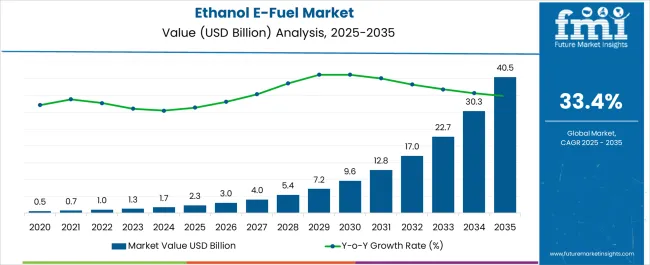

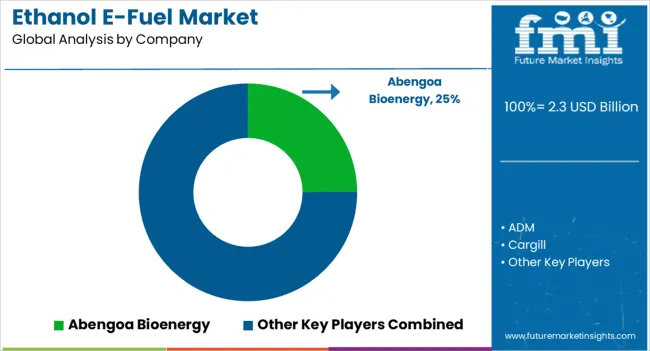

The Ethanol E-Fuel Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 40.5 billion by 2035, registering a compound annual growth rate (CAGR) of 33.4% over the forecast period. Regulatory frameworks are central to this rapid expansion, with government policies and environmental mandates driving both production and adoption. Emission reduction targets and renewable fuel standards established by authorities such as the US Environmental Protection Agency, the European Commission, and various national energy ministries are compelling refiners and distributors to integrate ethanol-based fuels into the broader energy mix. These policies incentivize cleaner fuel adoption through subsidies, tax credits, and mandated blending ratios, directly affecting market penetration and pricing structures.

Fuel economy and environmental regulations are pushing automotive manufacturers to optimize engines for ethanol compatibility, ensuring compliance with emission norms while maintaining performance. The international climate agreements, such as the Paris Accord, are influencing national strategies, resulting in accelerated R&D in high-octane ethanol E-fuels and supporting infrastructure, including distribution networks and refueling stations. Regulatory monitoring mechanisms also encourage adherence to safety, labeling, and handling standards, influencing cost structures across the supply chain.

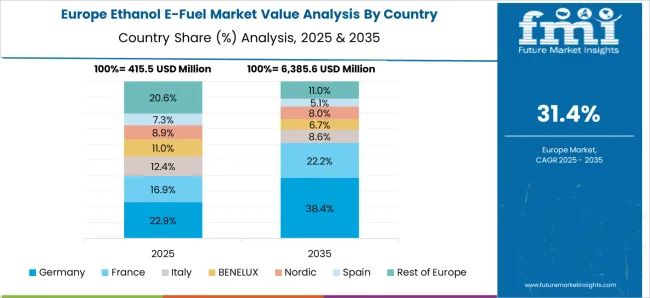

By 2035, regulatory oversight is expected to remain a primary driver of market dynamics, shaping both technological innovation and strategic investments. Markets with stringent emission and renewable energy mandates, particularly in North America and Europe, are likely to witness faster adoption, while emerging regions may experience accelerated growth as governments implement supportive regulatory frameworks to transition toward low-carbon fuel solutions.

| Metric | Value |

|---|---|

| Ethanol E-Fuel Market Estimated Value in (2025 E) | USD 2.3 billion |

| Ethanol E-Fuel Market Forecast Value in (2035 F) | USD 40.5 billion |

| Forecast CAGR (2025 to 2035) | 33.4% |

The ethanol e-fuel market is witnessing robust growth fueled by rising investments in sustainable transportation and tightening carbon emission norms across global economies. Increasing demand for low-carbon alternatives to conventional fossil fuels is accelerating the adoption of ethanol-based synthetic fuels.

Government incentives and mandates supporting renewable energy integration in fuel production are propelling technological advancements and project deployments. Innovations in solar-powered synthesis, carbon capture, and catalytic conversion have made ethanol a viable solution for decarbonizing transport and industrial sectors.

As countries aim to meet their net-zero targets, ethanol derived from renewable electricity and captured carbon dioxide is emerging as a scalable pathway to energy transition. The market outlook remains strong as public and private stakeholders align on climate goals and invest in renewable fuel infrastructures and next-generation refinery technologies.

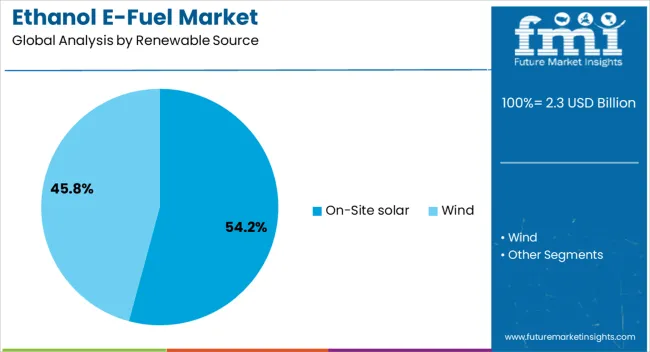

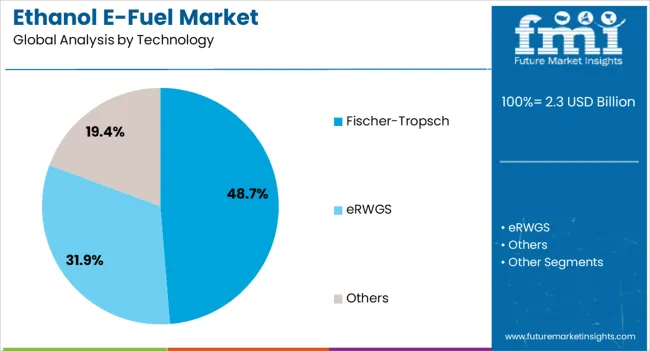

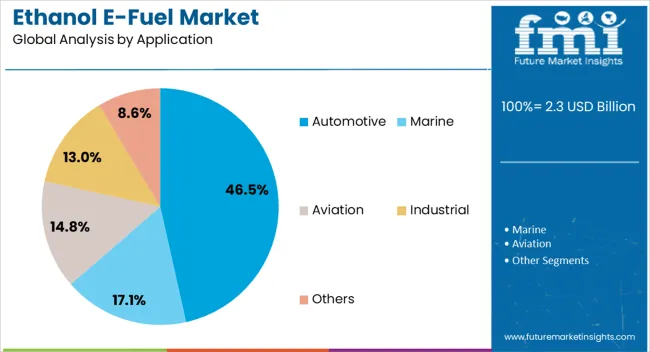

The ethanol e-fuel market is segmented by renewable source, technology, application, and geographic regions. By renewable source, the ethanol e-fuel market is divided into On-Site solar and Wind. In terms of technology, the ethanol e-fuel market is classified into Fischer-Tropsch, eRWGS, and Others. Based on the application, the ethanol e-fuel market is segmented into Automotive, Marine, Aviation, Industrial, and Others. Regionally, the ethanol e-fuel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on-site solar segment is anticipated to hold 54.20% of the total revenue by 2025 within the renewable source category, making it the leading contributor. This dominance is supported by growing interest in decentralized and emission-free power inputs for ethanol synthesis.

On-site solar enables efficient generation of renewable electricity directly at production facilities, reducing reliance on grid energy and associated transmission losses. Its compatibility with modular electrolysis systems and low operating costs have positioned it as a strategic enabler of e-fuel sustainability.

Additionally, policy frameworks promoting solar deployment and integration into industrial energy systems have further accelerated its adoption. As producers seek self sufficient and scalable renewable solutions on site solar remains the most viable and economically attractive source in the ethanol e fuel production ecosystem.

The Fischer Tropsch segment is expected to contribute 48.70% of total market revenue by 2025 within the technology category, marking it as the dominant process technology. This growth is attributed to its capability to convert syngas derived from biomass or renewable hydrogen and carbon dioxide into liquid fuel,s including ethanol.

The process offers high thermal efficiency and flexibility in feedstock input,s allowing producers to align with available renewable resources. Ongoing advancements in reactor design catalyst performance and process integration are enhancing scalability and cost competitiveness.

The Fischer-Tropsch pathway has also demonstrated compatibility with carbon capture and storage systems, aligning well with sustainability goals. Its industrial viability and proven success in pilot to commercial scale projects have solidified its position as the most relied upon technology for ethanol e-fuel production.

The automotive segment is projected to account for 46.50% of total market revenue by 2025 under the application category, establishing it as the leading end-use sector. The segment’s growth is fueled by the rising demand for cleaner liquid fuels that can be blended or used directly in internal combustion engines. Ethanol e fuel offers a drop in solution that enables decarbonization of existing vehicle fleets without requiring major infrastructure overhaul.

It is particularly appealing in markets with delayed electric vehicle adoption, where low-emission fuels serve as a transitional pathway. Regulatory mandates for fuel blending renewable content and lifecycle emissions have driven interest from automakers and fleet operators.

Additionally, ethanol e fuel provides high energy density and favorable combustion properties supporting engine performance and efficiency. These advantages have positioned the automotive industry at the forefront of ethanol e fuel adoption in the near term.

The market has been expanding as interest in alternative fuels and lower-emission transportation solutions has intensified. Ethanol-based fuels, produced from biomass such as sugarcane, corn, and agricultural residues, have been increasingly adopted to reduce dependency on conventional fossil fuels. Rising environmental regulations, growing investments in renewable energy infrastructure, and the need for sustainable mobility have collectively strengthened market growth. Automakers and fuel suppliers have focused on improving blend efficiency, engine compatibility, and energy density to ensure ethanol E-fuels meet performance and environmental standards globally.

The market has been significantly influenced by renewable energy policies and carbon reduction initiatives. Governments and regulatory authorities have incentivized the use of biofuels to decrease greenhouse gas emissions and improve air quality. Ethanol E-fuels have been incorporated into blends with gasoline to provide cleaner combustion and support sustainable transportation strategies. Industrial-scale production facilities have been expanded to meet increasing demand, while feedstock availability from agricultural sectors has been optimized to ensure consistent supply. Adoption has been particularly strong in regions where ethanol blending mandates and fuel substitution programs are actively enforced. Consumers and fleet operators have increasingly preferred ethanol E-fuel blends due to reduced environmental impact without compromising engine performance. Consequently, renewable energy policies and sustainability mandates have remained pivotal in driving ethanol E-fuel adoption across global transportation networks.

Technological improvements have been a critical driver in the ethanol E-fuel market, enhancing energy efficiency and engine compatibility. Innovations in ethanol processing, blending techniques, and bio-refining technologies have increased the energy density of fuels while minimizing impurities. Engine modifications, including adjustments to compression ratios and fuel injection systems, have enabled optimal performance with ethanol blends. Research on advanced catalysts and co-processing methods has improved combustion efficiency and reduced emissions. Flexible fuel vehicles (FFVs) have been increasingly designed to utilize higher ethanol blends without compromising durability. Continuous innovation in blending ratios and distribution infrastructure has allowed ethanol E-fuels to integrate seamlessly into existing fuel networks. These advancements have strengthened the market by addressing performance concerns and supporting wider adoption of ethanol-based fuels in both light-duty and commercial transportation sectors.

Regulatory frameworks and environmental legislation have had a major influence on the ethanol E-fuel market. Fuel standards, emission reduction mandates, and renewable energy incentives have encouraged adoption among manufacturers and end-users. Biofuel blending quotas have been implemented in several countries to reduce fossil fuel reliance, promote agricultural feedstock utilization, and lower carbon footprints. Subsidies, tax incentives, and grants for ethanol production facilities have supported market expansion and encouraged private sector participation. Penalties for high-emission vehicles and promotion of low-carbon transportation alternatives have indirectly increased ethanol E-fuel consumption. The environmental certifications and labeling programs have created transparency in fuel sustainability. These regulatory measures have collectively strengthened confidence among stakeholders, creating a structured framework that accelerates ethanol E-fuel integration into mainstream fuel supply chains and reinforces long-term market growth.

The market has been closely linked to the availability and cost of agricultural feedstock such as corn, sugarcane, and biomass residues. Production capacity has been expanded in regions with abundant feedstock resources to meet growing demand for ethanol blends. Supply chain optimization, including feedstock storage, transportation, and processing efficiency, has been critical in ensuring consistent fuel production. Seasonal agricultural cycles and global commodity pricing have influenced market dynamics, affecting the cost and availability of ethanol and e-fuels. Advanced fermentation, distillation, and refining technologies have improved yield and quality while reducing production costs. Investment in sustainable agriculture and energy crop cultivation has further enhanced feedstock reliability. The strategic alignment of agricultural production with ethanol fuel demand has ensured a steady supply, supporting market growth while maintaining cost competitiveness for producers and end-users globally.

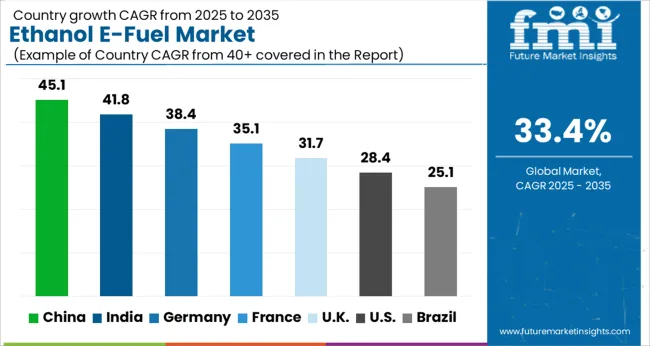

The market is projected to expand at a CAGR of 33.4% between 2025 and 2035, driven by rising demand for cleaner automotive fuels, government incentives for low-carbon alternatives, and technological advancements in biofuel production. China leads with a 45.1% CAGR, scaling through large-scale production facilities and aggressive adoption in transport sectors. India follows at 41.8%, advancing via government-backed biofuel programs and increasing blending mandates. Germany grows at 38.4%, supported by robust renewable energy policies and automotive industry adoption. The UK, at 31.7%, innovates through pilot projects and renewable fuel integration. The USA, with a 28.4% CAGR, witnesses steady growth from federal biofuel policies and ethanol blending initiatives. This report covers 40+ countries, with the top markets highlighted here for reference.

The market in China is projected to expand at a robust CAGR of 45.1% from 2025 to 2035, driven by government initiatives to reduce carbon emissions and promote alternative fuels. Rising adoption in transportation fleets and industrial applications is boosting demand, while technological advancements in biofuel production and blending are enhancing efficiency. Strategic collaborations between domestic energy producers and international technology providers are strengthening market presence. Urban and regional transport sectors are increasingly integrating ethanol-based fuels to meet stringent emission norms. The market benefits from supportive policies, tax incentives, and increasing research investments in renewable energy solutions.

India’s market is expected to grow at a CAGR of 41.8% over the next decade, fueled by government mandates for blending ethanol with gasoline and support for biofuel production infrastructure. Adoption is increasing in both urban and rural transport fleets, as companies aim to reduce dependency on fossil fuels. Investments in production technology and distribution networks are accelerating market penetration. Demand from industrial sectors for cleaner energy alternatives is rising. Domestic producers are forming alliances with international technology providers to enhance fuel quality and efficiency. Policy-driven incentives, including subsidies and tax benefits, are further strengthening the market outlook.

Germany is forecasted to grow at a CAGR of 38.4% between 2025 and 2035, driven by stringent European emission regulations and incentives for renewable fuels. Adoption in commercial transport fleets and industrial sectors is increasing, while technology innovations are improving blending and storage efficiency. Key players are focusing on partnerships and joint ventures to expand production capabilities and distribution networks. Integration with green energy initiatives and public awareness campaigns on low-carbon fuels is further enhancing market traction. Demand is particularly strong in urban logistics and medium-scale industrial operations seeking cleaner fuel alternatives.

The United Kingdom market is expected to grow at a CAGR of 31.7% from 2025 to 2035, driven by government policies promoting alternative fuels and low-carbon transport solutions. Increasing demand from commercial fleets and industrial applications is creating growth opportunities. Market expansion is supported by technological developments in ethanol production, blending, and storage systems. Key energy companies are adopting strategic alliances and collaborative research programs to improve efficiency and scale production. Urban and regional logistics are emerging as primary consumers, while incentives and grants support new infrastructure deployment.

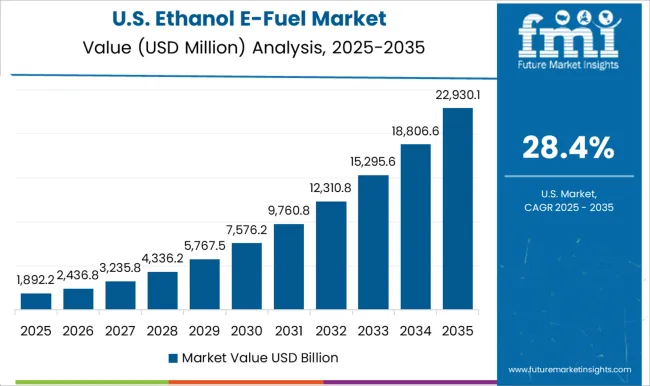

The market in the United States is projected to expand at a CAGR of 28.4% over the next decade, driven by policy frameworks promoting renewable energy and carbon reduction. Adoption is rising among transportation fleets, industrial sectors, and logistics operations. Investments in biofuel production technologies and distribution networks are supporting market growth. Strategic collaborations between domestic and international energy firms are enhancing production efficiency and market penetration. Growing consumer and corporate awareness about sustainable fuels and emission reductions is further fostering adoption. The market is poised for strong growth, particularly in regions with high transportation and industrial fuel consumption.

Major companies such as ADM, Cargill, and Abengoa Bioenergy lead the market with large-scale production capabilities, extensive distribution networks, and consistent quality standards. Valero Energy and POET focus on integrating advanced production technologies to enhance ethanol yields and energy efficiency, while companies like Pacific Ethanol and Green Plains Inc. emphasize sustainable feedstock sourcing and regional market penetration.

COFCO and Energix Renewable Fuels cater to the Asian and European markets, offering cost-effective ethanol solutions and tailored supply chains. Emerging providers such as GranBio, KAAPA Ethanol and Marquis Energy contribute by adopting innovative strategies, including product diversification, expansion of production capacity, and strategic partnerships with fuel distributors. Key market strategies among these players include investing in R&D to develop second-generation biofuels, process optimization for higher energy efficiency, and collaboration with automotive and energy sectors to promote ethanol adoption. Competitive advantage is increasingly driven by technological enhancements, operational efficiency, and compliance with evolving environmental regulations. The market is expanding through innovation, strategic collaborations, and focus on scalable, low-carbon fuel solutions that address growing global energy demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Renewable Source | On-Site solar and Wind |

| Technology | Fischer-Tropsch, eRWGS, and Others |

| Application | Automotive, Marine, Aviation, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abengoa Bioenergy, ADM, Cargill, COFCO, Energix Renewable Fuels, Flint Hills Resources, Glacial Lakes Energy, GranBio, Green Plains Inc., KAAPA Ethanol, Marquis Energy, Pacific Ethanol, POET, Raízen, The Andersons, Valero Energy, and Vivergo Fuels |

| Additional Attributes | Dollar sales by fuel type and application, demand dynamics across automotive and aviation sectors, regional trends in renewable energy adoption, innovation in biofuel production and efficiency, environmental impact of emissions reduction, and emerging use cases in hybrid engines and sustainable transport solutions. |

The global ethanol e-fuel market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the ethanol e-fuel market is projected to reach USD 40.5 billion by 2035.

The ethanol e-fuel market is expected to grow at a 33.4% CAGR between 2025 and 2035.

The key product types in ethanol e-fuel market are on-site solar and wind.

In terms of technology, fischer-tropsch segment to command 48.7% share in the ethanol e-fuel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethanol Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Ethanol Market Growth – Trends & Forecast 2023-2033

Diethanolamine Market Growth - Trends & Forecast 2025 to 2035

Bioethanol Market

Phenylethanol Market – Industry Trends & Market Expansion

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Phenoxyethanol Market

Direct Methanol Fuel Cell Market Growth – Trends & Forecast 2024-2034

Renewable Methanol Market Growth - Trends & Forecast 2025 to 2035

Cellulosic Ethanol Market

Stearic Acid Monoethanolamide (SMEA) Market Size and Share Forecast Outlook 2025 to 2035

1 - 4 - Cyclohexanedimethanol Dibenzoate Market

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Air-to-Air Refueling Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Refueling Hose Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA