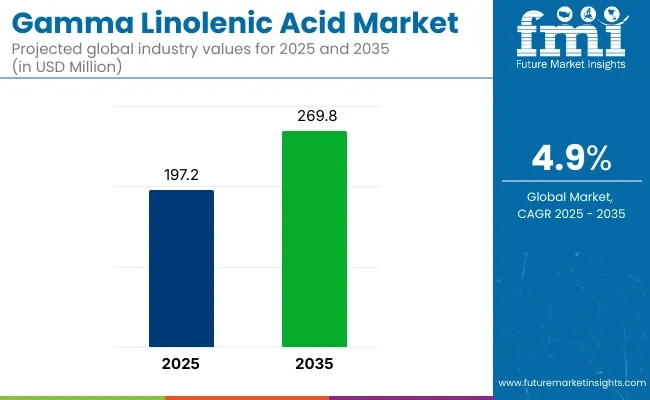

The global gamma linolenic acid industry was valued at USD 197.2 million in 2025 and is forecast to reach USD 269.8 million by 2035, translating to a 4.9% compound annual growth rate over the period. Expansion between 2020 and 2025 averaged 4.3%, reflecting rising demand for evidence-backed nutritional lipids. Gamma linolenic acid (GLA) has gained traction as a convenient route to improve inflammatory balance and cardiovascular resilience.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 197.2 million |

| Market Size in 2035 | USD 269.8 million |

| CAGR (2025 to 2035) | 4.9% |

The industry holds 3.1% of the nutritional lipids market, driven by its specialized use in inflammatory and metabolic health. Within functional food ingredients, GLA represents around 2.4%, given its presence in fortified snacks and beverages. It contributes nearly 4.6% to the dietary supplements segment, with demand concentrated in hormonal and skin health solutions.

In the plant-based oils category, GLA holds just 1.9%, as high-GLA seed oils form a niche subset. In the broader nutraceuticals market, its share reaches 3.7%, supported by clinical positioning and practitioner endorsements. Limited natural sources, high extraction costs, and targeted health claims have confined GLA to high-value subcategories, ensuring moderate yet consistent participation across its parent sectors.

Momentum has been supported by peer-reviewed studies linking GLA supplementation with improved eicosanoid profiles, moderated atopic-dermatitis symptoms, and reduced fasting-glucose fluctuations. A surge in clinical-trial registrations during 2023 to 2024 strengthened practitioner confidence, prompting formulators to adopt standardized GLA ingredients at efficacious dosages.

Dietary guidelines in Japan, the United Kingdom, and Canada now recognise seed-oil-derived GLA as a permissible functional component, while the United States Food and Drug Administration has issued several generally recognised as safe notifications. Concurrently, online search analytics recorded sustained interest in plant-based omega-6 supplements throughout 2024, underscoring the behavioural driver anchoring demand.

Across the supply chain, high-GLA cultivars of borage, evening primrose, and black currant are contract-grown, harvested, and dried before cold-press or solvent-extraction at crushing facilities. Crude oils undergo refining, degumming, neutralisation, bleaching, deodorisation-to reach 40-65% purity, then move in bulk to ingredient blenders for standardisation and micro-encapsulation.

Formulators in dietary supplements, pharmaceuticals, and personal care convert these intermediates into consumer-ready products, which are distributed through wholesalers, e-commerce, and mass-retail channels. ISO-22000 audits, allergen-control certificates, and region-specific labelling rules provide compliance checkpoints at every node of the chain.

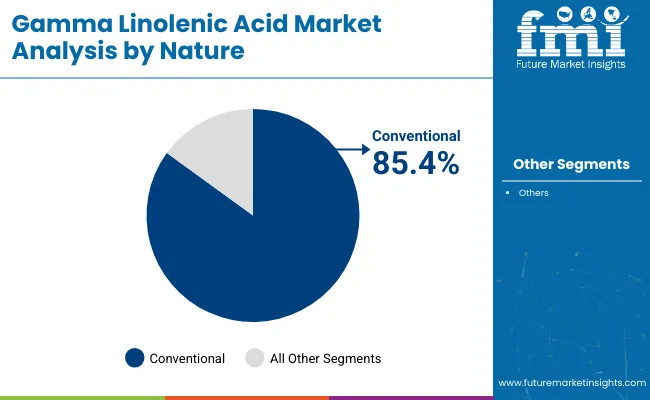

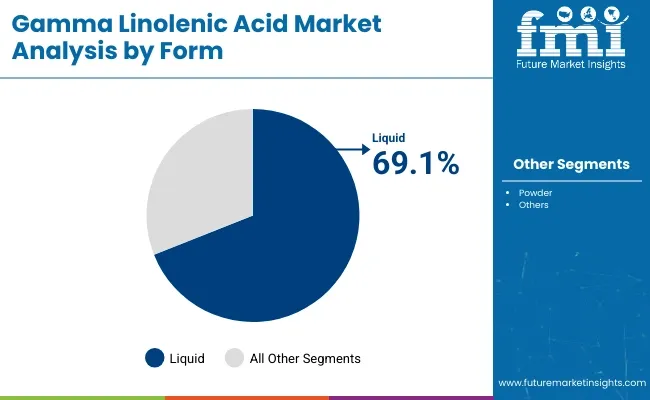

Conventional GLA derived from standard seed crops has been preferred because raw inputs remain abundant, extraction stays cost-efficient, and uniform quality meets pharma-grade specifications, whereas liquid formats are favored for superior bioavailability, straightforward processing, and seamless inclusion in capsules, soft gels, and skincare bases.

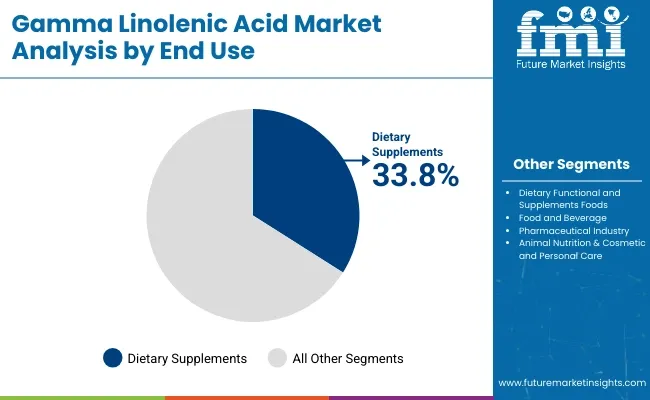

Dietary supplement and functional-food makers emerge as the chief buyers, as concentrated doses enable clinically validated benefits and clear label claims, while dosage limits and sensory hurdles restrict broader food-and-beverage adoption.

Conventional gamma linolenic acid (GLA) products are projected to account for nearly 85.4% of total market share in 2025. This dominance stems from consistent raw material availability, lower input costs, and scalable extraction processes associated with conventionally grown borage, evening primrose, and black currant seeds.

Liquid form is expected to capture 69.1% of the market share in 2025, far exceeding powder formulations. The preference for liquid GLA stems from its superior bioavailability, ease of integration into soft gels, capsules, and cosmetic emulsions, and lower processing requirements.

Dietary functional and supplement foods are projected to lead end-use consumption of gamma linolenic acid, capturing 33.8% of the market share in 2025. This preference is driven by consumer demand for targeted health benefits such as hormonal balance, anti-inflammatory support, and skin health, areas where GLA supplementation is clinically supported.

Therapeutic applications in inflammatory and hormonal conditions are driving gamma linolenic acid’s uptake in supplements, backed by clinical validation and practitioner use. On the supply side, improved extraction methods and regional sourcing hubs are ensuring cost-efficient, high-yield production.

Therapeutic Use Cases Boost Ingredient Adoption

Market growth is being shaped by the expanded clinical application of the product in conditions such as eczema, rheumatoid arthritis, and hormonal disorders. With rising consumer trust in plant-based therapeutic compounds, GLA has found a firm footing in both practitioner-prescribed and self-care formats. Scientific validation and peer-reviewed studies continue to support its inclusion in premium supplements and medical nutrition.

Supply-Side Control and Extraction Efficiency

Production economics remain favorable due to improved oil-yield cultivars and scalable extraction technology. Cold-press and supercritical CO₂ methods have streamlined manufacturing while reducing solvent risk and maintaining fatty acid integrity. Geographic clusters in Canada, Eastern Europe, and India are centralizing supply, enabling better cost control and faster throughput.

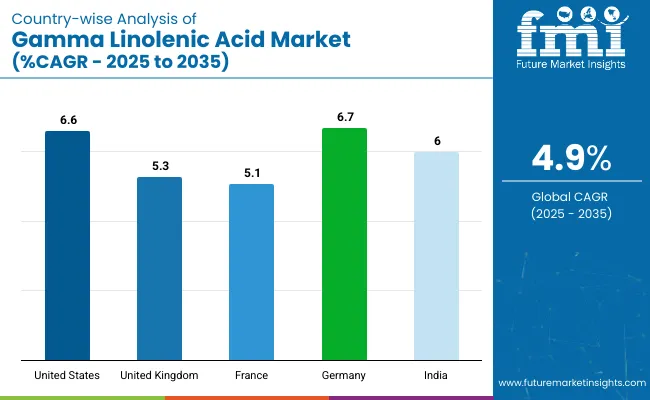

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.6% |

| United Kingdom | 5.3% |

| France | 5.1% |

| Germany | 6.7% |

| India | 6.0% |

Gamma linolenic acid sales are forecast to grow globally at a 4.9% CAGR between 2025 and 2035. All five profiled countries out of the 40 markets covered are projected to exceed this baseline, led by Germany at 6.7% and the United States at 6.6%. India follows with a projected 6.0%, while the United Kingdom and France register CAGRs of 5.3% and 5.1%, respectively.

These trends result in a growth premium ranging from +0.2% (France) to +1.8% (Germany) above the global average. The variation stems from distinct policy, production, and channel drivers: phytopharmaceutical reimbursement in Germany, GRAS approvals and e-commerce reach in the USA, Ayurvedic integration in India, HFSS-driven reformulation in the UK, and dermocosmetic endorsements in France.

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The United States gamma linolenic acid market is projected to grow at 6.6% CAGR during the forecast period. Government nutrition surveys have reported elevated incidence of eczema and joint inflammation, and practitioners have responded by prescribing plant-sourced omega-6 concentrates rather than steroidal interventions.

FDA Generally Recognized as Safe notifications covering borage-seed and evening-primrose oils have lowered regulatory barriers, so contract manufacturers in Utah and California have expanded soft-gel capacity. Domestic acreage of high-GLA borage hybrids has been increased under forward-purchase agreements that guarantee farmers premium pricing while locking processors into predictable input costs.

Pharmacies and mass-merchandise retailers maintain prominent shelf allocations for fatty-acid blends targeted for specific conditions, and e-commerce sport-nutrition outlets run subscription models that keep monthly demand steady.

The Germany gamma linolenic acid market is expected to grow at a 6.7% CAGR from 2025 to 2035. Federal statutory health insurers reimburse part of the cost of herbal preparations when monographs from the German Commission E list support efficacy, and GLA products fall within that framework for atopic-skin management.

Pharmacies therefore dispense pharmacist-compounded evening-primrose capsules alongside prescription emollients, increasing baseline uptake. Domestic cosmeceutical brands have incorporated high-purity GLA into intensive face-serum ranges because the fatty acid profile aligns with the country’s preference for evidence-based natural actives.

Seed-oil importers in Hamburg have entered long-term supply contracts with Canadian producers, allowing refinery plants in Schleswig-Holstein to meet oxidative-stability thresholds demanded by the Bundesinstitut für Arzneimittel und Medizinprodukte.

The India gamma linolenic acid market is estimated to grow at 6% CAGR during the study period. Traditional-medicine firms have reformulated Ayurvedic liver-tonics and women’s-health tonics to include standardized GLA because regulatory guidelines under AYUSH now recognise plant-derived fatty acids as compatible with classical texts, provided botanical provenance is documented.

Contract farming programs in Himachal Pradesh and Uttarakhand have encouraged borage cultivation at altitude, delivering seed oil with GLA content exceeding 20%, while cooperatives bundle crop insurance and post-harvest logistics. FSSAI nutrient-addition rules have placed stricter limits on trans-fat levels in processed foods, opening space for GLA-rich oils as healthier lipid sources in bakery shortenings. Online wellness portals running flash-sale events during festival seasons have popularised subscription packs of mixed omega-3/-6 gummies, thereby smoothing cyclical retail demand.

The France gamma linolenic acid market is anticipated to grow at 5.1% CAGR between 2025 and 2035. Dermatological laboratories in the Pharmacie-Cité network have championed GLA-enriched barrier creams because pharmacist recommendations carry high authority among French consumers; as a result, topical products drive considerable ingredient pull-through.

The country’s sizable dermocosmetic sector, headquartered in Nouvelle-Aquitaine and Île-de-France, funds clinical studies demonstrating improved transepidermal-water-loss metrics when evening-primrose oil is applied, reinforcing medical-beauty positioning.

Agri-tech grants under the “Plant Protein Plan” support trials of borage cultivars bred for elevated oil yield, and growers benefit from forward offtake contracts with cosmetic-ingredient refineries in Lyon. Organic retail chains such as Biocoop stock GLA capsules alongside herbal hormonal-balance supplements, tapping demand from women seeking alternatives to synthetic treatments.

The United Kingdom gamma linolenic acid market is estimated to grow at 5.3% CAGR during the forecast period. Post-Brexit reform of novel-food dossiers has enabled faster inclusion of plant-seed oils containing specified fatty-acid ratios, and suppliers have secured rapid authorisations for 40% GLA concentrates.

Retail pharmacies participating in NHS Healthy Start have promoted omega-fatty-acid soft gels to pregnant women, citing advisory-committee guidelines on skin health and post-natal mood regulation. High-fat-salt-sugar (HFSS) restrictions on confectionery advertising have encouraged snacking-bar manufacturers to pivot toward better-for-you positioning, and encapsulated GLA powder has been used to meet declared functional-lipid thresholds without taste compromise.

Life-science suppliers are recalibrating their gamma linolenic acid playbooks through API refinement, specialty distribution, and regulatory tightrope walking. Merck KGaA is driving pharma-grade purity with continuous-flow esterification at its Darmstadt hub, while Thermo Fisher Scientific pivots toward fermentation-derived GLA concentrates to de-risk botanicals.

Enzo Life Sciences packages diagnostic assay kits bundled with reference-standard GLA, pushing cross-sell into genomics accounts. China’s Changsha Vigorous-Tech scales borage-oil output under pesticide-residue thresholds that meet EU annexes, giving Charkit Chemical exclusive USA import rights.

Spanish processor Cailà & Parés accelerates supercritical CO₂ toll extraction for cosmetics. Domestic player Acme partners with Cherish Pharma to co-market micronized GLA for rheumatoid formulations, pairing QR-based traceability with hospital tenders. Early clinician feedback indicates improved absorption metrics and palatability.

Recent Gamma Linolenic Acid Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 197.2 million |

| Projected Market Size (2035) | USD 269.8 million |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Nature Analyzed (Segment 1) | Conventional and Organic. |

| Form Analyzed (Segment 2) | Liquid and Powder |

| End Use Analyzed (Segment 3) | Dietary Functional And Supplement Foods, Food And Beverage, Pharmaceutical Industry, Animal Nutrition, Cosmetic and Personal Care. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Merck KGaA, Enzo Life Sciences, Inc., Thermo Fisher Scientific, Changsha Vigorous-Tech, Cherish Pharma, Acme, Charkit Chemical, Cailà & Parés. |

| Additional Attributes | Dollar sales, share, CAGR by region, form preference (liquid vs. powder), key end-use sectors, pricing trends, regulatory updates, sourcing challenges, and competitor product positioning. |

The industry is segmented into conventional and organic.

The industry is segmented into liquid and powder.

The industry finds end use in dietary functional and supplement foods, food and beverage, pharmaceutical industry, animal nutrition, cosmetic and personal care.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 197.2 million in 2025.

It is forecasted to reach USD 269.8 million by 2035.

The industry is anticipated to grow at a CAGR of 4.9% during this period.

Conventional are projected to lead the market with a 85.4% share in 2025.

Europe, particularly Germany, is expected to be the key growth region with a projected growth rate of 6.7%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gamma Knife Market Analysis - Growth & Forecast 2025 to 2035

Gamma Probe Devices Market Growth - Trends & Forecast 2025 to 2035

Gamma Decalactone Market Analysis by End-Use Application, Form, Distribution Channel and Region through 2035

Gamma Glutamyl Transferase Testing Market

Gamma-Tocopherol Market

Mobile Gamma Cameras Market Growth - Industry Trends & Forecast 2025 to 2035

Alpha-Linolenic Acid Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA