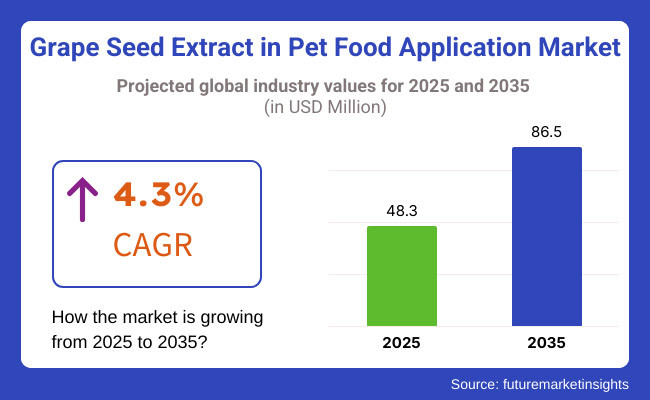

The grape seed extract in pet food application market is anticipated to reach a valuation of USD 48.3 million in 2025, expanding steadily to USD 86.5 million by 2035 at a CAGR of 4.3%.

North America is expected to remain the largest market through 2035, supported by higher pet food expenditure and strong functional claims validation. Meanwhile, East Asia is projected to register the fastest growth during the forecast period due to increased demand for premium pet nutrition and functional health supplements tailored for companion animals.

Rising awareness regarding pet health, coupled with the surge in humanization of pets, has significantly fueled the inclusion of natural antioxidant ingredients such as grape seed extract in formulations. Its polyphenol-rich profile and oxidative stress-reducing properties have positioned it as a preferred functional component, especially in clean-label and digestive-support pet foods.

On the flip side, regulatory hurdles surrounding standardization of botanical actives and inconsistencies in product potency pose barriers to adoption. Nevertheless, the market remains adaptive, with dry extract forms accounting for the bulk of demand due to their superior shelf stability and compatibility with kibble and extruded pet formats. Manufacturers are actively investing in quality certifications and clinical studies to enhance ingredient positioning, while product developers continue to seek bioactive synergies across multi-ingredient blends.

Looking forward to the 2025 to 2035 window, the grape seed extract segment in pet food is expected to gradually mature with a stronger orientation toward therapeutic positioning-particularly in senior pet nutrition, gut microbiome health, and inflammatory condition management.

Innovation is anticipated around enhanced bioavailability formats and synergistic botanical pairings, while supply chain integration with ethical sourcing of grape by-products may gain prominence in brand storytelling.

Functional transparency and EFSA/FDA-compliant claim substantiation will remain focal points, especially as consumer scrutiny toward active ingredient efficacy becomes more intense across Western markets. The growth trajectory, though moderate, is likely to favor companies that can validate scientific efficacy while aligning with pet wellness megatrends.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global grape seed extract in pet food application industry. This analysis provides insights into key performance trends and revenue realization patterns, allowing stakeholders to anticipate industry shifts. The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.7% |

| H2 (2024 to 2034) | 6.1% |

| H1 (2025 to 2035) | 5.8% |

| H2 (2025 to 2035) | 6.3% |

In the first half (H1) of the decade from 2025 to 2035, the industry is expected to grow at a CAGR of 5.7%, followed by an accelerated growth rate of 6.1% in the second half (H2) of the same decade. Moving into the subsequent period from H1 2025 to H2 2035, the CAGR is projected to rise to 6.3% in the first half and remain steady at 6.0% in the second half. The sector witnessed an increase of 10 BPS in the first half, while in the second half, it increased by 10 BPS.

Dry extract forms are projected to maintain a dominant share of 64.7% in the grape seed extract pet food market by 2025, anchored in their ease of integration and superior shelf stability. This segment’s resilience is driven by functional reliability-especially in extruded, dry kibble, and powdered formulations-which require consistent antioxidant delivery under thermal and storage stress. Pet food formulators increasingly favor dry extract formats due to their concentrated polyphenol content, minimal processing interference, and better dosage control across product lines.

Strategically, this dominance underscores a shift from incidental antioxidant use to targeted health-support roles in pet nutrition-particularly for digestive balance, immune resilience, and age-related oxidative stress. Despite supply-side challenges in active polyphenol standardization and bioactivity validation, innovation pipelines are expected to concentrate on optimizing solubility, absorption, and taste neutrality of dry forms.

North America remains the lead adopter market, propelled by premium-positioned pet SKUs with clean-label and functional nutrition claims. Meanwhile, Asian manufacturers are exploring dry extract variants to localize antioxidant-rich SKUs for small-breed and indoor companion pets.

Over the forecast period, stakeholder differentiation will hinge on format-based formulation agility and science-backed efficacy data. Dry extracts are thus poised to remain central to market value capture through both product scalability and cross-functional positioning in pet wellness portfolios.

Grape seed extract in pet food applications is projected to expand at a CAGR of 4.3% between 2025 and 2035, driven by its increasing inclusion in antioxidant and condition-specific formulations. This steady growth reflects the ingredient’s evolving role beyond basic nutrition, as pet owners demand preventive and functional solutions across life stages.

The extract’s high concentration of oligomeric proanthocyanidins (OPCs) enables it to combat oxidative stress, making it a preferred choice for addressing chronic inflammation and aging-related disorders in pets.

Formulators are utilizing grape seed extract in a range of applications-from dry kibble and soft chews to specialized supplements-particularly for senior pets needing joint support. Its anti-inflammatory and microcirculatory benefits are also relevant in addressing skin sensitivities and enhancing coat appearance, especially in allergic or indoor animals. Emerging applications in digestive health are capitalizing on grape seed extract’s role in gut lining support and immune modulation, often co-formulated with prebiotics or postbiotics for synergistic benefits.

In the oral health space, the ingredient is gaining traction in functional treats designed to reduce plaque buildup and support gum health. As consumer expectations around ingredient efficacy and transparency rise, grape seed extract’s multifunctional profile continues to strengthen its strategic fit in holistic pet nutrition.

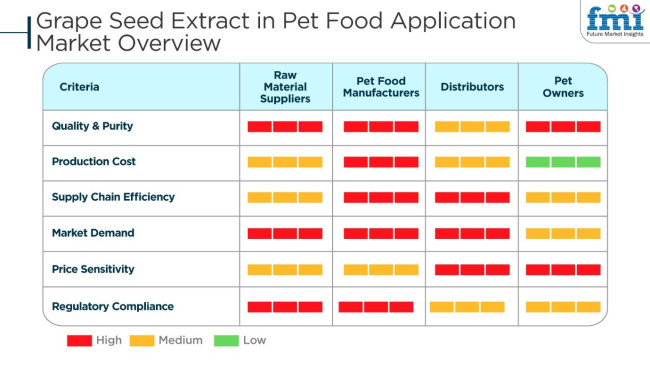

The grape seed extract in pet food application market is growing at a fast pace with increasing awareness of its antioxidant, anti-inflammatory, and immune-boosting effects in pets. Raw material suppliers emphasize high-quality extraction processes to maintain the purity and effectiveness of grape seed extract.

Manufacturers of pet foods highlight the incorporation of natural and functional ingredients in response to increasing demand for high-quality and health-focused pet food products. Distributors play an important role in making the supply chain effective, as they ensure timely availability to manufacturers and retailers.

Pet owners, due to growing health concerns and longevities for pets, choose pet foods supplemented with natural antioxidants to keep their pets' immune system healthy and overall well-being intact. Industry trends reflect the move toward clean-label, grain-free, and organic pet foods, and thus grape seed extract is a rich ingredient in the development of nutrient-rich and functional pet nutrition products in different segments of the industry.

Growing Emphasis on Sustainable Ingredient Sourcing

The global grape seed extract in pet food application market is witnessing a significant shift toward sustainability, with manufacturers prioritizing eco-friendly sourcing methods. As consumers become more conscious about the environmental impact of pet food ingredients, companies are focusing on ethically sourced grape seed extract derived from upcycled grape waste.

This approach not only minimizes agricultural waste but also aligns with the circular economy trend. Additionally, sustainable farming practices and transparency in ingredient sourcing are gaining traction, influencing purchasing decisions. Pet owners are increasingly seeking products that are free from synthetic additives and responsibly sourced, driving manufacturers to highlight their sustainability credentials.

The shift toward sustainable grape seed extract is also prompting companies to adopt third-party certifications and eco-friendly processing techniques, ensuring minimal environmental impact. This trend is expected to reshape the industry, encouraging companies to invest in greener solutions while maintaining product quality and efficacy in pet food formulations.

Rising Integration of Advanced Extraction Technologies

Innovations in extraction techniques are redefining the quality and efficacy of grape seed extract in pet food applications. Manufacturers are increasingly adopting advanced technologies such as cold-press extraction, supercritical CO₂ extraction, and ultrasonic-assisted methods to enhance the bioavailability of polyphenols and antioxidants in grape seed extract.

These advancements ensure that pet food formulations contain highly concentrated and stable active compounds, improving their functional benefits. The growing emphasis on natural, bioavailable ingredients has prompted research-driven developments that cater to the rising demand for premium pet food solutions.

Additionally, encapsulation technologies are being explored to enhance the stability and shelf life of grape seed extract, ensuring that its antioxidant properties remain effective throughout storage and consumption. As competition intensifies, companies leveraging innovative extraction techniques will gain a competitive edge by offering high-quality, functional pet food solutions that cater to health-conscious pet owners.

Evolving Price Dynamics Between Premium and Conventional Segments

The pricing structure of grape seed extract in pet food applications is witnessing a noticeable divergence between premium and conventional segments. The rising preference for natural and functional pet food ingredients has led to higher pricing for premium formulations incorporating high-purity grape seed extract. In contrast, conventional pet food brands continue to rely on cost-effective alternatives, creating a distinct pricing gap in the industry.

The influx of private-label brands offering budget-friendly pet food products with standard-grade grape seed extract is further intensifying price segmentation. Additionally, fluctuations in raw material costs and supply chain constraints are influencing industry prices, particularly for premium-grade extracts.

Manufacturers are adopting strategic pricing models, introducing differentiated product ranges that cater to both high-end consumers and cost-conscious buyers. This evolving pricing landscape is shaping purchasing behavior, encouraging companies to optimize their cost structures while maintaining quality and competitiveness in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 23.8% |

| China | 7.1% |

| UK | 6.4% |

| India | 15.4% |

| Japan | 13.4% |

The USA represents one of the largest markets for grape seed extract in pet foods, which is expected to grow at a CAGR of 23.8% during the period 2025 to 2035, as per FMI. Rising pet adoption and increasing pet health and wellness interest drive industry expansion.

Pet owners proactively search for natural supplements that improve their pets' nutrition, and grape seed extract, abundant in antioxidants, is well set to take command. The organic and premium pet food industry is growing, emphasizing science-based ingredients. The regulatory environment to ensure the safety and effectiveness of the ingredients utilized in pet foods forces manufacturers to include functional ingredients such as grape seed extract.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Increase in pet ownership | Greater adoption of pets leads to greater demand for higher-level nutrition. |

| Greater demand for natural nutrients | Pet food requiring natural antioxidants is needed. |

| Greater premium pet food industry | There is a promotion for rising disposable incomes for premium pet nutrition demand. |

| Regulation supported | The regulation requires a stricter emphasis on safety and scientific rationale for pet food ingredients. |

As per FMI, the UK industry is poised to witness 6.4% CAGR from 2025 to 2035. The growth of conventional pet food is reshaping the industry, with owners specifically searching for foods that improve overall health and life expectancy. Grape seed extract, anti-inflammatory and antioxidant in nature, is fast becoming one of the top ingredients in premium pet food.

Quality and safety of the product are the concerns of the regulatory bodies, forcing the manufacturers to incorporate science-based ingredients. Increased interest in holistic pet care also influences functional ingredients in pet food products.

Growth Factors in The UK

| Key Drivers | Details |

|---|---|

| Consumer demand for organic merchandise | Increased consciousness drives demand for natural pet food ingredients. |

| Animal welfare focus | Global trends favor the incorporation of functional nutrients. |

| Strict regulatory requirements | Regulations that make ingredients applied in pet food safe and effective. |

| Rise of the premium dog food segment | Pet owners seek quality nutrition with established benefits. |

FMI states that the Chinese industry is expected to grow at a 7.1% CAGR during 2025 to 2035. Urbanization and the expanding middle-class economy have driven the pet adoption rate since consumers seek additional health-enhancing pet food. Traditional Chinese medicine relies on natural treatments, to which grape seed extract lends itself quite naturally as a pet food supplement.

Expansion in online pet food websites providing convenient access to pet foods drives industry growth. Companies are formulating functional ingredients to meet evolving consumer needs.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Increased pet ownership | Urbanization levels speed up, and disposable incomes per capita rise, precipitating more pet adoptions. |

| Preferred for functional ingredients | Traditional medicine increases demand for natural antioxidants such as grape seed extract. |

| E-commerce growth | More accessible regarding the availability of specialty pet food items over internet channels. |

| Companies invest in R&D | Developing nutritionally enhanced formulations. |

FMI expects the Indian industry to expand at 15.4% CAGR over the study period. Urbanization and increasing disposable incomes increased pet ownership, with more consumers spending on pet health and nutrition. People are increasingly aware of the need for antioxidants in animal food, thus driving the application of grape seed extract in food. Structured pet retailing and e-platform growth enhance the penetration of pet food brands in the value category.

India Growth Drivers

| Key Drivers | Details |

|---|---|

| Pet adoption growth | Increases with urbanization and lifestyle changes. |

| Increased emphasis on pet nutrition | The consumer is aware of the requirement for quality, functional ingredients. |

| Pet retail and online shopping growth | Additional distribution channels increase the proximity of premium pet food products. |

| Pet care spending growth | Rising disposable incomes allow for pet specialty food expenditure. |

FMI opines that the Japan industry will likely achieve a 13.4% CAGR during the study period. The aging pet population is driving demand for specialty diets to enhance longevity and health. Japanese pet owners will pay extra for pet health and thus will demand natural and functional ingredients. Grape seed extract, which is claimed to be rich in antioxidants, is widely used in premium pet food. Strict quality control standards in the Japanese pet food industry also propel the growth of the industry.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Aging pet population | There is an increasing demand for general health-enhancing and longevity-type pet food. |

| Demand for value-added products | Individuals invest in pet nutrition that has been scientifically proven using high-quality. |

| Unwavering quality standards | Regulatory bodies have high priority in ingredient performance and safety. |

| Increasing antioxidant demand | The notion of the benefits of grape seed extract is growing. |

Kemin Industries (18-22%)

A worldwide pioneer in functional ingredients for pet food with a specialization in antioxidants as well as health-augmentation formulations.

Polyphenolics (12-16%)

Presents research-proven grape seed extracts that possess high concentrations of polyphenols with respect to pet health.

Indena S.p.A. (10-14%)

Introduces a concept that utilizes sustainable extraction procedures and clinically validated formulations based on polyphenols.

Botaniex Inc. (9-13%)

Enriches its arsenal of pet foods fortified with greenness and super purity grape seed extracts for pets.

Nexira (8-12%)

Offers a botanical extension aligned with sustainability and natural grape seed extraction for the pet industry.

Other Key Players (25-35% Combined)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 48.3 million |

| Projected Market Size (2035) | USD 86.5 million |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Product Type | Wet Food, Dry Food, Treats and Chews, Frozen |

| By Nature | Organic, Conventional |

| By Animal Type | Cat, Dog, Birds, Horse, Rabbits |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, MEA |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Kemin Industries, Polyphenolics, Indena S.p.A., Botaniex Inc., Nexira, Naturex, Maypro, Hangzhou Green Sky Biotechnology Co., Ltd., Royal Grapeseed, PureBulk, Inc., Organicway, NZ Extracts |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

By nature, the industry is segmented into organic and conventional.

By animal type, the industry is segmented into cats, dogs, birds, horses, and rabbits.

By product type, the industry is segmented into wet food, dry food, treats and chews, and frozen.

The industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is expected to reach USD 48.3 million in 2025.

The industry is projected to reach USD 86.5 million by 2035.

Key companies include Kemin Industries, Polyphenolics, Indena S.p.A., Botaniex Inc., Nexira, Naturex, Maypro, Hangzhou Green Sky Biotechnology Co., Ltd., Royal Grapeseed, PureBulk, Inc., Organicway, and NZ Extracts.

The USA, slated to grow at 23.8% CAGR from 2025 to 2035, is poised for the fastest growth.

Dry food is experiencing high demand.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Form, 2023 to 2033

Figure 27: Global Market Attractiveness by Grade, 2023 to 2033

Figure 28: Global Market Attractiveness by Nature, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Form, 2023 to 2033

Figure 57: North America Market Attractiveness by Grade, 2023 to 2033

Figure 58: North America Market Attractiveness by Nature, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Form, 2023 to 2033

Figure 117: Europe Market Attractiveness by Grade, 2023 to 2033

Figure 118: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Grade, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: MEA Market Attractiveness by Form, 2023 to 2033

Figure 177: MEA Market Attractiveness by Grade, 2023 to 2033

Figure 178: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 179: MEA Market Attractiveness by Application, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Grape Seed Extract in Pet Food Application in EU Size and Share Forecast Outlook 2025 to 2035

Grapefruit Peel Market Size and Share Forecast Outlook 2025 to 2035

Grape Crusher Market Analysis by Material, Application and Distribution Channel Through 2035

Grapefruit Oil Market Trends – Therapeutic Benefits & Growth 2025 to 2035

Grape Skin Extract Market Report - Trends & Forecast 2025 to 2035

Grapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Grape Seed Extracts Market Analysis - Growth Trends and Forecast 2025-2035

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA