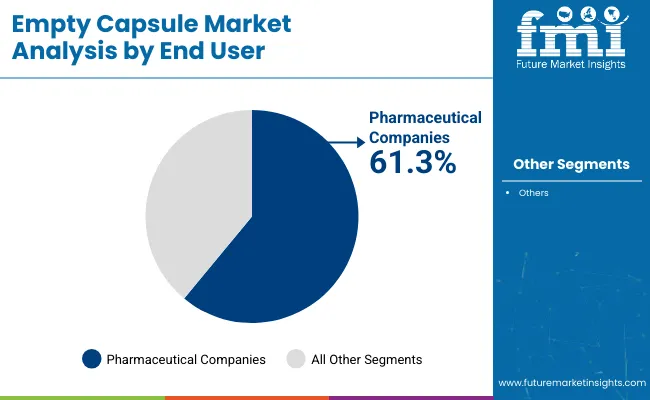

Pharmaceutical companies are expected to lead the empty capsule market by end user in 2025, capturing a 61.3% market share. This dominance is driven by high-volume drug manufacturing across therapeutic areas including pain management, antibiotics, and mental health.

| End User Segment | Market Share (2025) |

|---|---|

| Pharmaceutical Companies | 61.3% |

Capsules are preferred for their ease of formulation, cost-effectiveness, and adaptability to various release profiles. They are especially favored for generic drugs, over-the-counter (OTC) offerings, and combination therapies. Companies such as Lonza and Qualicaps are expanding global production capacities and developing pharma-compliant, plant-based capsule alternatives to cater to both conventional and specialty drug pipelines.

The clinical research organizations (CROs) segment is estimated to account for 18.5% of the market share in 2025. CROs rely on empty capsules for blinded trials, pharmacokinetic studies, and dosage flexibility during early-stage development.

Their ability to create custom-dosed, placebo-controlled capsules makes them ideal for clinical investigations across oncology, neurology, and infectious diseases. The rise of contract research outsourcing, particularly in Asia and Eastern Europe, is amplifying demand. While nutraceutical brands and cosmetic formulators contribute to overall market volume, pharmaceutical companies and CROs will remain central to innovation and adoption in capsule-based drug delivery systems through 2035.

Consumer preferences for capsule dose forms are increasing due to convenience, ease of ingesting, and enhanced taste masking. Capsules are a convenient and edible alternative to standard dose forms such as tablets or powders. The gelatin or vegetarian shells used in empty capsules conceal the taste of substances, making them more appealing to customers.

Consumer preferences are shifting toward capsules as the preferred dose form in various industries, driving the sales of empty capsules. This trend emphasizes the value of empty capsules as a versatile and adaptable solution that meets changing consumer expectations for smooth and enjoyable healthcare experiences.

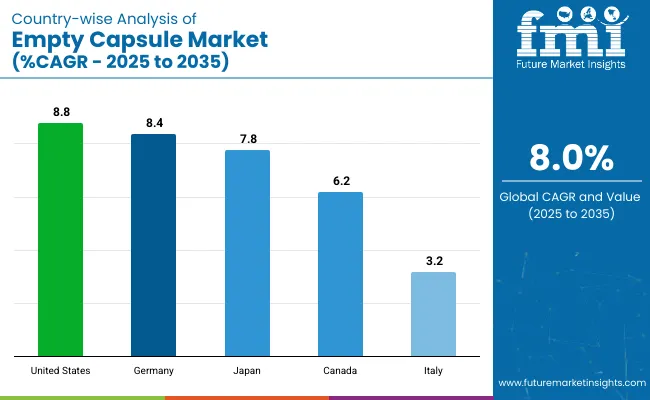

This section explores markets in many key economies, including the United States, Canada, Japan, Germany, and Italy. It also examines the various factors influencing empty capsule demand, adoption, and sales in these nations. A detailed investigation shows North America offers significant growth opportunities due to its robust empty capsule manufacturers.

The United States empty capsule market is anticipated to display a strong CAGR of 8.8% from 2025 to 2035. The increased preference for vegetarian and plant-based capsules helps stimulate the United States empty capsule market. The demand for empty capsules in the country is also driven by the growing acceptance of personalized medicine and nutraceutical products.

Furthermore, rising investments in drug research and development continue to benefit the expansion of the United States’ empty capsule industry, reinforcing the country’s position as a key global player.

| Country | CAGR |

|---|---|

| United States | 8.8% |

The empty capsule market in Germany is expected to evolve at a CAGR of 8.4% from 2025 to 2035. Germany's strict quality standards and adherence to Good Manufacturing Practices (GMP) enhance the reputation of its empty capsule industry both domestically and across Europe.

Ongoing technological advancements and the introduction of automation in pharmaceutical production have improved the industry’s operational efficiency. Additionally, Germany’s strategic geographic position and well-developed logistics infrastructure make it easier for manufacturers to distribute and export empty capsules throughout the European continent.

| Country | CAGR |

|---|---|

| Germany | 8.4% |

Japan's empty capsule market is projected to grow at a CAGR of 7.8% from 2025 to 2035, primarily due to the increasing demand for nutraceuticals. The country’s aging population and the rising need for geriatric-friendly medicine formats are key contributors to this growth.

Investment in pharmaceutical research and development is also intensifying, helping Japan’s empty capsule sector remain competitive on a global scale. Moreover, cultural preferences for easy-to-swallow dosage forms and precise medication administration continue to support the consistent expansion of the Japanese market.

| Country | CAGR |

|---|---|

| Japan | 7.8% |

The Canadian empty capsule market is expected to grow at a CAGR of 6.2% from 2025 to 2035. The country’s aging demographic is leading to increased demand for various drug forms, which has a direct positive impact on the empty capsule industry.

Government initiatives and legislative frameworks that support pharmaceutical manufacturing are further strengthening the market. Additionally, Canada's focus on sustainable and eco-conscious healthcare practices is shaping trends, with a growing emphasis on environmentally friendly capsule materials that align with the country’s values and consumer preferences.

| Country | CAGR |

|---|---|

| Canada | 6.2% |

Italy’s empty capsule market is forecast to expand at a relatively slower CAGR of 3.2% from 2025 to 2035. The country’s market dynamics are influenced by a strong cultural inclination toward natural wellness and the use of organic capsule materials.

Italy’s emphasis on traditional medicine and herbal supplement consumption is supporting demand in the nutraceutical segment. At the same time, a growing interest in customizable dosage formats and patient-centric medication options is gradually expanding the scope of the empty capsule industry within the Italian pharmaceutical and nutraceutical landscape.

| Country | CAGR |

|---|---|

| Italy | 3.2% |

In the competitive landscape of the empty capsule market, numerous important competitors have established themselves as significant contributors to the industry's growth and evolution. The empty capsule producers have shown dedication to innovation, dependability, and a wide range of competencies, altering market dynamics.

Empty capsule manufacturers, such as ABC Capsules, Capsugel, and ACG Worldwide, are at the forefront of innovation and have established themselves as dependable suppliers of empty capsules. Prominent vendors such as Qualicaps and Suheung Co. Ltd. share their capabilities and demonstrate various offerings. CapsCanada Corporation, Shanxi Guangsheng Medicinal Capsule Co. Ltd., and Bright Pharma Caps Inc. are notable participants, each making a unique contribution to the empty pill market.

HealthCaps India Limited and Sunil Healthcare Limited enhance the competitive landscape by providing innovative solutions and insights. As these key competitors negotiate the shifting empty capsule demand, the path is set for ongoing advancements and competition, undoubtedly encouraging innovation and success in the sector.

Notable Innovations and Developments

| Company | Details |

|---|---|

| CapsCanada Corporation | CapsCanada Corporation received a substantial boost in November 2023 with a USD 5 million investment from FedDev Ontario. This investment is likely to expand operations and fulfill increased demand for its made-in-Canada hard empty capsules. |

| Bright Pharma Caps Inc. | Bright Pharma Caps Inc. launched the world's first certified organic capsules, Bright-Poly, in August 2023. The capsules are manufactured of USDA-certified organic pullulan, which is NOP-approved and can be utilized in vegetarian, kosher, and halal products. |

| Vivion | Vivion, a leading ingredient solutions company, has introduced a new line of empty gelatin, HPMC, and pullulan capsules. |

| CapsCanada | CapsCanada, a Lyfe Group firm, announced in March 2021 the launch of a capsule manufacturing service for new liquid-filled hard capsules. |

| Lonza Group Ltd. | Lonza Group Ltd. announced in October 2020 that it would invest USD 93.0 million in its Capsules and Health Ingredients (CHI) Division, enabling the company to produce 30 billion pills annually. |

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.19 billion |

| Projected Market Size (2035) | USD 6.89 billion |

| CAGR (2025 to 2035) | 8.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value |

| By Product Type | Gelatin-Based Capsules, Vegetarian-Based Capsules |

| By Raw Material | Type-A, Type-B Gelatin, Fish Bone Gelatin, Hydroxy Propyl Methyl Cellulose (HPMC), Starch Materials, Pullulan |

| By Capsule Size | Size “000”, Size “00”, Size “0”, Size “1”, Size “2”, Size “3”, Size “4”, Size “5” |

| By Route of Administration | Oral Administration, Inhalation Administration |

| By End User | Pharmaceutical Companies, Cosmetic & Nutraceutical Companies, Clinical Research Organizations |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Germany, Japan, Canada, Italy |

| Key Players | ACG Worldwide, Capsugel, Qualicaps Inc., Bright Pharma Caps Inc., Medi-Caps Ltd., CapsCanada Corporation, Roxlor LLC, Snail Pharma Industry Co. Ltd., Suheung Co. Ltd., Sunil Healthcare Ltd |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global empty capsule market is projected to reach USD 6.89 billion by 2035, growing from USD 3.19 billion in 2025, at a CAGR of 8.0% over the forecast period.

Gelatin-based capsules are expected to dominate the market with a 60.2% share in 2025, favored for their cost-efficiency, machinability, and regulatory familiarity in pharmaceutical applications.

Type-B gelatin leads the raw material segment with a 30.2% market share in 2025, driven by cost-effectiveness, elasticity, and broad adoption in mass-market drug and supplement formulations.

Size “0” capsules are projected to grow at a CAGR of 3.57%, due to their optimal dosage capacity and popularity in adult health supplements and pharmaceutical applications globally.

Oral administration remains the dominant route, forecasted to grow at a CAGR of 4.3% from 2025 to 2035, supported by high patient compliance and broad application in both drug and nutraceutical delivery.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Empty Capsule Market - Growth & Forecast 2025 to 2035

Global Flavored Empty Capsule Market Analysis – Size, Share & Forecast 2024-2034

Demand for Empty Capsules in EU Size and Share Forecast Outlook 2025 to 2035

Depyrogenated Sterile Empty Vials Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Market Share Breakdown of Capsule Filling Machine Manufacturers

Capsule Coffee Machines Market

Wine Capsule Market Insights – Trends & Forecast 2024-2034

Resin Capsule Market Growth – Trends & Forecast 2024-2034

Flavor Capsule Cigarette Market Analysis - Size, Share, and Forecast 2025 to 2035

Liquid Capsule Filling Machines Market Trends – Growth & Forecast 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Capsules and Pods Market

Flavor Capsule Cigarettes Market

Washing Capsules Market Size and Share Forecast Outlook 2025 to 2035

Softgel Capsules Market Overview - Growth & Forecast 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Market Share Distribution Among Tablets And Capsules Packaging Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA