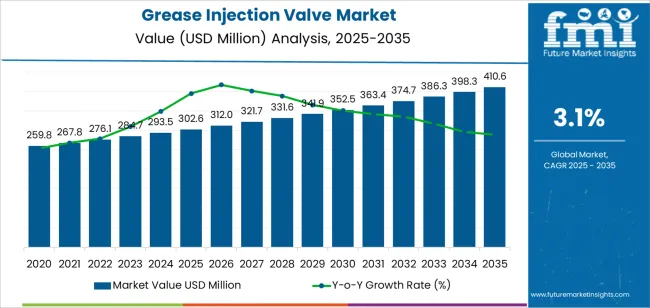

The grease injection valve market is forecast to grow from USD 302.6 million in 2025 to USD 410.7 million by 2035, reflecting a CAGR of 3.1%. The growth of this market is driven by the increasing demand for efficient lubrication systems in industries such as automotive, manufacturing, and heavy machinery. Grease injection valves play a critical role in maintaining machinery and equipment by ensuring the precise distribution of lubricants, thus enhancing the performance and longevity of mechanical components. As industries focus on reducing maintenance costs and improving operational efficiency, the adoption of such systems is expected to rise.

Technological advancements in lubrication systems, including automation and integration with condition monitoring systems, are further supporting the growth of the grease injection valve market. The ongoing demand for advanced lubrication solutions in sectors like automotive production, mining, and construction-where high-performance equipment is heavily relied upon-will continue to drive the market. Additionally, the increasing awareness of preventive maintenance and the need for sustainable solutions to reduce equipment downtime will contribute to the steady growth of the market over the next decade.

The Growth Rate Volatility Index (GRVI) for the grease injection valve market reflects the year-to-year growth rate fluctuations over the forecast period of 2025 to 2035. The GRVI is calculated based on the variations in the annual growth rates from year to year, with the market's overall CAGR of 3.1%. The values provided for the years 2025-2035 show a steady but modest increase each year, with relatively consistent growth observed, indicating low volatility in the market.

From 2025 to 2030, the growth rate fluctuates between approximately 3% to 3.5%, indicating stable but steady expansion. The market reaches USD 352.5 million by 2030, which reflects gradual growth with minimal fluctuation. After 2030, the market continues its upward trajectory with a similar steady pace, reaching USD 410.7 million in 2035. However, the GRVI index for this period remains low, indicating that the market will experience gradual and predictable growth, without significant spikes or dips.

The relatively low volatility in growth rates suggests that the grease injection valve market will maintain stable demand, driven by continuous but predictable advancements in lubrication technology and industrial practices. The absence of significant year-to-year fluctuations indicates a strong, consistent market trend, providing businesses and investors with a level of certainty for long-term investments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 302.6 million |

| Market Forecast Value (2035) | USD 410.7 million |

| Forecast CAGR (2025-2035) | 3.1% |

The grease injection valve market is expanding as industries prioritize equipment reliability, lubrication efficiency, and cost-effective maintenance. These valves allow for the controlled delivery of lubricants to machinery, reducing wear and tear, extending service intervals, and enhancing operational uptime. Industries such as oil and gas, petrochemical, mining, and manufacturing, which operate equipment under extreme pressure, temperature, and corrosive conditions, are increasingly adopting grease injection valves to meet the demands of these challenging environments.

The rise of automation and predictive maintenance systems is also contributing to market growth. These systems often require grease injection valves that integrate with lubrication monitoring tools, ensuring optimal performance and reducing the need for manual maintenance. However, challenges such as fluctuating raw material prices and stricter environmental regulations around lubrication practices may slow market growth in some regions. Despite these challenges, the need for minimized downtime and more efficient maintenance practices suggests that the demand for grease injection valves will continue to rise.

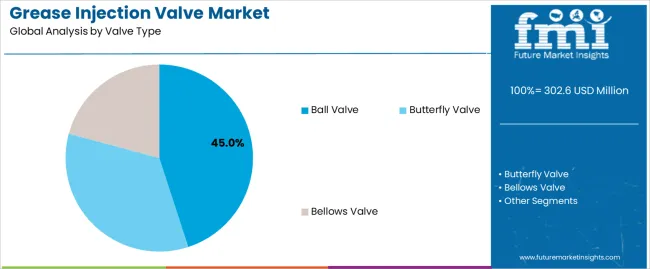

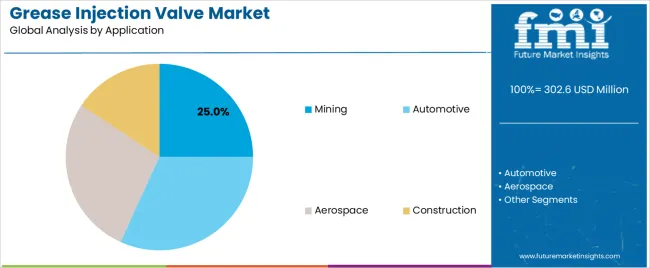

The grease injection valve market is mainly divided into segments based on valve type and application. The leading valve type in this market is the ball valve, which holds a market share of 45%. In terms of application, the mining sector leads with approximately 25% of the market share, with other key industries such as automotive, aerospace, and construction also contributing significantly to the market’s growth. These segments are driven by the increasing demand for efficient lubrication systems across various industrial sectors.

The ball valve segment leads the grease injection valve market, holding a 45% share. Ball valves are preferred for grease injection systems due to their durability, reliability, and ease of use in controlling the flow of grease. The robust design of ball valves ensures a secure seal, preventing grease leakage and providing precise flow control, which is essential in various industrial applications such as mining, automotive, and construction. Additionally, ball valves can handle high-pressure environments and are suitable for both small and large-scale lubrication systems.

This valve type's dominance is largely attributed to its wide range of applications and the increasing need for precision in grease delivery systems. The ball valve's ability to perform well in harsh operating conditions, such as extreme temperatures and pressures, makes it a go-to choice for industries where performance and longevity are crucial. The growth of industries that rely on heavy machinery, such as mining and construction, continues to drive demand for ball valves in grease injection systems. As the market for grease injection valves expands, the ball valve segment is expected to maintain its leading position due to its proven reliability and versatility.

The mining application segment holds a leading share of 25% in the grease injection valve market. Mining operations rely heavily on efficient lubrication systems to ensure the smooth functioning of heavy machinery and equipment, making grease injection valves essential in this industry. The need for reliable lubrication in mining equipment, which operates under extreme conditions, has driven the demand for specialized valves that can deliver grease effectively to critical components, reducing wear and tear and improving overall equipment lifespan.

The growth of the mining industry, particularly in regions such as North America, Latin America, and parts of Asia-Pacific, has further propelled the demand for grease injection valves. As mining operations expand and become more mechanized, the need for high-performance grease systems has increased, making the mining sector a key driver for the grease injection valve market. The constant demand for maintenance and upkeep of machinery in mining, which often involves high operating hours and tough environmental conditions, ensures that the mining segment will remain a dominant application in the grease injection valve market.

The grease injection valve market is experiencing growth driven by the increasing demand for lubrication solutions in various industrial applications, such as automotive, manufacturing, and machinery maintenance. These valves are critical for controlling the distribution of grease to machine parts, enhancing their lifespan and efficiency. The market is further boosted by technological advancements in valve design and automation systems. However, challenges such as the high cost of advanced valves and competition from alternative lubrication methods may affect growth. Key trends include a focus on automated systems, energy efficiency, and sustainability in manufacturing.

What Are The Primary Growth Drivers For The Grease Injection Valve Market?

The grease injection valve market benefits from several key drivers. First, the increasing complexity of machinery and equipment in industries such as automotive, heavy manufacturing, and construction requires more efficient lubrication systems. Grease injection valves ensure accurate distribution of lubricants, improving machine performance and reducing wear and tear. Second, the growth of automation and Industry 4.0 has led to greater adoption of automated grease injection systems, improving precision and reducing manual intervention. Lastly, growing awareness of the importance of preventive maintenance and the need for longer-lasting machinery fuels demand for efficient lubrication solutions.

What Are The Key Restraints In The Grease Injection Valve Market?

The grease injection valve market faces several challenges that may hinder its growth. The high initial investment and operational costs associated with advanced lubrication systems can be a barrier for smaller enterprises. In addition, the complexity of designing and manufacturing valves that can handle different types of lubricants and extreme conditions may limit market penetration. Furthermore, competition from alternative lubrication solutions, such as centralized lubrication systems or manual lubrication methods, can impede widespread adoption. Environmental concerns related to excessive use of grease and its disposal also add another layer of restraint in the market.

What Are The Emerging Trends In The Grease Injection Valve Market?

Several emerging trends are shaping the grease injection valve market. One key trend is the growing demand for automated and IoT-enabled grease injection systems, which allow real-time monitoring and control, improving operational efficiency and reducing downtime. Another trend is the focus on energy efficiency and sustainability, as manufacturers seek to develop valves and systems that minimize lubricant wastage and environmental impact. Additionally, the integration of smart technologies and sensors into lubrication systems is increasing, offering predictive maintenance capabilities. These trends are expected to drive the development of more advanced, efficient, and environmentally friendly lubrication solutions.

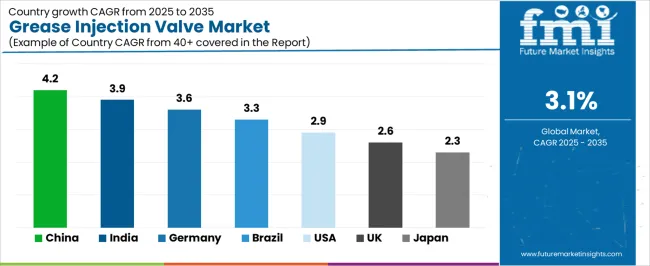

The grease injection valve market is experiencing steady growth, driven by the increasing need for efficient lubrication systems in various industries, including automotive, manufacturing, and heavy machinery. Grease injection valves play a crucial role in delivering precise amounts of grease to moving parts, ensuring smooth operation and extending the lifespan of machinery. Countries with rapidly growing industrial sectors, such as China and India, are experiencing higher growth rates, while more developed markets like the USA and Germany show steady demand driven by industrial upgrades and automation. This analysis explores the country-specific growth dynamics in the grease injection valve market, highlighting key drivers and challenges.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| Brazil | 3.3% |

| USA | 2.9% |

| United Kingdom | 2.6% |

| Japan | 2.3% |

China leads the grease injection valve market with a CAGR of 4.2%. The country’s rapid industrialization and expansion in manufacturing, automotive, and heavy equipment sectors are the primary drivers of this market growth. China’s large-scale production of vehicles and industrial machinery creates a consistent demand for effective lubrication solutions to ensure the smooth operation of mechanical components.

As the industrial sector in China continues to grow, there is an increasing need for automation and high-performance machinery, which requires more advanced lubrication systems. The demand for grease injection valves is also supported by China’s focus on reducing maintenance costs and improving machinery efficiency. With the growing emphasis on industrial modernization, sustainability, and automation, China’s grease injection valve market is expected to maintain strong growth.

India’s grease injection valve market is growing at a CAGR of 3.9%. The country’s expanding industrial base, especially in automotive manufacturing, construction, and heavy machinery, is driving demand for effective lubrication systems. As India continues to invest in infrastructure development and industrial upgrades, the need for high-quality grease injection valves to maintain operational efficiency in machinery and vehicles is rising.

The increasing adoption of automation and machinery in India’s manufacturing sector is further contributing to the market's growth. With the growing demand for vehicles, industrial equipment, and machinery, grease injection valves are becoming an essential part of maintenance and lubrication systems. Additionally, the rise of eco-friendly technologies and efficient manufacturing practices in India supports the demand for these components.

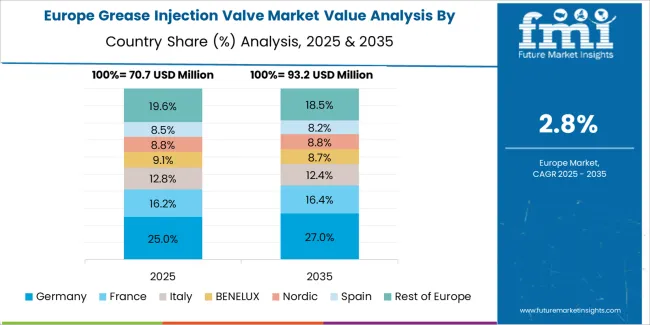

Germany’s grease injection valve market is expected to grow at a CAGR of 3.6%. As one of the largest manufacturing hubs in Europe, Germany's automotive and industrial machinery sectors are key drivers of the demand for grease injection valves. The country's commitment to precision engineering, advanced manufacturing, and automotive production ensures that the need for high-quality lubrication systems remains strong.

Germany's industrial focus on sustainability and reducing operational costs has led to greater investments in technologies that enhance machinery efficiency. Grease injection valves, which play a critical role in improving the performance and lifespan of industrial equipment, are becoming increasingly popular. The integration of automation and digitalization into manufacturing processes also supports the growth of the grease injection valve market in Germany.

Brazil’s grease injection valve market is projected to grow at a CAGR of 3.3%. The demand for grease injection valves in Brazil is largely driven by its expanding automotive and construction sectors, as well as the need for reliable lubrication systems in the country’s heavy machinery industry. Brazil’s infrastructure development and investments in the automotive industry are contributing to the increased demand for industrial equipment and vehicles that require efficient lubrication solutions.

As Brazil’s industrial automation and machinery sectors continue to grow, there is a growing need for high-quality lubrication systems that can ensure the long-term durability of equipment. Moreover, the country’s focus on improving manufacturing efficiency and reducing downtime for machinery is driving demand for grease injection valves, which help maintain smooth operations and reduce maintenance costs.

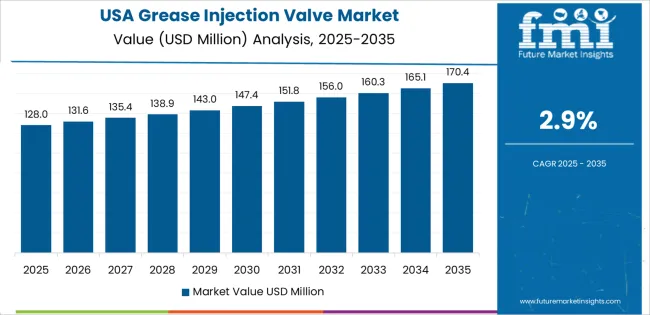

The United States has a projected CAGR of 2.9% for the grease injection valve market. As a mature market with a strong industrial and automotive base, the demand for grease injection valves in the USA is driven by the need for high-performance machinery and vehicles. Industries such as automotive, aerospace, and heavy manufacturing rely heavily on effective lubrication systems to ensure operational efficiency.

In addition, the ongoing trend towards automation and digital transformation in USA manufacturing is contributing to the market's growth. The focus on extending the lifespan of machinery and reducing downtime through advanced lubrication systems is a key factor supporting the demand for grease injection valves. Although the growth rate may be slower than in emerging markets, the USA remains a crucial market for high-quality, efficient lubrication solutions.

The grease injection valve market in the United Kingdom is projected to grow at a CAGR of 2.6%. As one of Europe’s leading industrial markets, the UK’s demand for grease injection valves is primarily driven by its automotive, aerospace, and manufacturing industries. These sectors require advanced lubrication solutions to ensure the smooth and efficient operation of machinery and vehicles.

The UK’s focus on sustainability and reducing industrial emissions is also pushing for the development of more efficient lubrication systems. As industries in the UK adopt more automated processes and advanced machinery, the need for effective lubrication solutions such as grease injection valves is expected to rise. While the growth rate may be moderate compared to some emerging markets, the UK remains a key player in the global grease injection valve market.

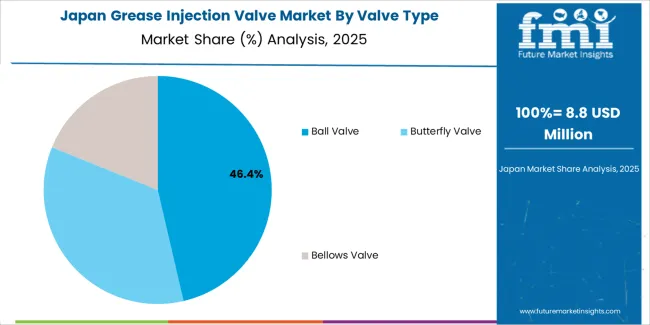

Japan’s grease injection valve market is expected to grow at a CAGR of 2.3%. Japan’s advanced industrial and automotive sectors are the primary drivers of demand for grease injection valves, as the country’s machinery and vehicles require reliable lubrication systems. Japan’s emphasis on precision engineering, automation, and sustainability in its manufacturing processes continues to support the need for high-performance lubrication solutions.

Although Japan's market growth is relatively slower compared to emerging economies, its strong focus on technological innovation and the efficient operation of machinery ensures a steady demand for grease injection valves. As Japan continues to invest in automation and high-efficiency machinery, the demand for these valves is expected to remain stable and gradually grow.

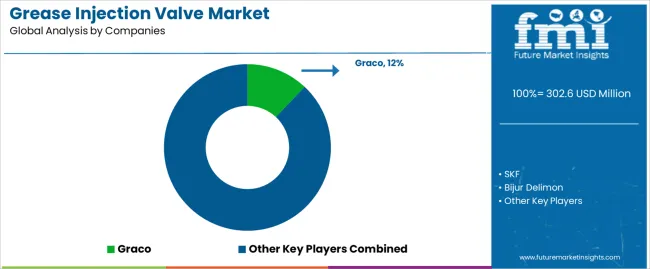

The grease injection valve market is characterized by the presence of several prominent players, with Graco holding a significant share of around 12%. Other key companies in this space include SKF, Bijur Delimon, DropsA, WOERNER, Lubrite Industries, Perma-tec, Groeneveld-BEKA, Groz Engineering Tools, Techno Drop Engineers, and GRM Flow Products. These companies compete in a growing market driven by increasing industrial automation, the demand for efficient lubrication systems, and advancements in technology. Grease injection valves are essential components in automated lubrication systems, used across industries like automotive, manufacturing, and machinery. The market is expanding as companies seek solutions that improve productivity and reduce maintenance costs by ensuring continuous, precise lubrication.

As for strategies, companies in this market focus on product innovation, expanding product portfolios, and regional penetration. Some firms prioritize the development of high-performance valves designed to handle harsh conditions, offering durability and reliability in demanding industrial environments. Others focus on expanding their reach in emerging markets, particularly in Asia-Pacific, where industrial growth and manufacturing activity are rapidly increasing. With the demand for automated lubrication systems rising, companies are also enhancing their offerings with digital solutions for monitoring and control, integrating IoT technologies for real-time tracking and maintenance alerts. This combination of technological innovation and regional market expansion is helping key players strengthen their position in the grease injection valve market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Valve Type | Ball Valve, Butterfly Valve, Bellows Valve |

| Application | Mining, Automotive, Aerospace, Construction |

| Key Companies Profiled | Graco, SKF, Bijur Delimon, DropsA, WOERNER, Lubrite Industries, Perma-tec, Groeneveld-BEKA, Groz Engineering Tools, Techno Drop Engineers, GRM Flow Products |

| Additional Attributes | The market analysis includes dollar sales by valve type and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape highlights key manufacturers in the grease injection valve industry, focusing on innovations in ball, butterfly, and bellows valves. Trends in the demand for grease injection valves in industries such as mining, automotive, and aerospace are explored, along with technological advancements in lubrication systems. |

The global grease injection valve market is estimated to be valued at USD 302.6 million in 2025.

The market size for the grease injection valve market is projected to reach USD 410.6 million by 2035.

The grease injection valve market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in grease injection valve market are ball valve, butterfly valve and bellows valve.

In terms of application, mining segment to command 25.0% share in the grease injection valve market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Grease Fitting Kits Market Size and Share Forecast Outlook 2025 to 2035

Greaseproof Sheets Market Size and Share Forecast Outlook 2025 to 2035

Greaseproof paper sheets Market Size, Share & Forecast 2025 to 2035

Grease Analyzer Market Growth - Trends & Forecast 2025 to 2035

Grease Gun Market Growth – Trends & Forecast 2025 to 2035

Market Share Insights for Greaseproof Sheets Providers

Grease Pump Market

Grease Market

Marine Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Polyurea Greases Market

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Grease Market

Industrial Degreaser Market

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

Automotive Part Cleaners and Degreasers Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA