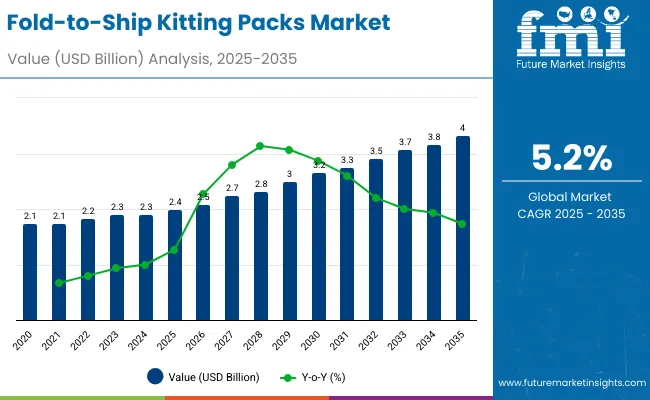

The fold-to-ship kitting packs market will rise from USD 2.4 billion in 2025 to USD 4.0 billion by 2035, growing at a CAGR of 5.2%. Market expansion is driven by sustainable packaging and integrated logistics that minimize warehouse storage space and enhance distribution speed. Flat-foldable and modular insert-based kitting designs are gaining traction across electronics and retail packaging. Between 2025 and 2030, automation in fulfilment centres and e-commerce warehouses will significantly boost market adoption. Asia-Pacific is set to dominate production, while North America leads in supply chain automation and advanced kitting design technologies. The fold-to-ship kitting packs market is being shaped by the growing need for packaging that reduces storage load, simplifies assembly, and supports faster movement through distribution networks. Growth from 2025 to 2035 is influenced by rising use of flat foldable structures that remain compact during warehousing and expand into full protective kits when required. Modular inserts and adaptive kitting layouts have gained strong acceptance within electronics and retail as brands seek packaging that offers organized component placement and easier line side handling. This shift has encouraged converters to advance board engineering, crease pattern optimization, and precision die cutting to ensure smoother erection during fulfilment.

From 2025 to 2030, fulfilment centers and e commerce warehouses are expected to increase adoption of automation systems that rely on predictable, fold ready packaging formats. Asia Pacific is positioned to lead production due to competitive manufacturing and access to large converting clusters. North America is expected to advance through stronger emphasis on supply chain automation, kitting precision, and improved layout design. Material innovation in corrugated grades, molded inserts, and paper based composites is likely to support broader usage across high volume categories. Key companies include KPAK, JBM Packaging, Lancaster Packaging, Coast to Coast Packaging, Anixter, Harte Hanks, Korpak, PackMax, Pollux Logistics, and Packlane.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.4 billion |

| Industry Value (2035F) | USD 4.0 billion |

| CAGR (2025 to 2035) | 5.2% |

Between 2020 and 2024, the rise of omnichannel logistics and automation accelerated demand for foldable kitting systems. These designs reduced warehouse storage costs and simplified packaging workflows. By 2035, the market will reach USD 4.0 billion, driven by the integration of robotics, modular insert technology, and sustainable corrugated materials. Asia-Pacific will dominate production capacity due to rapid e-commerce growth, while North America and Europe focus on automation and recyclable kitting innovations aligned with packaging waste regulations.

The market’s growth is driven by the global e-commerce boom, increasing logistics efficiency needs, and sustainability-driven packaging reforms. Retailers are adopting compact, customizable kitting systems to reduce shipping costs, improve product protection, and optimize storage and fulfillment processes.

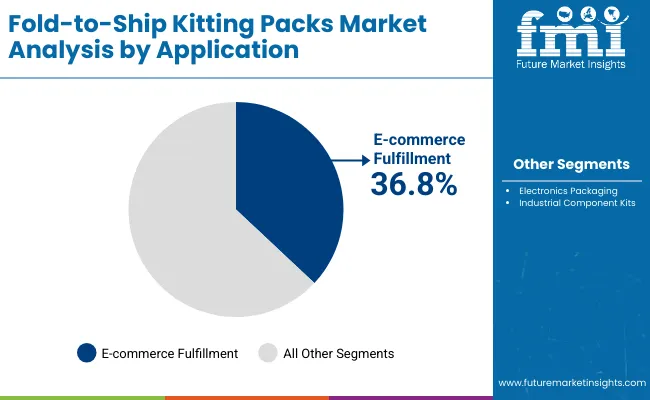

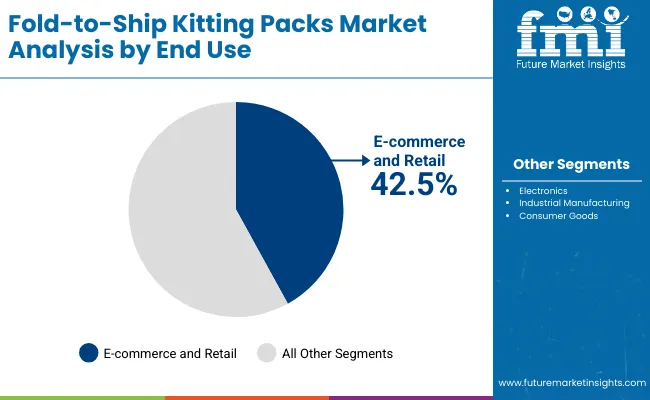

The market is segmented by pack type, design, application, end-use industry, and region. Pack types include corrugated, paperboard, and recycled fiber kitting packs. Designs encompass flat-foldable, multi-compartment, and modular insert-based layouts. Applications include e-commerce fulfillment, electronics packaging, and industrial component kits. End-use industries cover e-commerce and retail, electronics, industrial manufacturing, and consumer goods.

Flat-foldable designs are projected to hold 39.9% of the market in 2025, supported by their ability to minimize storage volume, reduce shipping costs, and simplify assembly. Their compact folding structure improves handling efficiency in large-scale fulfillmentcenters and retail operations.

These designs enable rapid deployment in automated packaging environments, aligning with sustainability and operational goals. Their reusability and ease of return logistics further enhance value for high-volume users. As global e-commerce scales, flat-foldable systems remain essential for optimizing packaging efficiency.

Corrugated kitting packs are expected to command 38.5% of the market in 2025, driven by their durability, recyclability, and adaptability for multi-item shipments. They ensure product protection while maintaining lightweight construction for cost-effective transport.

Compatibility with automated folding, sealing, and labeling systems accelerates throughput in modern distribution facilities. Their renewable fiber content supports corporate sustainability mandates. As supply chains prioritize efficiency and environmental responsibility, corrugated kitting packs continue to lead pack innovation.

E-commerce fulfillment is forecast to account for 36.8% of the market in 2025, fueled by expanding warehouse networks and rising customer expectations for secure delivery. Foldable kitting solutions provide tailored protection for diverse product assortments and minimize material waste.

Integration with digital order management and robotic systems enables faster packaging cycles. These packs balance protection with operational speed, reducing return rates from damaged goods. As online retail volume grows, e-commerce fulfillment remains the dominant application for foldable kitting packaging.

E-commerce and retail are projected to represent 42.5% of the market in 2025, supported by large-scale adoption of eco-efficient, foldable kitting solutions. Brands are transitioning to recyclable corrugated designs that streamline packaging and reduce emissions.

Automation in order assembly and packaging enhances accuracy and delivery performance. The reusability of foldable formats strengthens circular logistics frameworks. As global retail moves toward cost-effective, sustainable fulfillment, this sector continues to anchor end-use demand for foldable kitting systems.

The market is driven by rising e-commerce packaging volumes and increasing adoption of automation in logistics and fulfillmentcenters. Modular packaging kits enable rapid assembly, reduced storage needs, and tailored protection for diverse product categories. Growing demand for efficient, space-saving, and customizable packaging solutions across retail, electronics, and consumer goods sectors continues to accelerate market expansion.

Growth is hindered by the high setup costs associated with advanced folding and modular assembly machinery. Limited reusability of certain corrugated or laminated materials restricts sustainability performance. Integration challenges with existing automated packaging lines and the need for skilled operators further increase operational complexity. These factors slow widespread adoption, particularly in small and mid-sized enterprises.

Integration of digital printing and recyclable adhesives within modular packaging kits presents strong growth potential. On-demand printing allows brands to customize designs, barcodes, or promotional elements, enhancing consumer engagement while minimizing inventory. The use of recyclable or biodegradable adhesives aligns with global sustainability goals. These developments create new opportunities for cost efficiency and environmentally responsible packaging solutions.

The market is witnessing a transition toward lightweight corrugated materials that balance durability with reduced environmental impact. Digitally optimized kitting systems, equipped with automation and AI-driven layout design, are improving packaging speed and material efficiency. Customizable modular kits designed for rapid assembly and reduced waste are gaining traction. Collectively, these trends are redefining modular packaging as a cornerstone of sustainable, smart logistics operations.

The fold-to-ship kitting packs market is expanding rapidly as e-commerce growth, automation, and sustainability converge across logistics networks. Asia-Pacific leads due to its large-scale manufacturing and fulfillment infrastructure, supporting efficient, high-volume packaging operations. North America drives innovation in automation, robotics, and digital logistics optimization, while Europe prioritizes recyclable, regulation-compliant materials in modular kitting solutions. The growing need for lightweight, ready-to-ship, and reusable packaging designs continues to redefine fulfillment efficiency and reduce waste in supply chains.

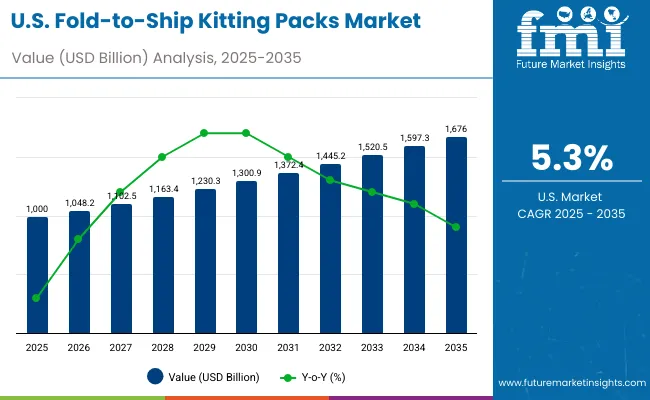

The USA will grow at 5.3% CAGR, supported by extensive warehouse automation and robotics integration. Subscription box and electronics sectors are fueling demand for customizable, fold-to-ship kitting systems. Investments in recyclable corrugated designs and smart packaging operations align with the country’s sustainability commitments.

Germany will expand at 5.1% CAGR, focusing on modular packaging inserts and eco-friendly materials in industrial logistics. Circular packaging initiatives and high-quality engineering in automation support scalable, sustainable kitting solutions. Industry collaboration continues to advance standardized, recyclable systems for cross-border trade.

The UK will grow at 5.2% CAGR, driven by on-demand automation for SMEs and growth in retail e-commerce. National waste-reduction programs encourage compact, reusable kitting formats. Retailers are prioritizing sustainable designs to optimize costs and material efficiency.

China will grow at 5.2% CAGR, with strong cross-border e-commerce expansion and robust domestic manufacturing capacity. The adoption of robotics and AI-enabled packaging lines enhances output and precision. Large-scale corrugated kit production continues to drive export competitiveness.

India will grow at 5.1% CAGR, supported by modernization of logistics infrastructure and the rise of D2C brands. Foldable and low-cost sustainable materials are being increasingly adopted for efficient order fulfillment. Government-backed initiatives further boost the country’s eco-packaging transition.

Japan will grow at 6.0% CAGR, emphasizing precision folding automation and export packaging innovation. Smart warehouse infrastructure and the use of durable paperboard materials are driving operational efficiency. Local R&D in design automation enhances flexibility for diverse shipping applications.

South Korea will lead with 6.1% CAGR, combining smart logistics and high-tech automation with sustainable material advancements. The country’s premium electronics and e-commerce packaging sectors are major drivers, supported by increasing exports of recyclable packaging solutions.

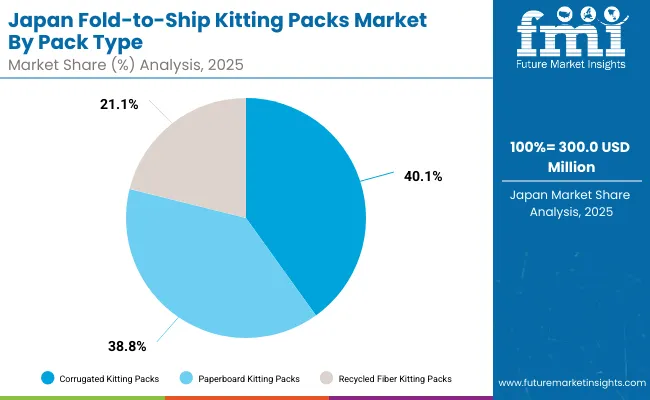

Japan’s fold-to-ship kitting packs market, valued at USD 300.0 million in 2025, is led by corrugated kitting packs, accounting for 39.8% of the share due to their durability and high recyclability. Paperboard kitting packs follow with growing use in e-commerce, while recycled fiber packs gain momentum as brands prioritize circular packaging solutions.

South Korea’s fold-to-ship kitting packs market, worth USD 200.0 million in 2025, is dominated by flat-foldable designs holding 41.8% share for their efficiency in storage and assembly. Multi-compartment designs optimize space for fragile items, whereas modular insert-based designs are increasingly used for electronics and healthcare shipments.

The market is moderately consolidated, with key players including KPAK, JBM Packaging, Lancaster Packaging, Coast to Coast Packaging, Anixter, Harte Hanks, Korpak, PackMax, Pollux Logistics, and Packlane. Companies are focusing on modularity, digitalized packaging design, and automation to optimize production and minimize logistics waste.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion (2025) |

| By Pack Type | Corrugated, Paperboard, Recycled Fiber |

| By Design | Flat-Foldable, Multi-Compartment, Modular Insert-Based |

| By Application | E-Commerce Fulfillment, Electronics, Industrial Components |

| By End-Use Industry | E-Commerce & Retail, Electronics, Industrial, Consumer Goods |

| Key Companies Profiled | KPAK, JBM Packaging, Lancaster Packaging, Coast to Coast Packaging, Anixter, Harte Hanks, Korpak, PackMax, Pollux Logistics, and Packlane |

| Additional Attributes | Market driven by automation, logistics optimization, and sustainable kitting innovation |

The market is valued at USD 2.4 billion in 2025, reflecting strong adoption in logistics and retail packaging.

It is expected to reach USD 4.0 billion by 2035, driven by automation and sustainability trends in global e-commerce.

The market is projected to grow at a CAGR of 5.2% during the forecast period.

Flat-Foldable Designs lead with a 39.9% share, offering superior storage efficiency and logistics performance.

E-Commerce and Retail dominate with 42.5% share, supported by the rise of online sales and rapid fulfillment infrastructure.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kitting Robots Market Size and Share Forecast Outlook 2025 to 2035

Gel Packs Market Size and Share Forecast Outlook 2025 to 2035

Cold Packs Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Perfume Packs Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Perfume Packs Market Share & Industry Leaders

Portion Packs Market Insights – Growth & Demand 2024-2034

Daily Backpacks Market Size and Share Forecast Outlook 2025 to 2035

Hiking Backpacks Market Analysis - Trends, Growth & Forecast 2025 to 2035

PVC Blister Packs Market

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Portion Control Packs Market

Bio-Fiber Tether Packs Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Structural Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Osmotic Self-Cooling Packs Market Size and Share Forecast Outlook 2025 to 2035

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Shelf-Adaptive Geometry Packs Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Q-Commerce Last-Mile Thermal Packs & Reverse Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA