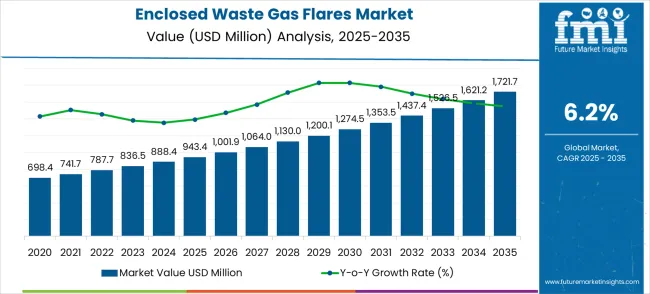

The enclosed waste gas flares market is expected to expand from USD 943.4 million in 2025 to USD 1,721.7 million by 2035, at a CAGR of 6.2%. The market sees consistent growth with periodic fluctuations, driven by advancements in waste gas treatment technologies, rising industrial emission regulations, and an increasing demand for cleaner, more efficient flaring systems. From 2025 to 2030, the market progresses from USD 698.4 million to USD 943.4 million, with intermediate values passing through USD 741.7 million, 787.7 million, 836.5 million, and 888.4 million. This phase is characterized by steady growth as industries implement enclosed waste gas flaring systems to comply with environmental standards.

The global enclosed waste gas flares market is projected to grow from USD 943.4 million in 2025 to approximately USD 1,721.7 million by 2035, recording an absolute increase of USD 778.3 million over the forecast period. This translates into a total growth of 82.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.8X during the same period, supported by increasing methane emission regulations, growing waste management infrastructure development, and rising adoption of enclosed flaring technologies in industrial and municipal applications requiring enhanced emission control and environmental compliance.

Between 2030 and 2035, the market experiences a sharp increase, moving from USD 943.4 million to USD 1,721.7 million. Values progress through USD 1,001.9 million, 1,064.0 million, 1,130.0 million, 1,200.1 million, 1,274.5 million, and 1,353.5 million. This surge is driven by technological innovations and the implementation of stricter global environmental policies. While economic challenges or supply chain disruptions may cause occasional dips, the overall market trajectory is upward. The growth rate volatility increases during this phase, reflecting the shift from early adoption to widespread industry acceptance, as companies worldwide increasingly invest in efficient and eco-friendly waste gas treatment solutions.

Between 2025 and 2030, the enclosed waste gas flares market is projected to expand from USD 943.4 million to USD 1,278.6 million, resulting in a value increase of USD 335.2 million, which represents 43.1% of the total forecast growth for the decade. This phase of growth will be shaped by tightening methane emission regulations, increasing landfill gas management requirements, and growing adoption of enclosed flaring systems in waste management facilities. Environmental equipment manufacturers are expanding their enclosed flare portfolios to address the growing demand for efficient gas destruction systems with enhanced emission control and operational reliability characteristics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 943.4 million |

| Forecast Value in (2035F) | USD 1,721.7 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The enclosed waste gas flares market plays a crucial role within several interconnected industries, addressing environmental concerns and regulatory requirements. In the waste gas treatment market, enclosed waste gas flares account for around 6-8% of the market share. These flares are essential in safely disposing of harmful gases, making them a critical solution for industries that generate waste gases. Within the environmental protection equipment market, they represent approximately 5-7% of the market, as they help companies comply with stringent air quality regulations by controlling and reducing emissions from industrial processes.

The oil & gas industry market is one of the largest users of enclosed waste gas flares, where they hold a market share of around 7-9%. These flares are used to manage excess or vented gases during oil extraction and refining, helping to minimize the environmental impact of flaring. In the industrial flares market, enclosed waste gas flares make up 10-12% of the total market, due to their specialized design, which ensures the controlled combustion of hazardous gases across various industrial settings. In the chemical processing market, enclosed waste gas flares account for about 4-6% of the market

From 2030 to 2035, the market is forecast to grow from USD 1,278.6 million to USD 1,721.7 million, adding another USD 443.1 million, which constitutes 56.9% of the overall ten-year expansion. This period is expected to be characterized by widespread deployment of advanced emission control technologies, integration with renewable energy systems, and development of next-generation high-efficiency flare systems. The growing demand for sustainable waste management and carbon footprint reduction will drive adoption of sophisticated enclosed flares with enhanced destruction efficiency and environmental performance characteristics.

Between 2020 and 2025, the enclosed waste gas flares market experienced steady growth, driven by increasing environmental regulations governing methane emissions and growing recognition of enclosed flaring benefits over traditional open flaring systems. The market evolved as waste management operators and industrial facilities recognized the superior emission control capabilities and environmental compliance advantages of enclosed flare technologies. Progress in combustion efficiency improvement and emission monitoring established the foundation for more effective and environmentally responsible waste gas management across various industrial applications.

Market expansion is being supported by increasingly stringent methane emission regulations and the corresponding demand for enclosed flaring systems that can achieve higher destruction efficiency while minimizing visible emissions and environmental impact. Modern waste management facilities and industrial operators are increasingly focused on flaring technologies that can provide reliable gas destruction while meeting strict regulatory requirements and community acceptance standards. The proven capability of enclosed flares to deliver superior destruction efficiency, reduced visible emissions, and enhanced operational control makes them essential components of comprehensive waste gas management systems.

The growing emphasis on environmental stewardship and sustainable waste management is driving demand for advanced flaring technologies that can support both regulatory compliance and corporate environmental responsibility objectives. Industry preference for flare systems that can handle varying gas compositions, provide consistent performance, and integrate with existing waste management infrastructure is creating opportunities for enclosed flare technology development. The rising influence of climate change mitigation efforts and greenhouse gas reduction targets is also contributing to increased adoption of high-efficiency flaring systems across different waste management and industrial applications.

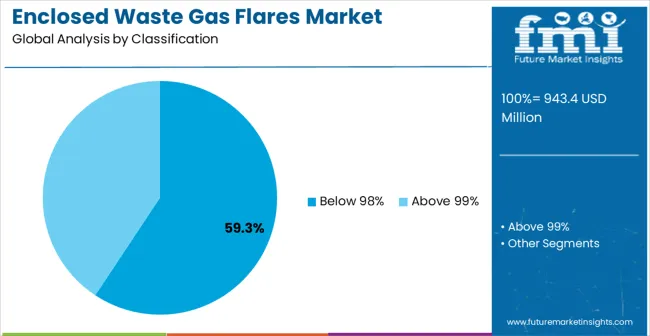

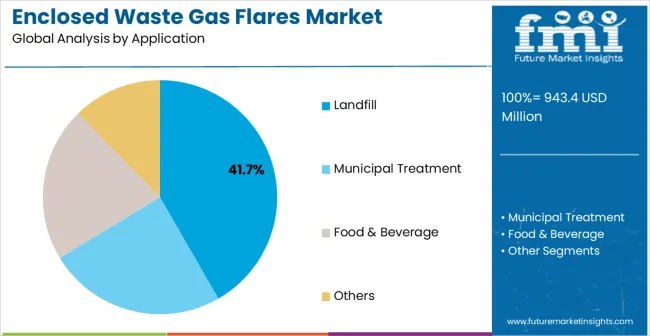

The market is segmented by classification, application, and region. By classification, the market is divided into below 98% efficiency, above 99% efficiency, and others. Based on application, the market is categorized into landfill, municipal treatment, food & beverage, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

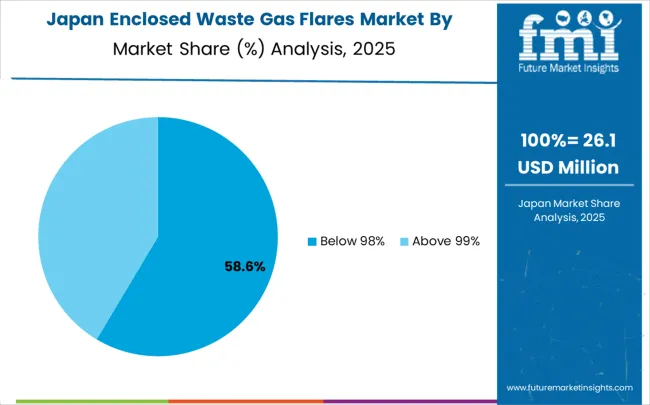

The below 98% efficiency classification is projected to account for 59.3% of the enclosed waste gas flares market in 2025, reaffirming its position as the category's dominant performance segment. Waste management operators increasingly recognize the cost-effective balance of destruction efficiency and operational economics provided by sub-98% efficiency systems for many standard waste gas applications. This classification addresses the majority of current regulatory requirements while providing essential emission control capabilities.

This classification forms the foundation of most waste gas flaring installations, as it represents the most practical and widely applicable approach for meeting environmental compliance requirements across diverse applications. Technology development and cost optimization continue to strengthen confidence in below 98% efficiency systems for standard waste gas management applications. With increasing recognition of the importance of achieving regulatory compliance while managing operational costs, sub-98% efficiency systems align with both current regulatory frameworks and operational budget considerations. Their broad applicability across multiple waste gas types ensures sustained market dominance, making them the central growth driver of enclosed flare adoption.

Landfill applications are projected to represent 41.7% of enclosed waste gas flares demand in 2025, underscoring their role as the primary application driving market development. Landfill operators recognize that methane gas management requires reliable and efficient flaring systems to ensure environmental compliance and community acceptance. Landfill applications demand consistent performance and operational reliability that enclosed flare systems are uniquely positioned to deliver.

The segment is supported by the continuous expansion of landfill gas collection systems requiring comprehensive management solutions and the increasing adoption of enclosed flaring to address community concerns about visible emissions and odors. Additionally, Llandfill operations are increasingly implementing advanced gas management technologies that can optimize both environmental performance and energy recovery potential. As understanding of landfill gas management requirements advances, enclosed flare applications will continue to serve as the primary commercial driver, reinforcing their essential position within the waste management technology market.

The enclosed waste gas flares market is advancing steadily due to increasing methane emission regulations and growing demand for environmentally responsible waste gas management. The However, the market faces challenges including higher capital costs compared to open flares, maintenance complexity, and varying regulatory requirements across different jurisdictions. Innovation in combustion efficiency improvement and automated control systems continue to influence product development and market expansion patterns.

The growing development of waste-to-energy facilities is creating enhanced opportunities for enclosed flare integration with comprehensive energy recovery systems. Advanced waste management facilities offer integrated energy generation capabilities, including biogas capture and utilization, that can optimize both waste treatment and energy production. Renewable energy integration provides opportunities for sophisticated waste gas management systems that can support both environmental compliance and sustainable energy generation.

Modern environmental equipment companies are incorporating real-time emission monitoring, automated combustion control, and predictive maintenance systems to enhance enclosed flare performance and operational reliability. These technologies improve destruction efficiency monitoring, enable optimized fuel utilization, and provide enhanced operational visibility throughout system operation. Advanced integration also enables automated compliance reporting and improved environmental performance verification.

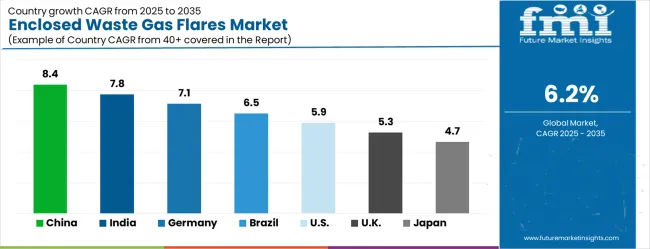

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The enclosed waste gas flares market is experiencing solid growth globally, with China leading at an 8.4% CAGR through 2035, driven by rapid urbanization requiring expanded waste management infrastructure, increasing environmental regulations, and government support for advanced waste treatment technologies. India follows at 7.8%, supported by growing municipal waste management needs, increasing environmental compliance requirements, and expanding industrial waste treatment capabilities. Germany shows growth at 7.1%, emphasizing environmental technology excellence and comprehensive waste management systems. Brazil records 6.5% growth, focusing on expanding waste management infrastructure and growing adoption of advanced flaring technologies. The USA shows 5.9% growth, representing steady demand from established waste management operations and industrial applications.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The market for enclosed waste gas flares in China is expected to grow at a solid CAGR of 8.4% through 2035. Revenue from enclosed waste gas flares in China is projected to exhibit solid growth with a CAGR of 8.4% through 2035, driven by massive urbanization creating expanded waste management requirements and comprehensive government support for advanced environmental technologies. The country's rapidly developing waste management infrastructure and increasing environmental compliance standards are creating substantial opportunities for enclosed flare adoption. Major domestic and international environmental equipment companies are establishing comprehensive manufacturing and service capabilities to serve the expanding waste management market.

In India, the market for enclosed waste gas flares is expanding at a CAGR of 7.8%. Revenue from enclosed waste gas flares in India is expanding at a CAGR of 7.8%, supported by rapidly growing municipal waste management requirements, increasing environmental awareness, and expanding industrial waste treatment capabilities. The country's substantial urbanization and commitment to environmental improvement are driving demand for advanced waste gas management solutions. International environmental equipment companies and domestic manufacturers are establishing partnerships to serve the growing demand for waste management technologies.

Revenue from enclosed waste gas flares in Germany is projected to grow at a CAGR of 7.1%, supported by the country's leadership in environmental technology and comprehensive expertise in waste management systems. German waste management operators and environmental equipment providers consistently invest in cutting-edge flaring technologies and emission control systems. Advanced engineering capabilities, comprehensive regulatory frameworks, and established relationships between equipment suppliers and waste management operators characterize the market.

In Brazil, the market for enclosed waste gas flares is projected to grow at a CAGR of 6.5%. Revenue from enclosed waste gas flares in Brazil is projected to grow at a CAGR of 6.5% through 2035, driven by expanding waste management infrastructure, increasing environmental compliance requirements, and growing adoption of advanced waste treatment technologies. Brazilian waste management operators are increasingly recognizing the importance of efficient gas management in achieving environmental compliance and operational sustainability.

The USA market for enclosed waste gas flares is expected to grow at a CAGR of 5.9%. Revenue from enclosed waste gas flares in the USA is projected to grow at a CAGR of 5.9%, supported by established waste management infrastructure, comprehensive environmental regulations, and continued investment in emission control technologies. American waste management companies maintain consistent adoption of advanced flare technologies through established regulatory compliance requirements and environmental stewardship programs.

In the UK, the market for enclosed waste gas flares is projected to grow at a CAGR of 5.3%. Revenue from enclosed waste gas flares in the UK is projected to grow at a CAGR of 5.3% through 2035, supported by comprehensive environmental regulations and established waste management frameworks. British waste management operators emphasize advanced environmental technologies within established regulatory frameworks that prioritize emission control and environmental stewardship.

Demand for enclosed waste gas flares in Japan is projected to growing at a CAGR of 4.7% through 2035, supported by the country's leadership in precision environmental engineering and comprehensive approach to waste management technologies. Japanese waste management companies emphasize technology-driven development of sophisticated flare systems within established frameworks that prioritize technical excellence and environmental responsibility.

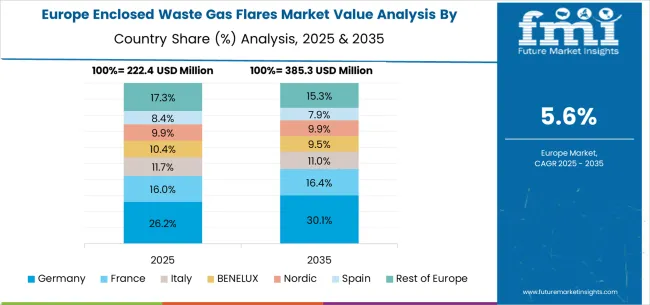

The enclosed waste gas flares market in Europe is projected to expand steadily through 2035, supported by established environmental regulations, comprehensive waste management systems, and ongoing innovation in emission control technologies. Germany will continue to lead the regional market, accounting for 30.7% in 2025 and rising to 31.5% by 2035, supported by strong environmental technology capabilities, advanced waste management infrastructure, and comprehensive regulatory compliance frameworks. The United Kingdom follows with 18.9% in 2025, maintaining 19.1% by 2035, driven by environmental compliance initiatives, established waste management operations, and consistent demand patterns.

France holds 16.4% in 2025, edging up to 16.7% by 2035 as waste management operators expand emission control capabilities and demand grows for advanced flaring technologies. Italy contributes 12.8% in 2025, remaining stable at 13.0% by 2035, supported by waste management infrastructure development and growing adoption of environmental technologies. Spain represents 9.6% in 2025, moving upward to 9.7% by 2035, underpinned by expanding waste management requirements and increasing investment in emission control systems.

Nordic countries together account for 7.2% in 2025, maintaining their position at 7.3% by 2035, supported by advanced environmental initiatives and early adoption of innovative flare technologies. The Rest of Europe represents 4.4% in 2025, declining slightly to 2.7% by 2035, as larger markets capture greater investment focus and established waste management infrastructure advantages.

The enclosed waste gas flares market is characterized by competition among specialized environmental equipment companies, established combustion technology providers, and innovative emission control manufacturers. Companies are investing in advanced combustion technologies, efficiency enhancement, strategic partnerships, and application development to deliver high-performance, reliable, and cost-effective enclosed flare solutions. Technology development, regulatory compliance, and customer service strategies are central to strengthening competitive advantages and market presence.

Cimarron Energy leads the market with significant expertise in combustion and flare technologies, offering comprehensive enclosed flare solutions with focus on efficiency optimization and waste management applications. L&J Technologies (Cognesense) provides established environmental equipment capabilities with emphasis focus on advanced monitoring and control systems. Eneraque focuses on specialized flare technologies with comprehensive waste gas management expertise. Varec Biogas delivers advanced biogas and waste gas handling solutions with strong focus on landfill and municipal applications.

ZEECO operates with focus on comprehensive combustion technologies and industrial flare systems. Combustion Research Associates (CRA) specializes in advanced combustion research and flare optimization technologies. Pollution Systems provides environmental equipment solutions with an emphasis on emission control applications. Catalytic Combustion focuses on specialized combustion technologies with catalyst-based systems. John Zink, GBA Flare, MRW Technologies, and Perennial Energy provide diverse technological approaches and application expertise to enhance overall market development and waste gas management capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 943.4 mMillion |

| Classification | Below 98%, Above 99%, Others |

| Application | Landfill, Municipal Treatment, Food & Beverage, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Cimarron Energy, L&J Technologies (Cognesense), Eneraque, Varec Biogas, ZEECO, Combustion Research Associates (CRA), Pollution Systems, Catalytic Combustion, John Zink, GBA Flare, MRW Technologies, Perennial Energy |

| Additional Attributes | Dollar sales by efficiency level and application, regional adoption trends, competitive landscape, waste management partnerships, integration with gas collection systems, innovations in combustion efficiency and emission control, regulatory compliance analysis, and operational optimization strategies |

The global enclosed waste gas flares market is estimated to be valued at USD 943.4 million in 2025.

The market size for the enclosed waste gas flares market is projected to reach USD 1,721.7 million by 2035.

The enclosed waste gas flares market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in enclosed waste gas flares market are below 98% and above 99%.

In terms of application, landfill segment to command 41.7% share in the enclosed waste gas flares market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enclosed Motor Starter Market Growth – Trends & Forecast 2024-2034

Enclosed Smokeless Flares Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed Cartons Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

Waste Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Waste-derived Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Heavy Metal Treatment Agent Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Treatment Aerators Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat To Power Market Size and Share Forecast Outlook 2025 to 2035

Waste to Energy Market Growth - Trends & Forecast 2025 to 2035

Waste Recycling Services Market by Application, Product Type, and Region - Growth, Trends, and Forecast 2025 to 2035

Waste Wrap Film Market

E-Waste Management Market Growth - Trends & Forecast 2025 to 2035

AI Waste Sorting Robots Market Forecast and Outlook 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA