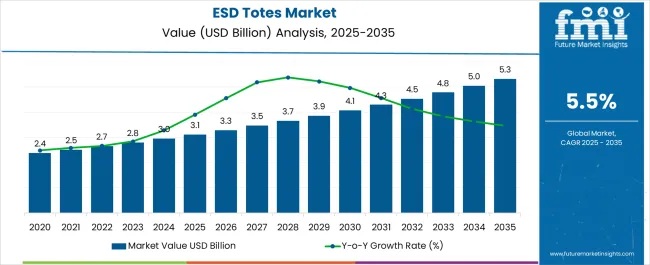

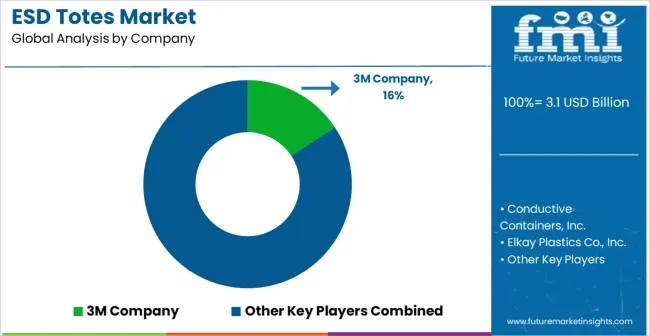

The ESD Totes Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| ESD Totes Market Estimated Value in (2025 E) | USD 3.1 billion |

| ESD Totes Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The ESD Totes market is growing steadily, supported by rising demand for safe handling, storage, and transportation of electronic components sensitive to electrostatic discharge. Increasing complexity in semiconductor and electronics manufacturing has heightened the need for specialized packaging and storage solutions to ensure product integrity and compliance with quality standards. These totes are being widely adopted across electronics, automotive, aerospace, and telecommunication sectors where static-sensitive devices form a critical part of operations.

Advances in conductive and dissipative materials, coupled with enhanced manufacturing techniques, are improving the durability and efficiency of ESD totes. Their use is also being driven by stricter safety and reliability standards imposed by industries that cannot afford damage to high-value components.

The adoption of automation in warehouses and manufacturing units is reinforcing demand for standardized, stackable, and reusable totes that streamline inventory handling With industries increasingly prioritizing quality assurance, operational efficiency, and compliance, the ESD Totes market is expected to expand consistently, fueled by sustained technological innovation and rising global electronics production.

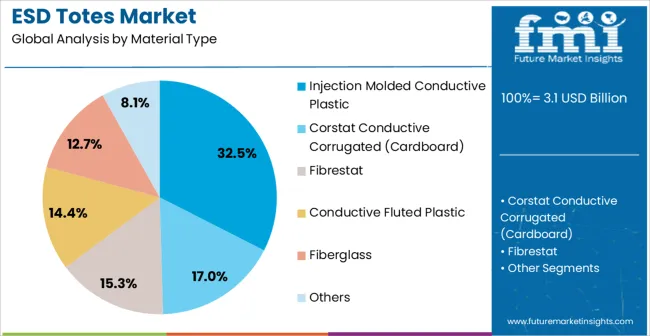

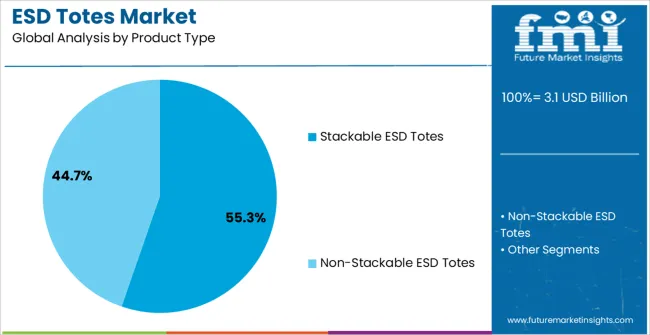

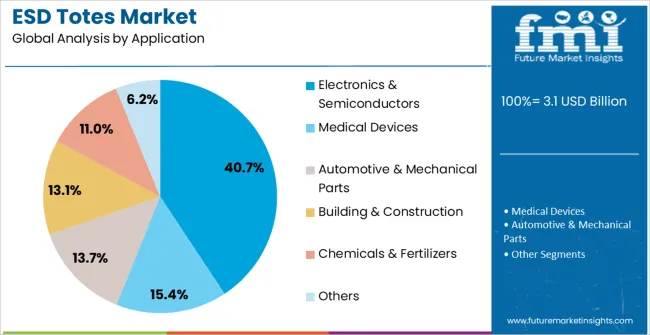

The esd totes market is segmented by material type, product type, application, and geographic regions. By material type, esd totes market is divided into Injection Molded Conductive Plastic, Corstat Conductive Corrugated (Cardboard), Fibrestat, Conductive Fluted Plastic, Fiberglass, and Others. In terms of product type, esd totes market is classified into Stackable ESD Totes and Non-Stackable ESD Totes. Based on application, esd totes market is segmented into Electronics & Semiconductors, Medical Devices, Automotive & Mechanical Parts, Building & Construction, Chemicals & Fertilizers, and Others. Regionally, the esd totes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The injection molded conductive plastic material type segment is projected to account for 32.5% of the market revenue in 2025, establishing itself as the leading material type. Growth in this segment is driven by the superior protective properties of conductive plastics, which dissipate static charges effectively and safeguard sensitive electronic components. Injection molding technology ensures high precision and consistency in product design, allowing for the manufacture of durable and lightweight totes that are widely used in advanced electronics industries.

The cost-effectiveness of mass production through injection molding has further strengthened the appeal of this material type. Additionally, these plastics can be engineered to offer high resistance to wear and chemical exposure, making them suitable for demanding industrial environments.

Their ability to be recycled also aligns with sustainability goals of manufacturers, enhancing adoption across regions focused on environmental compliance As demand for reliable and long-lasting ESD protection solutions continues to rise, injection molded conductive plastics are expected to retain their dominant role in the market.

The stackable ESD totes product type segment is expected to hold 55.3% of the market revenue share in 2025, making it the dominant product category. This leadership is supported by the high level of functionality offered by stackable totes, which optimize space utilization and streamline logistics in manufacturing and storage facilities. Their design allows for secure stacking without compromising the integrity of sensitive components, making them especially popular in electronics and semiconductor industries.

Stackable totes enable efficient inventory handling, reduce storage footprints, and support lean manufacturing processes by improving organization and accessibility. The ability to integrate these totes into automated systems has further enhanced their relevance in modern industrial settings.

They also contribute to cost savings by being reusable and highly durable, which reduces overall packaging and handling expenses As industries focus on operational efficiency, scalability, and compliance with strict safety standards, stackable ESD totes are anticipated to maintain their leadership, reinforced by their adaptability to diverse industrial applications.

The electronics and semiconductors application segment is anticipated to capture 40.7% of the market revenue share in 2025, emerging as the largest application area. This growth is being fueled by the critical role of ESD protection in safeguarding delicate semiconductor devices and electronic assemblies during production, storage, and transport. Damage from electrostatic discharge can lead to significant losses, making ESD totes an indispensable solution for manufacturers seeking to ensure quality and compliance with international standards.

With the global expansion of semiconductor fabrication plants and electronic assembly units, demand for specialized totes has accelerated. These totes enable companies to minimize risks of failure, extend product lifecycles, and maintain competitiveness in a fast-paced industry.

Furthermore, as emerging technologies such as 5G, electric vehicles, and advanced consumer electronics drive higher production volumes, the requirement for reliable protective packaging continues to grow The electronics and semiconductors segment is expected to remain the key driver of the ESD totes market, underpinned by innovation and sustained industry expansion.

Electrostatic discharge protection plays a vital role in electrical & electronics manufacturing, fibre optics, telecommunication and other industrial applications. The demand for ESD protective packaging has grown rapidly in the last decade. Digital revolution caused the electronic & electric manufacturing market to grow rapidly to meet the exponentially rising demand for smartphones, smart TVs and the Internet of Things (IoT) technology.

ESD totes are box like containers which come with stackable and lidding options. These are basically manufactured on two basic principles: conductive or dissipative. ESD totes can come with dividers. Growing regulatory environment related to imports and exports of electronics & electrical components and devices is influencing the demand growth for ESD totes.

Integrated circuits, printed electronic boards (PCBs), Capacitors, Resistors and other electronic parts and devices are shipped using ESD totes. Growing penetration of tablets and smartphones market in developing countries is expected to drive the worldwide demand for ESD totes.

Majorly ESD totes are used in in-house material handling, in electronics & electric manufacturing, automotive, aerospace, defence and other manufacturing industries, where ESD protection is necessary.

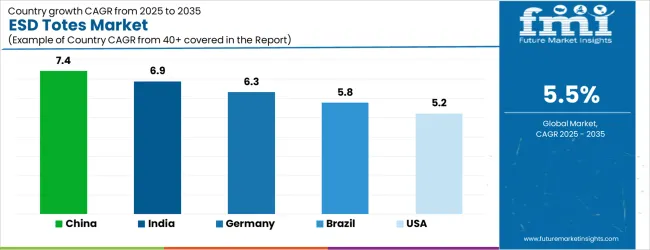

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The ESD Totes Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global ESD Totes Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%.

The USA ESD Totes Market is estimated to be valued at USD 1.1 billion in 2025 and is anticipated to reach a valuation of USD 1.1 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 165.9 million and USD 97.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Material Type | Injection Molded Conductive Plastic, Corstat Conductive Corrugated (Cardboard), Fibrestat, Conductive Fluted Plastic, Fiberglass, and Others |

| Product Type | Stackable ESD Totes and Non-Stackable ESD Totes |

| Application | Electronics & Semiconductors, Medical Devices, Automotive & Mechanical Parts, Building & Construction, Chemicals & Fertilizers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Conductive Containers, Inc., Elkay Plastics Co., Inc., ESD Systems, GWP Conductive, InterMetro Industries Corporation, LewisBins+, MFG Tray Company, Mouser Electronics, Inc., Plasticoid Manufacturing Inc., Quantum Storage Systems, Richco, Inc., and RTP Company |

The global ESD totes market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the ESD totes market is projected to reach USD 5.3 billion by 2035.

The ESD totes market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in ESD totes market are injection molded conductive plastic, corstat conductive corrugated (cardboard), fibrestat, conductive fluted plastic, fiberglass and others.

In terms of product type, stackable ESD totes segment to command 55.3% share in the ESD totes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ESD Divider Market Size and Share Forecast Outlook 2025 to 2035

ESD Valve Market Forecast and Outlook 2025 to 2035

ESD Safe Matting Market Size and Share Forecast Outlook 2025 to 2035

ESD Clamshell Market Size and Share Forecast Outlook 2025 to 2035

ESD Trays Market Size and Share Forecast Outlook 2025 to 2035

ESD Protective Signage Labels Market Size and Share Forecast Outlook 2025 to 2035

ESD Foldable Container Market Size and Share Forecast Outlook 2025 to 2035

ESD Tapes and Labels Market from 2025 to 2035

ESD Stackable Box Market Trends & Industry Analysis 2024-2034

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

ESD workstations Market

ESD Suppressors Market

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Lab Totes Market

Unidirectional ESD Diode Market Size and Share Forecast Outlook 2025 to 2035

Electrostatic Discharge (ESD) Packaging Market Growth - Forecast 2025 to 2035

Demand for Unidirectional ESD Diode in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA