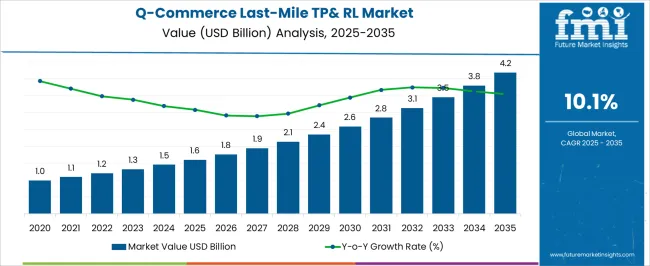

The q-commerce last-mile thermal packs & reverse logistics market is expected to grow from USD 1.6 billion in 2025 to USD 4.2 billion by 2035, resulting in a total increase of USD 2.6 billion over the forecast decade. This represents a 162.5% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 10.1%. Over ten years, the market grows by a 2.6 multiple.

In the first five years (2025 to 2030), the market progresses from USD 1.6 billion to USD 2.6 billion, contributing USD 1.0 billion, or 38.5% of total decade growth. This phase is shaped by rapid expansion of quick-commerce platforms requiring temperature-controlled packaging for perishable goods. Growing consumer demand for grocery and pharmacy delivery within 10-30 minutes drives thermal protection needs.

In the second half (2030 to 2035), the market grows from USD 2.6 billion to USD 4.2 billion, adding USD 1.6 billion, or 61.5% of the total growth. This acceleration is supported by advanced phase change materials, smart temperature monitoring integration, and sustainable packaging innovations. Expansion into emerging markets and increasing adoption of reusable thermal systems ensure continued growth in this specialized cold chain segment.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.6 billion |

| Forecast Value in (2035F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

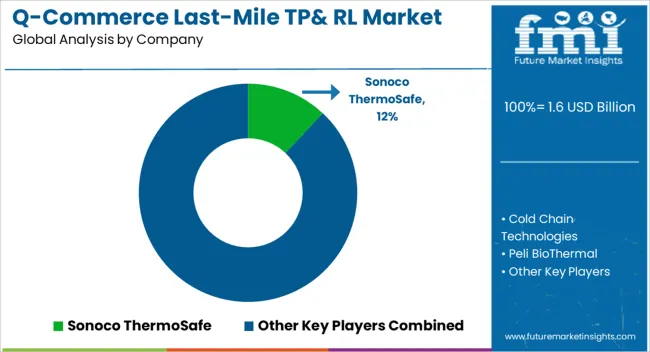

From 2020 to 2024, the Q-commerce last-mile thermal packs & reverse logistics market increased from USD 0.9 billion to USD 1.5 billion, supported by rapid growth in on-demand grocery delivery and pharmaceutical e-commerce. Nearly 65% of revenue came from single-use thermal packaging solutions addressing immediate delivery needs. Leading companies such as Sonoco ThermoSafe, Cold Chain Technologies, and Peli BioThermal advanced PCM gel technologies, vacuum insulated panels, and temperature monitoring systems. Competitive focus remained on maintaining cold chain integrity during 30-60 minute delivery windows, while smart packaging features and sustainability remained secondary priorities.

By 2035, the Q-commerce last-mile thermal packs & reverse logistics market will reach USD 4.2 billion, growing at a CAGR of 10.1%, with intelligent thermal monitoring and circular economy solutions representing over 45% of market value. Competition will intensify as providers offer biodegradable phase change materials, IoT-enabled temperature tracking, and automated reverse logistics platforms. Established players are pivoting toward hybrid models combining thermal protection with digital supply chain integration. Emerging market expansion and regulatory emphasis on pharmaceutical cold chain compliance will drive continued innovation in temperature-controlled packaging solutions.

The explosive growth of quick-commerce platforms delivering groceries, pharmaceuticals, and fresh foods within 10-30 minutes is driving demand for specialized thermal packaging. These solutions maintain product integrity during ultra-fast delivery cycles, preventing spoilage and ensuring consumer safety. Rising expectations for fresh produce, dairy, and medication delivery are expanding thermal protection requirements across urban markets.

Advanced thermal packs featuring phase change materials, vacuum insulation, and smart monitoring capabilities are gaining adoption for their ability to maintain precise temperature ranges. Reverse logistics systems enable package recovery and reuse, reducing costs while meeting sustainability goals. Integration with dark store networks and automated sorting systems enhances operational efficiency in the rapidly scaling Q-commerce ecosystem.

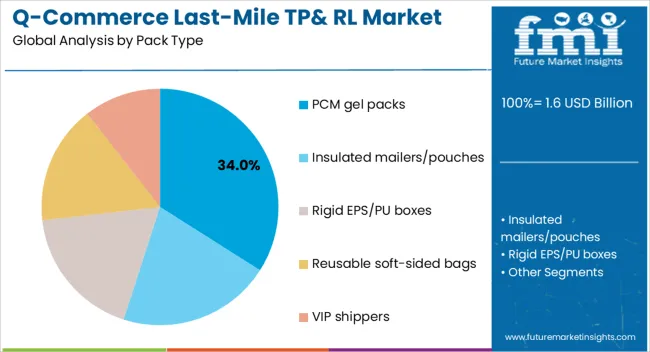

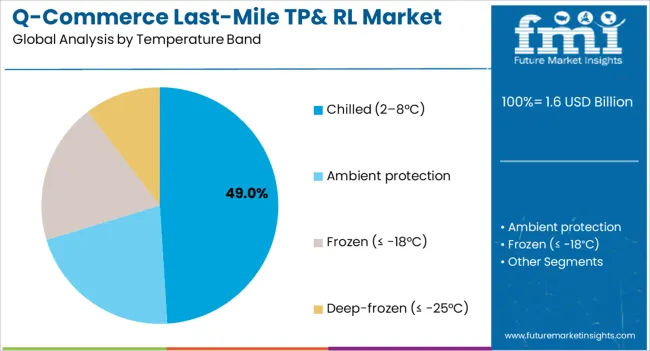

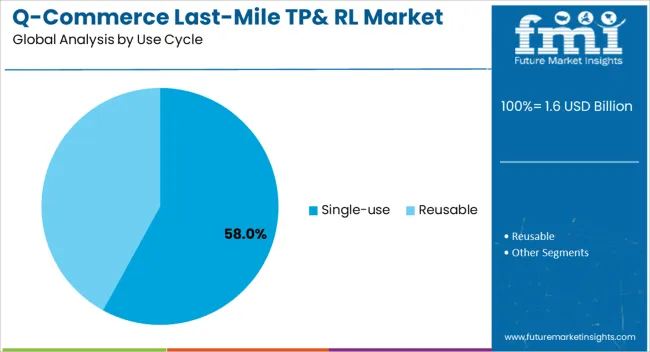

The market is segmented by pack type, temperature band, use cycle, and region. Pack type segmentation includes PCM gel packs, insulated mailers/pouches, rigid EPS/PU boxes, reusable soft-sided bags, and VIP shippers. Temperature band covers chilled (2-8°C), ambient protection, frozen (≤ −18°C), and deep-frozen (≤ −25°C). Use cycle segmentation includes single-use and reusable systems. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

PCM gel packs are projected to account for 34.0% of the market in 2025, driven by their ability to maintain consistent temperatures during extended delivery periods. These packs use phase change materials that absorb and release thermal energy at specific temperatures, providing more stable protection than traditional ice packs. Their lightweight design and leak-proof construction make them ideal for Q-commerce applications requiring rapid deployment and handling.

The chilled (2-8°C) temperature band is forecast to hold 49.0% of the market in 2025, driven by extensive use in fresh produce, dairy products, and pharmaceutical delivery. This temperature range covers the majority of temperature-sensitive items in Q-commerce, from vegetables and meat to vaccines and insulin. Maintaining this range prevents spoilage while ensuring product safety and efficacy throughout the delivery cycle.

Single-use thermal packs are expected to represent 58.0% of the market in 2025, driven by operational efficiency and hygiene requirements in fast-paced Q-commerce environments. These systems eliminate the need for complex reverse logistics while ensuring consistent performance for each delivery. Food safety regulations often favor single-use solutions to prevent cross-contamination between different product categories and delivery cycles.

The Q-commerce last-mile thermal packs & reverse logistics market is expanding rapidly as ultra-fast delivery platforms require specialized temperature-controlled packaging to maintain product quality during 10-30 minute delivery windows. Rising consumer demand for fresh groceries, pharmaceuticals, and prepared meals delivered within hours is driving thermal protection needs. However, high packaging costs and complex reverse logistics operations challenge profitability. Innovations in smart packaging, sustainable materials, and automated recovery systems are reshaping market opportunities.

Q-commerce platforms delivering groceries and pharmaceuticals within 10-30 minutes require specialized thermal packaging to prevent spoilage and maintain product efficacy. Strict temperature control requirements for medications, vaccines, and fresh produce demand reliable cold chain solutions. Growing consumer expectations for product quality and safety during rapid delivery cycles are pushing retailers to invest in premium thermal protection. Dark store networks and micro-fulfillment centers rely on thermal packaging to maintain inventory quality and reduce waste, while regulatory compliance in pharmaceutical delivery creates mandatory thermal protection requirements.

Despite strong demand, high costs of advanced thermal packaging solutions impact profit margins in price-sensitive Q-commerce operations. Complex reverse logistics systems for reusable packaging require significant infrastructure investment and operational coordination. Single-use thermal packs generate substantial waste, creating environmental concerns and potential regulatory restrictions. Limited recycling infrastructure for specialized thermal materials complicates waste management. These challenges force companies to balance thermal protection needs with cost efficiency and environmental responsibilities.

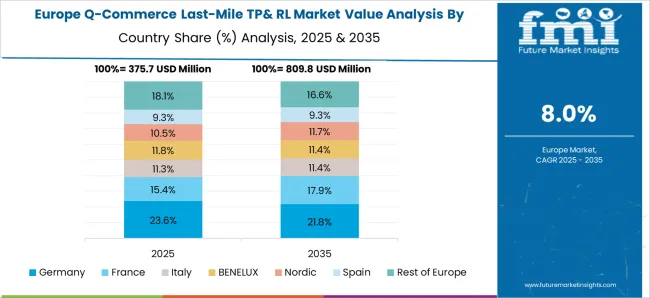

The global Q-commerce last-mile thermal packs & reverse logistics market is experiencing rapid expansion, driven by the proliferation of ultra-fast delivery platforms and increasing consumer demand for temperature-sensitive products delivered within minutes. Asia-Pacific is emerging as the fastest-growing region, with India and the UAE leading adoption due to extreme climate conditions and rapid Q-commerce penetration. Developed markets such as the USA, UK, and Germany are focusing on sustainable thermal solutions, regulatory compliance, and advanced reverse logistics systems to support mature Q-commerce ecosystems across urban centers.

India is projected to record the fastest growth at a CAGR of 13.2% from 2025 to 2035, driven by rapid expansion of Q-commerce platforms in Tier-1 and Tier-2 cities. The extreme heat conditions across most regions create critical needs for thermal protection during grocery and pharmaceutical deliveries. Major players are investing in affordable PCM gel packs and insulated mailers designed for India's price-sensitive market while maintaining cold chain integrity during monsoon and summer seasons.

The UAE market is expected to grow at a CAGR of 10.4%, supported by extreme climate conditions that demand robust thermal protection for all temperature-sensitive deliveries. High Q-commerce adoption rates and premium consumer expectations drive investment in advanced VIP shippers and rigid EPS/PU boxes for luxury food and pharmaceutical products. The country's strategic position as a regional logistics hub is spurring innovation in thermal packaging solutions designed for desert climates.

Saudi Arabia's market is forecast to grow at a CAGR of 9.3%, driven by Vision 2030 retail digitization initiatives and extreme heat exposure risks requiring thermal protection. Chain pharmacy delivery scale-up and grocery Q-commerce expansion in major cities are creating substantial demand for cost-effective thermal packaging solutions. Local companies are developing thermal systems specifically designed for Saudi Arabia's unique climate challenges and consumer preferences.

Brazil's market is projected to grow at a CAGR of 9.7%, fueled by big-city dark-store expansion and online pharmacy growth in major metropolitan areas. Grid variability and power infrastructure challenges drive preference for PCM-based thermal packs that provide reliable temperature control independent of electrical systems. Local manufacturers are developing tropical-climate thermal solutions designed for Brazil's diverse regional conditions and consumer preferences.

The USA market is expected to grow at a CAGR of 8.8%, supported by large-scale grocery delivery operations and specialized pharmaceutical cold chain requirements. GLP-1 medications and OTC cold shipments create premium thermal packaging demand, while curbside-recyclable and reusable pilot programs address environmental concerns. Major retailers are investing in automated reverse logistics systems to optimize thermal packaging recovery and reuse across nationwide networks.

The UK market is forecast to grow at a CAGR of 7.5%, driven by consolidated Q-commerce players and meal-kit/grocer own-delivery services. Circular packaging mandates are accelerating adoption of reusable thermal systems and biodegradable single-use options. Major retailers are implementing comprehensive reverse logistics networks to support thermal packaging recovery while meeting stringent environmental regulations and consumer sustainability expectations.

Germany's market is projected to grow at a CAGR of 7.1%, supported by e-grocery expansion and strict packaging waste regulations favoring reusable solutions. Pharmacy click-and-collect cold chain operations and premium fresh food delivery create demand for high-performance thermal packaging systems. German engineering expertise is driving innovation in automated reverse logistics and smart thermal monitoring technologies.

The Q-commerce last-mile thermal packs & reverse logistics market is moderately fragmented, with thermal packaging specialists, logistics providers, and material innovation companies competing across grocery, pharmaceutical, and specialty delivery segments. Global leaders such as Sonoco ThermoSafe, Cold Chain Technologies, and Peli BioThermal hold notable market share, driven by advanced phase change materials, validated thermal performance, and compliance with international cold chain standards. Their strategies increasingly emphasize sustainable packaging solutions, smart monitoring integration, and scalable reverse logistics capabilities.

Established mid-sized players including Nordic Cold Chain Solutions, va-Q-tec, and Insulated Products Corporation (IPC) are supporting adoption of specialized thermal packaging featuring vacuum insulated panels, customizable temperature ranges, and automated recovery systems. These companies are especially active in pharmaceutical and premium food delivery applications, offering validated solutions that meet regulatory requirements while optimizing cost efficiency and operational performance for Q-commerce platforms.

Specialized providers such as Cryopak, TemperPack, Vericool, and PackIt Fresh focus on innovative thermal solutions for regional markets and niche applications. Their strengths lie in biodegradable materials, smart packaging integration, and flexible manufacturing capabilities, enabling Q-commerce platforms to implement customized thermal protection strategies while addressing sustainability goals and regulatory compliance requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 billion |

| By Pack Type | PCM Gel Packs, Insulated Mailers/Pouches, Rigid EPS/PU Boxes, Reusable Soft-Sided Bags, VIP Shippers |

| By Temperature Band | Chilled (2-8°C), Ambient Protection, Frozen (≤ −18°C), Deep-Frozen (≤ −25°C) |

| By Use Cycle | Single-Use, Reusable |

| By Application | Grocery & Fresh Produce, Pharmaceutical & Healthcare, Meal Kits & Prepared Foods, Specialty Items |

| Key Companies Profiled | Sonoco ThermoSafe, Cold Chain Technologies, Peli BioThermal, Nordic Cold Chain Solutions, va-Q-tec, Insulated Products Corporation (IPC), Cryopak, TemperPack, Vericool, PackIt Fresh |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Additional Attributes | Rising demand for PCM gel packs due to superior temperature stability, strong growth in chilled temperature applications for grocery and pharmaceutical delivery, increasing adoption of reusable systems to reduce packaging waste, expanding pharmaceutical cold chain requirements driving VIP shipper demand, and growing integration with smart monitoring systems for real-time temperature tracking and compliance verification. |

The global Q-commerce last-mile thermal packs & reverse logistics market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the Q-commerce last-mile thermal packs & reverse logistics market is projected to reach USD 4.2 billion by 2035.

The Q-commerce last-mile thermal packs & reverse logistics market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in Q-commerce last-mile thermal packs & reverse logistics market are pcm gel packs, insulated mailers/pouches, rigid eps/pu boxes, reusable soft-sided bags and vip shippers.

In terms of temperature band, chilled (2–8°c) segment to command 49.0% share in the Q-commerce last-mile thermal packs & reverse logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Sublimation Paper Market Size and Share Forecast Outlook 2025 to 2035

Unidirectional Tape (UD) Market Size and Share Forecast Outlook 2025 to 2035

Tableware Market Size and Share Forecast Outlook 2025 to 2035

Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

Signage Market Size and Share Forecast Outlook 2025 to 2035

Straw Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Reconditioned Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA