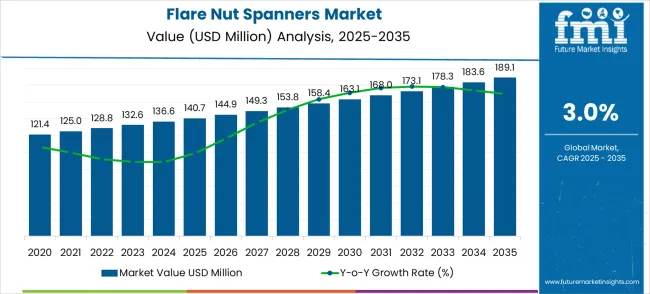

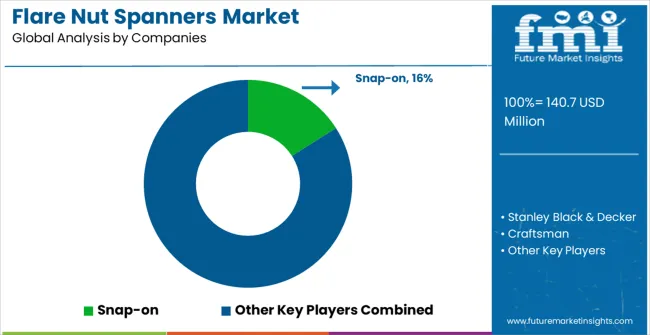

The flare nut spanners market is expected to expand at a modest pace, with the overall valuation projected to increase from USD 140.7 million in 2025 to USD 189.1 million by 2035, reflecting a CAGR of 3.0%. The incremental growth highlights steady but controlled demand patterns across various industries, including automotive repair, plumbing, industrial machinery, and maintenance services. The market’s expansion is largely supported by the continuous use of flare nut spanners in tightening and loosening hexagonal nuts on fuel lines, brake systems, and refrigeration pipelines. These tools are considered essential by technicians and service providers due to their precision grip and ability to reduce the chances of rounding or damaging fittings. Rising investments in automotive servicing, coupled with the increasing complexity of maintenance operations, are directly influencing the market trajectory. The steady CAGR suggests that while the industry is not experiencing rapid spikes, it is benefiting from its indispensable role in both professional and household toolkits.

The projected CAGR of 3.0% also reflects broader industry trends where reliability and consistent demand outweigh volatility. The flare nut spanners market is seen as stable because the tool itself has a highly specific yet irreplaceable application, making its demand largely immune to short-term industrial shifts. Increased activity in aftermarket automotive repair, expanding construction services, and a higher reliance on refrigeration and HVAC systems are further driving the need for such specialized spanners. Industries prioritizing accuracy and safety during fluid line connections are continuously depending on these tools. Moreover, regulatory adherence in mechanical servicing, which stresses the importance of precision tools for safe operations, adds to the market’s long-term relevance. The projected growth indicates that, although this is not a high-velocity market, it will maintain its position as a necessary component in industrial and mechanical tool portfolios, gradually expanding its scope in both advanced and emerging economies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 140.7 million |

| Market Forecast Value (2035) | USD 189.1 million |

| Forecast CAGR (2025-2035) | 3.0% |

The flare nut spanners market has been evaluated as a key segment under multiple tool-based industries, holding around 6.4% of the hand tools market, 8.7% of the automotive repair tools market, 4.9% of the industrial tools market, 3.5% of the construction tools market, and 5.2% of the maintenance and repair operations (MRO) tools market. Collectively, the share of the flare nut spanners market across these broader categories accounts for nearly 28.7%. This positioning reflects how such spanners are being relied upon for precise tightening and loosening of fittings in both professional and workshop environments. Growing dependence on durable and accurate fastening equipment has placed this market in a favorable spotlight, with its value being acknowledged by industrial users, construction contractors, and automotive service providers alike.

Market expansion is being supported by the continuous growth of automotive aftermarket services and the corresponding need for specialized tools designed for brake line, fuel line, and hydraulic fitting maintenance. Modern automotive and HVAC systems require precise tools that can access confined spaces while providing optimal grip on delicate flare nut fittings. The superior design and functionality of flare nut spanners make them essential tools in professional workshops where preventing fitting damage and ensuring leak-free connections is critical.

The growing emphasis on professional tool quality and workplace efficiency is driving demand for premium flare nut spanners from established manufacturers with proven track records of durability and precision. Professional technicians are increasingly investing in specialized tool sets that offer superior performance and reduced risk of component damage during maintenance procedures. Industry standards and professional certification requirements are establishing performance benchmarks that favor precision-engineered flare nut spanner solutions with ergonomic designs and advanced metallurgy.

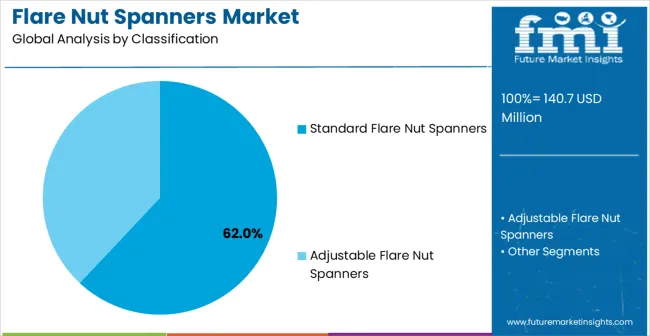

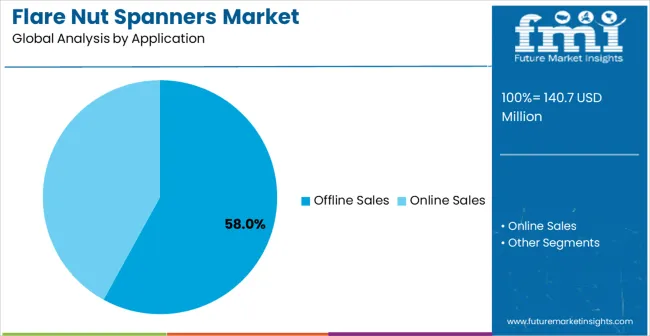

The market is segmented by product type, distribution channel, and region. By product type, the market is divided into standard flare nut spanners and adjustable flare nut spanners configurations. Based on distribution channel, the market is categorized into online sales and offline sales channels. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

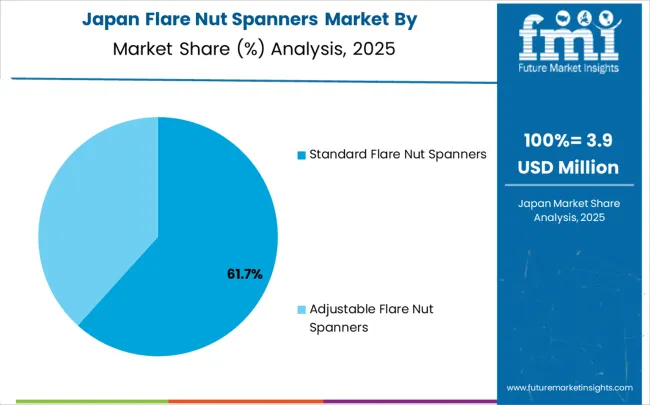

Standard flare nut spanners configurations are projected to account for 62% of the flare nut spanners market in 2025. This leading share is supported by the widespread use of fixed-size spanners in professional automotive and plumbing applications where precise fit and maximum torque transfer are essential. Standard flare nut spanners provide superior grip and control compared to adjustable alternatives, making them the preferred choice for professional mechanics, HVAC technicians, and plumbing specialists. The segment benefits from established tool set configurations and professional training programs that emphasize the importance of proper tool selection for specific applications.

Professional-grade standard flare nut spanners incorporate precision manufacturing tolerances, hardened steel construction, and specialized jaw geometry designed to maximize contact with flare nut surfaces while minimizing the risk of rounding or damage. These tools have demonstrated consistent performance in demanding professional environments where tool failure can result in costly repairs and customer dissatisfaction. The automotive service industry particularly drives demand for complete standard spanner sets, as these provide the range of sizes necessary for comprehensive brake system and fuel system maintenance.

Additionally, the cost-effectiveness and proven reliability of standard flare nut spanners make them attractive for both professional workshops and serious DIY enthusiasts seeking professional-quality results. Tool manufacturers continue to refine metallurgy and manufacturing processes to enhance durability while maintaining competitive pricing for standard configurations.

Offline sales channels are expected to represent 58% of flare nut spanners demand in 2025. This significant share reflects the preference of professional technicians and serious tool users to physically examine tools before purchase and the importance of immediate availability for urgent repair situations. Traditional tool distributors, automotive parts stores, and industrial supply companies provide expert advice and product demonstrations that help customers select appropriate tools for specific applications. The segment benefits from established relationships between tool suppliers and professional users who value personalized service and technical support.

Professional tool distribution through offline channels enables hands-on evaluation of tool quality, ergonomics, and build characteristics that are difficult to assess through online channels. These distribution partnerships provide immediate product availability for emergency repairs and maintenance situations where tool failure cannot result in extended downtime. The established network of tool trucks, industrial distributors, and specialty automotive suppliers contributes significantly to market accessibility and customer service excellence.

Additionally, the trend toward tool warranties and service support creates opportunities for offline distributors to provide value-added services including tool repair, replacement programs, and technical training. The segment also benefits from professional tool financing programs and volume discounts that make premium tool investments more accessible to working professionals.

The flare nut spanners market is advancing steadily due to increasing automotive complexity and growing recognition of specialized tool importance in professional maintenance applications. However, the market faces challenges including price competition from low-cost alternatives, need for extensive size ranges in professional applications, and varying quality standards across different manufacturers. Professional certification programs and industry training initiatives continue to influence tool quality expectations and market development patterns.

The growing deployment of advanced steel alloys and surface coating systems is enabling production of flare nut spanners with enhanced durability, corrosion resistance, and improved grip characteristics. Modern heat treatment processes and specialized coatings provide better tool life and performance consistency while maintaining the precision tolerances required for professional applications. These technologies are particularly valuable for tools used in harsh environments where exposure to chemicals, moisture, and extreme temperatures can affect tool performance and longevity.

Modern spanner manufacturers are incorporating ergonomic handle designs, optimized weight distribution, and user-friendly features that reduce hand fatigue and improve control during extended use periods. Integration of non-slip grip surfaces and balanced tool geometry enables more precise control and reduced effort requirements compared to traditional designs. Advanced manufacturing techniques also support development of more compact tool profiles that provide better access in confined spaces without compromising strength or durability.

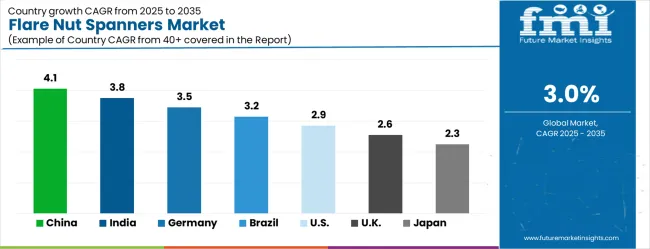

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| Brazil | 3.2% |

| United States | 2.9% |

| United Kingdom | 2.6% |

| Japan | 2.3% |

The flare nut spanners market is growing rapidly, with China leading at a 4.1% CAGR through 2035, driven by expanding automotive manufacturing sector, increasing vehicle ownership, and growing aftermarket service industry. India follows at 3.8%, supported by rising automotive sales, expanding industrial infrastructure, and increasing adoption of professional-grade tools. Germany records strong growth at 3.5%, emphasizing precision engineering, quality standards, and advanced automotive technology applications. Brazil grows steadily at 3.2%, integrating specialized tools into expanding automotive service sector and industrial maintenance operations. The United States shows moderate growth at 2.9%, focusing on premium tool quality and professional market expansion. The United Kingdom maintains steady expansion at 2.6%, supported by automotive aftermarket growth and industrial maintenance requirements. Japan demonstrates stable growth at 2.3%, emphasizing precision manufacturing and technological innovation in tool design.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The flare nut spanners market in China is projected to exhibit the highest growth rate with a CAGR of 4.1% through 2035, driven by rapid expansion of automotive manufacturing sector and massive growth in vehicle ownership creating substantial aftermarket service demand. The country's expanding industrial infrastructure and growing skilled technician workforce are creating significant demand for professional-grade tools and equipment. Major automotive manufacturers and service providers are establishing comprehensive tool programs to support high-quality maintenance and repair operations.

The flare nut spanners market in India is expanding at a CAGR of 3.8%, supported by increasing automotive sales, expanding industrial infrastructure, and growing adoption of professional maintenance practices across service sectors. The country's rising middle class and increasing vehicle ownership are driving expansion of automotive service facilities requiring specialized tools and equipment. Professional technicians are investing in quality tools to improve service efficiency and customer satisfaction.

The flare nut spanners market in Germany is projected to grow at a CAGR of 3.5%, supported by the country's emphasis on precision engineering, advanced manufacturing capabilities, and stringent quality standards in automotive and industrial applications. German automotive sector and industrial facilities are implementing high-performance tool systems that meet demanding operational requirements. The market is characterized by focus on tool precision, durability, and compliance with comprehensive industry standards.

The flare nut spanners market in Brazil is growing at a CAGR of 3.2%, driven by expanding automotive aftermarket sector, increasing industrial maintenance requirements, and growing adoption of professional-grade tools in service applications. The country's established automotive industry is investing in advanced service capabilities and technician training programs. Industrial facilities are adopting modern tool standards to support growing production requirements and equipment maintenance needs.

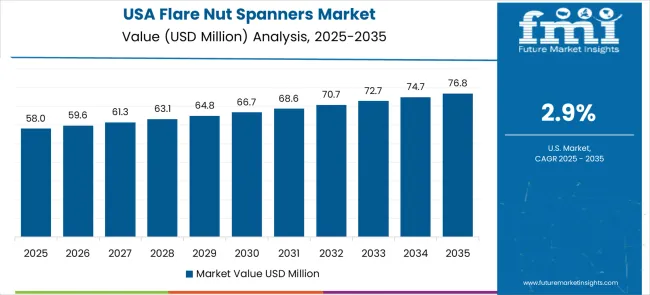

The flare nut spanners market in the United States is expanding at a CAGR of 2.9%, driven by ongoing emphasis on premium tool quality, professional market expansion, and increasing demand for specialized automotive and HVAC service tools. Professional technicians are upgrading tool collections with advanced products that provide superior performance and durability. The market benefits from strong distribution networks and established professional training programs.

The flare nut spanners market in the United Kingdom is projected to grow at a CAGR of 2.6%, supported by ongoing emphasis on quality standards, professional tool applications, and automotive aftermarket service expansion. British automotive service providers are investing in reliable tool systems that provide consistent performance and meet regulatory compliance requirements. The market is characterized by focus on tool quality, professional training, and service excellence across automotive and industrial applications.

The flare nut spanners market in Japan is expanding at a CAGR of 2.3%, driven by the country's emphasis on technological innovation, manufacturing excellence, and precision tool applications in automotive and industrial sectors. Japanese manufacturers are developing advanced tool technologies that incorporate precision engineering and superior materials science. The market benefits from focus on quality, reliability, and continuous improvement in professional tool performance.

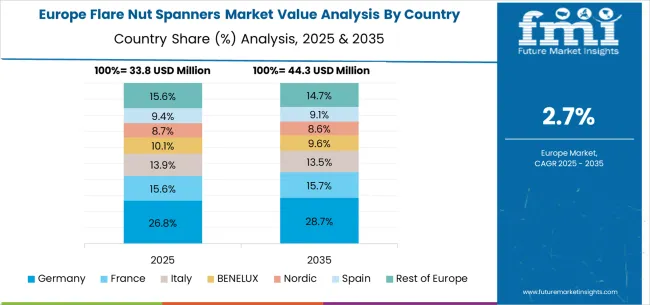

The flare nut spanners market in Europe is projected to grow from USD 38.1 million in 2025 to USD 50.9 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain its leadership with a 31.4% share in 2025, supported by its strong automotive industry and advanced industrial tool market. The United Kingdom follows with 19.7% market share, driven by ongoing automotive aftermarket growth and industrial maintenance requirements. France holds 16.8% of the European market, benefiting from automotive manufacturing expansion and professional tool adoption. Italy and Spain collectively represent 18.3% of regional demand, with growing focus on automotive service and industrial maintenance applications. The Rest of Europe region accounts for 13.8% of the market, supported by industrial development in Eastern European countries and Nordic automotive sectors.

The flare nut spanners market is defined by competition among established tool manufacturers, specialized automotive tool companies, and regional industrial suppliers. Companies are investing in advanced metallurgy, ergonomic design technologies, quality control systems, and distribution capabilities to deliver durable, precise, and user-friendly flare nut spanner solutions. Strategic partnerships, product innovation, and market expansion are central to strengthening product portfolios and market presence.

Snap-on, operating globally, offers comprehensive professional tool solutions with focus on precision engineering, durability, and premium quality standards. Stanley Black & Decker, multinational, provides advanced tool systems with emphasis on innovation, reliability, and broad market accessibility. Craftsman, established brand, delivers reliable tool solutions for professional and consumer applications with focus on value and performance. GearWrench offers specialized automotive tools with emphasis on innovative design and professional functionality.

Wright Tool provides professional-grade tool systems with focus on quality manufacturing and industrial applications. Klein Tools delivers specialized electrical and mechanical tools with emphasis on professional performance. Wiha Tools offers precision tool solutions with focus on quality, ergonomics, and professional applications. Beta Tools provides comprehensive tool systems with emphasis on Italian engineering excellence.

Hazet, Makita, SATA, Tajima Tool, Bosch, Deli Tool, Endura, Hebei Botou Safetytools, and LAOA offer specialized tool expertise, regional manufacturing capabilities, and technical support across global and regional networks.

The flare nut spanners market underpins automotive service excellence, industrial maintenance efficiency, HVAC system reliability, and professional craftsmanship standards. With increasing quality requirements, stricter safety standards, and demand for specialized professional tools, the sector must balance cost competitiveness, performance reliability, and ergonomic innovation. Coordinated contributions from governments, industry bodies, manufacturers, distributors, and investors will accelerate the transition toward precision-engineered, ergonomically designed, and professionally optimized flare nut spanner systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 140.7 million |

| Product Type | Standard Flare Nut Spanners, Adjustable Flare Nut Spanners |

| Distribution Channel | Online Sales, Offline Sales |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Snap-on, Stanley Black & Decker, Craftsman, GearWrench, Wright Tool, Klein Tools, Wiha Tools, Beta Tools, Hazet, Makita, SATA, Tajima Tool, Bosch, Deli Tool, Endura, Hebei Botou Safetytools, LAOA |

| Additional Attributes | Dollar sales by product type and distribution channel, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, customer preferences for standard versus adjustable configurations, integration with advanced materials and coating technologies, innovations in ergonomic design and user-focused features for enhanced performance, and adoption of precision-engineered solutions with superior durability and reliability for professional automotive and industrial applications. |

The global flare nut spanners market is estimated to be valued at USD 140.7 million in 2025.

The market size for the flare nut spanners market is projected to reach USD 189.1 million by 2035.

The flare nut spanners market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in flare nut spanners market are standard flare nut spanners and adjustable flare nut spanners.

In terms of application, offline sales segment to command 58.0% share in the flare nut spanners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flare Gas Recovery System Market Outlook – Share, Growth & Forecast 2025–2035

Flare Monitoring Market

Flare Stack Monitoring Systems Market

GCC Flare Gas Recovery System Market Report – Trends, Demand & Industry Forecast 2025–2035

Japan Flare Gas Recovery System Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Flare Gas Recovery System Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Flare Gas Recovery System Market - Growth & Demand 2025 to 2035

Aqueous Flare Meter Market Size and Share Forecast Outlook 2025 to 2035

Germany Flare Gas Recovery System Market Trends – Growth, Demand & Forecast 2025–2035

United States Flare Gas Recovery System Market Analysis – Demand, Trends & Forecast 2025-2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

Enclosed Smokeless Flares Market Size and Share Forecast Outlook 2025 to 2035

Enclosed Waste Gas Flares Market Size and Share Forecast Outlook 2025 to 2035

Nutritive Sweetener Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA