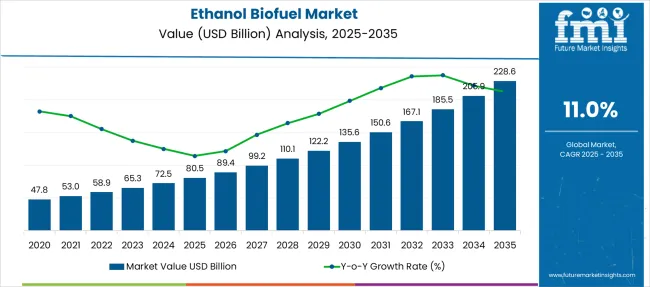

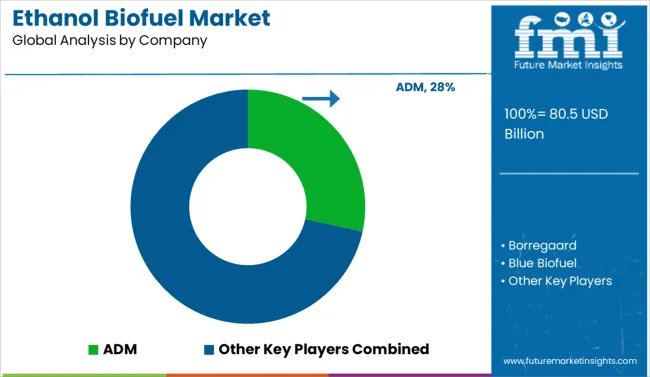

The Ethanol Biofuel Market is estimated to be valued at USD 80.5 billion in 2025 and is projected to reach USD 228.6 billion by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period.

| Metric | Value |

|---|---|

| Ethanol Biofuel Market Estimated Value in (2025 E) | USD 80.5 billion |

| Ethanol Biofuel Market Forecast Value in (2035 F) | USD 228.6 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

The ethanol biofuel market is experiencing robust growth, supported by increasing global focus on renewable energy, energy security, and the decarbonization of transportation sectors. Ethanol has emerged as a key alternative to fossil fuels due to its compatibility with existing vehicle engines and ability to reduce greenhouse gas emissions.

Government mandates and blending targets across developed and developing economies are propelling production and consumption of ethanol-based fuels. Investment in advanced bio-refining technologies and infrastructure expansion is accelerating feedstock utilization efficiency.

The market outlook remains optimistic as nations enhance their energy transition frameworks, promote sustainable agriculture integration, and encourage the adoption of low carbon fuels in domestic and commercial transportation networks.

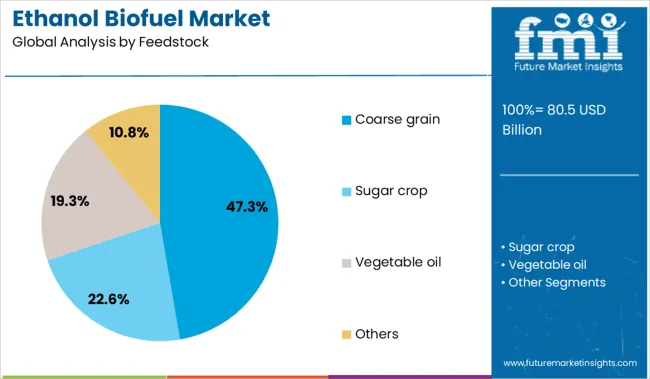

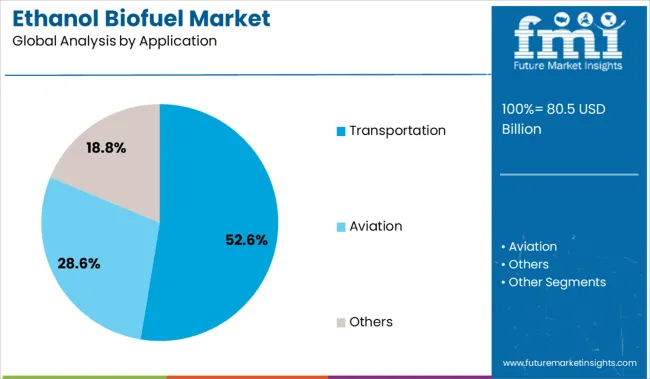

The ethanol biofuel market is segmented by feedstock, application, and geographic regions. The feedstock of the ethanol biofuel market is divided into Coarse grain, Sugar crop, Vegetable oil, and Others. The ethanol biofuel market is classified into Transportation, Aviation, and Others. Regionally, the ethanol biofuel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The coarse grain segment is projected to contribute 47.30 percent of total market revenue by 2025 within the feedstock category, positioning it as the most dominant source for ethanol production. This prominence is driven by the widespread availability, cost efficiency, and high starch yield of coarse grains such as corn and sorghum.

These characteristics allow for efficient conversion into ethanol through mature fermentation processes, making coarse grain an economically viable and scalable option. Moreover, existing agricultural supply chains and government subsidies in major producing regions have supported the stable supply and use of coarse grains.

Their role in ensuring feedstock consistency and supporting year round production has further reinforced their leadership in this segment..

The transportation segment is expected to hold 52.60 percent of the total market revenue by 2025 under the application category, making it the largest end use sector. This growth is being propelled by stringent vehicle emission norms, increasing ethanol blend mandates, and rising fuel consumption in emerging economies.

Ethanol's ability to improve combustion efficiency and reduce carbon emissions makes it a favorable additive or replacement for gasoline. As automotive manufacturers and fuel retailers align with sustainable fuel policies, ethanol is being increasingly adopted as a mainstream transportation fuel.

Government initiatives promoting biofuel use, including tax incentives and infrastructure investments, are further driving its integration across public and private vehicle fleets. This convergence of environmental, regulatory, and operational factors has firmly positioned transportation as the primary growth driver in the ethanol biofuel market.

Demand for ethanol biofuel is accelerating due to blending mandates, energy security goals, and shifting fleet fuel strategies. Sales of cellulosic ethanol and corn-based ethanol continue to expand as producers scale capacity, optimize enzyme use, and integrate with biogas co-generation to improve unit economics.

Demand for ethanol biofuel has risen 22% YoY as producers diversify feedstock beyond corn to include bagasse, wheat straw, and cassava peel. Plants deploying third-generation enzymes saw a 14% increase in ethanol yield per ton of biomass. In Brazil, second-gen ethanol from sugarcane waste reached 6.2 billion liters, up from 4.9 billion in 2024. USA producers added 11 new pretreatment modules to process sorghum and switchgrass, reducing input volatility. Asian distilleries utilizing alkali-based hydrolysis systems improved starch-to-sugar conversion by 19%, boosting throughput. These process shifts are helping ethanol players mitigate feedstock inflation and secure multi-crop procurement deals with farmer collectives.

Sales of blending-grade ethanol jumped 29% in 2025 as global E10 and E15 mandates expanded. Indian oil firms raised monthly ethanol lifts by 18%, while Indonesia introduced a B35 biofuel policy that triggered a 21% demand spike for industrial-scale fermentation. USA exporters shipped over 1.3 billion gallons in the first half of 2025, supported by tax credit extensions and low-carbon fuel standards. Bio-refineries integrating CO₂ capture systems qualified for new green finance instruments, lowering per-liter production cost by 7%. Meanwhile, refiners in Europe ramped up purchases of fuel-grade ethanol to meet updated RED III targets, driving up contract prices by 11% QoQ.

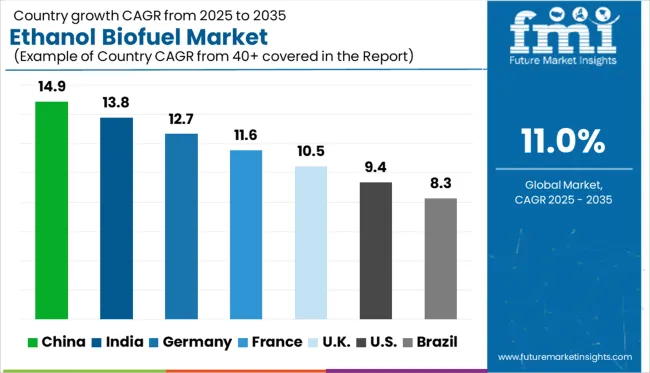

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

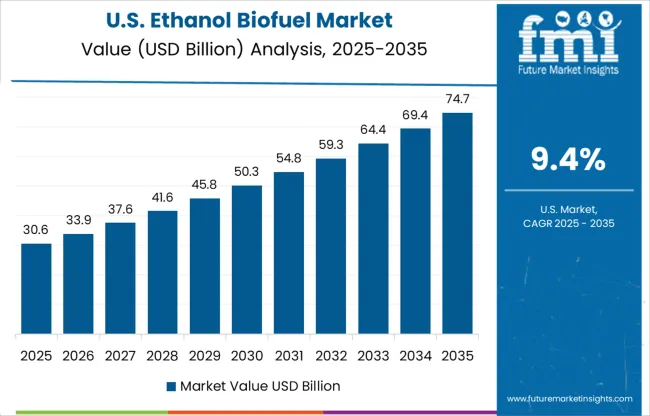

| USA | 9.4% |

| Brazil | 8.3% |

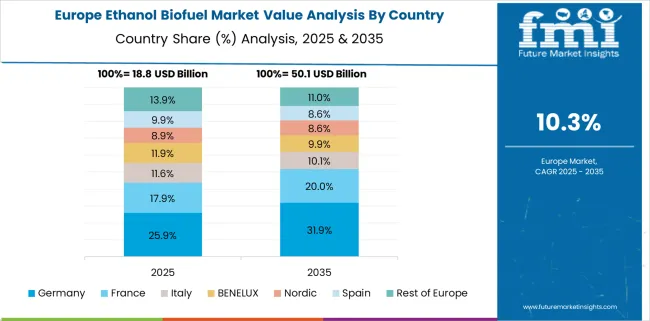

The global market is projected to expand at a CAGR of 11.0% from 2025 to 2035. Leading this growth, China (BRICS) records a robust CAGR of 14.9%, outperforming the global average by 3.9 percentage points, fueled by national clean energy targets, agricultural feedstock availability, and expansion of ethanol blending mandates. India (BRICS) follows with 13.8% (+2.8 pp), driven by aggressive government blending programs, rising flex-fuel vehicle adoption, and domestic production scale-up. Among OECD countries, Germany posts 12.7% (+1.7 pp), reflecting strong EU-level policy support and sustained biofuel innovation. The UK records 10.5% (–0.5 pp), indicating a stable but moderate trajectory. Meanwhile, the United States trails slightly at 9.4% (–1.6 pp), pointing to a mature market landscape with slower growth despite federal incentives and blending mandates. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s ethanol biofuel market is forecast to grow at a CAGR of 14.9% between 2025 and 2035, positioning the country as a global frontrunner in renewable fuel adoption. From 2020 to 2024, market growth was uneven due to regional blending restrictions. However, national mandates aiming for 10% ethanol blending by 2030 have revitalized investment in corn- and cassava-based ethanol production. Automotive decarbonization and surplus grain policies are key drivers shaping the decade ahead.

A projected CAGR of 13.8% will drive India’s ethanol biofuel market forward from 2025 to 2035, anchored in government-led initiatives like the Ethanol Blended Petrol (EBP) program. While growth between 2020 and 2024 was focused on sugarcane-based ethanol, diversification into grain- and waste-based feedstocks is gaining momentum. Policy targets of 20% blending by 2025 are pushing public and private refiners to scale up domestic production capacity.

Germany’s ethanol biofuel market is set to expand at a CAGR of 12.7% from 2025 to 2035, driven by sustainability benchmarks and the phase-out of fossil-based transport fuels. During 2020–2024, growth was largely shaped by demand for low-carbon fuels in logistics and public transport. Looking ahead, advancements in cellulosic ethanol and regulatory support for greenhouse gas (GHG) reduction will shape the competitive dynamics of domestic suppliers.

The UK ethanol biofuel market is projected to register a 10.5% CAGR from 2025 to 2035, supported by clean transport strategies and increasing E10 fuel uptake. During the 2020–2024 period, domestic production met only part of the demand, relying heavily on imports. Policy refinements, including sustainability-linked incentives, are expected to boost local ethanol output in the coming years, especially in Northern England and Scotland.

The USA market is anticipated to record a CAGR of 9.4% during 2025–2035, maintaining its position as one of the world’s leading ethanol producers and consumers. Between 2020 and 2024, corn-based ethanol dominated fuel blending in the Midwest and Great Plains. Future growth will hinge on expanding exports, sustainable aviation fuel (SAF) pathways, and carbon intensity reduction credits under California’s LCFS and similar state policies.

Sales of ethanol biofuel are experiencing robust growth in 2025 as the global shift toward low-carbon energy intensifies. ADM dominates the market with a commanding share, supported by integrated feedstock processing and expansive USA refining capacity. POET LLC and Valero remain key players in North America, leveraging domestic corn availability and government blending mandates. Raízen and Zilor are scaling operations in Brazil, benefiting from sugarcane’s high ethanol yield. In Europe, CropEnergies and Verbio are strengthening their market position through wheat- and waste-based bioethanol. Asian players such as Wilmar International and COFCO are expanding into regional fuel markets with advanced fermentation technologies. Meanwhile, Chevron, TotalEnergies, and Neste are increasing investment in ethanol to align with corporate sustainability goals.

In January 2024, POET LLC announced a major carbon-capture partnership with Summit Carbon Solutions, connecting 17 of its Midwest biorefineries to a carbon sequestration pipeline to permanently capture up to 4.7 million metric tons of CO₂ annually, marking a significant carbon-management milestone.

| Item | Value |

|---|---|

| Quantitative Units | USD 80.5 Billion |

| Feedstock | Coarse grain, Sugar crop, Vegetable oil, and Others |

| Application | Transportation, Aviation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADM, Borregaard, Blue Biofuel, BTG Bioliquids, Cargill, Chevron, Clariant, COFCO, CropEnergies, Munzer Bioindustrie, Neste, POET LLC, Praj Industries, Raízen, The Andersons, TotalEnergies, UPM, Valero, Verbio, Wilmar International, and Zilor |

| Additional Attributes | Dollar sales by ethanol type and feedstock source, demand dynamics across transportation, aviation‑grade fuel, and industrial applications, regional trends in sugarcane versus corn and cellulosic ethanol adoption, innovation in second‑generation biomass conversion, carbon capture utilization and microbial fermentation technologies, environmental impact of land use, GHG emissions, water use, and air pollutant release, and emerging use cases in sustainable aviation fuel (SAF), circular‑economy carbon recycling, and waste‑derived bioethanol. |

The global ethanol biofuel market is estimated to be valued at USD 80.5 billion in 2025.

The market size for the ethanol biofuel market is projected to reach USD 228.6 billion by 2035.

The ethanol biofuel market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in ethanol biofuel market are coarse grain, sugar crop, vegetable oil and others.

In terms of application, transportation segment to command 52.6% share in the ethanol biofuel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethanol E-Fuel Market Size and Share Forecast Outlook 2025 to 2035

Ethanol Market Growth – Trends & Forecast 2023-2033

Diethanolamine Market Growth - Trends & Forecast 2025 to 2035

Bioethanol Market

Phenylethanol Market Forecast and Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Phenoxyethanol Market

Direct Methanol Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Renewable Methanol Market Growth - Trends & Forecast 2025 to 2035

Cellulosic Ethanol Market

Stearic Acid Monoethanolamide (SMEA) Market Size and Share Forecast Outlook 2025 to 2035

1 - 4 - Cyclohexanedimethanol Dibenzoate Market

Biofuel Testing Services Market Growth – Trends & Forecast 2018-2028

Biofuel Enzymes Market

Algae Biofuel Prospects Market Size and Share Forecast Outlook 2025 to 2035

Advanced Biofuels Market Growth - Trends & Forecast 2025 to 2035

Aviation Biofuel Market

Industrial Biofuel Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

First Generation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA