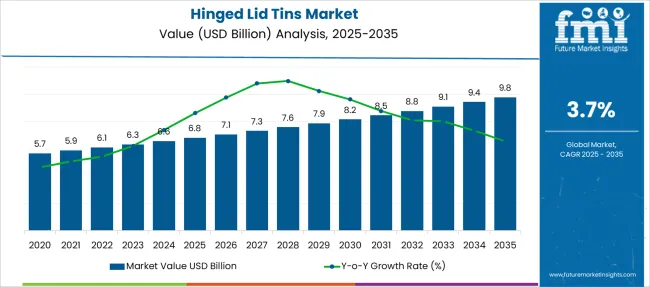

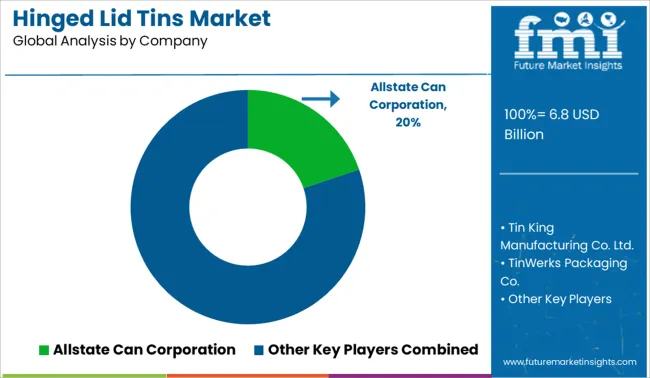

The Hinged Lid Tins Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 9.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Hinged Lid Tins Market Estimated Value in (2025 E) | USD 6.8 billion |

| Hinged Lid Tins Market Forecast Value in (2035 F) | USD 9.8 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The hinged lid tins market is growing steadily, driven by increasing demand for convenient and durable packaging solutions in the food industry. Consumer preferences have shifted towards packaging that offers ease of use and product protection while maintaining aesthetic appeal. The food sector has particularly favored hinged lid tins for their ability to preserve freshness and facilitate resealing.

Additionally, packaging innovations and sustainability concerns have led manufacturers to adopt recyclable and reusable materials. Offline distribution channels remain dominant as consumers continue to prefer in-store purchases for packaged foods, benefiting from tactile experience and immediate availability.

Expansion of retail outlets and grocery stores further supports the growth of this segment. The market outlook remains positive, with growth expected to continue due to evolving packaging trends and the rising importance of convenience in food packaging. Segment growth is anticipated to be led by the 151-200 ML capacity segment, the food end use sector, and offline distribution channels.

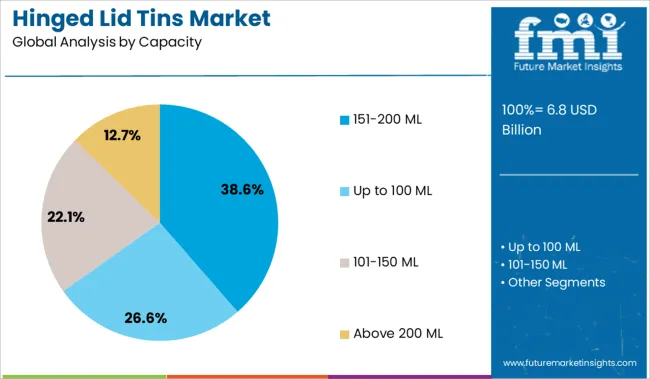

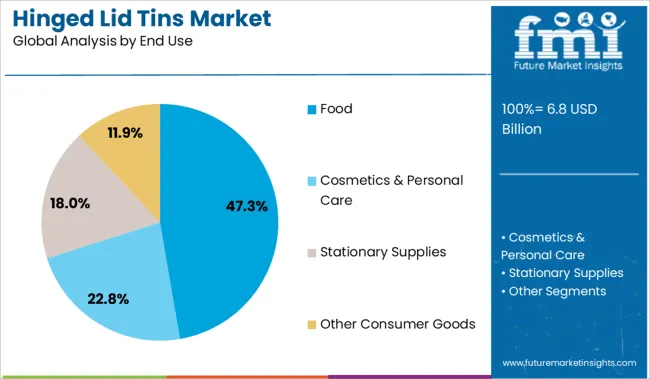

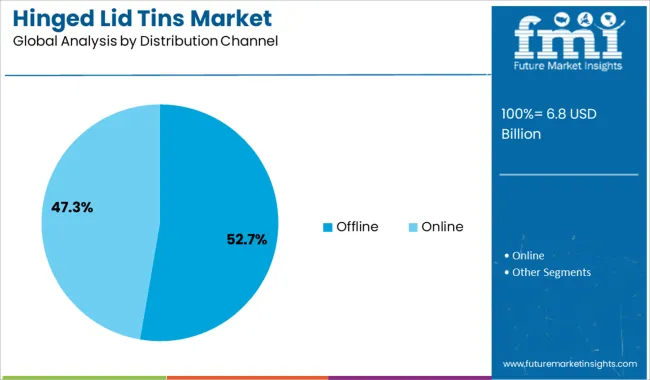

The market is segmented by Capacity, End Use, and Distribution Channel and region. By Capacity, the market is divided into 151-200 ML, Up to 100 ML, 101-150 ML, and Above 200 ML. In terms of End Use, the market is classified into Food, Cosmetics & Personal Care, Stationary Supplies, and Other Consumer Goods. Based on Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 151-200 ML capacity segment is expected to account for 38.6% of the hinged lid tins market revenue in 2025, positioning it as the leading size category. This capacity offers a balance between portability and sufficient storage, making it ideal for food products such as snacks, spices, and confectionery. The segment benefits from consumer preference for moderate-sized packaging that supports portion control and product freshness.

Manufacturers have focused on designing tins in this range to cater to both single-use and multi-use packaging needs. Additionally, this size fits well on retail shelves and complements consumer lifestyles that favor compact yet practical packaging options.

The 151-200 ML capacity segment is anticipated to sustain its growth due to its versatility and alignment with consumer convenience trends.

The food segment is projected to hold 47.3% of the hinged lid tins market revenue in 2025, maintaining its lead as the primary end-use sector. Hinged lid tins have been widely adopted in food packaging due to their ability to protect products from moisture, air, and contamination. Their resealable design enhances product shelf life and supports consumer convenience.

The segment’s growth is supported by increasing demand for packaged snacks, baked goods, and specialty food items. Retailers and manufacturers have invested in innovative packaging designs that appeal visually and functionally to consumers.

Moreover, food safety regulations and quality standards have encouraged the use of secure and reliable packaging solutions like hinged lid tins. The food segment is expected to continue driving the market as consumer demand for convenience and product integrity grows.

The offline distribution channel is projected to account for 52.7% of the hinged lid tins market revenue in 2025, securing its position as the leading channel. Physical retail stores including supermarkets, grocery shops, and specialty stores remain the preferred choice for many consumers when purchasing packaged food products. The tactile experience and ability to inspect packaging quality before purchase continue to drive offline sales.

Additionally, offline channels benefit from established supply chains and strong retailer relationships, enabling broad product availability. Promotional activities and in-store marketing also play a significant role in influencing consumer buying decisions in offline settings.

Despite the growth of online retail, the offline segment is expected to maintain its dominance due to consumer shopping habits and the importance of impulse purchases. The offline distribution channel is poised to remain a key revenue driver in the market.

The consumer-friendly and ergonomic format of hinged lid tins is a major factor that is anticipated to augur well for the global market. Companies are developing new tin packaging to attract more customers as metal packaging adds an aesthetic appeal and a premium feel to the package.

Further, hinged lid tins enable manufacturers to develop their brand image among customers owing to their ease of printing. Some of the other decorations, such as 3D printing and embossing can also be done on these tins to improve the products’ visibility on shelves.

Spurred by the aforementioned factors, the hinged lid tins market growth is anticipated to surge in future.

One of the major challenges of hinged lid tins is that if the lid gets broken, then the container loses its functionality. It results in cracking or breaking of the hinges as the lids cannot be reattached to the joining point. This factor may obstruct the sales of hinged lid tins in the upcoming years.

Asia Pacific is set to remain at the forefront by procuring the largest hinged lid tins market share in the evaluation period. This growth is attributable to the ongoing development of the food supply channel across India and China. Hinged lid tins are expected to transform the food industry in these countries with the rising popularity of online food delivery systems.

In addition to that, the ever-increasing demand for ready-to-go meals among millennials is another vital factor that is estimated to propel the regional market. The rising trend of consuming various flavoured coffees across the Asia Pacific is also projected to drive growth. Increasing sales of such coffees through e-commerce platforms is set to push growth.

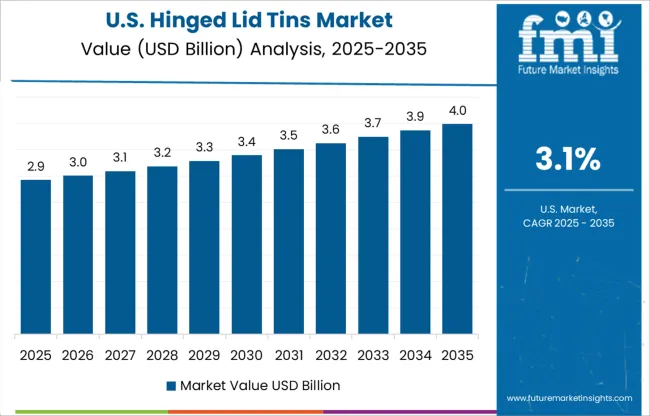

The rising demand for hinged lid tins in Canada and the USA for tobacco packaging, especially for premium cigarettes, is likely to augur well for the North American market. Governments of these countries have put forward stringent norms to ban the usage of plastic packaging and thus, companies are rapidly inclining towards metal packaging, such as tins.

The growing usage of hinged lid tins by pharmaceutical companies for medicine shipment and storage is another significant factor that is set to accelerate growth. These are nowadays used by cosmetics manufacturers to store compact powders, lipsticks, eyeshadows, and blush. This factor is also expected to support the North American market.

Some of the leading companies in the global hinged lid tins market include Allstate Can Corporation, Tin King Manufacturing Co. Ltd., TinWerks Packaging Co., Tin-Pac Promotional Packaging, and SKS Bottle & Packaging, Inc. among others.

Renowned companies are engaging in mergers and acquisitions with local firms to co-develop cutting-edge products and distribute these in the market. Meanwhile, a few other key players are striving to broaden their manufacturing capacities by investing huge sums in the development of new production facilities, especially in untapped areas.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Capacity, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Allstate Can Corporation; Tin King Manufacturing Co. Ltd.; TinWerks Packaging Co.; Tin-Pac Promotional Packaging; SKS Bottle & Packaging, Inc. |

The global hinged lid tins market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the hinged lid tins market is projected to reach USD 9.8 billion by 2035.

The hinged lid tins market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in hinged lid tins market are 151-200 ml, up to 100 ml, 101-150 ml and above 200 ml.

In terms of end use, food segment to command 47.3% share in the hinged lid tins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hinged Dual Flap Caps Market Size and Share Forecast Outlook 2025 to 2035

Hinged Dispensing Caps Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Hinged Dispensing Caps Providers

Hinged Deli Containers Market Growth & Trends 2025 to 2035

Hinged Lid Compostable Container Market

PET Hinged Container Market Innovations & Trends 2024-2034

Foam Hinged Take-Out Containers Market

Clear Hinged Container Market

LiDAR in Mapping Market Size and Share Forecast Outlook 2025 to 2035

LiDAR Drone Market Size and Share Forecast Outlook 2025 to 2035

Lid Laminates Market Size and Share Forecast Outlook 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Lidding Foil Market

Lid Applicator Machine Market

Sliding Patio Glass Door Market Size and Share Forecast Outlook 2025 to 2035

Slide Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Sliding Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Slideway Oil Market Size and Share Forecast Outlook 2025 to 2035

Sliding Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA