The global hematology diagnostics market is estimated to be valued at USD 3,971.8 million in 2025 and is projected to reach USD 6,287.2 million by 2035, registering a compound annual growth rate of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,971.8 million |

| Industry Value (2035F) | USD 6,287.2 million |

| CAGR (2025 to 2035) | 6.5% |

The hematology diagnostics market has witnessed sustained momentum as healthcare systems prioritize early detection and management of hematological disorders, including anemia, leukemia, and clotting abnormalities.

Rising global disease prevalence, expanding access to laboratory services, and the shift toward automated, high-throughput analyzers have collectively accelerated adoption. Clinical laboratories and hospitals have increasingly invested in integrated platforms that combine CBC testing, differential counts, and advanced cellular morphology capabilities to improve diagnostic accuracy and turnaround time. Regulatory guidance and quality assurance initiatives have further stimulated demand for validated reagents and consumables that comply with stringent performance standards.

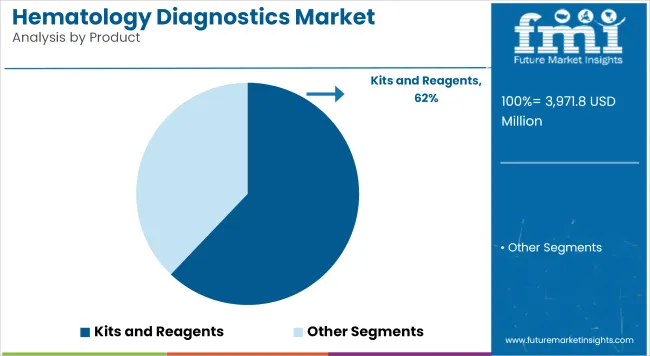

Product Analysis: Kits and Reagents

In 2025, Kits and Reagents is estimated to account for 62.1% revenue share, underscoring their indispensable role in haematology workflows. Growth of this segment has been driven by the necessity of reliable consumables that deliver reproducible results across high-throughput analyzers.

Hospitals and laboratories have prioritized validated reagent systems compatible with automated platforms to meet accreditation standards and ensure consistent quality. Increasing test volumes for anemia screening, coagulation assessment, and oncology diagnostics have further contributed to robust recurring demand.

The segment is expected to maintain a dominant position as laboratories expand preventive screening programs and adopt advanced diagnostic algorithms requiring specialized reagent formulations.

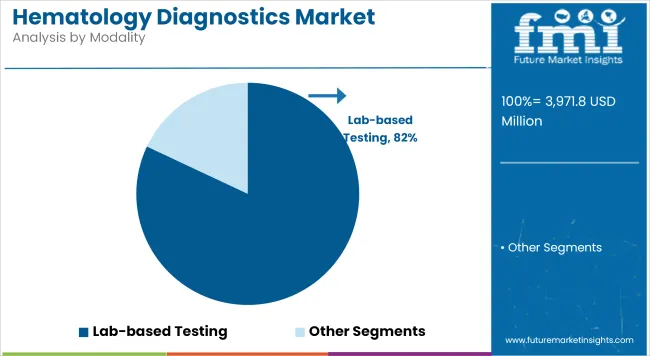

Modality Analysis

Lab-Based Testing contributes a revenue share of 82.0% in the overall hematology diagnostics market. This segment is being driven by centralized laboratories’ ability to process large specimen volumes efficiently and deliver standardized, high-quality results. Providers have favored lab-based platforms to leverage economies of scale, integrate advanced analytics, and comply with rigorous regulatory requirements.

The prevalence of chronic hematological disorders and the increasing adoption of routine CBC and differential testing have reinforced demand for centralized lab services. Lab-based testing is anticipated to remain dominant, although incremental growth in decentralized and near-patient testing solutions is likely to emerge.

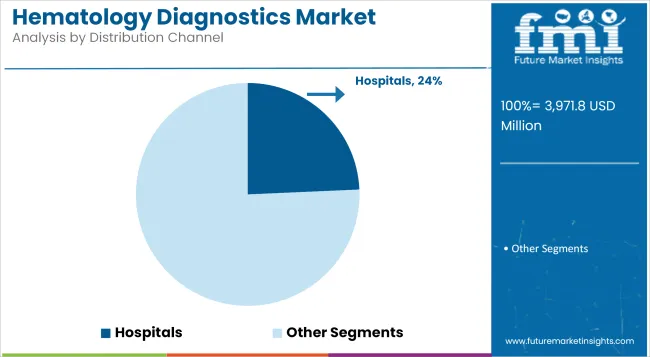

Hospitals contribute a revenue share of 24.3%, highlighting their key role in providing hematology testing as part of comprehensive inpatient and outpatient care. Utilization has been driven by the need for rapid diagnostics in critical care, oncology, and surgical departments.

Hospitals have maintained robust demand for automated analyzers and consumables to ensure continuous operation and timely result reporting. The expansion of oncology treatment programs and the integration of multidisciplinary care models have further supported segment growth.

Equipment Cost and Skilled Labor Shortage

The hematology diagnostics arena is confronted with serious challenges, such as the prohibitively high costs of analyzers, consumables and the need for specialist personnel to interpret results. Though automated hematology systems improve throughput, the more sophisticated equipment that can differentiate blood disorders of high complexity cannot be afforded by smaller labs and rural clinics.

Also, the interpretation of abnormal cell morphology or rare conditions needs to be reviewed manually by a trained hematologist, subjecting the system to further bottlenecks in resource-limited settings. Compliance with regulatory requirements, high costs of maintenance, and high degree of variations in laboratory infrastructure are all factors that make standardization an even more daunting task particularly as emerging markets seek to fast-track their horizons in diagnostic capabilities.

Rising Burden of Blood Disorders and Diagnostic Automation

Hematology diagnostics market is forecasted to grow in spite of infrastructural limitations due to rising incidence of anemia, leukemia, and chronic diseases affecting blood parameters all over the world. Advancements in automated analyzers, point-of-care (POC) devices, integrated diagnostic platforms include improved technology to enhance test speed, accuracy, and accessibility.

Enhanced diagnostic efficiency in centralized labs or remote clinics with the advent of AI-assisted blood cell differentiation, Cloud-based data analytics, and telehematology. Accurate, high-throughput hematology diagnostics are increasingly demanded in hospitals, oncology centers, and preventive health programs worldwide as personalized medicine and routine screening take off.

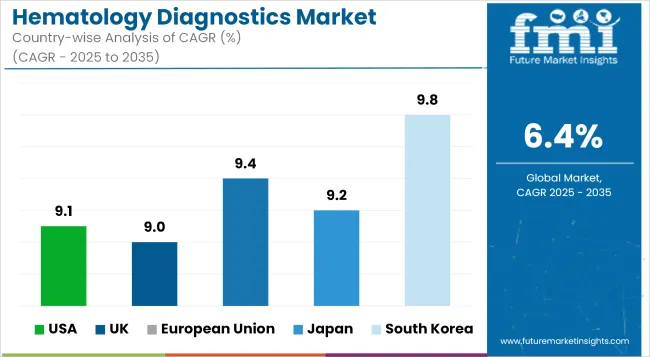

Strong market growth in hematology diagnostics in the United States is propelled by increased demand for complete blood count (CBC) testing owing to the rise in the incidence of hematologic cancers and lab automation innovations.

High-throughput hematologyanalyzers and integrated systems for slide review are increasingly taken into use by major hospitals and diagnostic labs for early discovery of disease, blood transfusion management, and chemotherapy monitoring. The expansion in outpatient testing and value-based care models further supports the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.1% |

Modernization of the NHS, increased screening for blood disorders, and huge demand for rapid diagnostic testing in emergency and oncology care are what drive the growth of hematology diagnostics market in the United Kingdom.

UK laboratories use compact, automated analyzers and middleware solutions for seamless integration with electronic health records (EHR), thus expediting turnaround time for diagnosis and coordination of care.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.0% |

The European Union is a highly active and fast developing market for hematology diagnostics particularly in Germany, France and Netherlands. Hospitals and private laboratories are increasingly embracing 5-part and 6-part differential analyzers, digital morphology platforms as well as AI-enabled image recognition-based blood profiling systems.

The EU regulatory frameworks and national cancer plans give impetus to the early detection of hematologic diseases in the market, thus increasing the demand in both centralized labs and point-of-care networks.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 9.4% |

The hematology diagnostics market is steadily growing, driven by the aging population and continuous monitoring of chronic blood conditions. Compact, low-maintenance hematology systems integrated into service delivery and patient care solutions are being deployed by Japanese healthcare providers in regional hospitals and clinics to widen the access to diagnostic services.

Purchasing in government and private sectors is being influenced by an increasing focus on quality assurance, standardization, and advanced flagging algorithms.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.2% |

The rapid expansion of the hematology diagnostics market within South Korea is on account of an advanced laboratory infrastructure, heavy investment in precision oncology, and government-supported mass health screening programs.

Hematology platforms using AI are merged with digital pathology workflows in South Korean labs, whilst native manufacturers are broadening the outreach of compact, cost-effective systems for both rural and urban clinics.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.8% |

The competitive landscape has been defined by companies expanding automated hematology platforms and validated reagent portfolios. Leading manufacturers are investing in digital imaging, AI-powered classification, and connectivity solutions to enhance laboratory workflows and diagnostic accuracy.

Strategic partnerships with reference labs and hospital networks have been prioritized to strengthen distribution and accelerate adoption in emerging markets. Furthermore, investments in training, accreditation support, and service infrastructure are enabling suppliers to differentiate offerings and capture share in a highly competitive market. These trends are expected to maintain innovation intensity and competitive momentum over the forecast period.

Key Development

In 2025, Sysmex Corporation has received 510(k) clearance from the USA FDA for its XR-Series Automated Hematology Analyzer. The company is now preparing for an early market launch of this product in the United States..

In 2024, HORIBA Medical has launched the HELO 2.0, a high-throughput automated hematology platform with CE-IVDR approval and pending US FDA clearance. Designed with customer input, this next-generation system offers a flexible, efficient, and scalable modular solution for mid to large-scale laboratories, building on the success of its predecessor.

The overall market size for the hematology diagnostics market was USD 3,971.8 million in 2025.

The hematology diagnostics market is expected to reach USD 6,287.2 million in 2035.

The increasing incidence of blood disorders, rising demand for early cancer detection, and growing use of leukemia testing kits in lab-based testing fuel the hematology diagnostics market during the forecast period.

The top 5 countries driving the development of the hematology diagnostics market are the USA, UK, European Union, Japan, and South Korea.

Leukemia testing kits and lab-based testing lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hematology Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hematology Analyzer And Reagents Market

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Rabies Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sepsis Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Covid-19 Diagnostics Market – Demand, Growth & Forecast 2022-2032

In-Vitro Diagnostics Packaging Market

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Psychosis Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Pneumonia Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA