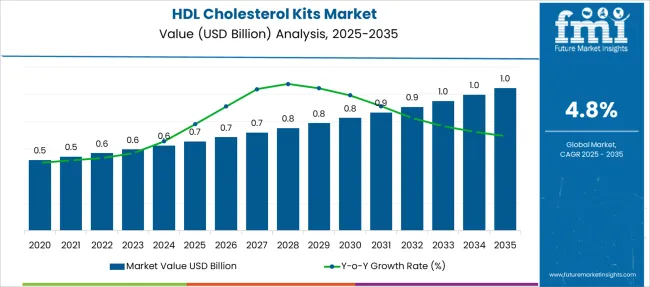

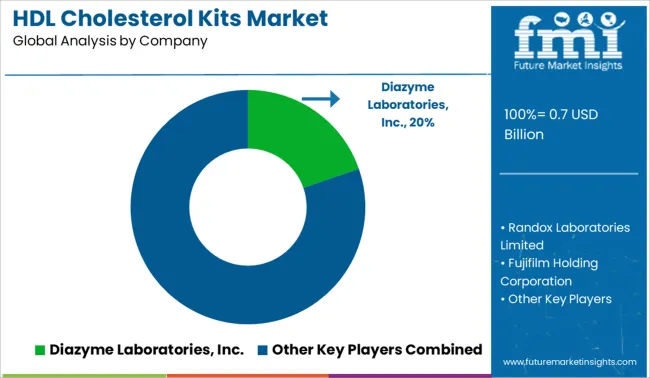

The HDL Cholesterol Kits Market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| HDL Cholesterol Kits Market Estimated Value in (2025 E) | USD 0.7 billion |

| HDL Cholesterol Kits Market Forecast Value in (2035 F) | USD 1.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The HDL cholesterol kits market is showing consistent growth driven by the increasing focus on cardiovascular health and preventive diagnostics. With rising prevalence of heart diseases, healthcare providers are emphasizing early detection and monitoring of lipid profiles.

Advances in biochemical assay technologies have improved the accuracy and speed of cholesterol testing, leading to broader adoption of HDL cholesterol kits. Hospitals and diagnostic centers are investing in reliable kits that provide direct measurement of HDL cholesterol to aid in risk assessment and treatment planning.

Public health initiatives encouraging routine cholesterol screening have further expanded the market. The increasing burden of lifestyle-related diseases and growing awareness among clinicians and patients support continued market expansion. Segment growth is anticipated to be led by HDL cholesterol direct reagent kits, widely used in clinical settings, and hospitals as the primary end users due to their extensive testing capabilities.

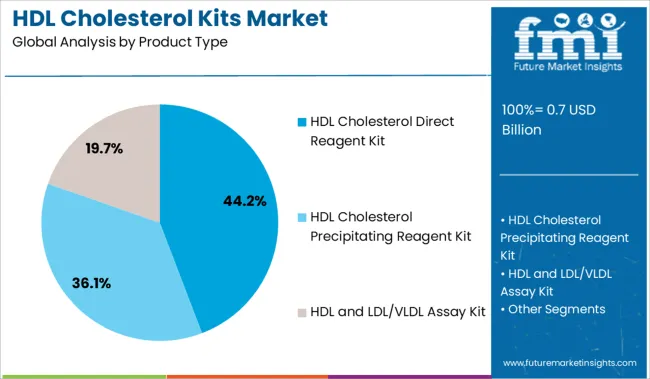

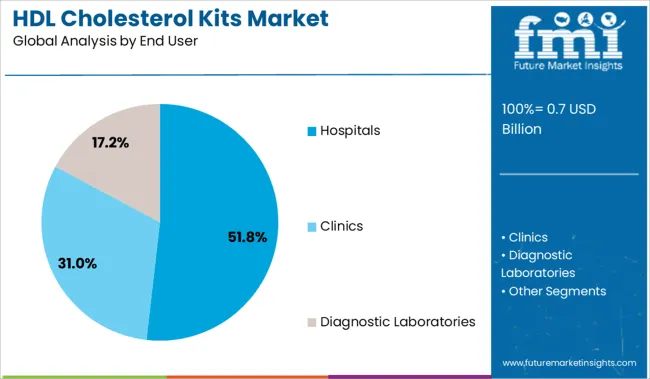

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into HDL Cholesterol Direct Reagent Kit, HDL Cholesterol Precipitating Reagent Kit, and HDL and LDL/VLDL Assay Kit. In terms of End User, the market is classified into Hospitals, Clinics, and Diagnostic Laboratories. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HDL cholesterol direct reagent kit segment is expected to account for 44.2% of the market revenue in 2025, establishing itself as the leading product type. Growth of this segment has been supported by its ability to provide precise and direct measurement of HDL cholesterol levels without requiring complex sample preparation. Clinical laboratories favor these kits for their accuracy, reliability, and faster turnaround times compared to indirect methods.

The ease of integration with automated analyzers and compatibility with high-throughput testing has increased their demand in hospital laboratories. Continuous improvements in reagent formulation have enhanced assay stability and reproducibility.

These factors contribute to the widespread adoption of direct reagent kits for routine cardiovascular risk assessment and patient monitoring.

The hospitals segment is projected to hold 51.8% of the HDL cholesterol kits market revenue in 2025, maintaining its position as the leading end user. Hospitals utilize HDL cholesterol kits extensively in their clinical laboratories due to the high volume of lipid profile testing required for cardiovascular disease diagnosis and management. The demand is driven by the need for accurate and timely results to support patient treatment decisions.

Hospitals often invest in advanced diagnostic technologies, including automated systems compatible with direct reagent kits, facilitating efficient workflow and consistent testing quality.

The growing emphasis on preventive healthcare and regular screening programs within hospital settings further drives the demand. As cardiovascular diseases remain a leading cause of morbidity, hospitals are expected to continue dominating the end-user segment for HDL cholesterol kits.

| Particulars | Details |

|---|---|

| H1, 2024 | 4.70% |

| H1, 2025 Projected | 4.75% |

| H1, 2025 Outlook | 4.65% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 10 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 05 ↓ |

The comparative analysis and market growth rate of the global HDL cholesterol kits market as studied by Future Market Insights will show a negative BPS growth in the H1-2025 outlook as compared to H1-2025 projected period by 10 BPS, and a decline in the BPS values is expected in H1-2025 over H1- 2024 duration with 05 Basis Point Share (BPS).

The drop in the BPS values is associated with the development of home test kits, however, the adoption of these products is limited because of the high costs associated with the product, and their inefficiency in providing an accurate diagnosis.

Moreover, the home test kits are not easily comprehensible, and thus detain the future adoption of HDL cholesterol kits in the future.

Conversely, the advent of several regional government initiatives in the regions of Asia Pacific for comprehensive diagnosis and point-of-care for infectious and chronic diseases will subsequently present positive outcomes for market growth over the forecasted years.

The market is subject to regulatory impositions and product adoption rate, as per the macro and industry standards. The key developments in the market include product revamp strategies that incorporate an electronic meter within the test kits.

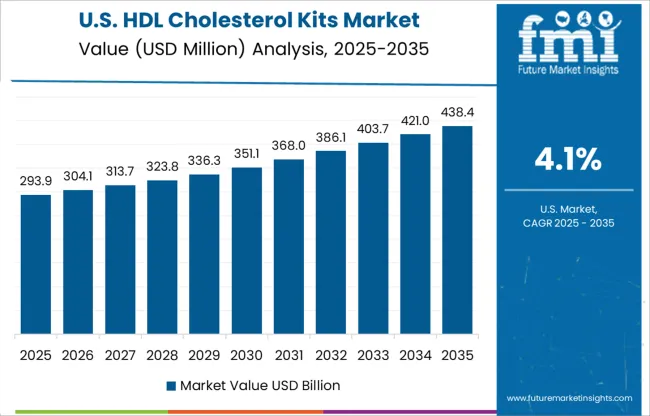

The HDL cholesterol kits market is expected to register a 4.8% CAGR between 2025 and 2035, up from a 4.0% CAGR recorded from 2014 to 2024, predicts Future Market Insights.

The soaring need for the prompt determination of a person’s risk for stroke or heart disease is likely to propel the demand for HDL cholesterol level kits in the forthcoming years.

This is mainly happening because of the surging geriatric population across the globe who are at a high risk of developing severe heart conditions.

As per the World Population Prospects 2020 published by the United Nations (UN), 1 in 6 people in the world will be over the age of 65 years by 2050, up from 1 in 11 in 2020.

The organization further revealed that in 2020 there were approximately 703 million individuals belonging to the age group of 65 years and above in the world. In 2050, this number is estimated to double to 1.5 billion.

Thus, the increasing geriatric population in various parts of the globe is set to bolster the sales of HDL cholesterol test kits in the forthcoming years.

Uncontrolled diabetes, untreated hypothyroidism, liver disease, high sugar intake, and low or high-fat percentage in the body are some of the other crucial factors that are anticipated to negatively affect a person’s level of cholesterol.

These factors are projected to increase the need for timely cholesterol testing and help in propelling the sales of novel kits.

The rising prevalence of diabetes is expected to propel the demand for HDL cholesterol level test kits in the forecast period. Diabetic dyslipidemia is often linked with elevated levels of LDL cholesterol and lower levels of HDL cholesterol.

As changing cholesterol levels can cause heart disease even with well-controlled blood glucose levels, healthcare professionals recommend diabetic patients enhance their coronary health by lowering their cholesterol levels.

According to the International Diabetes Federation (IDF), around 0.6 million adults belonging to the age group of 20 to 79 years were living with diabetes in 2024.

It is projected to reach 1 million by 2045 and 643 million by 2035. Also, 1 in 6 live births is impacted by diabetes during pregnancy. These trends are estimated to continue in the near future and augment the sales of HDL cholesterol detection kits.

Many research and educational institutions are conducting extensive Research and Development activities to discover new approaches for treating diabetes and other associated conditions. Some of the others are trying to investigate the risk factors of diabetic dyslipidemia.

For instance, in October 2020, the National Institute for Nutrition and Health found that the prevalence of dyslipidemia was 59.3%, 46.8%, and 39.9% in individuals with Type 2 Diabetes Mellitus (T2DM), prediabetes, and normal glucose, respectively. Hence, the rising prevalence of this condition among people worldwide is expected to bolster the sales of innovative kits.

“Increasing Obesity Cases to Drive Sales of HDL Cholesterol Test Kits”

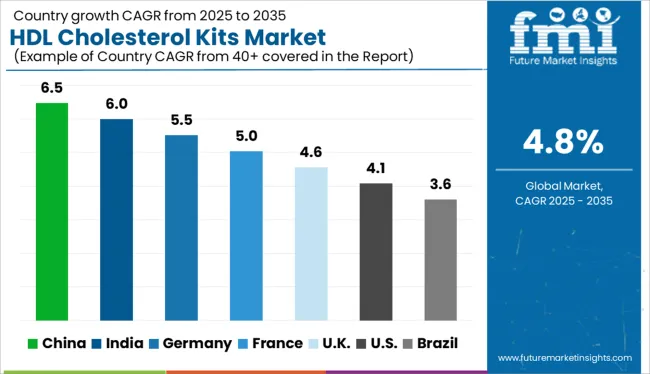

The surging cases of obesity in the USA owing to the rapid adoption of sedentary lifestyles and the increasing consumption of junk food are anticipated to propel the demand for HDL cholesterol test kits in North America. The sales of home test kits are likely to rise as body weight has a direct association with cardiovascular risk factors, such as high and low cholesterol.

As per the Centers for Disease Control and Prevention (CDC), from 2020 to 2020, the prevalence of obesity was 42.4% in the USA The organization further mentioned that medical costs for people who were affected by obesity were D1,429 higher than medical costs for those with a healthy weight.

Thus, the increasing risk of developing obesity-related conditions is projected to compel people to get their medical tests done from time to time, which would propel the sales of HDL cholesterol detection kits in the USA

“Prevalence of Hypothyroidism to Bolster Demand for HDL Cholesterol Level Test Kits”

The increasing prevalence of hypothyroidism among people in the UK is estimated to drive the demand for HDL cholesterol level test kits in Europe over the forthcoming years.

Radiation therapy, certain medications containing lithium compounds, thyroid surgery, and the occurrence of autoimmune disorders are some of the major causes of hypothyroidism.

According to the National Institute for Health and Care Excellence (NICE), hypothyroidism is found in more than 5% of the UK population over the age of 60. Compared to men, women are 5 to 10 times more likely to be affected by this condition. These numbers are expected to surge in the upcoming years, thereby driving the market in the UK

“Surging Government Funding in Healthcare to Spur Sales of HDL Cholesterol Detection Kits”

The rising demand for cholesterol testing in China because of the need to prevent chronic diseases is projected to push the sales of HDL cholesterol detection kits in East Asia. The growing awareness about the significance of regular healthcare testing among people is another factor that is set to surge sales in China.

The high healthcare expenditure and the ongoing development of the healthcare infrastructure in this country are anticipated to bode well for the market. In 2020, for instance, China spent about 6.6% of its GDP on healthcare, which amounts to USD 1,665 billion.

Out of this, 28% was paid out-of-pocket, 44% was financed by social health donations, private health insurance, or publicly funded health insurance, and 28% was financed by the local and central governments. Hence, increasing government support in terms of funding in this country is projected to accelerate the market.

“HDL and LDL/VLDL Cholesterol Level Kits to Be in High Demand among CVD Patients”

Based on product type, the HDL and LDL/VLDL assay kit segment is likely to dominate the HDL cholesterol kits market in the near future. The rising prevalence of lifestyle disorders, such as Cardiovascular Disease (CVD) globally owing to the higher adoption of a sedentary culture and the lack of time to prepare healthy meals is anticipated to fuel the sales of HDL and LDL/VLDL cholesterol level kits.

As per the World Health Organization (WHO), in 2020, around 0.5 million people died from CVDs, thereby exhibiting 32% of all global deaths. The organization also stated that CVD can be prevented by eliminating the harmful use of alcohol and tobacco, physical inactivity, and the adoption of an unhealthy diet. This trend is set to continue in the forecast period, thereby propelling the segment’s growth.

“Availability of Advanced HDL Cholesterol Test Kits in Hospitals to Continue Increasing”

In terms of end users, the hospital's segment is projected to remain at the forefront by accounting for 50.1% of the HDL cholesterol kits market share in 2025, estimated by FMI. The ongoing development of cutting-edge hospitals equipped with technologically advanced medical testing products, such as HDL cholesterol test kits is anticipated to drive the segment.

On the other hand, the diagnostic labs and clinics segments are estimated to generate approximately 31.3% and 18.6% of the market share in 2025, respectively. The cost-effectiveness of laboratory testing and the ability of clinics to provide urgent medical attention to those who require it are likely to bolster both segments.

Key players operating in the HDL cholesterol kits market are focusing on acquisitions and collaborations with international and regional companies to surge their sales and attract large consumer bases across the globe.

Meanwhile, some of the other HDL cholesterol level kit manufacturers are aiming to broaden their global presence by opening new manufacturing facilities and signing distribution agreements with firms located in developed, as well as emerging markets of Europe, the Middle East, and Asia Pacific.

A few of the players are engaging in the development of point-of-care testing as it is convenient and helpful for making quick decisions.

For instance,

| Attributes | Details |

|---|---|

| Forecast Period | 2014 to 2024 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | Units for Volume and USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and the Middle East & Africa (MEA). |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, and others. |

| Key Market Segments Covered | Product Type, End User, and Region |

| Key Companies Profiled | Diazyme Laboratories, Inc.; Randox Laboratories Limited; Fujifilm Holding Corporation; Thermo Fisher Scientific; Abcam plc.; Merck KGaA; Abbott Laboratories; Danaher Corporation; PerkinElmer, Inc.; Hoffmann-La Roche Ltd. |

| Pricing | Available upon Request |

The global hdl cholesterol kits market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the hdl cholesterol kits market is projected to reach USD 1.0 billion by 2035.

The hdl cholesterol kits market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in hdl cholesterol kits market are hdl cholesterol direct reagent kit, hdl cholesterol precipitating reagent kit and hdl and ldl/vldl assay kit.

In terms of end user, hospitals segment to command 51.8% share in the hdl cholesterol kits market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cholesterol Esterase Market Size and Share Forecast Outlook 2025 to 2035

Cholesterol Medicine Market Size and Share Forecast Outlook 2025 to 2035

Cholesterol and Lipid Test Market Size and Share Forecast Outlook 2025 to 2035

Cholesterol Monitors Market Size and Share Forecast Outlook 2025 to 2035

Cholesterol API Market Analysis - Size, Share, and Forecast 2025 to 2035

Cholesterol Control Supplements Market – Growth, Demand & Health Trends

Cholesterol Reduced Butter Market

Point-of-care Cholesterol Monitoring Device Market Size and Share Forecast Outlook 2025 to 2035

Low-Fat and Low-Cholesterol Diet Market Growth - Health Trends 2025 to 2035

Heterozygous Familial Hypercholesterolemia (HEFH) Management Market Trends - Innovations & Growth 2025 to 2035

Hip Kits Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Audio Kits Market

RT-PCR Kits Market Growth - Trends & Forecast 2023 to 2035

Lavage Kits Market

Organoids Kits Market

Connector Kits Market

Capacitor Kits Market

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DIY Haircut Kits Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA