The heterozygous familial hypercholesterolemia (HeFH) management market encompasses the diagnosis, treatment, and long-term care of individuals with inherited high cholesterol levels due to mutations affecting LDL receptor function.

HeFH is a genetic lipid disorder that significantly elevates low-density lipoprotein cholesterol (LDL-C), increasing the risk of premature cardiovascular disease (CVD). Management involves lipid-lowering therapies (statins, ezetimibe, PCSK9 inhibitors, and bempedoic acid), genetic testing, lifestyle interventions, and specialist care programs.

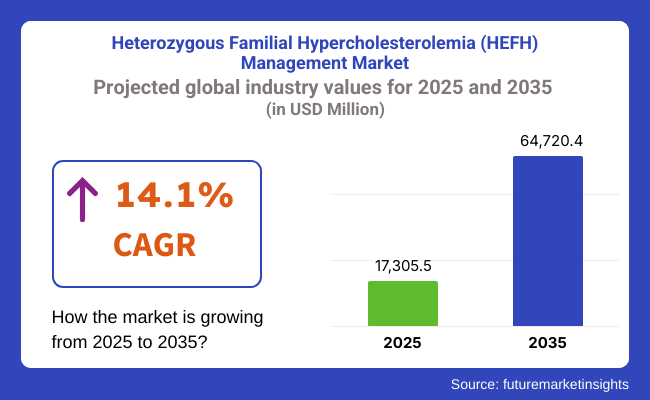

In 2025, the global HeFH management market is projected to reach approximately USD 17,305.5 million, with expectations to grow to around USD 64,720.4 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 14.1% during the forecast period.

This growth is driven by increased clinical awareness and screening programs, emergence of novel lipid-lowering drugs, and expanding genetic testing infrastructure across both developed and emerging markets.

North America is the leading regional segment of the HeFH management market due in large part to robust genetic assessment and screening capabilities, widespread physician usage of early diagnosis protocols, and broad access to high-quality lipid-lowering treatments.

Familial screening programs and adoption of statin + PCSK9 inhibitors in high-risk populations are being expanded further in the US and Canada. Payer support for newer therapies and tele cardiology platforms are also improving adherence and some outcomes.

Europe is a market following policy and genomics, with Germany, UK, Netherlands and France leading the way in cascade screening programmes, lipid specialist clinics and early treatment initiation. EU-funded preventive health programs support patient registries and integrating LDL-C management guidelines into primary care. The trend favors greater use of biosimilar PCSK9 inhibitors due to cost trajectories.

The highest redemption rates will occur in the Asia-Pacific region, particularly Japan, South Korea, China, and India, where increasing awareness about familial cholesterol disorders and evolving urban health systems are driving expansion of cardiovascular screening programs. Improving access to low-cost statins and fixed-dose combinations are contributing to the market; pharma collaborations and awareness campaigns are improving the rates of diagnosis.

Challenges

Underdiagnosis, High Treatment Costs, and Genetic Testing Access

The heterozygous familial hypercholesterolemia (HeFH) management market faces persistent challenges due to widespread underdiagnosis, with many cases misclassified as standard hyperlipidemia. Access to genetic screening and early detection tools remains limited, especially in developing countries, leading to delayed intervention and elevated risk of cardiovascular events.

In high-income regions, cost remains a barrier, particularly for PCSK9 inhibitors and emerging RNAi therapies, which are often not fully covered by insurance. Additionally, lifetime therapy requirements complicate adherence and affordability, especially in younger populations.

Opportunities

Personalized Lipid-Lowering Therapies and Preventive Cardiology Programs

The HeFH management market is expanding as genetic awareness, early screening programs, and guideline-based intervention strategies become more prevalent. Advances in lipid-lowering agents, including PCSK9 inhibitors (e.g., evolocumab, alirocumab), bempedoic acid, and siRNA drugs (inclisiran) are high-efficacy options for resistant LDL-C cases.

The early detection is being driven by AI-based risk scoring, tele cardiology platforms, and family-based cascade screening. Moreover, the trend in value-based care and preventive health model is providing a ground for growth in pharmacogenomics and personalized therapy.

Market was impacted by updated global guidelines (AHA, ESC) in 2020, recommending more aggressive reduction of LDL-C, leading to increased uptake of PCSK9 inhibitors in at-risk patients. Nevertheless, economic factors, lack of awareness amongst general practitioners, and absence of established genetic testing pathways limited mass population screening.

The market is expected to move toward integrated, multi-modal approach strategies during 2025 to 2035 comprising AI-aided early diagnosis, genetic counselling, and polygenic risk scoring and long-duration lipid-lowering therapies. Because of preventive cardiovascular care now being more widespread worldwide, HeFH will no doubt play a key role in precision cardiology and population health efforts.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Expanded approvals for PCSK9 inhibitors, inclisiran |

| Technology Innovations | Growth in injectable biologics, EHR-linked LDL tracking |

| Market Adoption | Focused on secondary prevention and statin-intolerant patients |

| Sustainability Trends | Focused on biosimilar statins and low-cost generics |

| Market Competition | Led by Amgen ( Repatha ), Sanofi/Regeneron ( Praluent ), Novartis ( Leqvio ), Esperion ( Nexletol ) |

| Consumer Trends | Patient concerns around cost, injections, and side effects |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Fast-track pathways for gene-silencing therapies, early screening mandates, and value-based pricing models |

| Technology Innovations | Development of once-yearly RNA therapies, digital adherence tools, and AI-guided lipid clinics |

| Market Adoption | Widespread uptake in family-based screening, pediatric preventive programs, and global lipid registries |

| Sustainability Trends | Rise of long-acting therapies that reduce treatment burden and systemic costs |

| Market Competition | Entry of gene-editing firms, digital therapeutics, and hybrid telehealth-genomics platforms |

| Consumer Trends | Preference for less frequent dosing, personalized therapy plans, and family health integration |

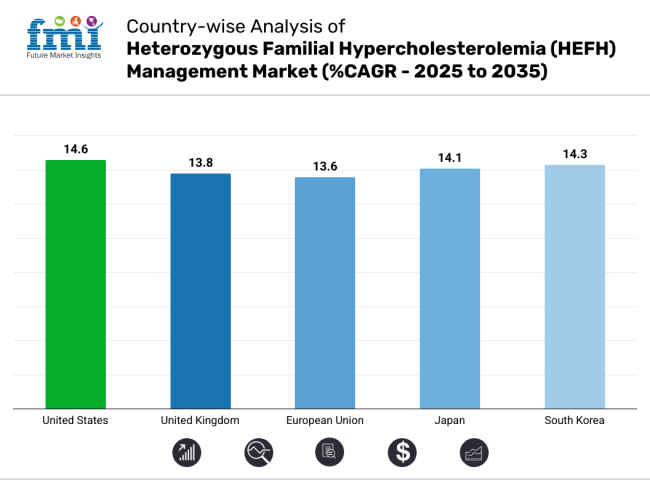

The early disease awareness initiative, very high public old-age awareness and widespread application of new lipid-lowering therapies, the United States HeFH Management Market has witnessed a substantial rate of growth in the past few years. PCSK9 inhibitors, statins and RNA-based therapy are driving enormous therapeutic benefits.

Strong insurance protection for specialty pharmaceuticals, effective screening of at-risk populations, and the continued investment of large biopharma companies in second-generation HeFH therapies are fortunate for the USA And patient advocate organizations and trial networks are putting money into quick-moving therapy development.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.6 % |

The gradual rise in the UK HeFHmanagement market is supported by NHS-funded familial screening programs, early intervention programs and national lipid clinics. This cascade testing with genetic counselling is actively used by the nation to put HeFH under control in a population level.

Therapeutic advances such as access to PCSK9 inhibitors and inclisiran for everyone are leading to improved clinical outcomes. This has resulted in sustained investment in ongoing R&D as academic centers collaborate with biotech companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 13.8 % |

The EU HeFHmanagement market is strong and continues to expand in countries like Germany, the Netherlands, and Sweden that harbor established familial screening programs and national cholesterol registries.

EMA's positive recommendation for next-generation lipid-lowering drugs, including monoclonal antibodies and gene-silencing therapies, paves the way for an expanding access to innovative treatments. In addition, there are Europe-wide initiatives increasing visibility and standardisation of HeFH management protocols.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 13.6 % |

The Japan HeFHmanagement market is gaining momentum due to increasing diagnosis rates, innovations in pharmacogenomics, and incorporation of lipid clinics in primary care. The country is adopting the latest therapies and diagnostic techniques, such as lipoprotein(a) testing and next-generation genetic screening technologies.

More collaboration between academic research institutions, government health agencies and drug companies is allowing for faster diagnosis and access to newer drugs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.1 % |

The HeFHmanagement market in South Korea is booming, driven by improved genetic testing availability, the upsurge in preventive cardiology programs and the growing awareness among patients.

Government-endorsed screening programs, along with increasing uptake of targeted therapies like PCSK9 inhibitors and antisense oligonucleotides, are closing the gap in treatment. South Korea is also a growing regional clinical research hub for lipid disorders.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.3 % |

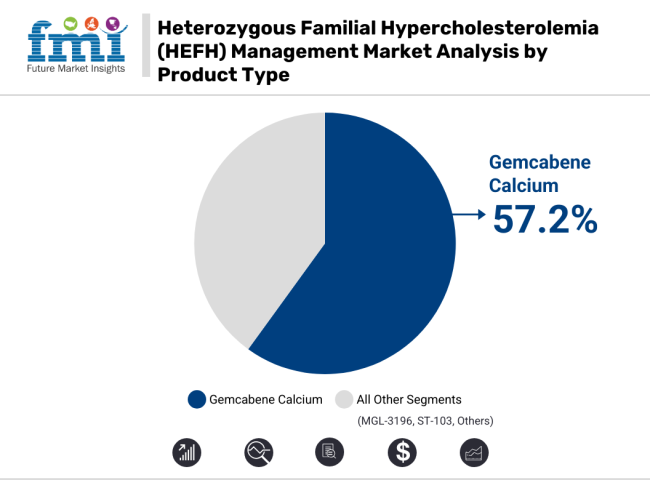

The product type segment for HeFH management market Gemcabene Calcium is expected to capture the largest market share in 2035 and is likely to have a share of 57.2%. Its dominance is not by accident rather it is the result of a strong clinical efficacy profile, a better safety profile and a wide range of use across different severities of disease.

Gemcabene Calcium has, thus, emerged at the intersection of traditional lipid-altering lifestyle modifications and pharmaceutical interventions versus novel anti-inflammatory maneuver as the de facto standard of care, at least of statin-intolerant or combination therapy candidates.

Unlike many of the other traditional lipid-lowering drugs, which primarily work on LDL-C levels, Gemcabene Calcium is designed for both addressing lipid dysregulation and systemic inflammation-this dual action complements the shifting paradigm of atherosclerosis as an inflammatory disease. Its dual-action efficacy, as well as its concomitance with statins, PCSK9 inhibitors, or ezetimibe, has made it a flexible component of both monotherapy and multi-drug therapy.

Gemcabene Calcium is gaining traction among physicians looking to achieve target lipid profiles along with residual inflammatory risk in patients who have a partial response to statin therapy, elevated hs-CRP levels, or other inflammatory markers associated with comorbidity.

This increase market share of Gemcabene is furthermore underpinned by its well documented tolerability. The statin-induced myopathy, gastrointestinal side effects, or liver enzymes elevated for long-term adherence, 60-85% of patients HeFH does not tolerate statin therapy.

Gemcabene has an excellent side effects profile and good compliance that has made it very attractive in chronic disease management, where maintaining continuity of therapy is important. Long term Gemcabene treated patients exhibits not only durable LDL-C lowering but also increased compliance with reduction in side effects which make it quite attractive in long term treatment regimes.

Data from clinical trials has significantly boosted the confidence in Gemcabene efficacy. Real-world clinical experience from Phase III trials over the past year showed significant reduction of LDL-C in HeFH subjects, including statin intolerant and first-line treatment resistant subjects.

It was also observed to favourably influence Apo lipoprotein B and inflammatory marker levels, thus further cementing its use in cardiovascular risk modification. These results have been key in driving global regulatory approvals, while several health authorities gave general orphan drug or fast-track designations that helped prepare a fast rollout in the key markets.

Gemcabene is also positioned by market availability. Unlike monoclonal antibody PCSK9 inhibitors, which require cold chain storage and are delivered via injection, Gemcabene is an oral formulation. This makes it easier to store, deliver and distribute - particularly in developing markets or in community-based care. The relative cost-effectiveness versus biologics alongside oral delivery has increased usage across high-income and resource-limited health systems.

In comparison, MGL-3196 and ST-103 are early- or mid-stage in development. MGL-3196 however based on metabolic modulation ability (lipids and the liver function) it’s still not in accepted clinical yet and have regulatory momentum like gemcabene. While the targeted gene expression mechanisms of ST-103 are promising second-generation lipid therapeutics, safety concerns, long-term data, and scalable manufacture continue to be barrier to widespread adoption.

Based on application, hospitals are expected to have the leading market share in HeFH management at 42.8% during the forecast period for HeFH management market, which we have projected for 2035. Their stance is based on their unique ability to deliver high-complexity practice, leverage advanced diagnostic technologies, and manage the entire continuum of HeFH-from early identification through advanced lipid-lowering therapy and complication surveillance.

As the treatment of genetic dyslipidemias advances into targeted, specific therapy based on individual genetics, hospitals will remain the locus of integrated, technology-based care delivery at the intersection of specialty disciplines.

Early diagnosis is vital for optimal management of patients with HeFH, and hospitals are well positioned for detection and confirmation of HeFH through the performance of comprehensive lipid panels, NGS and family cascade screening. HeFH remains under-diagnosed without specialized testing, which can only be provided in tertiary hospitals, where the complex biochemical and genetic tests can be performed. These testing technologies are usually bundled with cardiovascular imaging and biomarker testing so patient risk and disease severity can be comprehensively assessed at a single visit.

It is also where complex therapies are initiated. There are multiple pharmacologic therapies for the management of HeFH, including Gemcabene Calcium, PCSK9 inhibitors, and experimental RNA therapies, which require early, intensive monitoring in patients after initiation.

Hospitals provide the infrastructure and clinical supervision required for safe and effective dosing, particularly in individuals with multiple comorbidities or a past of medication intolerance. Often, the pharmacokinetic testing, drug-drug interaction evaluation, and dose adjustment occurs in a hospital setting before therapy is resumed in an outpatient setting.

The second major strength of hospital-based care is access to multidisciplinary teams. Ideally, proper management of patients with HeFH involves a multifaceted approach: cardiologists to assess risk for atherosclerosis, endocrinologists to manage lipid metabolism disorders, genetic counselors to communicate risk to family members, and pharmacists for drug education. This team approach is not usually offered at free-standing centers or outpatient clinics and so defaults to hospitals for patients with new diagnoses or toward high risk.

The hospitals play also a central role in the treatment of acute complications resulting from improperly controlled HeFH. Patients who suffer early-onset cardiovascular eventssuch as myocardial infarction or strokeare often diagnosed with HeFH only after the case becomes severe.

In such cases, hospitals not only handle the acute event, but also place patients on appropriate chronic lipid-lowering therapy, with directed follow-up treatment. Their role in acute and chronic disease management creates a continuum reinforcing this centrality in the care of HeFH.

Research is another critical component to getting hospitals involved. Clinical trials of new HeFH therapies are largely conducted by academic hospitals and teaching institutions. By pushing the envelope in the pursuit of innovative therapeutic approaches, these institutions often set new standards that ripple through the broader healthcare system. Hospitals drive innovation and shape future guidelines through early access to innovative therapies and participation in registries and observational studies.

Hospitals are also well compensated for complicated procedures from an economical and logistical perspective. Universal healthcare in all other countries pays hospitals bundled payments, or payments based on procedures, for advanced lipid diagnostics and initiation of biologic therapy.

In the USA, advanced therapies are reimbursed more consistently in the hospital inpatient setting, in particular with assay guidance. This system-based incentive makes hospitals the easiest and cheapest place to care for complex HeFH patients.

Hospitals offer a broader range and a higher degree of medical specialization than clinics and medical centers. Clinics tend to refer more complicated cases to specialists in hospitals, while easily available for regular check-ups and refills. Medical centers are typically secondary only and may be engaged in rudimentary management but lack the in-house specialty teams that hospitals, from the perspective of their research capabilities, maintain. Due to the diagnostic complexity of the HeFH condition, and multidisciplinary care required for management, however, the "Others" segmenttelehealth platforms and home care modelshad a small penetration among HeFH.

Finally, hospitals remain at the center of HeFH management due to their ability to diagnose, offer a wide array of therapies, and provide team-based care for a chronic disease. Their continued investment in genetic medicine, cardiovascular research, and innovative pharmacologic approaches all ensure they will remain key players in the fight against HeFH-induced premature cardiovascular morbidity and mortality.

The heterozygous familial hypercholesterolemia (HeFH) management market is developing at a significant pace owing to the rising prevalence of inherited cholesterol disorders, improved genetic screening as well as the introduction of innovative lipid-lowering therapies.

HeFH is an inherited disorder resulting in extremely elevated levels of LDL cholesterol and long-term treatment with statins, PCSK9 inhibitors, and bempedoic acid and gene-silencing agents. Market drivers include clinical recommendations encouraging early diagnosis and combination therapy, increasing awareness, and the availability of specialty lipid clinics.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Amgen Inc. | 18-22% |

| Regeneron Pharmaceuticals, Inc. | 14-18% |

| Novartis AG | 12-16% |

| Esperion Therapeutics, Inc. | 10-14% |

| Ionis Pharmaceuticals, Inc. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Amgen Inc. | In 2024 , Amgen expanded access to Repatha ® ( evolocumab ), a PCSK9 inhibitor proven to reduce LDL-C in HeFH patients by over 60% when combined with statins. |

| Regeneron Pharmaceuticals, Inc. | As of early 2025 , Regeneron, in partnership with Sanofi, markets Praluent ® ( alirocumab ), another PCSK9 monoclonal antibody, approved for HeFH and atherosclerotic cardiovascular disease (ASCVD) risk reduction. |

| Novartis AG | In 2023 , Novartis launched Leqvio ® ( inclisiran ) - a siRNA-based gene silencing therapy that targets PCSK9 synthesis with biannual dosing, gaining momentum as a long-term LDL-lowering option for HeFH patients. |

| Esperion Therapeutics, Inc. | In mid to 2024 , Esperion advanced its Nexletol ® ( bempedoic acid) and Nexlizet ® ( bempedoic acid + ezetimibe) oral tablets, offering an alternative for statin-intolerant HeFH patients. |

| Ionis Pharmaceuticals, Inc. | As of 2025 , Ionis is progressing in late-stage development of ION449, an investigational antisense oligonucleotide targeting PCSK9, with potential for HeFH patients not responding adequately to standard treatments. |

Key Market Insights

Amgen Inc. (18-22%)

Amgen is the market leader in HeFH management, with Repatha® widely prescribed across global lipid clinics, supported by robust clinical data and reimbursement pathways in both high- and middle-income countries.

Regeneron Pharmaceuticals, Inc. (14-18%)

Regeneron’s Praluent® remains a top choice for patients requiring PCSK9 inhibition, especially in patients with both HeFH and cardiovascular risk, leveraging co-marketing synergies with Sanofi.

Novartis AG (12-16%)

Novartis has disrupted the market with Leqvio®, offering convenient, twice-yearly dosing through a gene-silencing mechanism, potentially improving patient adherence in chronic management.

Esperion Therapeutics, Inc. (10-14%)

Esperion is carving a niche with oral LDL-lowering drugs like Nexletol®, providing a non-statin alternative for HeFH patients who are either intolerant or require complementary therapies.

Ionis Pharmaceuticals, Inc. (8-12%)

Ionis is a front-runner in next-generation antisense therapeutics, aiming to offer long-acting, targeted cholesterol reduction solutions through innovative mRNA interference platforms.

Other Key Players (26-32% Combined)

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 75: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 76: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 89: MEA Market Attractiveness by Application, 2023 to 2033

Figure 90: MEA Market Attractiveness by Country, 2023 to 2033

The overall market size for heterozygous familial hypercholesterolemia (HEFH) management market was USD 17,305.5 million in 2025.

The heterozygous familial hypercholesterolemia (HEFH) management market is expected to reach USD 64,720.4 million in 2035.

Increasing prevalence of genetic cholesterol disorders, advancements in lipid-lowering therapies, and rising awareness of early diagnosis and personalized treatment will drive market growth.

The top 5 countries which drives the development of heterozygous familial hypercholesterolemia (HEFH) management market are USA, European Union, Japan, South Korea and UK.

Gemcabene calcium expected to grow to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA