The osmotic self-cooling packs market will increase from USD 1.4 billion in 2025 to USD 2.7 billion by 2035, growing at a CAGR of 6.8%. The osmotic self cooling packs market is being influenced by strong regional activity across Asia Pacific, North America, and Europe as countries expand cold-chain, medical logistics, and food delivery networks. Growth from 2025 to 2035 is supported by wider use of osmotic evaporative and salt-based endothermic systems that deliver temperature stability without external power. Asia Pacific is poised to dominate manufacturing, driven by large-scale production in China and India, rising export activity in Japan, and rapid material innovation in South Korea, resulting in a regional CAGR of 7.6%. China remains a major supplier of cooling pouches for food and healthcare distribution, while India advances through rising vaccine storage needs and government backed cold-chain upgrades.

North America is driven by the United States, where demand from meal kit services, biologics handling, and last mile grocery delivery continues to rise. Europe maintains strong adoption through Germany, France, and the United Kingdom, supported by strict temperature compliance norms and growing interest in reusable cooling materials. Japan and South Korea strengthen the market with compact, high precision osmotic systems used in diagnostics, premium food transport, and pharmaceutical logistics.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 2.7 billion |

| CAGR (2025 to 2035) | 6.8% |

From 2020 to 2024, demand for temperature-stable packaging rose sharply in the food and healthcare sectors. Innovations in osmotic and endothermic cooling systems enhanced efficiency without external power sources. By 2035, the market will reach USD 2.7 billion, supported by global cold chain growth, vaccine logistics, and eco-conscious transport solutions. Asia-Pacific will lead global manufacturing due to its cost-effective production base, while North America and Europe drive adoption through advanced R&D and strict temperature compliance standards.

The market’s growth is fuelled by rising requirements for energy-free cooling in food storage, pharmaceuticals, and logistics. Increased demand for compact, reusable packs and regulatory support for eco-friendly thermal solutions are key contributors to expansion.

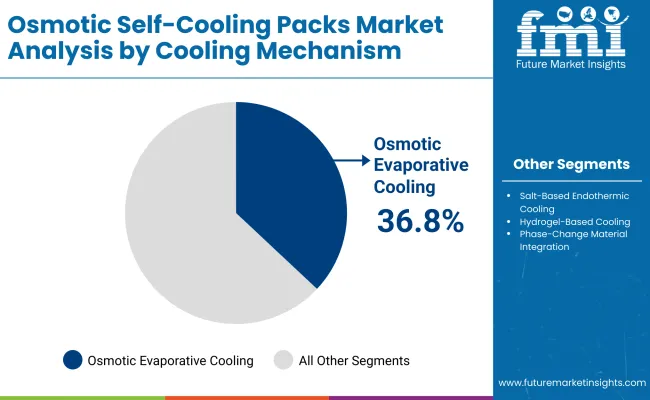

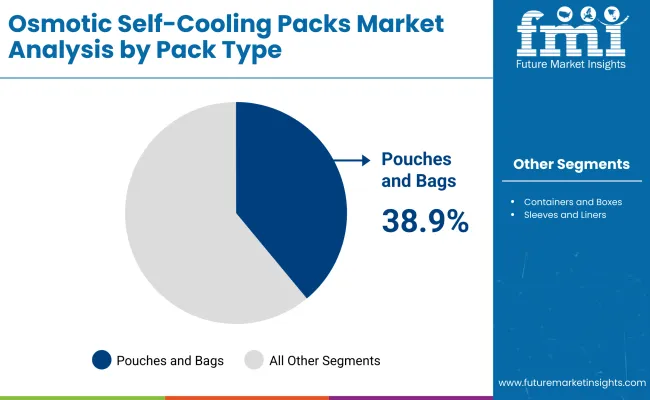

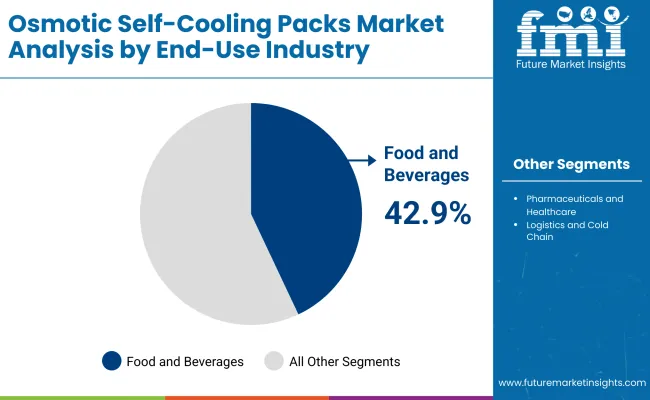

The market is segmented by cooling mechanism, pack type, end-use industry, and region. Cooling mechanisms include osmotic evaporative, salt-based endothermic, hydrogel-based, and phase-change material integration. Pack types comprise pouches and bags, containers and boxes, and sleeves and liners. End-use industries include food and beverages, pharmaceuticals and healthcare, and logistics and cold chain. Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Osmotic evaporative cooling is projected to account for 36.8% of the market in 2025, driven by its ability to maintain low temperatures without chemical refrigerants. The process leverages natural water evaporation through osmotic membranes, providing steady cooling across food, pharmaceutical, and logistics packaging applications.

Its energy-free and eco-friendly operation aligns with sustainable cold-chain initiatives. Adoption is increasing in regions emphasizing low-carbon storage solutions. As manufacturers seek safer and more portable alternatives to conventional gel packs, osmotic evaporative systems continue to dominate the cooling mechanism category.

Pouches and bags are expected to capture 38.9% of the market in 2025, supported by their portability, flexible design, and ease of integration with evaporative materials. These formats are well-suited for small-scale logistics and perishable goods transport.

Their lightweight construction reduces shipping costs while ensuring consistent cooling performance. The rise of insulated, multi-layer pouch systems enhances moisture retention and reusability. As on-the-go consumption and temperature-sensitive packaging demand expand, pouches and bags remain the preferred form factor for cooling applications.

The food and beverage sector is forecast to hold 42.9% of the market in 2025, propelled by global growth in ready-to-eat meals, fresh produce transport, and outdoor food service. Evaporative cooling packaging enables freshness preservation without external power sources.

Manufacturers are incorporating osmotic cooling layers into flexible packaging for extended temperature regulation. The sector’s commitment to reducing cold-chain emissions further supports adoption. As convenience and sustainability converge, the food and beverage industry continues to lead market growth in evaporative cooling packaging solutions.

The market is being driven by rapid cold chain expansion and rising demand for temperature-controlled logistics across pharmaceuticals, food, and biotechnology sectors. Innovations in eco-friendly cooling materials and phase-change technologies are enhancing performance and sustainability. The surge in vaccine distribution, meal-kit delivery, and perishable exports is further propelling the adoption of reliable and reusable gel pack solutions for maintaining product integrity.

Market growth is restrained by the limited duration of cooling performance, which restricts gel packs’ effectiveness for extended transport periods. The high cost of advanced hydrogel formulations and bio-based coolants increases production expenses. Additionally, disposal challenges and lack of standardized cold chain handling practices in developing regions hinder large-scale adoption. These factors limit competitiveness against conventional ice-based or mechanical cooling alternatives.

The integration of reusable materials and smart temperature indicators offers strong potential for market differentiation. Reusable gel packs made from recyclable polymers and non-toxic gels are addressing sustainability goals. Smart indicators embedded within packs enable real-time monitoring of temperature conditions during transit, ensuring regulatory compliance. Partnerships between logistics providers and packaging innovators are driving the development of next-generation cold chain systems optimized for efficiency and traceability.

Biodegradable phase-change materials are gaining prominence for their ability to maintain precise temperature ranges while reducing environmental impact. Lightweight and energy-efficient cold storage alternatives are being adopted to minimize carbon emissions across logistics networks. Manufacturers are investing in multi-use gel pack systems compatible with automated packaging lines. Collectively, these trends are redefining cold chain packaging toward sustainable, technology-integrated thermal protection solutions.

The global osmotic self-cooling packs market is expanding as cold-chain logistics, healthcare, and food delivery sectors embrace eco-efficient temperature control technologies. Asia-Pacific dominates due to its vast food logistics networks, vaccine distribution programs, and scalable manufacturing infrastructure. North America leads in compliance-driven, temperature-regulated packaging innovations, while Europe prioritizes recyclable and sustainable osmotic cooling solutions. Advancements in hydrogel chemistry, phase-change materials, and automated insulation packaging continue to enhance performance, efficiency, and environmental sustainability across industries.

The USA will grow at 6.9% CAGR, fueled by strong demand from meal kit providers, e-commerce grocery delivery, and the pharmaceutical cold chain. Adoption of reusable and temperature-stable osmotic materials enhances sustainability while reducing waste across logistics operations.

Germany will expand at 6.7% CAGR, driven by growth in perishable food and medical supply logistics. Companies are focusing on recyclable osmotic cooling systems with integrated temperature control sensors, aligning with EU sustainability and safety directives.

The UK will grow at 6.8% CAGR, supported by rising pharmaceutical exports and growing demand for outdoor-ready chilled food packaging. Continuous R&D in reusable hydrogel-based cooling technologies enhances energy efficiency and packaging life cycles.

China will grow at 6.8% CAGR, maintaining leadership in large-scale manufacturing of eco-cooling pouches for food and healthcare sectors. Expanding temperature-controlled logistics and innovation in sustainable endothermic formulations boost market reach.

India will grow at 6.7% CAGR, supported by increased vaccine storage, dairy transport, and cold-chain investments. Local production of hydrogel-based osmotic cooling packs is accelerating, aided by government programs to modernize cold storage infrastructure.

Japan will grow at 7.5% CAGR, driven by compact, reusable cooling pack innovation. Applications in high-value medical and premium food products are expanding, supported by strong R&D and patent activity in osmotic and endothermic material technologies.

South Korea will lead with 7.6% CAGR, underpinned by innovation in eco-cooling materials and high-tech packaging exports. Growth in diagnostics and pharmaceutical logistics is complemented by advances in biodegradable and smart temperature-regulating designs.

Japan’s osmotic self-cooling packs market, valued at USD 200.0 million in 2025, is dominated by osmotic evaporative cooling, which holds 38.4% share for its rapid temperature regulation and reusability. Salt-based endothermic cooling is expanding in logistics packaging, while hydrogel-based and phase-change material systems serve high-performance pharmaceutical and food transport applications.

South Korea’s osmotic self-cooling packs market, worth USD 100.0 million in 2025, is led by pouches and bags, capturing 37.3% share for their portability and flexible design. Containers and boxes are preferred for bulk cold-chain distribution, while sleeves and liners see rising adoption in e-commerce and last-mile perishable deliveries.

The market is moderately fragmented with key players including Tempra Tech, Nortech Labs, Cryopak, Polar Tech, Tempack, Siddhi Coolpack, Creative Packaging, Cold Chain Technologies, Nordic Cold Chain, and Pelton Shepherd Industries. Companies focus on reusable pack innovation, phase-change integration, and sustainable temperature-controlled packaging.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion (2025) |

| By Cooling Mechanism | Osmotic Evaporative, Salt-Based Endothermic, Hydrogel-Based, Phase-Change Material |

| By Pack Type | Pouches & Bags, Containers & Boxes, Sleeves & Liners |

| By End-Use Industry | Food & Beverages, Pharmaceuticals & Healthcare, Logistics & Cold Chain |

| Key Companies Profiled | Tempra Tech, Nortech Labs, Cryopak, Polar Tech, Tempack, Siddhi Coolpack, Creative Packaging, Cold Chain Technologies, Nordic Cold Chain, and Pelton Shepherd Industries |

| Additional Attributes | Market driven by eco-cooling innovation, portable storage demand, and sustainable cold chain systems |

The market is valued at USD 1.4 billion in 2025, reflecting growing adoption in food and healthcare packaging.

It is projected to reach USD 2.7 billion by 2035, supported by rising demand for power-free cooling solutions.

The market will expand at a CAGR of 6.8% throughout the forecast period.

Osmotic Evaporative Cooling dominates with a 36.8% share, offering energy-efficient and eco-safe temperature regulation.

The Food and Beverages sector leads with a 42.9% share, driven by global cold chain and on-the-go consumption growth.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Osmotic Pump Market Growth – Trends & Forecast 2024-2034

Gel Packs Market Size and Share Forecast Outlook 2025 to 2035

Cold Packs Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Perfume Packs Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Perfume Packs Market Share & Industry Leaders

Portion Packs Market Insights – Growth & Demand 2024-2034

Daily Backpacks Market Size and Share Forecast Outlook 2025 to 2035

Hiking Backpacks Market Analysis - Trends, Growth & Forecast 2025 to 2035

PVC Blister Packs Market

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Portion Control Packs Market

Bio-Fiber Tether Packs Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Structural Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Fold-to-Ship Kitting Packs Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Bags and Backpacks Market - Trends, Growth & Forecast 2025 to 2035

Shelf-Adaptive Geometry Packs Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Q-Commerce Last-Mile Thermal Packs & Reverse Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA