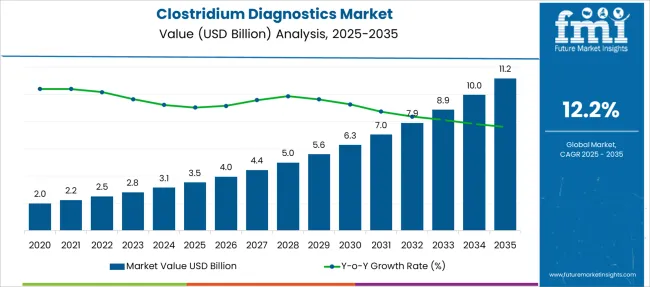

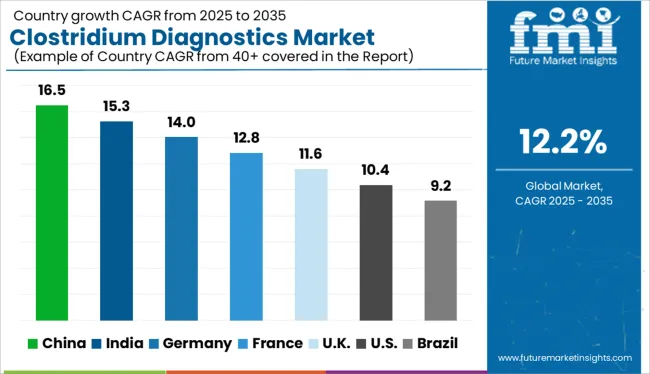

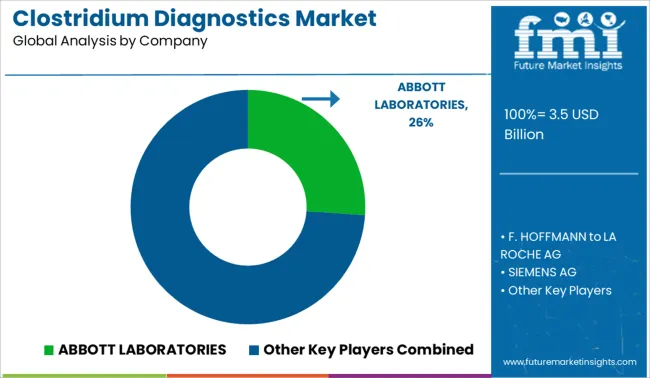

The Clostridium Diagnostics Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 11.2 billion by 2035, registering a compound annual growth rate (CAGR) of 12.2% over the forecast period.

| Metric | Value |

|---|---|

| Clostridium Diagnostics Market Estimated Value in (2025 E) | USD 3.5 billion |

| Clostridium Diagnostics Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

The Clostridium diagnostics market is growing steadily as healthcare providers seek faster and more accurate detection methods for Clostridium infections. The increased prevalence of Clostridium difficile infections in healthcare settings has heightened the need for reliable diagnostic technologies.

Advances in immunoassay techniques have improved sensitivity and specificity while reducing turnaround times. Hospitals have expanded their infection control programs, which has driven higher adoption of advanced diagnostics to quickly identify Clostridium presence and prevent outbreaks.

The market growth is further supported by rising awareness among clinicians and the implementation of stricter regulatory standards for infectious disease management. Looking ahead, technological improvements and integration with automated laboratory systems are expected to fuel further expansion. Segmental growth is projected to be driven by immunoassays-based diagnostics, hospital end users, and Clostridium difficile-specific testing.

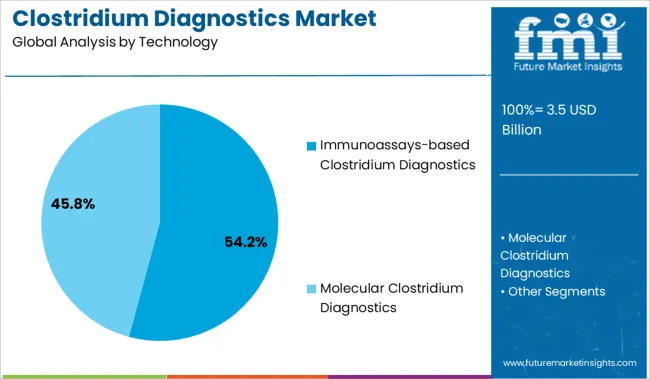

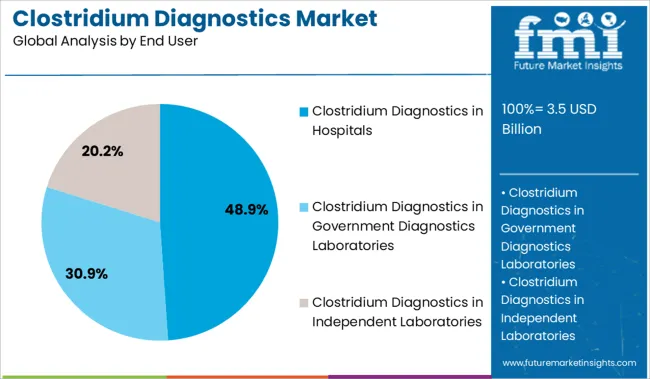

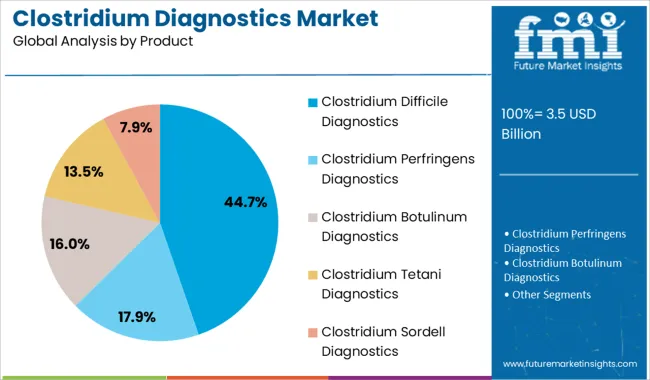

The market is segmented by Technology, End User, and Product and region. By Technology, the market is divided into Immunoassays-based Clostridium Diagnostics and Molecular Clostridium Diagnostics. In terms of End User, the market is classified into Clostridium Diagnostics in Hospitals, Clostridium Diagnostics in Government Diagnostics Laboratories, and Clostridium Diagnostics in Independent Laboratories. Based on Product, the market is segmented into Clostridium Difficile Diagnostics, Clostridium Perfringens Diagnostics, Clostridium Botulinum Diagnostics, Clostridium Tetani Diagnostics, and Clostridium Sordell Diagnostics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The immunoassays-based Clostridium diagnostics segment is expected to account for 54.2% of the market revenue in 2025, retaining its leadership among diagnostic technologies. This segment has been favored due to its rapid detection capabilities and improved accuracy in identifying Clostridium toxins.

Immunoassays offer cost-effective and easy-to-use solutions that can be integrated into routine hospital laboratory workflows. The ability to provide timely results supports faster clinical decision-making and effective infection control.

These factors have encouraged widespread adoption in healthcare facilities. As hospitals continue to prioritize quick and reliable diagnostics for Clostridium infections, this segment is likely to sustain its market dominance.

Clostridium diagnostics in hospitals is projected to hold 48.9% of the market revenue in 2025, maintaining its position as the largest end-user segment. Hospitals have increasingly implemented comprehensive infection control measures requiring accurate diagnostic tools to manage Clostridium outbreaks effectively.

The clinical setting demands high-throughput and reliable testing methods to ensure patient safety and minimize healthcare-associated infections. The segment’s growth is also supported by the expansion of hospital laboratory infrastructure and increasing emphasis on diagnostic stewardship programs.

As healthcare systems strengthen infection surveillance, hospitals are expected to remain the primary adopters of Clostridium diagnostics.

The Clostridium difficile diagnostics segment is forecasted to contribute 44.7% of the market revenue in 2025, establishing it as the leading product category. This segment’s growth is linked to the high clinical importance of C. difficile as a major cause of hospital-acquired infections.

Diagnostic tools targeting C. difficile toxins and genes have been developed to provide accurate identification and enable timely treatment. Rising incidence rates and the need for effective outbreak management have increased demand for these specialized diagnostics.

Healthcare providers are focusing on improving detection methods to reduce infection transmission and improve patient outcomes. This focus ensures continued growth of the Clostridium difficile diagnostics segment.

Ongoing Partnerships among Players and Launch of new Vaccines to Spike the Market Growth Graph Notably

Growing expenditure on healthcare infrastructure is expected to have played a significant role in developing the market during the timeframe. As per the analysis, from 2020 to 2024, the market is projected to display a CAGR of 13.6%. Initiatives by players in the market are expected to have strengthened the industry growth during the aforementioned time period.

For instance, in August 2020, Boehringer Ingelheim Vetmedica, Inc. launched the Alpha-7 vaccine, the only first-of-a-kind vaccine, single-dose vaccination offering a 7-way defense against clostridium diseases.

Other factors contributing to the market growth include technological development in diagnostic equipment and growing awareness about clostridium-related disorders. Owing to the aforementioned factors, the market is anticipated to have developed significantly during the time period from 2020 to 2024.

During the forecast period from 2025 to 2035, the market is expected to display a CAGR of 12.2%. The growth of the market can be attributed to the growing focus of players to expand their footprint in the industry. For instance, in March 2024, Peggy Lillis Foundation for Clostridium difficile infections announced a partnership with Ferring Pharmaceutical through a new sponsorship to assist new and existing patient advocacy initiatives.

The sponsorship focuses on supporting the organization’s National C. doff Adovacy summit, 2024 FIGHT C.Diff Gala. Attributed to such factors, the global clostridium diagnostics market is projected to develop significantly during the forecast period from 2025 to 2035.

Growing Launch of New Vaccines for Clostridium Condition to Boost the Market

Players in the market are taking various efforts to offer effective vaccines against the deadly Clostridium condition, which is expected to benefit the industry in the forecast period. Growing cases of the condition among animals have encouraged players in the market to launch new vaccines.

For instance, in August 2024, Huvepharma Canada Corportation Inc. launched a new vaccine that has been shown to be effective against necrotic enteritis (NE) due to Clostridium perfringens Type A in broiler chickens.

Other factors contributing to the market growth include increasing awareness about the condition, changing lifestyles, and the development of healthcare infrastructure, among others. Such factors are expected to drive the global clostridium diagnostics market during the forecast period.

Lack of Awareness and Resources in Developing Countries to Hamper the Market Growth

Scarcity of resources and lack of awareness in developing countries is expected to be the most significant factor impeding market growth during the forecast period. Further, the high costs involved in R&D and vaccine manufacturing is projected to be another potential challenge to the market in the forecast period.

Launch of Awareness Campaigns in the States to Augment the Market Size of the USA

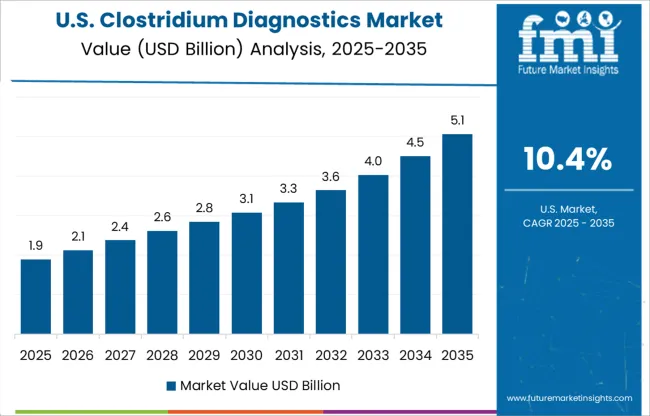

As per the analysis, the USA is anticipated to secure a market value worth USD 3.5 Billion during the forecast period. From 2025 to 2035, the country is projected to display a CAGR of 11.8%, while it was 13.3% from 2020 to 2024.

The growth of the USA market can be attributed to the growing awareness among people owing to the rising launch of campaigns by various bodies. For instance, the “See C. diff” campaign, launched by Peggy Lillis Foundation in December 2024, attained its objective by reaching more than 250,000 Americans.

The organization launched the “See C. diff” to commemorate C.diff Awareness Month in 2020, and reached about 80,000 people. Attributed to such efforts, the market in the USA is projected to flourish significantly in the coming time.

Implementation of Favorable Initiatives to Support the Market in Japan

As per the analysis, the market in Japan is projected to display a CAGR of 11.1% during the forecast period from 2025 to 2035. The market value is estimated at USD 11.2 Million by 2035. From 2020 to 2024, the country experienced a CAGR of 12.4%.

The growth of the Japanese market can be attributed to the implementation of favorable initiatives. For instance, in March 2025, Japan launched a new center, with a budget of USD 1.6 Billion, to support vaccine and drug projects as a part of a larger scheme to tackle infectious diseases.

SCARDA will be in charge of establishing a flagship R&D site for innovative collaborations and controlling funds for R&D projects. Due to such factors, the market in Japan is expected to experience various opportunities for expansion in the forecast period.

Growing Adoption of Antibiotics for the Treatment of Infection to Develop the Segmental Growth

As per the analysis, by technology, the global clostridium diagnostics market is expected to be dominated by the immunoassays segment. The segment is anticipated to display a CAGR of 11.7% during the assessment period from 2025 to 2035.

The development of the segment can be attributed to the increasing adoption of antibiotics for infection treatment. Also, development in drug design and availability of higher antibiotics, and growing awareness about the disease are projected to strengthen the segmental growth in the forecast period.

Growing Prevalence of Clostridium-related Ailments to Boost the Segmental Growth

According to the analysis, the clostridium difficile segment is anticipated to dominate the global clostridium diagnostics market during the forecast period. From 2025 to 2035, the segment is projected to display a CAGR of 11.6%.

The development of the segment can be attributed to the growing prevalence of clostridium-related diseases and expanding geriatric population. Also, developing healthcare infrastructure and technical development are projected to be other salient factors driving the growth of the segment in the forecast period.

Acurx Pharmaceuticals, Cubist Pharmaceuticals, Endo Aesthetics, Avisa Pharma, and MGB Bio Pharma, among others, are anticipated to play a significant role in developing the market during the forecast period. Emerging entities are taking several initiatives that are likely to benefit the industry during the forecast period.

Key players in the global clostridium diagnostics market include Abbott Laboratories, F. Hoffmann-LA ROCHE AG, Siemens AG, Becton Dickinson and Company, and Beckman Coulter, INC.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12.2% from 2025 to 2035 |

| Market Value in 2025 | USD 3.5 billion |

| Market Value in 2035 | USD 11.2 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Technology, Product, End User, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, France, UK, Italy, BENELUX, Nordics, China, Japan, South Korea, GCC, South Africa, Turkey |

| Key Companies Profiled | Abbott Laboratories; F. Hoffmann La-Roche AG; Siemens AG; Becton, Dickinson & Company; Beckman Coulter Inc.; Sysmex India Pvt. Ltd.; Thermo Fisher Scientific Inc.; Fujirebio US Inc.; BioMerieux S.A; Diazyme Laboratories Inc. |

| Customization | Available Upon Request |

The global clostridium diagnostics market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the clostridium diagnostics market is projected to reach USD 11.2 billion by 2035.

The clostridium diagnostics market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in clostridium diagnostics market are immunoassays-based clostridium diagnostics and molecular clostridium diagnostics.

In terms of end user, clostridium diagnostics in hospitals segment to command 48.9% share in the clostridium diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Difficile Infections (Clostridium Difficile Associated Disease) Market Size and Share Forecast Outlook 2025 to 2035

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Rabies Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sepsis Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Covid-19 Diagnostics Market – Demand, Growth & Forecast 2022-2032

In-Vitro Diagnostics Packaging Market

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Psychosis Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Pneumonia Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

The Companion Diagnostics Market is segmented by product, technology, application and end user from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA