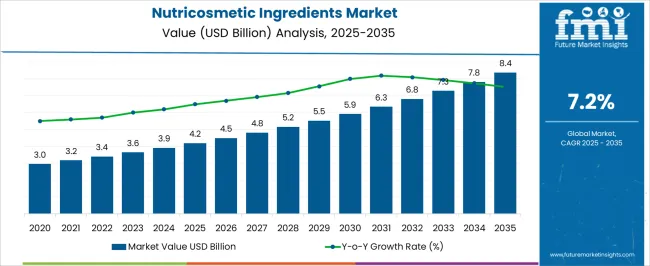

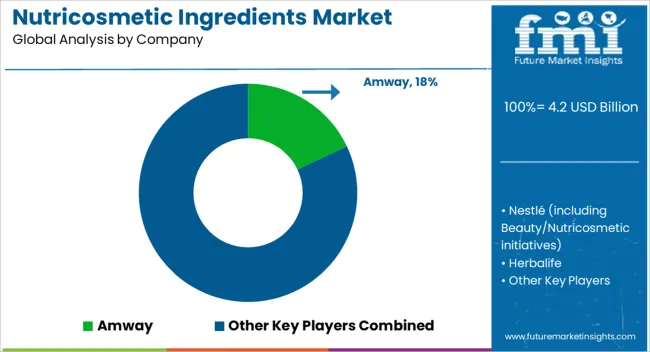

The nutricosmetic ingredients market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

Growth is being influenced by increasing consumer preference for ingestible beauty products that support skin health, hair strength, and anti-aging benefits. Nutritional supplements fortified with collagen peptides, antioxidants, and vitamins are gaining traction, while the crossover between dietary products and personal care is strengthening. This early growth phase reflects how wellness-driven purchasing behavior is creating long-term prospects for nutricosmetic ingredients. Between 2030 and 2035, the market is expected to expand from USD 5.9 billion to USD 8.4 billion, underscoring the continued importance of functional nutrition in beauty and wellness.

Nutricosmetic ingredients are being used more widely in capsules, powders, gummies, and fortified beverages, which has helped diversify consumption formats. As consumers seek multi-functional solutions that combine health and aesthetics, ingredient innovation is shaping the industry outlook. The inclusion of marine-based collagen, carotenoids, plant extracts, and probiotics is strengthening product portfolios. This consistent upward trajectory demonstrates how nutricosmetic ingredients are shifting from niche to mainstream, with growth supported by rising awareness, broader distribution, and brand investments in premium offerings.

| Metric | Value |

|---|---|

| Nutricosmetic Ingredients Market Estimated Value in (2025 E) | USD 4.2 billion |

| Nutricosmetic Ingredients Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

Within the broader nutraceuticals market, nutricosmetic ingredients account for around 1%, reflecting their niche positioning amidst a vast array of wellness and health-related ingredients. In the functional foods and beverages market, these ingredients make up approximately 2%, as food and drink products incorporate beauty-supporting actives but still face competition from other functional components. When viewed within the general dietary supplements market, nutricosmetic ingredients hold roughly 3%, signaling their rising appeal among supplement consumers interested in beauty-boosting benefits. In the beauty-from-within or beauty supplements category, the share is more notable at around 5%, since this segment directly revolves around ingestible products designed specifically for skin, hair, and nail health.

Finally, within the health and wellness ingredients market, nutricosmetic ingredients contribute roughly 2%, reflecting their emerging role within a wide pool of wellness-focused components. Collectively, these percentages underline that while nutricosmetic ingredients remain a relatively small portion of large and established markets, they stand out more prominently in beauty-oriented supplement segments. Their increasing shares in targeted sectors reflect growing consumer demand for internal beauty solutions, even as their overall scale remains modest when compared to broader nutraceutical and wellness categories.

The market is experiencing accelerated growth as consumers increasingly adopt ingestible beauty solutions that support skin health, hair vitality, and overall wellness from within. Demand is being driven by the convergence of nutritional science and cosmetic innovation, enabling the development of bioactive compounds that deliver visible and clinically validated benefits. Growing consumer awareness of preventive healthcare, coupled with rising disposable incomes, is fostering the adoption of premium nutricosmetic products across developed and emerging economies.

Technological advancements in extraction, formulation, and encapsulation techniques are enhancing ingredient bioavailability, ensuring improved efficacy. Regulatory support for functional food and dietary supplement markets is also reinforcing the industry’s credibility and adoption rates.

As the market evolves, partnerships between nutraceutical companies and cosmetic brands are increasing, allowing for broader product portfolios and brand reach With a strong emphasis on clean label, plant-derived, and scientifically backed formulations, the market is positioned for sustained expansion in the coming years.

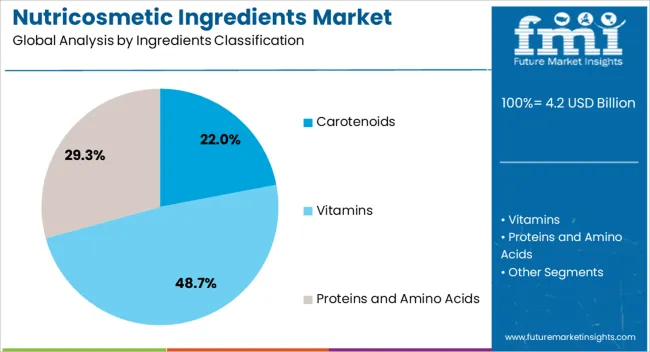

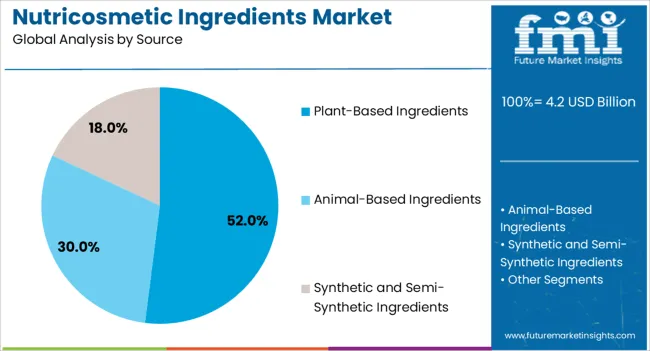

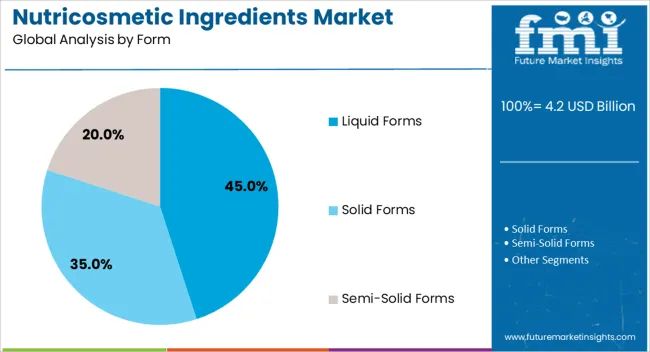

The nutricosmetic ingredients market is segmented by ingredients classification, source, form, application, end use, and geographic regions. By ingredients classification, nutricosmetic ingredients market is divided into carotenoids, vitamins, proteins and amino acids, omega fatty acids, polyphenols and flavonoids, minerals, prebiotics, probiotics, and postbiotics, ceramides and lipids, enzymes and coenzymes, and other Ingredients. In terms of source, nutricosmetic ingredients market is classified into plant-based ingredients, animal-based ingredients, synthetic and semi-synthetic ingredients, and biotechnology-derived ingredients. Based on form, nutricosmetic ingredients market is segmented into liquid forms, solid forms, semi-solid forms, and novel delivery systems. By application, nutricosmetic ingredients market is segmented into skin health and anti-aging, hair care, nail health, weight management and body sculpting, sun protection and tanning, oral care, and other applications. By end use, nutricosmetic ingredients market is segmented into dietary supplements, functional beverages, topical product combinations, and others. Regionally, the nutricosmetic ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The carotenoids segment is expected to hold 22% of the nutricosmetic ingredients market revenue share in 2025, making it the leading classification within ingredients. Growth in this segment has been driven by the well-documented antioxidant properties of carotenoids, which contribute to skin protection and anti-aging benefits. Demand has been reinforced by consumer preference for natural compounds that provide both health and aesthetic advantages.

Carotenoids have gained traction due to their role in supporting skin photoprotection and improving overall skin appearance when consumed regularly. Advancements in extraction and stabilization methods have enhanced the bioavailability of carotenoids, ensuring consistent results in nutricosmetic applications.

The rising popularity of beauty-from-within solutions, coupled with increased research validating the efficacy of carotenoids, has strengthened their position in both dietary supplements and fortified functional foods Their strong safety profile and natural origin further enhance market appeal, securing their dominant status in the ingredient classification category.

The plant-based ingredients segment is projected to command 52% of the market revenue share in 2025, making it the dominant source type. The segment’s leadership is attributed to growing consumer demand for natural, sustainable, and ethically sourced products that align with clean-label trends. Increased awareness of plant-derived bioactives and their multiple skin and wellness benefits has propelled adoption across global markets.

Manufacturers have focused on optimizing extraction processes to preserve the potency of botanical compounds, enhancing the functional properties of nutricosmetic products. Rising concerns over synthetic additives and allergenic reactions have encouraged the shift toward plant-based alternatives, particularly among health-conscious and vegan consumers.

The segment is also benefiting from the marketing appeal of botanicals, which resonates strongly with consumers seeking transparency and environmental responsibility With expanding R&D into novel plant-derived actives, the segment is expected to maintain its strong growth trajectory.

The liquid forms segment is anticipated to hold 45% of the market revenue share in 2025, emerging as the leading form category. This dominance has been supported by the high bioavailability and rapid absorption associated with liquid formulations, which improve the delivery of active ingredients. Liquids offer flexible dosage formats, making them suitable for a range of functional beverages, shots, and concentrated elixirs that integrate seamlessly into daily routines.

The convenience of liquid delivery has been particularly appealing to consumers seeking quick and effective beauty-from-within solutions. Advances in solubilization and emulsification technologies have further enhanced the stability and taste profile of liquid nutricosmetic products, supporting broader adoption.

The segment’s growth is also linked to the rising popularity of ready-to-drink functional products in both retail and online channels With the ability to combine multiple actives in a single serving, liquid forms continue to be a preferred choice for both manufacturers and consumers seeking efficacy and convenience.

The nutricosmetic ingredients market is growing as consumers adopt ingestible beauty solutions targeting skin, hair, and overall wellness. Opportunities are expanding in functional foods, beverages, and convenient supplement formats, while trends emphasize plant-based, natural, and transparent formulations. Challenges include regulatory variations, skepticism regarding efficacy, and affordability concerns. In my opinion, brands that deliver clinically validated, affordable, and plant-driven formulations while educating consumers about long-term benefits will gain a competitive advantage, making nutricosmetic ingredients a defining element in the convergence of beauty and nutrition industries worldwide.

Demand for nutricosmetic ingredients has been reinforced by consumer preference for supplements that promote skin, hair, and nail health from within. Ingredients such as collagen peptides, carotenoids, hyaluronic acid, and vitamins are being widely adopted in functional foods, beverages, and dietary supplements. Growing awareness of anti-aging and skin hydration benefits has further encouraged their use. In my opinion, demand will continue to strengthen as consumers move beyond topical cosmetics and embrace ingestible beauty products that deliver visible and holistic wellness benefits over time.

Opportunities are growing in functional foods, fortified drinks, and gummies, where nutricosmetic ingredients are being incorporated to enhance consumer appeal. Manufacturers are exploring innovative delivery systems, including powders and ready-to-drink beverages, to reach younger and health-conscious buyers. Opportunities also exist in emerging economies where awareness of beauty nutrition is rapidly rising. I believe companies that expand into these convenient formats and collaborate with food and beverage producers will capture stronger positions, as consumers prefer multifunctional products that blend nutrition with cosmetic benefits seamlessly.

Trends indicate a clear shift toward natural, plant-based, and clean-label nutricosmetic ingredients. Botanical extracts such as green tea, aloe vera, and turmeric are being used to meet consumer demand for safer and more transparent formulations. Brands are emphasizing vegan collagen alternatives and fermented actives to appeal to diverse lifestyles. Transparency in sourcing and ingredient traceability are becoming central to brand positioning. In my opinion, these trends highlight that natural formulations will dominate the competitive landscape, with innovation centered on botanical science and consumer trust in authenticity and efficacy.

Challenges remain around regulatory inconsistencies and limited consumer understanding of nutricosmetic efficacy. Varying rules across regions complicate product labeling and claims, creating hurdles for global expansion. Some consumers remain skeptical about ingestible beauty supplements due to a lack of immediate visible results. Price sensitivity also limits adoption in developing regions. In my assessment, success will require clearer clinical validation, harmonized regulatory pathways, and strong education campaigns. Companies that can demonstrate efficacy through scientific evidence and maintain transparency will overcome these barriers and secure long-term credibility in this growing sector.

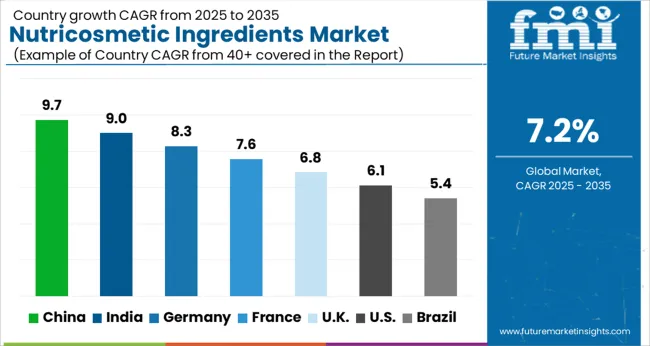

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global nutricosmetic ingredients market is projected to grow at a CAGR of 7.2% from 2025 to 2035. China leads with a growth rate of 9.7%, followed by India at 9%, and France at 7.6%. The United Kingdom records a growth rate of 6.8%, while the United States shows the slowest growth at 6.1%. Growth is fueled by rising consumer awareness of beauty-from-within solutions, expanding applications of collagen, carotenoids, and botanical extracts, and increasing interest in anti-aging and skin health supplements. Emerging economies such as China and India benefit from rising disposable incomes and evolving beauty preferences, while mature markets like France, the UK, and the USA focus on premium formulations, regulatory compliance, and product innovation.

The nutricosmetic ingredients market in China is projected to grow at a CAGR of 9.7%. Rising demand for beauty-from-within products, particularly collagen and herbal extracts, is a key driver. Expanding middle-class populations and increasing consumer focus on anti-aging and skin health have accelerated adoption. E-commerce platforms are enhancing product accessibility, while international and domestic players are expanding offerings to capture a growing consumer base. Regulatory support for functional foods and supplements is also contributing to wider use of nutricosmetic ingredients in both dietary and topical formulations.

The nutricosmetic ingredients market in India is expected to grow at a CAGR of 9%. Increasing awareness of skin health, hair care, and overall wellness is driving demand for functional ingredients. The rising popularity of Ayurvedic formulations blended with modern nutricosmetic ingredients such as collagen and antioxidants is expanding product diversity. Growth in urban populations, combined with rising disposable incomes, supports adoption across dietary supplements and fortified beauty products. Marketing campaigns by both domestic and international brands highlighting natural and science-backed benefits further drive consumer interest.

The nutricosmetic ingredients market in France is projected to grow at a CAGR of 7.6%. Strong consumer interest in beauty-from-within products and dietary supplements is fueling demand. France has a mature cosmetics industry that increasingly integrates nutricosmetic elements, particularly collagen, carotenoids, and plant-based antioxidants. Regulatory frameworks ensure product quality and safety, enhancing consumer confidence. The demand for premium and organic formulations continues to rise, with brands targeting anti-aging, hydration, and hair-strengthening benefits. Distribution through pharmacies, retail stores, and online channels sustains market expansion.

The nutricosmetic ingredients market in the UK is projected to grow at a CAGR of 6.8%. Growth is driven by consumer interest in natural and functional supplements addressing skin, hair, and nail health. Increasing awareness of holistic beauty and preventive care supports the adoption of nutricosmetic products. The market benefits from innovation in delivery formats such as gummies, powders, and fortified beverages, appealing to younger demographics. Premium positioning and targeted marketing campaigns around wellness and beauty continue to reinforce demand for nutricosmetic ingredients in the UK

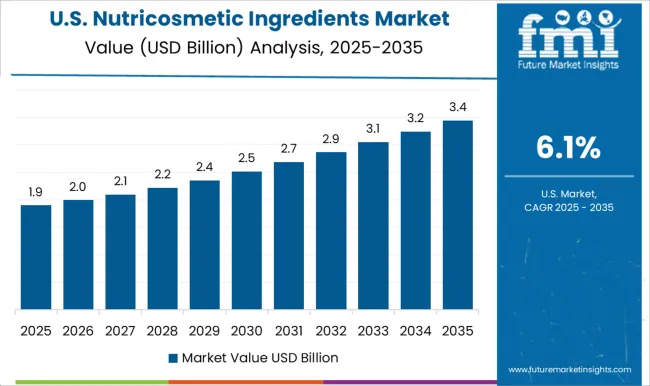

The nutricosmetic ingredients market in the USA is projected to grow at a CAGR of 6.1%. Demand is steady, driven by rising consumer interest in anti-aging, skin hydration, and hair-strengthening solutions. The market is characterized by innovation in science-backed formulations, with collagen peptides, carotenoids, and probiotics being widely used. While regulatory requirements influence product launches, they also ensure consumer trust in quality. E-commerce platforms and specialty wellness stores are strong growth enablers. Although growth is slower compared to emerging markets, rising emphasis on premium, clinically proven products ensures stable expansion.

Competition in the nutricosmetic ingredients market has been directed by a blend of consumer goods giants and specialist ingredient developers. Amway has been reinforcing its presence by combining direct-selling channels with proprietary nutricosmetic formulations, where its positioning as a wellness brand has been leveraged to promote beauty-from-within concepts. Nestlé has been advancing through its nutrition and health science divisions, where nutricosmetic initiatives have been embedded into broader functional food and supplement strategies. Herbalife has been pushing its identity as a lifestyle nutrition company, where beauty-linked dietary supplements have been integrated with weight management and general wellness offerings. Shiseido has been extending its authority from topical beauty into ingestible beauty products, where its heritage in skincare has been paired with dietary formulations targeted at skin hydration, elasticity, and anti-aging.

Specialist suppliers such as CollPlant and CLS have been introducing advanced nutricosmetic ingredients, where biotechnological expertise in collagen, peptides, and regenerative proteins has been recognized as a differentiator. Collectively, these players have been defining the landscape by merging consumer familiarity with ingredient innovation, building credibility in both retail and professional channels. Strategic direction among these firms has been influenced by their ability to balance branding, research, and product differentiation. Amway and Herbalife have been dominating through distribution strength and direct engagement with consumers, ensuring that nutricosmetic products are positioned as part of daily wellness routines.

Nestlé has been leveraging its scientific credibility, developing nutricosmetic solutions supported by clinical validation and functional ingredient research. Shiseido has been capitalizing on its premium beauty reputation, using nutricosmetic formulations to extend customer loyalty from skincare to supplements. CollPlant and CLS have been carving a niche by targeting B2B opportunities, supplying innovative raw materials to companies seeking advanced nutricosmetic formulations. This competitive matrix has been shaping buyer perception, where long-term authority is granted to those companies that can combine scientific credibility, strong branding, and consistent product availability across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 billion |

| Ingredients Classification | Carotenoids, Vitamins, Proteins and Amino Acids, Omega Fatty Acids, Polyphenols and Flavonoids, Minerals, Prebiotics, Probiotics, and Postbiotics, Ceramides and Lipids, Enzymes and Coenzymes, and Other Ingredients |

| Source | Plant-Based Ingredients, Animal-Based Ingredients, Synthetic and Semi-Synthetic Ingredients, and Biotechnology-Derived Ingredients |

| Form | Liquid Forms, Solid Forms, Semi-Solid Forms, and Novel Delivery Systems |

| Application | Skin Health and Anti-Aging, Hair care, Nail health, Weight management and body sculpting, Sun protection and tanning, Oral care, and Other applications |

| End Use | Dietary supplements, Functional beverages, Topical product combinations, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amway, Nestlé (including Beauty/Nutricosmetic initiatives), Herbalife, Shiseido, CollPlant / CLS / (specialist ingredient suppliers), and Other companies |

| Additional Attributes | Dollar sales by ingredient type (collagen peptides, carotenoids, plant extracts), Dollar sales by application (skin health, hair care, nail strength), Trends in beauty-from-within and functional nutrition, Use in dietary supplements and fortified beverages, Growth of marine and botanical ingredient adoption, Regional consumption dynamics across Asia-Pacific, Europe, and North America. |

The global nutricosmetic ingredients market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the nutricosmetic ingredients market is projected to reach USD 8.4 billion by 2035.

The nutricosmetic ingredients market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in nutricosmetic ingredients market are carotenoids, beta-carotene, lycopene, lutein and zeaxanthin, astaxanthin, other carotenoids, vitamins, and other fatty acids.

In terms of source, plant-based ingredients segment to command 52.0% share in the nutricosmetic ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Market Share Breakdown of Nutricosmetics Manufacturers

UK Nutricosmetics Market Growth – Demand, Trends & Forecast 2025-2035

GCC Nutricosmetics Market Outlook - Size, Growth & Trends 2025-2035

USA Nutricosmetics Market Trends – Size, Share & Growth 2025-2035

Japan Nutricosmetics Market Report – Trends, Demand & Outlook 2025-2035

Germany Nutricosmetics Market Insights – Size, Trends & Forecast 2025-2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA