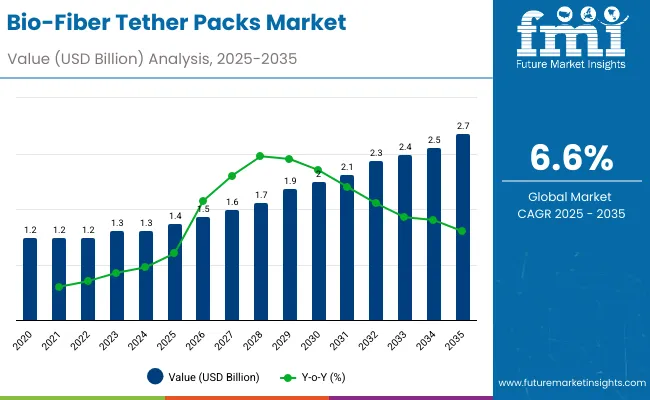

The bio-fiber tether packs market is likely to expand from USD 1.4 billion in 2025 to USD 2.7 billion by 2035 at a CAGR of 6.6% during the forecast period. Bans on single-use plastics, circular-economy goals, and rapid adoption of molded-fiber and paper-pulp composites support growth. Beverage brands increasingly favor bottle tether packs for their recyclability and compatibility with lightweight closures. Between 2025 and 2030, high-volume automation and fiber innovation will enhance scalability and barrier strength. Asia-Pacific will lead production, while North America and Europe emphasize compliance and design optimization.

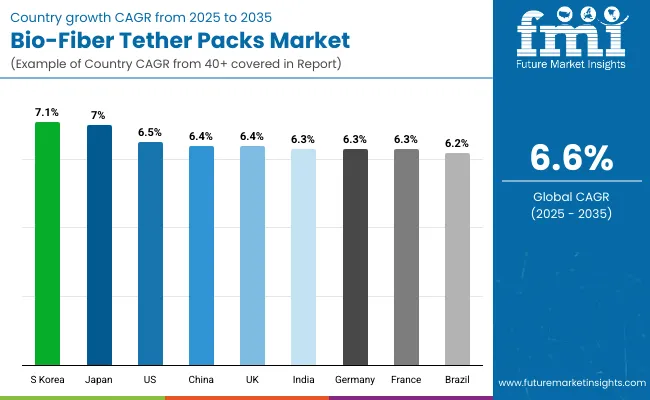

Growth from 2025 to 2035 is driven by stronger interest in molded fiber structures, paper pulp composites, and cellulose formats that allow packaging lines to adopt tethered closures without compromising recyclability or shelf appeal. Beverage brands, dairy producers, and ready-to-drink operators have moved toward biofiber tether packs because they offer structural strength, low migration behavior, and compatibility with lightweight caps during high-speed bottling. This shift is being influenced by national restrictions on single use plastics across regions such as Europe, North America, and parts of Asia Pacific, which has encouraged packaging converters to scale fiber processing units and hybrid forming equipment. Production centers in Asia Pacific, led by South Korea, China, and India, are expected to supply a large share of global volumes due to cost efficiency and easier access to fast-growing fiber supply chains. North America and Europe are expected to focus more on design optimization, barrier control, and manufacturing consistency to meet regional compliance norms.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 2.7 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2020 and 2024, global bans on plastic rings and caps accelerated investment in fiber-based tether solutions. Beverage manufacturers shifted to bio-pulp molding and residue fiber composites for premium and mass market products. By 2035, the market will reach USD 2.7 billion with broad industrial adoption and advances in wet press forming and multi-layer coatings. Asia-Pacific will dominate manufacturing volumes while Europe drives regulatory innovation and design standardization.

Rising eco-legislation and consumer awareness of biodegradable packaging are driving the transition away from petroleum-based tethers. Fiber packs offer low carbon footprint, mechanical durability, and compatibility with existing filling lines. Sustainability commitments from beverage giants and food brands continue to strengthen market momentum.

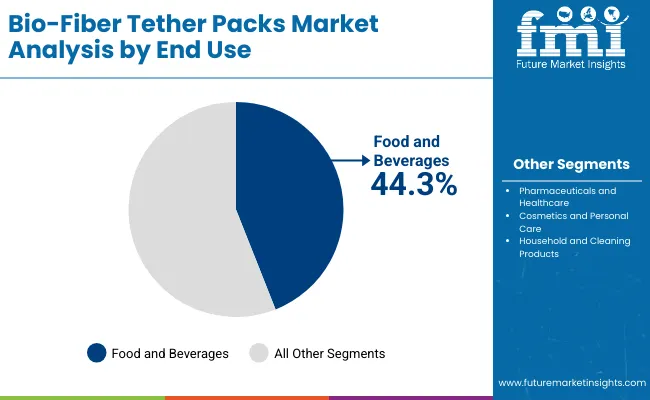

The market is segmented by material, pack type, end-use industry, and region. Materials include moldedfiber, paper pulp composites, agricultural residue fiber, bamboo fiber, and recycled cellulose fiber. Pack types comprise bottle tether packs, carton tether packs, multipack carriers, and folding/snap-lock tether packs. End-use industries span food & beverages, pharmaceuticals & healthcare, cosmetics & personal care, and household & cleaning products.

Moldedfiber is projected to command 38.6% of the market in 2025, favored for its rigidity, recyclability, and cost-effective production. It provides durable, impact-resistant protection for bottles and cartons while enabling complete compostability and easy disposal within existing recycling streams.

Its compatibility with automated forming and molding equipment enhances throughput for high-volume packaging operations. Manufacturers prefer moldedfiber for its low carbon footprint and biodegradability. As brands transition from single-use plastics to renewable materials, moldedfiber continues to lead as the preferred substrate for tether pack designs.

Bottle tether packs are expected to hold 41.2% of the market in 2025, supported by regulations requiring attached closures for improved recyclability. Their lightweight design reduces material use and supports seamless production on automated assembly lines.

The use of blended fibers and molded reinforcements improves tensile strength while maintaining flexibility. As beverage producers emphasize packaging that meets circular economy goals, bottle tether packs stand out for balancing sustainability, convenience, and consumer safety. Their compatibility with multiple bottle formats drives global adoption.

The food and beverage industry is forecast to capture 44.3% of the market in 2025, driven by the shift toward eco-friendly carriers and fiber-based cartons. Major beverage brands are investing in moldedfiber tether systems to comply with sustainability pledges and regulatory frameworks for attached caps.

These solutions reduce reliance on plastic rings and shrink wraps while improving transport safety and recyclability. As demand for premium and sustainable beverages rises, fiber tether packs enable operational efficiency and brand differentiation. The segment remains the largest consumer of fiber-based tethering solutions.

The market is primarily driven by the global ban on single-use plastics and the rapid shift toward sustainable, fiber-based packaging. Rising corporate ESG commitments are accelerating the replacement of plastic coatings with renewable nanocellulose alternatives. Demand from food and consumer goods sectors for recyclable, compostable, and high-barrier materials continues to boost market expansion.

Growth is restrained by higher production and processing costs compared to conventional polymer coatings. Limited availability of water-resistant nanocellulose formulations reduces usability in high-moisture environments. Scalability challenges, along with the lack of standardized performance testing, further delay mass commercialization in cost-sensitive markets.

Emerging agro-residue fibers and automated forming technologies are unlocking new avenues for innovation. Integration of nanocellulose with bio-based or mineral fillers is enhancing barrier performance while supporting recyclability. Expanding R&D in bio-coating technologies offers manufacturers the chance to meet sustainability targets without compromising functionality or aesthetics.

The market is witnessing a shift toward bamboo and cellulose blend coatings for improved strength and flexibility. Lightweight packaging designs and wet-molding automation are optimizing efficiency and reducing production waste. Ongoing development of multi-functional coatings combining oxygen, grease, and moisture resistance, is setting new standards for next-generation sustainable packaging.

The global bio-fiber tether packs market is expanding rapidly as sustainability regulations and packaging circularity drive global adoption. Asia-Pacific dominates production due to large-scale fiber processing and cost-efficient molding machinery. North America and Europe follow with rising regulatory alignment, strong corporate sustainability goals, and consumer preference for biodegradable packaging. Growing substitution of plastic bottle holders with fiber-based alternatives continues to reshape global beverage and FMCG packaging ecosystems.

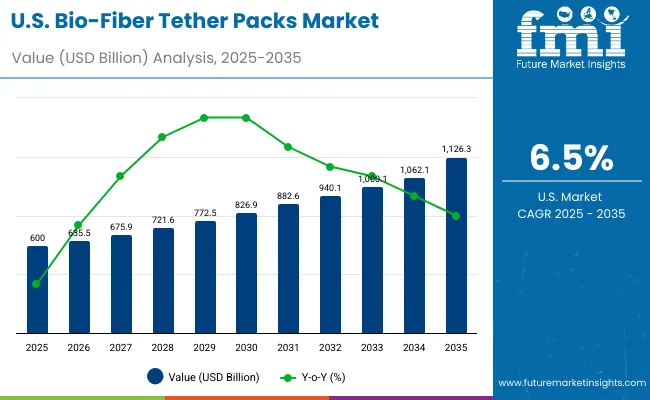

The USA will grow at 6.5% CAGR, supported by major beverage producers adopting fiber tethers to reduce single-use plastic waste. Expansion of automation in wet molding lines is improving manufacturing throughput and quality consistency. Increased R&D in biodegradable and bio-coated fiber technologies reinforces domestic leadership in sustainable packaging innovation.

Germany will expand at 6.3% CAGR, driven by strong R&D investment in multi-layer paper composites and moldedfiber innovation. EU recycling mandates are accelerating fiber packaging adoption across food and beverage sectors. Domestic production capacity is growing to meet premium packaging and sustainability standards.

The UK will grow at 6.4% CAGR, focusing on lightweight fiber alternatives for bottled drink packaging. Retail sustainability commitments are fueling biodegradable tether integration. The emergence of local bio-pack manufacturers is boosting domestic supply and reducing import dependence.

China will grow at 6.4% CAGR, supported by large-scale industrial fiber processing facilities and government backing for bio-packaging development. Expanding exports of affordable fiber-based tether packs are strengthening the country’s global footprint. Ongoing automation in molding processes continues to enhance production efficiency.

India will grow at 6.3% CAGR, driven by strong momentum in eco-bottle and biodegradable packaging manufacturing. Public-private partnerships are advancing fiber-based alternatives to plastic across beverage and household sectors. Collaborations with food and drink brands are accelerating domestic market transformation.

Japan will grow at 7.0% CAGR, leading in precision fiber forming and advanced coating technologies. Smart coating integration enhances moisture resistance and structural durability. Increased demand from functional beverage brands is propelling fiber tether use in high-performance bottle carriers.

South Korea will lead with 7.1% CAGR, supported by strong bio-polymer research and industrial collaboration. High export activity in fiber pack machinery and innovative molded bottle attachments strengthens its market position. Ongoing R&D in bio-composites is driving further adoption across beverage packaging lines.

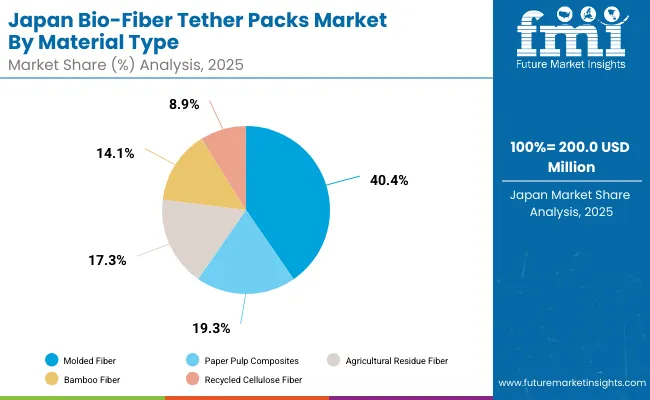

Japan’s bio-fiber tether packs market, valued at USD 200 million in 2025, is led by moldedfiber, commanding a 39.5% share due to its recyclability, strength, and suitability for beverage carriers. Paper pulp composites support lightweight packaging innovations, while agricultural residue and bamboo fibers enhance biodegradability. Recycled cellulose fibers gain traction for circular economy goals.

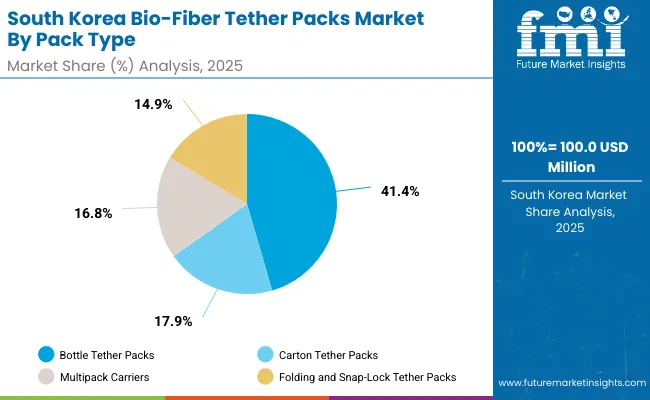

South Korea’s bio-fiber tether packs market, worth USD 100 million in 2025, is dominated by bottle tether packs, holding a 40.3% share driven by sustainability mandates for attached caps. Carton tether packs and multipack carriers serve the food and beverage sector, while folding and snap-lock tether packs improve recyclability and production efficiency.

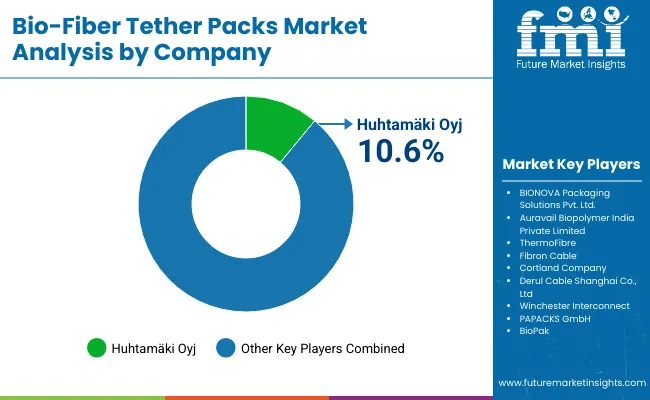

The market is moderately fragmented with leading players such as BIONOVA Packaging Solutions Pvt. Ltd., Auravali Biopolymer India Private Limited, ThermoFibre, Fibron Cable, Cortland Company, Derul Cable Shanghai Co., Ltd., Winchester Interconnect, HuhtamäkiOyj, PAPACKS GmbH, and BioPak. Companies focus on wet-press molding efficiency, bio-polymer integration, and fiber recycling.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion (2025) |

| By Material | Molded Fiber, Paper Pulp Composites, Agricultural Residue Fiber, Bamboo Fiber, Recycled Cellulose Fiber |

| By Pack Type | Bottle Tether, Carton Tether, Multipack Carriers, Folding & Snap-Lock Tether |

| By End-Use Industry | Food & Beverages, Pharmaceuticals & Healthcare, Cosmetics & Personal Care, Household & Cleaning |

| Key Companies Profiled | BIONOVA Packaging Solutions Pvt. Ltd., Auravali Biopolymer India Private Limited, ThermoFibre, Fibron Cable, Cortland Company, Derul Cable Shanghai Co., Ltd., Winchester Interconnect, Huhtamäki Oyj, PAPACKS GmbH, and BioPak |

| Additional Attributes | Market driven by eco-design mandates, fiber innovation, and sustainable packaging automation |

The market is valued at USD 1.4 billion in 2025, reflecting rising fiber adoption in sustainable packaging.

It is projected to reach USD 2.7 billion by 2035, supported by eco-policy compliance and automated fiber production.

The market is forecast to grow at a CAGR of 6.6% over the period.

Molded Fiber dominates with a 38.6% share, owing to strength and recyclability advantages.

The Food and Beverage sector leads with a 44.3% share, driven by plastic replacement initiatives and global brand adoption.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Tool Tethering Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Spinal Tethering Systems Market Size and Share Forecast Outlook 2025 to 2035

Gel Packs Market Size and Share Forecast Outlook 2025 to 2035

Cold Packs Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Perfume Packs Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Perfume Packs Market Share & Industry Leaders

Portion Packs Market Insights – Growth & Demand 2024-2034

Daily Backpacks Market Size and Share Forecast Outlook 2025 to 2035

Hiking Backpacks Market Analysis - Trends, Growth & Forecast 2025 to 2035

PVC Blister Packs Market

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Portion Control Packs Market

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Structural Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Osmotic Self-Cooling Packs Market Size and Share Forecast Outlook 2025 to 2035

Fold-to-Ship Kitting Packs Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA